Hybrid Algo

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

HYBRID ALGO AMA VIDEO

Hybrid Algo. Momentum Reversal Algorithm Overview:

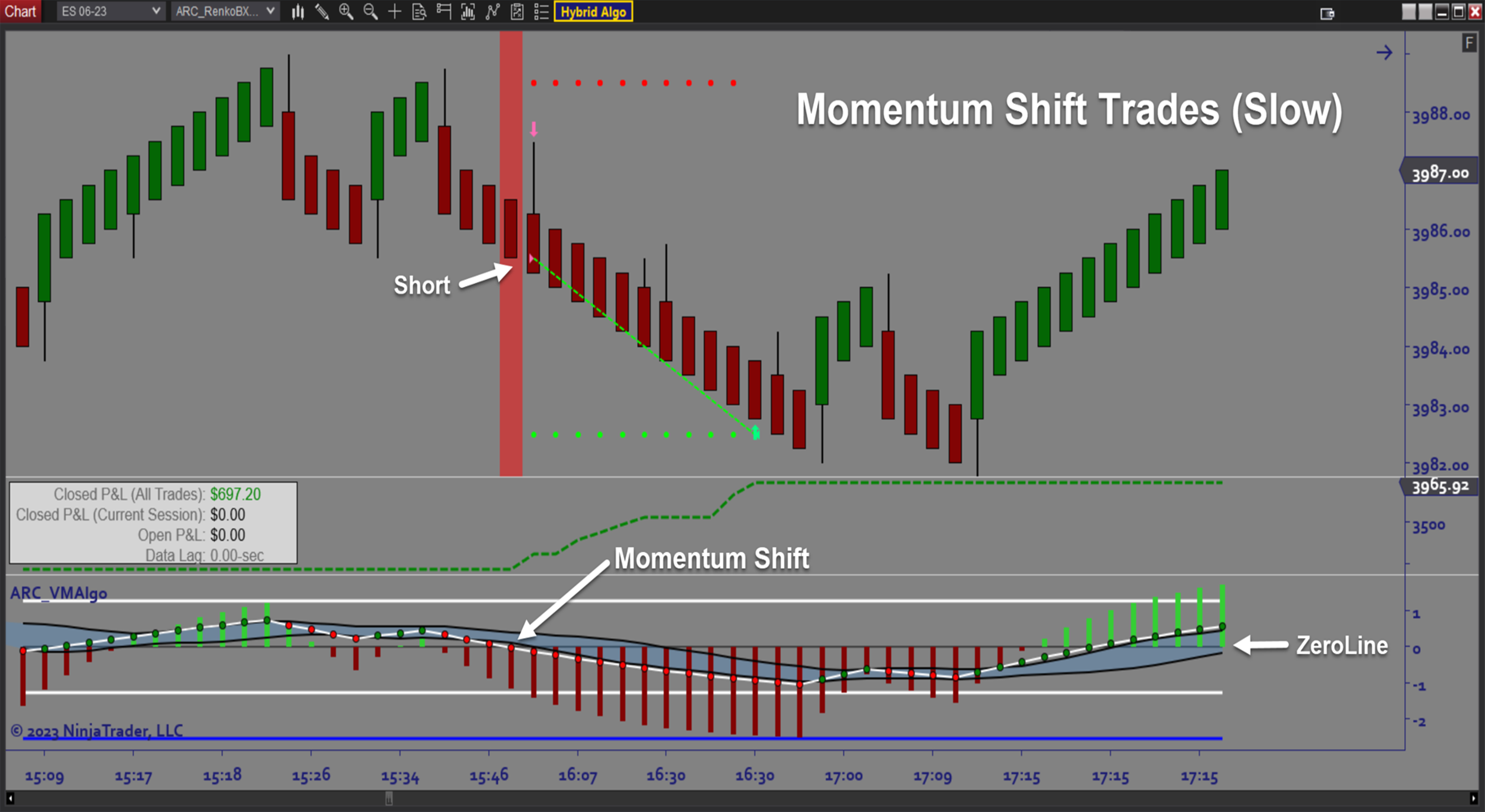

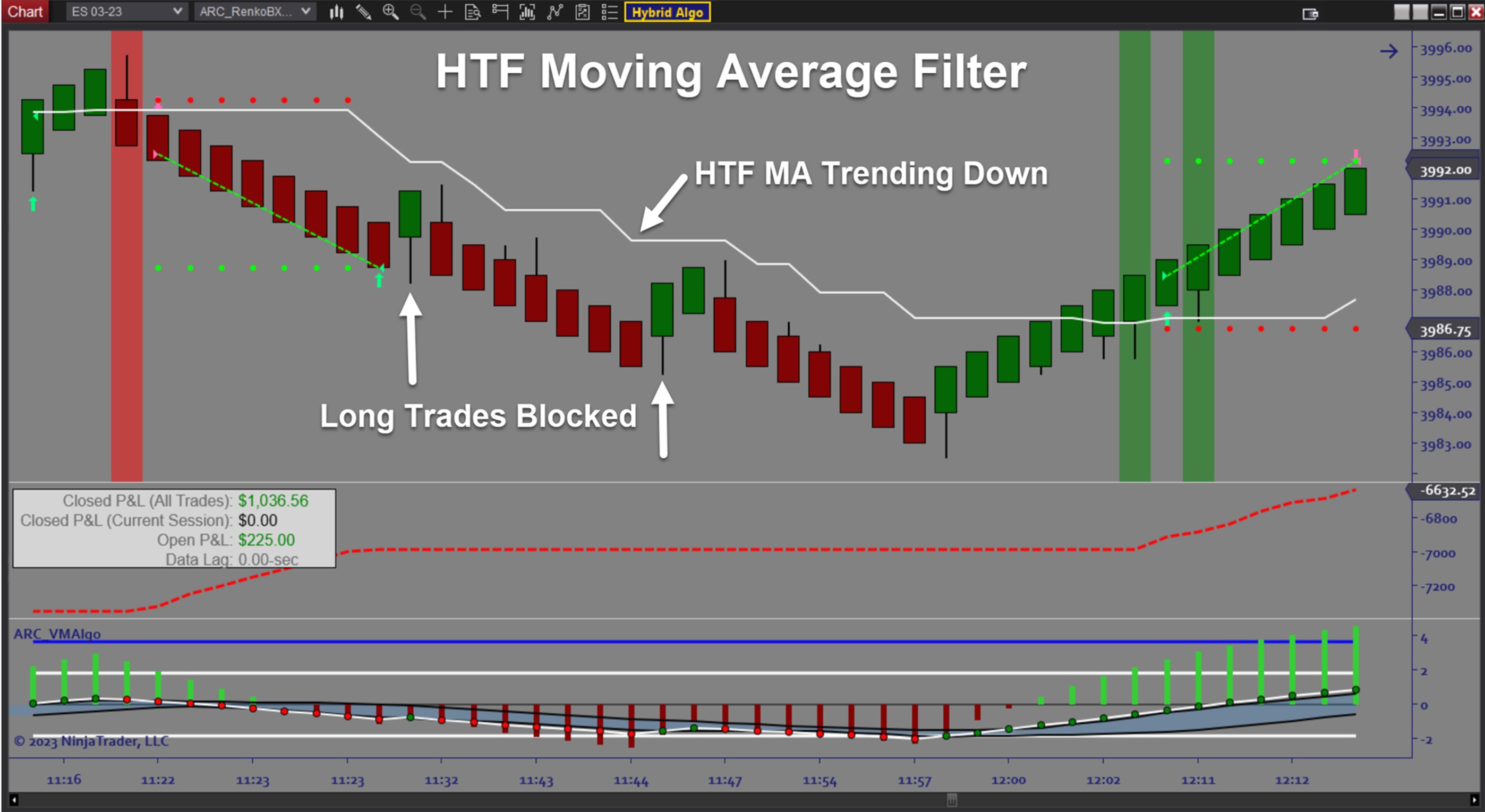

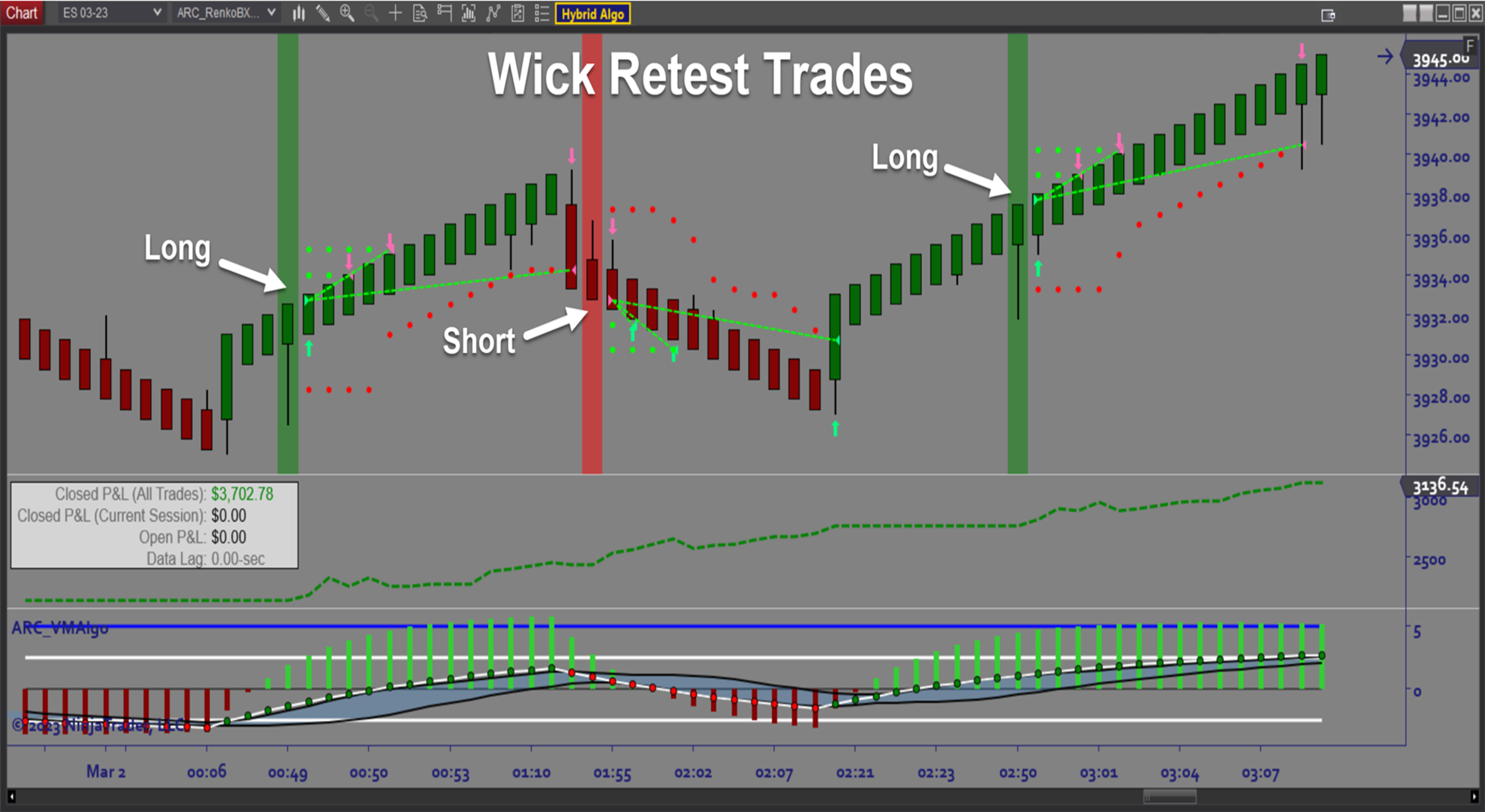

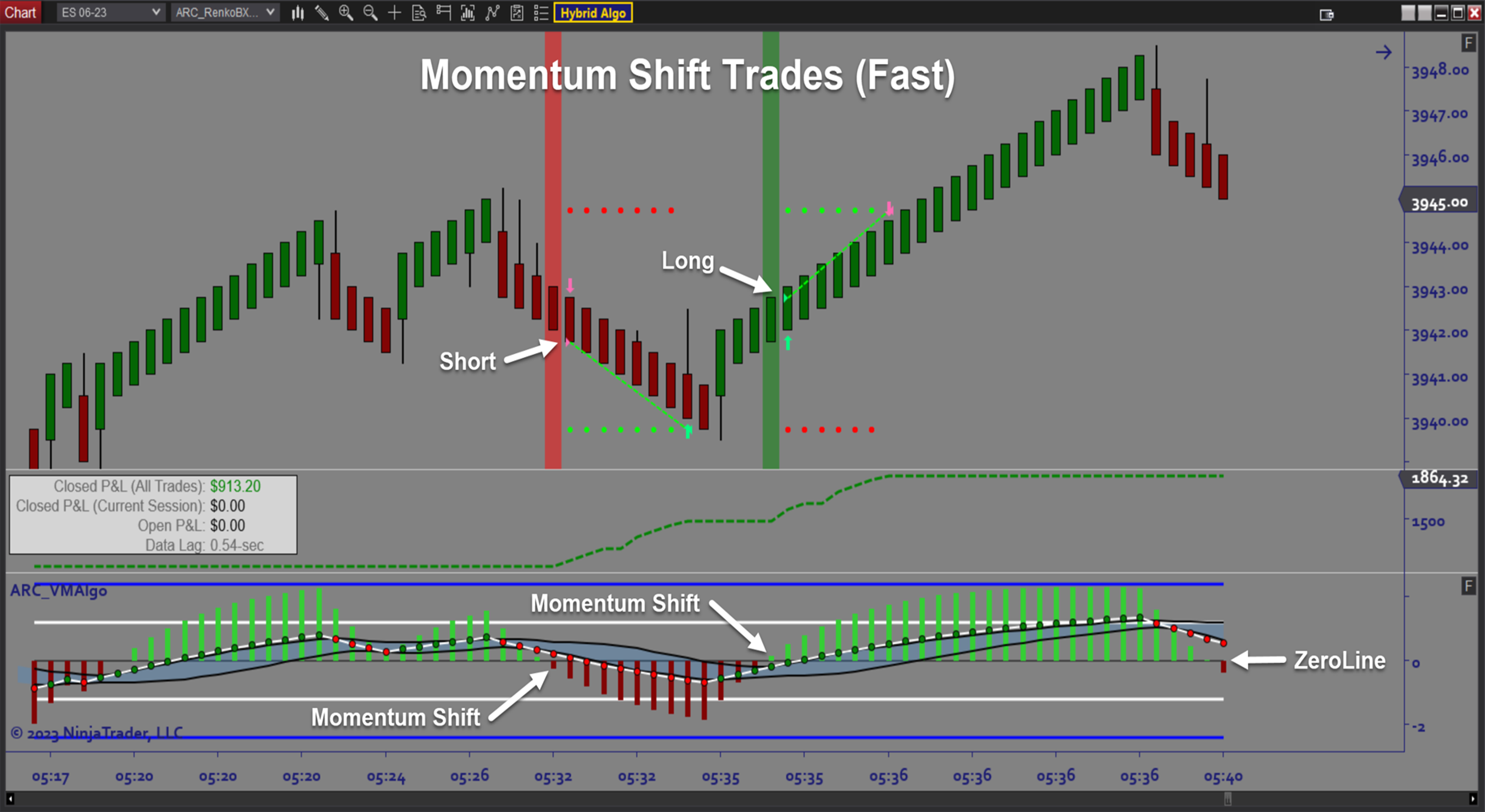

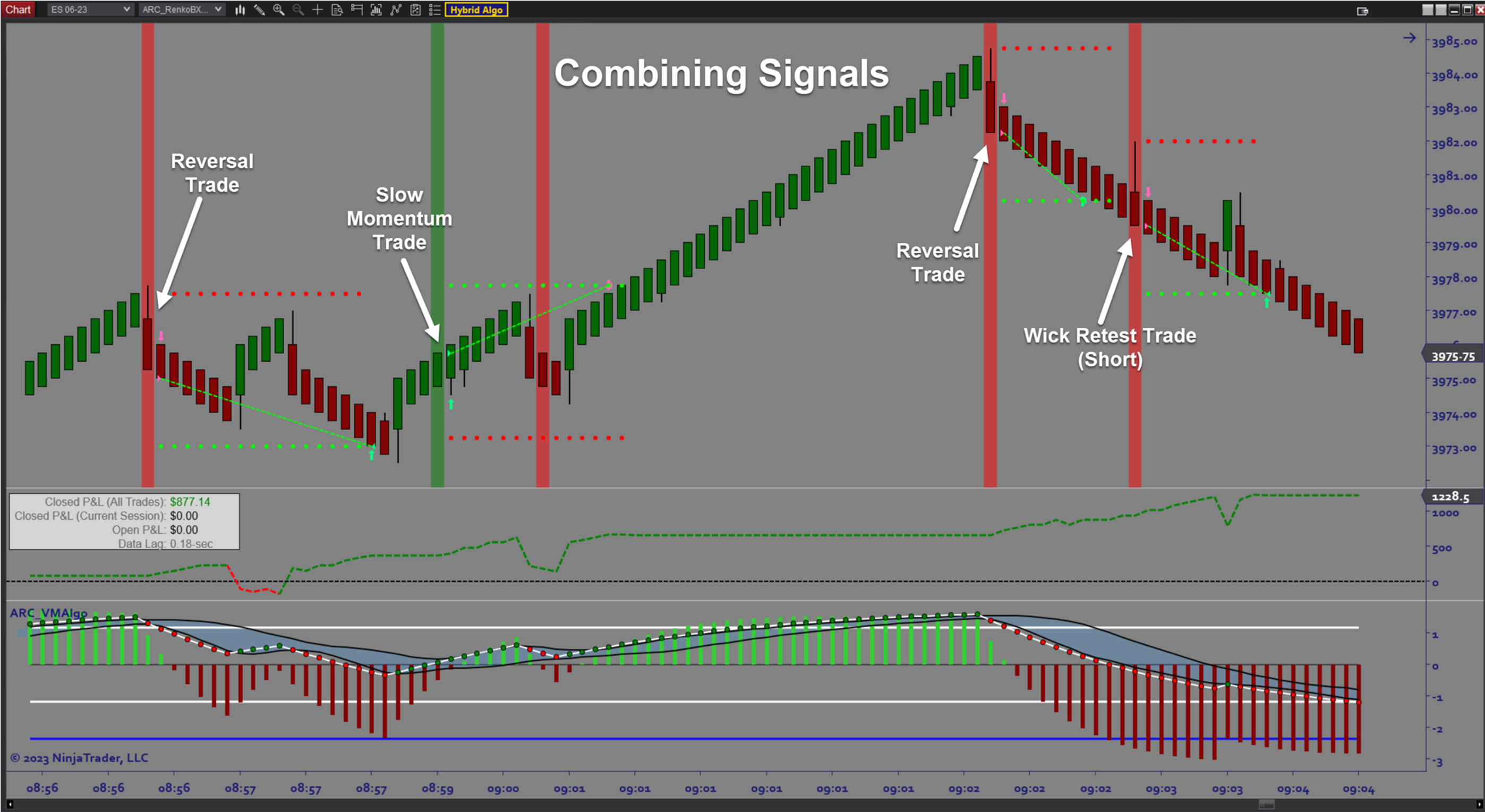

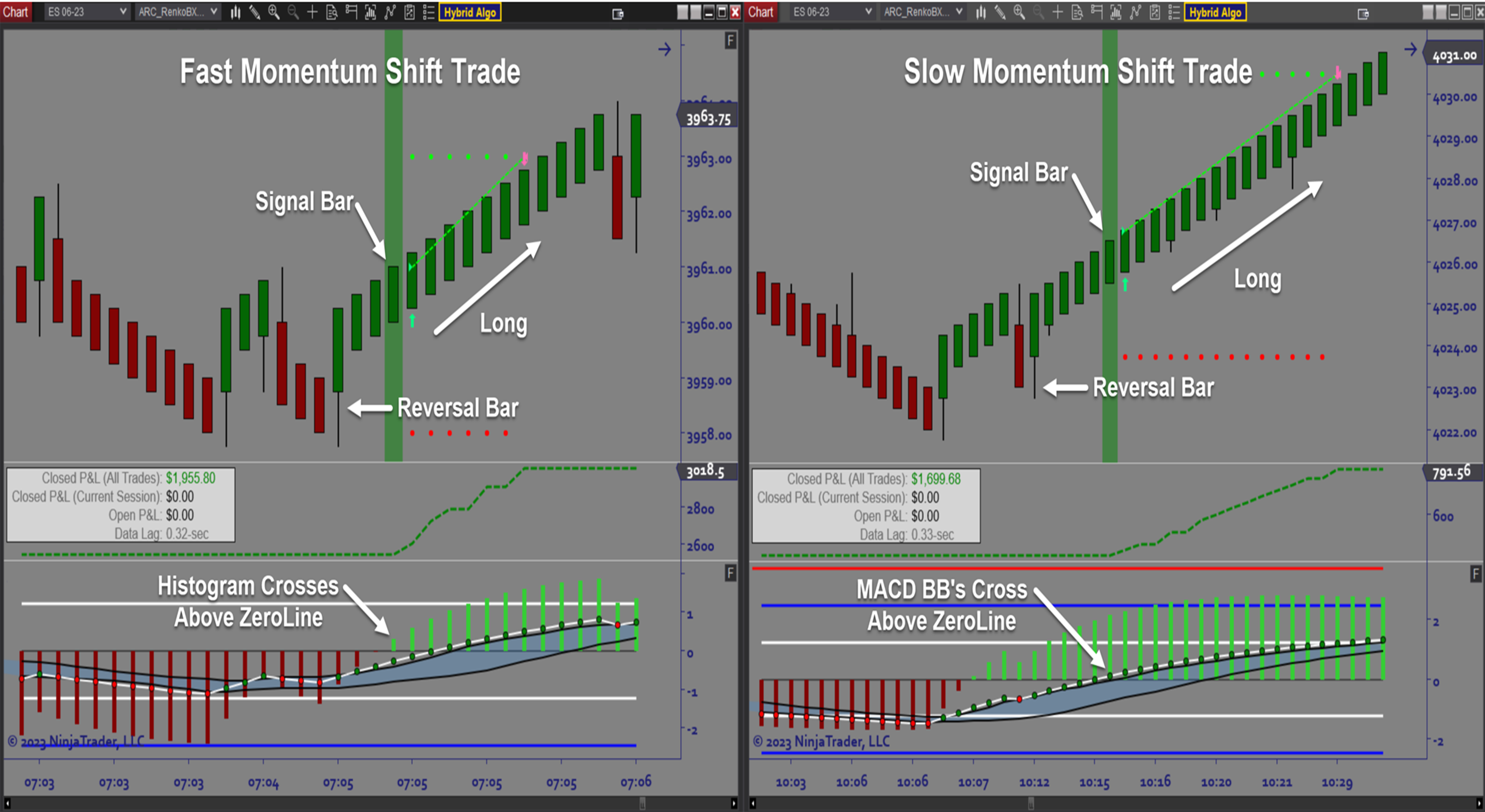

The ARC_Hybrid Algo software is an automated trading solution for Ninjatrader which provides a simple but effective way to auto-trade both reversal patterns and momentum setups. The software leverages custom bartypes to identify trade setups through pattern recognition. The software scans for 2 reversal setups and 2 momentum breakout patterns for a total of 4 different strategies in one auto trader. All entries and exits are handled automatically by the algo. You can trade multiple signals simultaneously, manage directional bias and adjust stops on the fly while the algo is running making this a truly versatile autotrading tool.

Purpose:

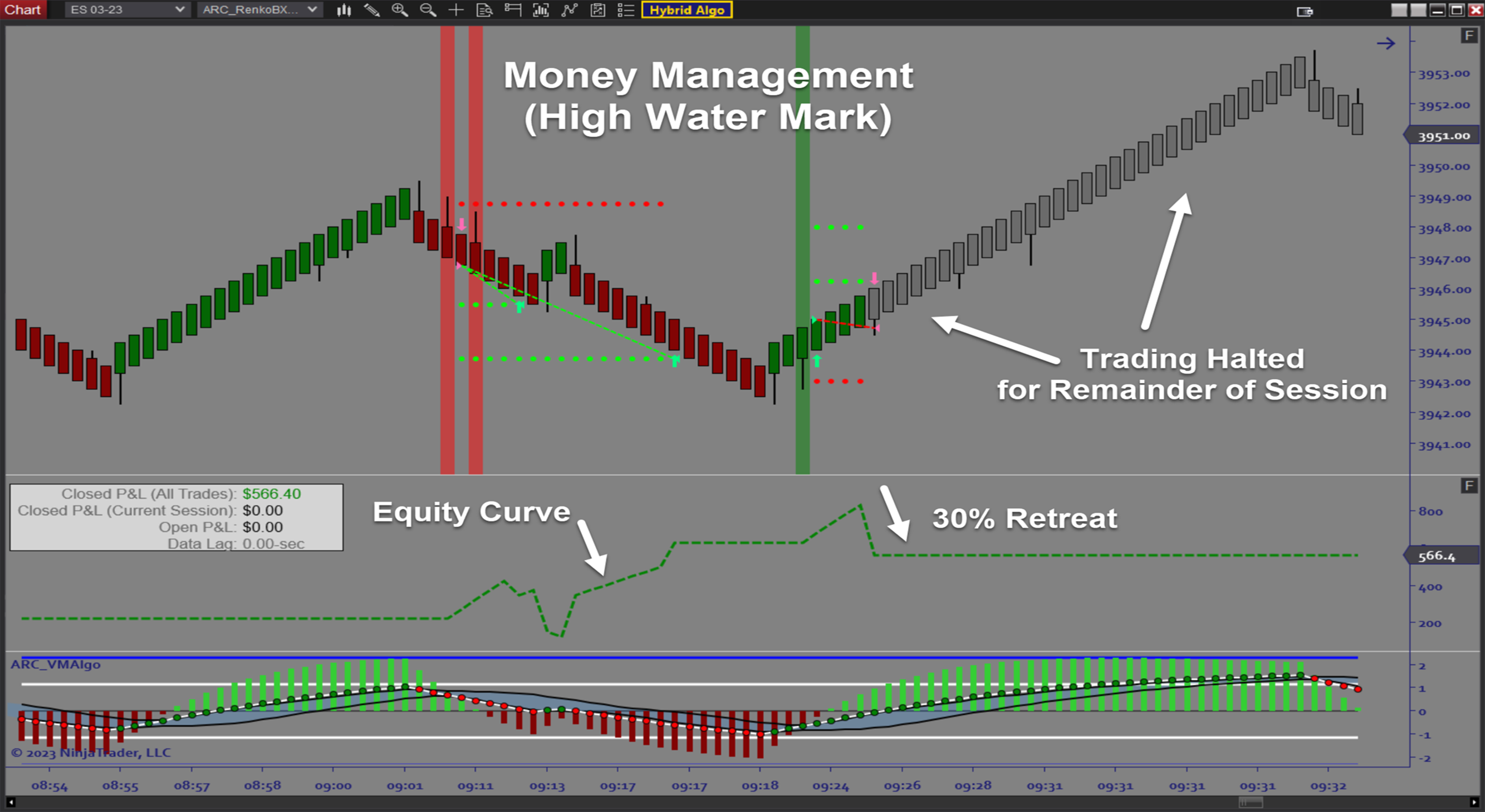

Traders need the Hybrid Algo because reversal patterns and momentum breakouts can occur frequently and traders need a way to efficiently filter out lower probability setups. This Momentum Reversal Algorithm can be difficult to do without a set of clear rules that have been validated through backtesting and optimization. Besides supporting strategy development, the software also handles all order execution according to a user defined trade plan, including risk management, money management, breakeven, and trail functionality. This results in better fills, less mistakes, and ultimately more profitable and consistent trading performance.

Elements:

- Autotrade reversal setups and momentum breakouts all in one system

- Trade multiple setups simultaneously

- Signal filters included for finding the best setups and avoid overtrading

- On screen trade signals, entry/exit markers, stops/targets, realized/unrealized P&L

- Customizable Trade Plan

- AutoTrail and Breakeven

- Money Management (Max Daily Loss, Profit Goals, High Watermark Trail)

- Trend Filters/Momentum/OBOS FIlters

- Datafeed Lag Monitor for Safety

- Backtesting and Optimization

Functions:

The Hybrid Algo is best used by taking advantage of built in backtesting and optimization capability to find profitable settings for your chosen instrument. Each market will have unique characteristics. Strategies can then be forward tested in live trading conditions. Best practice is to optimize one Signal type at a time and then trade multiple setups if desired. The key is to follow the steps from design and optimization to Sim trading and only when performance is validated to actually autotrade a live account.

Problem Solved:

- Stops traders from second guessing reversal setups

- Stops traders from second guessing momentum breakouts

- Stops traders from entering at the wrong time or place

- Stops traders from getting stopped out on false signals

- Stops traders from sabotaging their trading due to fear and uncertainty

- Stops traders from relying on opinion and guesswork

- Stops traders from entering too late and missing out on most of the profits

- Stops traders from dealing with the stress of live trading

- Stops traders from breaking the rules of their trade plan