PatternFinder Algo A.M.A.

Overview:

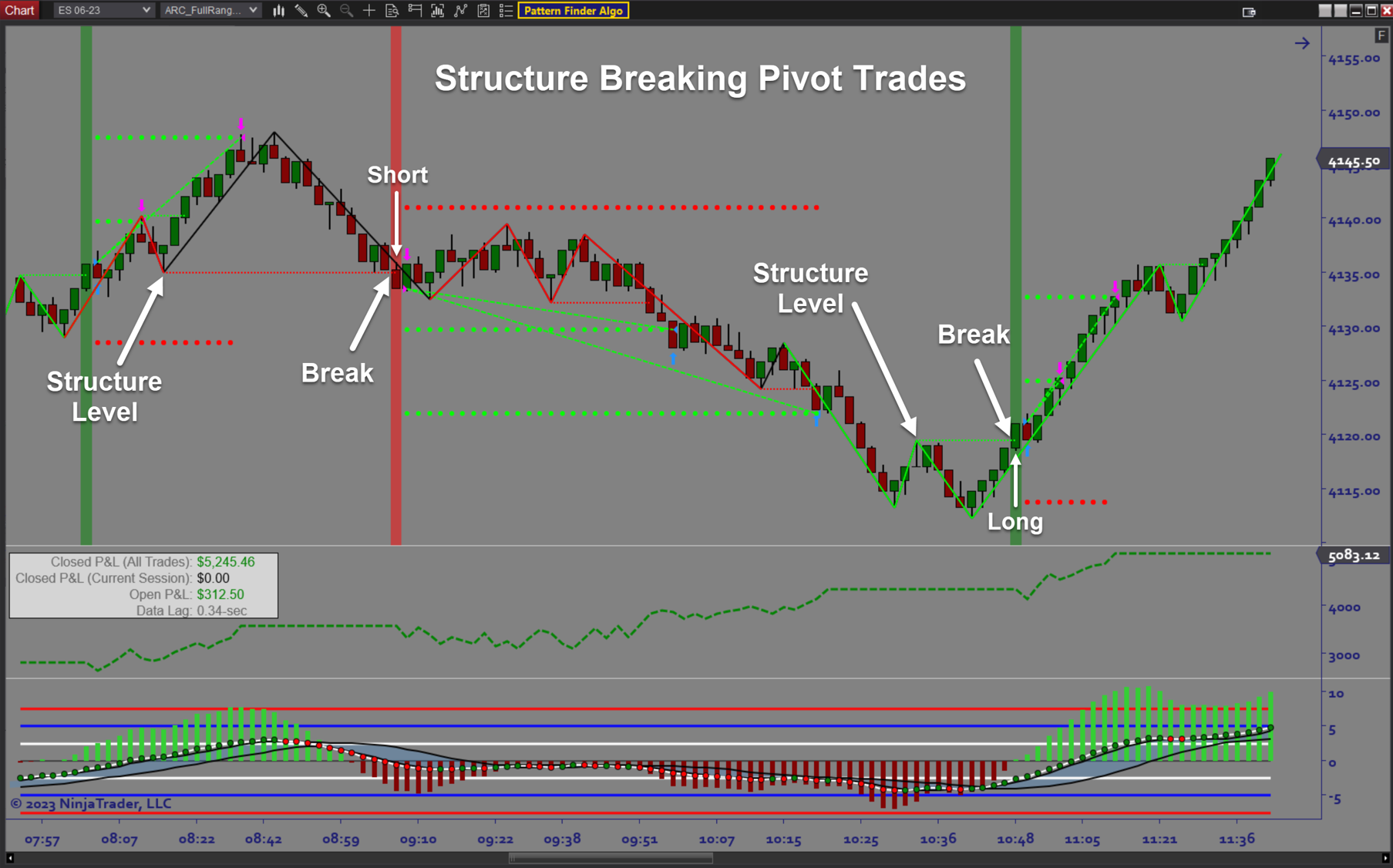

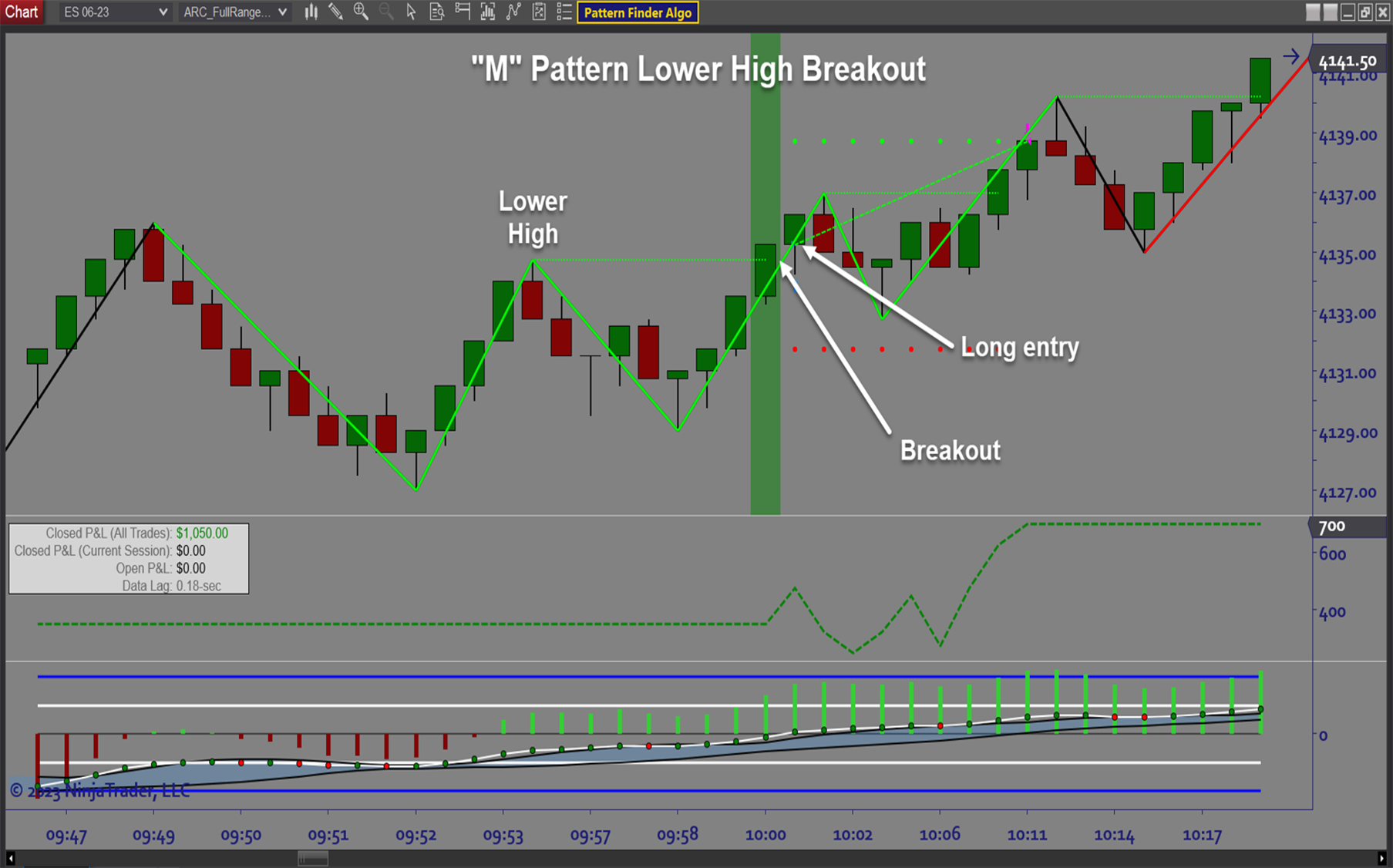

The PatternFinder Algo is an automated trading solution for Ninjatrader which uses pattern recognition to locate breakout pattern setups that can be used to autotrade any instrument and timeframe. Breakout patterns are based on mapping out market structure and finding “M” and “W” patterns which generate a variety of automated trade signals that can be exploited for consistent profits. It is difficult to trade these patterns manually so using a flexible and powerful automated trading system such as the PatternFinder Algo is the best way to take advantage of breakouts when they occur.

Purpose:

Traders need the PatternFinder Algo because breakout trades happen quickly and trading them manually sometimes causes you to miss out on most of the potential profits. The software allows you to customize the algo settings to each market as well as your own preferred trading style. Market Structure is key to understanding when to trade and when to wait. This is all done automatically so all you have to do is focus on fine tuning your trade plan and let the software do the trading for you.The end result is more consistent trading performance.

Elements:

- Autotrade market structure breakouts

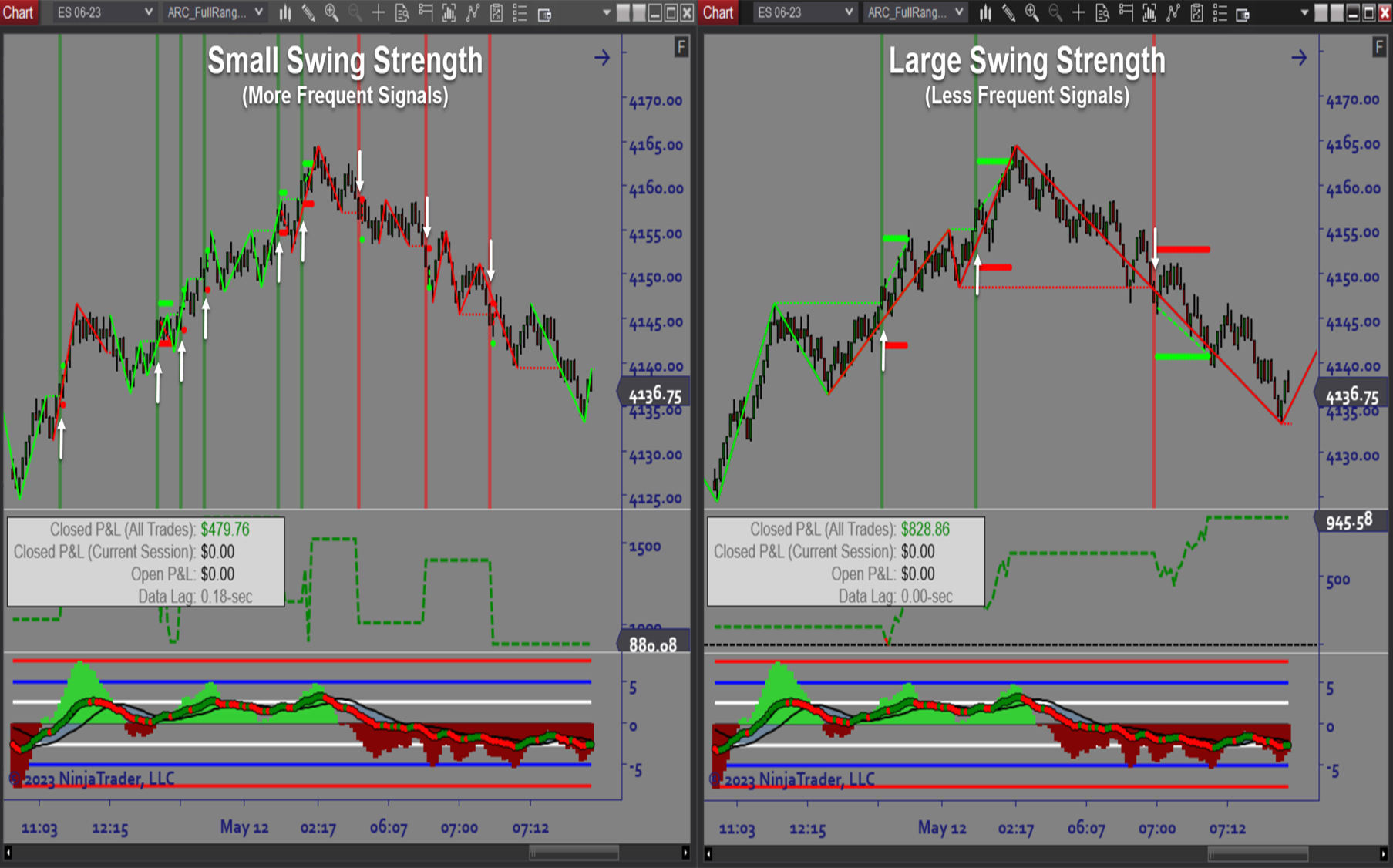

- Fine-tune market structure to fit any trading style

- Customizable Signal logic to tailor fit your strategy to each market that you trade

- On-screen trade signals, entry/exit markers, stops/targets, real-time P&L

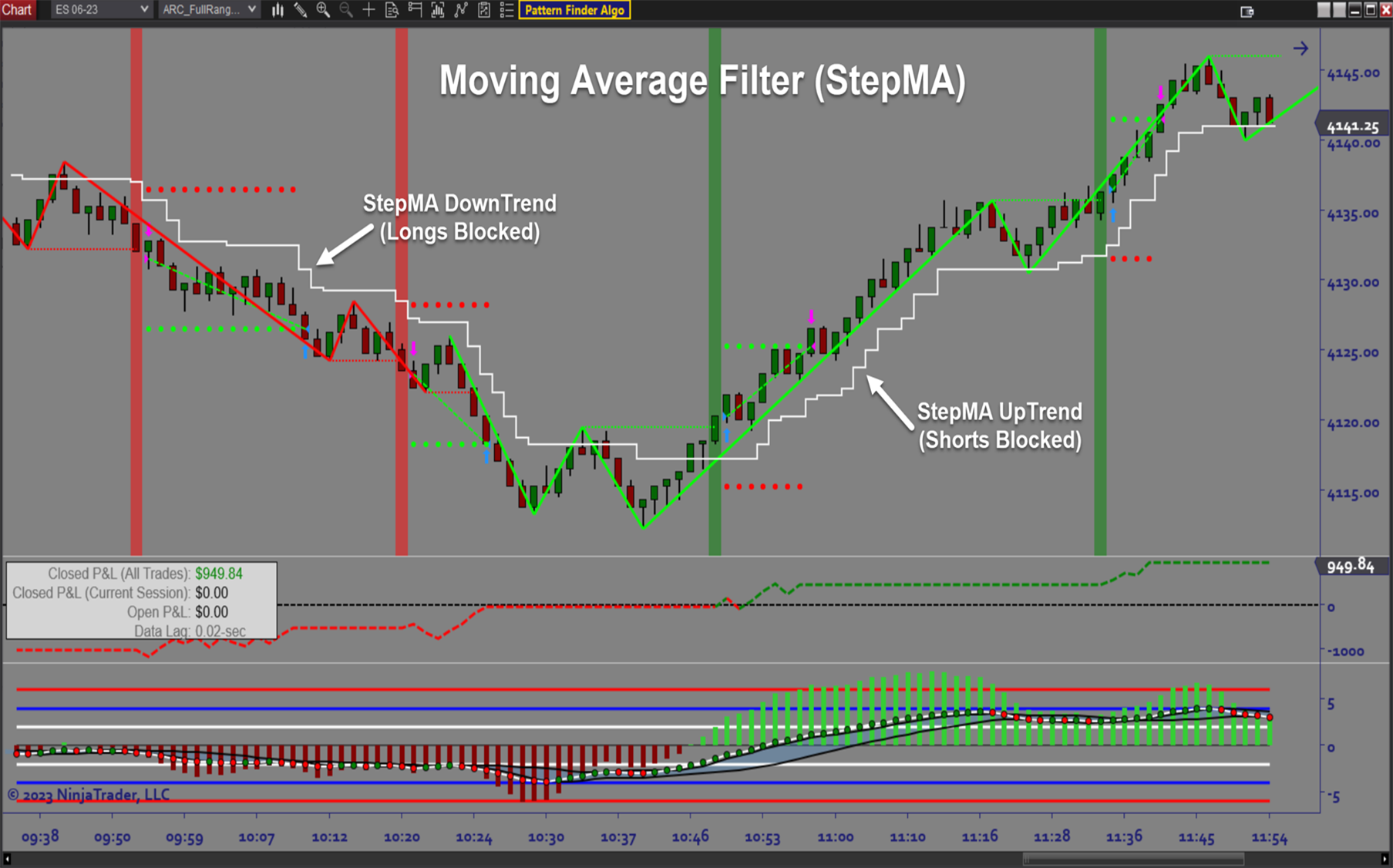

- Dual-purpose market structure algorithm applied to both trade signals and trend filtering

- Fine-tuned momentum filtering to capture only the best setups

- ATR-based Stops and R-Multiple Targets

- AutoTrail and Breakeven

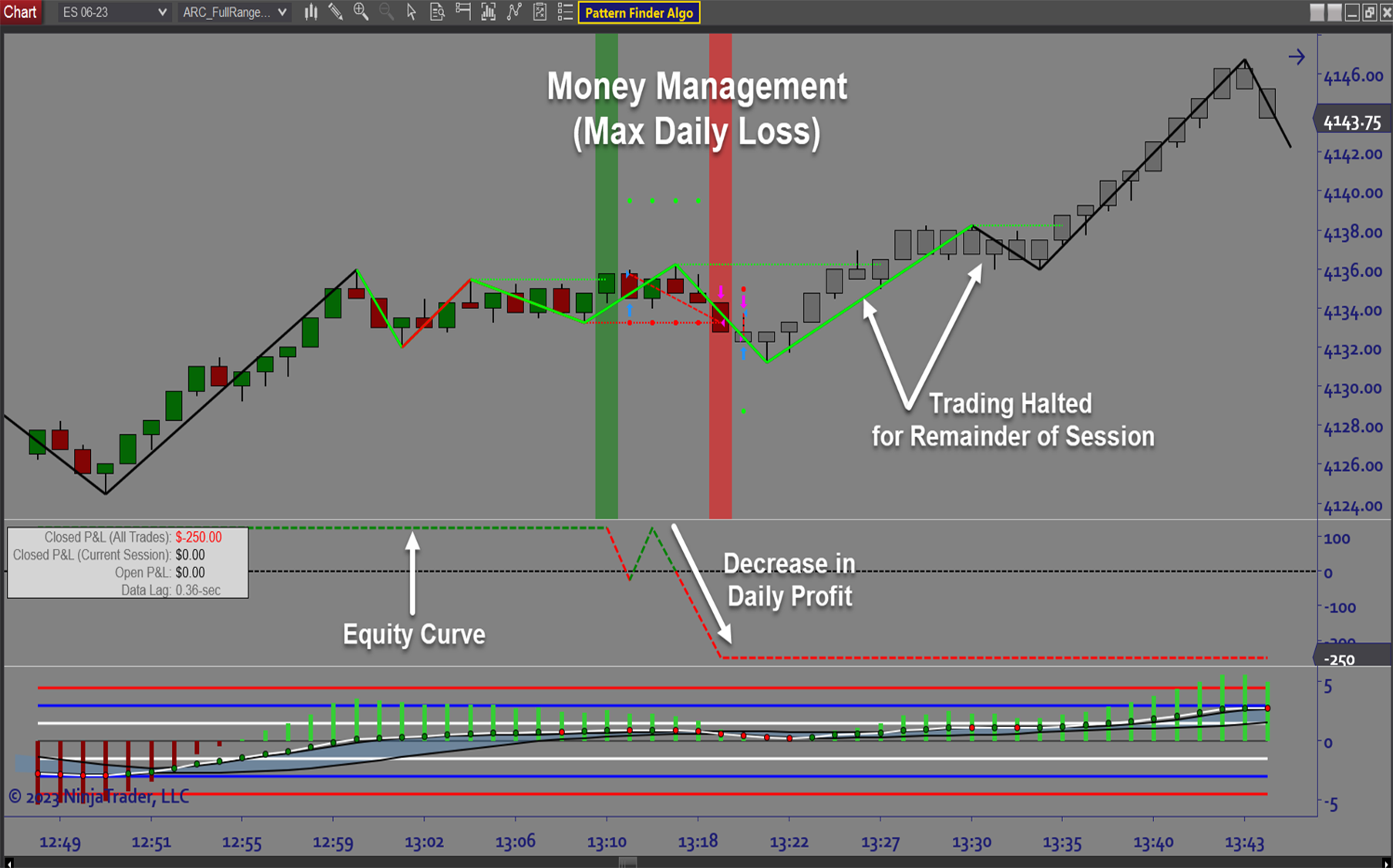

- Money Management (Max Daily Loss, Profit Goals, High Watermark Trail)

- Backtesting and Optimization

Functions:

The PatternFinder Algo is best used by finding the best market structure settings for the specific instruments you trade. This in turn determines the frequency and the expected size of the move once the breakout occurs. This helps with setting the stop size and target placement for the customizable trade plan which is an important component of the Autotrader. The built-in optimization and backtesting will help refine your settings. The key is to validate those settings with SIM trading and then when ready, allow the software to trade your account live for consistent profits.

Problem Solved:

- Stops traders from second-guessing breakout setups

- Stops traders from entering too late and missing out on most of the profits

- Stops traders from misreading market structure

- Stops traders from overtrading

- Stops traders from sabotaging their trading due to fear and uncertainty

- Stops traders from entering at the wrong time or place

- Stops traders from trading when momentum conditions are not ideal

- Stops traders from dealing with the stress of live trading

- Stops traders from breaking their money management rules