HFT ALGO ASK ME ANYTHING (A.M.A.) VIDEOS

Overview:

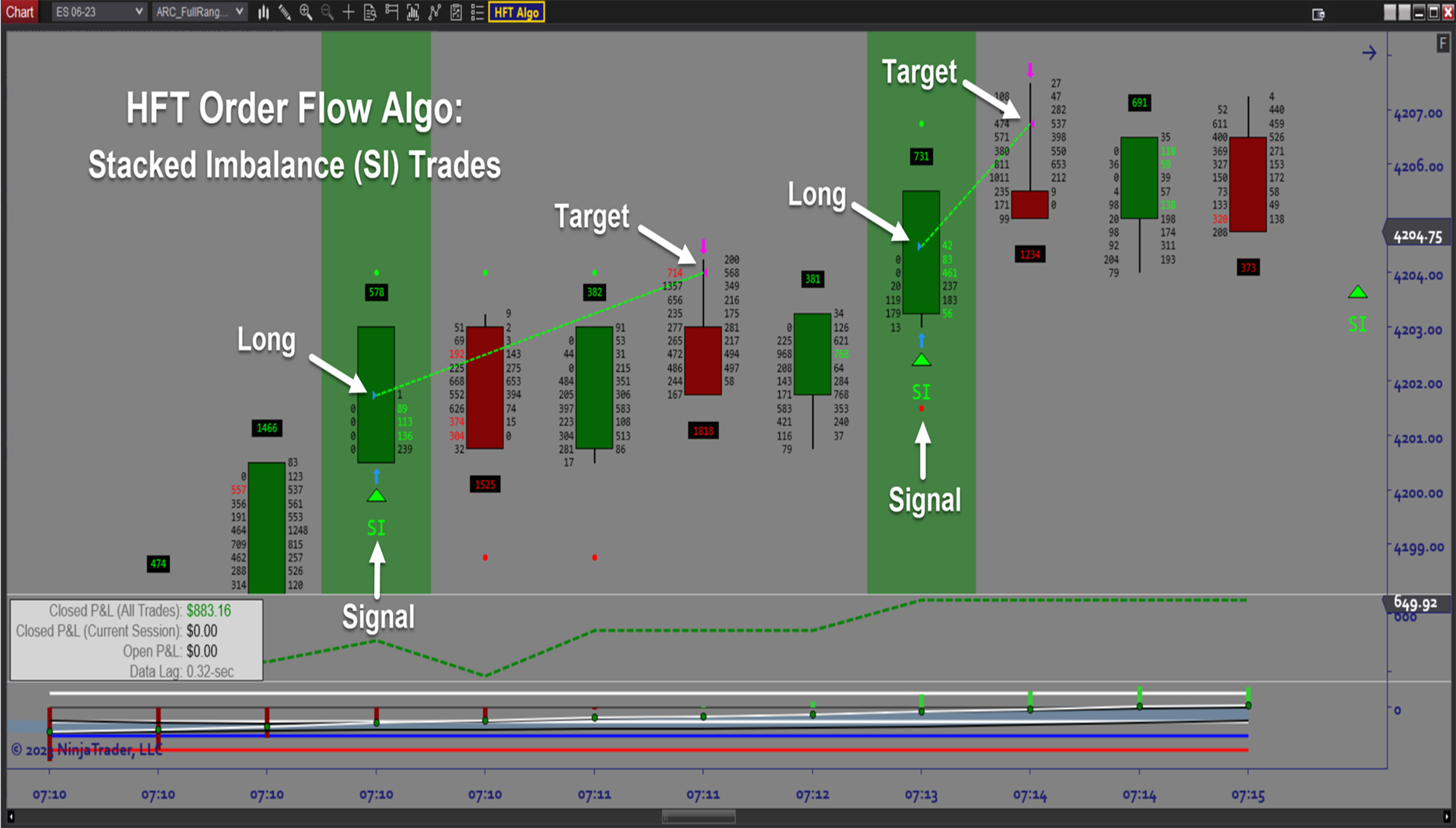

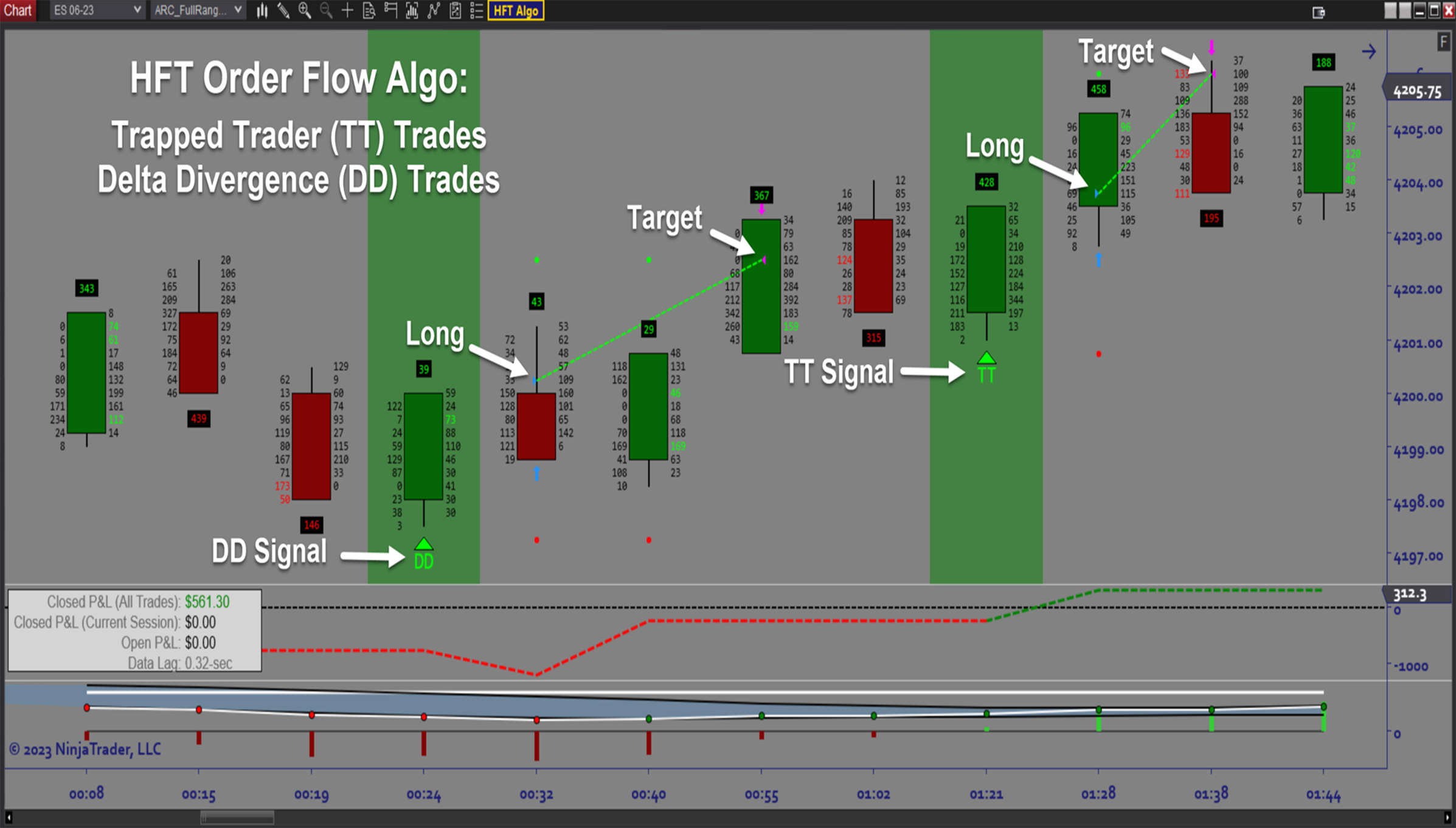

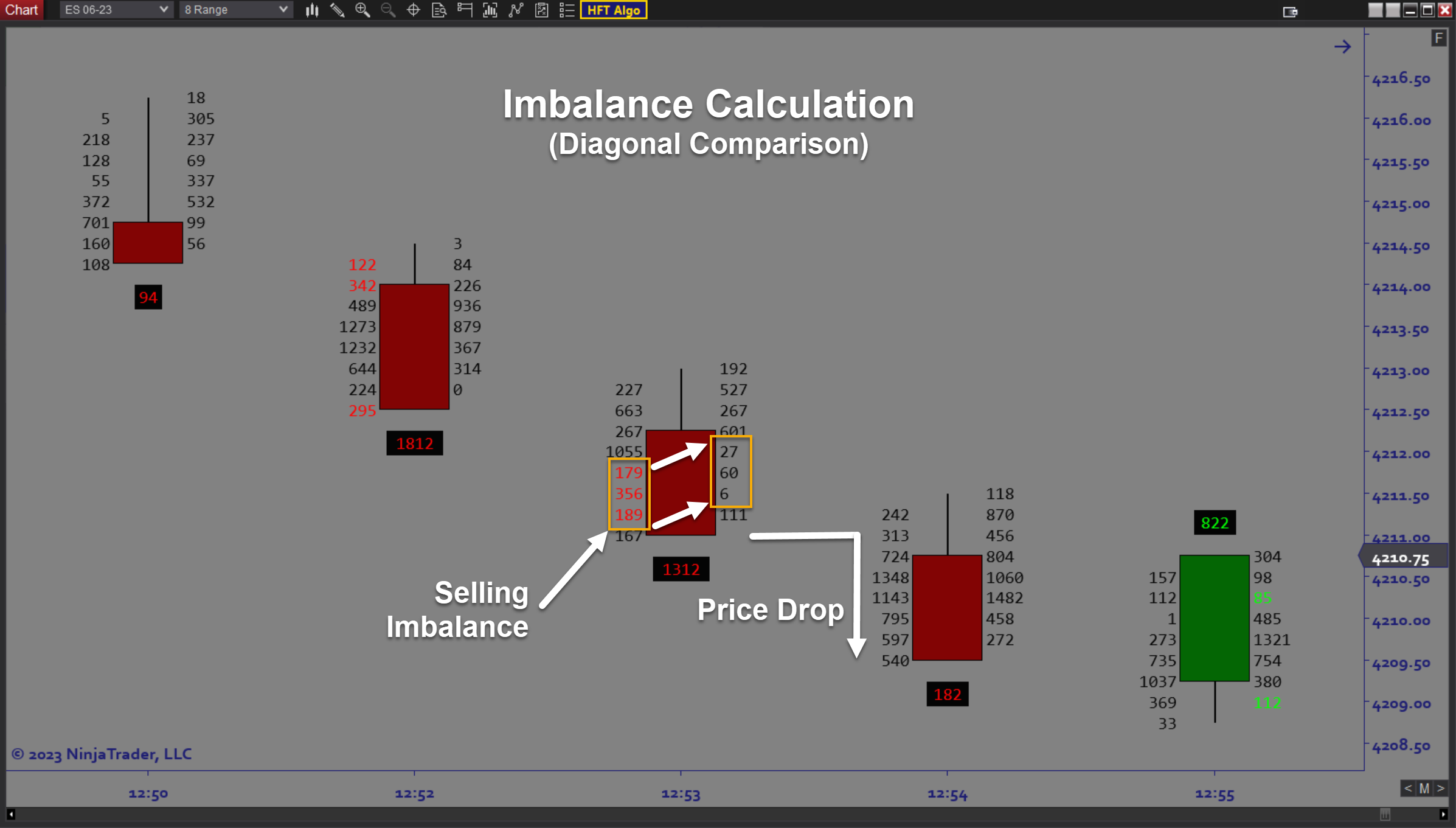

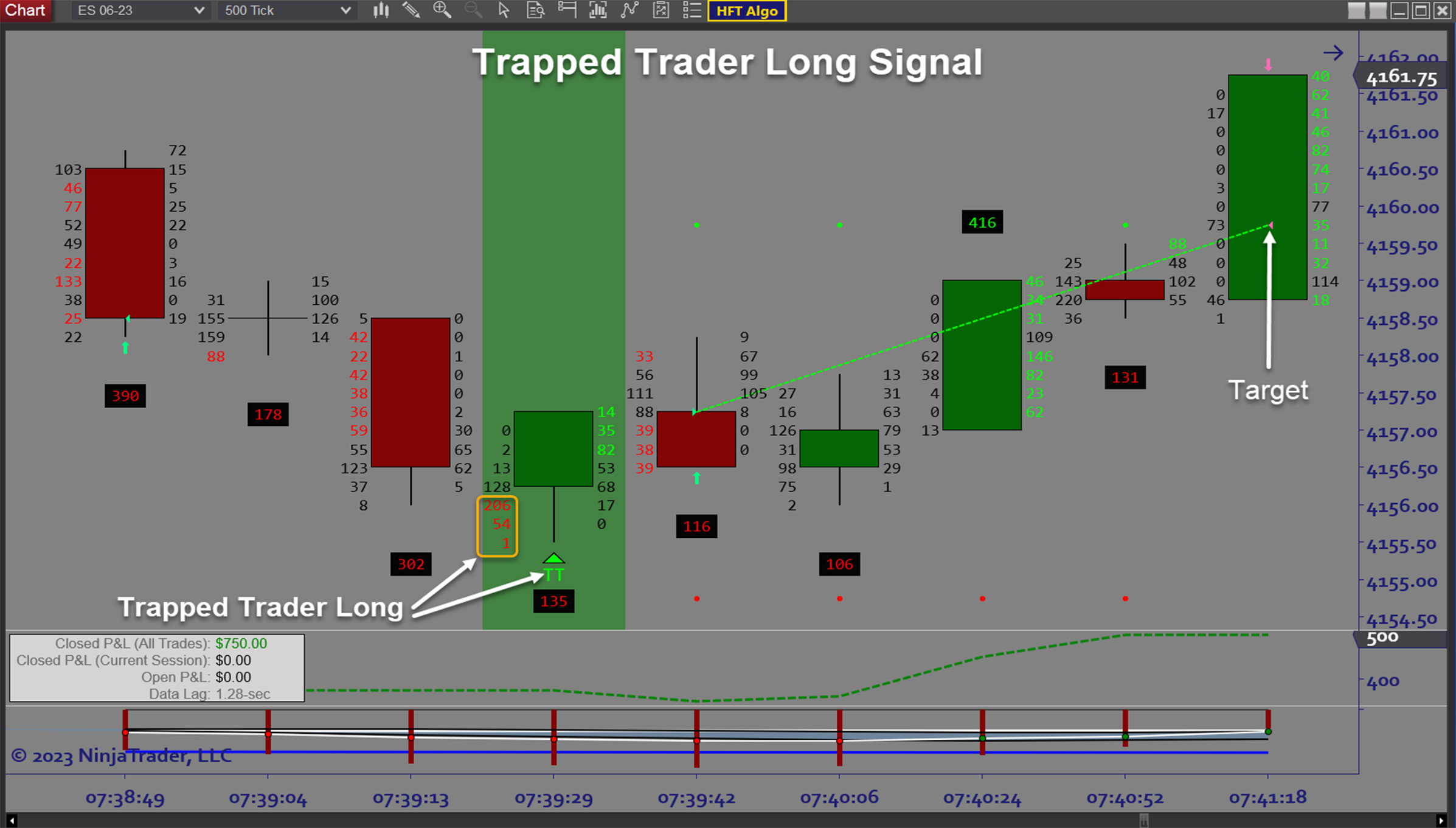

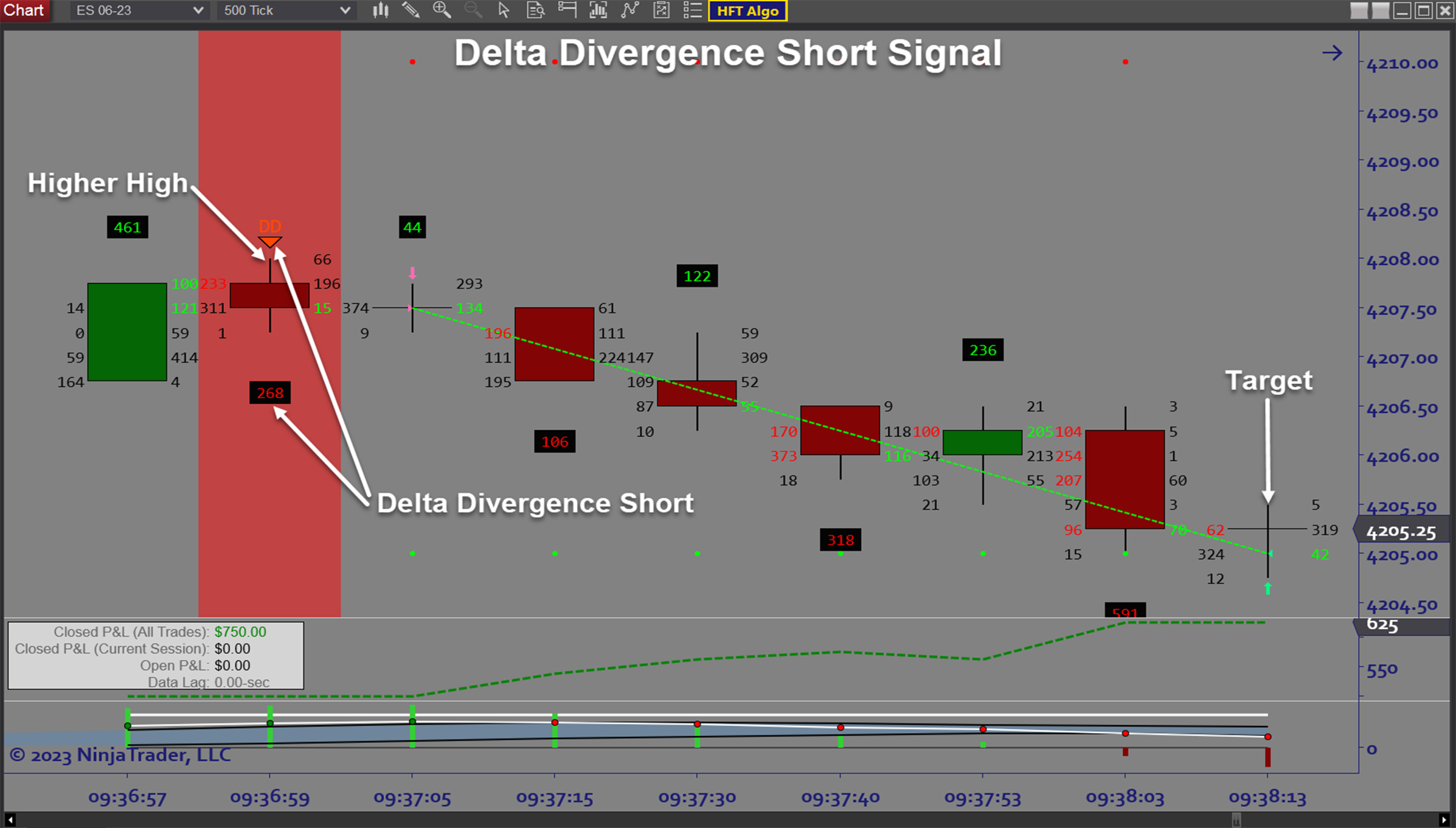

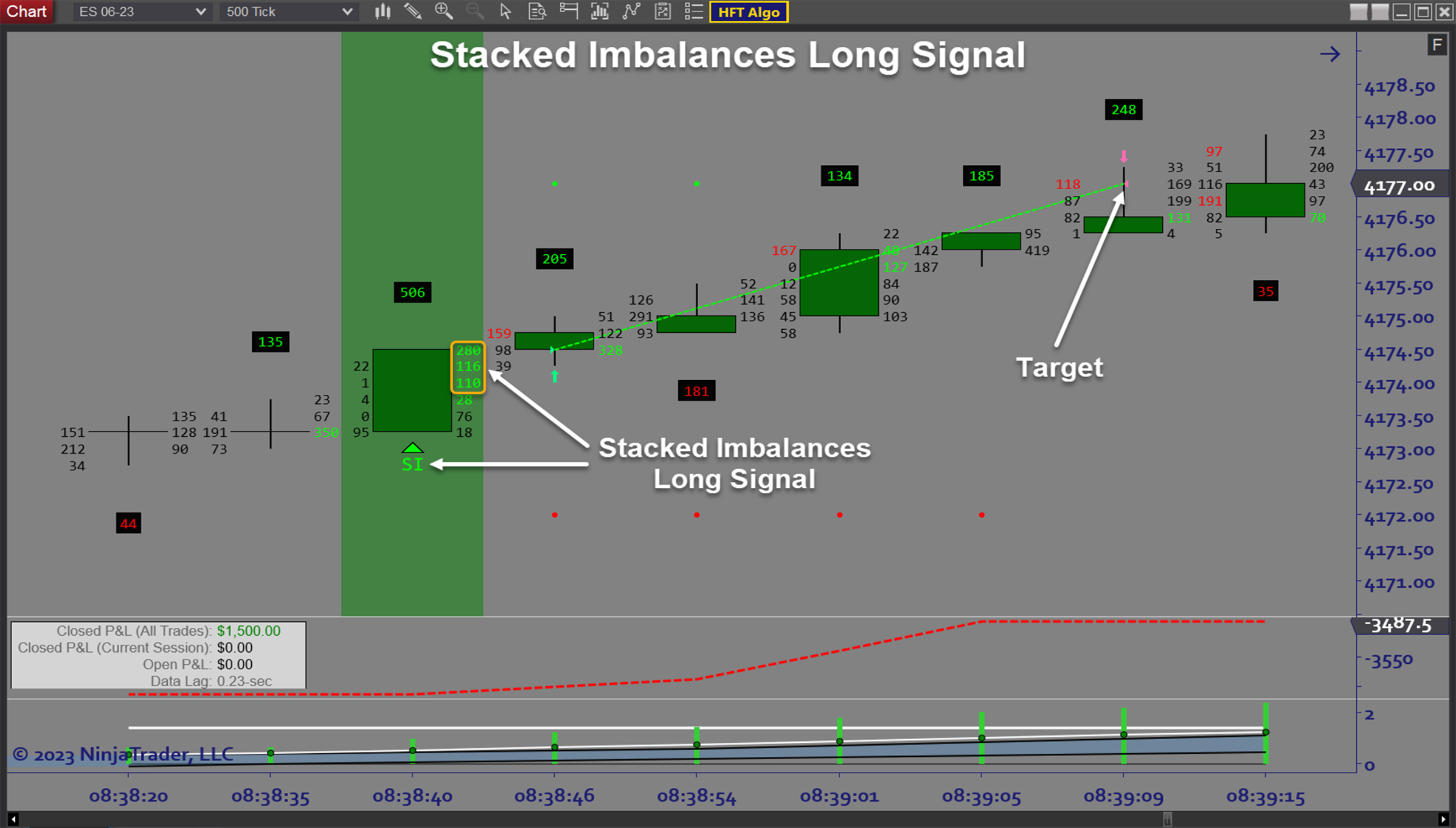

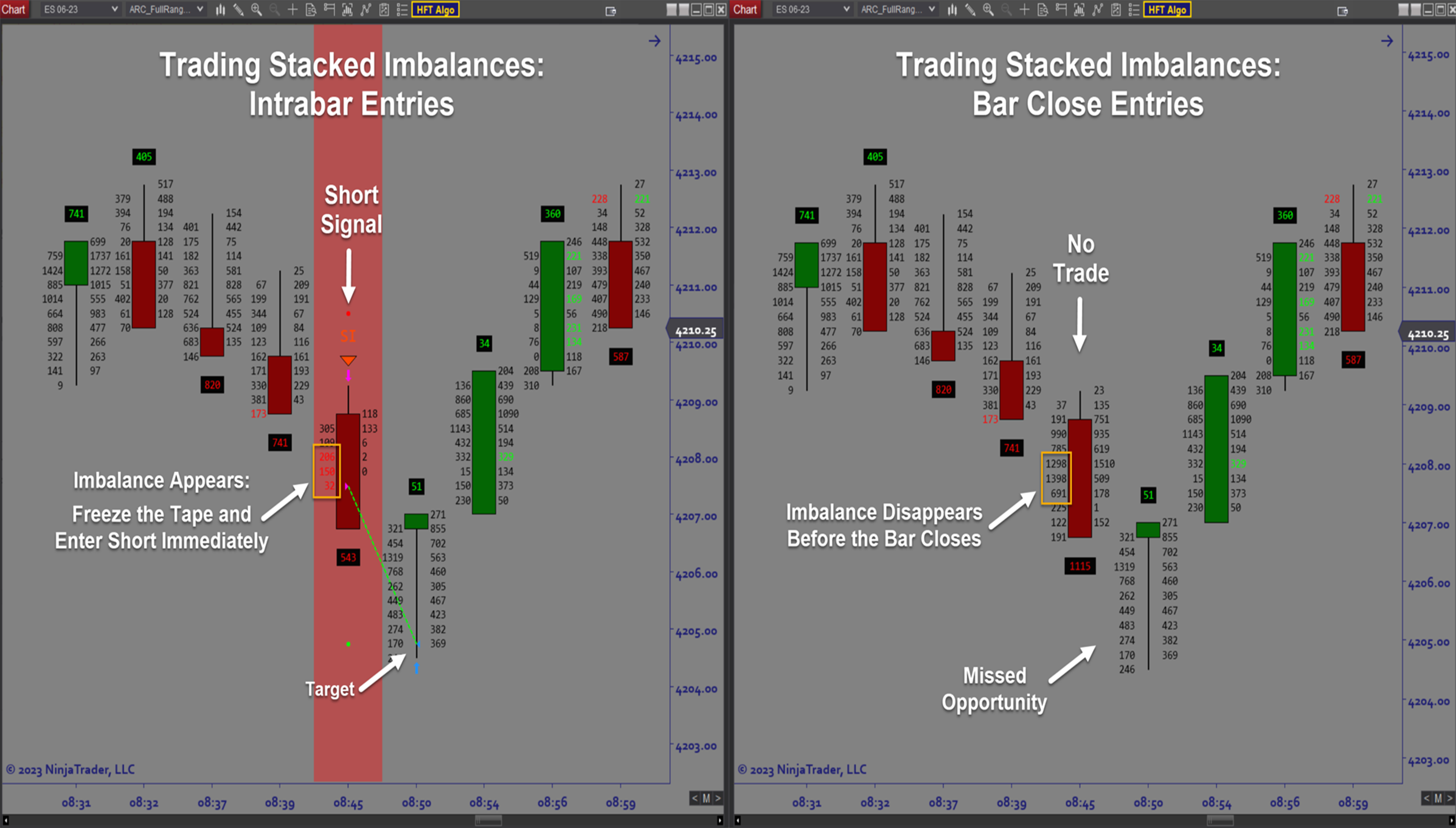

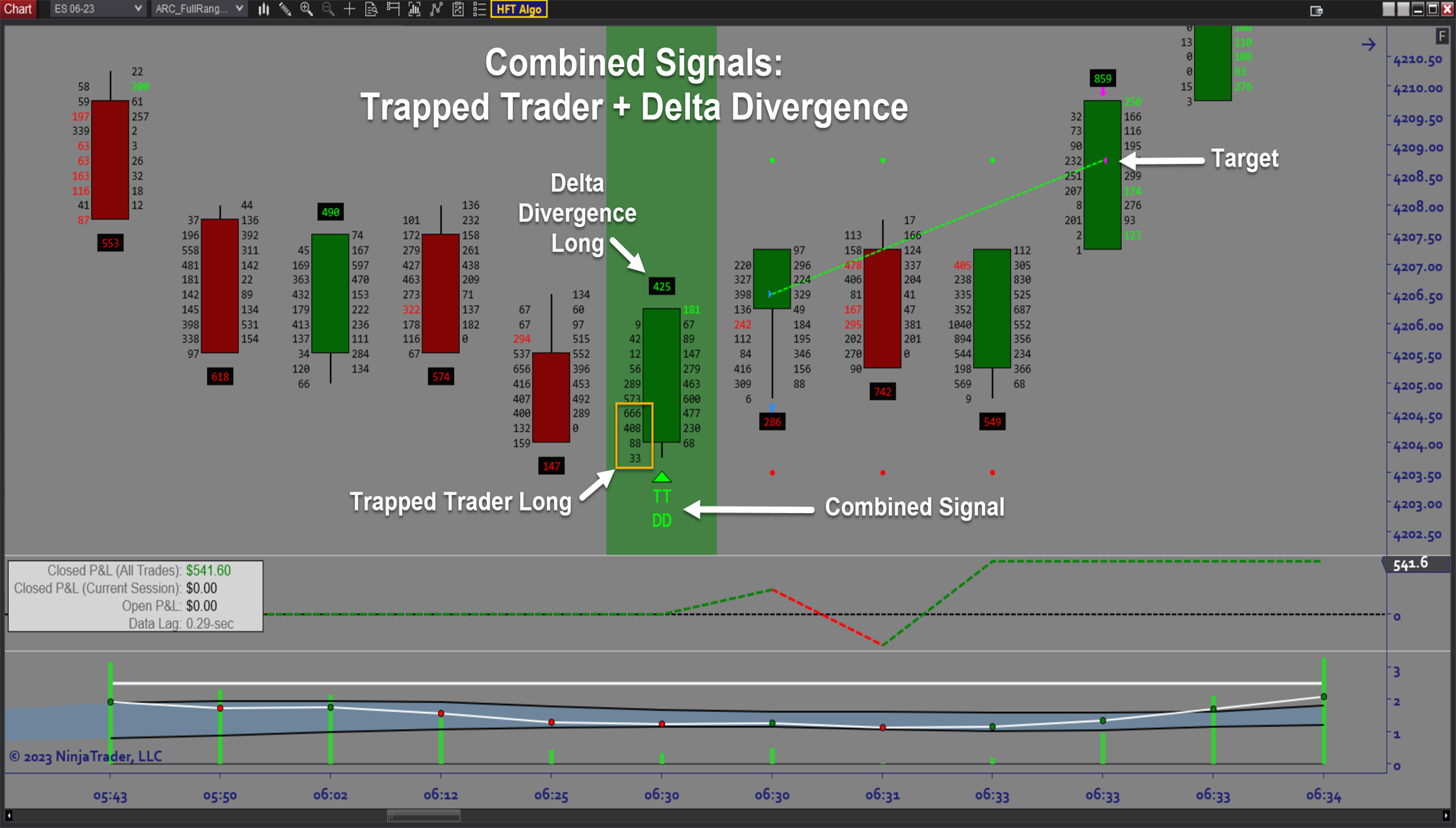

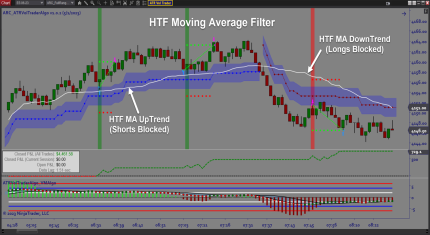

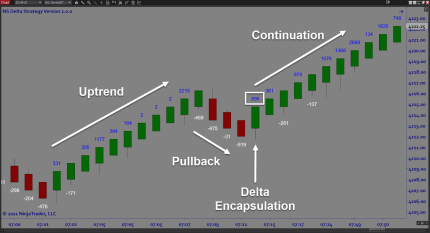

The ARC_HFT Algo software is an automated trading solution for Ninjatrader which uses Order Flow imbalances, delta divergence, and buyer/seller exhaustion for trade setups. This trading system is named “HFT” (high frequency trading”) because of its ability to continuously monitor order flow conditions and “freeze the tape” intrabar at the very moment that a setup occurs. Trades are entered immediately rather than waiting for the current bar to close. This means that you can capture many profit opportunities that are often missed when trading manually or with software that does not have an “HFT” capability. These intrabar entries provide a substantial edge when it comes to capturing quick profits based on real time order flow data.Purpose:

Traders need the HFT Algo because order flow imbalances, exhaustion, and divergence occur constantly but cannot be captured unless you have a specialized tool to exploit those opportunities in real time. Trying to trade these types of setups manually is nearly impossible because the setup condition may appear and then disappear in the blink of an eye. So it is very difficult to recognize visually let alone have enough time to react to exploit these setups. The HFT Algo opens up an abundance of profit opportunities that are simply not available otherwise.Elements:

- High frequency trading capability

- Intrabar signal detection in real time

- Stacked Imbalance, Trapped Trader, and Delta Divergence trade setups

- Individual and Combined Signals capability

- Option to choose intrabar or bar close entries

- Customizable Signal logic to tailor fit your strategy to each market that you trade

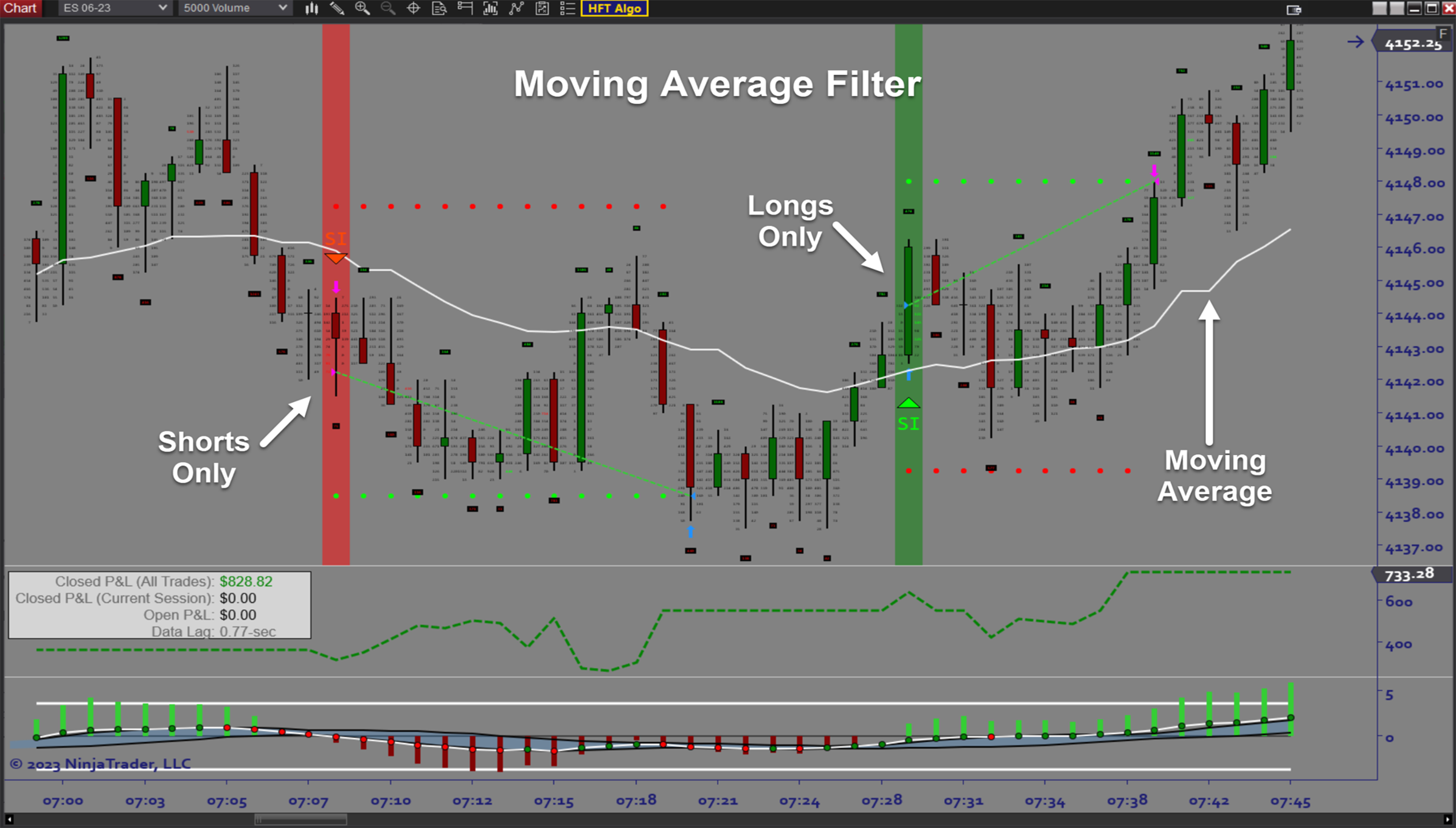

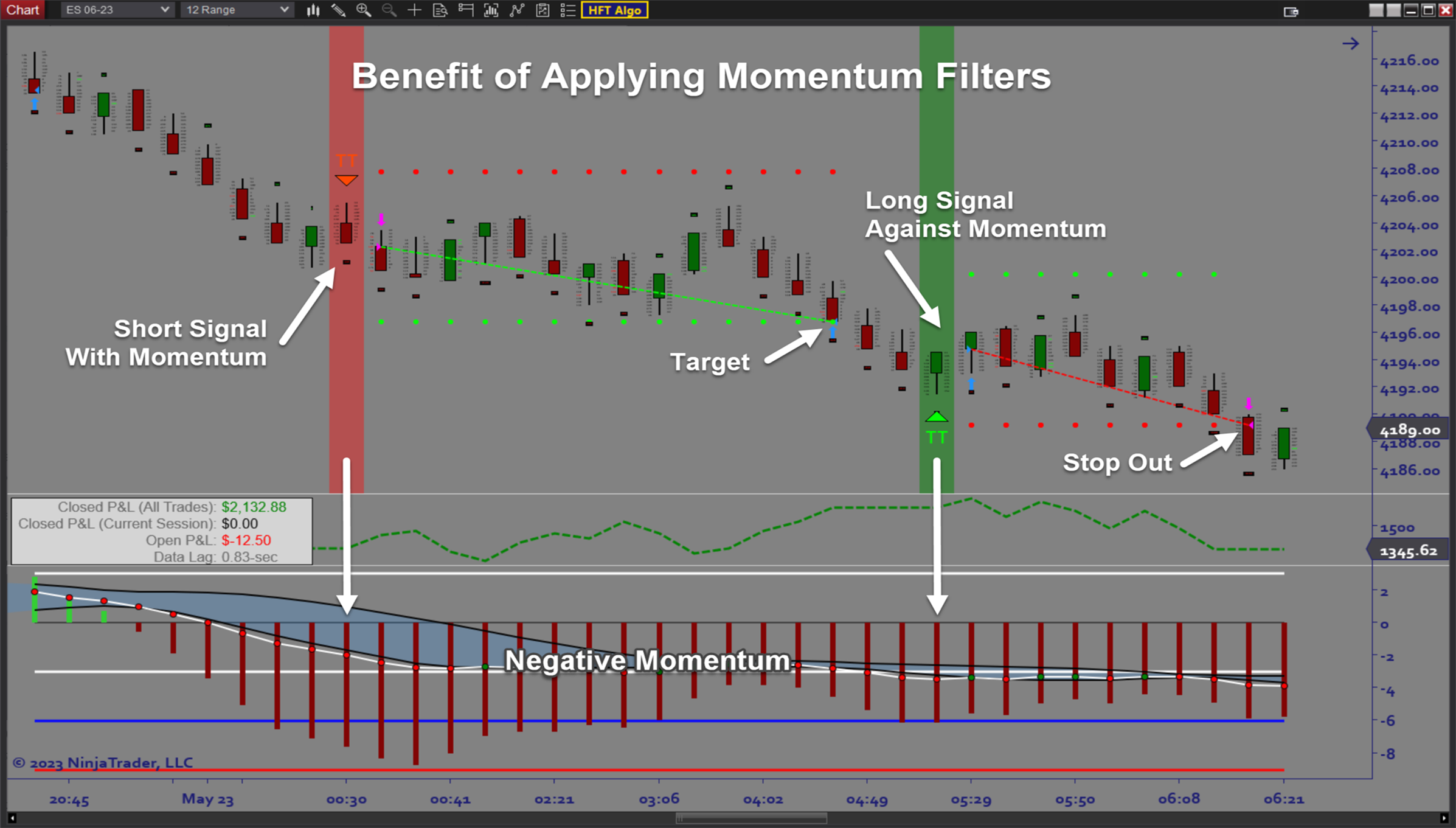

- Customizable Signal filters based on trend direction, momentum , and market structure

- Ability to control directional bias and breakeven strategies on the fly while the algo is enabled

- On screen trade signals, entry/exit markers, stops/targets, realtime P&L

- ATR-based Stops and R-Multiple Targets

- AutoTrail and Breakeven

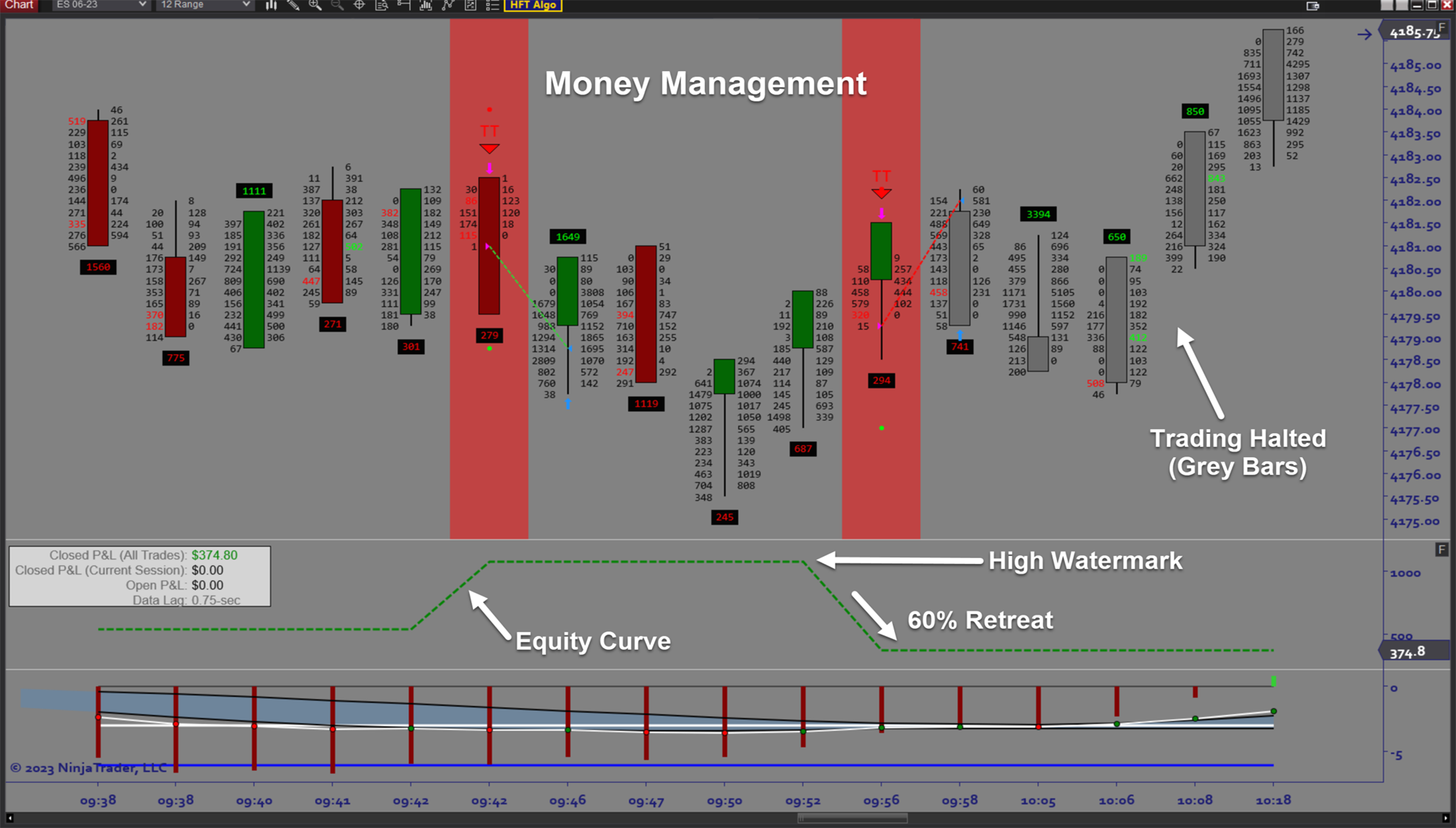

- Money Management (Max Daily Loss, Profit Goals, High Watermark Trail)

- Backtesting and Optimization

Functions:

The HFT Algo is best used by using the backtesting and optimization capabilities to customize the algo to each specific instrument that you trade. The signal settings are quite flexible enabling you to fine tune to your favorite markets. The HFT Algo was specifically designed to take advantage of the many hidden opportunities that arise in the order flow data. It would be impossible to exploit these setups without a tool such as this. The key is to validate those settings with Sim trading and then when ready, allow the software to trade your account live for consistent profits.Problem Solved:

- Stops traders from second guessing order flow analysis

- Stops traders from missing out on hidden order flow setups

- Stops traders from entering too late and missing out on most of the profits

- Stops traders from dealing with the stress of manual live trading

- Stops traders from sabotaging their trading due to fear and uncertainty

- Stops traders from overtrading

- Stops traders from spending too much time exposed to risk in the market

- Stops traders from waiting forever for a good trade setup

- Stops traders from breaking their money management rules

- Stops traders from breaking the rules of their trade plan

![HFT_Front[1]](https://architectsai.com/wp-content/uploads/2023/06/HFT_Front1.png)