ATRVOL ALGO VIDEOS

Overview:

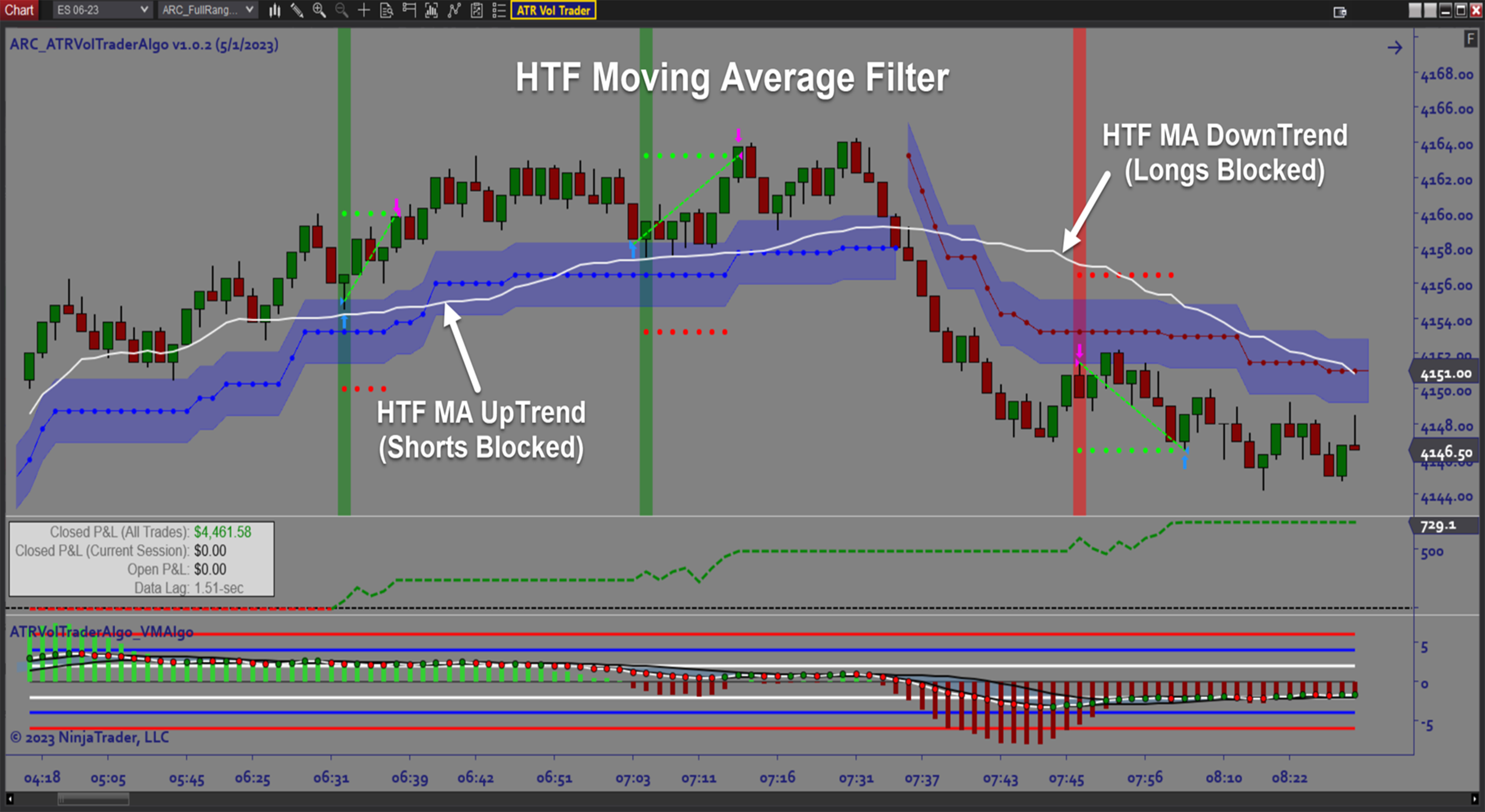

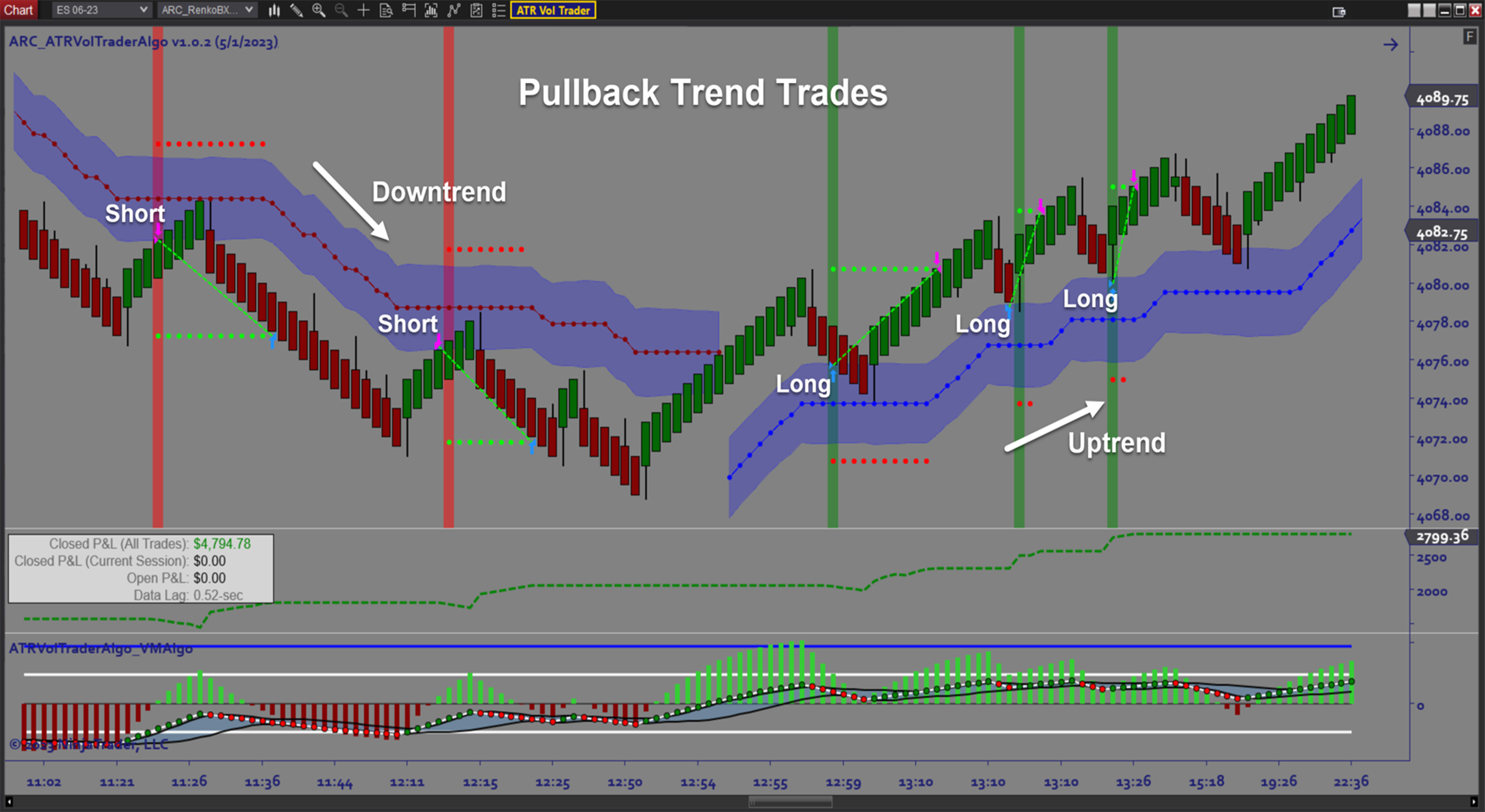

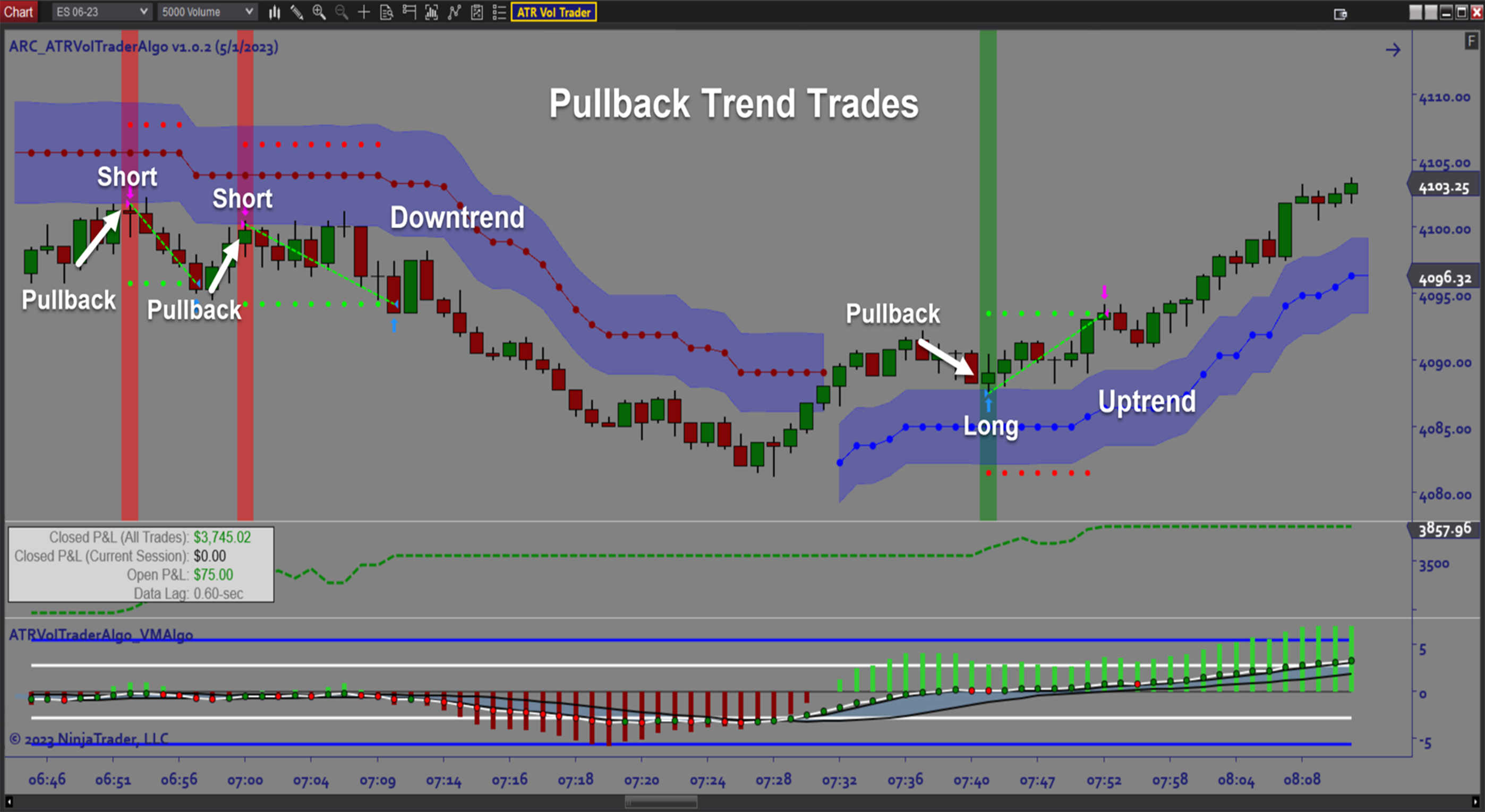

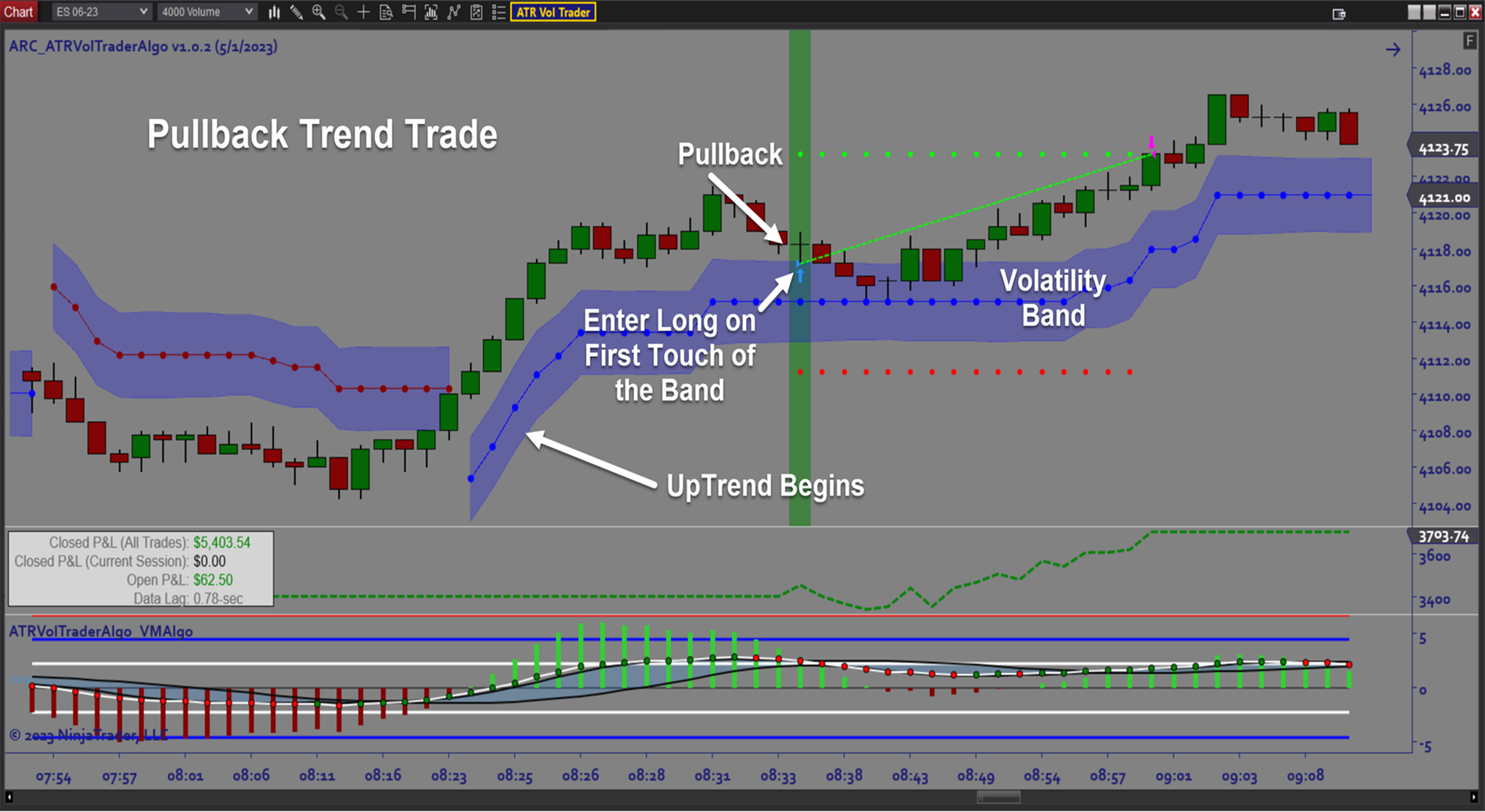

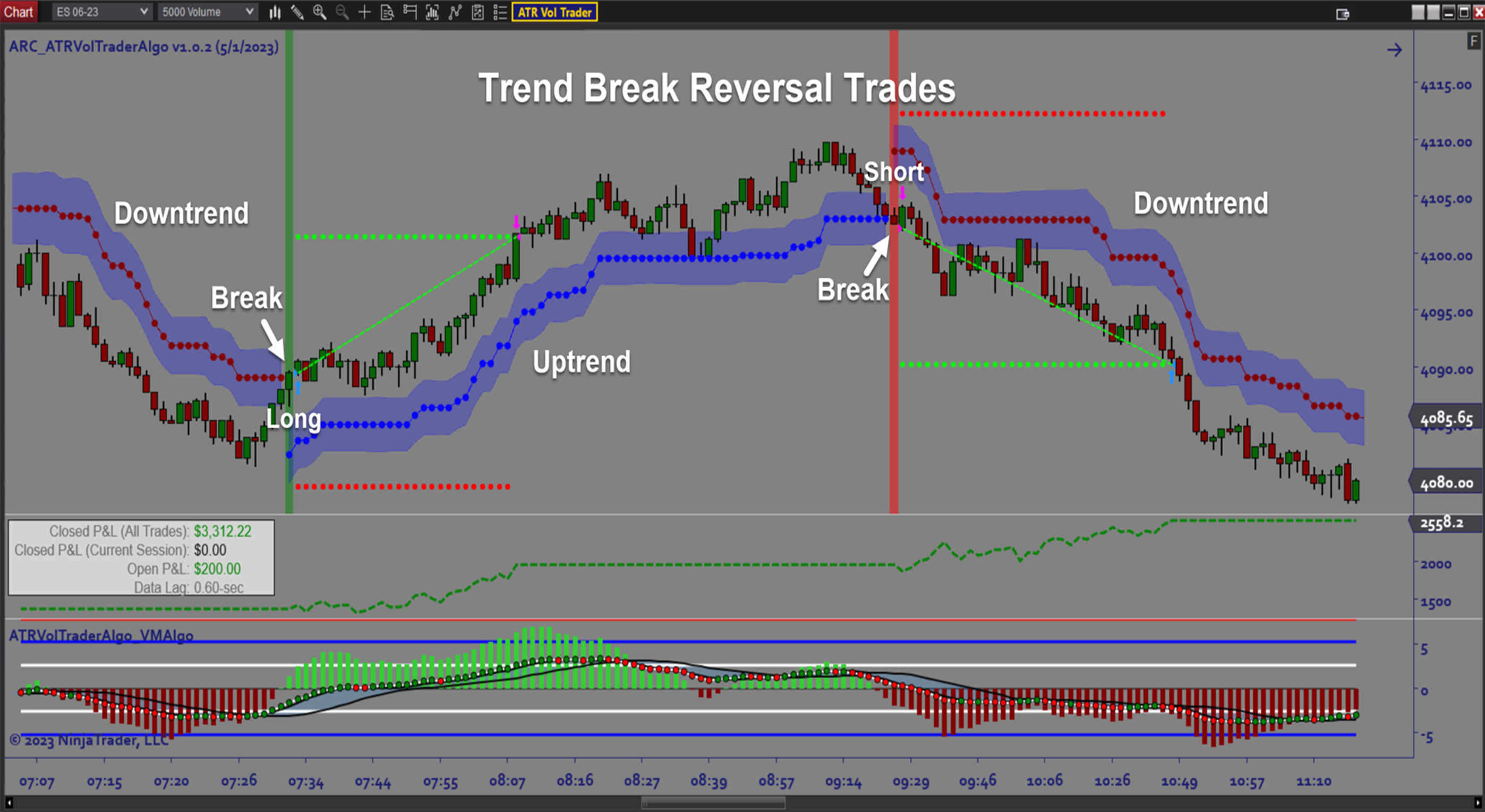

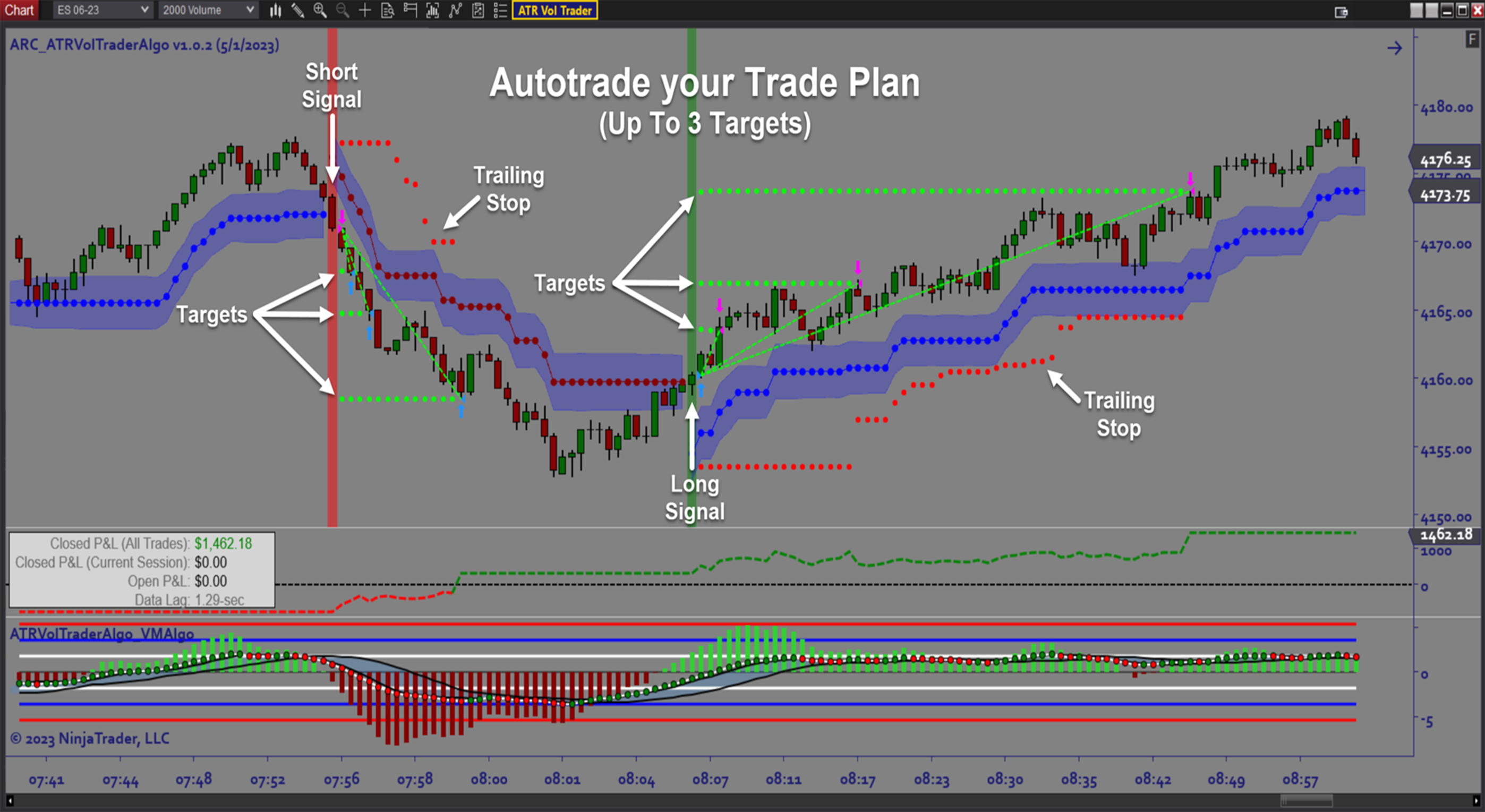

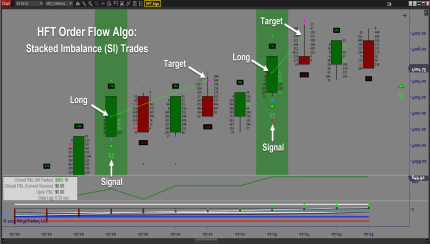

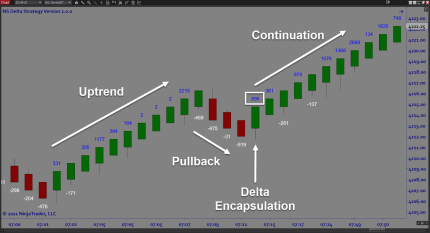

The ATRVol Algo is an automated trading solution for Ninjatrader which uses a volatility adjusted trailing stop line with a volatility band for signal generation. The volatility adjustment determines the frequency and location of signals. The software supports 2 distinct types of signals: Trend Break Reversals and Pullback Trend Trades. Trend Break Reversals occur when price breaks a trailing stop line. Pullback Trend Trades occur on pullbacks when price enters the volatility band. The ability to capture both reversals and directional trades, all while factoring in changes in price volatility, make the ATRVol Algo a versatile and effective auto trading system.

Purpose:

Traders need the ATRVol Algo because both trend trading and reversal trade setups can be significantly affected by changes the market environment, especially changes in volatility. Entry locations, stop sizes, and target placement are adjusted based on changes in volatility conditions. Constantly figuring out how to modify your trade plans in real time can be very difficult and time consuming. The software does all that for you by handling all order execution and money management. By automating all aspects of trading your strategy, using the ATRVol Algo software eliminates manual execution errors which results more core consistent trading performance.

Elements:

- Autotrade trend following and reversal trade setups all in one system

- Continuous monitoring and adjusting for changes in volatility conditions

- Option to trade the trend, capture trend break reversals, or both simultaneously

- Customizable Signal logic to tailor fit your strategy to each market

- On screen trade signals, entry/exit markers, stops/targets, realized/unrealized P&L

- ATR-based Stops

- R-Multiple Targets

- AutoTrail and Breakeven

- Money Management (Max Daily Loss, Profit Goals, High Watermark Trail)

- Trend Filters/Momentum/OBOS FIlters

- Datafeed Lag Monitor for Safety

- Backtesting and Optimization

Functions:

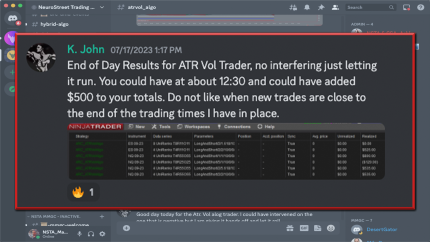

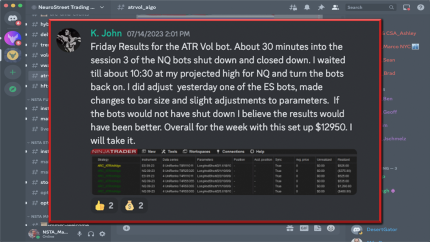

The ATRVol Algo is best used by finding profitable system parameters and letting the software do what it is designed to do: scan for good trade signals, entering the market when the setups occur, and automatically managing those positions until an exit condition occurs. The best approach is to take advantage of built in backtesting and optimization capability to find the best settings. The system is well suited to exploit instruments which display significant variations in volatility over time. The key is to follow the steps from design and optimization to Sim trading and only when performance is validated to actually autotrade a live account.

Problem Solved:

- Stops traders from second guessing reversal setups

- Stops traders from not knowing where to enter when there is a pullback within a trend

- Stops traders from entering at the wrong time or place

- Stops traders from failing to account for changes in volatility

- Stops traders from sabotaging their trading due to fear and uncertainty

- Stops traders from trading against momentum

- Stops traders from entering too late and missing out on most of the profits

- Stops traders from dealing with the stress of live trading

- Stops traders from breaking their money management rules

ATRVOL ALGO DISCORD CHANNEL