Overview:

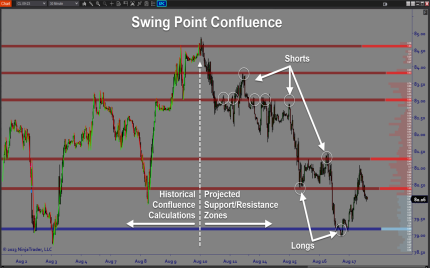

TrapFinder is a price levels tool which uses price action to identify important areas of interest which are essential for all styles of trading. Traps are essentially a 3-bar pattern which locates hidden gaps that can occur at any time through the trading day. These hidden gaps represent key support and resistance zones which can be used to improve trading decisions and performance. These zones are displayed right on the chart for easy reference. Audio alerts ensure you never miss a new zone when it appears.

Purpose:

Traders need the TrapFinder because hidden gaps are very difficult to find with the unaided eye. Without this tool, you might be missing out on levels that would provide a good trade opportunity or keep you out of a bad trade. These levels also help with better stop and target placement, which translates into leaving less money on the table and also avoiding unnecessary stop outs. TrapFinder reveals missing but crucial information for better trading.

Elements:

- Automatically displays all Traps on the chart

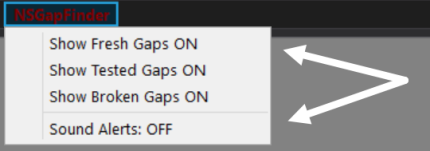

- Differentiates Fresh, Tested, and Broken Zones

- Ability to apply a size filter Trap Zones based on either ATR or Number of Ticks

- Separate Audio Alerts for Support and Resistance Zones

- Supports custom audio files for Alerts

- User Interface function menu to show/hide Traps and enable Alerts

Functions:

The TrapFinder is best used by taking the displayed Support and Resistance Zones into account when setting up trade plans. The chart can be customized to display only the relevant Zones, keeping the chart free of unnecessary clutter.

Problem Solved:

- Stops traders from missing out on key levels

- Stops traders from wasting time drawing support and resistance manually

- Stops traders from trading in the wrong place and time

- Stops traders from second guessing their exit strategies

- Stops traders from cutting their profits short

- Stops traders from getting stopped out prematurely