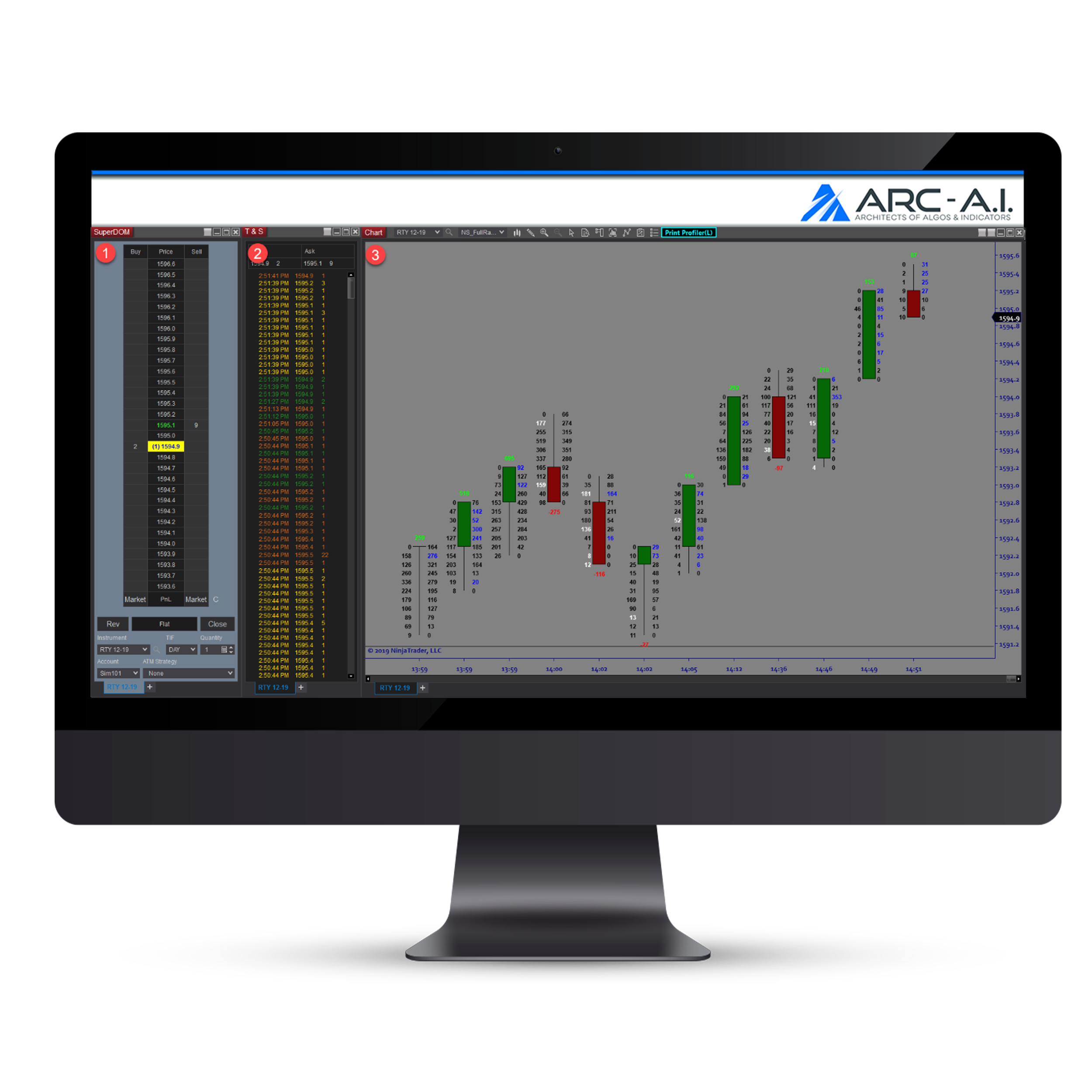

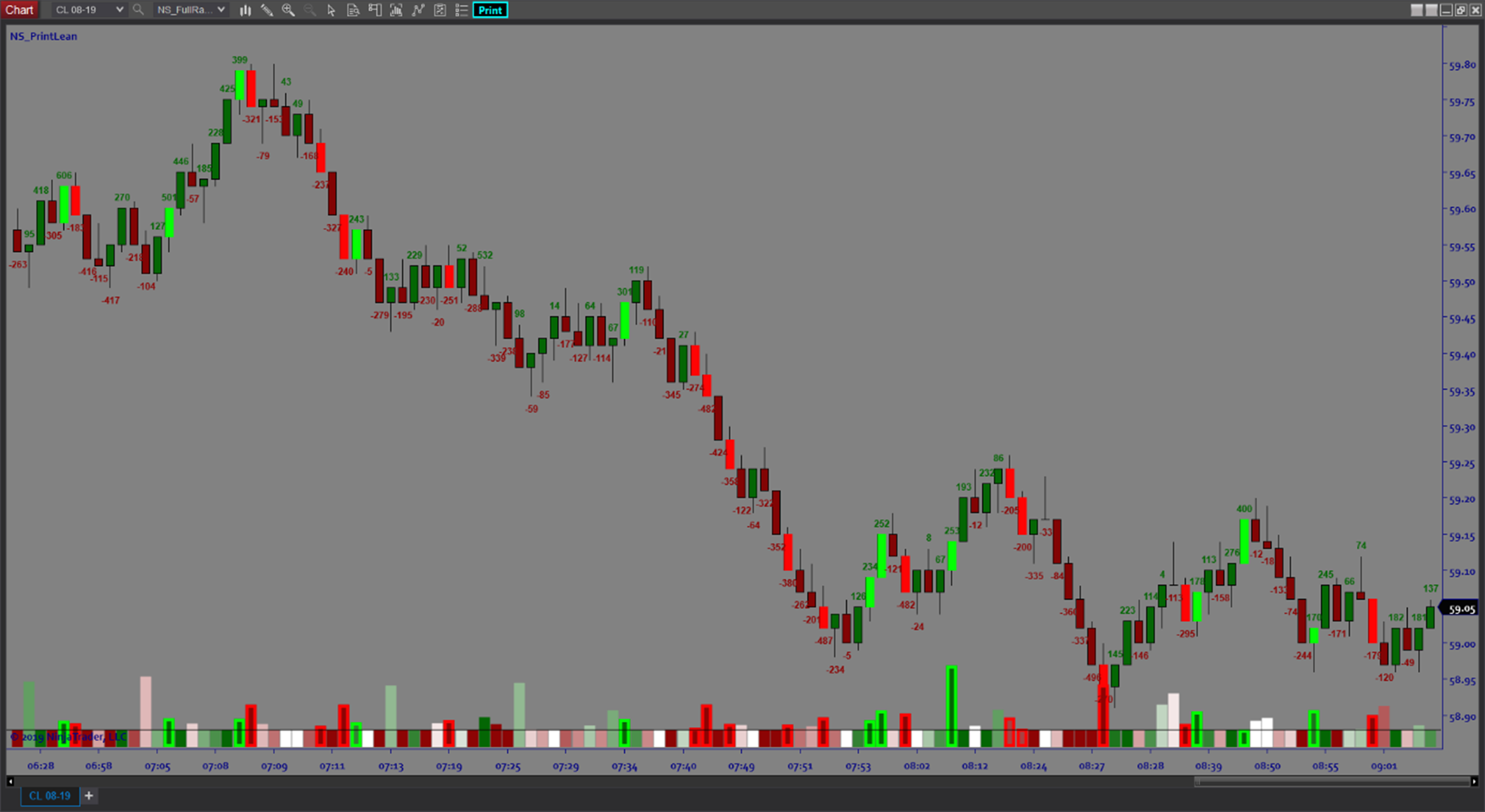

Overview:

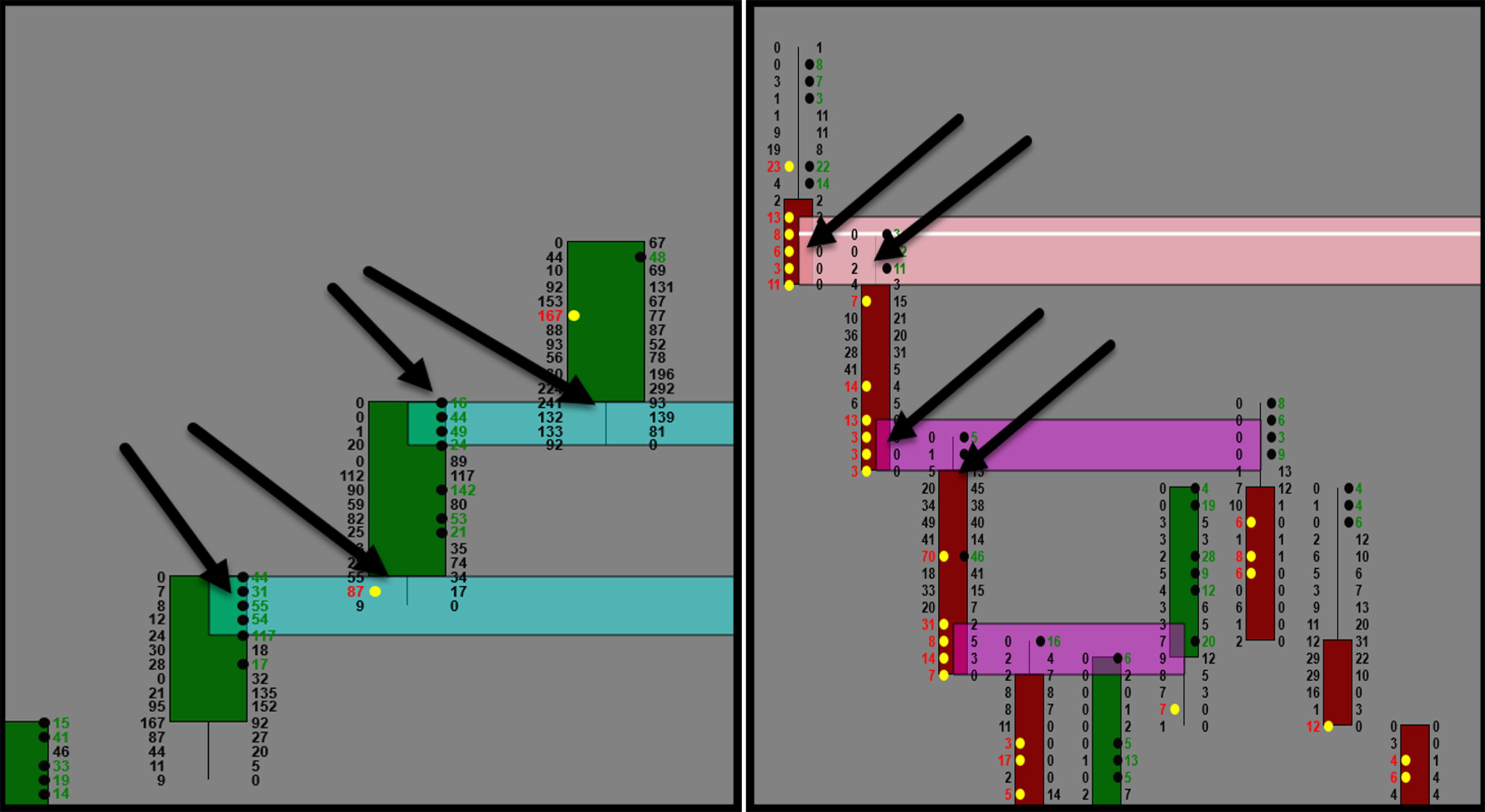

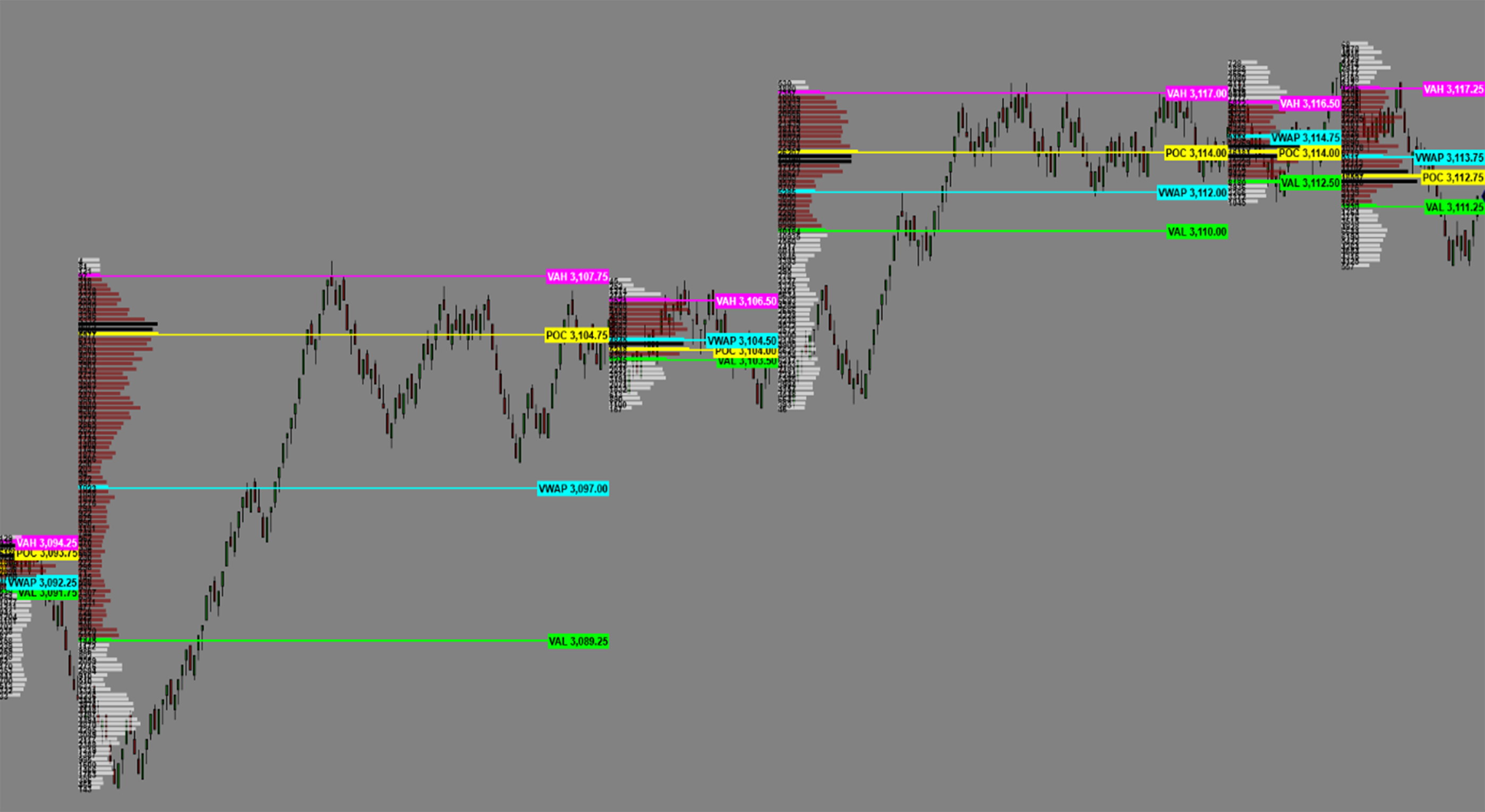

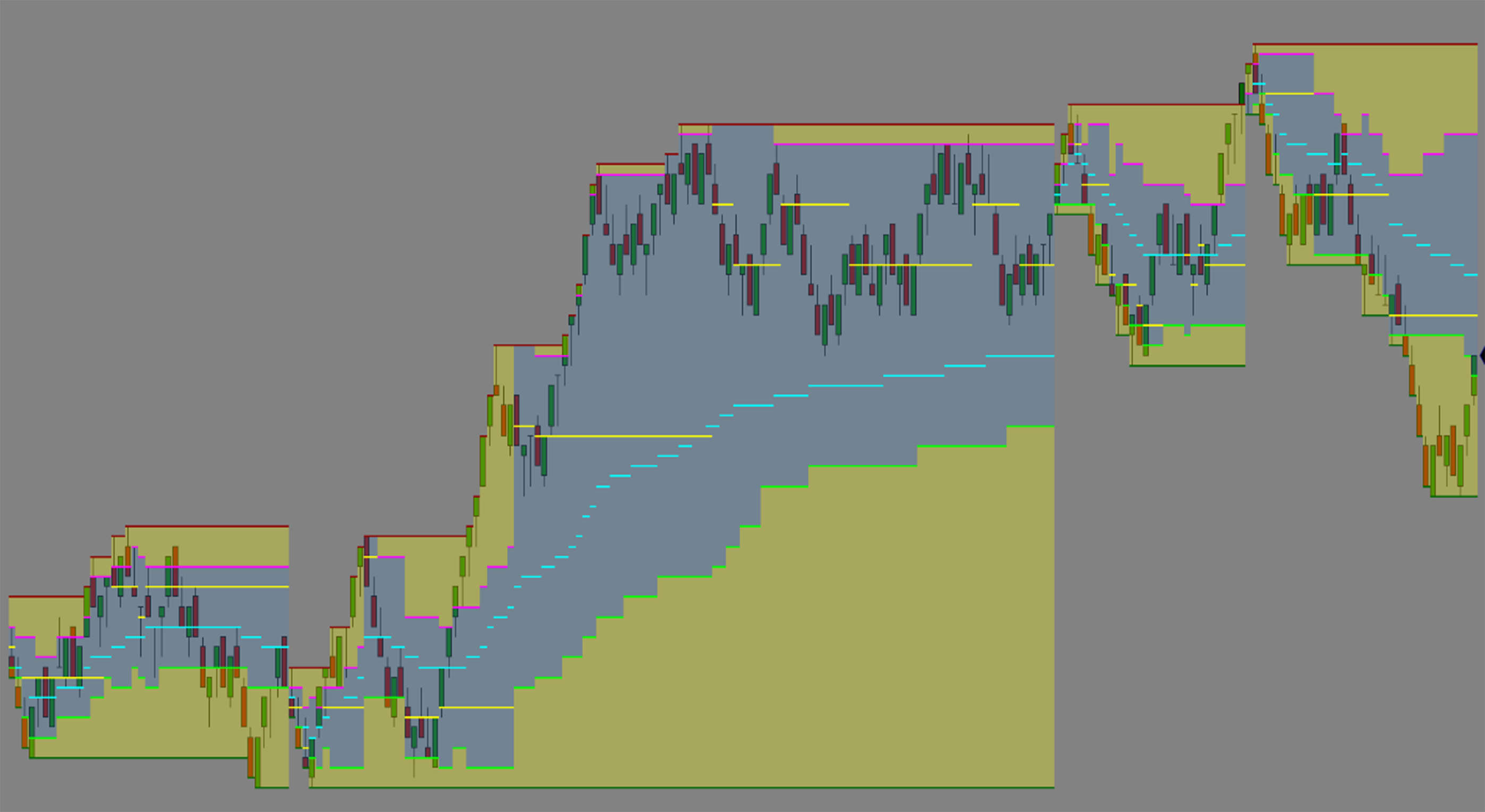

The Print Profiler is a Hybrid tool that combines orderflow footprint and volume profile. The orderflow footprint tracks multiple variations of orderflow and trade signal features. The volume profile produces both micro and macro volume profile data.

Purpose:

Traders need orderflow tools to confirm entry locations I read the inside price bar trading data. Without usig footprint toolsets and inside orderflow time and sales data, traders are literally trading blind not knowing whats going on inside the price action data. Alongside Orderflow, traders need volume profile tools to determine the daily auction based on volume profile as well as micro volume analysis to view each impulse and corrective nature and its low and high volume price relationships.

Elements:

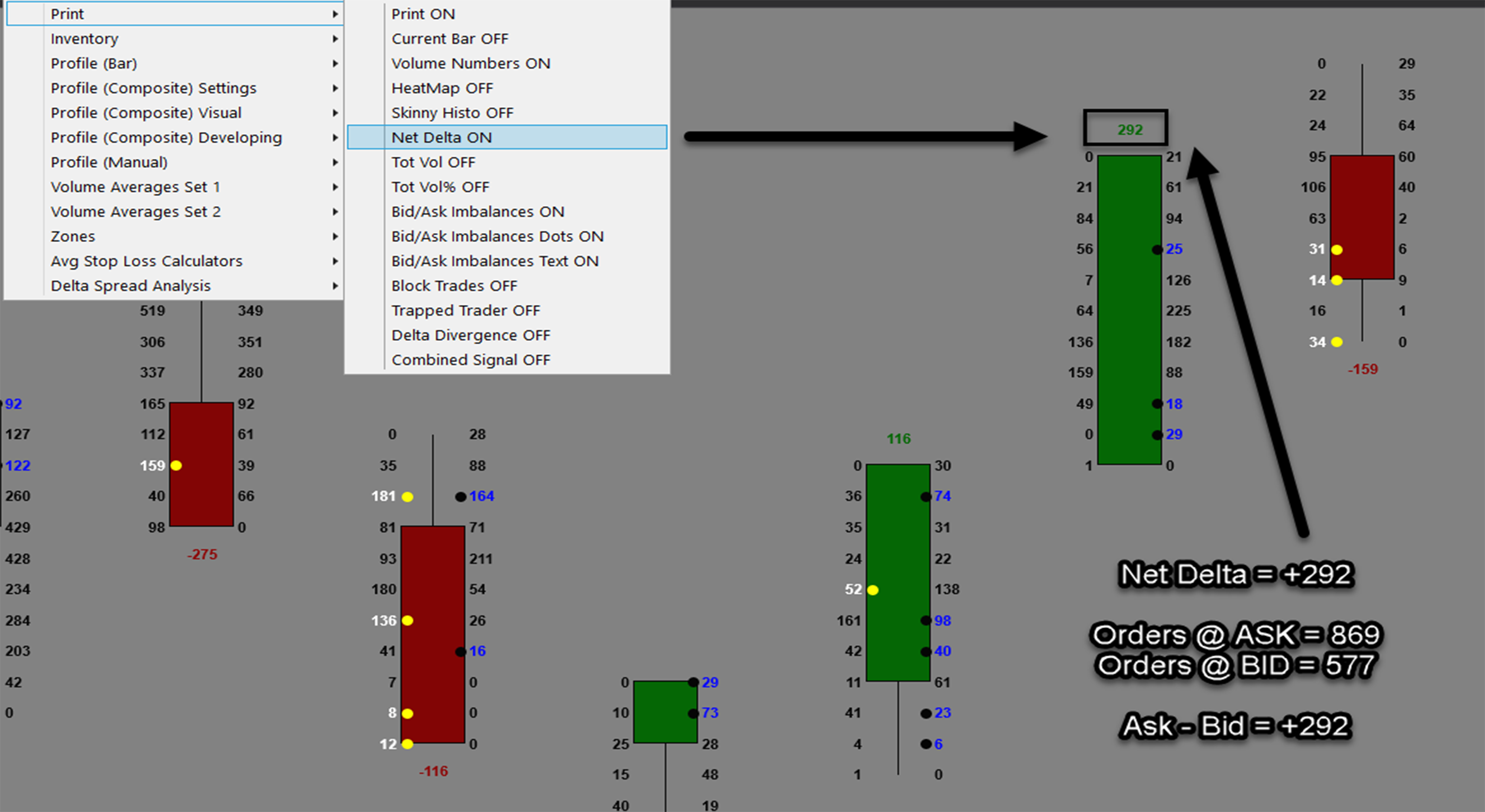

- Footprint & volume bars

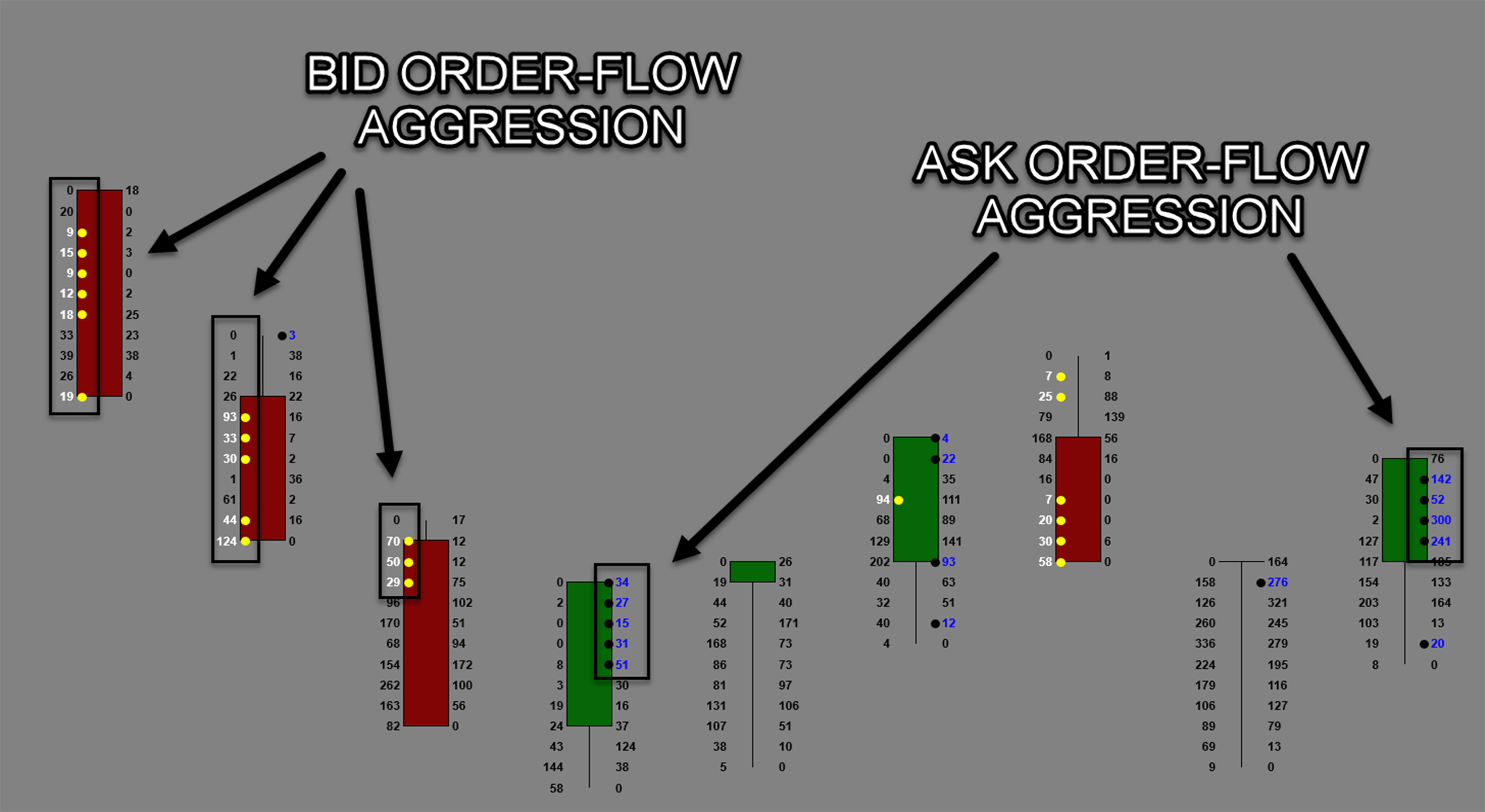

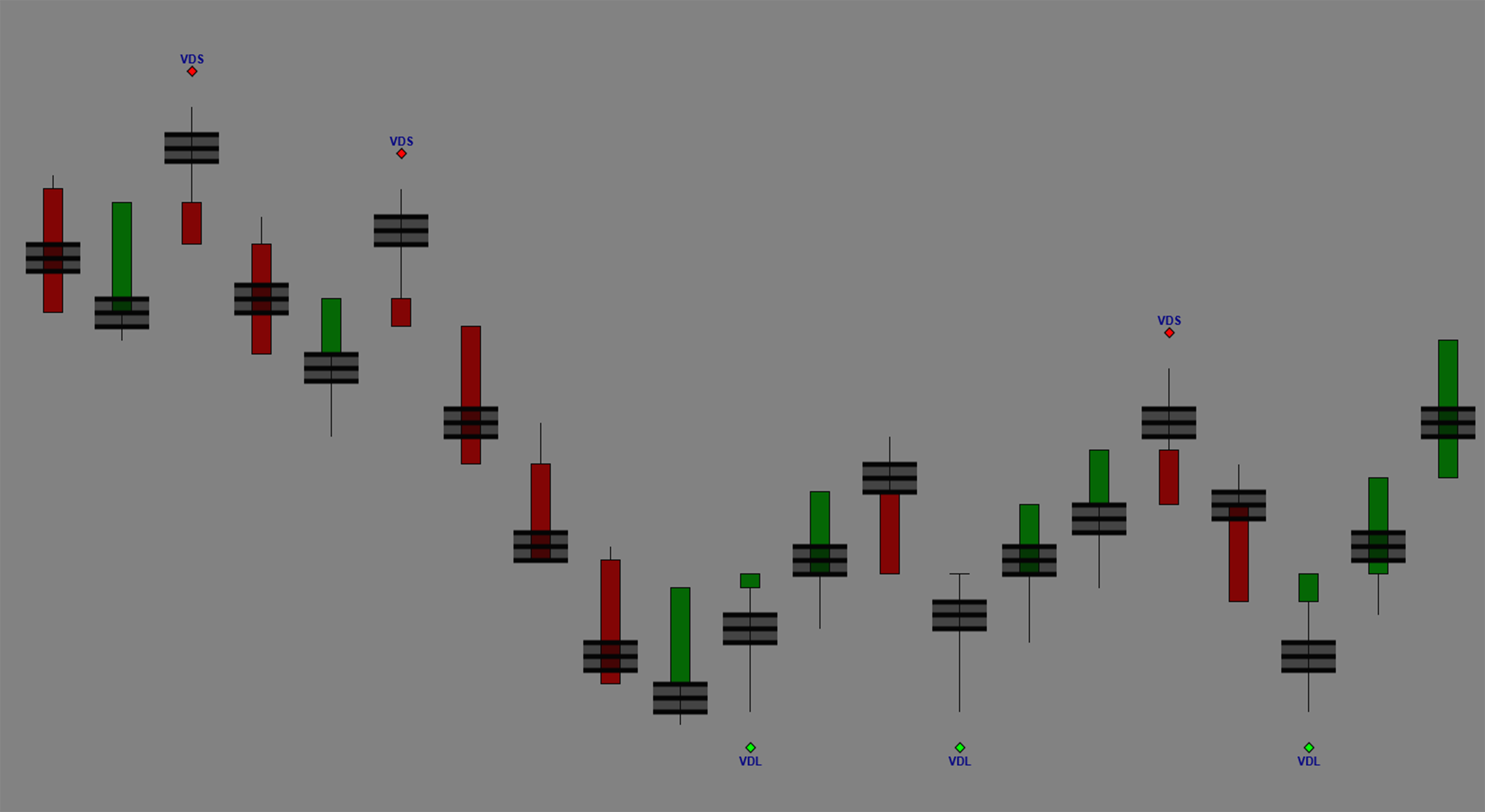

- Orderflow aggression detection

- Supply & demand print analysis

- Big money footprint detection

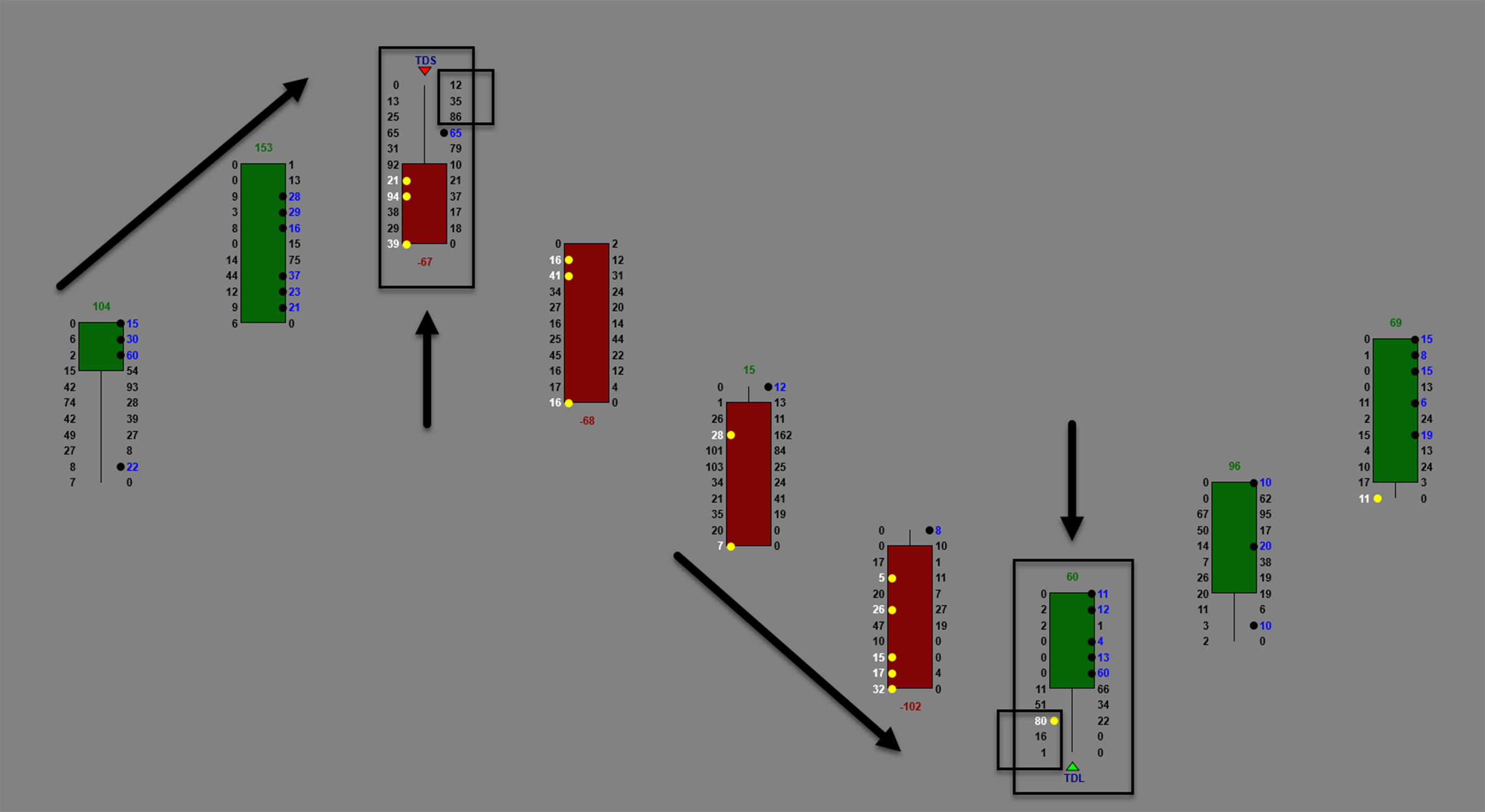

- Orderflow Trade Signal suite

- Big Order Block Trade Analysis

- Micro & Macro Volume Profile

Functions:

This software is best used as either a standalone trade orderflow system for signal generation, a volume profile add on suite or both for market confirmation when using order flow and volume to confirm trade setups on other indicators and trading systems.

Problem Solved:

- Stops traders from second guessing orderflow

- Stops traders from second guessing volume profile

- Stops traders from trading the wrong orderflow and volume profile

- Stops traders from not knowing waters going on inside price data

- Stops traders from taking the wrong trades because orderflow warns them not to

- Stops traders fromm trading into low volume areas not suitable for trading

- Stops traders from geting caught in choppy high volume rotation areas

- Stops traders from trading blindfolded.