Overview:

MarketMakerTapeTrader (MMTT) is an Order Flow add-on software tool which continuously “reads the Tape” and performs 3 essential functions. First, it provides an easy to read graphical representation of the Tape. Second, it allows you to pause the Tape to make it readable when it is flowing too fast. Third, and most importantly, it instantly analyzes the incoming data to locate and display important Support and Resistance levels right on the price chart.Purpose:

Traders need the Market Maker Tape Trader software because reading the “Tape” is nearly impossible to do with the naked eye. Executed transactions come through the trading platform at a rate that is way too fast to process manually. But hidden within this data is important information about the behavior of buyers and sellers in the market. This software makes it possible to translate all that data into price zones and absorption symbols taking all the guesswork out of Tape Reading.Elements:

- Easy to Read Tape Display

- Freeze the Tape option for closer inspection

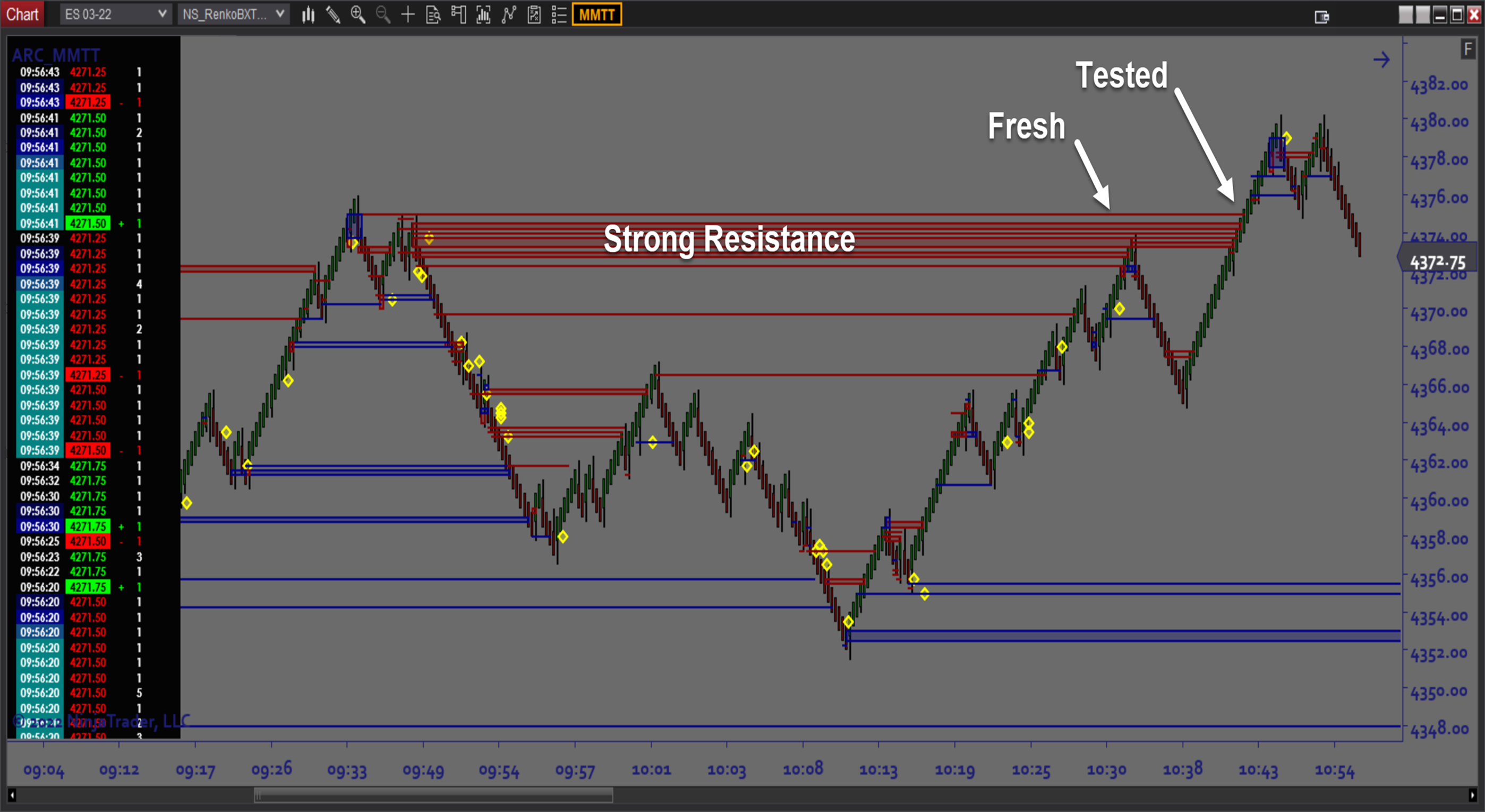

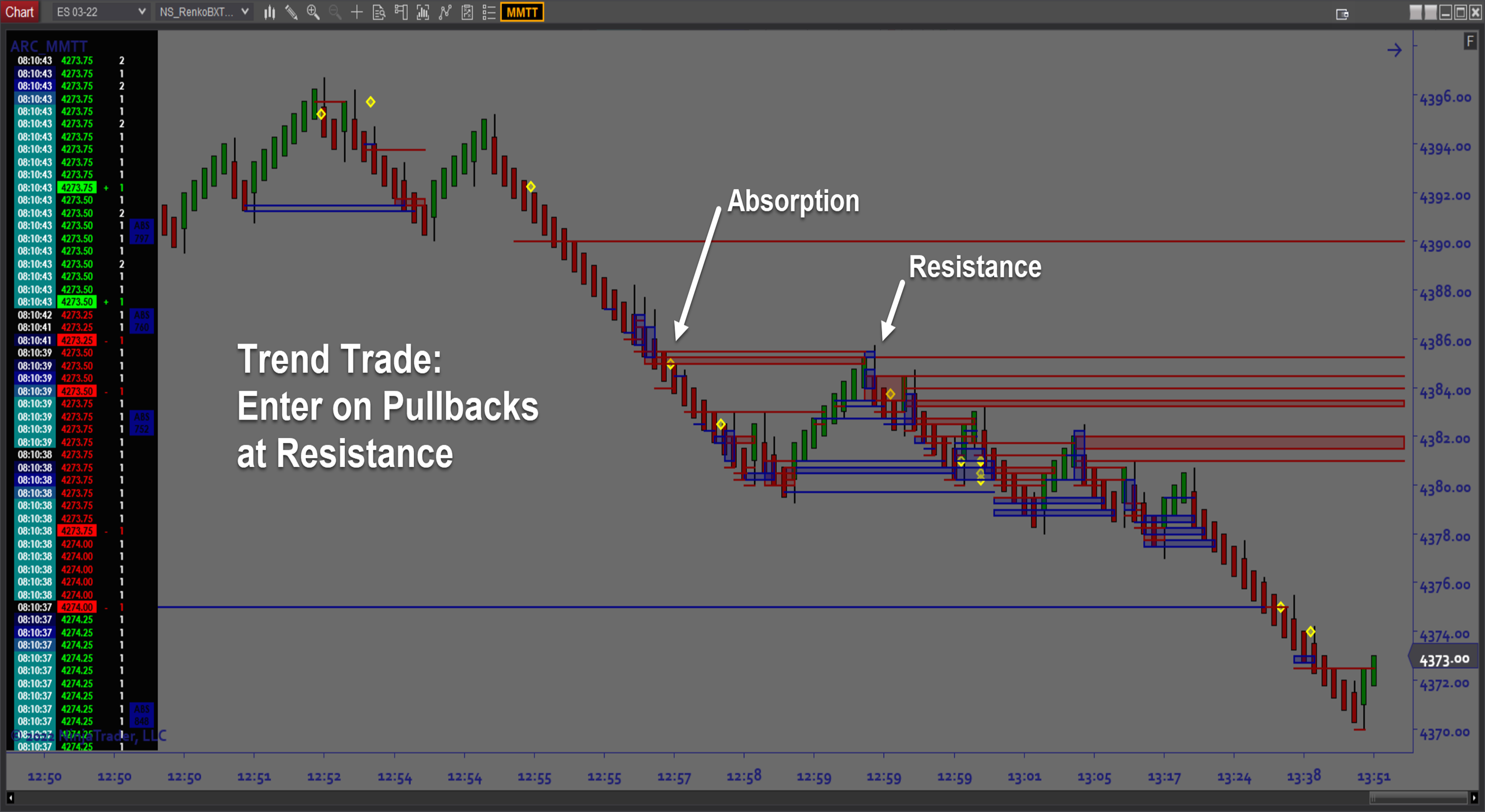

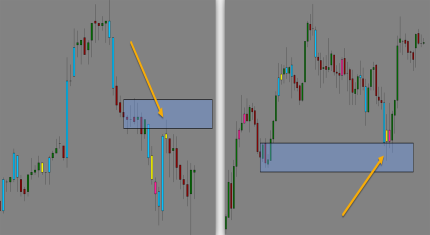

- Automated Support and Resistance Zones signifying significant absorption

- Block Order Signals

- Easy User Interface Menu for quick adjustments

- Customizable Minimum Absorption and Block Size

Functions:

The Market Maker Tape Trader software is best used by ensuring that absorption zones (support and resistance) are incorporated in trading decisions to ensure that the footprint of market makers is revealed. Support and Resistance Zones based on Order Flow represent important areas where we can expect price to react so being aware of them will keep you on the right side of the market. Each instrument will have unique characteristics so it is important to set the size thresholds on absorption and block size to keep charts clean and easy to read.Problem Solved:

- Stops traders from missing out on reliable entry locations

- Stops traders from getting stopped out due to opposing absorption or aggression

- Stops traders from entering at the wrong time or location

- Stops traders from trading in the wrong direction

- Stops traders from second guessing support and resistance levels

- Stops traders from failing to see when and where Big Money steps in to move the market

- Stops traders from getting blindsided by sudden unexpected moves

- Stops traders from failing to see where broken resistance becomes support and vice versa