Overview:

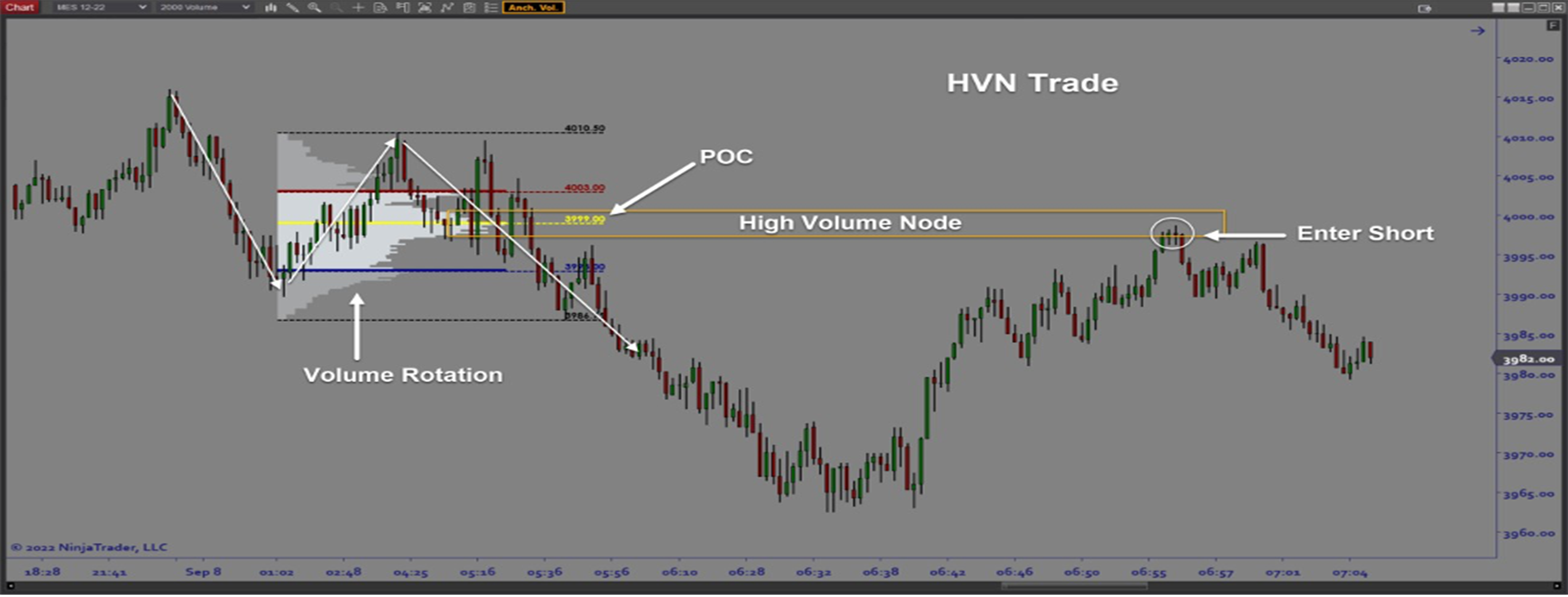

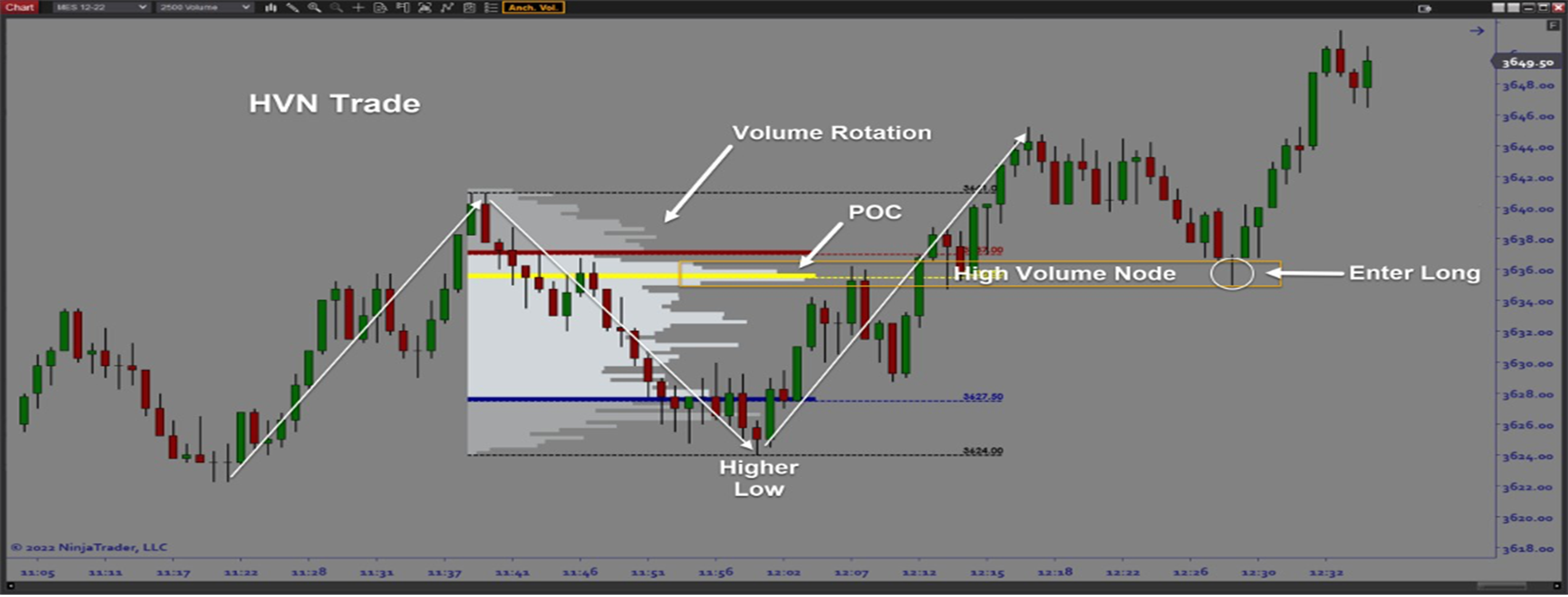

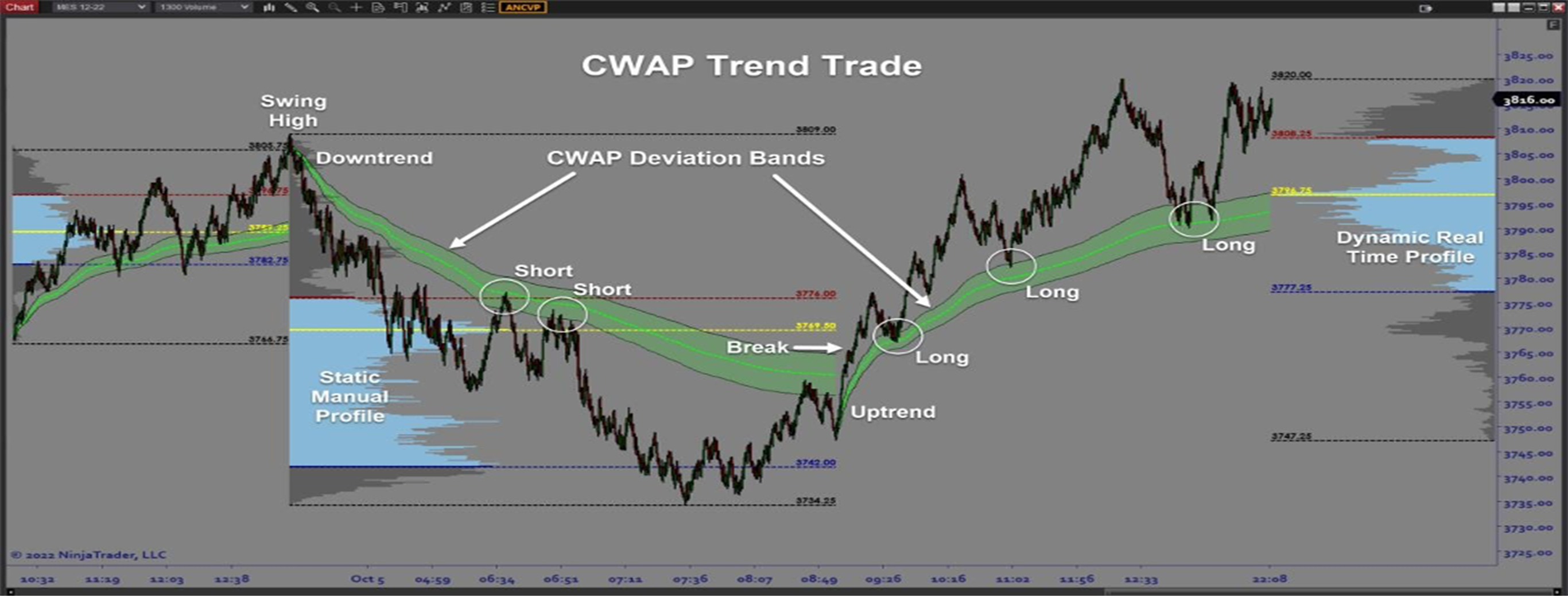

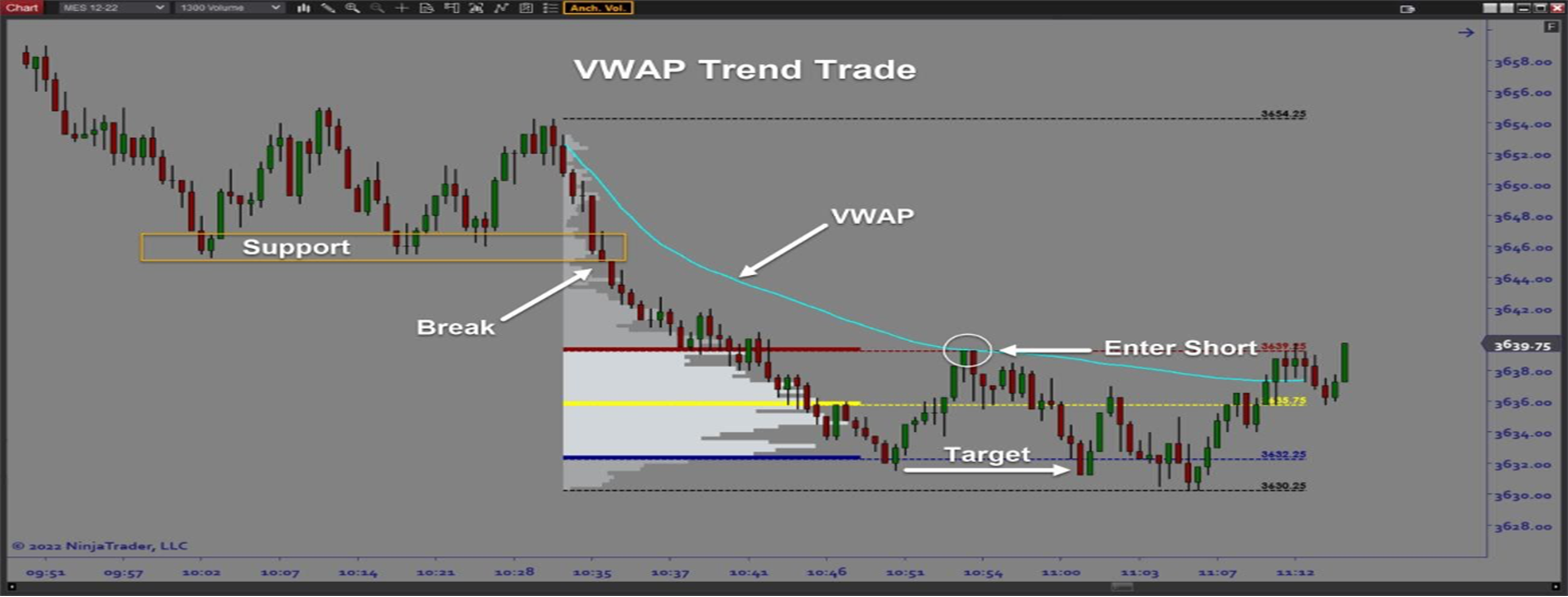

Anchored Volume is a multi-purpose volume profiling and weighted average pricing tool which unlocks key areas of interest for both trend trading and reversal trade setups. The software includes composite profiles, manually drawn historical and real time profiles, and dynamically updating volume weighted average prices. The end result is a powerful yet flexible set of components which can greatly improve trade performance by revealing the influence of volume on price action.

Purpose:

Traders need the Anchored Volume software because retail traders need a way to easily identify where and how the big money is engaging in the market. Knowing how to locate key volume levels substantially improves a trader’s ability to take trades in the right locations and in the right direction and also to know when to stay out of the market.

Elements:

- Composite Profiles (Daily, Weekly, Monthly, and Custom Time Windows)

- Manual Historical Profiles (Static)

- Real Time Profiles (Dynamic)

- Volume Weighted Average Price (VWAP)

- Volume Cluster Weighted Average Price (CWAP)

- VWAP/CWAP Standard Deviation Bands

- Volume Clusters on the bars (Size Customizable)

- Ticks Per Profile Level (Customizable)

- Customizable Datafeed (Minute, Second, Tick)

Functions:

The Anchored Volume software is best designed to overlay on your trading chart so you can view the current developing profile and VWAP/CWAP lines to help identify the best locations for reversal trades or trend trade entries on pullbacks. For backtesting and strategy development, the Composite and Manual profiles make it easy to study past price action against important volume components.

Problem Solved:

- Stops traders from second guessing trade direction

- Stops traders from taking trades in wrong locations

- Stops traders from chasing the market

- Stops traders from cutting their winners short

- Stops traders from second guessing support and resistance

- Stops traders from fearing their strategy and execution

- Stops traders from trading without proper volume information