This indicator is part of our Annual Indicators Membership.

To access this indicator for free, please click the link below.

Overview:

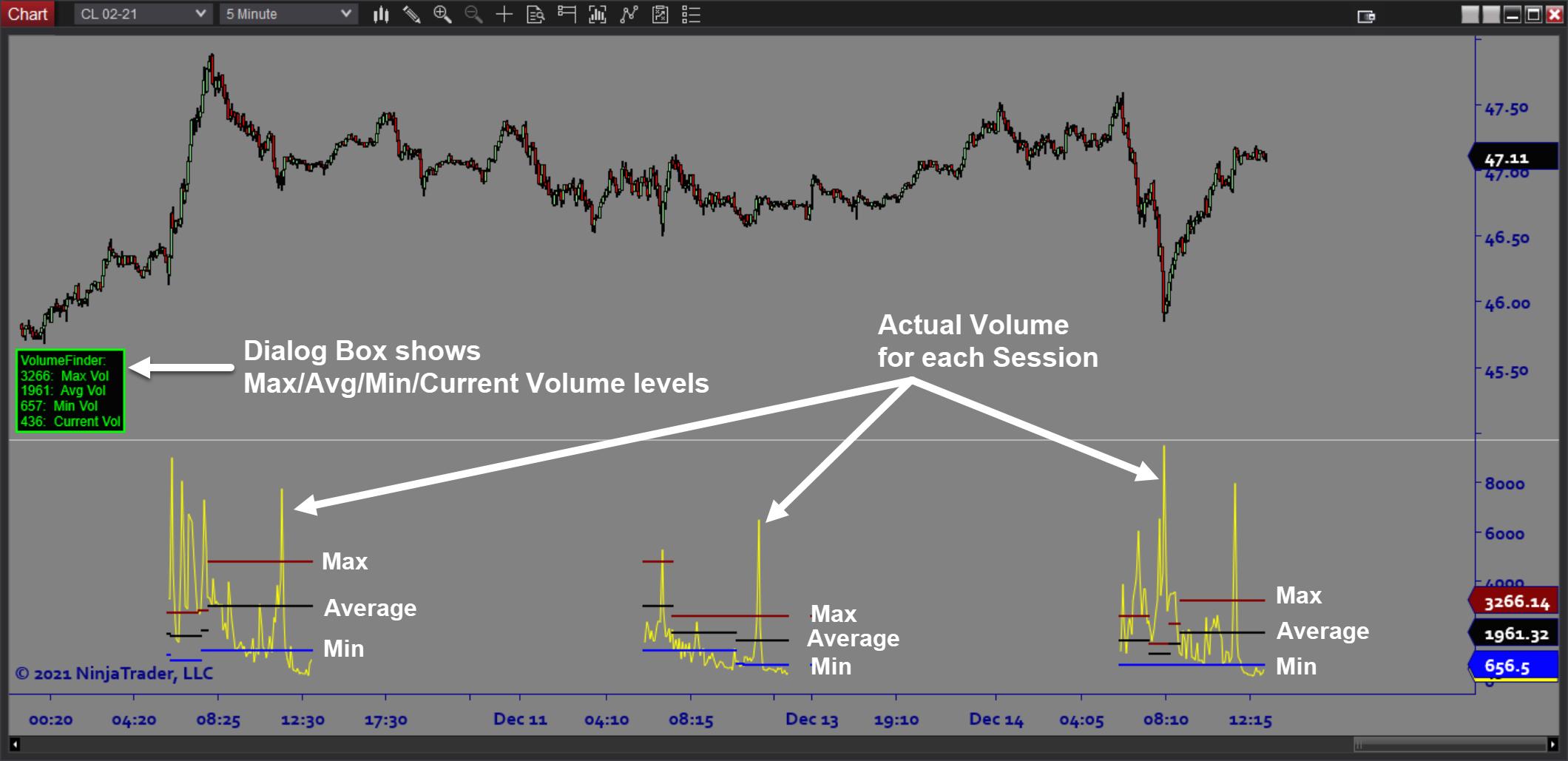

The VolumeFinder software is a system Add On that helps answer the question: “Are current volume levels above or below average and by how much?” The software tracks volume over time and overlays the current actual volume onto a volume grid to help answer that question. Volume drives price movement so keeping track of current volume conditions leads to smart trading decisions.

Purpose:

Traders need the VolumeFinder software to get a better handle on current market conditions. If large players are disengaged, volume will be low and directional moves may stall out before reaching targets. This tool simplifies the task of determining relative volume levels by displaying an easy to read grid which shows the Min, Max, and Average historical volume as a backdrop to current volume levels.

Elements:

- Volume Grid showing Min, Max, Average, and Current Volume Levels

- Customizable Session Volume Windows

- Customizable Lookback Period

- Volume Info Display Box

Functions:

The VolumeFinder software is best used by keeping the relative volume grid visible while you are trading so you can monitor volume conditions. If current volumes become very low or very high compared to the norm, it may be advisable to alter your approach or possibly wait until conditions normalize.

Problem Solved:

- Stops traders from second guessing relative volume

- Stops traders from trading at the wrong times

- Stops traders from losing sight of important market conditions