MTF VWAP. Average Price Indicator Overview:

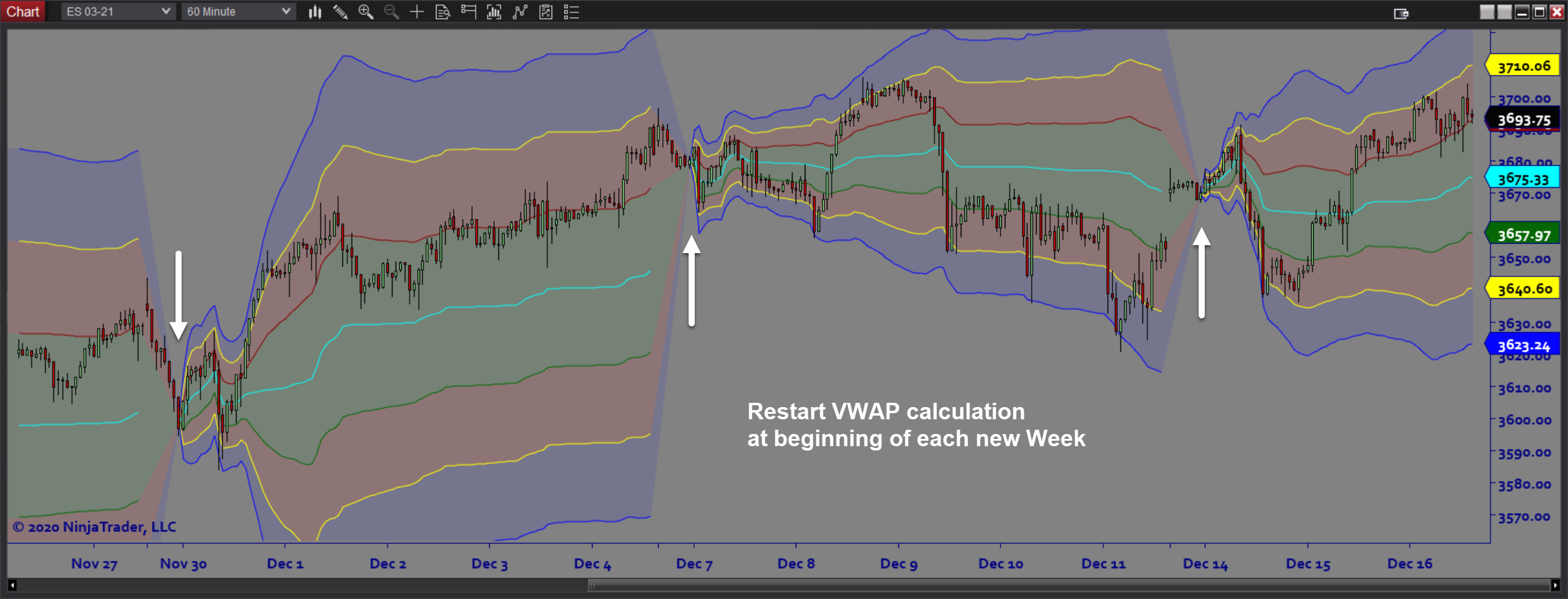

The MTF VWAP software is a volume weighted average price indicator that locates daily, weekly and monthly VWAPS. This identifies the benchmark price levels for institutional value across multiple timeframes. Volatility Bands measure how far price deviates from the VWAP line.

Purpose:

Traders need the MTF VWAP indicator because the VWAP line is a key level that impacts price action. Many traders treat it as a line in the sand for trend identification. It is also important to have a way to statistically measure deviations in price away from the VWAP line. MTF VWAP makes it easy to see where price is trading in relation to the volume weighted volatility spectrum.

Elements:

- Volume Weighted Average Price

- Multi Timeframe VWAP (Daily, Weekly, and Monthly)

- Standard Deviation Bands

- Customizable ATR Multipliers to Adjust Deviation Bands

Functions:

The MTF VWAP software is best designed to remain constantly aware of where price is in relation to the VWAP line as well as the Volatility Bands. Choose Daily, Weekly or Monthly VWAPs based on your timeframe preference and trading style (eg. a scalper would most likely use Daily VWAP). Overlaying the VWAP lines on your chart will provide you with important market context when you are trading.

Problem Solved with our Average Price Indicator:

- Stops traders from second guessing trending conditions

- Stops traders from missing important levels of interest

- Stops traders from entering in the wrong direction or location

- Stops traders from lacking market context

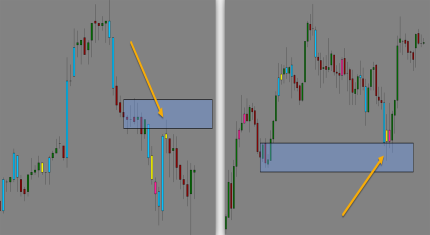

- Stops traders from missing out on mean reversion trades