Overview:

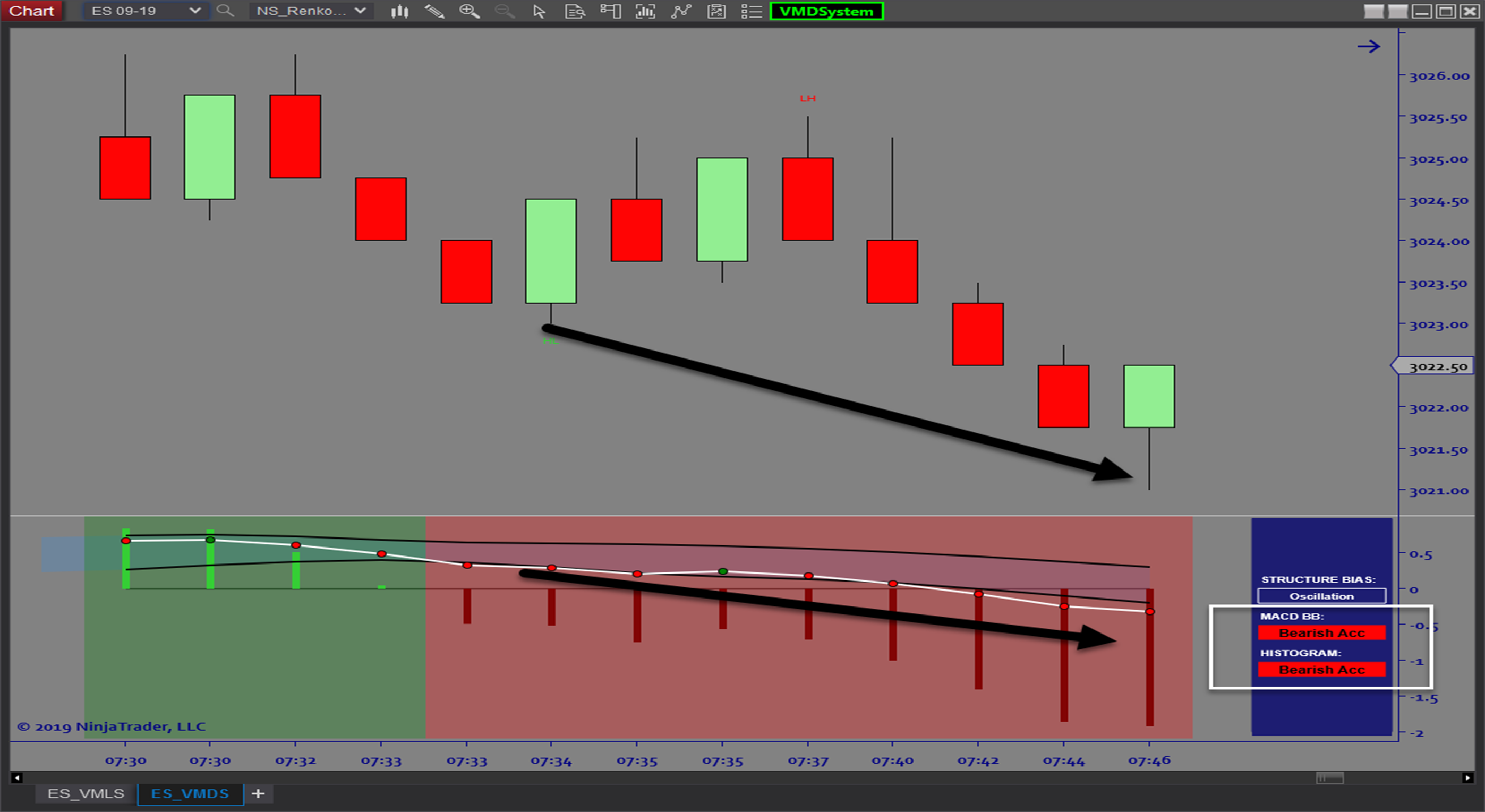

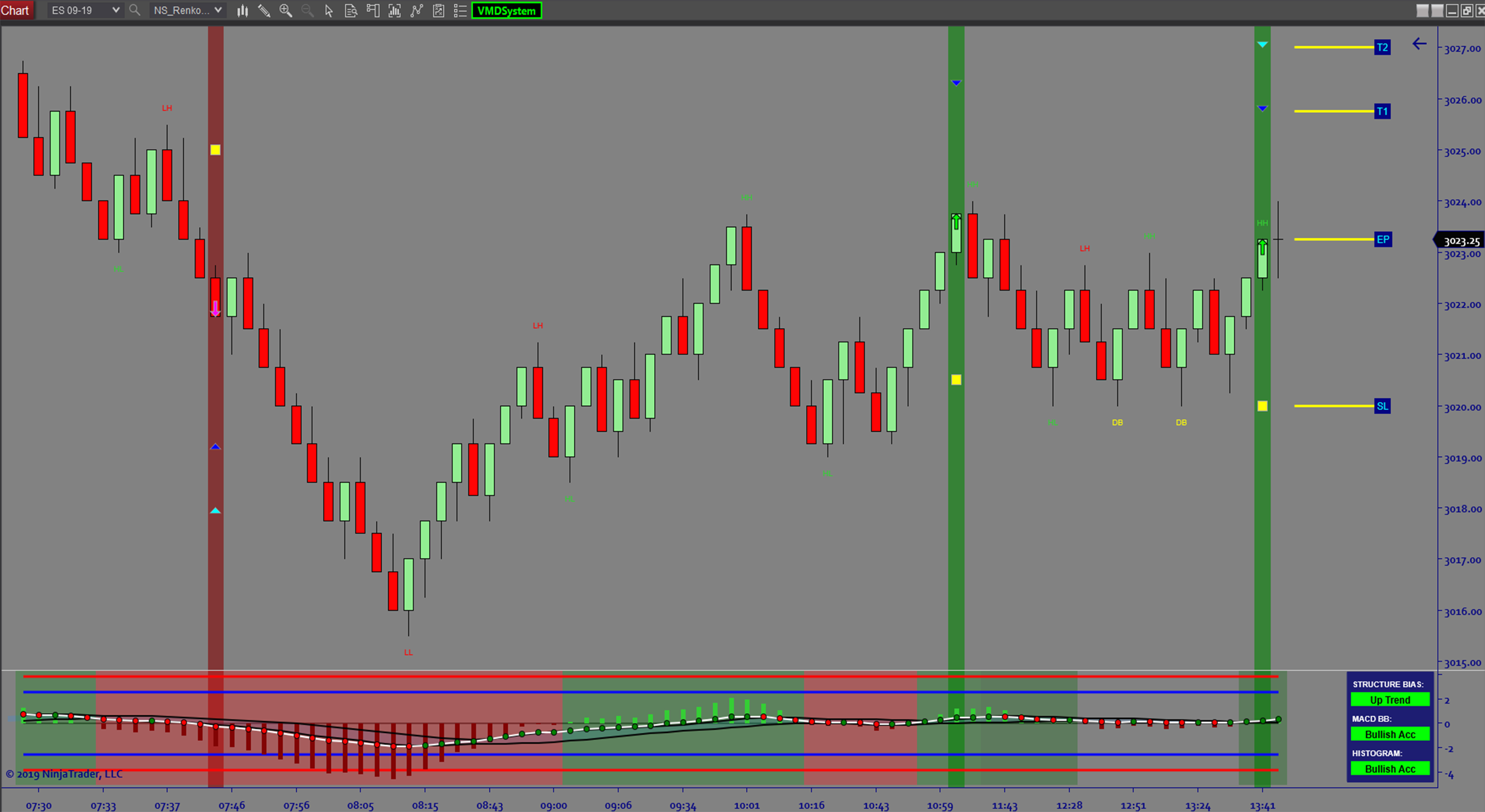

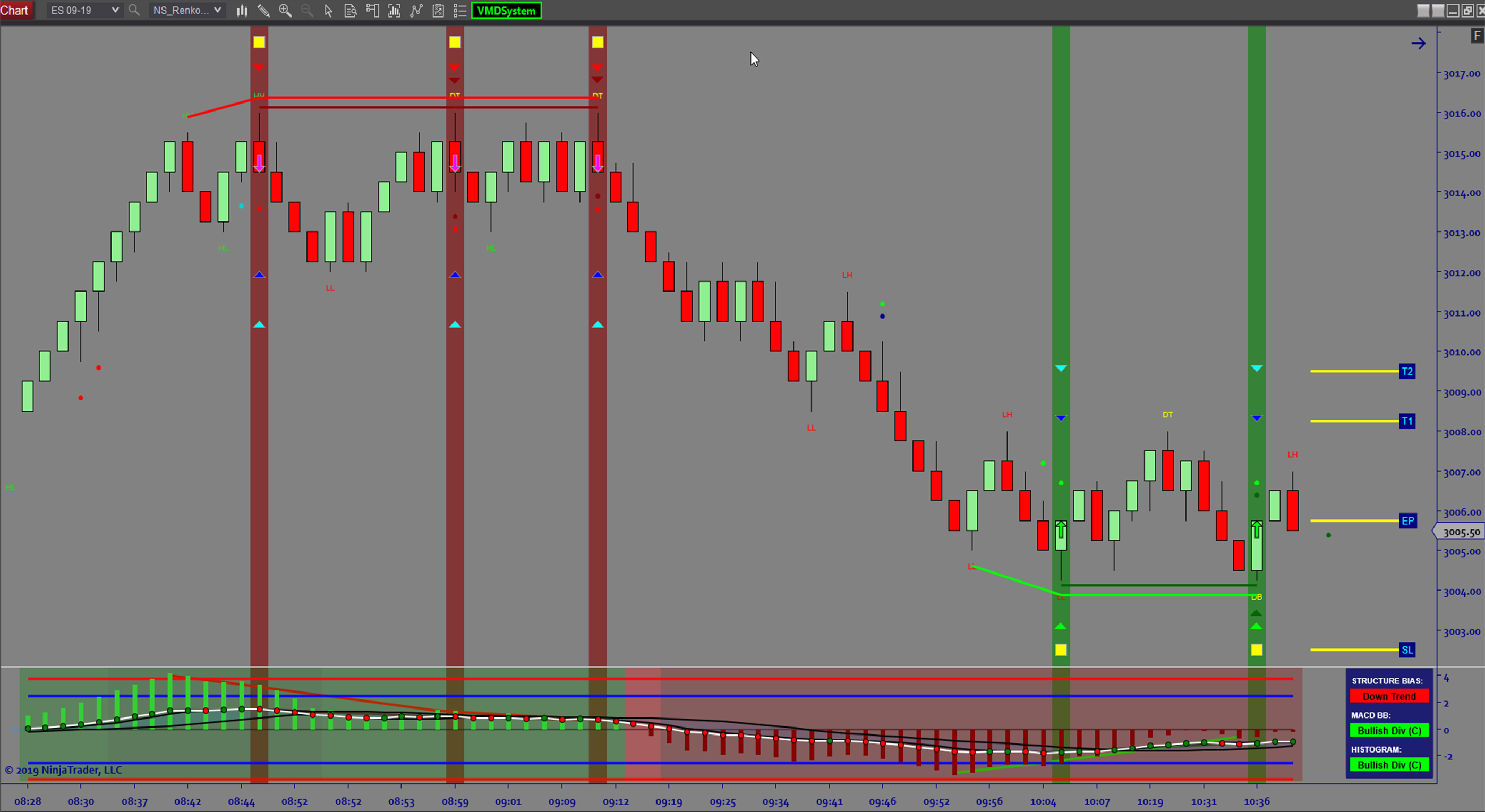

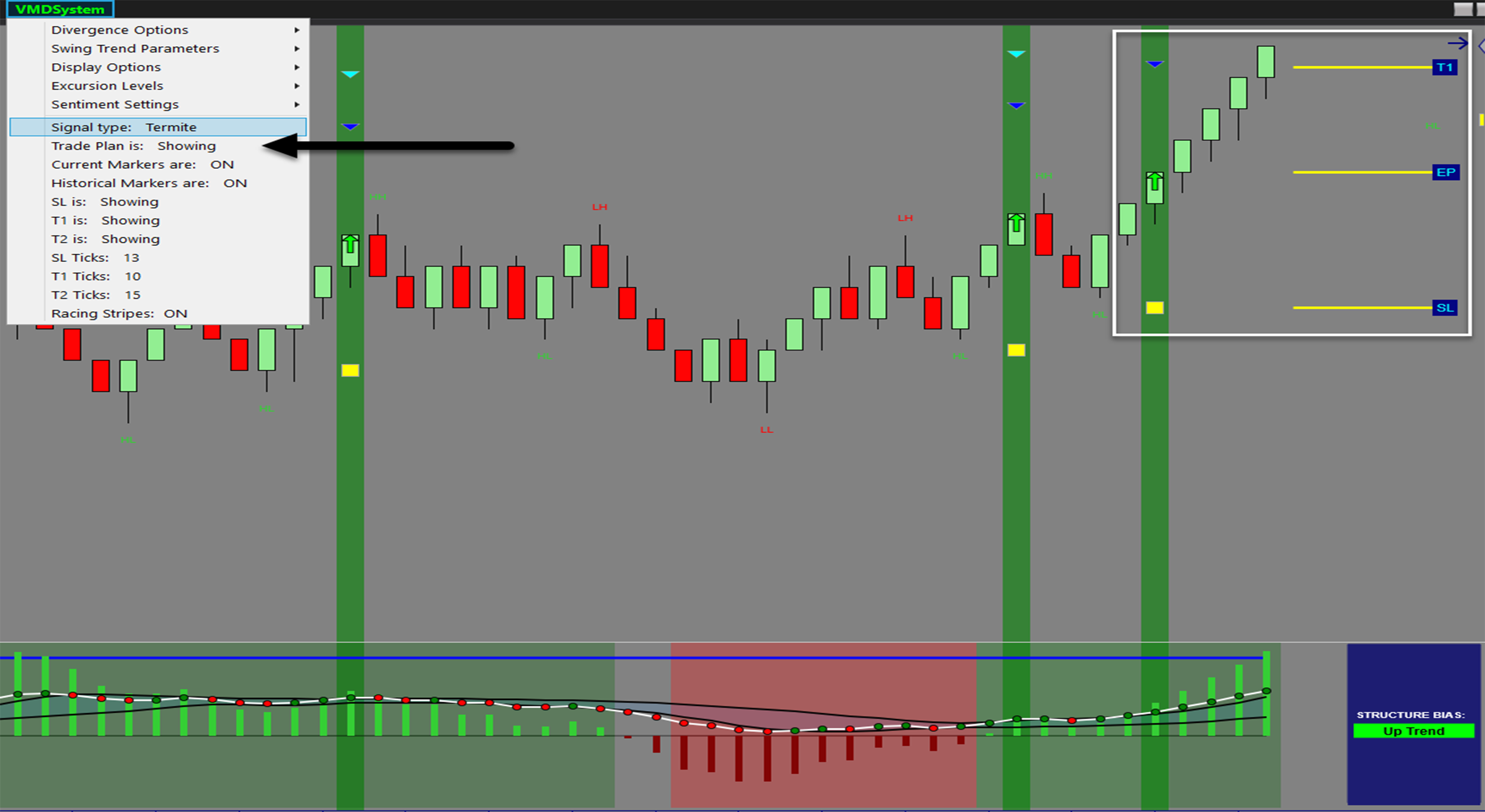

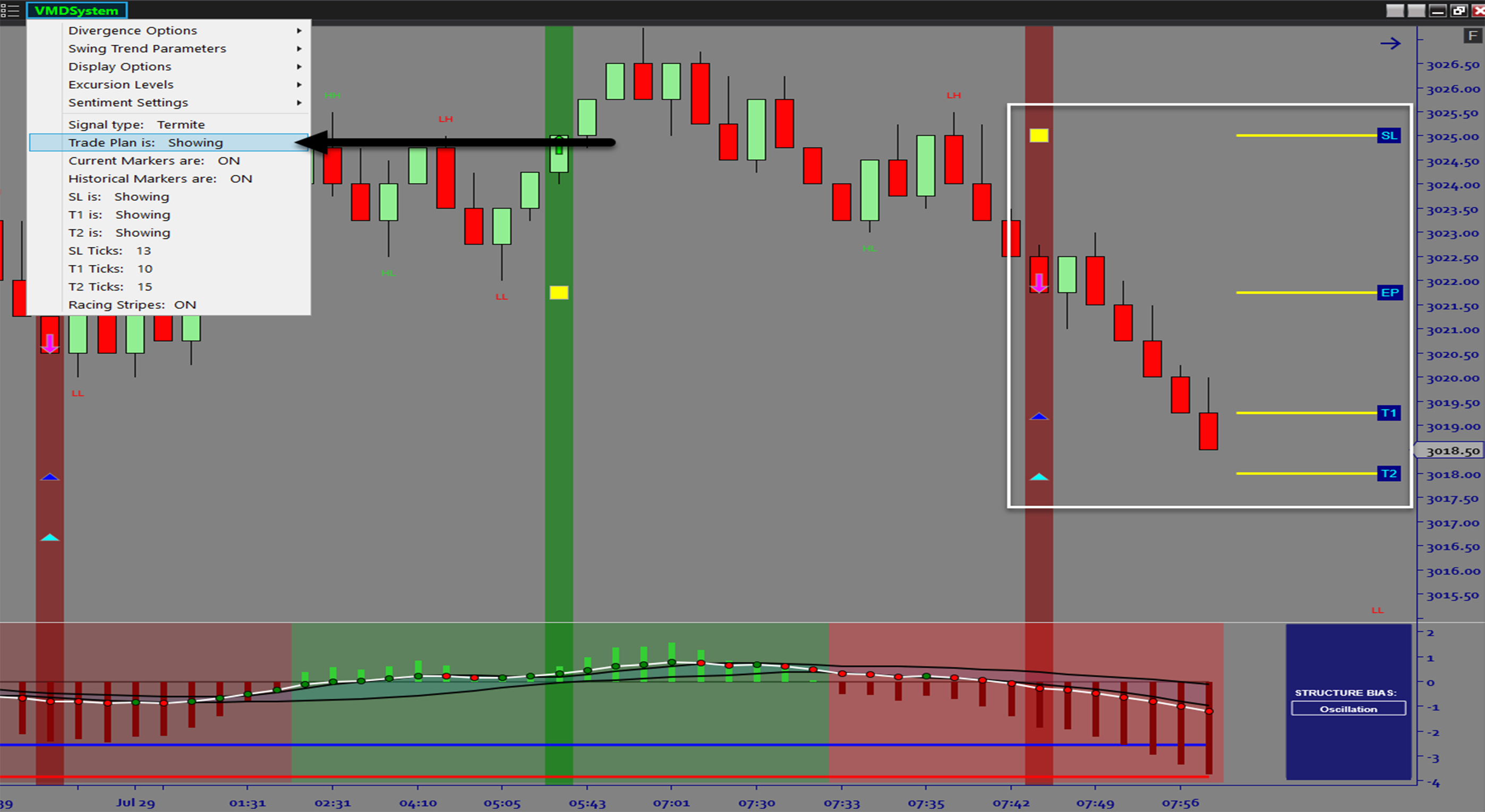

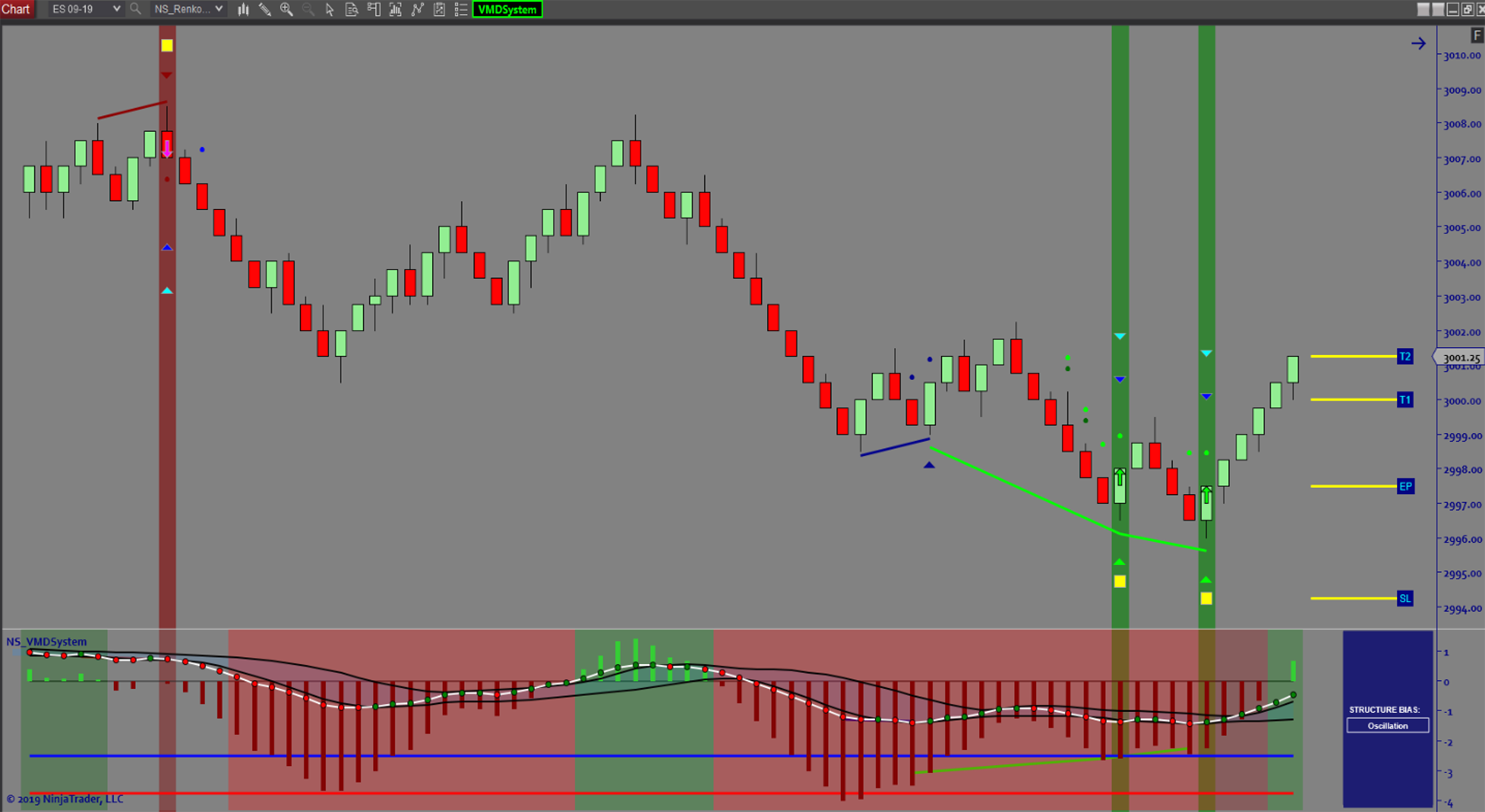

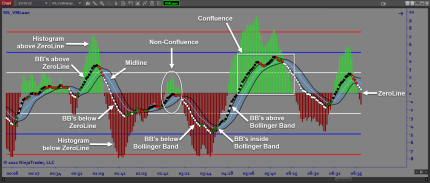

The VMD_System software is a Hybrid momentum software tool that depicts fast and slow momentum cycles using velocity cycles and MACD-BB. Its built in automatic divergence detection plots in advance and on-the-fly automatic divergence (both regular and hidden divergence is calculated) It allows for signal trading & momentum analysis as it caters to both.

Purpose:

Momentum is very important for intraday scalping especially when looking for continuation or trend trades. We also need to know when we are trading at the extremes so we can map out price reversals and use Overbought/Oversold cycle analysis to spot reversal setups accurately. Plus, when trading, traders need to know when to buy or sell and having an automated signal tool to show them when the market is set to reverse while plotting divergence reversal signals is an asset for getting in early and managing good trades.

Elements:

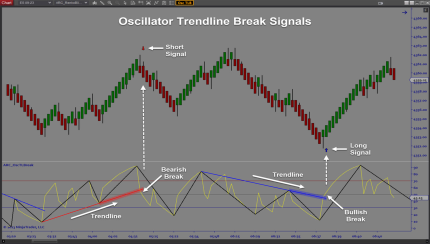

- Hybrid momentum detection

- Auto divergence (type 1 and type 2)

- OBOS Cycle levels

- Built in trend detection

- Auto divergence signals

Functions:

- Automating divergence

- Momentum analysis & cycle detection

- Market Structure detection

- Divergence & Momentum signals

Problem Solved:

- Stops traders from second guessing market structure

- Stops traders from second guessing their reversal and price action divergence setups

- Stops traders from buying high and selling low at the wrong side of momentum reversals.

- Stops traders from making human errors reading momentum and divergence