Volume Profile Tool Overview:

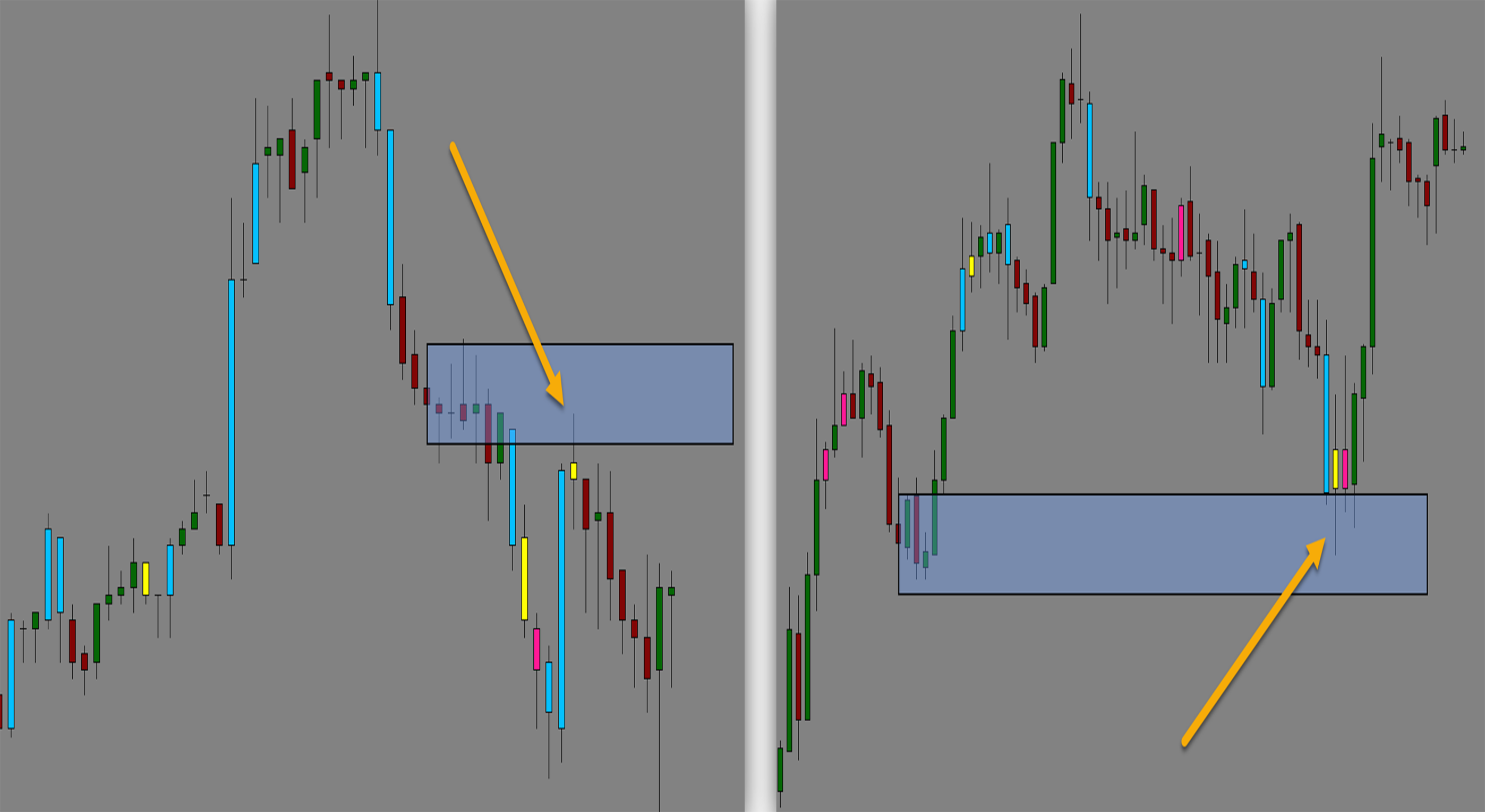

The VSA Suite is a hybrid volume profile tool used to merge Volume Spread Analysis with Profile Pattern Recognition. The software analyzes climactic volume, locates churn and rotations, and leverages micro volume profiles to lead the market activity. The VSA Suite can be used for both trend and reversal trading. Clear signals are displayed taking the guesswork out of knowing when to trade and when to wait for the right setup.

Purpose:

Traders need the VSA Suite software because it is very difficult to recognize Volume Spread Analysis Signals and micro volume patterns by simply looking at a chart. A software algorithm is needed to be able to efficiently process all the price and volume data required to calculate these signals. Since volume has a big impact on price action, having a tool which provides clear signals and actionable information is a must have for any trader.

Elements:

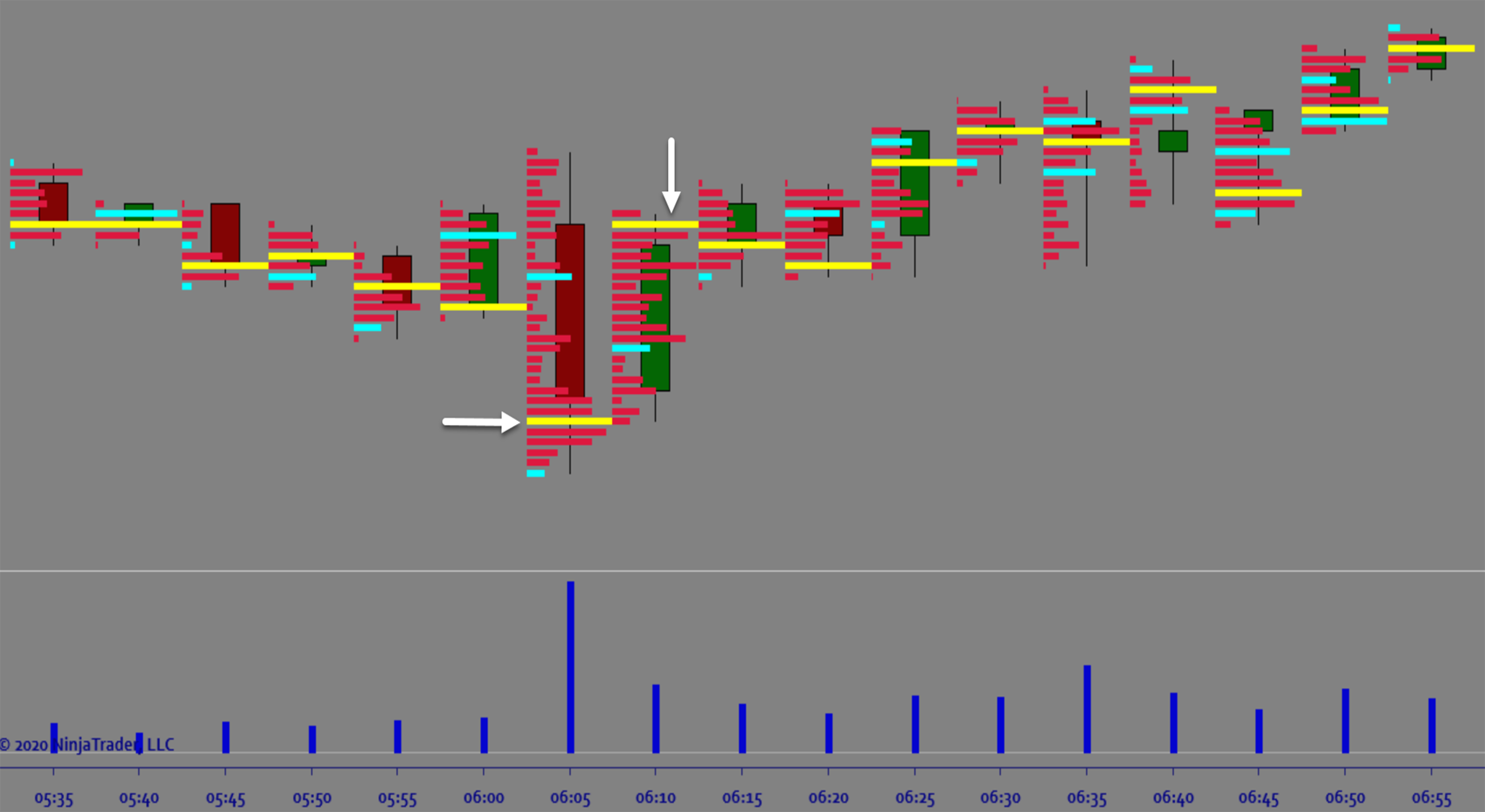

- Volume Spread Analysis Signals

- Climactic and Churn Bars

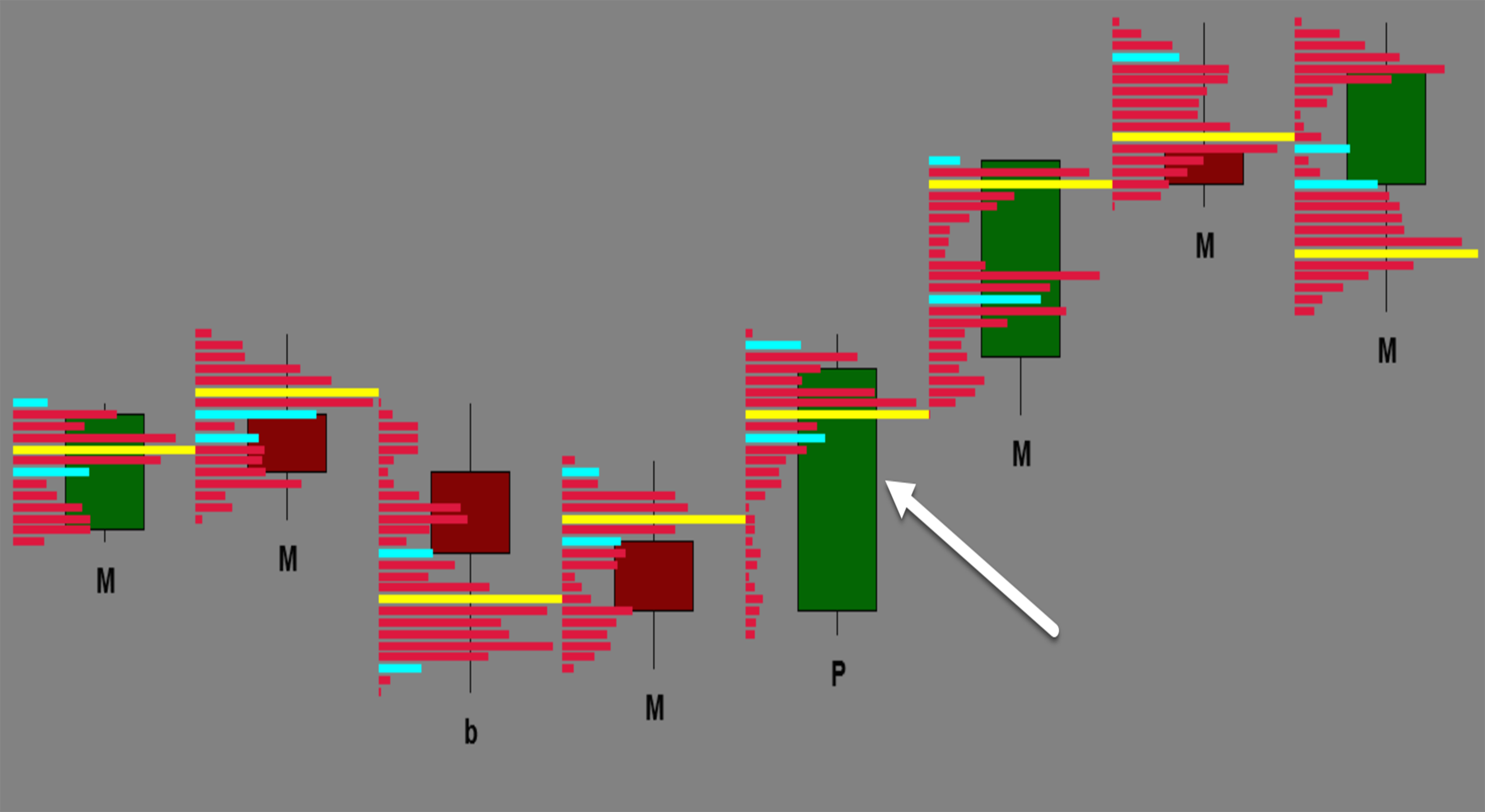

- 2 Bar Churn Pattern

- 2 Bar Pin Pattern

- Micro Volume Profile Patterns

- Relative Volume Analysis

- Directional Entry Signals

Functions:

The VSA Suite is best used by focusing on the signals that occur at important areas of interest (AOI). Because the software provides timing signals as well as micro volume patterns for anticipating directional changes, it makes an excellent complement to any analysis which identifies the best locations to trade. When price reaches an AOI, if a signal occurs and a trade is entered, the subsequent bar profiles can provide extra confirmation of follow through.

Volume Profile Tool Problem Solved:

- Stops traders from second guessing the timing of their trades

- Stops traders from second guessing directional bias

- Stop traders from not knowing when to engage and when to wait

- Stops traders from missing out on hidden information inside the candles

- Stops traders from missing important information provided by volume profile analysis

- Stops traders from failing to recognize reversal patterns