Overview:

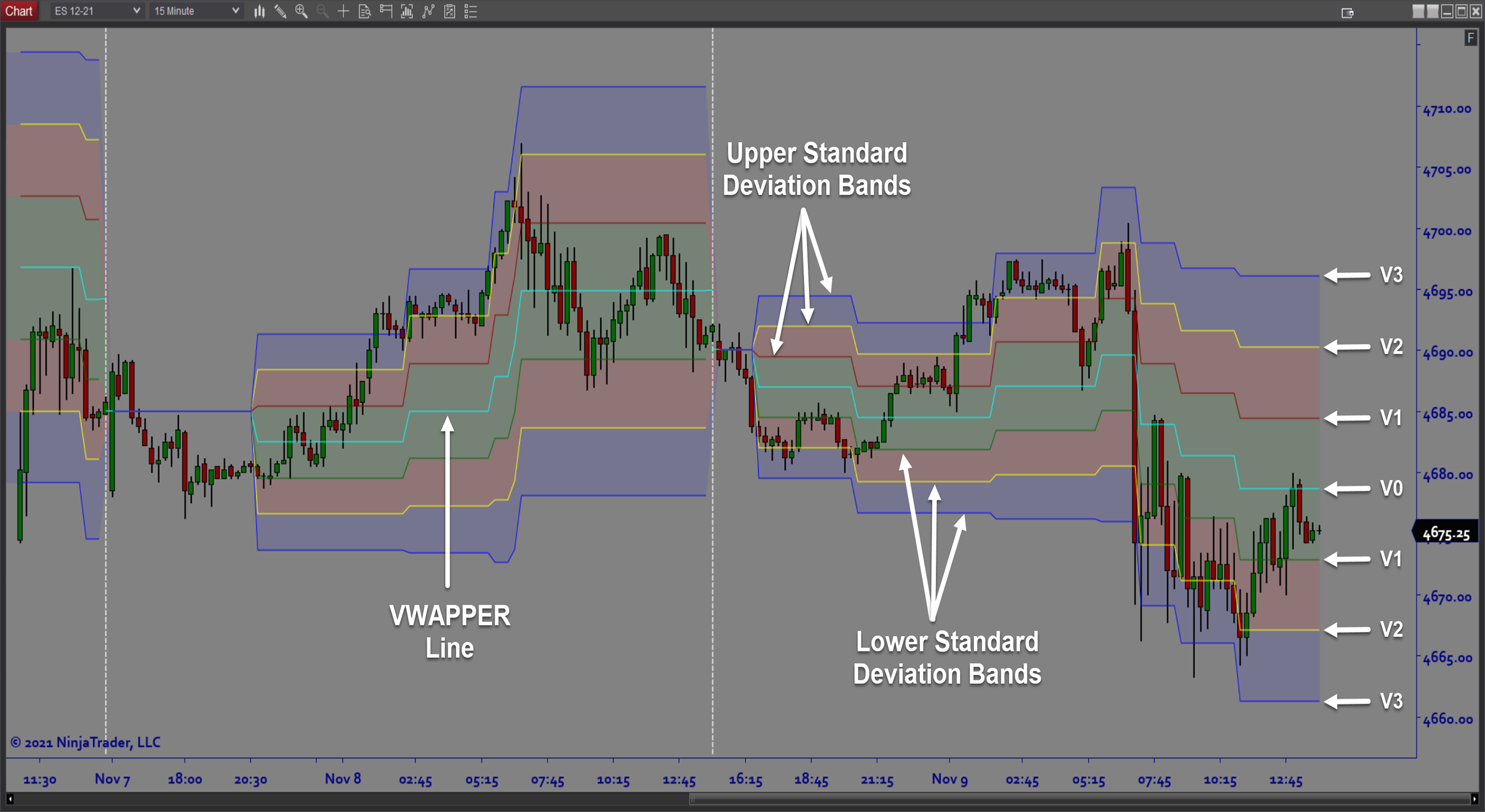

Vwapper Algo is a fully automated trading solution based on a volume weighted volatility driven standard deviation algorithm. The strategy uses statistical measures to identify key support and resistance levels around volume weighted prices. Price action at these key levels create reversal signals for both mean reversion and trend continuation setups. The software includes all the components necessary for trade setups, order execution, filter conditions, and trade and risk management. The ability to conduct extensive backtesting and performance analysis allows for robust strategy development and optimization. Once your strategy is fine tuned, the software robotically trades your strategy for you, removing the risk of human error and emotions and ensuring that your strategy is executed flawlessly.

Purpose:

Traders need the Vwapper Algo because a statistically based approach to analyzing volume weighted pricing is a very effective way to trade both trend and mean reversion strategies. These signals are simply not feasible to calculate manually. Using an automated trading algo is a great way to remove the emotional side of live discretionary trading. Some traders struggle with indecision and fear. By letting the algo mechanically perform the order execution, you can focus on optimizing all the algo settings to maximize profitability and then trade with confidence.

Elements:

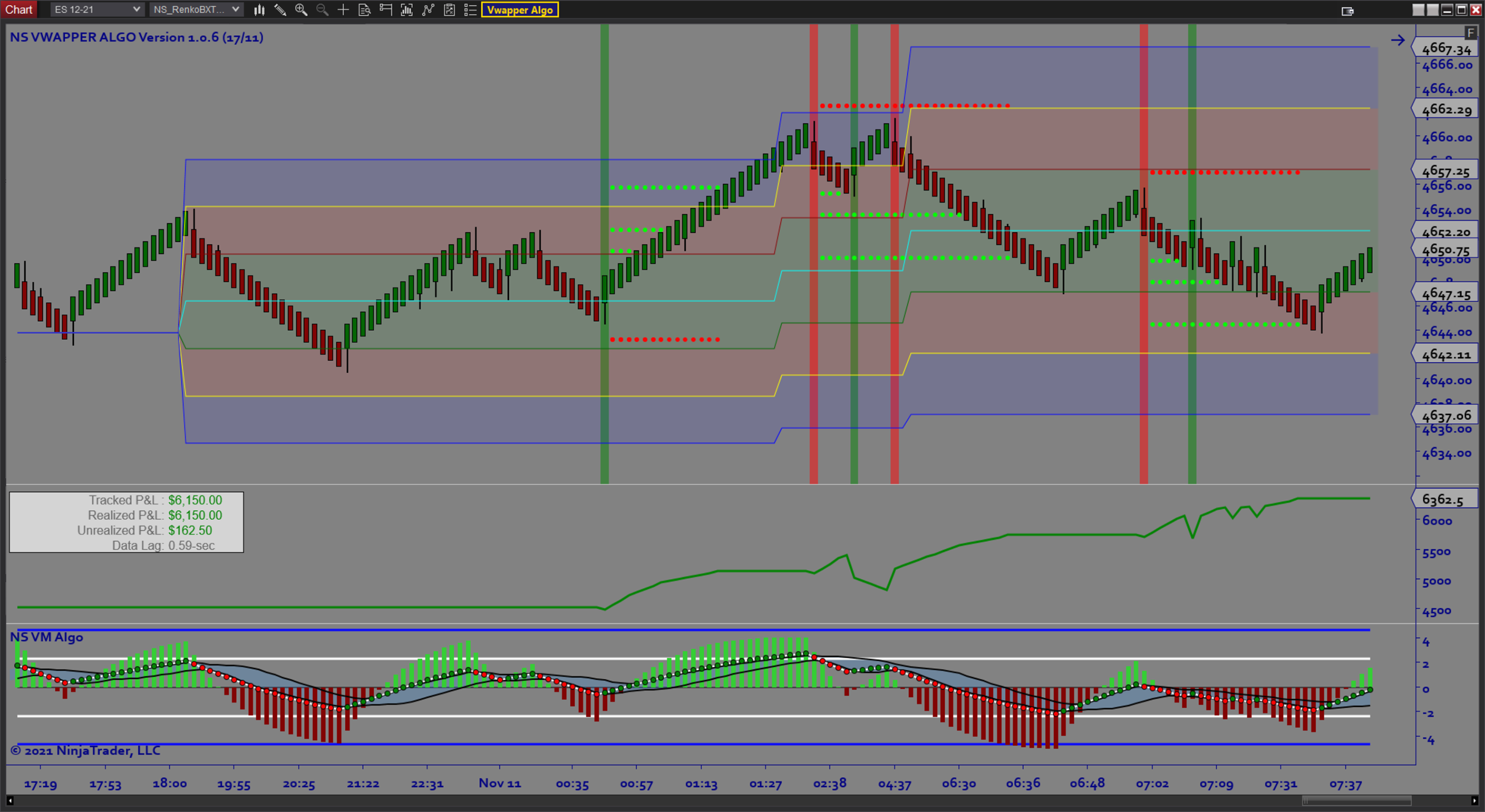

- Vwapper Stepwise Volume Weighted Average Prices

- Statistical Deviation Bands

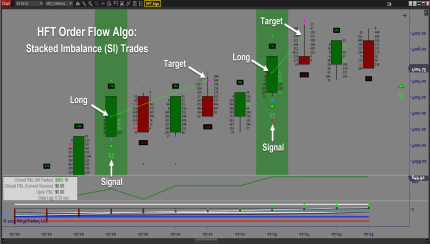

- Price Action Pattern Recognition

- Mean Reversion and Trend Signals

- On screen trade signals, entry/exit markers, stops/targets, realized/unrealized P&L

- Customizable Trade Plan

- AutoTrail and Breakeven

- Trade Time Windows

- Money Management (Max Daily Loss and Profit Goals)

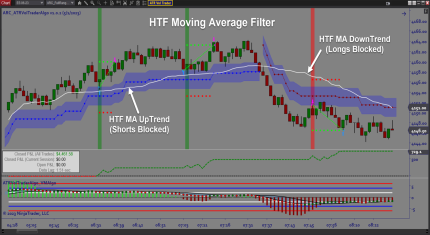

- Trend Filters

- Momentum FIlters

- OBOS Filters

- Datafeed Lag Monitor for Safety

- Backtesting and Optimization

Functions:

The Vwapper Algo software is best used by using backtesting and optimization to find the most profitable settings for each market that you trade. Because it is a statistically based strategy, this is the best place to start. Each market will have unique characteristics. The benefit is that the final strategy is mathematically derived and free of opinion and expectations. The software is flexible enough to fit your preferences and trading style and also adjust to changing market conditions. The key is to follow the steps from design and optimization to Sim trading and eventually put real capital to work.

Problem Solved:

- Stops traders from missing out on mean reversion trades

- Stops traders from missing out on trend trades

- Stops traders from trading strategies that have no statistical backing

- Stops traders from relying on opinion and guesswork

- Stops traders from second guessing directional bias

- Stops traders from second guessing trade timing

- Stops traders from dealing with the stress of live trading

- Stops traders from sabotaging their trading due to fear and uncertainty

- Stops traders from breaking the rules of their trade plan

- Stops traders from breaking their risk management rules

- Stops traders from breaking their money management rules