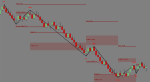

Waves Indicator Overview:

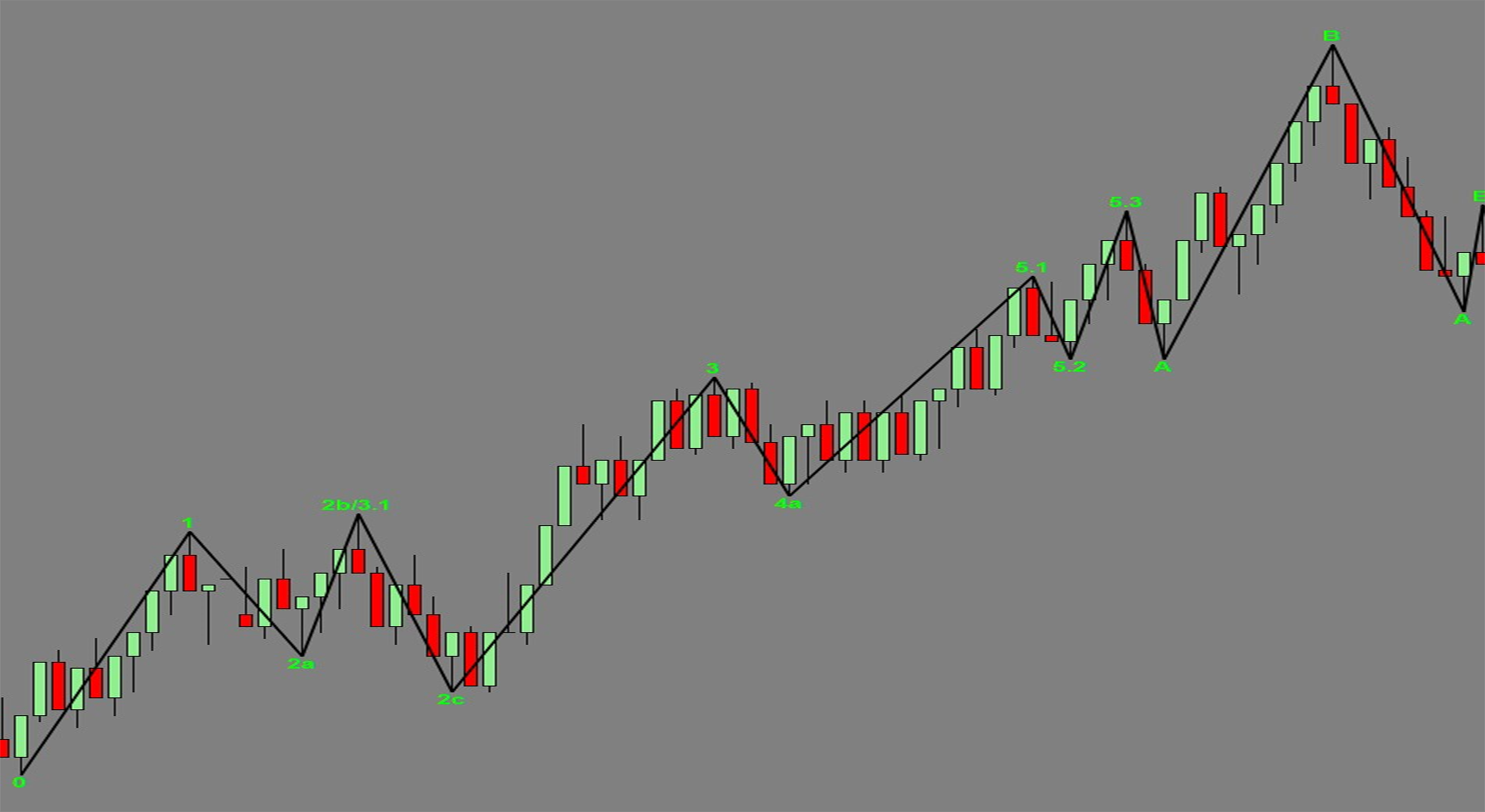

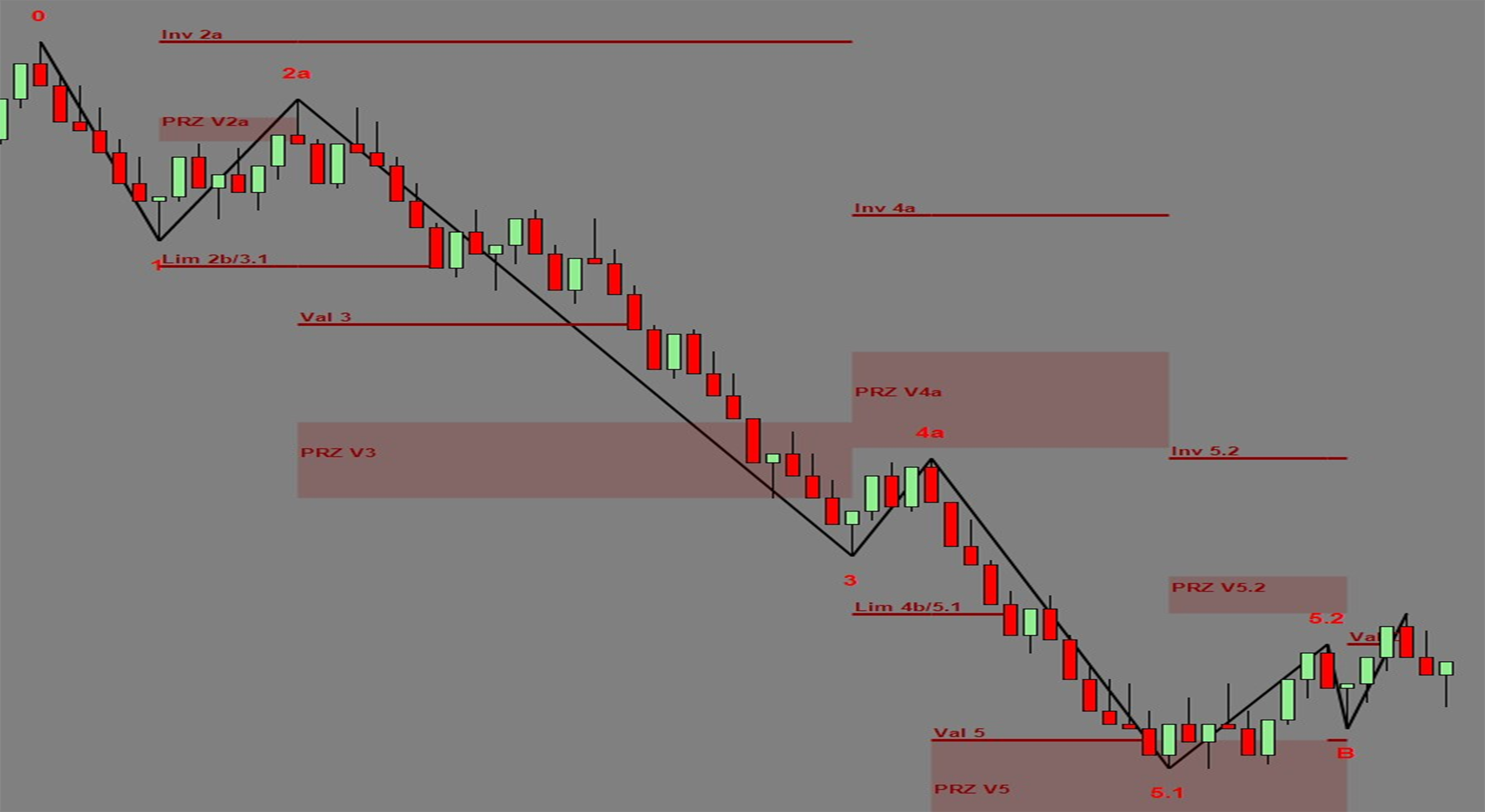

The Waves is an automated Wave analysis add-on. It calculates Impulsive and corrective waves. It auto populates PRZ’s (Price reversal zones) for trade entry. It auto populates validation and invalidation levels to make sure the math calculations for auto wave detection are all done on the fly. This software automates elliott wave theory and populates impulsive and corrective wave counts. Essentially this software is a trend traders best friend, allowing you to trade the right times and locations on a moving market.

Purpose:

Mostly wave analysis is used in trending markets. Knowing the correct impulse and correction is important for trade entry and mgmt. Knowing when a trend is expected to end is valuable information. If you’re planning on getting in early or trying to trade an impulsive wave, you will need such information to ensure you have enough room to let a trend trade play out or if you should manage your risk for a shorter term play. This will stop you from guessing trending markets and put logic and math on your side

Elements:

- Automated wave detection

- Auto PRZ’s (Price Reversal Zones)

- Auto trend detection (useful for knowing when to apply it)

- Automated math & mesurred move calculations

- Automated trade planning capabilities

Functions:

The waves are best designed to assist trend traders where to engage in pullbacks and when to expect a trend to end. By automating the mathematics of elliot wave and fibonacci measured moves, it will automatically do all the heavy lifting for you. In short, the waves will tell you what impulse to trade and what correction to enter on, it will also tell you when to pass on trading at the wrong times as a trend is already about to end!.

Problem Solved:

- Stops traders from second guessing market structure

- Stops traders from second guessing their waves counts

- Stops traders from trading trends at the wrong place and time.

- Stops traders from entering late in a correction

- Stops traders from calculating math and measured moves incorrectly