Overview:

TrendStepperAlgo is a fully automated trading solution based on a custom noise reduction trend crossover strategy. When paired with a custom Renko bartype, the strategy setups are configured to capture more of the trend while minimizing false signals. The software includes all the components necessary for trade setups, order execution, filter conditions, and trade and risk management. The ability to conduct extensive backtesting and performance analysis allows for robust strategy development and optimization. Once your strategy is fine tuned, the software robotically trades your strategy for you, removing the risk of human error and emotions and ensuring that your strategy is executed flawlessly.

Purpose:

Traders need the TrendStepper Algo because the core strategy extracts more profits out of trend trading through noise reduction and signal filtering. Using an automated trading algo to deploy such a strategy is a great way to remove the emotional side of live discretionary trading. A good strategy can still generate bad results if the trader is struggling with indecision or fear. By letting the algo mechanically perform the order execution, you can focus on optimizing all the algo settings to maximize profitability and then trade with confidence.

Elements:

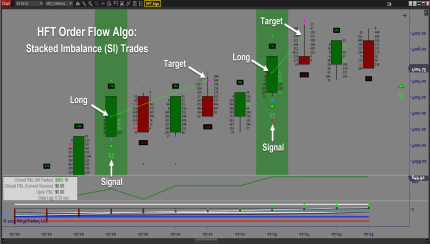

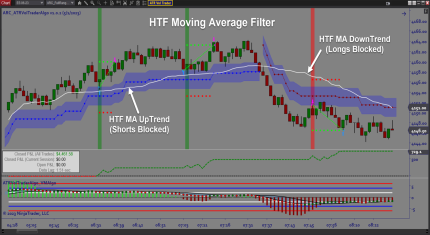

- Stepwise Trend Smoothing

- Micro and Macro Trend Signals

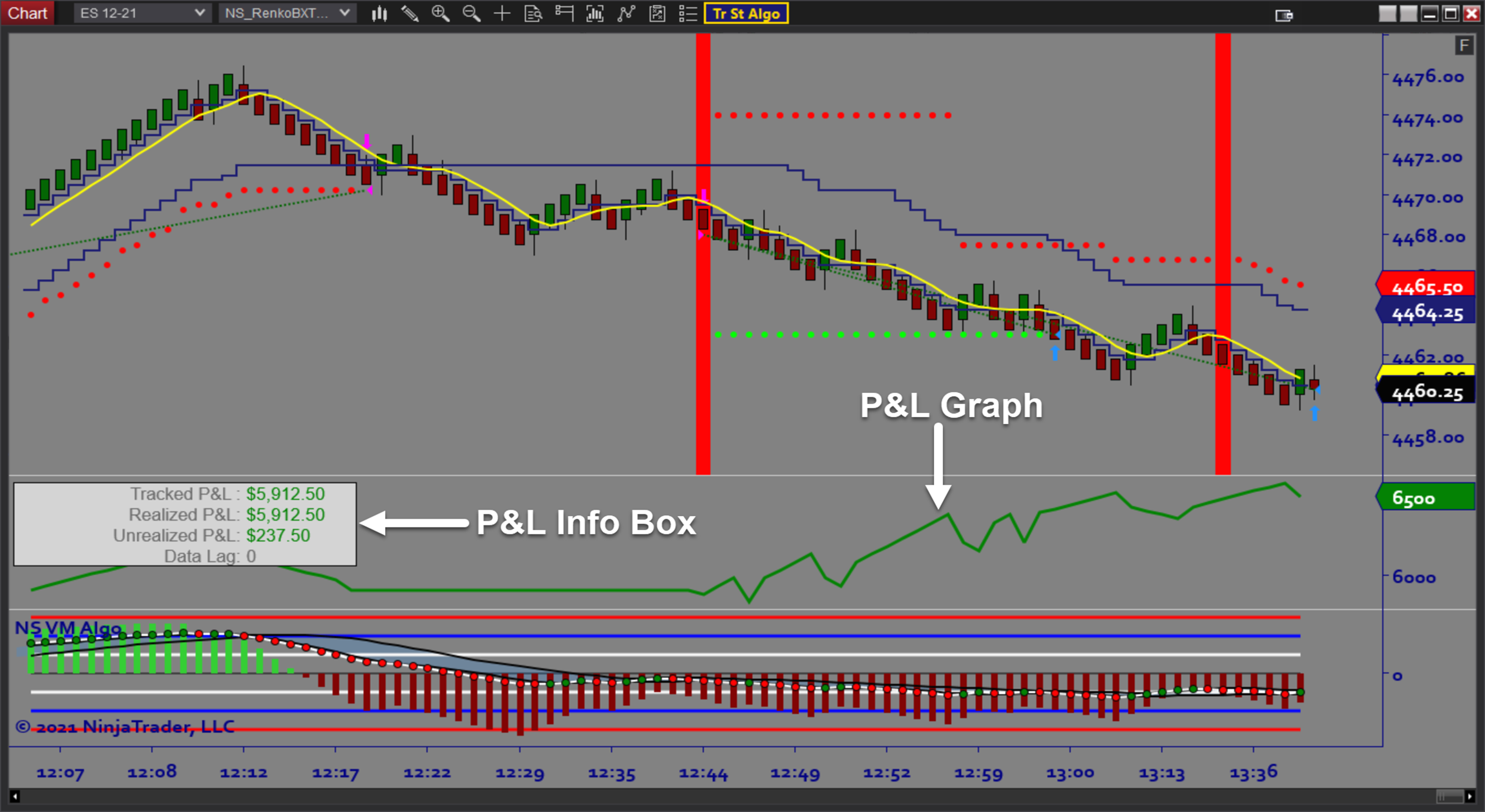

- On screen trade signals, entry/exit markers, stops/targets, realized/unrealized P&L

- Customizable Trade Plan

- AutoTrail and Breakeven

- Trade Time Windows

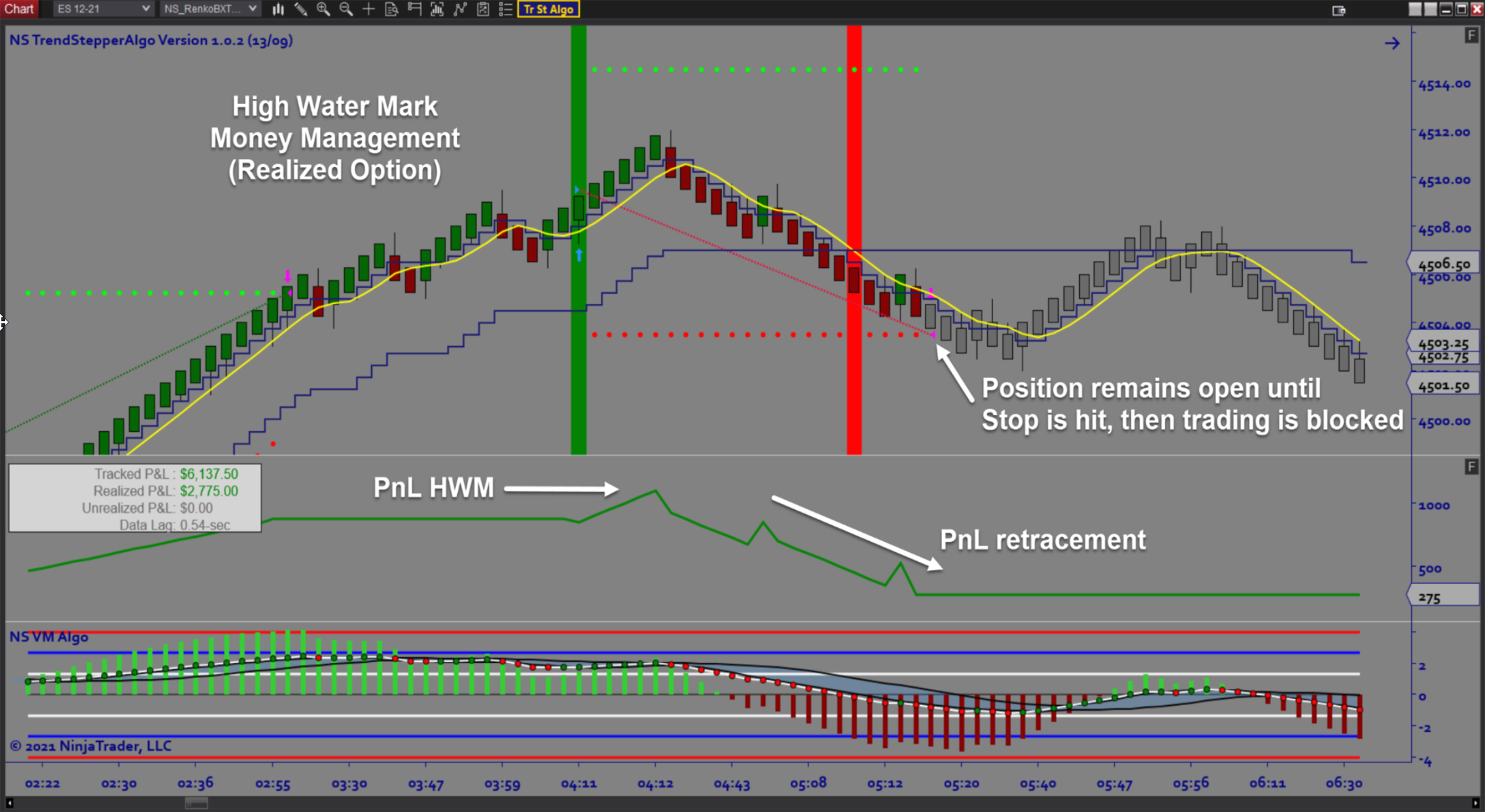

- Money Management (Max Daily Loss and Profit Goals)

- Trend Filters

- Momentum FIlters

- OBOS Filters

- Datafeed Lag Monitor for Safety

- Backtesting and Optimization

Functions:

The TrendStepper Algo is best used by relying on the noise reduction components to capture more of the trend by entering early and reducing false signals. Customizing to each market is a good way to get the most out of the software if you trade multiple instruments. Backtesting to find the most profitable settings can further be forward-tested in live conditions. Once profitability is stable, running the algo on a live account can produce consistent profits. The key is to follow the steps from design and optimization to Sim trading and eventually put real capital to work.

Problem Solved:

- ⦁ Stops traders from missing out on trend trades

⦁ Stops traders from second guessing directional bias

⦁ Stops traders from getting stopped out on false signals

⦁ Stops traders from getting in at the wrong time or in the wrong place

⦁ Stops traders from entering too late and missing out on most of the profits

⦁ Stops traders from dealing with the stress of live trading

⦁ Stops traders from sabotaging their trading due to fear and uncertainty

⦁ Stops traders from breaking the rules of their trade plan

⦁ Stops traders from breaking their risk management rules

⦁ Stops traders from breaking their money management rules

⦁ Stops traders from trading strategies that have no statistical performance data