Overview:

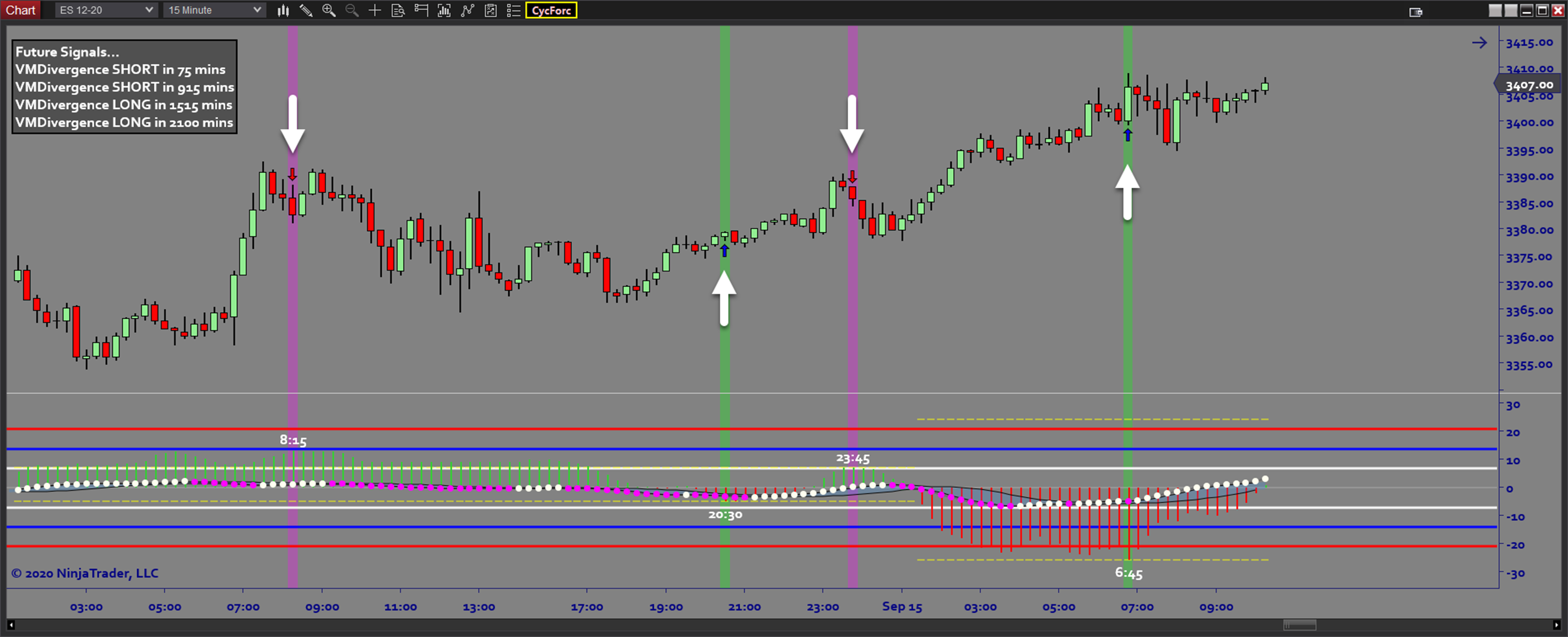

Cycle Forecaster is a tool that allows you to capture the statistical time cycle of each market and use it to predict the best time to enter the market, minutes or even hours in advance. The software includes the most commonly used oscillators as the basis for measuring the cycle pattern. The cycle projection algorithm essentially transforms a lagging indicator (standard oscillator) into a leading indicator (predictive timing signals). Cycle Forecaster can be used on any timeframe, making it a must have for any style of trader.

Purpose:

Traders need the Cycle Forecaster software because having a prediction about when to expect a price reversal is an invaluable addition to any trading strategy. There are many tools that give you areas of interest, directional bias, and momentum but there are very few ways to obtain a specific timing signal in the future. When such a prediction can be narrowed down to a specific timestamp (to the minute), it can dramatically improve your trade performance. The Cycle Forecaster provides this capability by using standard oscillators to capture the cycle pattern of the instrument being traded and then projecting that cycle into the future.

Elements:

- 2 Modes of Operation: Analysis and Forecast

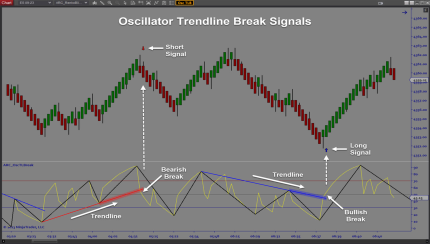

- Option to choose from 6 Different Oscillators

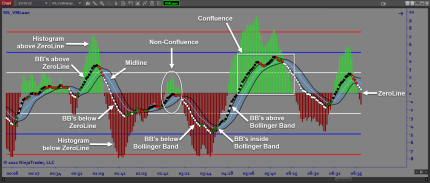

- Multi Signal Mode captures signal confluence

- Multi Timeframe Signals

- Maximum Adverse Excursion Signal Performance Statistics

- Globalized Trading Signals across multiple charts

- Supports Auto trading with Chart Marker Signals

Functions:

The Cycle Forecaster is best used by setting up a timing chart which can complement any trading strategy and using the predicted timestamps to time your entries. The software can be easily customized to the unique characteristics of each market. You may have a favorite oscillator for producing timing signals or you may choose multi-signal mode which searches for confluence across multiple oscillators. You can trade with the Cycle Forecaster as a standalone tool or you can enhance your existing strategy by improving the timing of your entries from your strategy.

Problem Solved:

- Stops traders from second guessing the timing of their trades

- Stops traders from second guessing directional bias

- Stops traders from getting stopped out due to entering at the wrong times

- Stops traders from missing opportunities due to using lagging indicators

- Stops traders from entering too late and missing out on most of the profits

- Stops traders from missing out on multi timeframe signals