Volume Divergence Algorithm Overview:

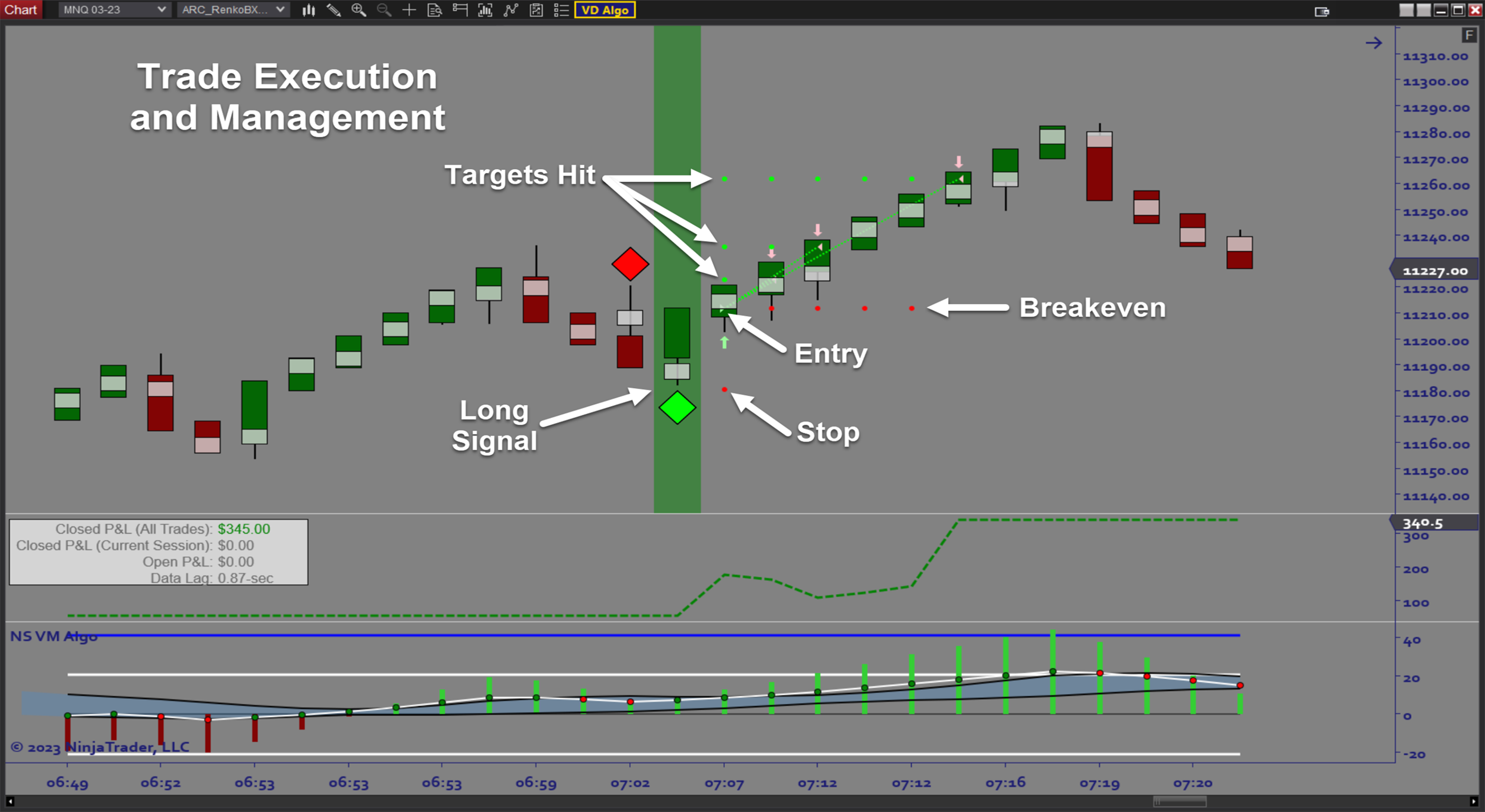

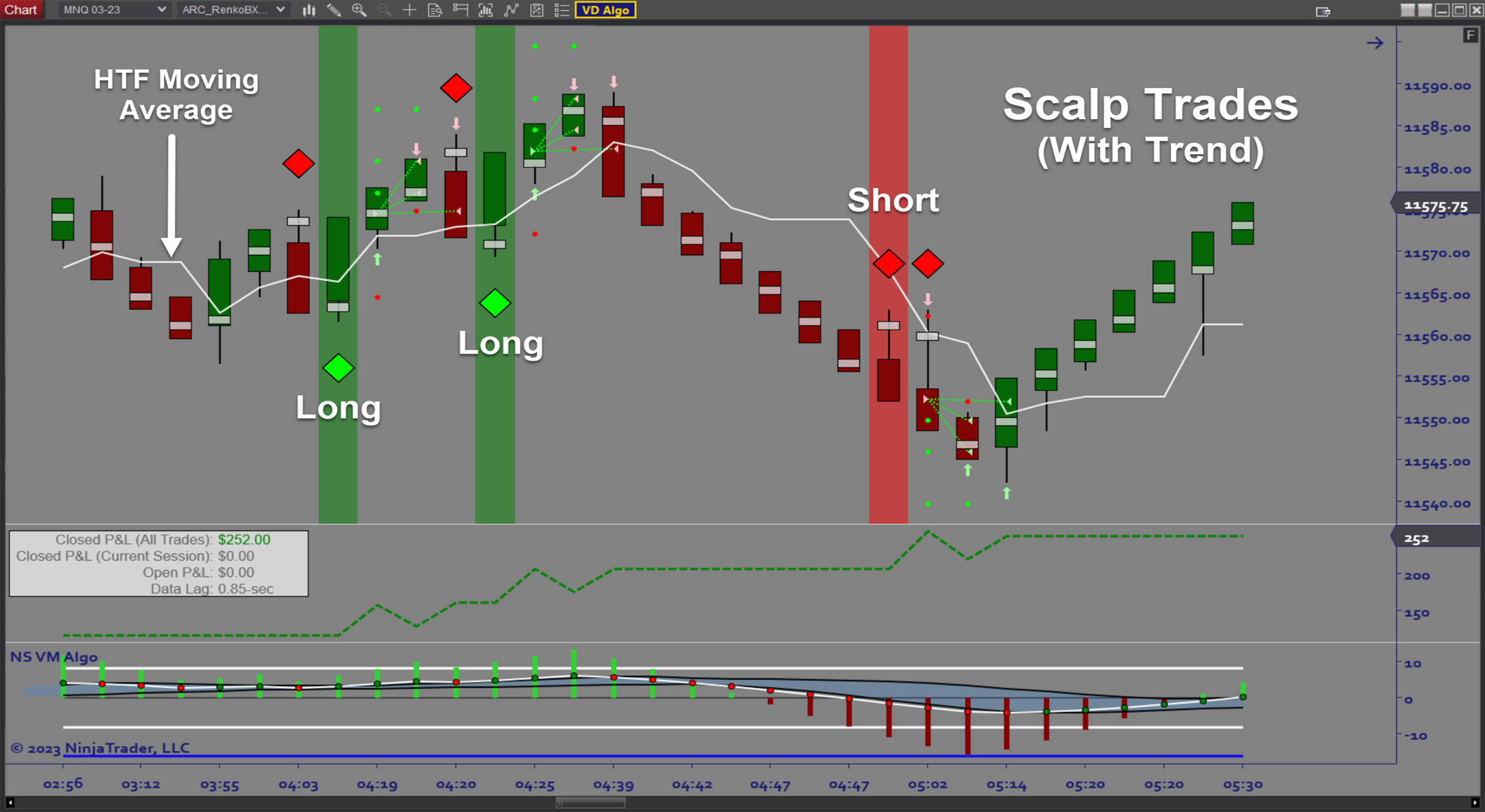

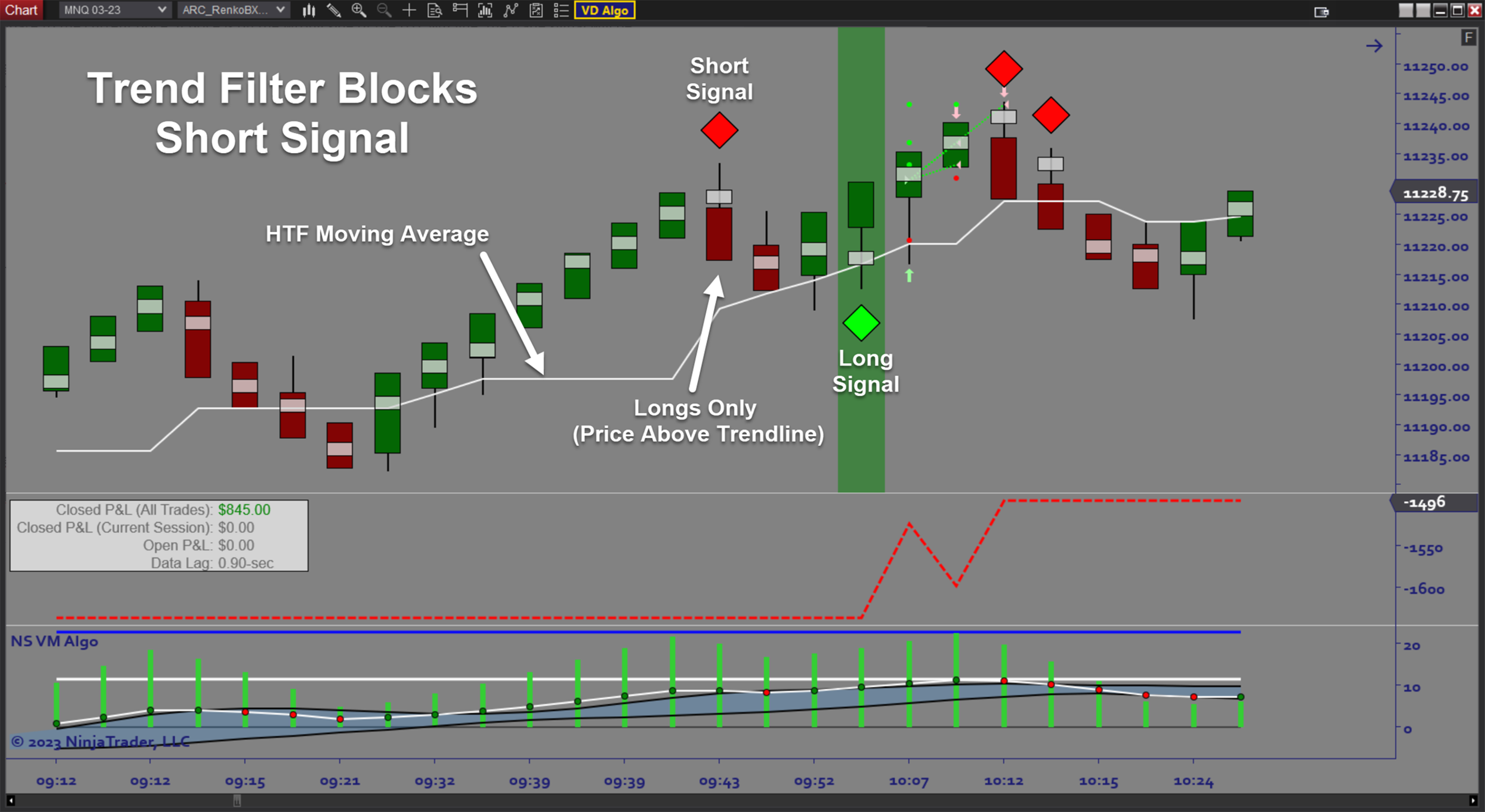

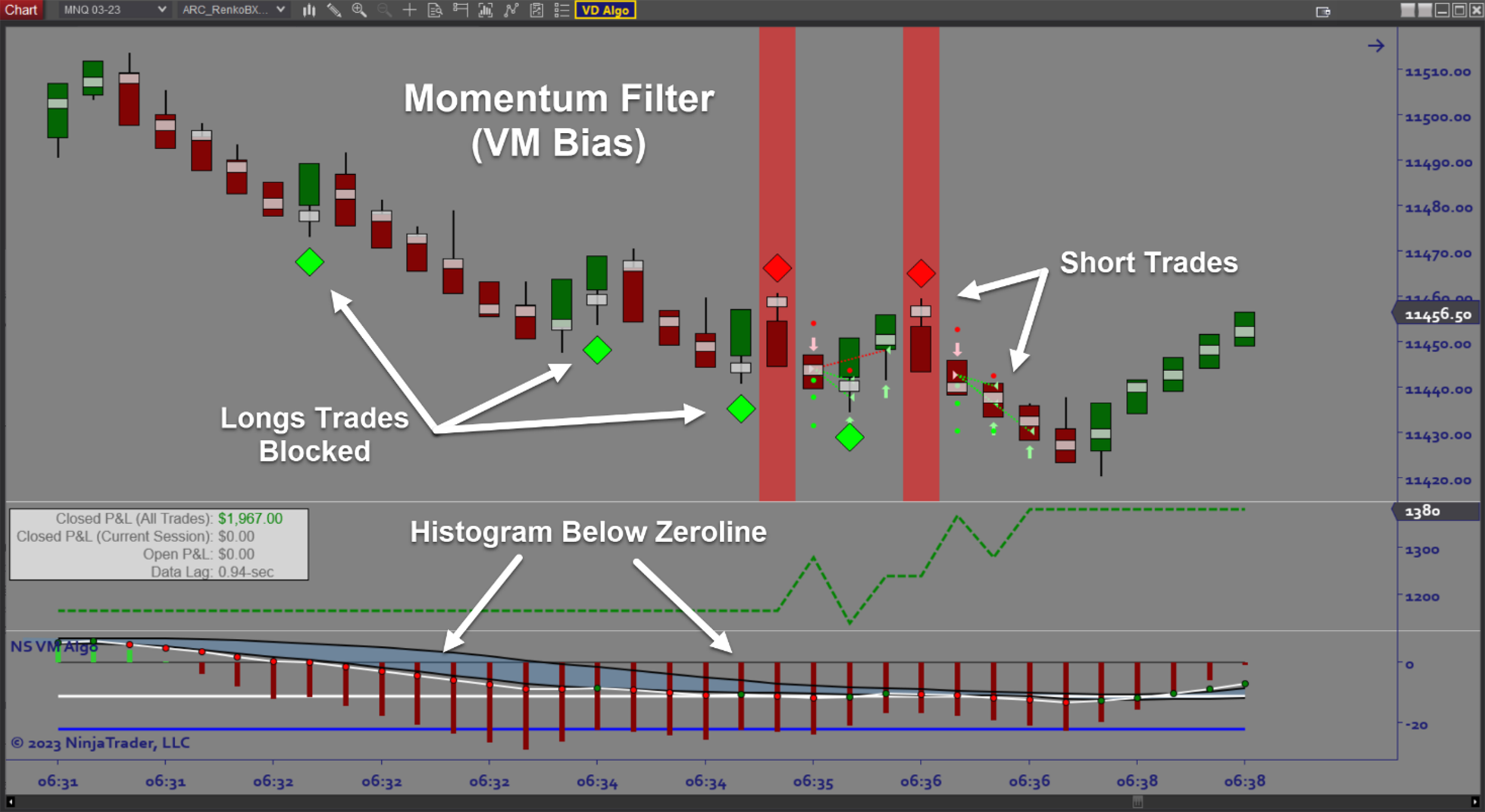

Volume Divergence Algo is a fully automated trading solution for Ninjatrader based on a micro level divergence detection algorithm. The software scans price action and volume in real time and generates a trade signal when the pattern is detected. Once a trade has been entered, the software manages the position according to a predetermined trade plan which includes up to 3 targets. The software also includes risk management, money management, breakeven, and trail functionality as well as a variety of trade selection criteria such as trend and momentum filters and trading time windows. Trade performance, backtesting, and optimization are all supported as part of Ninjatrader Strategy functionality.

Purpose:

Traders need the Volume Divergence Algo because the process of detecting micro volume divergence and then planning and executing a trade is very difficult to do manually. Due to the nature of the micro Volume Divergence setup, the time window for entering the trade at a good entry price is very brief. Using an automated trading algo in this situation is essential because the software is able to place the correct orders almost instantaneously. This results in better fills, less mistakes, and ultimately more profitable trading performance. Automated trading is also a great solution to remove the emotional side of live discretionary trading.

Elements:

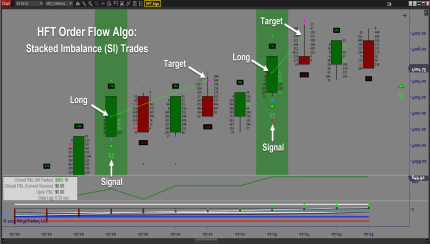

- Real Time micro volume profile calculation and tracking

- Integrated Volume Divergence Signal Engine and Live Trade Management

- Tick-level datafeed for most accurate results

- Customizable Bar Volume Cluster Size

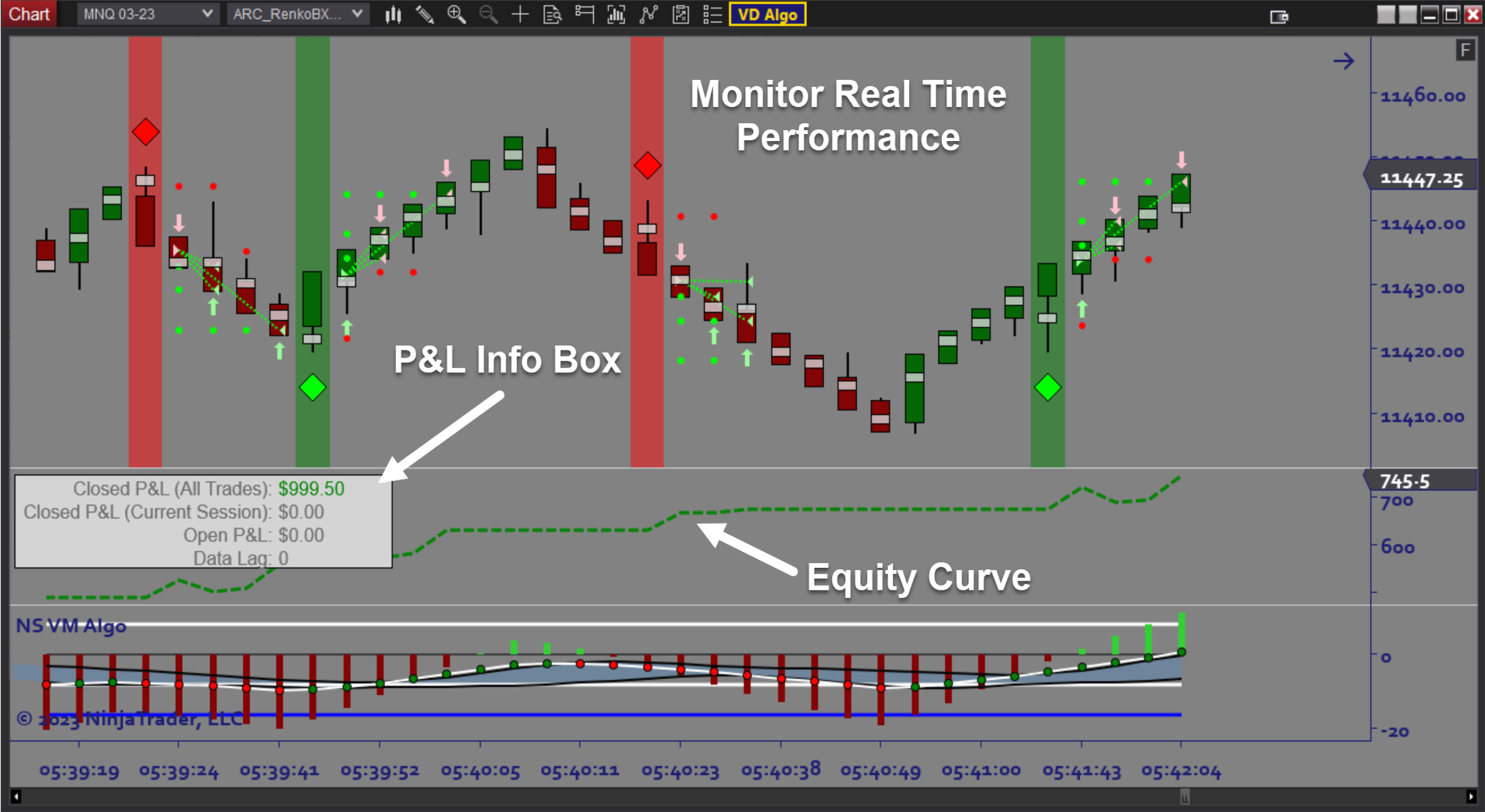

- On screen trade signals, entry/exit markers, stops/targets, realized/unrealized P&L

- Customizable Trade Plan

- AutoTrail and Breakeven

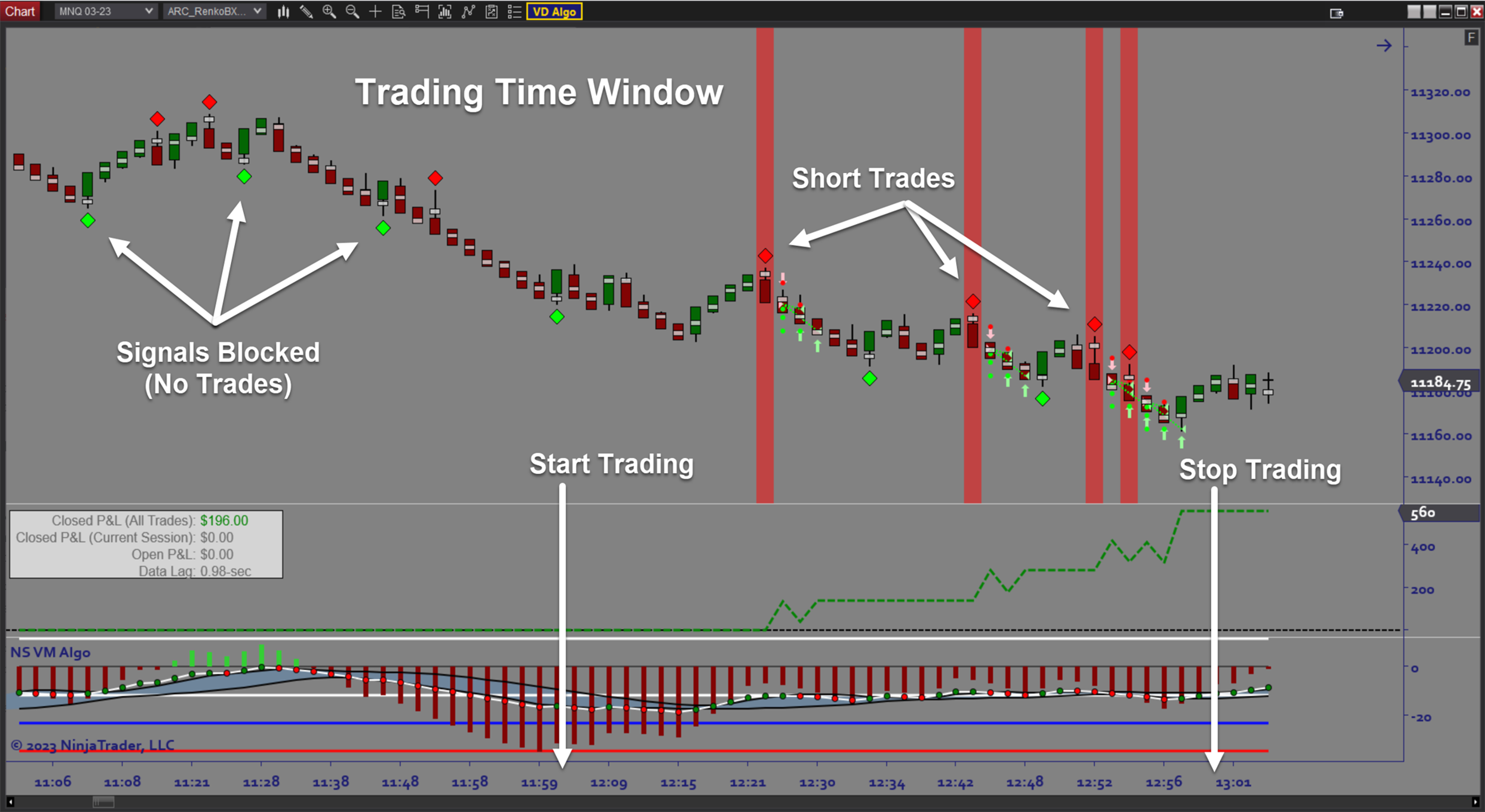

- Trade Time Windows

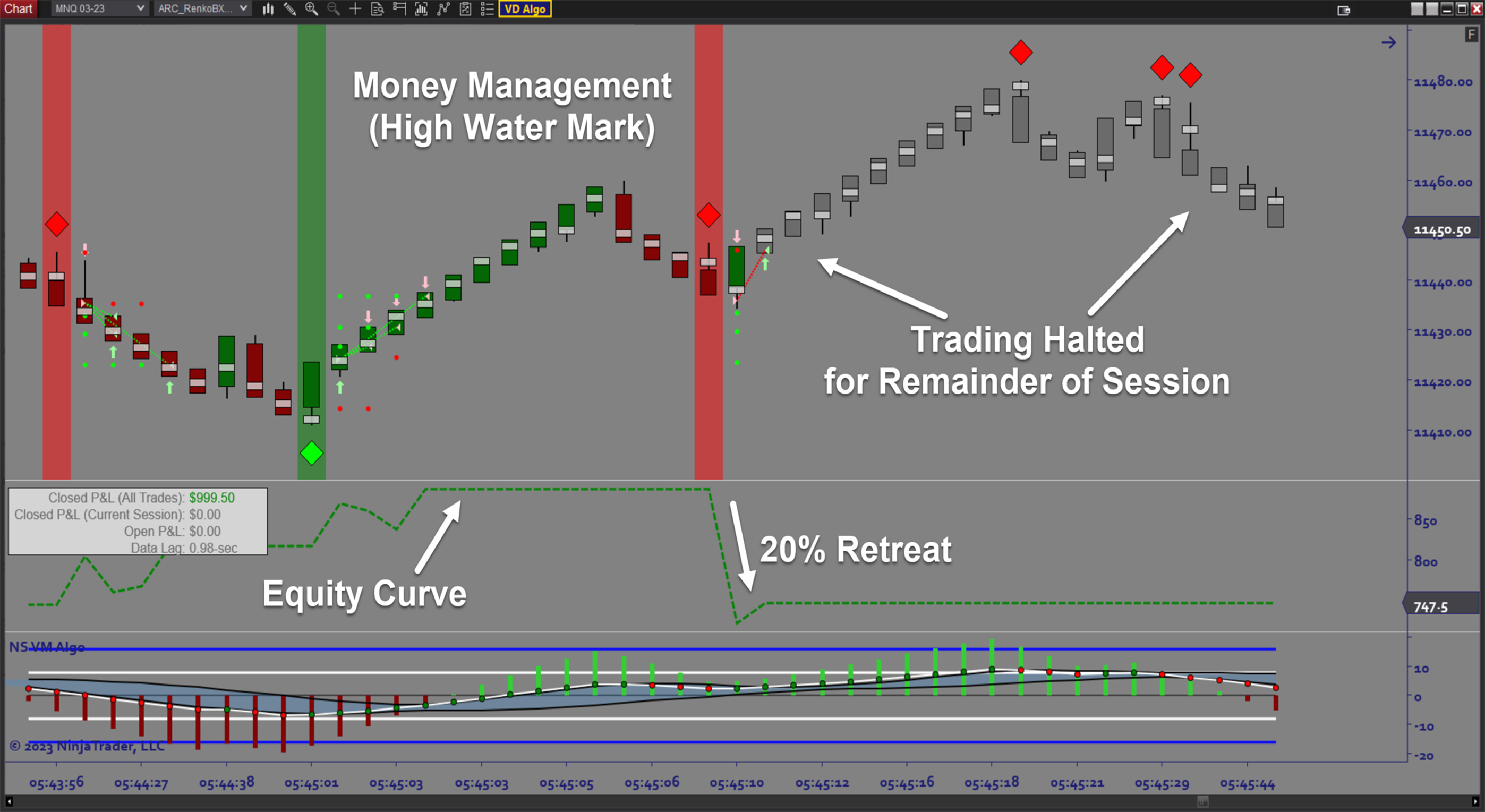

- Money Management (Max Daily Loss and Profit Goals)

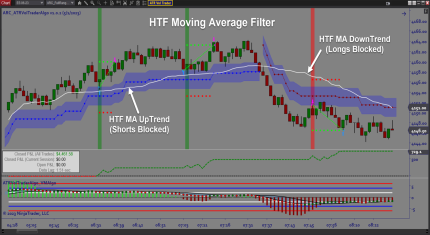

- Trend and Momentum Filters

- Datafeed Lag Monitor for Safety

- Backtesting and Optimization

Functions:

The Volume Divergence Algo is best used by letting the software do the heavy lifting of scanning for setups, entering the market when opportunities arise, and then managing those positions until an exit condition is met. Backtesting to find the most profitable settings can further be forward-tested in live conditions. Once profitability is stable, running the algo on a live account can produce consistent profits. The key is to follow the steps from design and optimization to Sim trading and eventually put real capital to work.

Problem Solved with our Volume Divergence Algorithm:

- Stops traders from missing out on scalp trades

- Stops traders from missing out on difficult to find micro volume pattern setups

- Stops traders from entering too late and missing out on most of the profits

- Stops traders from overlooking the importance of strategy development and testing

- Stops traders from dealing with the stress of live trading

- Stops traders from sabotaging their trading due to fear and uncertainty

- Stops traders from breaking the rules of their trade plan

- Stops traders from breaking their risk management rules

- Stops traders from breaking their money management rules