MTF_Divergence A.M.A. (Ask Me Anything) Video

Divergence Indicator Overview:

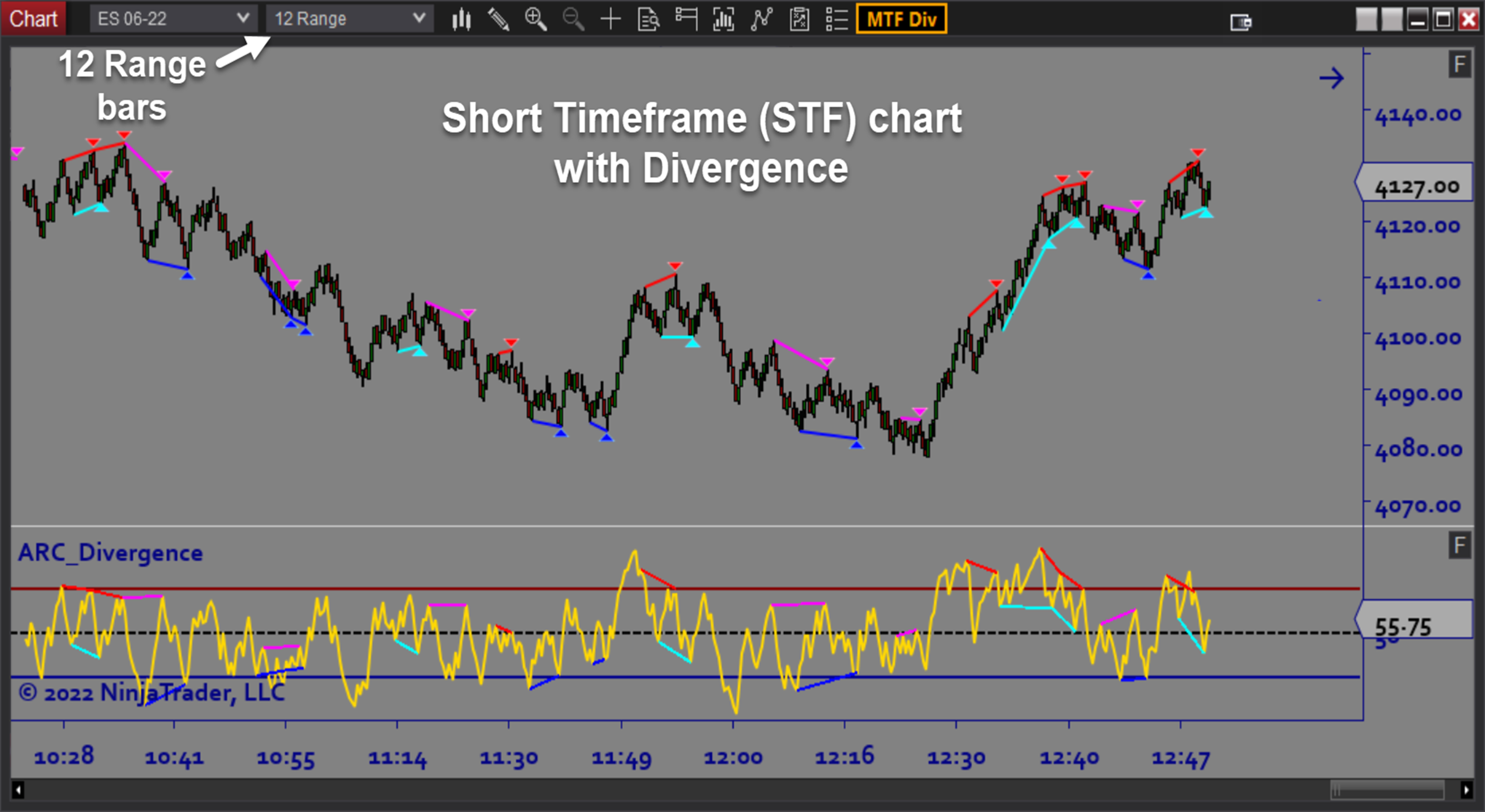

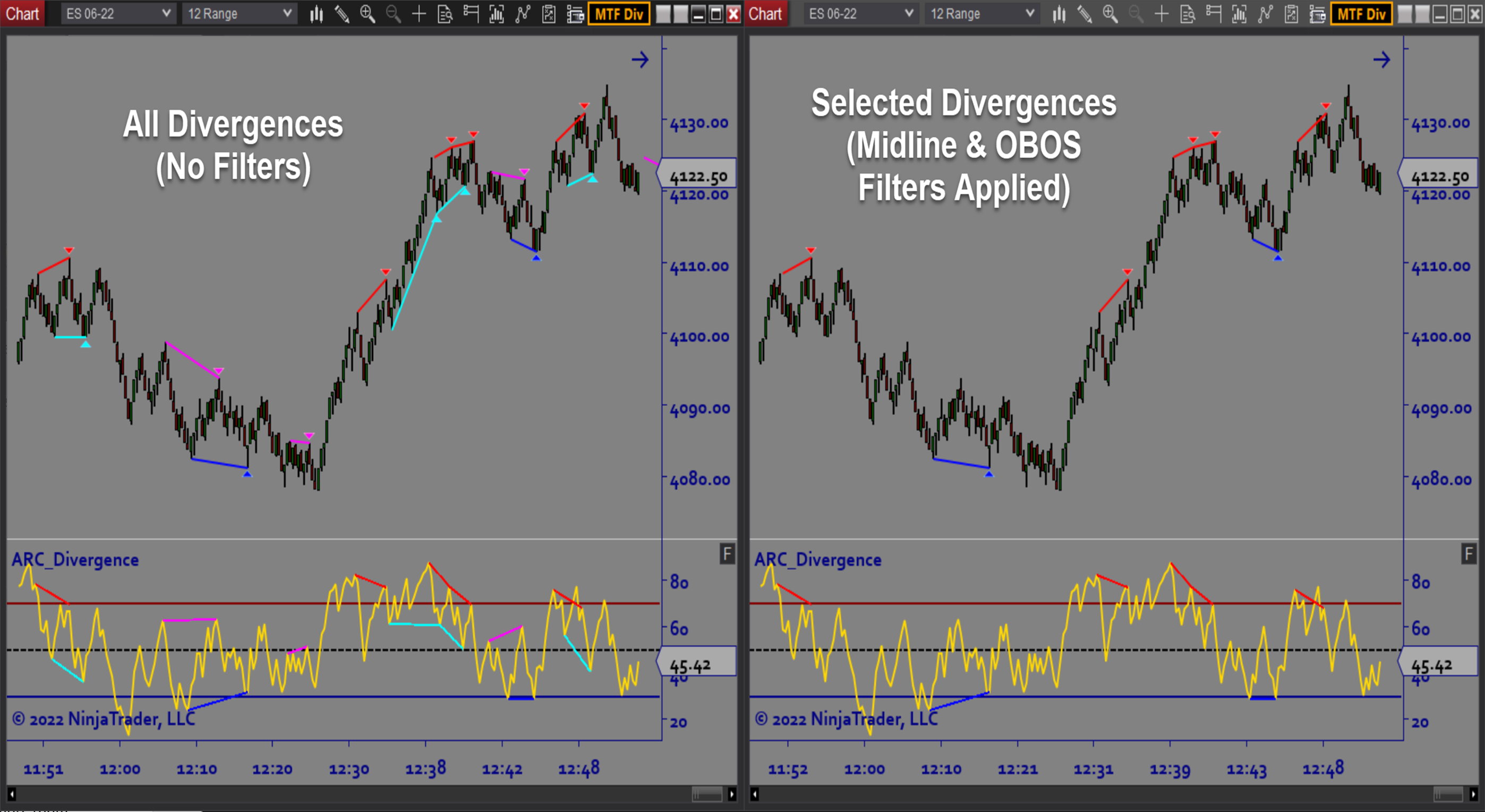

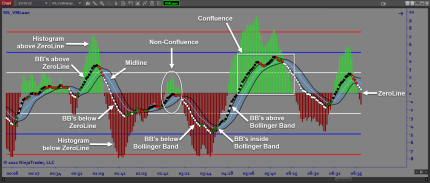

The MTF_Divergence (“MTF_Divergence”) software is a universal, multi-timeframe Divergence indicator which facilitates the identification of high-quality trade setups. The software provides a visual indication whenever Divergence exists between the price chart and an oscillator. What makes it “universal” is that it includes a variety of different oscillators. It is “multi-timeframe” because it includes the ability to plot Divergences calculated from a higher timeframe (HTF) chart directly on your trading chart of a shorter timeframe (STF).Purpose:

Traders need the MTF_Divergence software because trading without Divergence information is like being in a fight with one hand tied behind your back. Divergence acts as an early warning of a potential reversal which can work against a normally reliable trade setup. Ignoring Divergence can negatively affect your trade performance. The Divergence lines are displayed both on the price bars and in the oscillator subpanel, making it very easy to remain fully aware of potential Divergence conditions at all times.Elements:

- Option to choose from 8 different oscillators

- Multi timeframe option (HTF DIvergence displayed directly on a STF chart)

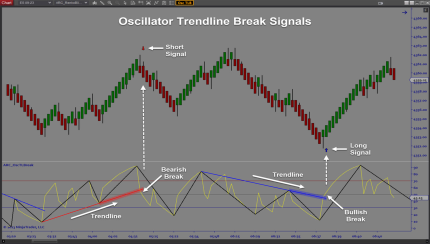

- Divergence Signals displayed on the Price Bars

- Both Regular and Hidden Divergence

- Potential and Confirmed Divergence

- Can be used on any bartype or timeframe

- Optional Zig Zags on Price Bars

- Customizable Swing Strength

- Overbought/Oversold Filter

Functions:

The MTF_Divergence software is best used by adding it to your price charts and using it as a filter on your trade setups. If you are considering a long trade but then suddenly bearish Divergence occurs, you know that it is better to wait. Alternatively, if a long signal occurs shortly after Bullish Divergence has occurred then that lends support to the long strategy. Keeping aware of Divergence conditions at all times while trading will help your trading performance.Problem Solved with the best divergence indicator:

- Stops traders from wasting time trying to keep track of Divergence manually

- Stops traders from missing Hidden Divergence

- Stops traders from second guessing trade timing

- Stops traders from trading in the wrong direction

- Stops traders from getting stopped out for no apparent reason

- Stops traders from uncertainty and fear due to missing information

- Stops traders from entering too late and missing out on most of the profits

- Stops traders from lacking confidence due to poor performance