Overview:

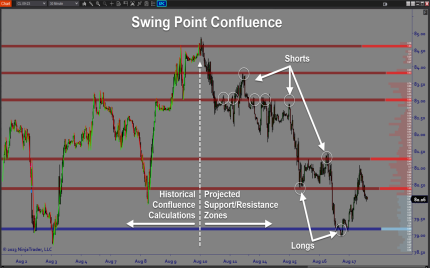

The GF_System is a Semi-Auto Multi-Timeframe Fibonacci Confluence Trading System. It leverages the power of MTF Support & Resistance, trade planning, risk planning, trend detection and automatic volatility assessment. This is a superior solution for Fibonacci and levels trading systems as it uses integrated confluence algorithms for more accurate and probably trading levels.

Purpose:

It’s humanly not possible to calculate multiple time frame confluence without a computer algo. This software takes all the hard work out of the identification and trade setup planning process and allows us to trust the levels based on fibonacci confluence. It allows for user input and customization so that we can control the strength of the levels as well as the frequency of trade locations. Simply put this is one of the most powerful trading levels software applications built for active traders.

Elements:

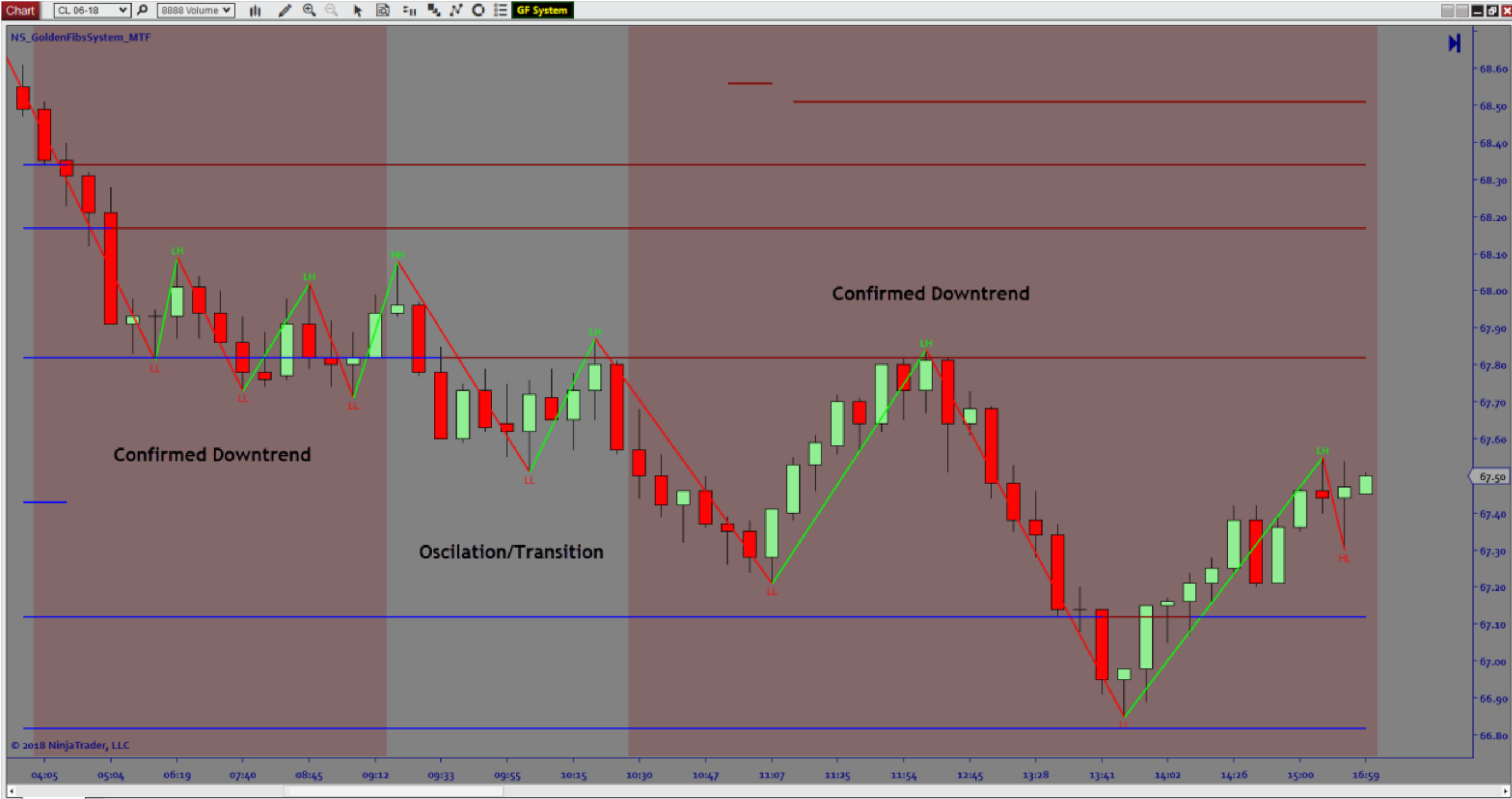

- Multiple Timeframe Confluence Algorithm

- Fibonacci Confluence Support & Resistance

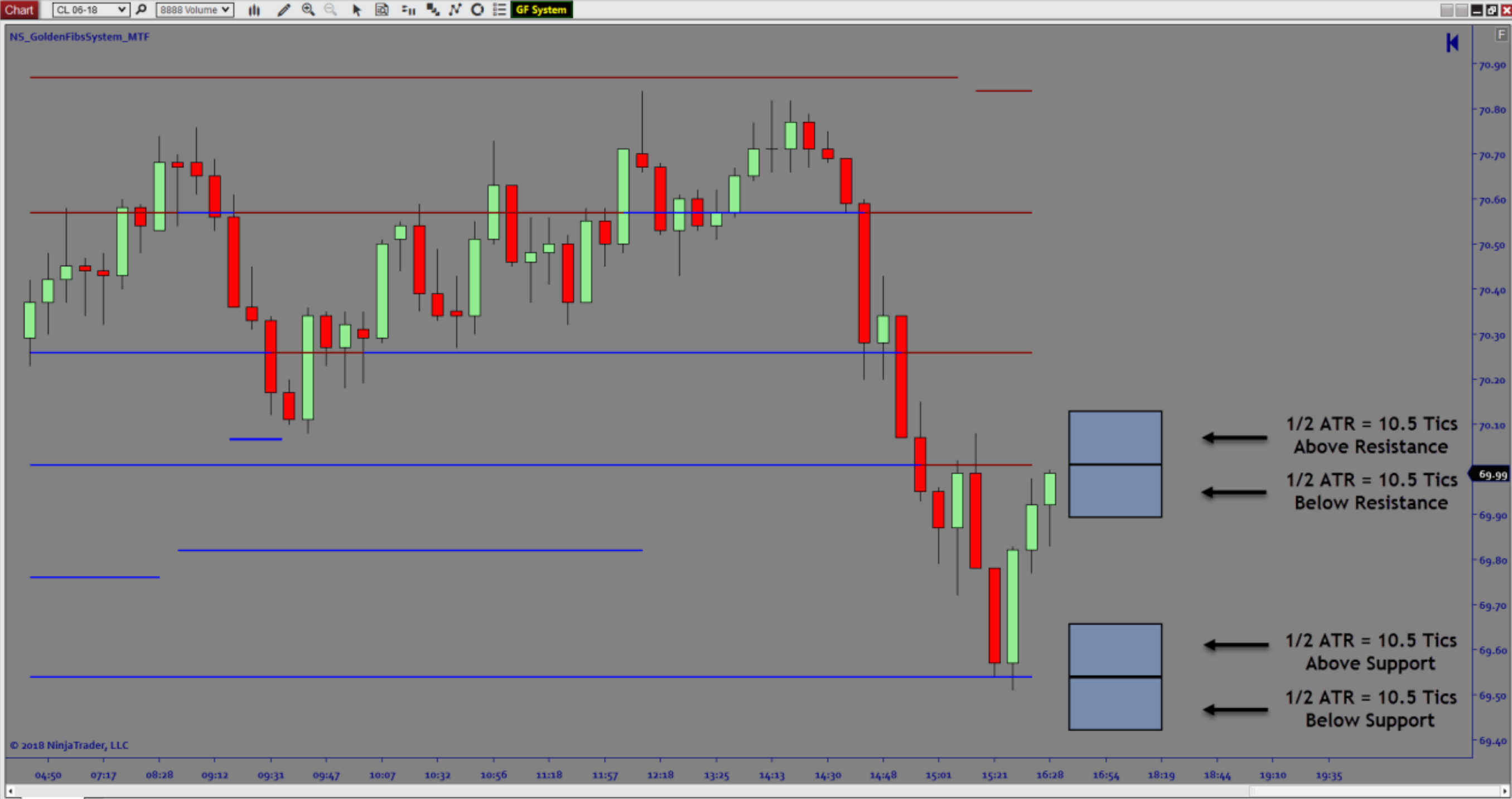

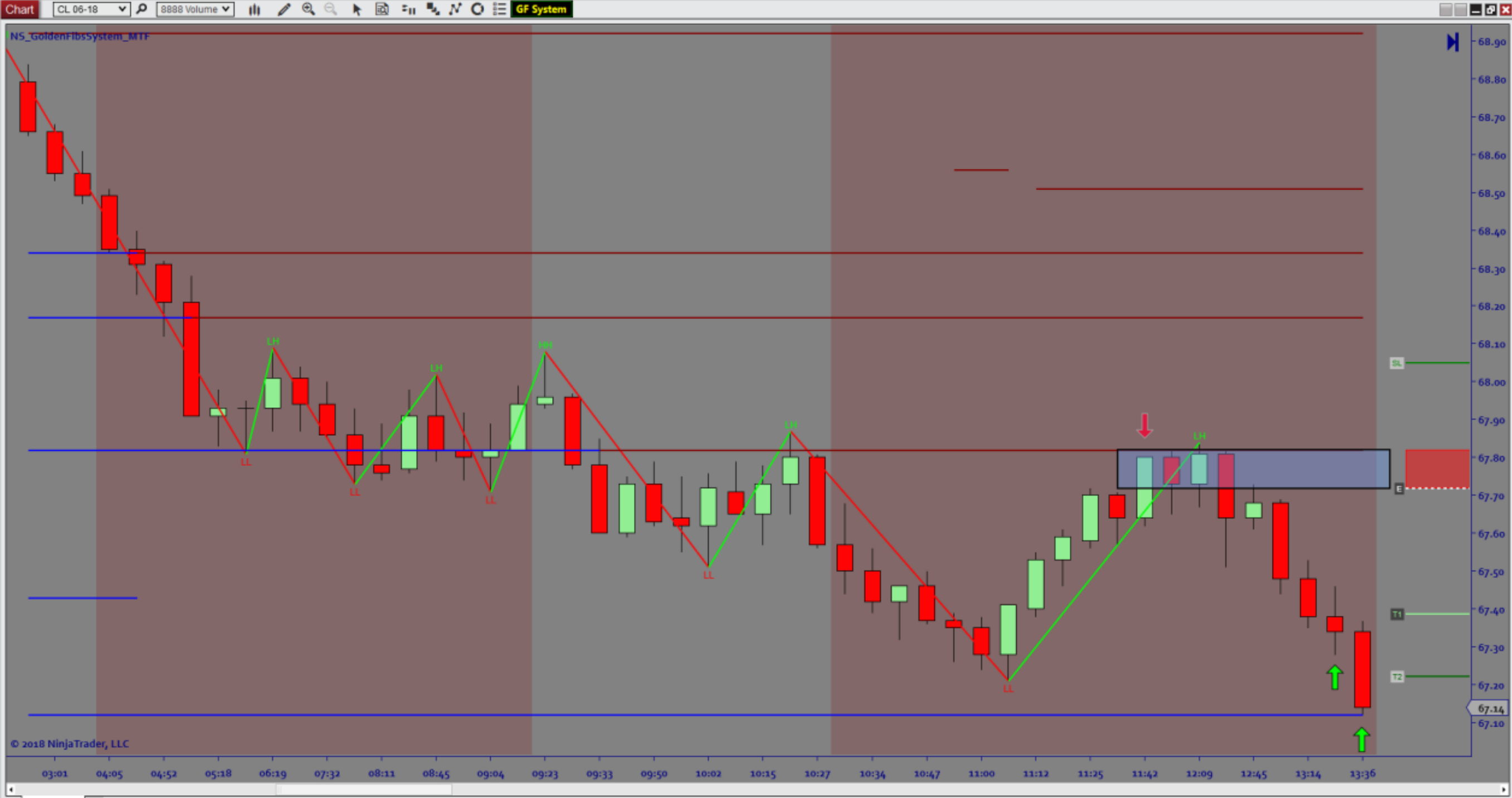

- Auto Trade Planning – Entry, Stops & Targets

- Volatility Control Inputs – Contractions & Expansion

- Automatic Level Adjustment (Only The Fly Fib Placement)

Functions:

Locate support and resistance using fibonacci Confluence and provide a semi auto trade planner to help; assess risk, entry and exit placement.

Problem Solved:

- Stops traders from second guessing fibonacci support & resistance

- Stops traders from second guessing trade planning, risk planning, and mgmt

- Stops traders from trading the wrong side of support & resistance.

- Stops traders from having to manually place levels & avoid human error