Overview:

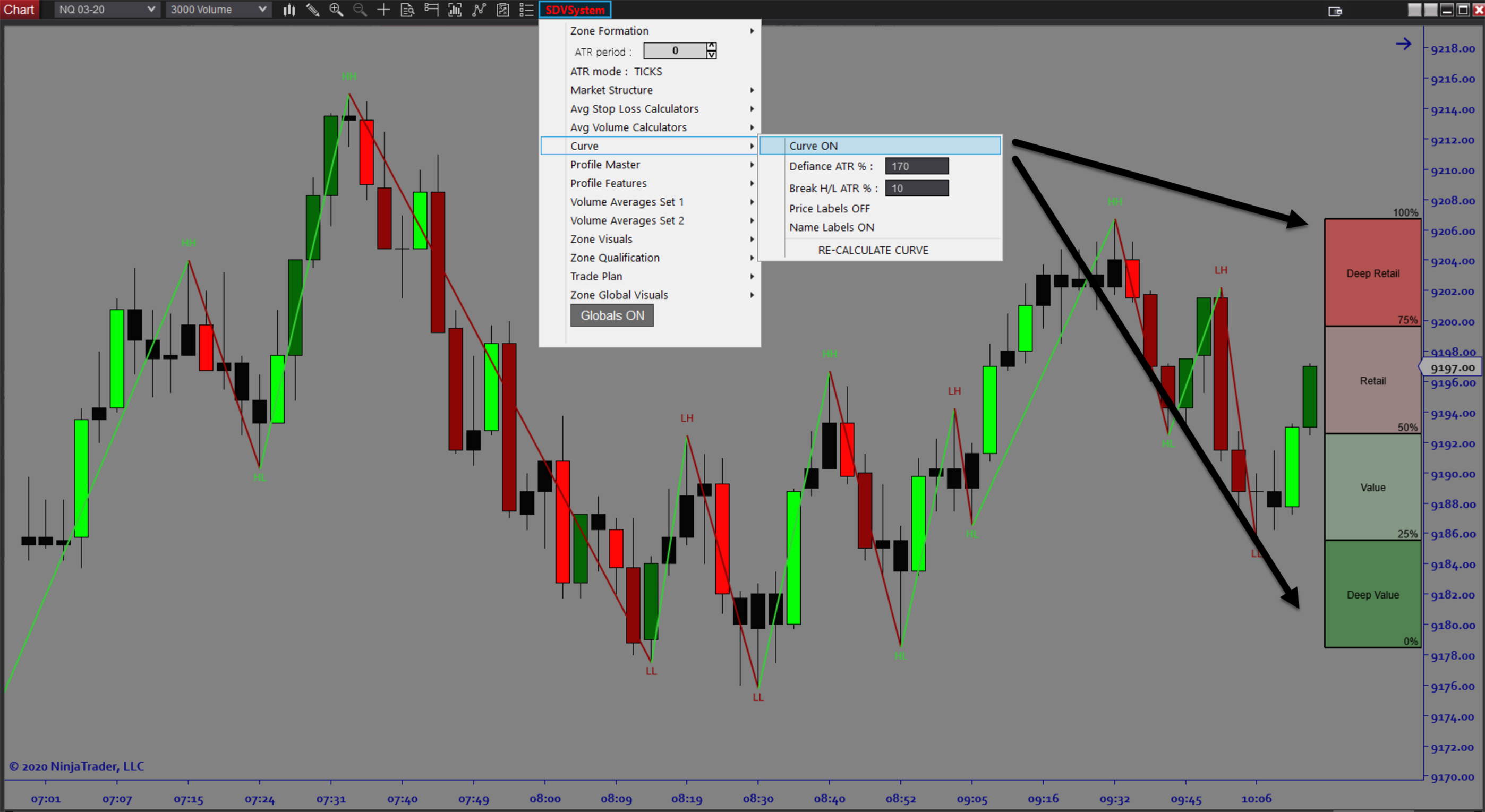

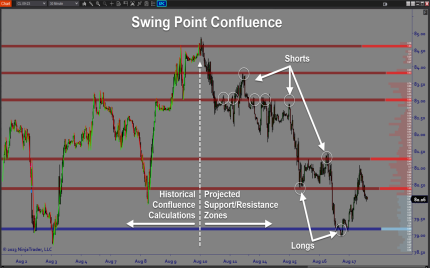

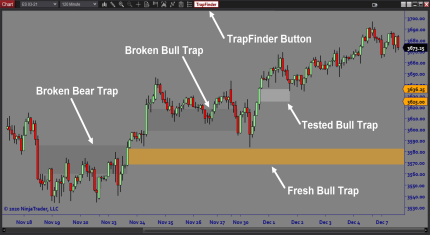

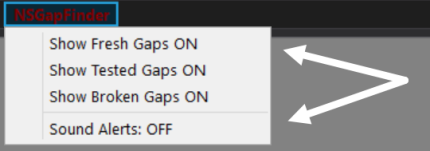

SDVSystem is an all-inclusive semi-auto Supply and Demand & Volume Profile QUANT trading system. It comes with pre-configured zone scanning technology and custom pre-built trade plans for low-risk reversal zones with volume scanning technology

Purpose:

Traders struggle with manually identifying supply & demand volume imbalances for trade entry & mgmt. Using the SDV_System, will automate their levels and increase trade efficiency while providing faster trade application and more accurate trading zones for strategies and execution. This form of analysis is not possible without computing software, therefore making it an automatic necessity for professional traders

Elements:

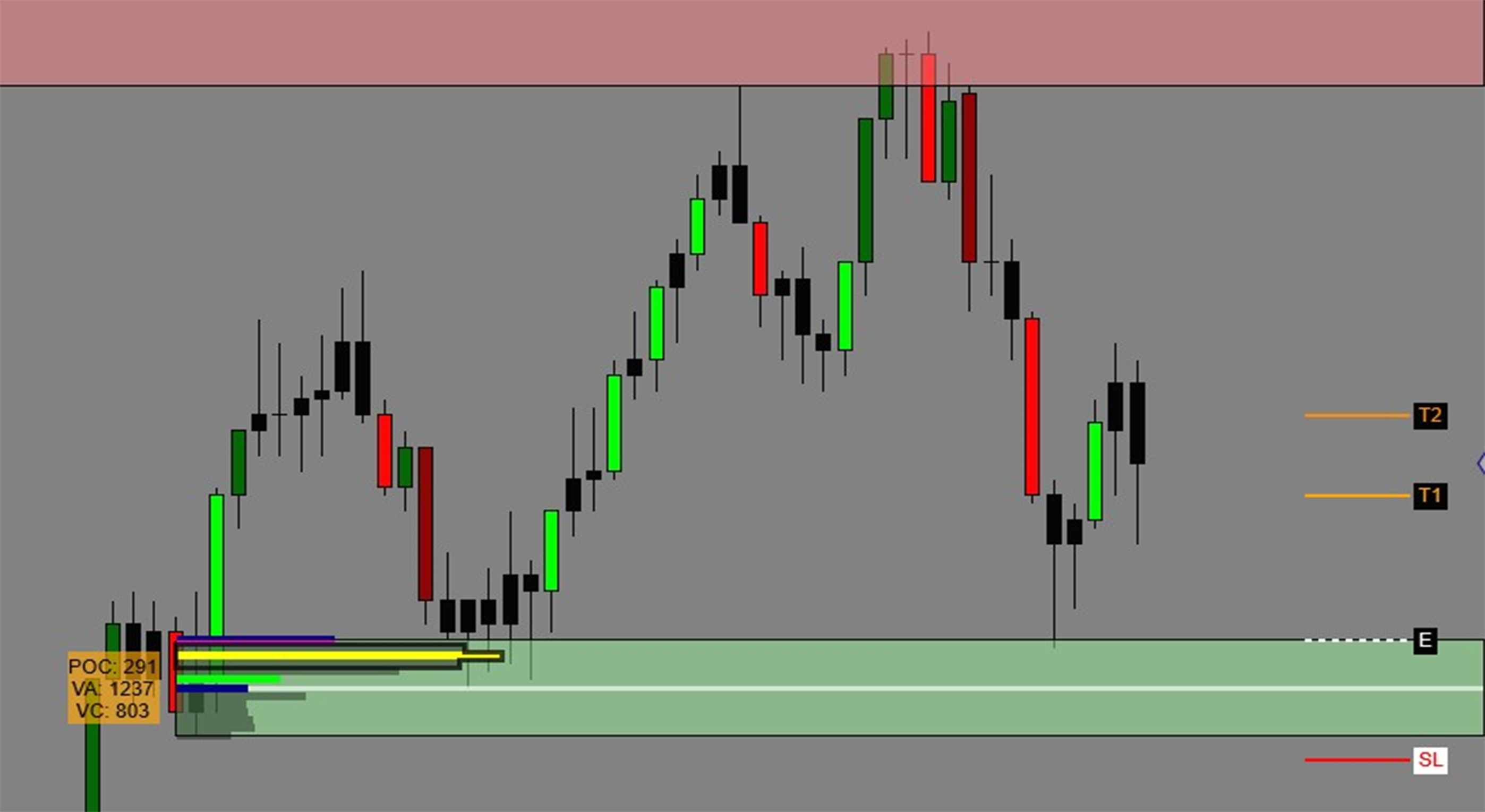

- Supply & Demand imbalance zones

- Volume profile zones transparency

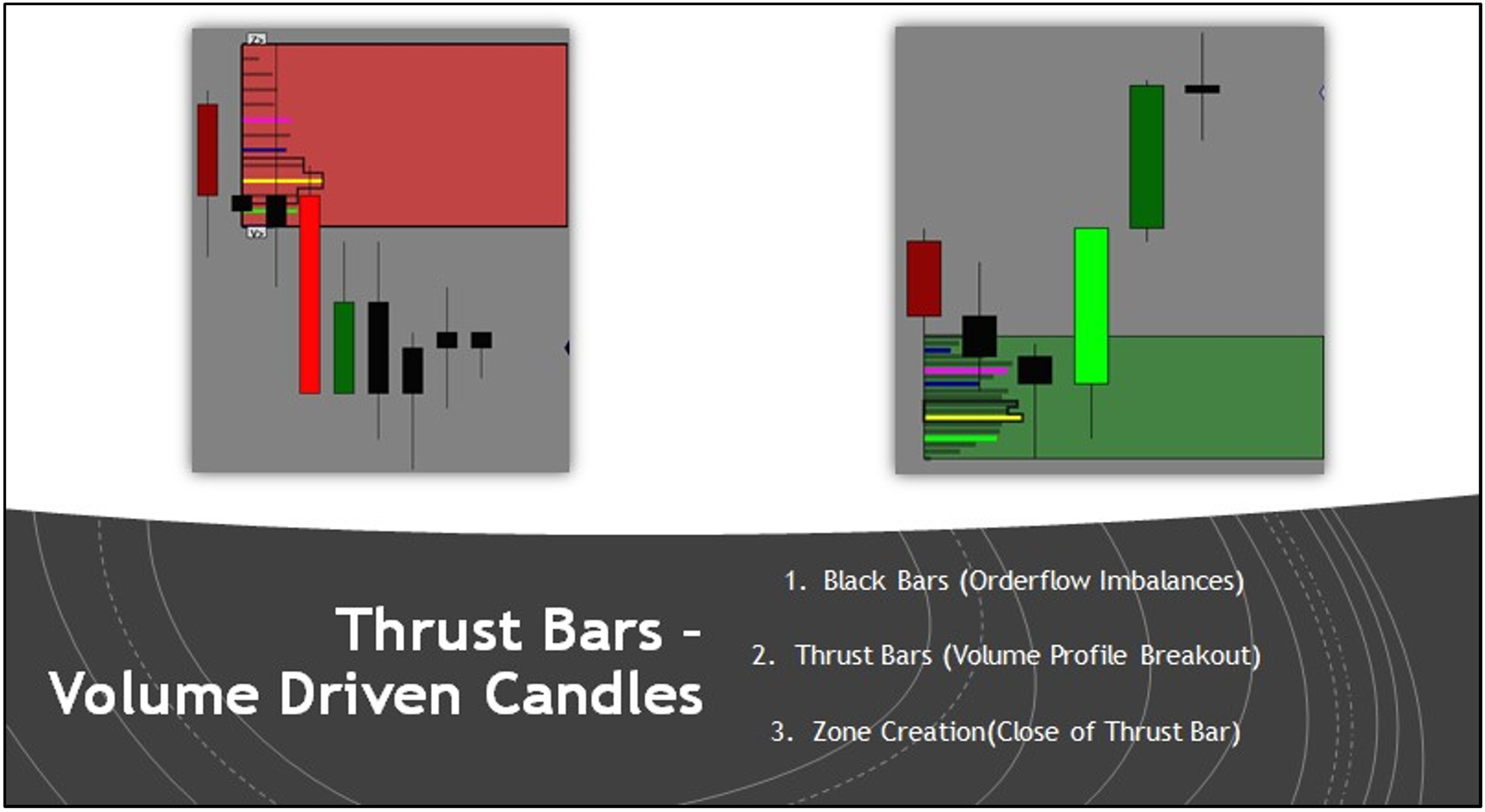

- volume thrust bar/candle analysis

- Volume Quant Zone Data

- SD Trade System & Entry

Functions:

The SDV System software is best designed to show traders how to plan trades in advance using supply/demand and volume profile. Its built in volume candles allow for on-the fly detection of when volume profile breakouts are going to produce trading zones based on Supply & Demand

Problem Solved:

- Stops traders from second guessing supply & demand trade locations

- Stops traders from second guessing zone efficiency & probability

- Stops traders from trading the wrong side of price and volume imbalances.

- Stops traders from having to perform their supply & demand analysis manually

- Stops traders from making mistakes with S/D where software can perform more accurate and efficient data analysis