This indicator is part of our Annual Indicators Membership.

To access this indicator for free, please click the link below.

Line Alert Indicator Overview:

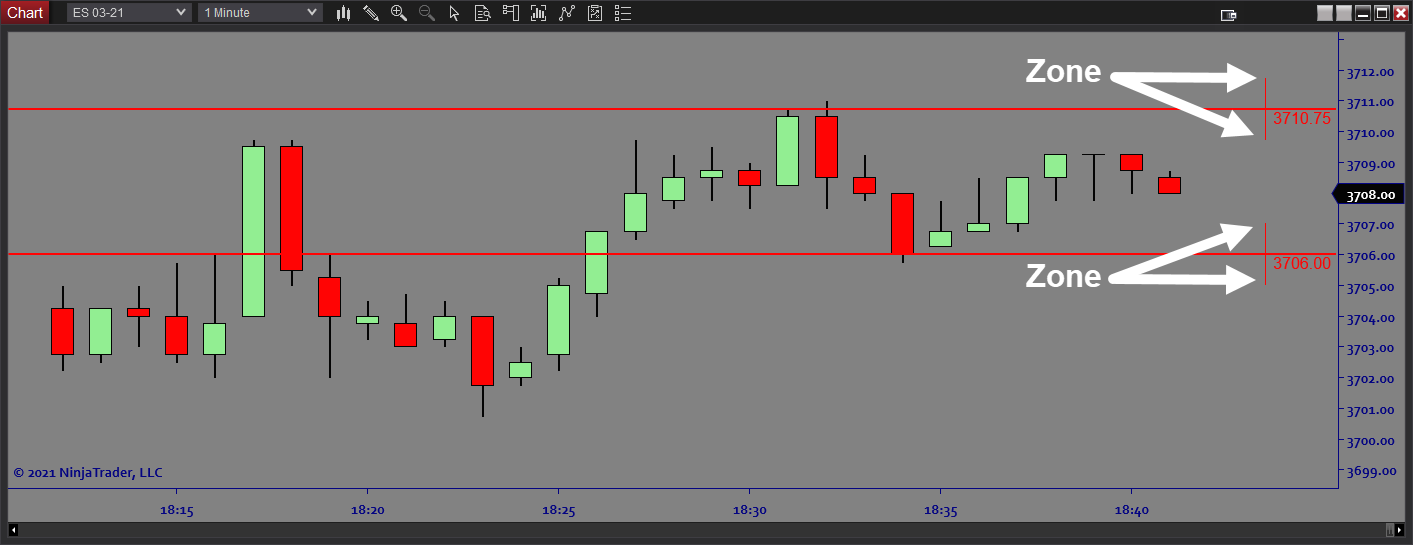

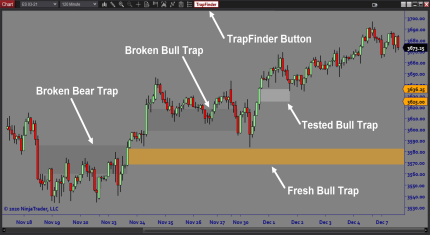

The Line Alert software provides an easy way to add Alerts when price touches any horizontal price level on your chart. This is a very useful capability for any trader that uses price levels or areas of interest in their trading. If you are not watching the chart constantly, you will still be alerted (sound, email) and once you view the chart you will see the price line and a chart marker on the bar that triggered the event.

Purpose:

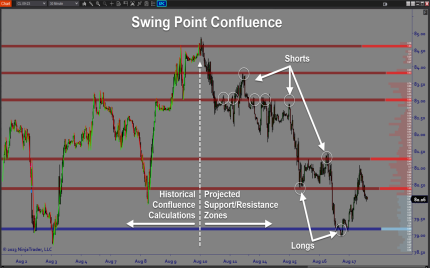

Traders need the LineAlert software for timing levels-based entries, especially for higher timeframe traders who may not be watching charts constantly. You can set a price level on the chart and instruct the software to create an Alert when that level is touched, or even within a number of ticks to allow for time to plan the trade.

Elements:

- Price Level Alerts (Audible/Email)

- Chart Marker Signal when Alert is triggered

- Separate Marker for Continuation and Reversal Signals

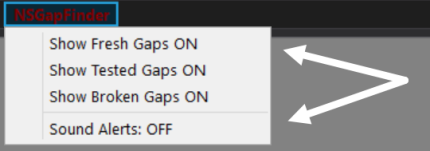

- Buffer Zone for early warning Alerts

- Max Number of Alerts per level

- Max number of Alerts per bar

Functions:

The Line Alert Indicator is best used by traders who are waiting for a specific price level for their entries. This tool watches for that level to be hit so you don’t have to. When price reaches the area, the platform plays a sound (or sends an email). If you want advance warning that price is getting close, set up a buffer Zone which will trigger the Alert earlier.

Problem Solved:

- Stops traders from missing planned entries

- Stops traders from getting distracted by too many things to keep track of

- Stops traders from losing focus by having too many charts

- Stops traders from wasting time waiting for trades