Delta Algo

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

Delta Algorithm Overview:

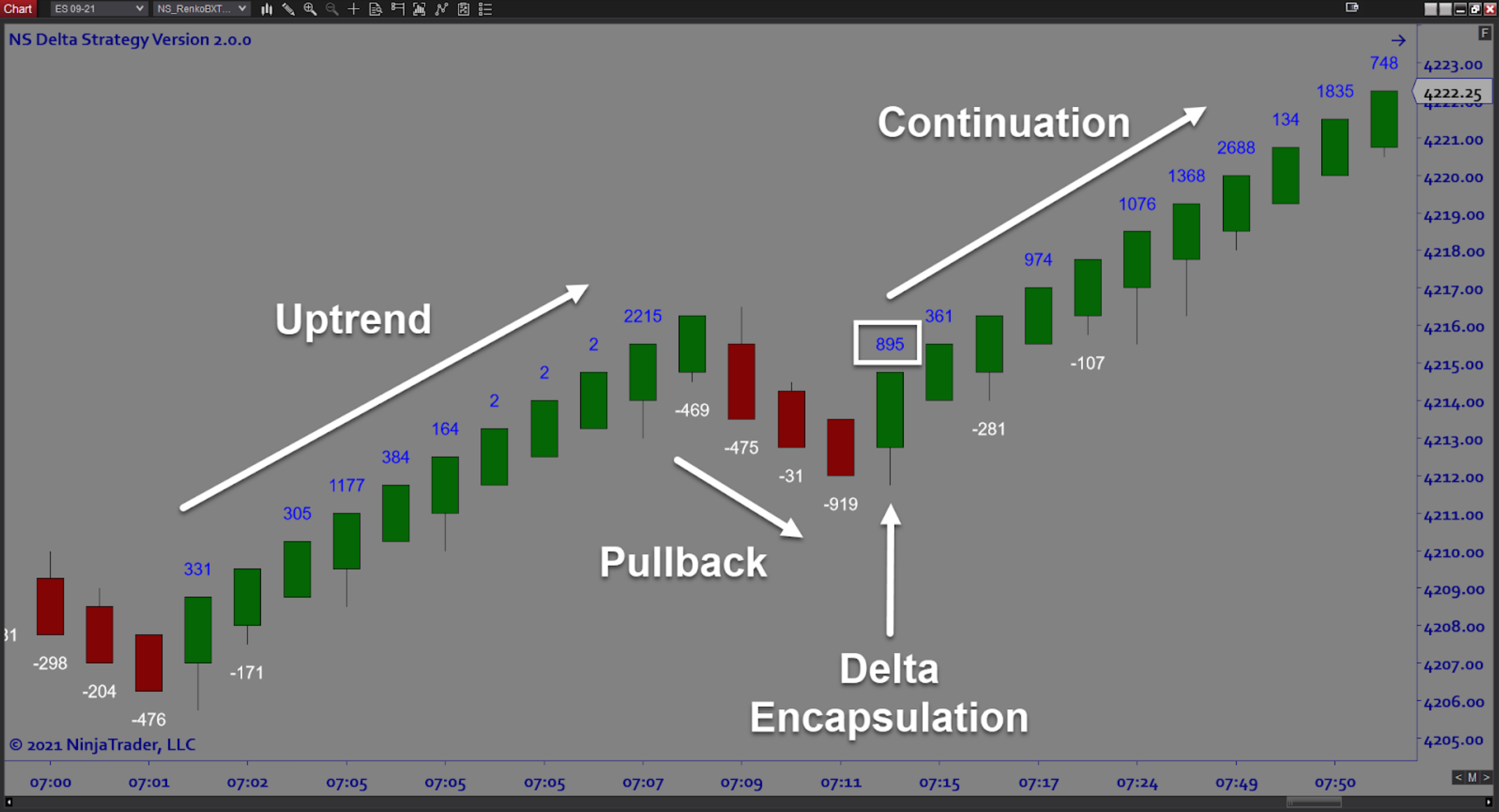

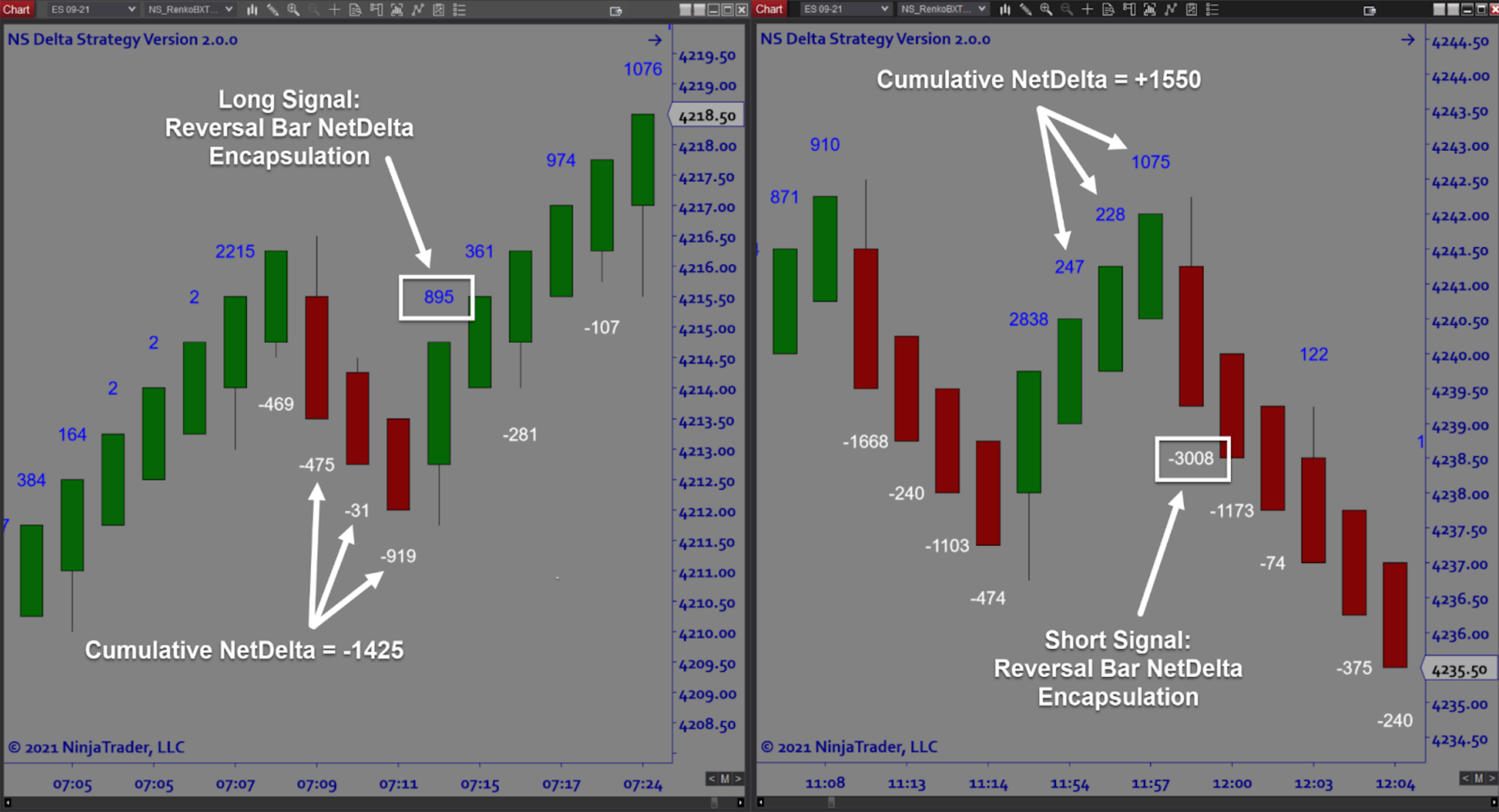

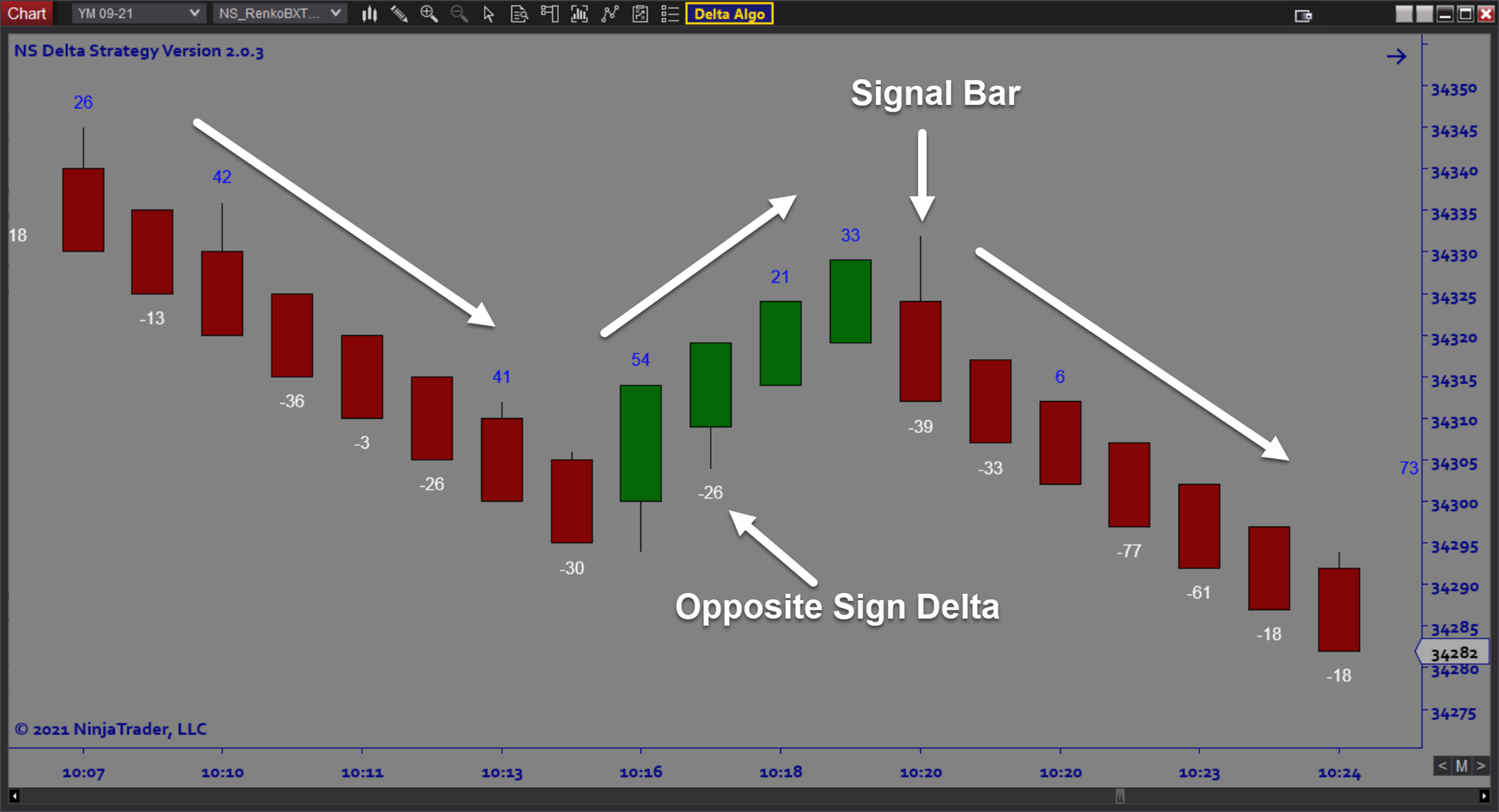

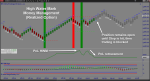

DeltaAlgo is a fully automated trading solution based on a Net Delta Encapsulation strategy, which measures Order Flow aggression on pullbacks within a trend. The Delta Algorithm includes all the components necessary for trade setups, order execution, filter conditions, and trade and risk management. The ability to conduct extensive backtesting and performance analysis allows for robust strategy development and optimization. Once your strategy is fine tuned, the software robotically trades your strategy for you, removing the risk of human error and emotions and ensuring that your strategy is executed flawlessly.

Purpose:

Traders need the Delta Algorithm software not only because of the importance of Order Flow (net delta) in trading but also because it is important to remove the emotional aspect associated with discretionary trading. The best strategy in the world can lose money if the trader breaks rules or simply struggles with hesitation or uncertainty in live conditions. By letting the algo mechanically perform the order execution, you can focus on perfecting all the strategy rules and trade with confidence.

Elements:

- Automatic Delta Encapsulation Signal Generator

- On screen trade signals, entry and exit markers, stop/targets, realized/unrealized P&L

- Customizable Trade Plan (Stop plus 3 Targets)

- Auto Trail and Breakeven Functions

- Trade Time Windows

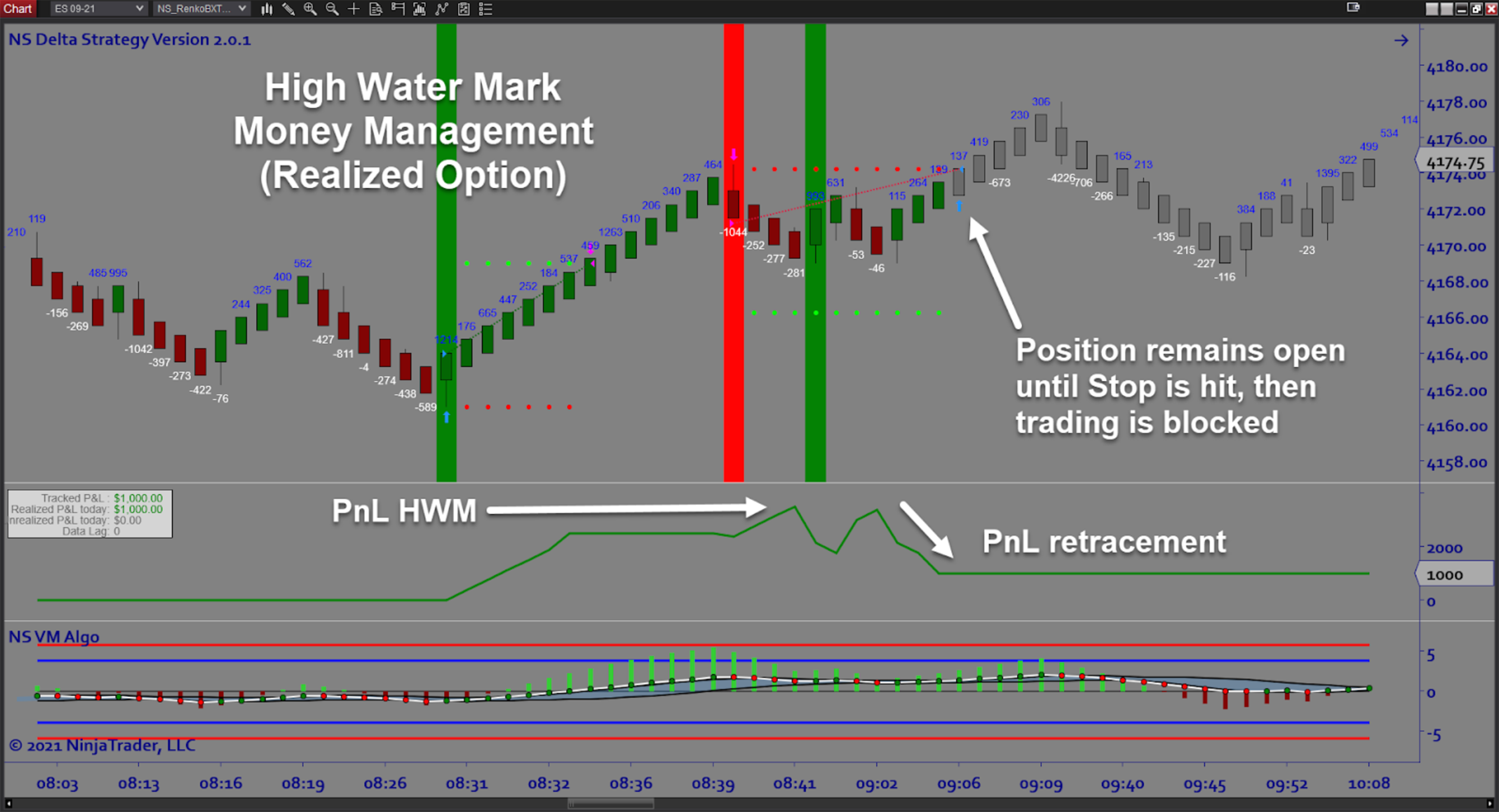

- Money Management (Max Daily Loss and Profit Goals)

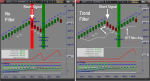

- Trend Filters

- Momentum FIlters

- OBOS Filters

- Datafeed Lag Monitor for Safety

- Backtesting and Optimization

Functions:

The Delta Algo software is best used in trending conditions to enter the market at the right time during temporary pullbacks. The software’s reversal signals can also be exploited for scalp opportunities regardless of trending conditions. Backtesting to find the most profitable settings can further be forward-tested in live conditions. Once profitability is stable, running the algo on a live account can produce consistent profits. The key is to follow the steps from design and optimization to Sim trading and eventually put real capital to work.

Problem Solved with Delta Algorithm:

- Stops traders from missing out on the benefits of using Order Flow

- Stops traders from having decipher complex Order Flow information

- Stops traders from dealing with the stress of live trading

- Stops traders from sabotaging their trading due to fear and uncertainty

- Stops traders from breaking the rules of their trade plan

- Stops traders from breaking their risk management rules

- Stops traders from breaking their money management rules

- Stops traders from entering too late and missing out on most of the profits

- Stops traders from getting in at the wrong time or in the wrong place

- Stops traders from trading strategies that have no statistical performance data