Market Mapper Overview:

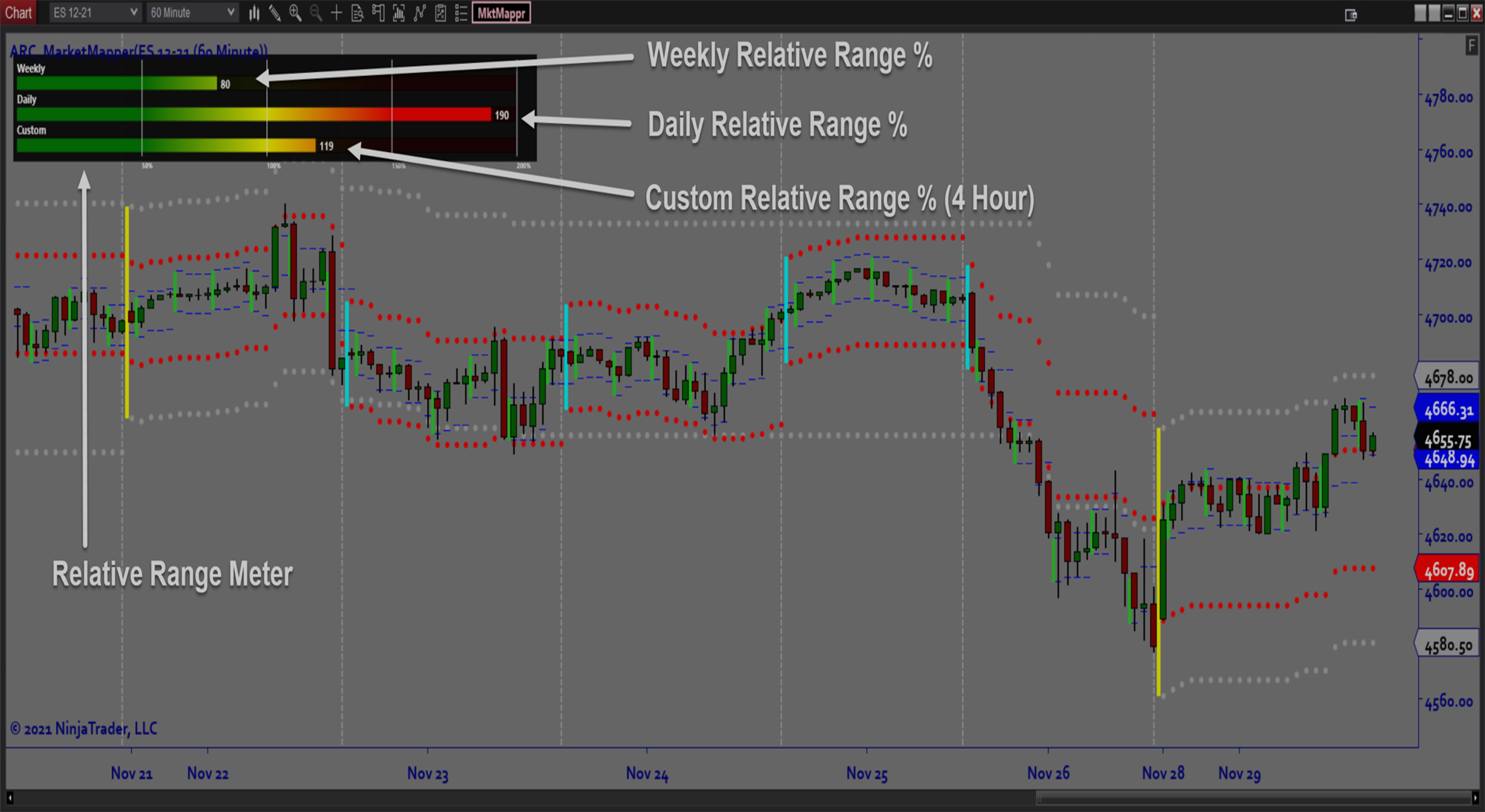

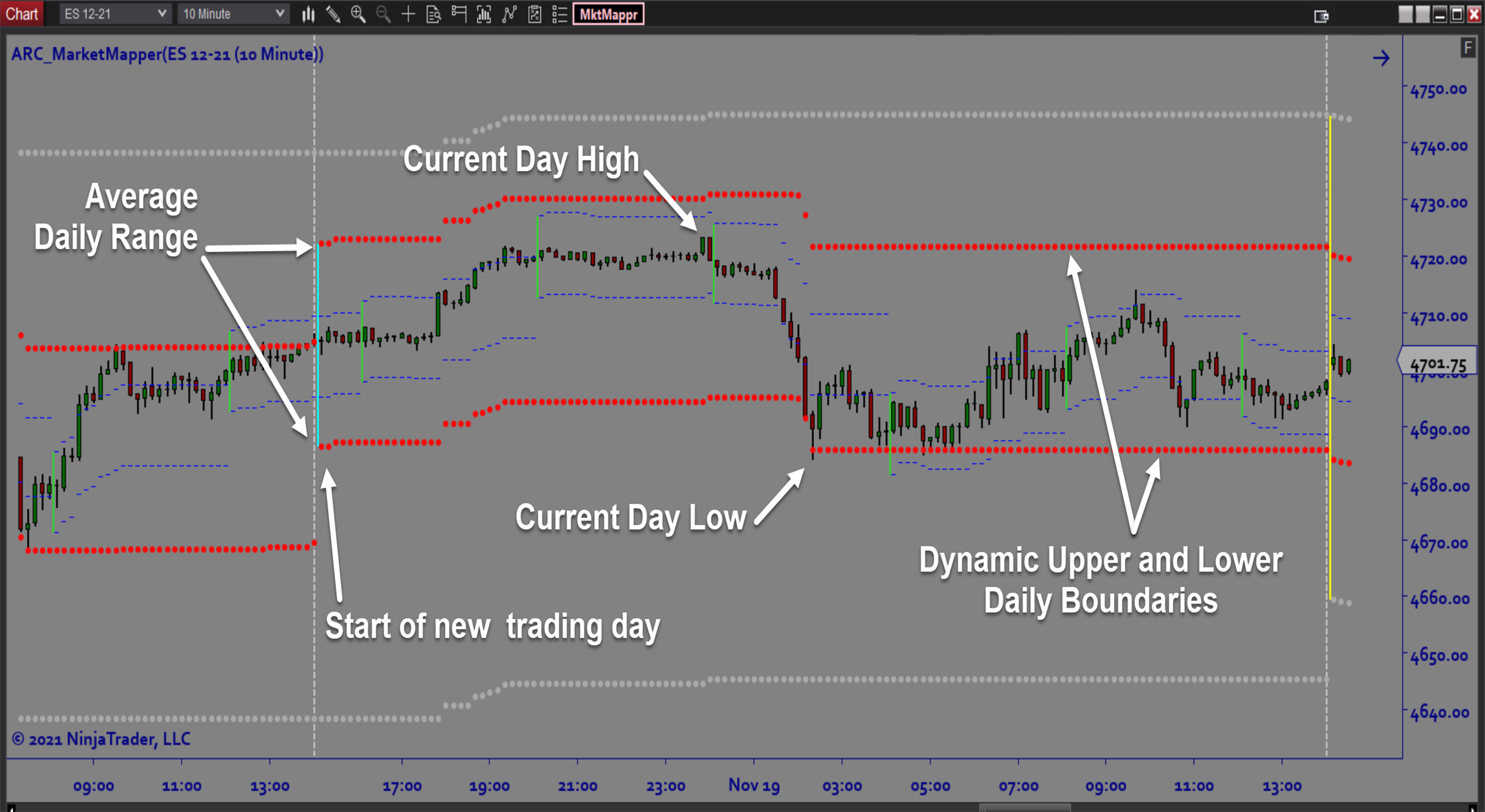

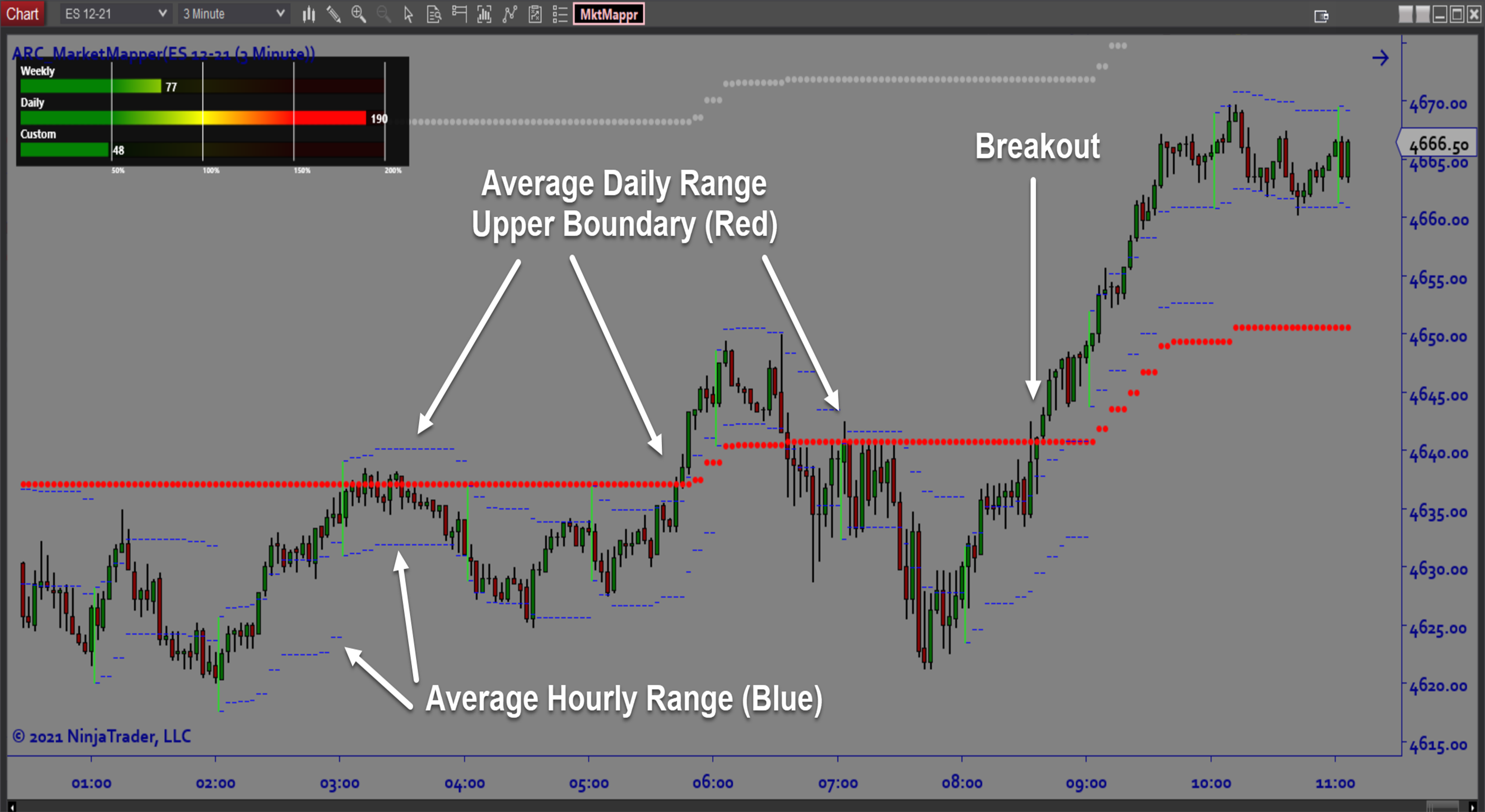

The Market Mapper Indicator provides traders with an anticipated range of price based on historical analysis of prior market ranges. These ranges are estimated for both daily and weekly price action along with one additional custom timeframe based on the user’s preference.

Purpose:

Traders need the Market Mapper software because it is important to view current price action in the context of historical price ranges. Understanding the anticipated trading range and knowing when the “playing field” is shifting really helps traders stay on the right side of the market. This is especially helpful for traders using trending and/or range-based strategies. The easy to read graphics which map out the key range boundaries prove to be very useful for all trading styles.

Elements:

- Daily, Weekly, and Custom Range Boundaries

- Daily, Weekly, and Custom Range Vertical Period Separator Lines

- Daily, Weekly, and Custom Range Stats

- Dynamic Current Ranges based on historical average

- Relative Range Meter with Adjustable Scale

- User Interface Menu

Functions:

The Market Mapper software is best used by always keeping track of the visual range boundaries that are displayed by this tool. This helps the trader understand anticipated ranges and also the key levels that, once violated, will tell you to adjust your strategy. Using this tool helps take the blinders off so you are always aware of the current market context while you are trading.

Problem Solved with our Market Mapper:

- Stop traders from getting caught on the wrong side of the market

- Stops traders from second guess market conditions

- Stops traders from losing track of the big picture

- Stops traders from failing to recognize breakout boundaries

- Stops traders from failing to recognize trending or oscillating conditions

- Stops traders from missing key levels of interest