MT_Filter – Multi Timeframe Indicator

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

Overview:

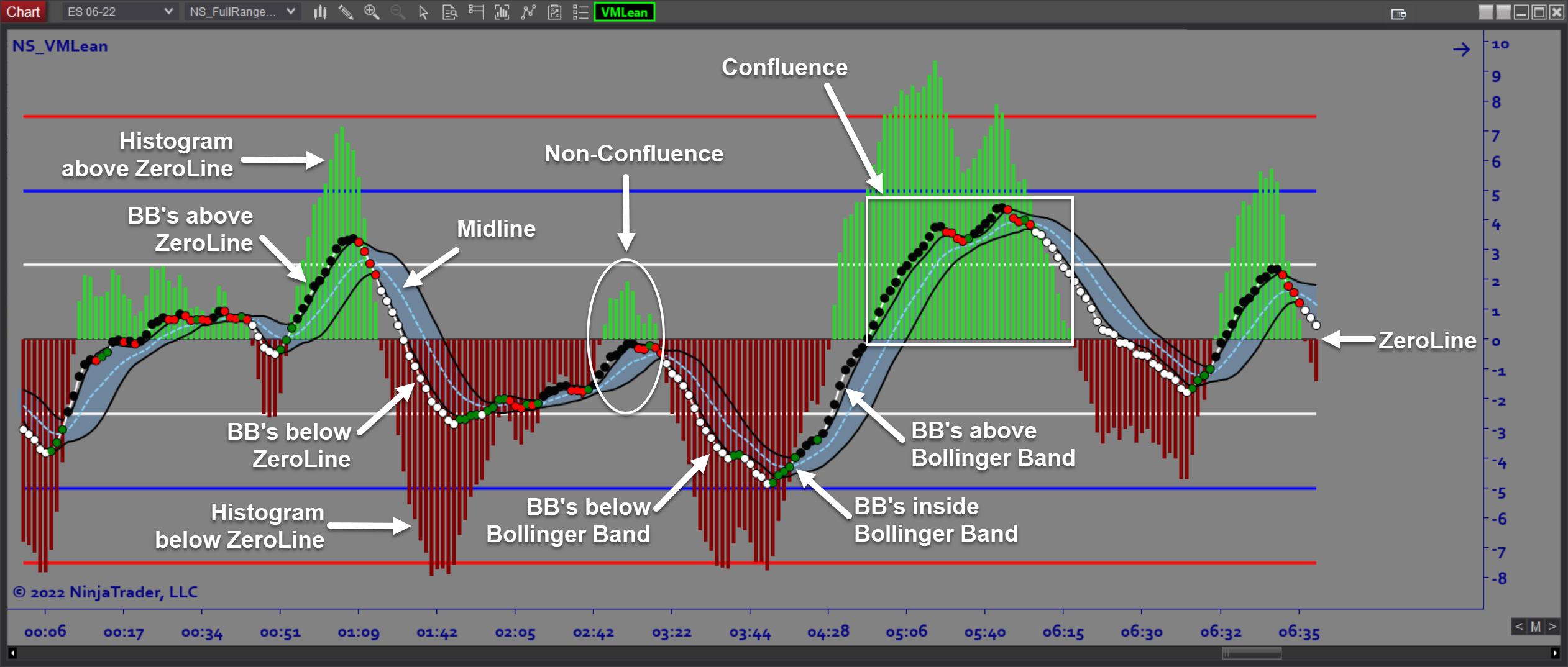

The MTFilter software is a multi timeframe “confluence of conditions” indicator which greatly simplifies the process of determining directional bias and trending conditions. The indicator tracks momentum, price structure, and moving averages on any alternate timeframe/bartype and looks for confluence across 11 different filters to display easy to read directional bias for permissive action.

Purpose:

Traders need the MTFilter because understanding the dominant directional bias is critical when trading any kind of strategy. The dominant trend is usually revealed by looking at a higher timeframe. Also there are many different measures which can be used. When there is confluence across several measures that provides extra confidence. Traders need a way to simplify all these calculations and also reduce the number of charts needed. MTFilter translates all these components into a simple background shading on your trading chart, telling you whether there is an uptrend, downtrend, or no trend conditions.

Elements:

- Measures confluence of directional conditions

- Up to 11 different measures of momentum, market structure, and moving averages

- User selects any combination of trend measures that must be satisfied

- Multi Timeframe capability

- Optional alternate bartypes for trend calculations

- Simplified background shading to show trending conditions

Functions:

The MTFilter software is best used by selecting the trend measurement criteria as well as the higher timeframe and bartype to be used so that a simple background shading can be displayed right on the trading chart. This saves on screen real estate and greatly simplifies the trade selection process to ensure you remain on the correct side of the market.

Problem Solved:

- Stops traders from second guessing directional bias

- Stops traders from getting stopped out due to lack of follow through and unexpected reversals

- Stops traders from trading in the wrong direction

- Stops traders from trading trend strategies when there is no trend

- Stops traders from losing sight of market conditions

- Stops traders from using too much screen real estate for market conditions rather than trading activity