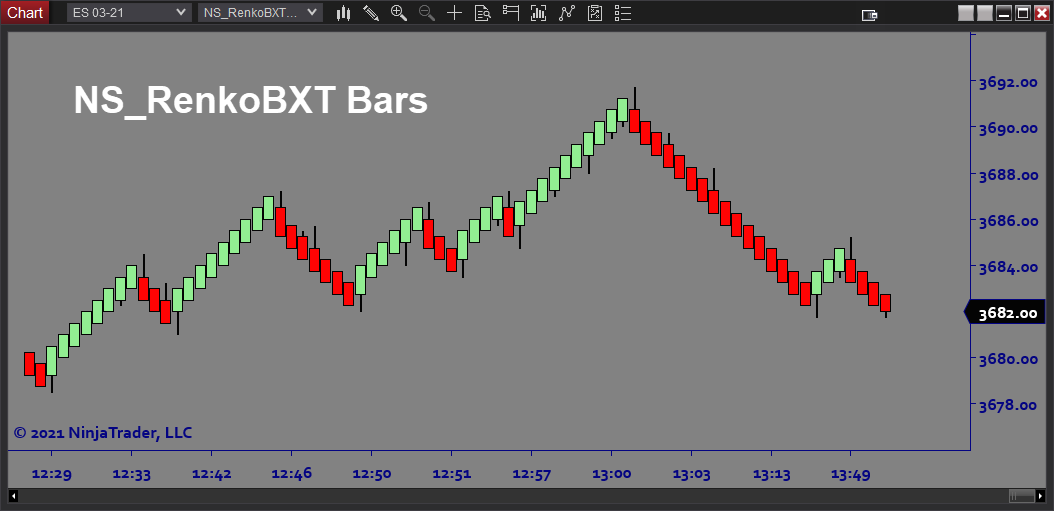

Overview:

The RenkoBXT software is a custom bar type which uses a standard Renko based construction for trends, and Range based construction for reversals. This applies a smoothing filter to price action, which reduces noise and makes it easier to see important swing points and identify trending conditions.

Purpose:

Traders need the RenkoBXT software because they need a better way to smooth out the noise by filtering out small temporary pullbacks. Cleaner charts that are easier to read saves time and avoids confusion. Another benefit is that trend measuring indicators applied to RenkoBXT bars tend to be easier to interpret and lead to better trade performance.

Elements:

- Bar size determines the base fractal

- Reversal Size allowing for trailing wicks which ignore small pullbacks

- Open Offset controlling the degree of bar overlap for smoothing

- Optional Backtestable version which adjusts the bar open to match the previous bar close

Functions:

The RenkoBXT bartype software is best used when trending conditions play a large role in your trading strategy. Using this bartype on your trading chart prevents you from losing track of the current trend. The trailing wicks provide potential locations for entering on pullbacks. Customizing the fractal size and other settings to each market that you trade will ensure you get the most out of this software.

Problem Solved:

- Stops traders from second guessing directional bias

- Stops traders from trading in the wrong direction

- Stops traders from losing sight of market structure

- Stops traders from getting confused by lagging indicators

- Stops traders from getting stopped out due to false moves

- Stops traders from getting distracted by noisy price action