Overview:

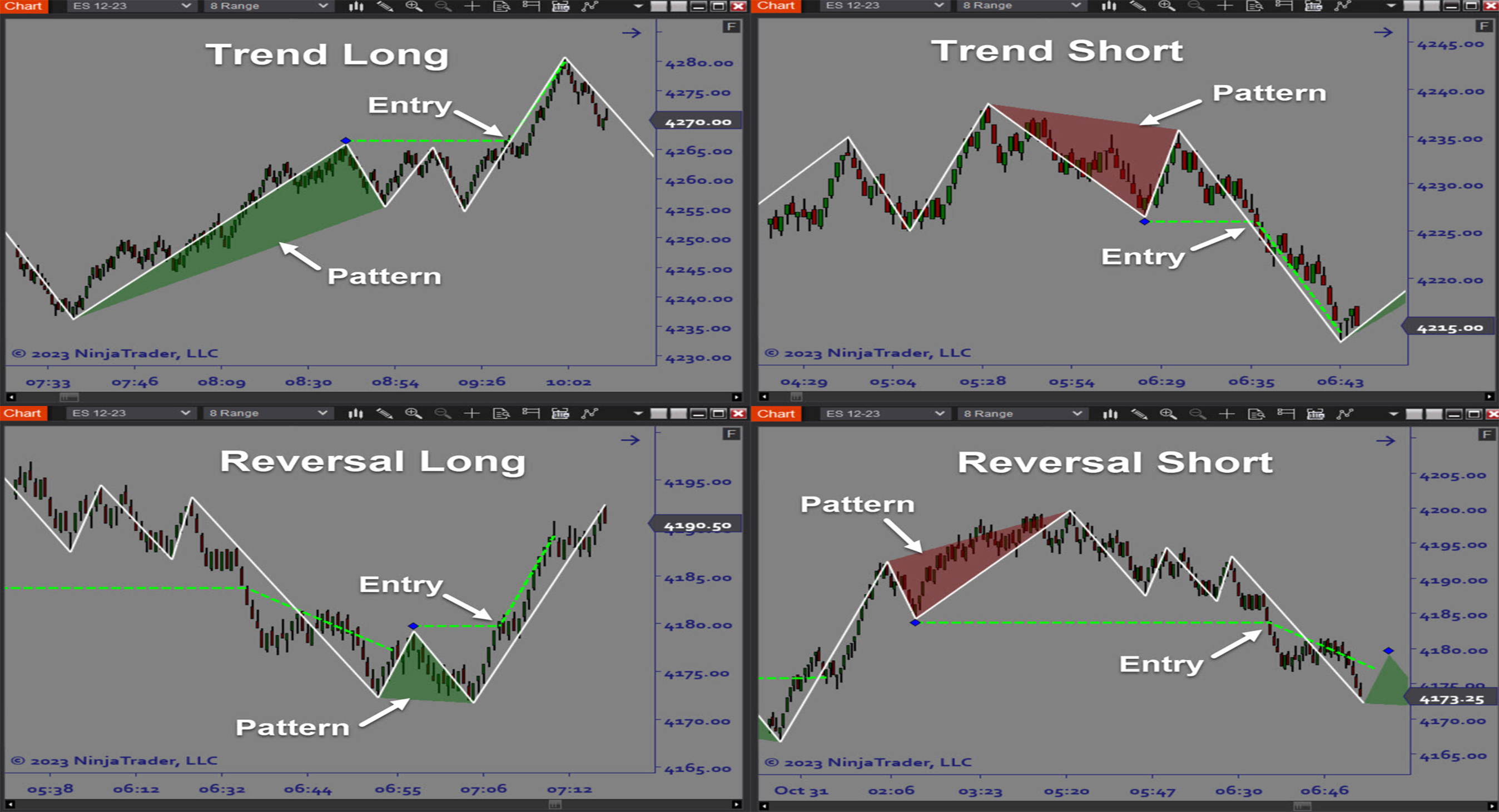

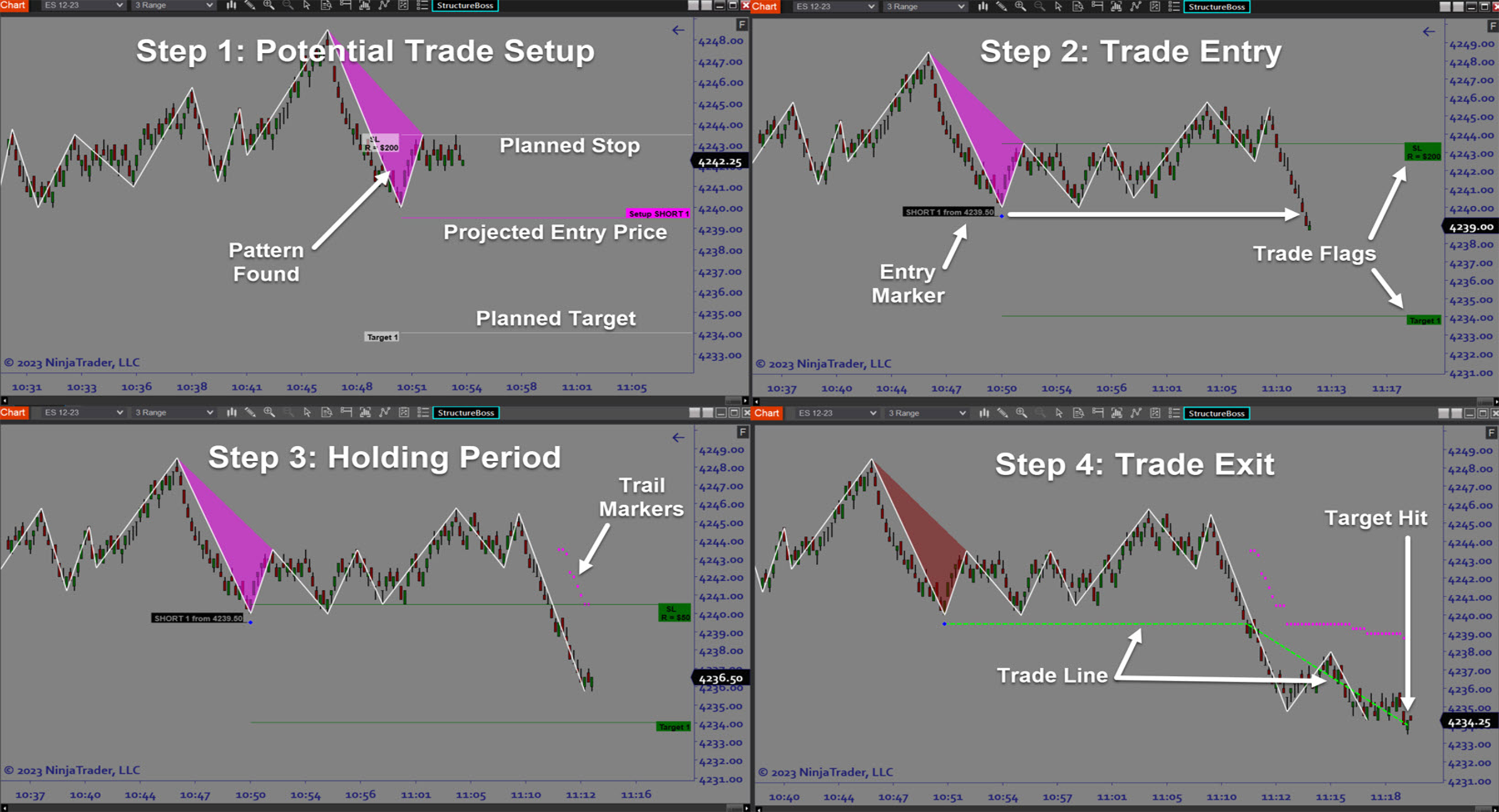

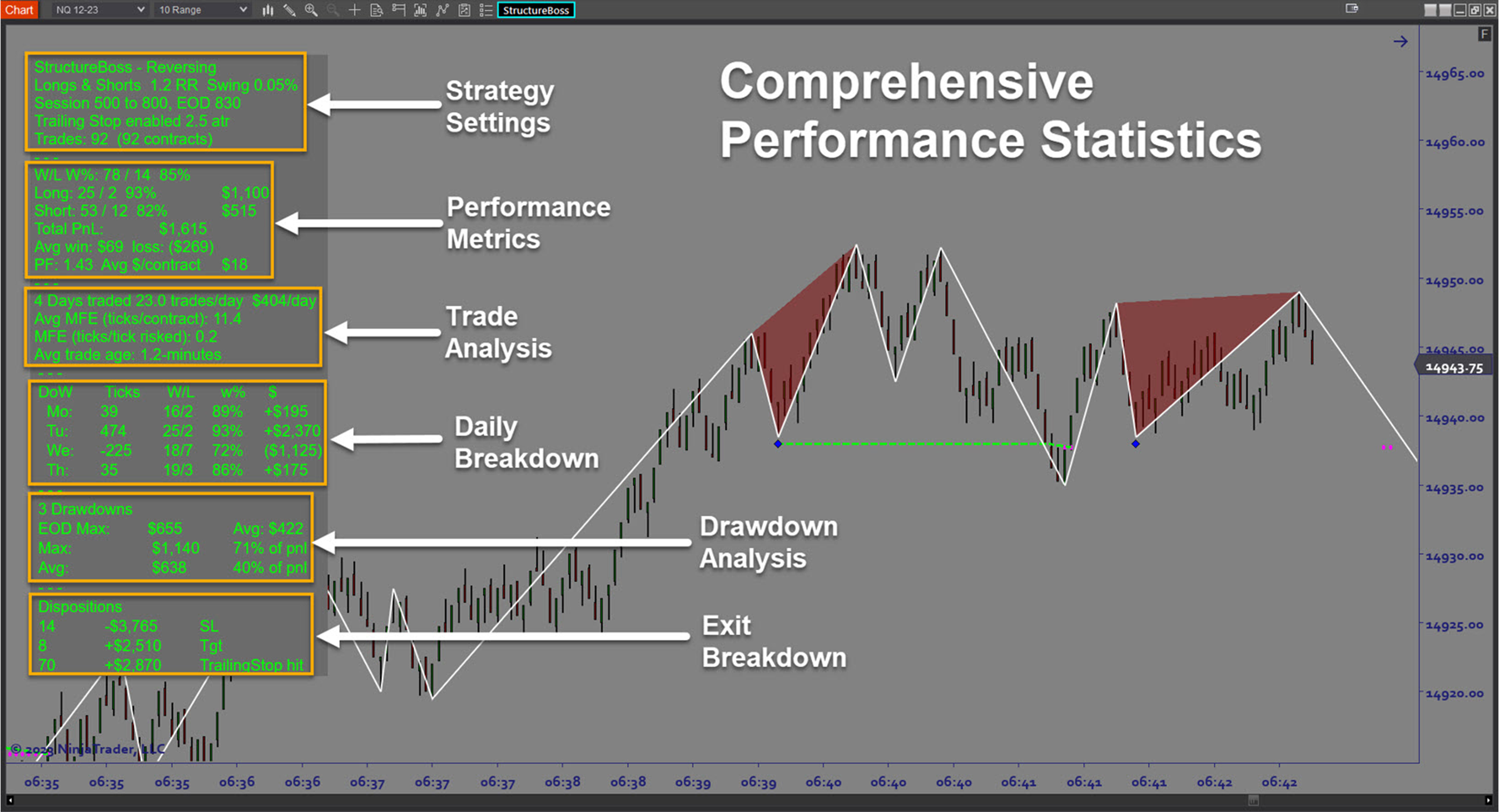

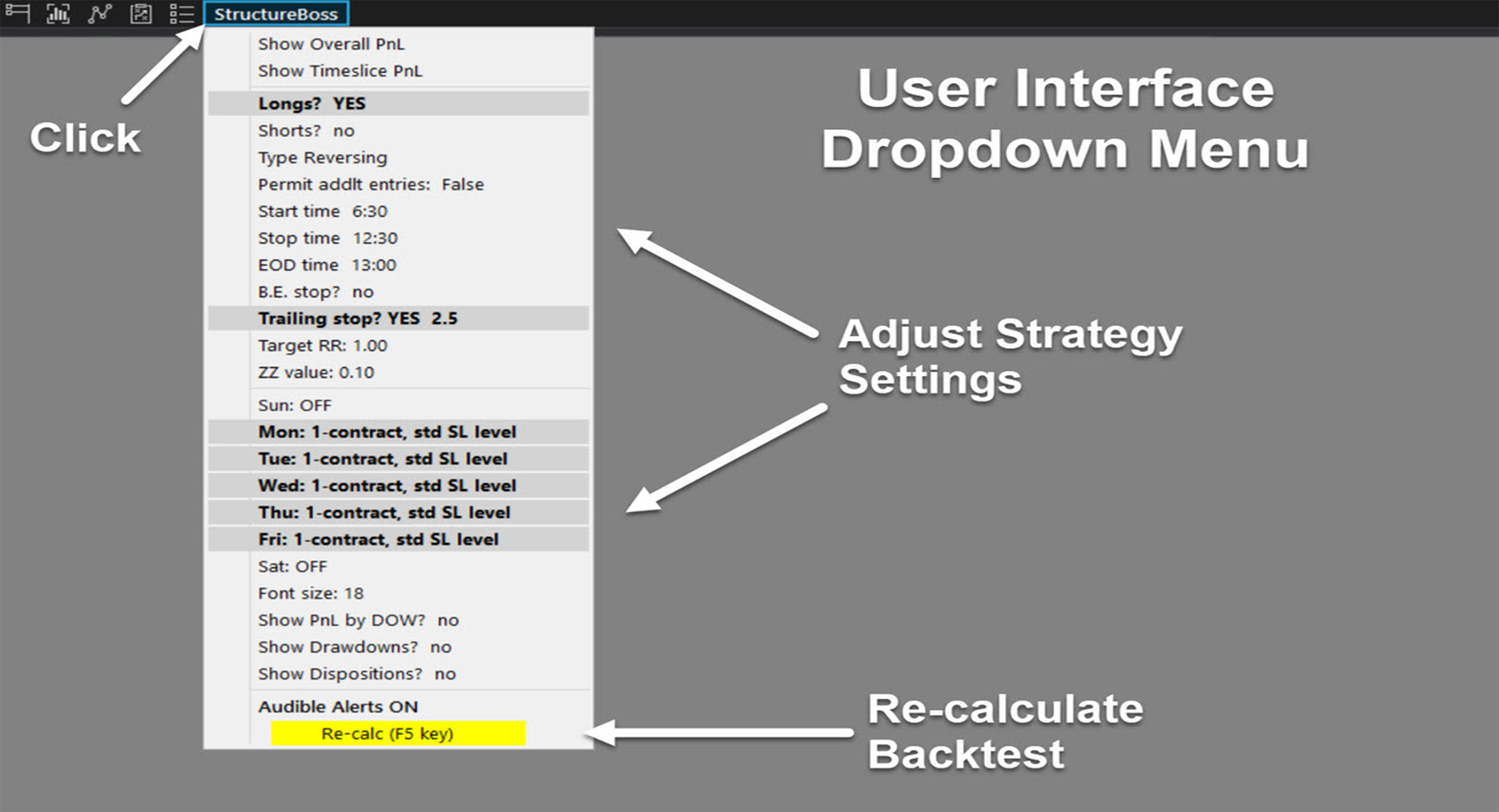

StructureBoss is a semi-automated Pattern Signal System utilizing market geometry. It scans for structure break setups and prints Triangle patterns denoting a potential Trend or Reversal trade opportunity. When a trade setup is identified, the software tracks the position internally according to your predefined trade strategy and displays flags and markers on the chart that can be used to manage the position manually. All of the necessary data for each trade is captured and used to generate a detailed performance report and graphs directly on the price chart. The robust backtesting capability combined with easy-to-read realtime chart graphics gives traders confidence knowing that their actual live trading is conforming to their pre-optimized strategy rules.

Purpose:

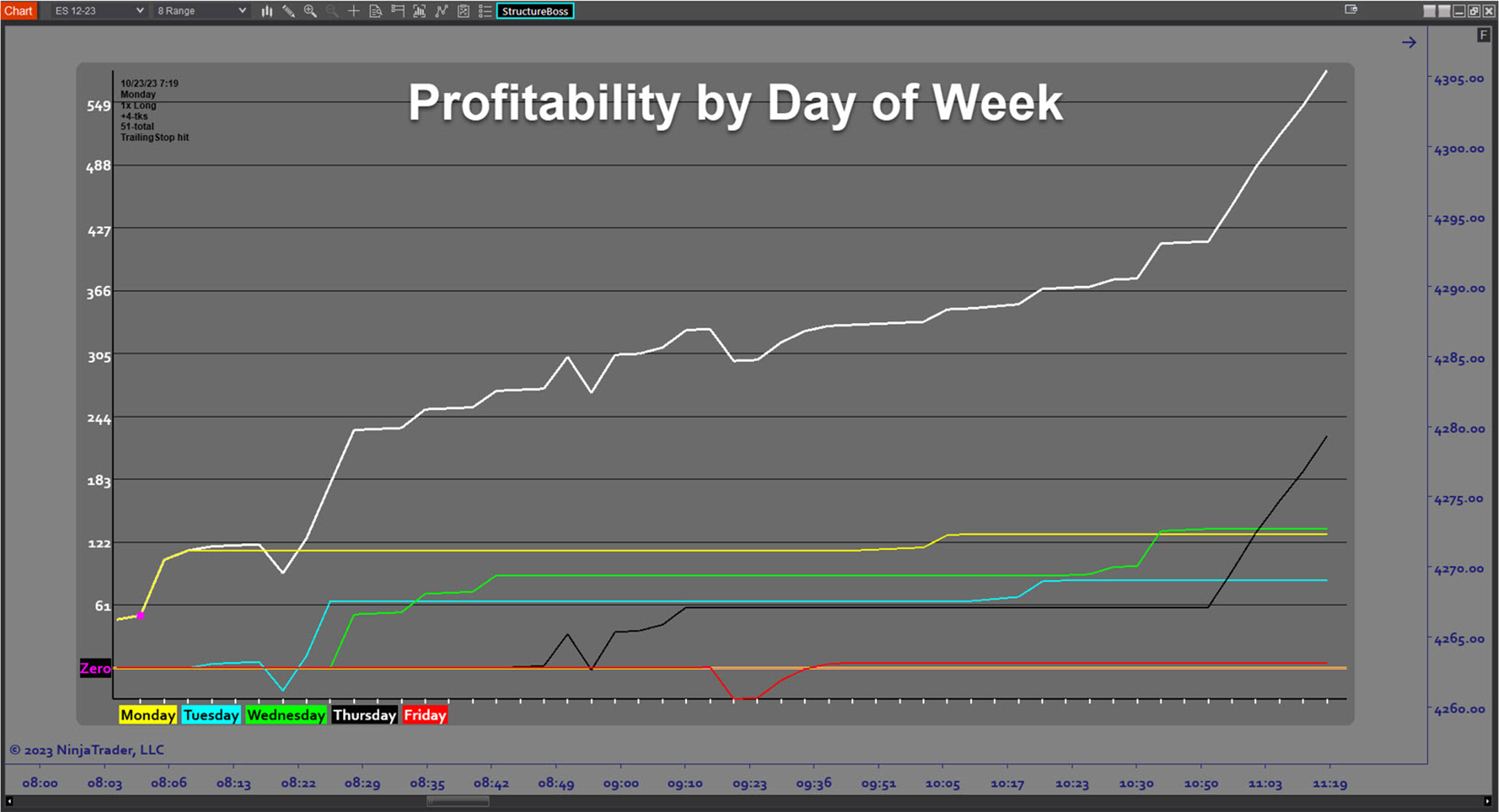

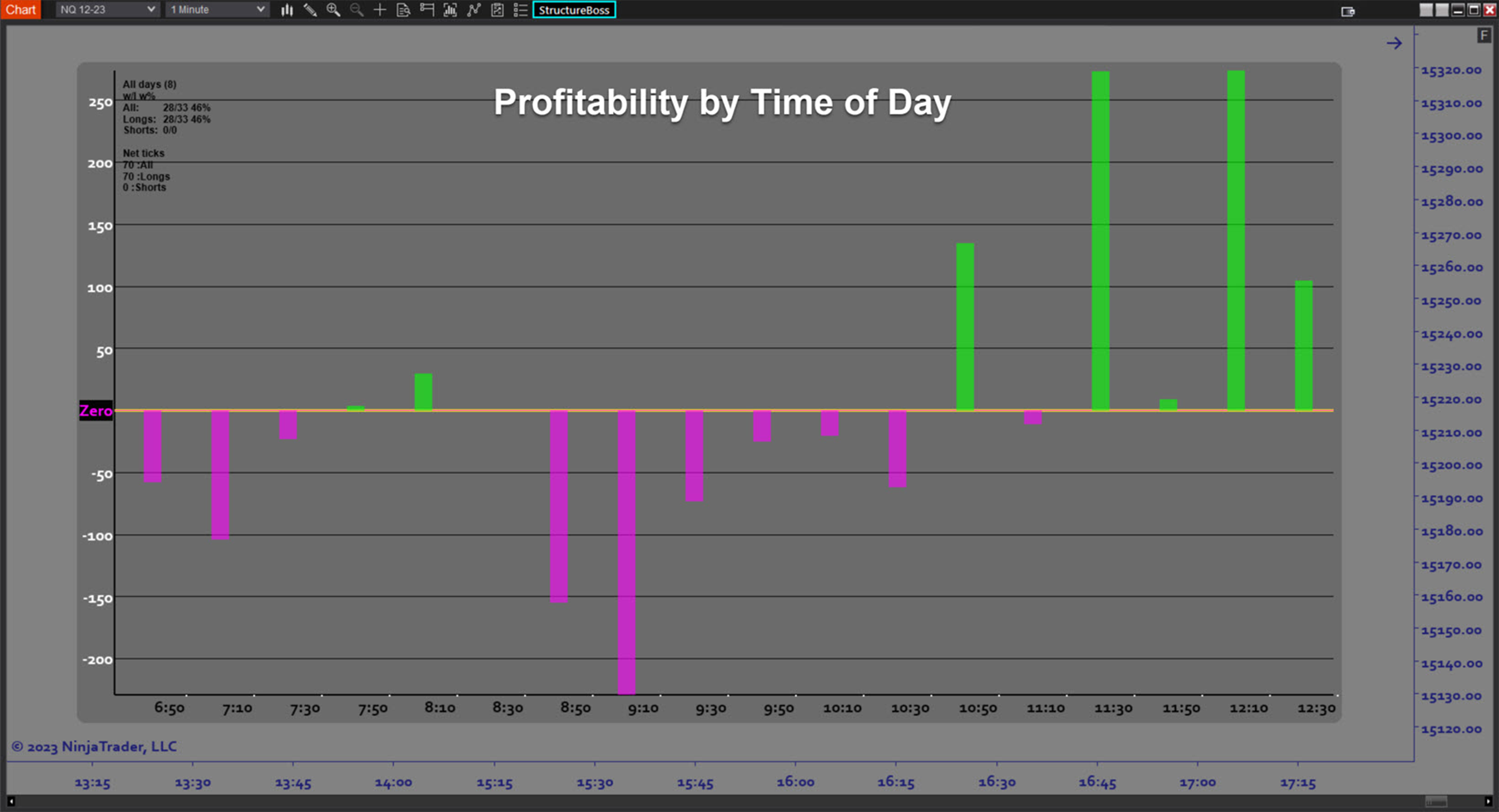

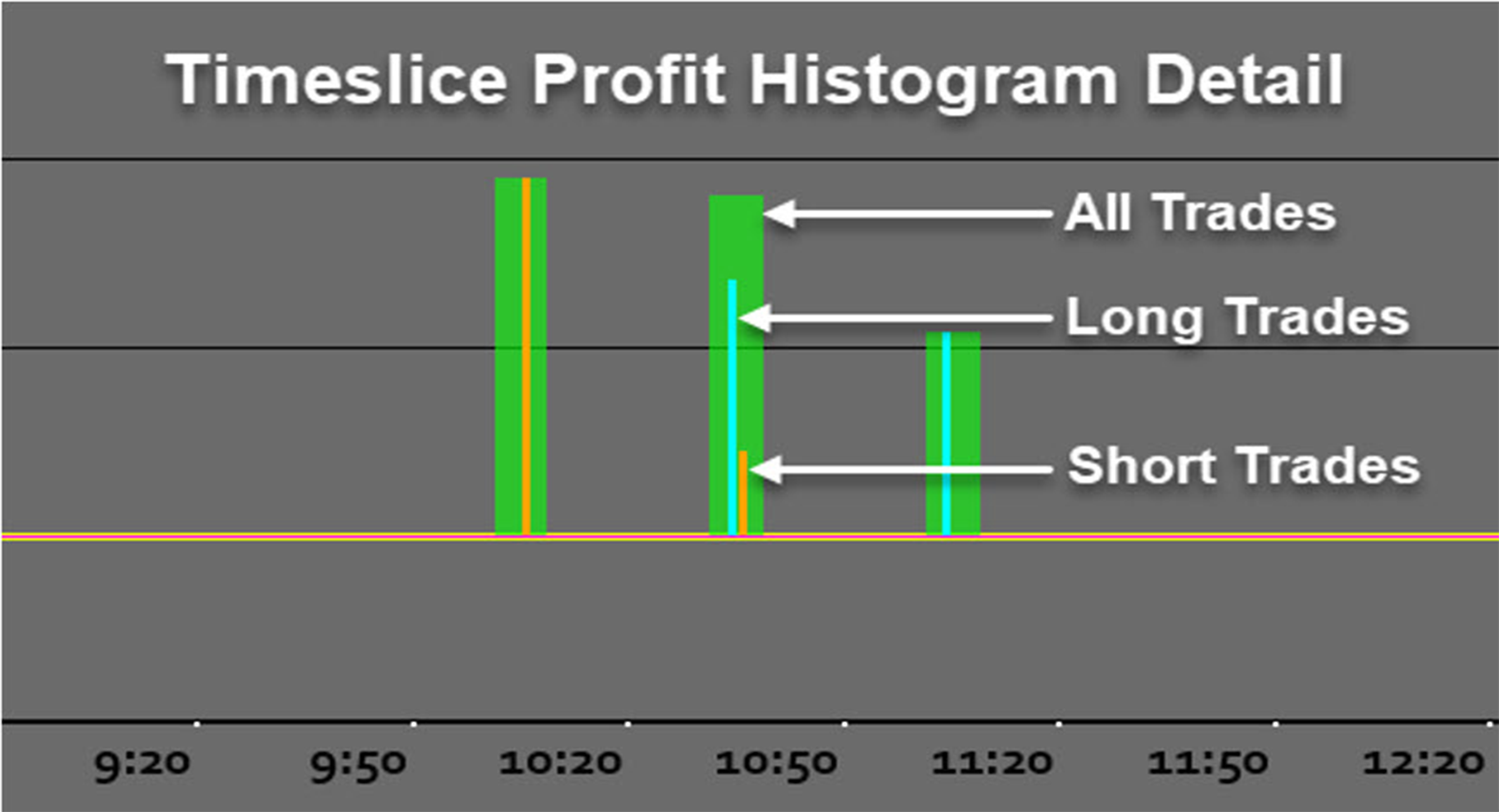

Traders need the StructureBoss software because trading structure breaks for both trending and reversal setups can be difficult to do in live trading conditions, especially in fast markets. The extensive and very fast backtesting engine produces results almost instantly after changing a setting. This makes it easy to find a profitable strategy in a short amount of time. Once you have identified a profitable result, you can further fine tune your strategy by using the built in time of day and day of week filters. The end result is knowing that when you trade live using the semi-automated signals, you don’t have to second guess your trading decisions.

Elements:

- Structure Breakout Trend and Reversal Trade Setups

- Comprehensive and very efficient backtesting capability

- Semi Automated signals including entry, stop, and target locations

- Triangle Pattern recognition and chart graphics for easy market structure assessment

- Historical trade lines and graphics showing the entry and exit of every trade

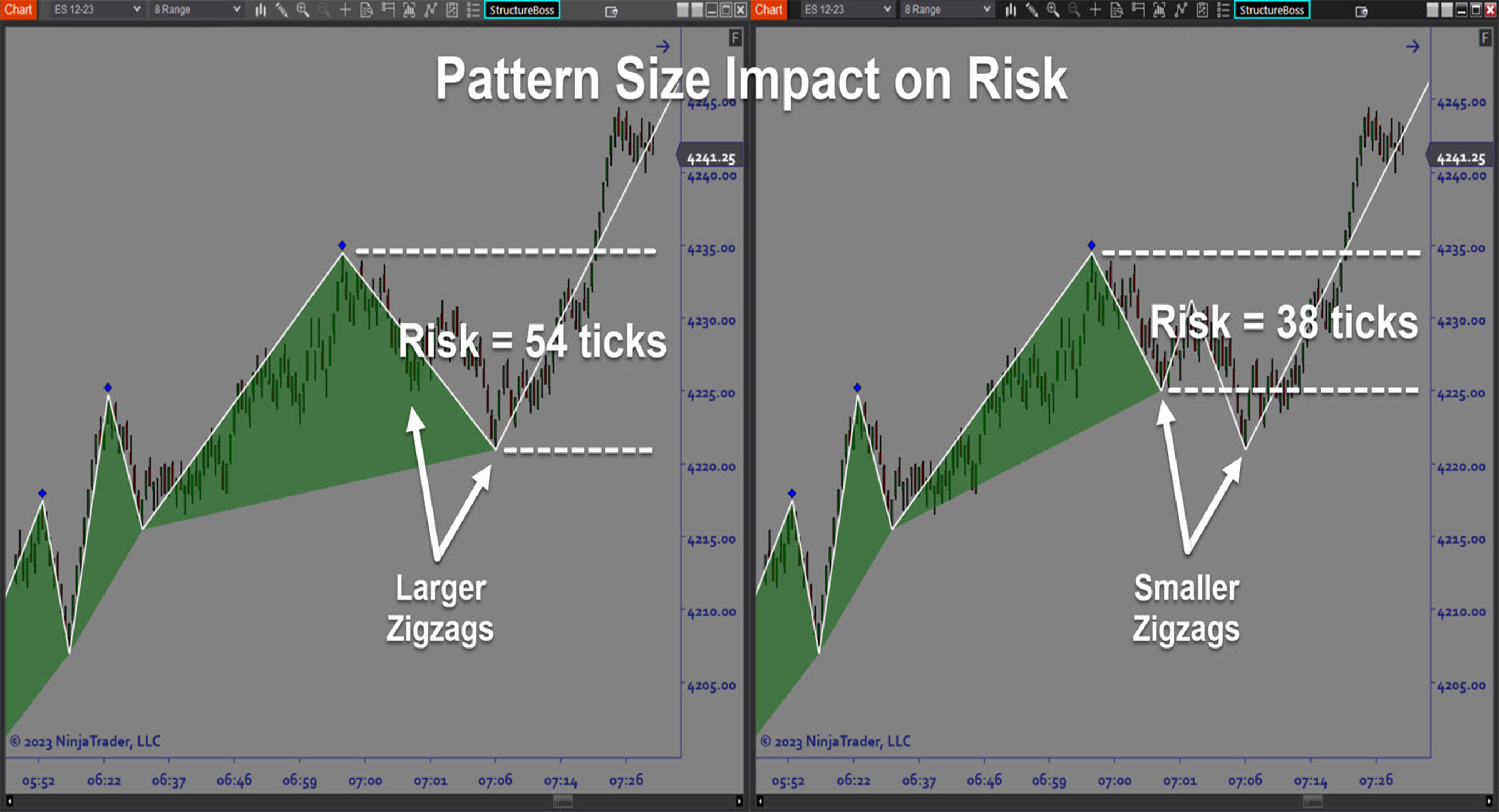

- Pattern size adjustment setting to accommodate all trading styles

- Fixed Dollar Risk per Trade option

- Risk-Reward ratio Target placement

- Auto Breakeven and ATR-based Trailing Stop functionality

- Time of Day filters

- Day of Week filters

- Drawdown analysis

- Profitability breakdown by exit type

- Audible Alerts

Functions:

The StructureBoss software is best used initially by making full use of the comprehensive backtesting and optimization tool. The Performance Metrics Table and Graphs appear right on the chart and calculate quickly after adjusting your strategy settings, allowing you to find profitable strategies very efficiently. Then you can apply your strategy settings to your trading chart and use the semi-automated signals, markers, and flags to guide you as you enter and manage trades manually. This simplifies the trading process because you know exactly what to do to follow your strategy precisely without having to do a lot of mental calculations. The end result is knowing when and how to trade and when to wait if conditions aren’t the best, making this an essential tool for any momentum or reversal trader.

Problem Solved:

- Stops traders from second guessing structure breakouts

- Stops traders from second guessing structure reversals

- Stops traders from not knowing when to trade and when to stay out of the market

- Stops traders from chasing the market by knowing where to enter

- Stops traders from taking excessive risk

- Stops traders from making risk management mistakes

- Stops traders from failing to wait for the best setups

- Stops traders from letting winners turn into losers

- Stops traders from failing to adjust their strategy to changes in volatility