SOUNDWAVE SOFTWARE VIDEO

SoundWave Overview:

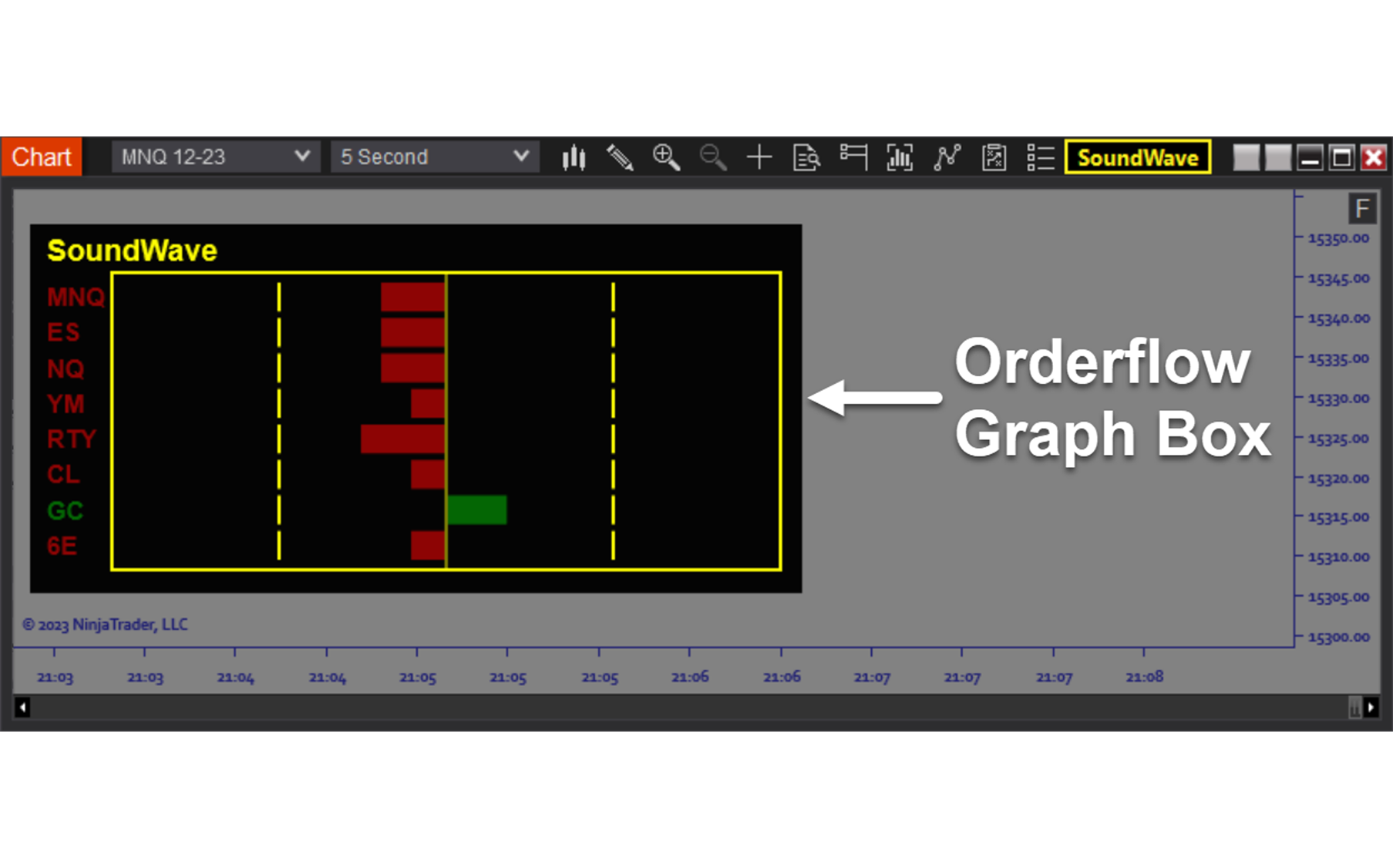

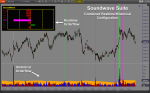

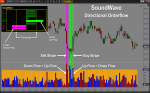

The ARC_Soundwave software is a Ninjatrader indicator that provides an audible and visual representation of realtime orderflow. When a sudden influx of orders hits the Tape, that usually means that something important is happening and it may be time to take action. Soundwave makes it easy to know immediately when orderflow suddenly spikes by generating sounds and also displaying a Graph Box which this visually. Soundwave also includes the ability to view historical orderflow corresponding to historical price action for backtesting and strategy development. The Soundwave functionality is applicable to any trading strategy, making this tool a must have for all types of traders.

Purpose:

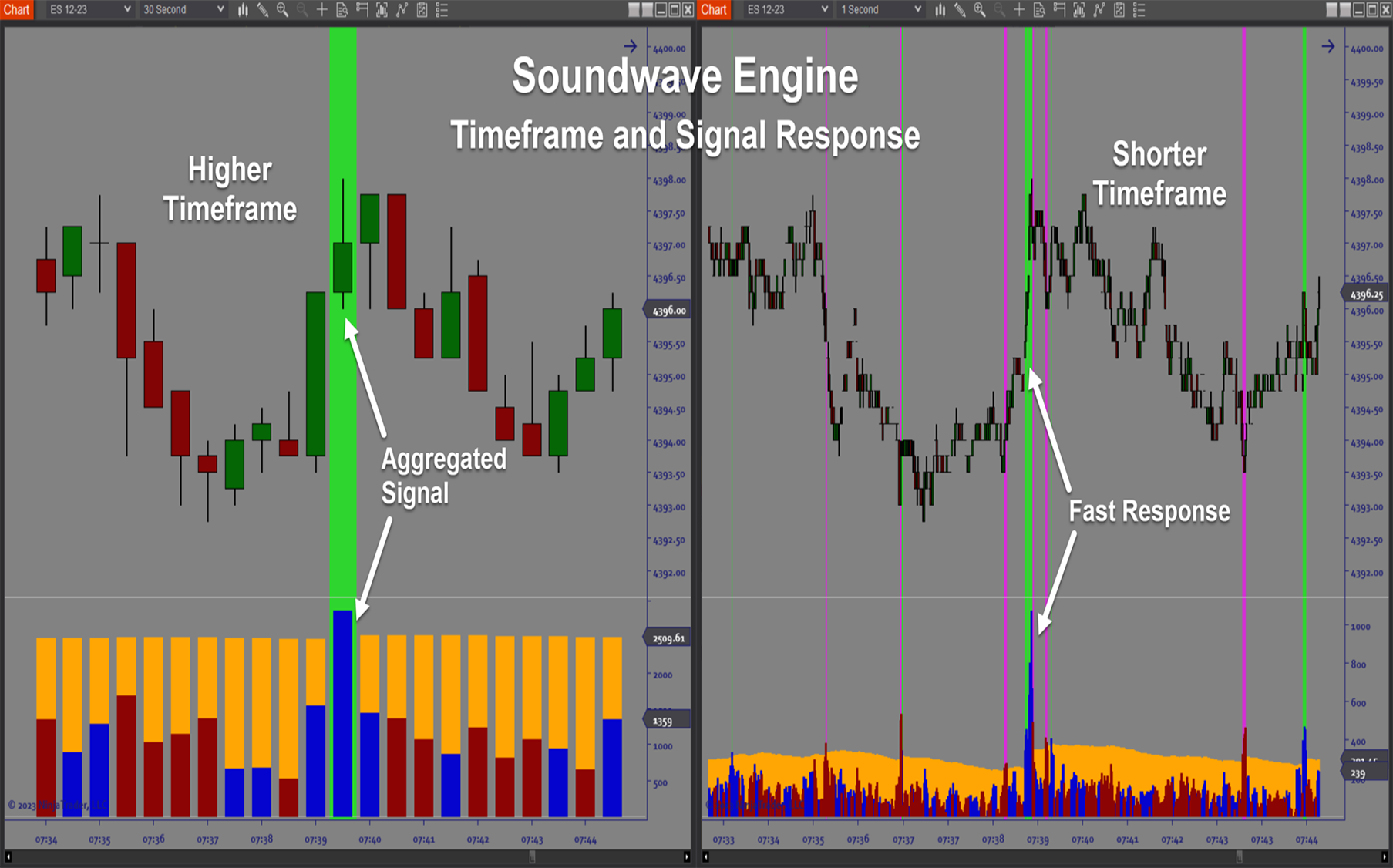

Traders need the ARC_Soundwave software because having a true read on the pulse of the market is the best way to know when to take action. By translating the pace of orderflow into easily recognizable sounds, you are leveraging all your senses to achieve your best performance. By using sound, you never have to dilute your focus on your trading chart and all the factors that go into your trading decisions. Lastly, the historical backtesting feature makes it possible to truly customize the signal sensitivity to each instrument that you trade.

Elements:

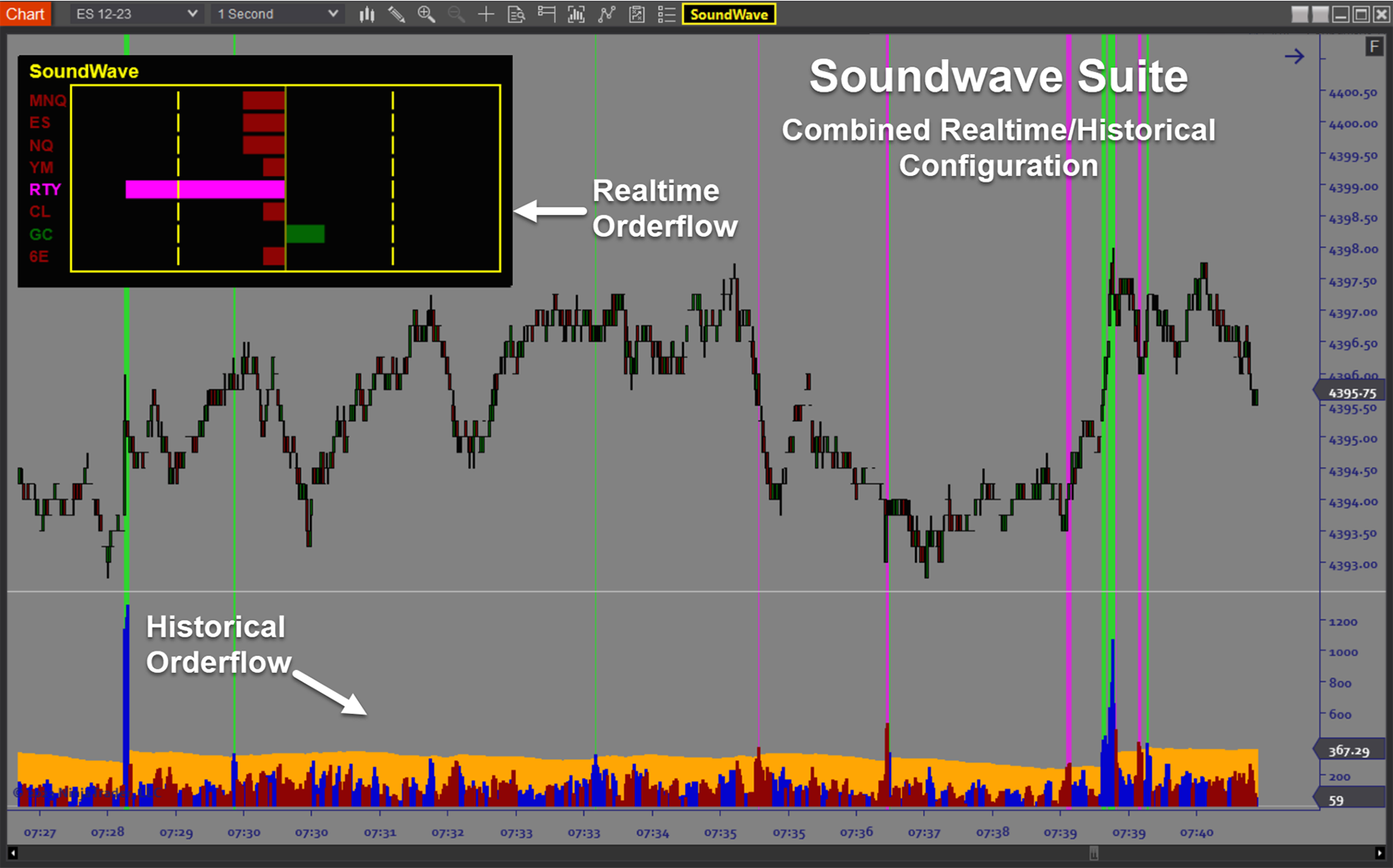

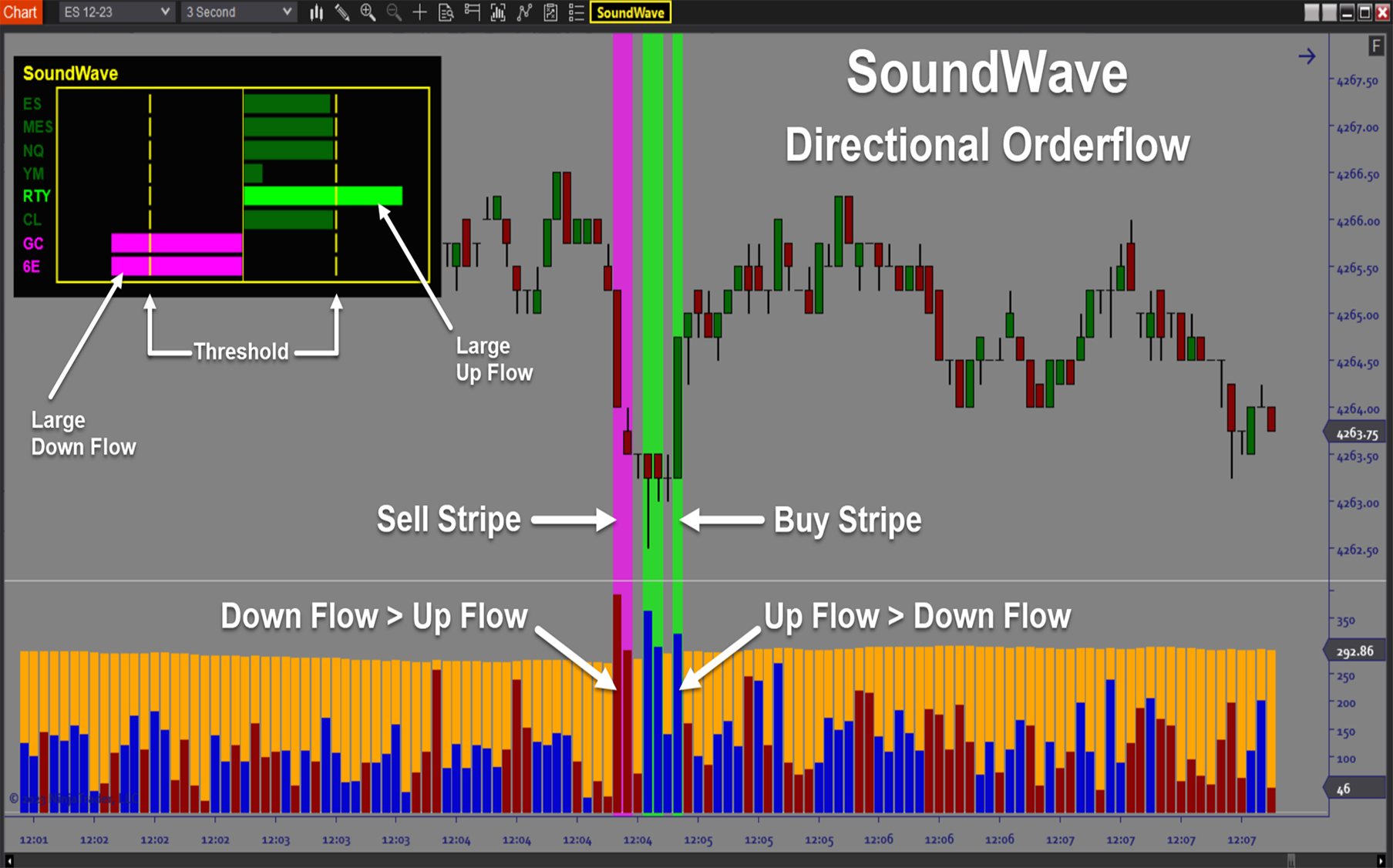

- Realtime orderflow speed monitor (audio and visual)

- Audible sounds correlated with various levels of elevated orderflow

- Graph Box visual showing current orderflow speed across multiple instruments

- Compatible with any instrument in your datafeed

- Fully customizable sensitivity adjustments

- Adjustable volume controls

- Separate On/Off sound switch for each instrument

- Quick access user interface dropdown menu

- Customizable color palette for visual components

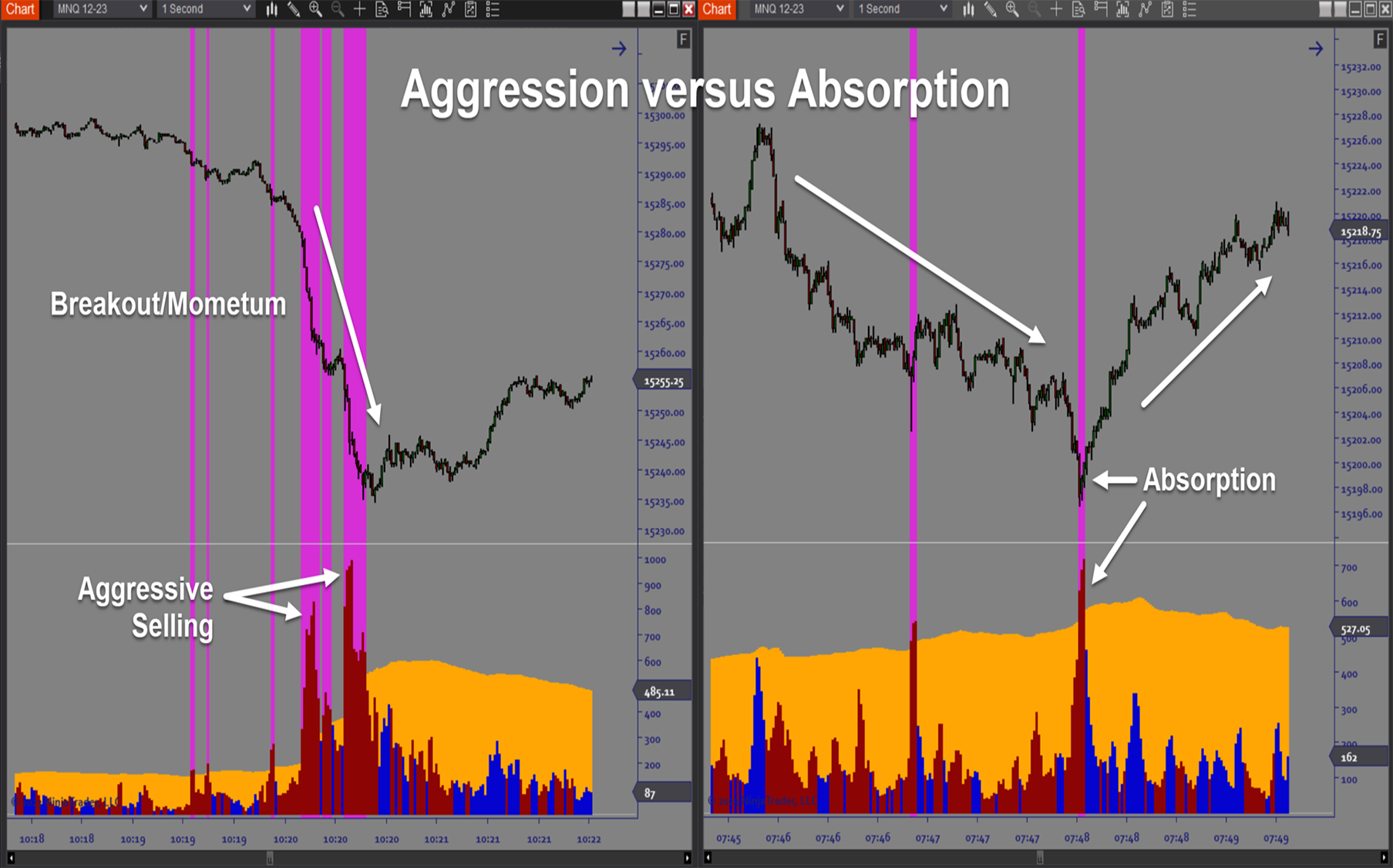

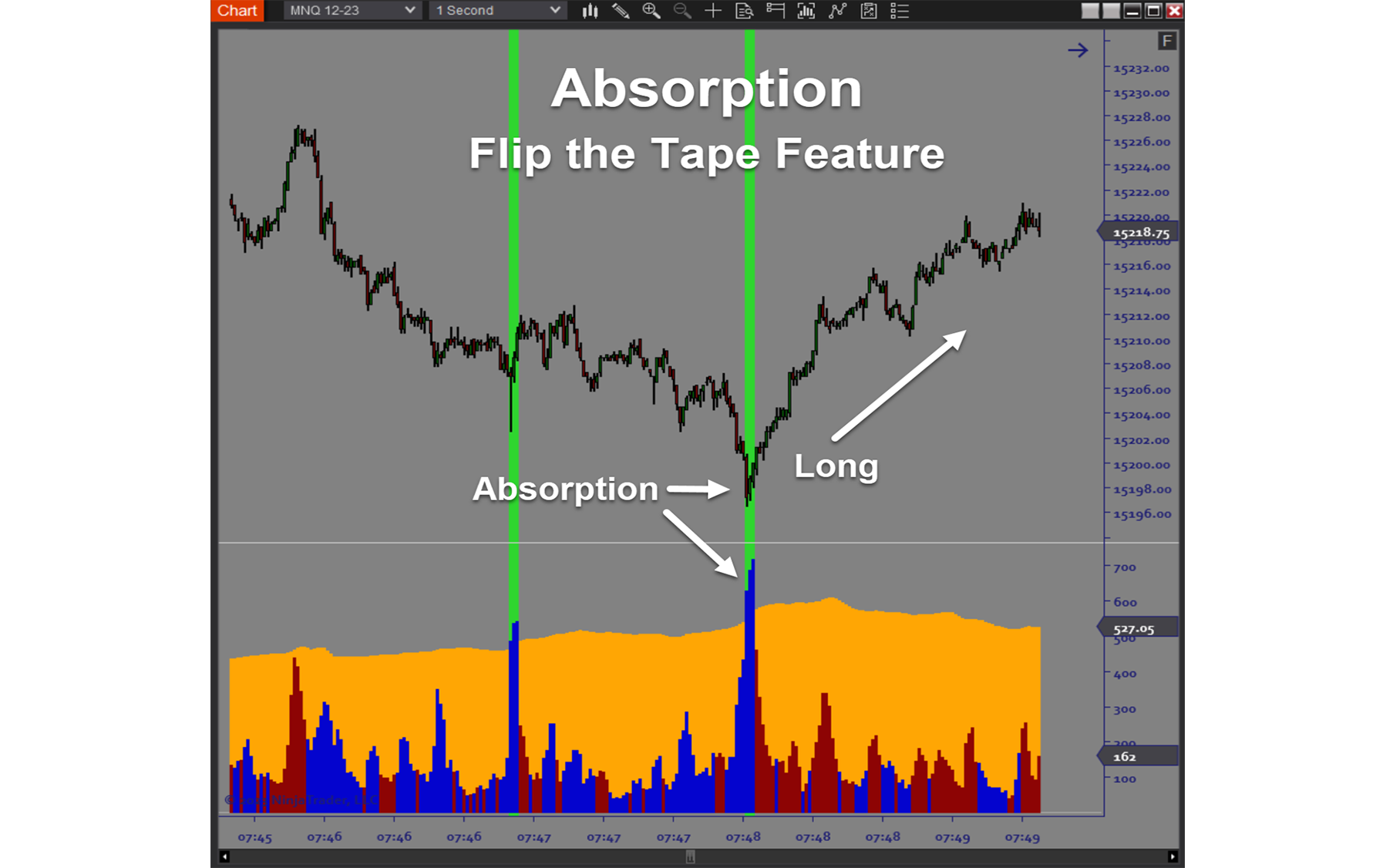

- “Flip The Tape” feature facilitating Absorption-based strategies

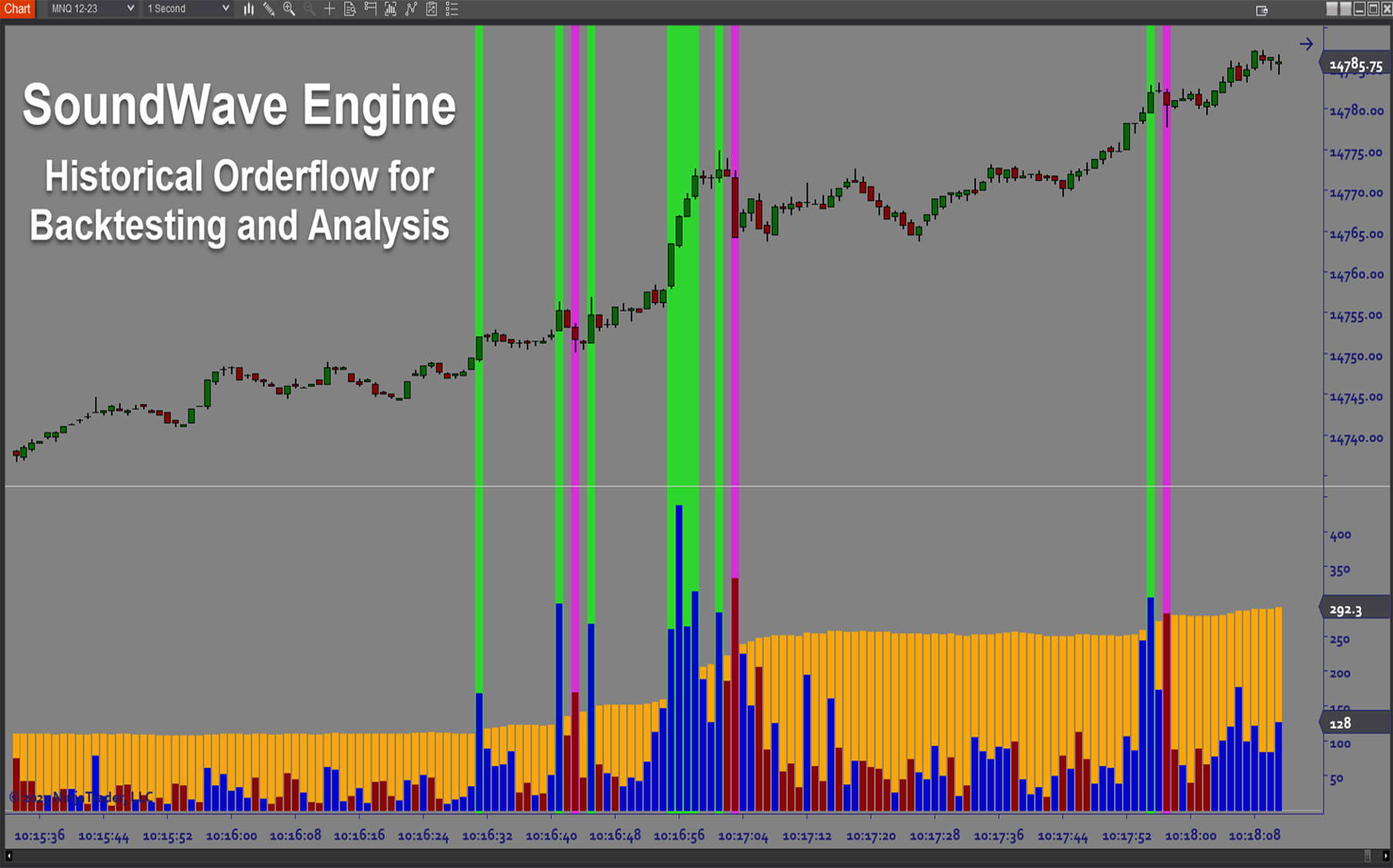

- Historical orderflow data for backtesting, strategy development, and instrument specific adjustments

- Applicable to any bartype and timeframe

Functions:

The Soundwave software is best used by sticking to your favorite strategy and using the audible sounds (and visual cues) to enhance your performance by having a better understanding of where and when to act. This tool basically turbocharges any strategy by knowing when to take action and when to wait. The flexible configuration options make it very easy to incorporate this functionality into your process without diluting your focus. Traders who prefer visual cues have excellent options without taking up unnecessary screen real estate.

Problem Solved:

- Stops traders from second guessing trade timing

- Stops traders from second guessing orderlow

- Stops traders from getting blindsided by unexpected moves

- Stops traders from missing out on the best signals at Areas of Interest

- Stops traders from missing out on multiple scalp opportunities

- Stops traders from chasing the market at the wrong times

- Stops traders from second guessing whether to act or wait

- Stops traders from trying to catch a falling knife

- Stops traders from failing to convert good backtest results into actual profits