Frequently Bought Together

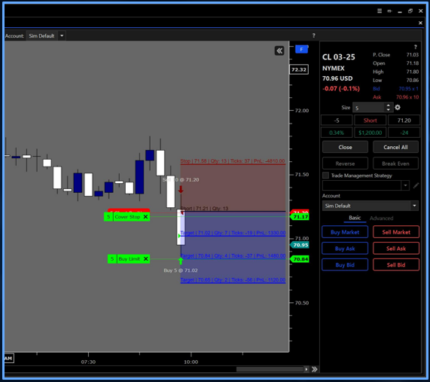

Fractal Breakout Algo

INCLUDED

- Code & Updates Available on NT8 | 2 PC : $1990

- Custom Built Algo ENGINE 2.0 : $1990

- Detailed User Documentation : $495

- White Glove Install & Ongoing Support : $995

- Prebuilt Optimized Templates : $995

- Deep Dive Algo Video Course : $995

- Live VIP Algo Training AMA's : $995

- TOTAL VALUE

:

$8450

VP Scalper Algo

INCLUDED

- Code & Updates Available on NT8 | 2 PC : $1990

- Custom Built Algo ENGINE 2.0 : $1990

- Detailed User Documentation : $495

- White Glove Install & Ongoing Support : $995

- Prebuilt Optimized Templates : $995

- Deep Dive Algo Video Course : $995

- Live VIP Algo Training AMA's : $995

- TOTAL VALUE

:

$8450

One and Done System

ONE AND DONE SYSTEM PACKAGE

- Pre-Built Workspaces : $495

- Live Trading Social Proof Results : $495

- Strategy Cheat Sheets (Trade Plan) : $495

- Trading VIP Masterclass (Recorded) : $795

- Live Trade Room Trial (System Exposure) : $995

- Unlimited Support (White Glove) : INCLUDED

- TOTAL COMBINED VALUE

:

$3,275 - Discount (78% off) NOW ONLY : $749

Div Algo

INCLUDED

- Code & Updates Available on NT8 | 2 PC : $1990

- Custom Built Algo ENGINE 2.0 : $1990

- Div Algo Discord Group : $495

- Detailed User Documentation : $495

- White Glove Install & Ongoing Support : $995

- Prebuilt Optimized Templates : $995

- Deep Dive Algo Video Course : $995

- Live VIP Algo Training AMA's : $995

- TOTAL VALUE

:

$8950