Thrust Breakout Algo

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

Category: Algos

Tags: Backtesting, Breakouts, Candle Patterns, Chart Patterns, Market Structure, Momentum, Money Management, Patterns, Reversals, Risk Management, Signals, Strategy Development, Supply/Demand, Support & Resistance, Trade Management, Trade Performance, Trade Planning, Trade Sizing, Trend Trading

Description

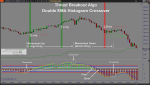

Overview:

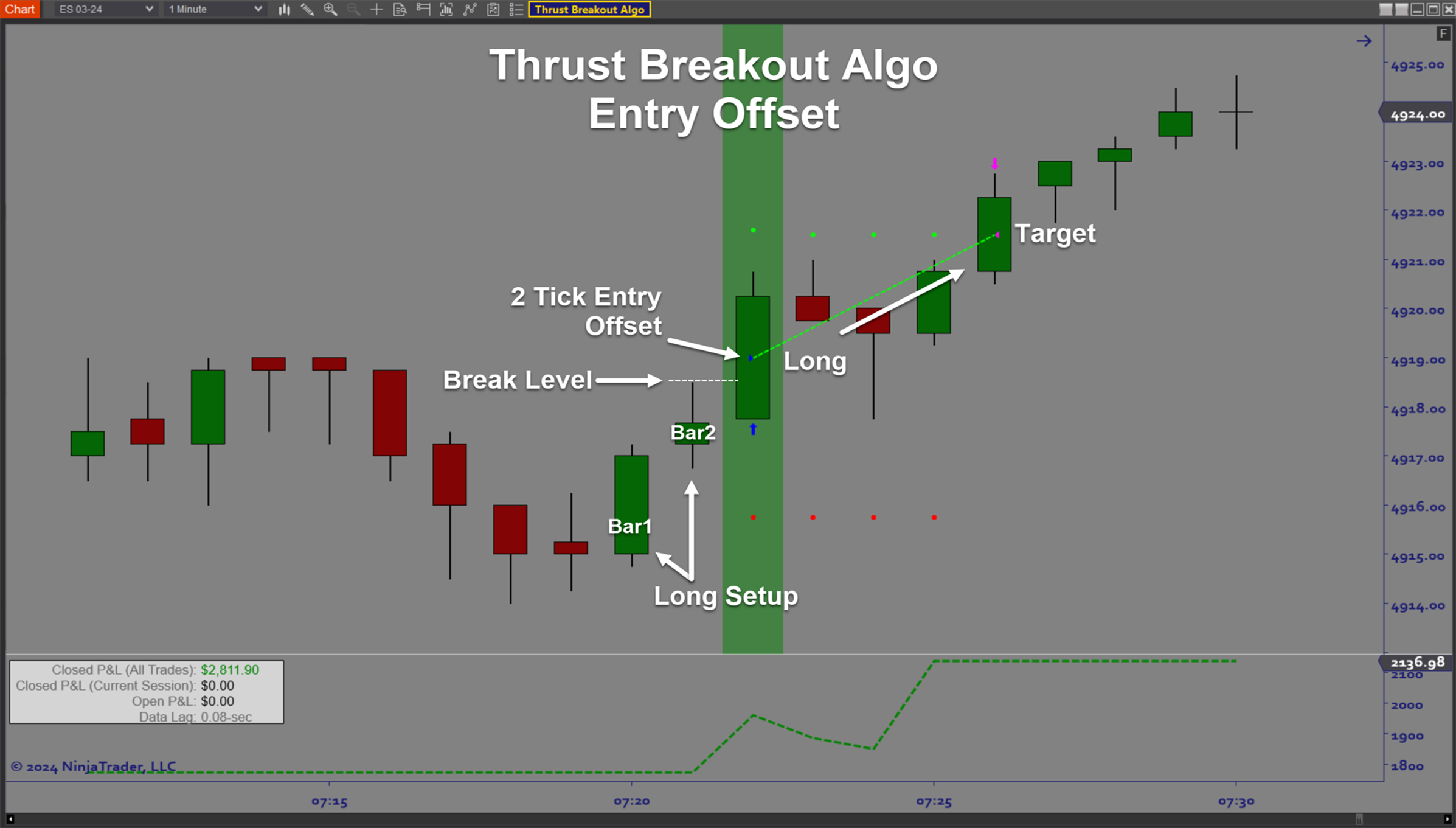

The Thrust Breakout Algo is a pure price action-based automated trading solution for Ninjatrader which leverages breakout setups following consolidation within a trend. Most traders that use Support/Resistance (S/R) for trade entries are waiting for a pullback to test those levels, sometimes many hours after the zone was created. Instead of waiting and hoping that an S/R Level will hold, traders using the TBO Algo are capturing profits early as the thrust pattern is just beginning to unfold. You no longer have to wait and run the risk that conditions change and work against you. Timing these types of breakout entries is absolutely critical because entering even a few moments too late will cause you to miss out on a good portion of the profits. That is what makes using an automated solution so beneficial. The software can identify the breakout pattern and enter the trade instantaneously which is faster than is humanly possible. The software includes a wide range of adjustable signal rules and filters making it possible to customize to any market or timeframe. This is what makes the TBO Algo a truly valuable solution for autotrading breakout setups.Purpose:

Traders need the Thrust Breakout Algo software because while bar pattern breakouts can be a very effective trading strategy they are very difficult and time consuming to identify manually. If you are not able to enter in time you can miss out on good trade opportunities or even worse enter too late causing you to get stopped out. The Thrust Breakout Algo automatically finds the setups and enters the trade for you. When you take the time to optimize the algo settings for the instrument that you are trading, you can rely on the software to automatically trade the best setups and allow you to focus on strategy development and managing risk to protect your trading capital.Elements:

- Autotrade price action patterns for frequent trade opportunities

- Capture hidden breakouts within a trend

- Customize the trade setup rules to optimize for any instrument

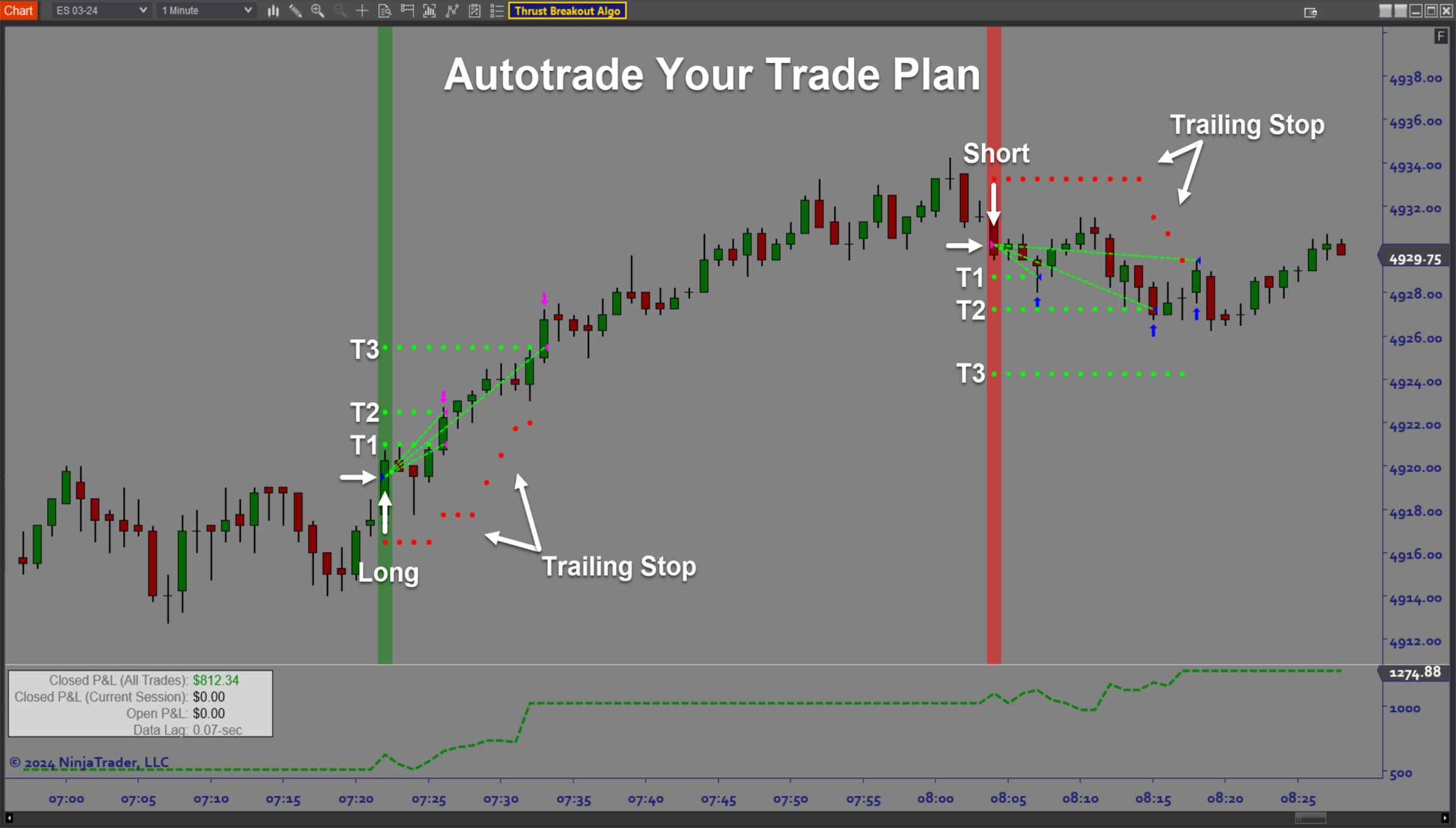

- Fully automated trade plans with stop placement and up to 3 targets

- Adaptive Stop placement to reflect volatility and market dynamics

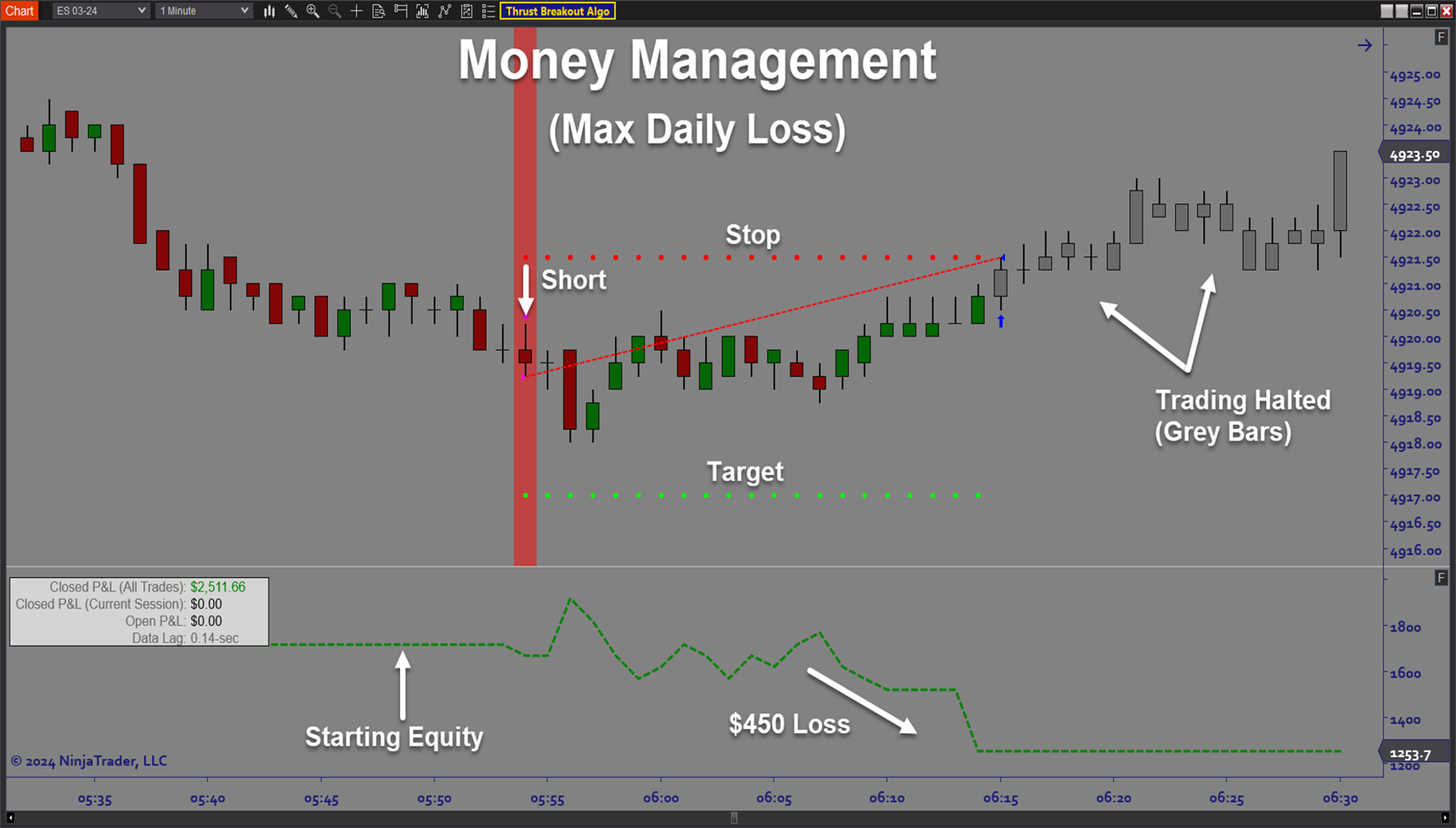

- Dynamic trade sizing to control Dollar Risk per trade

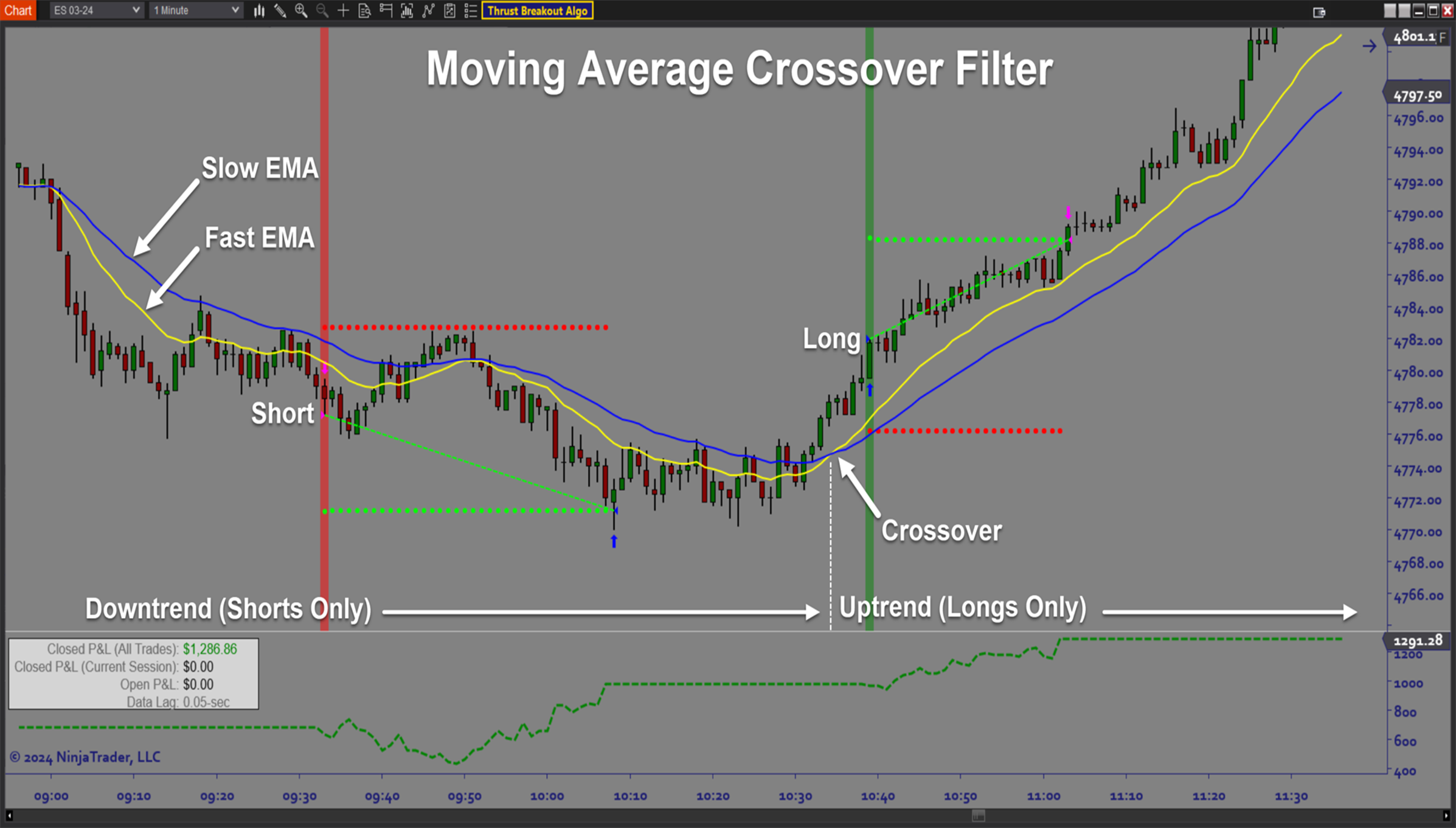

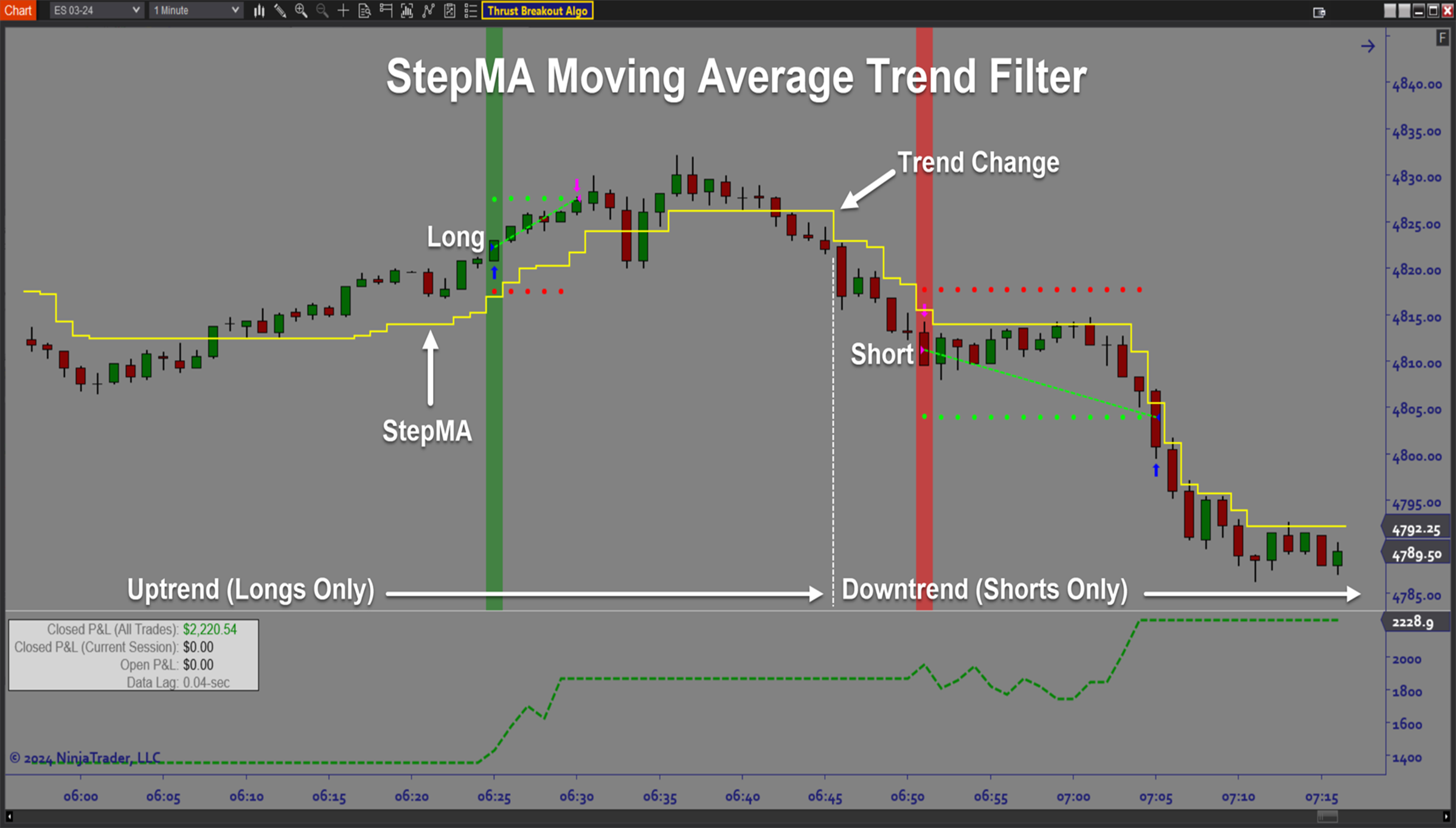

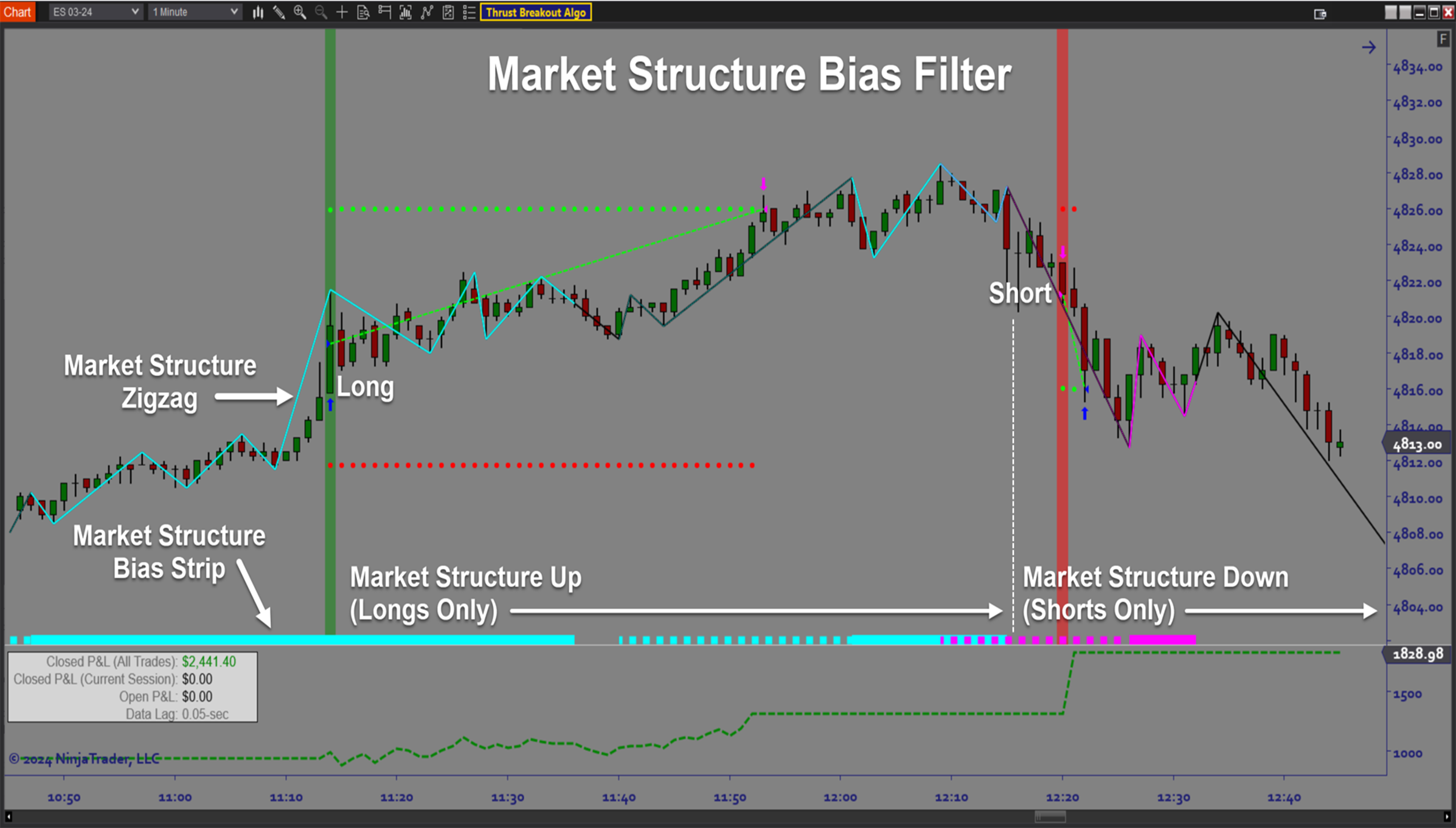

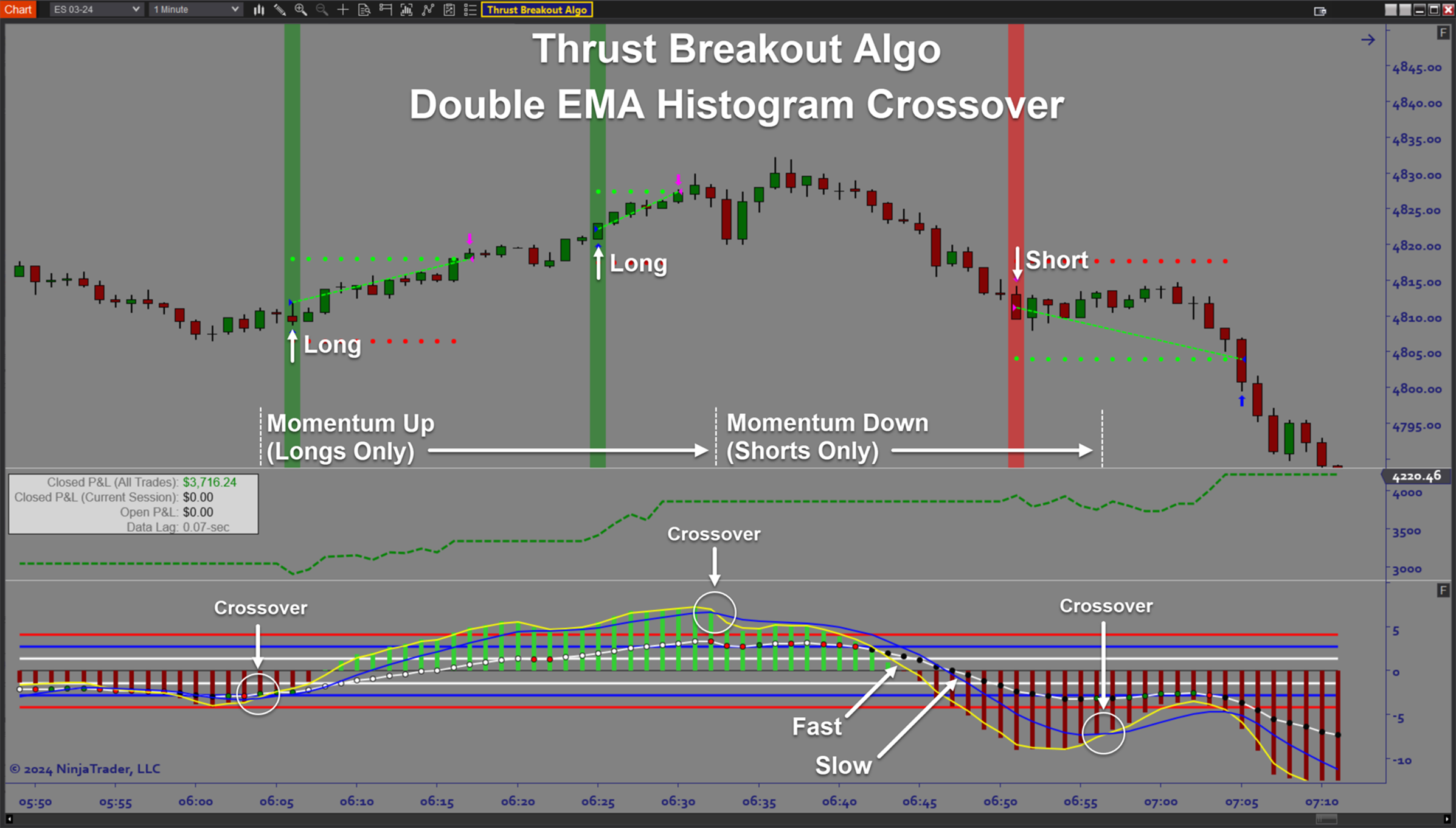

- Comprehensive trend, momentum, and market structure directional filters

- AutoTrail and Breakeven strategies

- R-multiple target placement

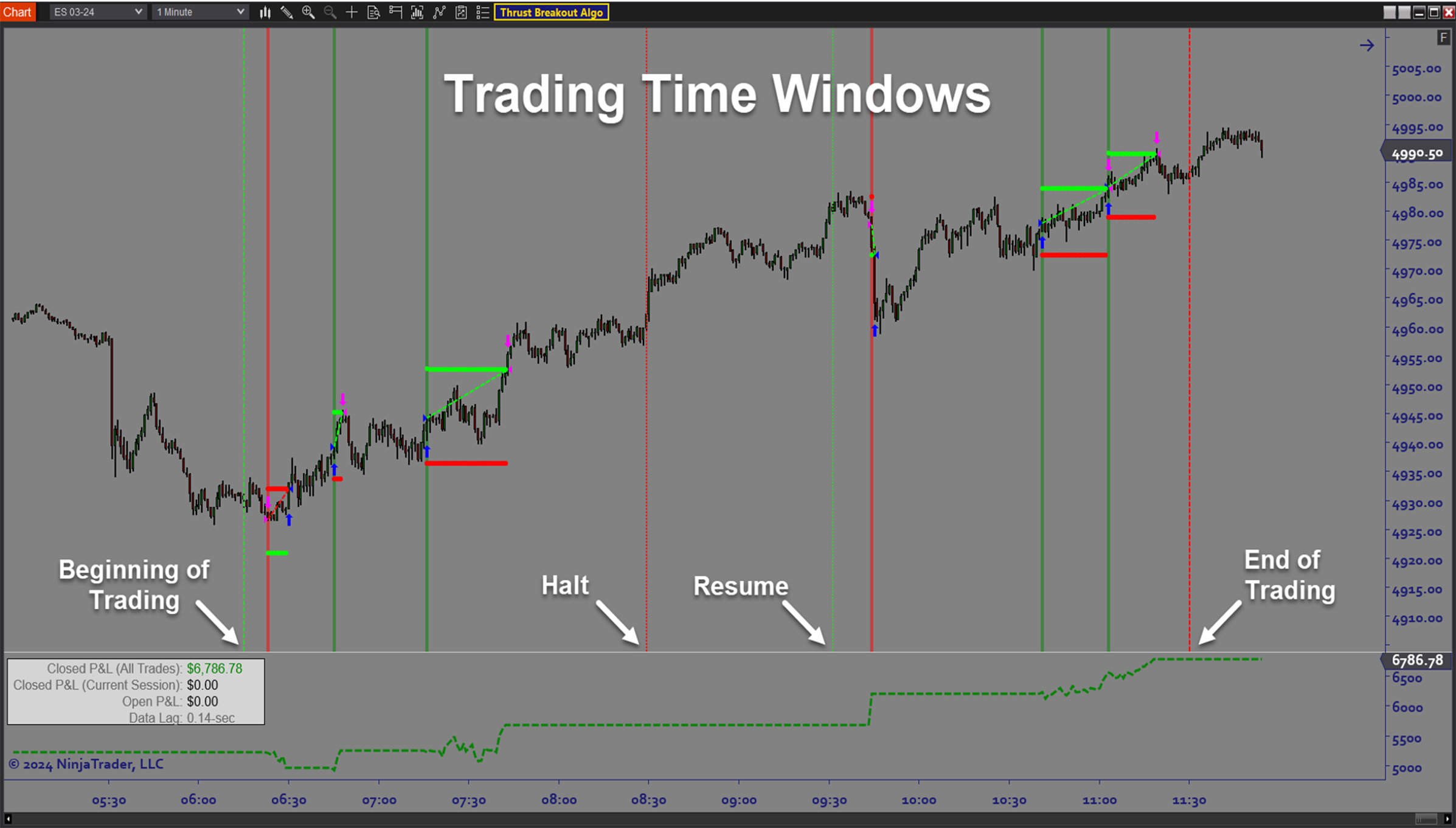

- Time filters, Day of Week filters, Holiday filters, and money management function

- On screen trade signals, entry/exit markers, stops/targets, realtime P&L

- Built In Backtesting and Optimization capability

Functions:

The Thrust Breakout Algo is best used by sticking to the instruments and timeframes you know best. You can always expand to other markets and timeframes when ready to do so. The settings which dictate the frequency and location of trade setups are very straightforward making it easy to use the built-in backtesting and optimization features to get a preliminary strategy configuration. Next forward-test your strategy in live simulation mode. Only when you are satisfied with the performance in Sim should you deploy the algo using actual risk capital. Using this approach to trading actually frees up your time to continue to focus on testing and improving the strategy as well as adjust to changing market conditions.Problem Solved:

- Stops traders from failing to find hidden price action patterns

- Stops traders from missing out on powerful breakout setups within a trend

- Stops traders from having to wait all day for one good trade setup

- Stops traders from entering too late and missing out on most of the profits

- Stops traders from sabotaging their trading due to indecision and fear

- Stops traders from dealing with the stress of manual trading

- Stops traders from trading against momentum, market structure, and directional bias

- Stops traders from failing to manage risk appropriately

- Stops traders from failing to identify the best days to trade

- Stops traders from failing to adjust to market conditions