VSR_ARB. Arbitrage Indicator

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

Overview:

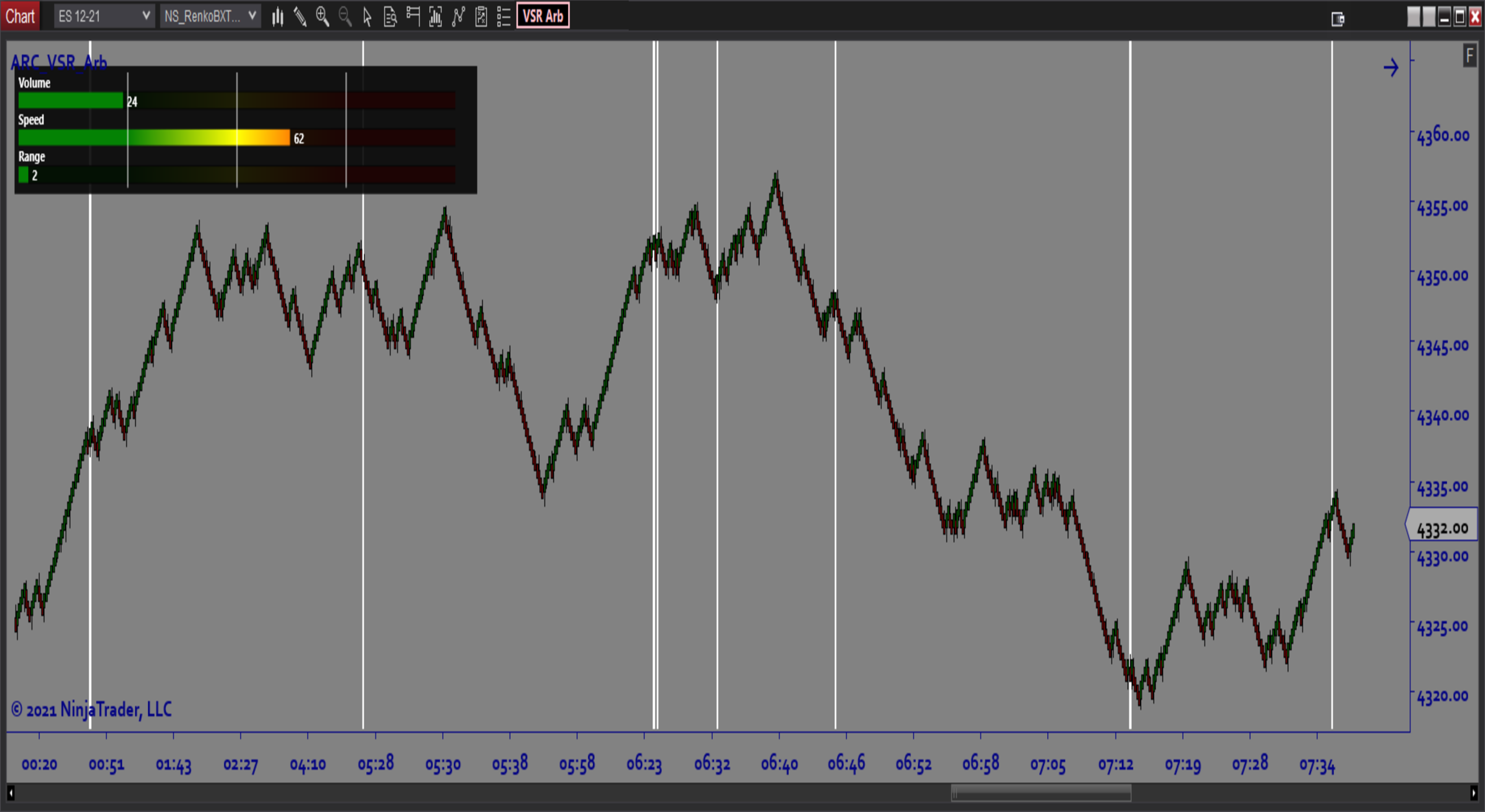

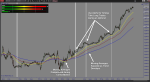

The VSR_Arbitrage is a universal measurement tool used to identify actionable opportunities based on statistical anomalies in Volume, Speed, and Range. The software tracks market internals data in real time and generates an alert when arbitrage opportunities arise. This serves as a warning sign that something is about to happen of high importance. This is what makes the VSR_Arbitrage the ultimate system add-on – it enhances any trading strategy by providing alerts when to take action.

Purpose:

Traders need the VSR Arbitrage software because any trading approach, no matter how successful, can always benefit from an extra edge which improves performance. VSR_Arbitrage detects anomalies in market internals that alert you that a move is imminent. Even a few seconds of advanced warning can make a noticeable difference but the software typically gives you plenty of time to act. It would be nearly impossible to perform these calculations manually so software is necessary to benefit from this type of analysis.

Elements:

- Market Internals Arbitrage Algorithm

- Real time On Screen Monitor (Volume, Speed, and Range “needles”)

- Automatic Arbitrage Alerts

- Absolute and Relative Arb Thresholds

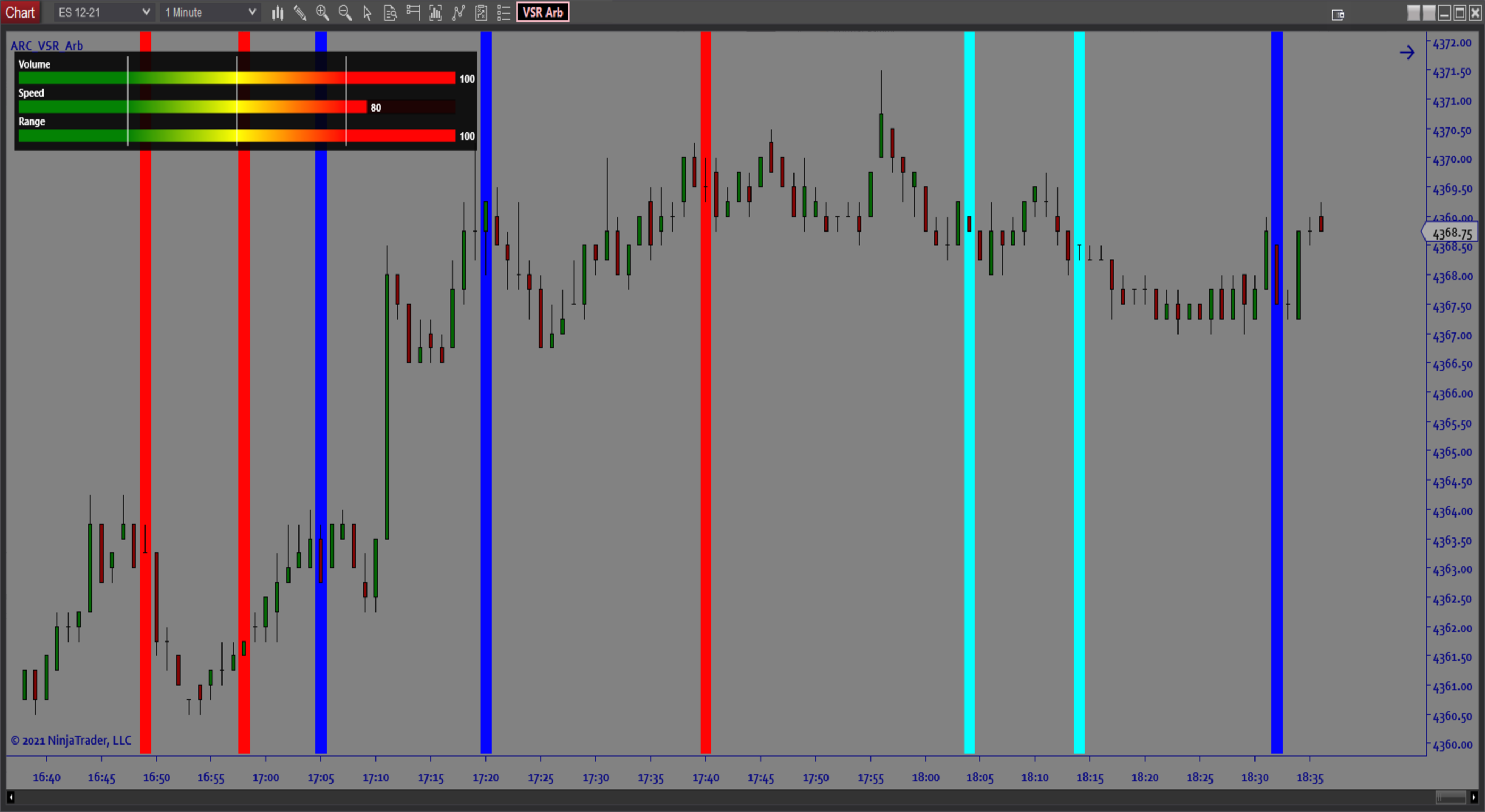

- Racing Stripe Signals pinpointing the signal bar

- Color Coding racing stripes by Alert Type

Functions:

The VSR_Arbitrage software is best used by setting up Alerts to let you know when an imminent move is anticipated. The chart graphics display a “racing stripe” on the signal bar making it easy to know when to engage. The signals can be traded as a stand alone system or layered onto your existing strategy for extra timing refinement. Some of the best setups are when the Alert occurs at an Area of Interest.

Problem Solved:

- Stops traders from second guessing trade timing

- Stops traders from getting blindsided by sudden unexpected moves

- Stops traders from missing opportunities due to using lagging indicators

- Stops traders from entering too late and missing out on most of the profits

- Stops traders from getting in too late because there is not enough time to plan the trade

- Stops traders from losing confidence because they second guess their entries