Unizones A.M.A. (Ask Me Anything)

UNIzones. Price Action and Market Structure Indicator Overview:

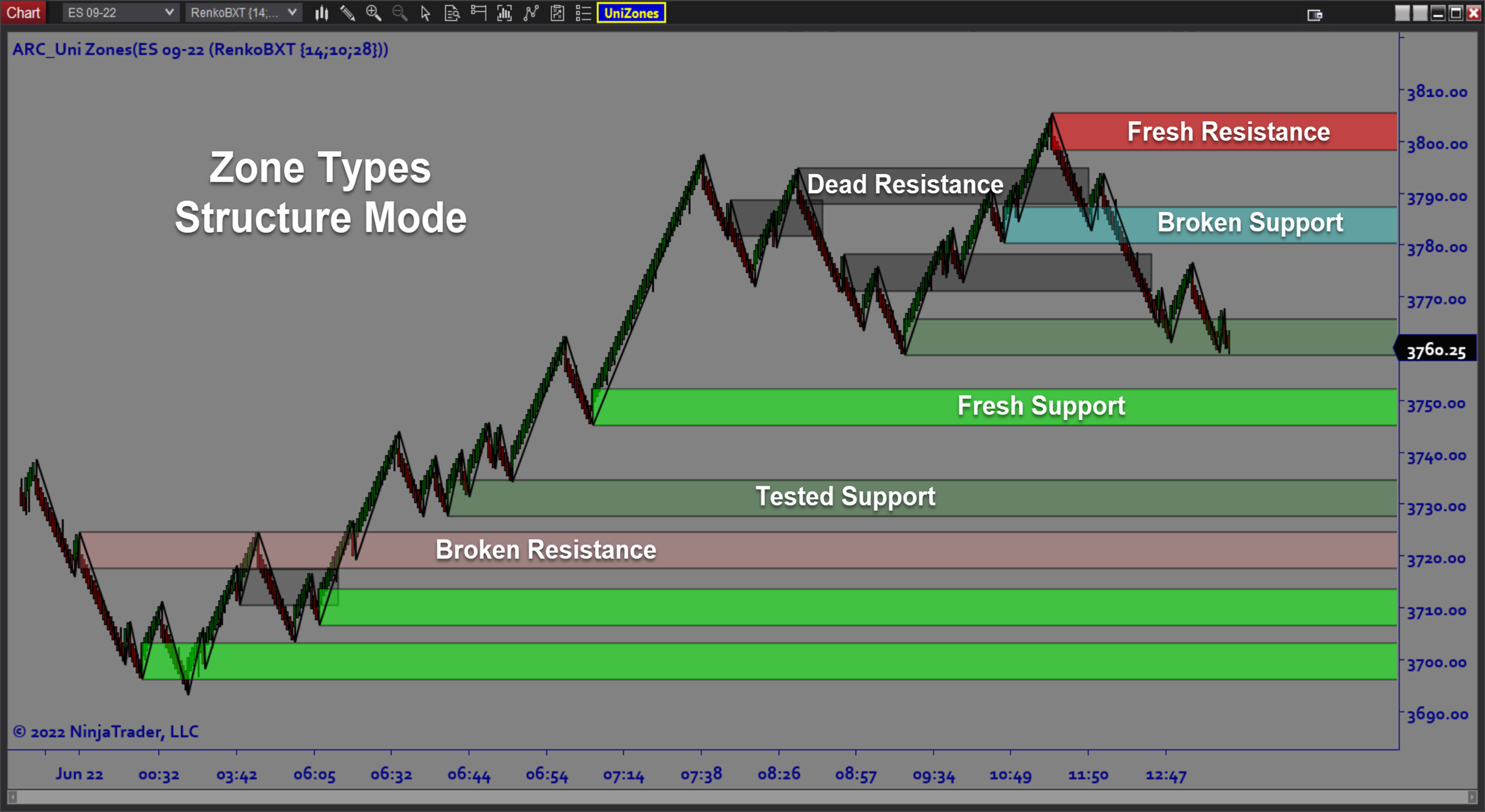

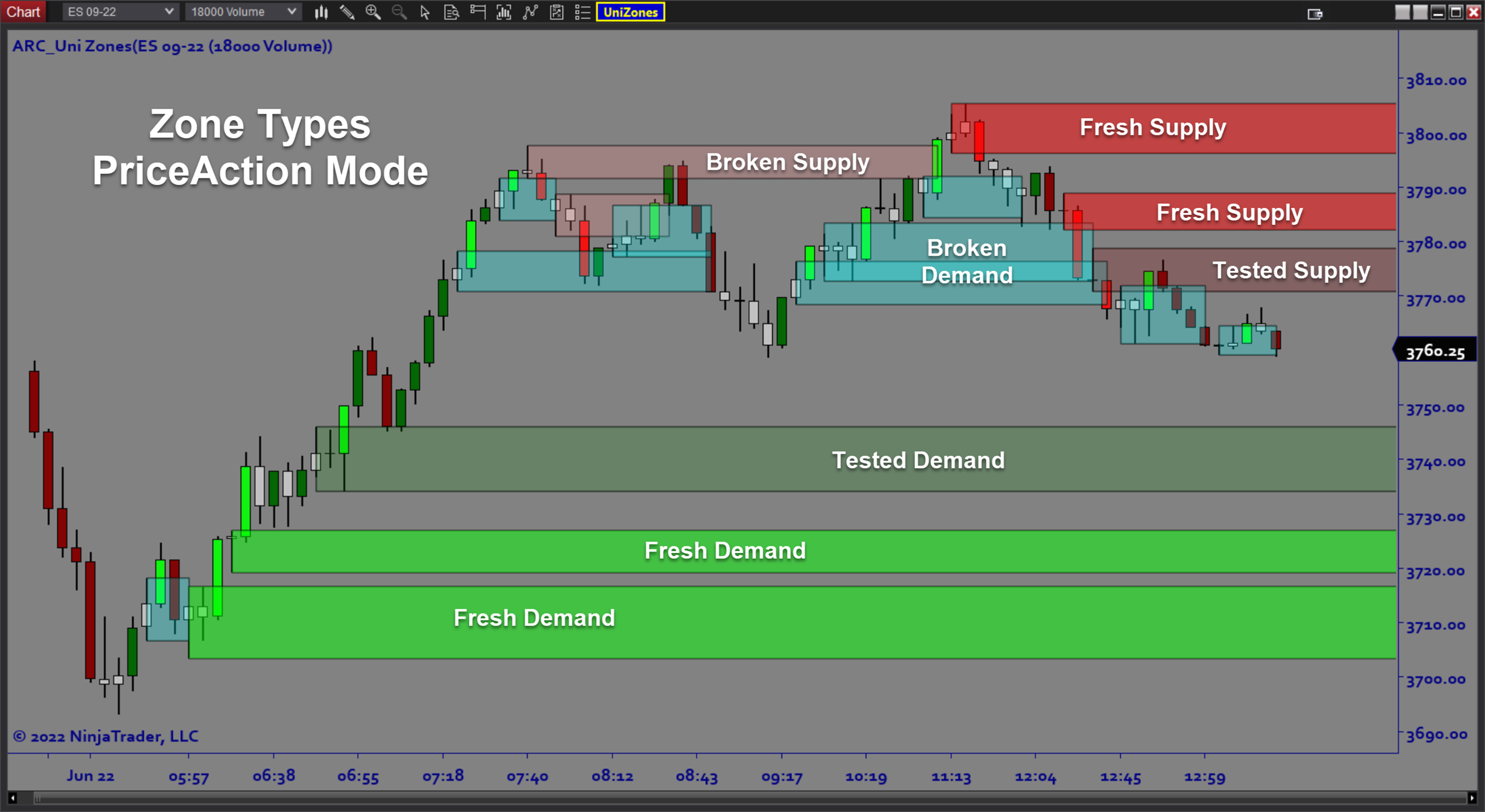

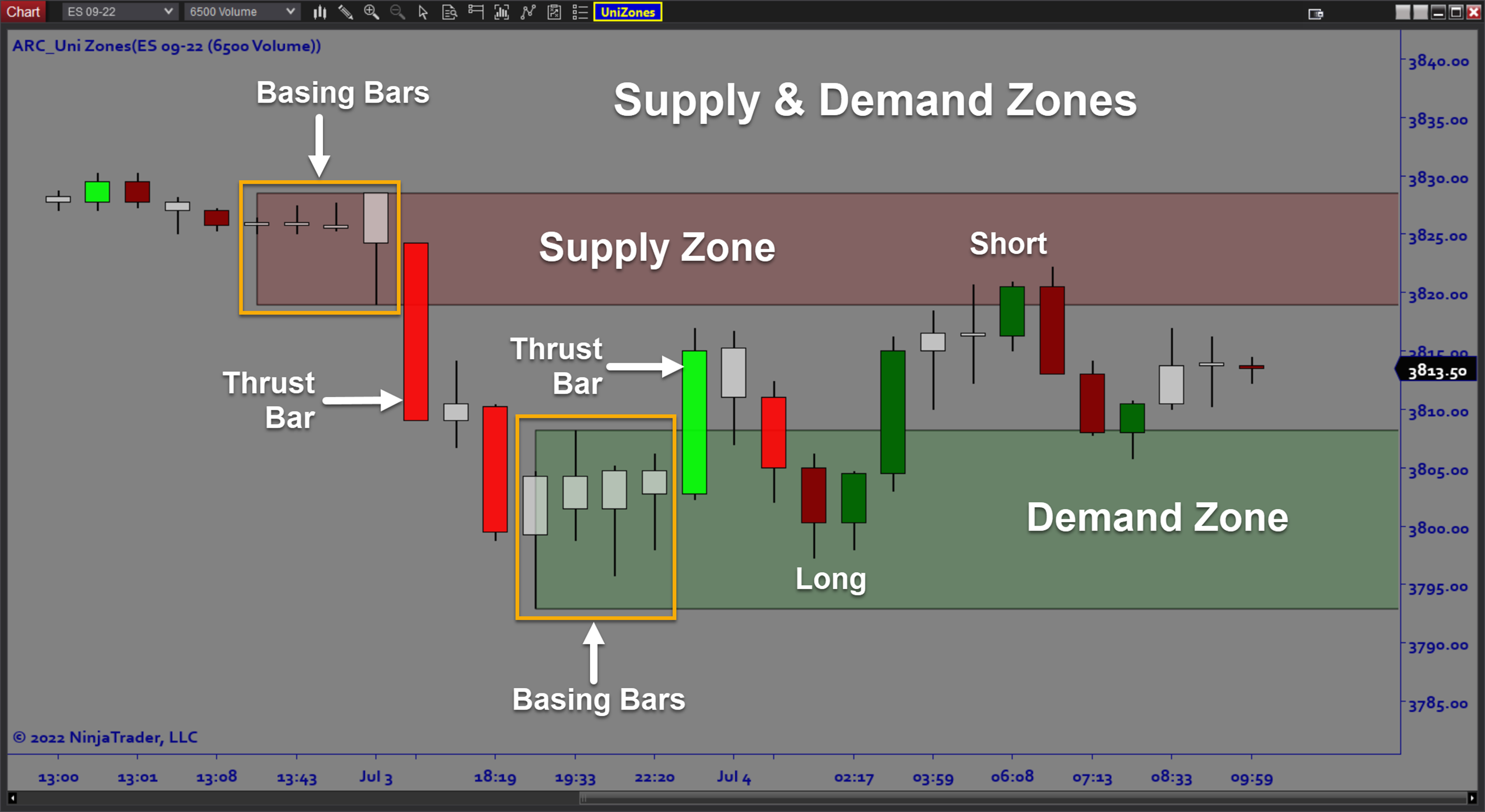

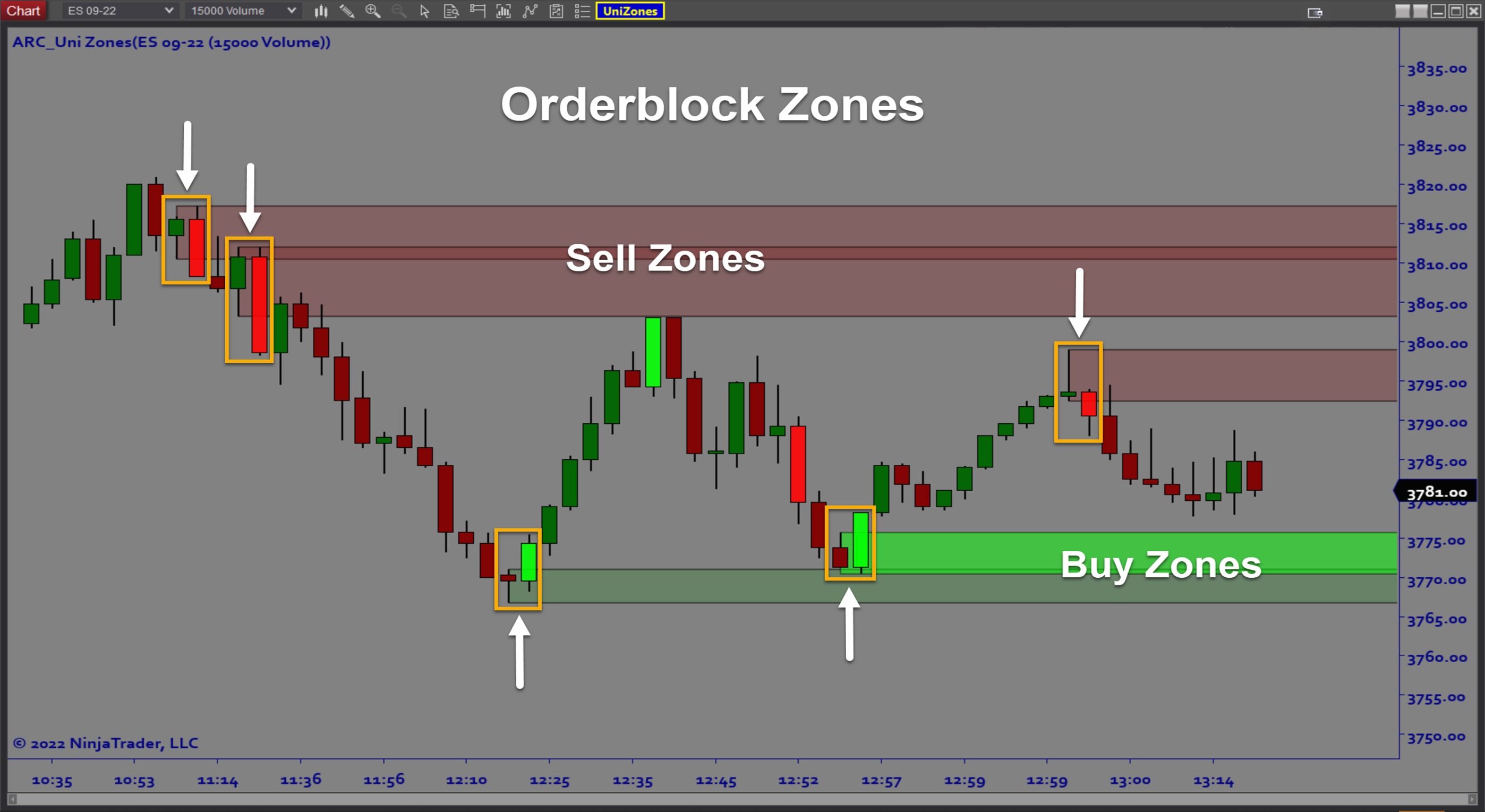

UniZones is a universal price level and trading tool which locates key areas of interest (AOI’s) and trade setups based on Price Action and Market Structure. In Price Action Mode, the software scans for Supply/Demand zones, Order Blocks, and Traps, which represent key entry locations for directional trade setups. In Structure Mode, Support and Resistance areas are derived by analyzing the structure of the market, providing a true read on directional bias and expected range. UniZones is a truly comprehensive tool for locating key areas of interest.Purpose:

Traders need the UniZones software because it provides 2 critical functions. First, knowing where to locate key levels of support and resistance is absolutely essential for any trading style. True Support and Resistance is based on the dynamics of market structure and is often difficult to see. Having levels you can trust can really improve your trading. Second, good entry setups based on price action patterns are difficult to calculate manually. The software uses pattern recognition to locate Supply/Demand, Order Blocks, and Trap Zones, which present directional trade setups that you would normally miss. Having both of these capabilities in one tool makes UniZones a must have for any serious trader.Elements:

- 2 Modes of operation: Market Structure and Price Action

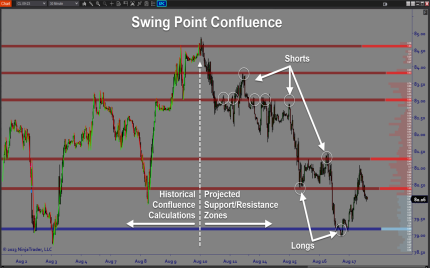

- True Support and Resistance based on market structure analysis

- Supply and Demand Entry Zones

- Order Block Entry Zones

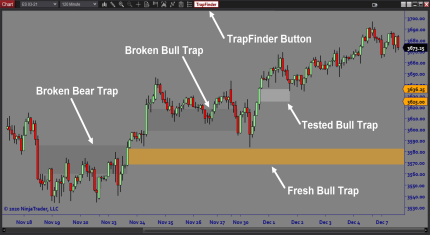

- Trap Entry Zones

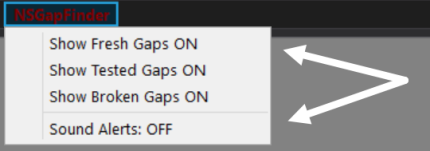

- Fresh, Tested, and Broken Zones

- Potential and Confirmed Zones

- Globalization of Zones across multiple charts

- Customizable Zone creation and Zone termination rules

- Zone Overlap rules

- Optional Zig Zags on Price Bars

- Customizable Swing Strength

Functions:

The UniZones software is best used by treating it as a true 2 in 1 tool. It helps you remain aware of current market conditions by revealing the major areas of support and resistance. And then it can also be used to provide directional entry locations so you can trade Supply/Demand, Order Blocks, and Traps directly. The ability to globalize all of these zones across multiple charts makes it easy to keep track of the most important levels while you are trading.Problem Solved with price action indicator: Unizones:

- Stops traders from second guessing support and resistance

- Stops traders from missing the most important levels of interest

- Stops traders from trading against the structure of the market

- Stops traders from missing where broken support becomes resistance (and vice versa)

- Stops traders from missing out on the best levels of supply and demand

- Stops traders from missing out on order block trades

- Stops traders from missing hidden trap zones