Overview:

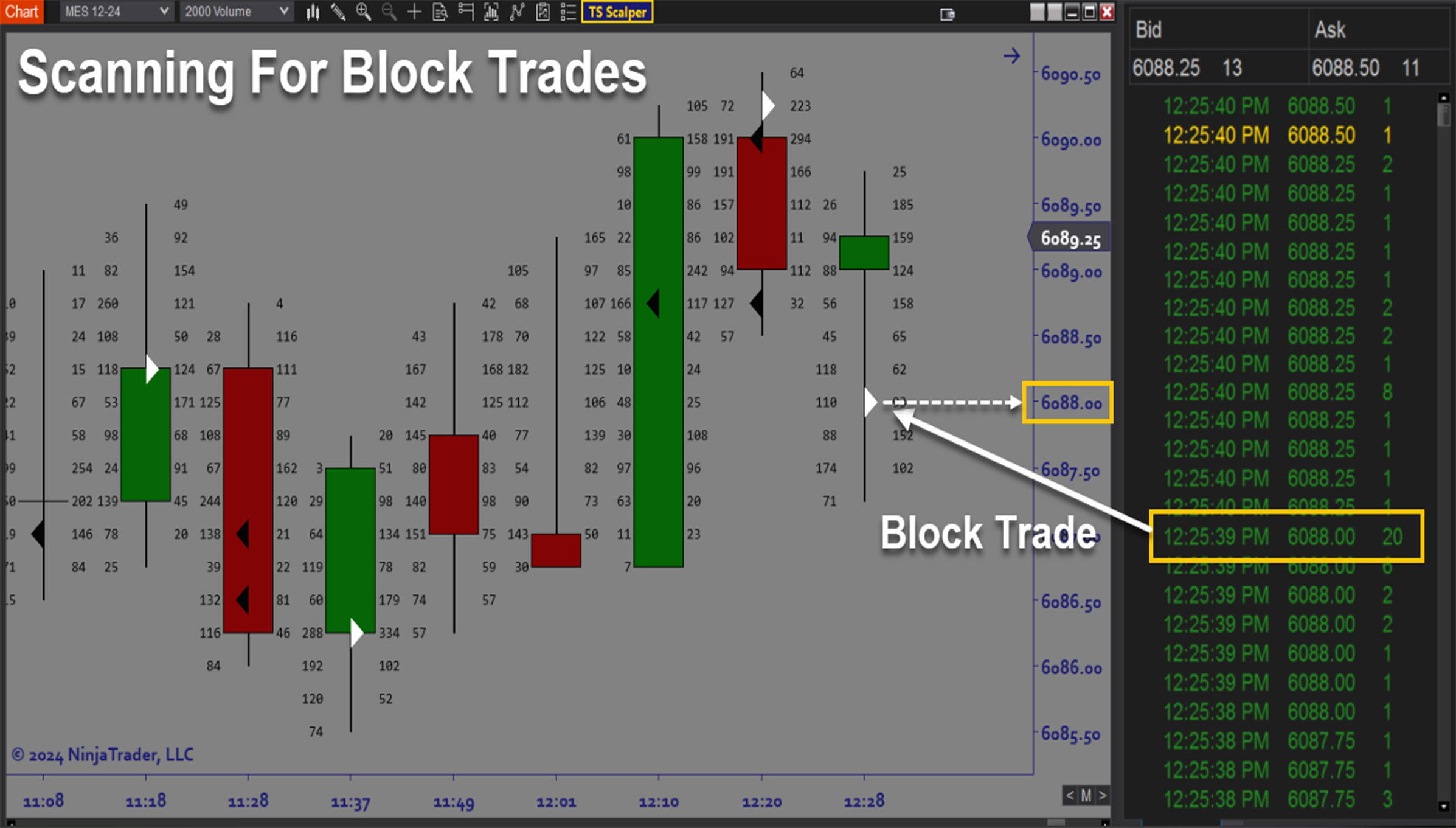

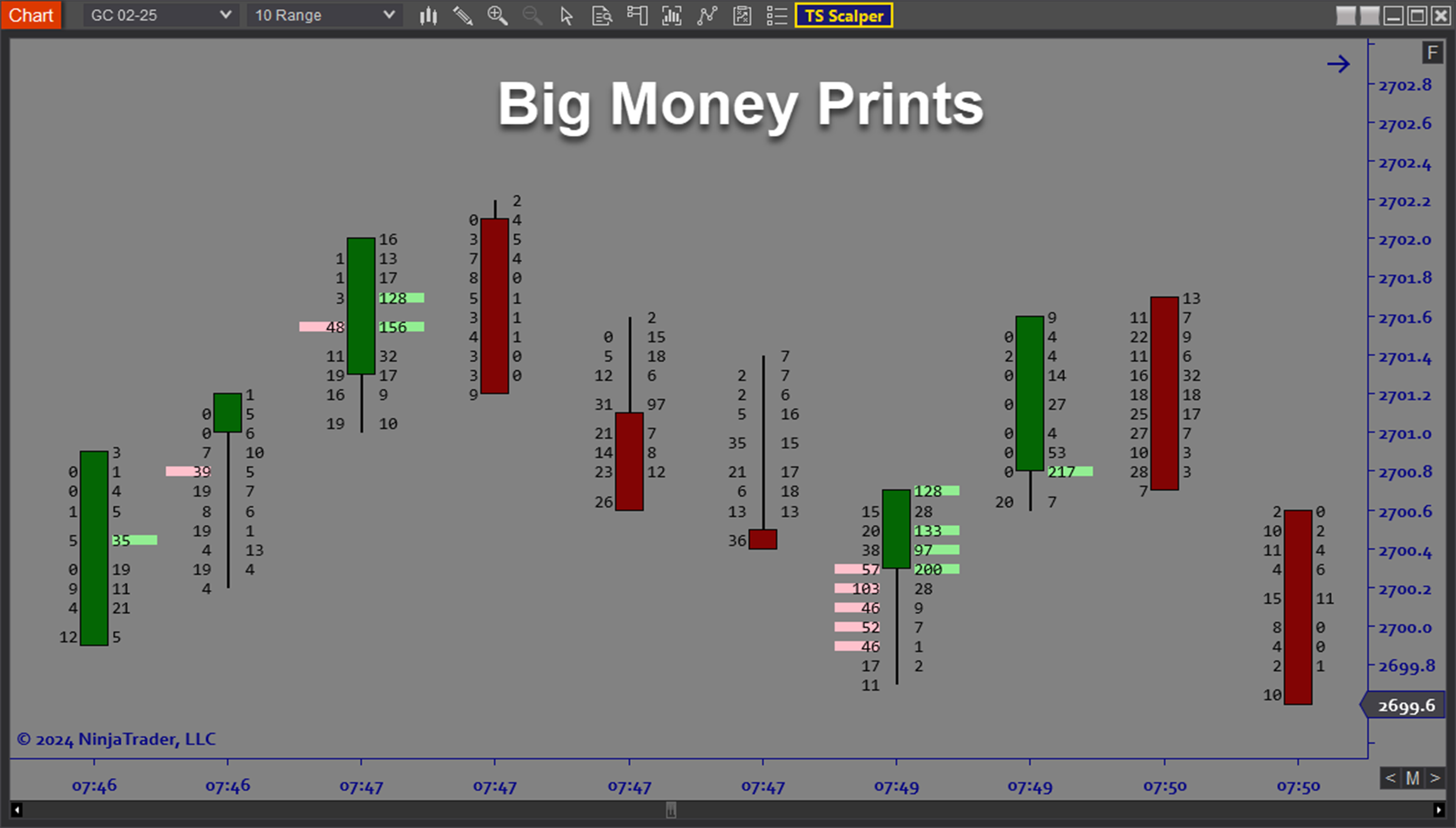

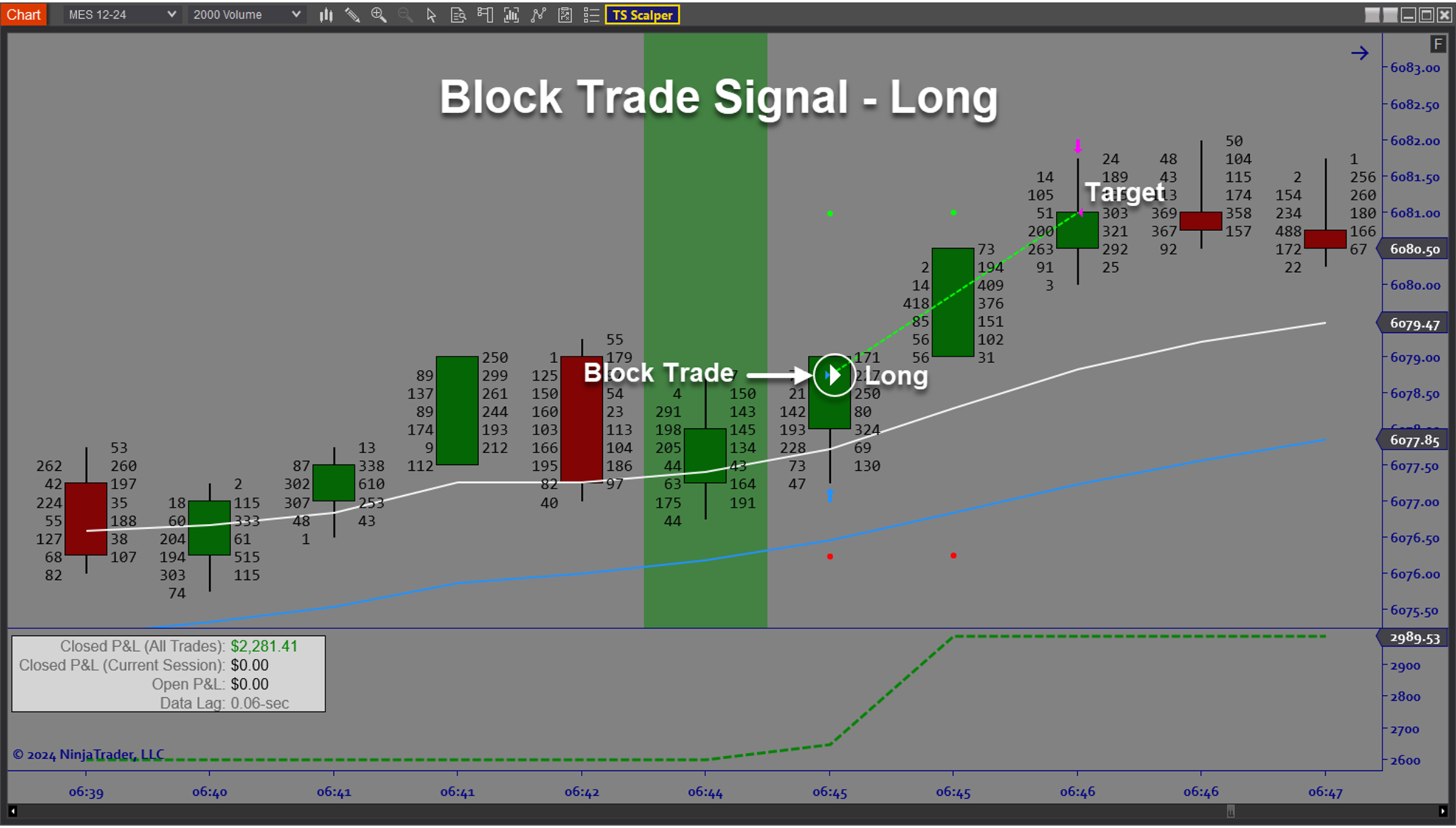

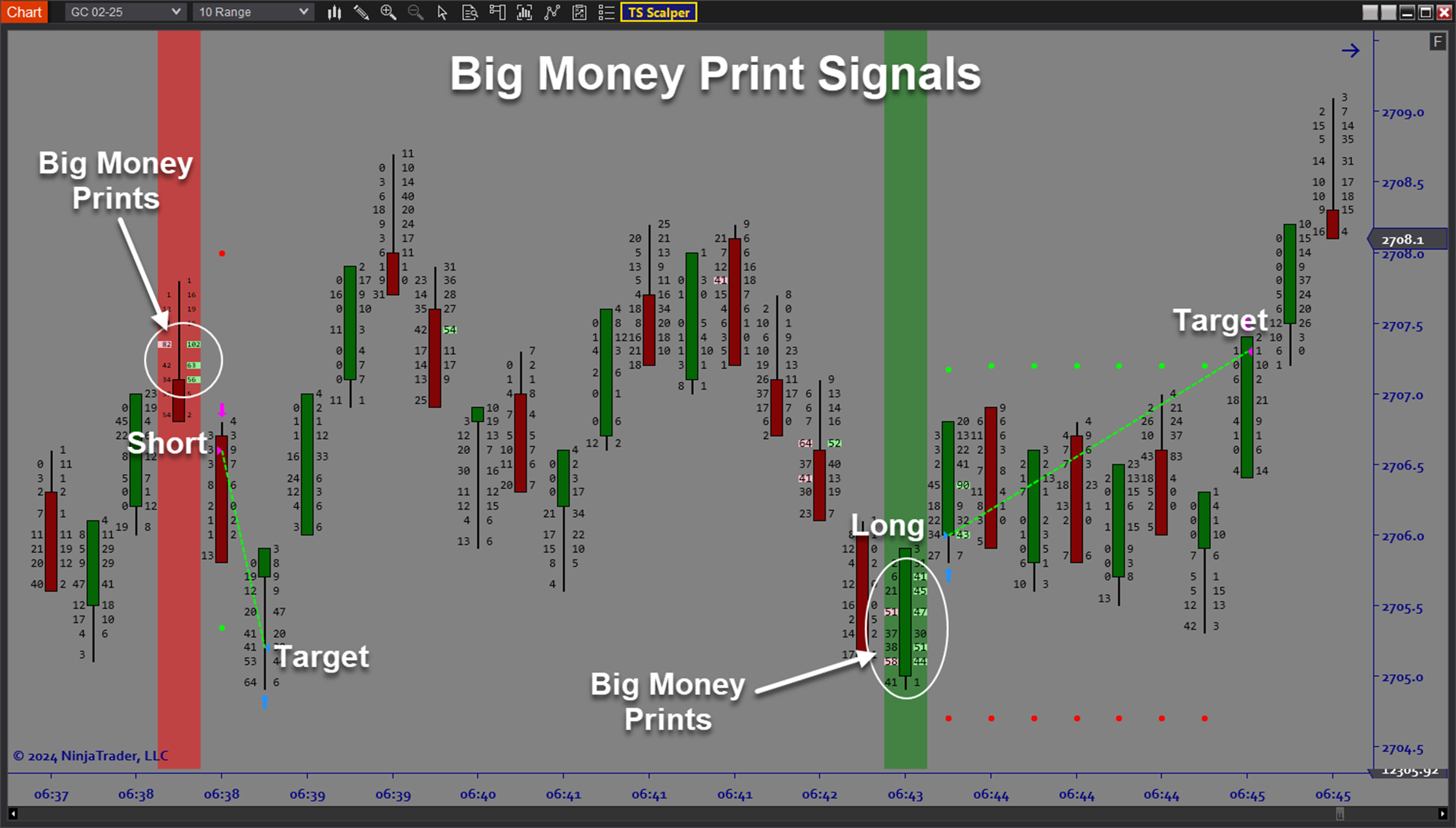

The ARC_Time and Sales Scalper Algo (“TS Scalper”) is an automated trading solution for Ninjatrader which scans for big money participation in the order flow as a trigger for scalp trade opportunities. Large block trades in the Time and Sales offer a clue that institutional traders are stepping in. Additionally, the sudden appearance of large bid/ask volumes at certain price levels combined with pattern recognition provides an indication of a short term reversal that is about to occur. These setups often lead to a quick move in the anticipated direction which can be exploited using an automated trading algo. The speed at which these setups occur make it difficult to trade manually. By automating the trade entries, you can capture more of the potential profits. Once a trade is entered the software automatically manages the position according to your personalized trade plan. The end result is the TS Scalper Algo which is very effective at capturing scalp trade opportunities based on surges in volume when reading the Tape (Time and Sales).

Purpose:

Traders need the ARC_TS Scalper Algo software because trading orderflow for quick scalps depends heavily on speed of execution. Even the best manual traders take a certain reaction time to recognize the pattern and enter the trade. An automated system can react virtually instantly, avoiding any delays that result in a reduction in potential profits. The other advantage is that you know the software will implement your trade plan exactly as configured, giving you the confidence of knowing you won’t be committing manual errors and can rely on the system to implement your strategy as designed.

Elements:

- Autotrade order flow volume anomalies for quick profits

- Take advantage of the ability to detect when large traders step in to move the market

- Trade with the big boys not against them

- Trade both continuation and reversal setups based on surges in order flow

- Customize Stop size based on price action

- Utilize optimization functionality to get the best signals

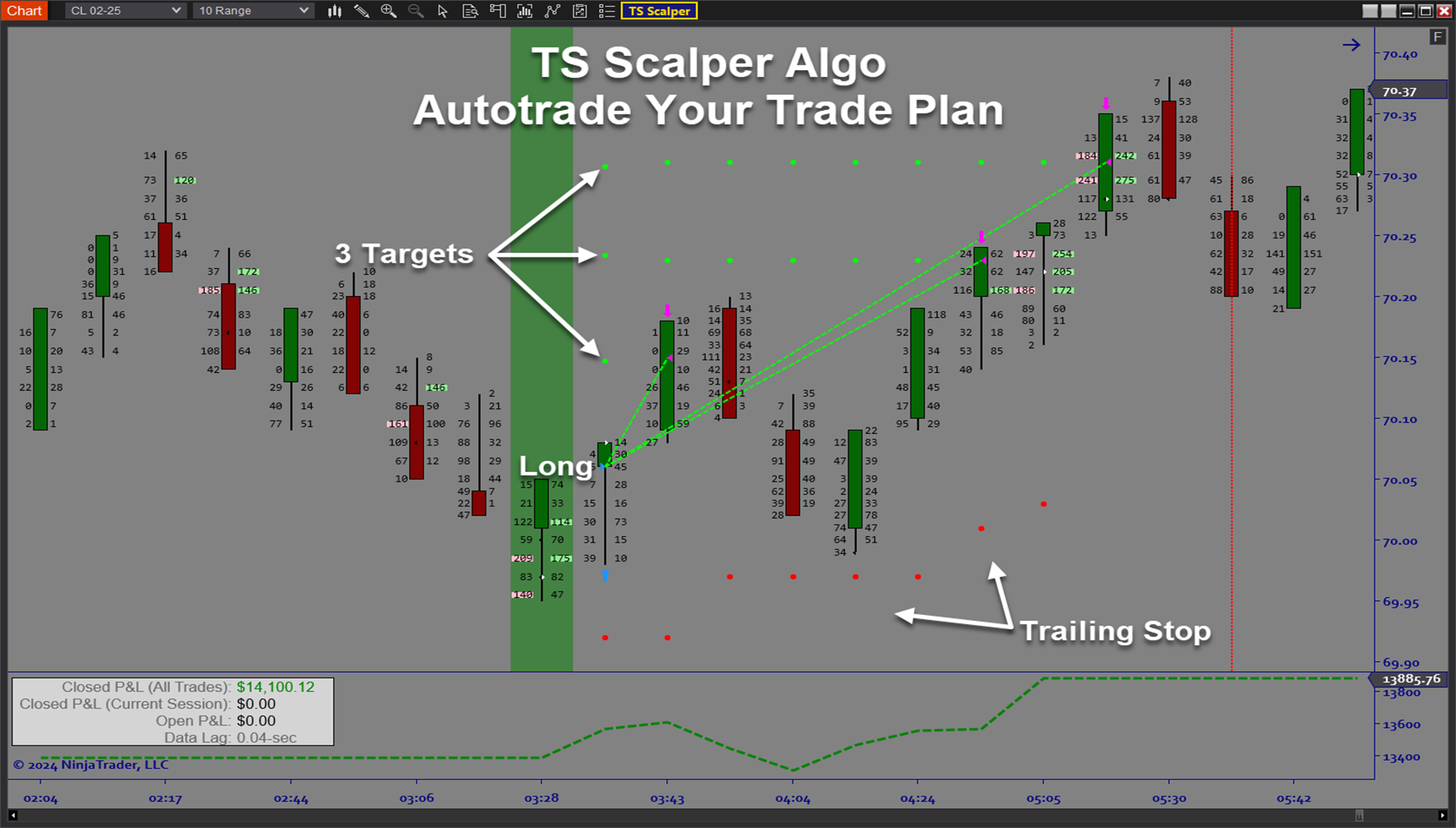

- Apply fully automated trade plans with stop placement and up to 3 targets

- Utilize R-multiple target placement

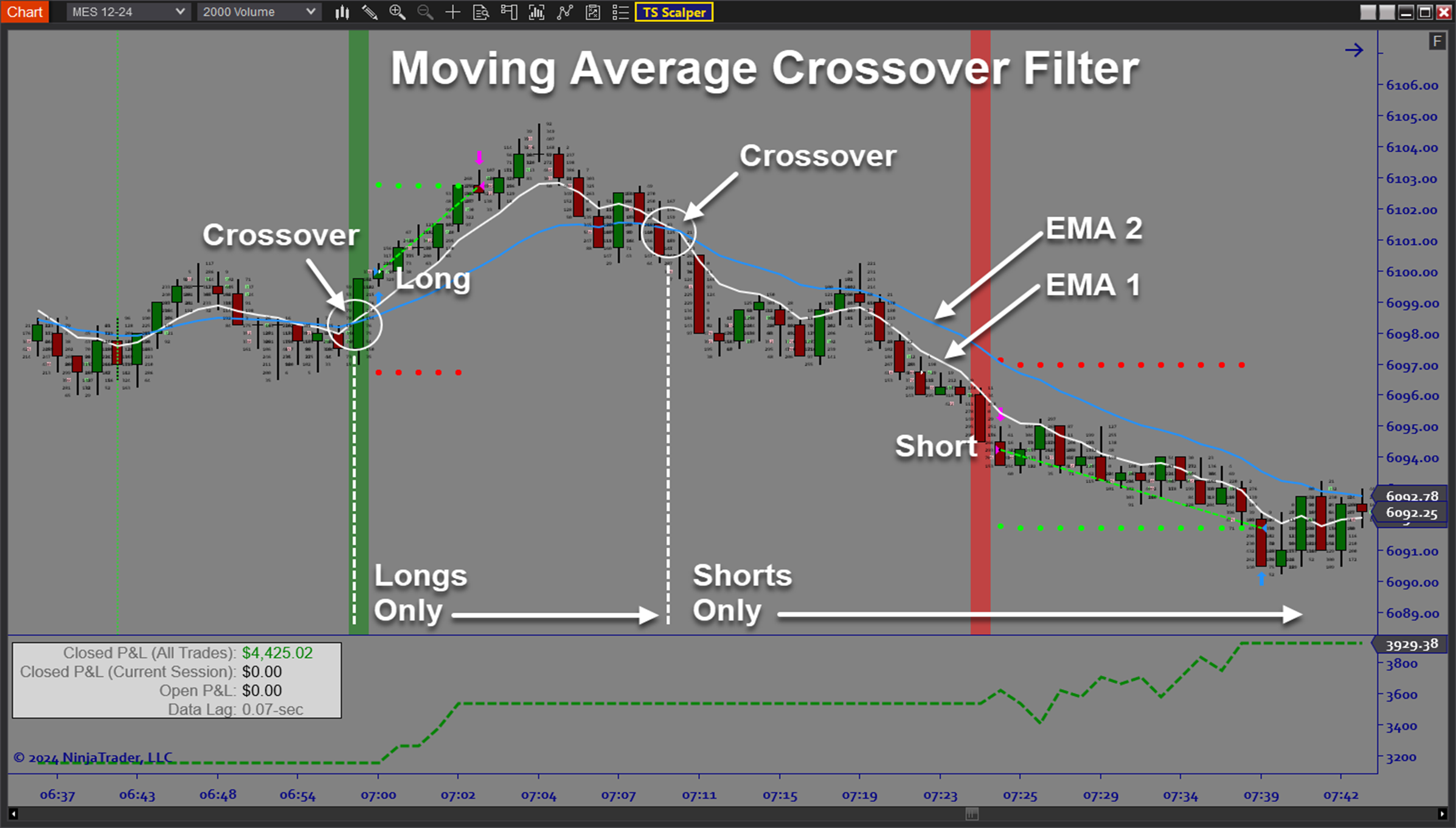

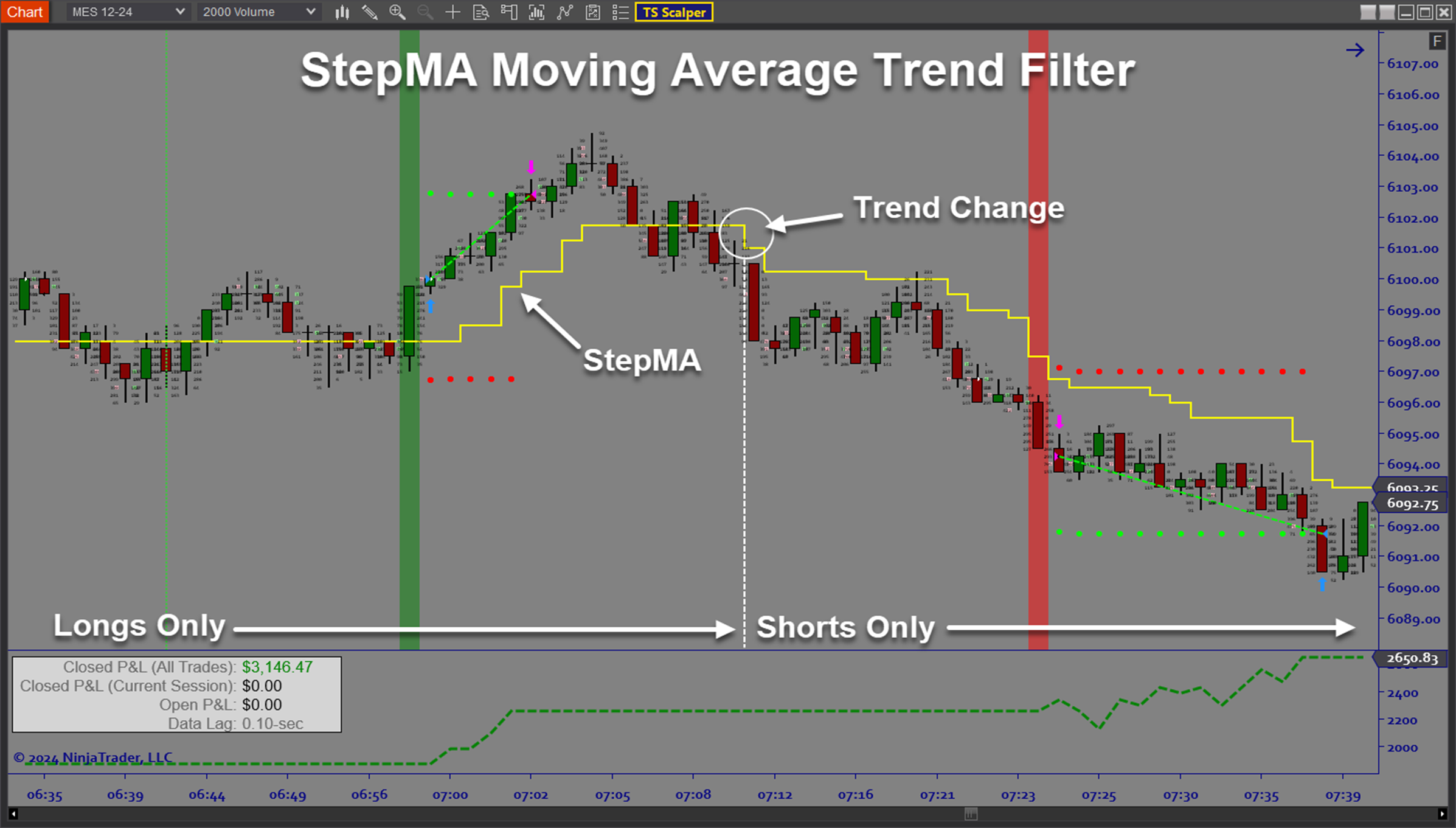

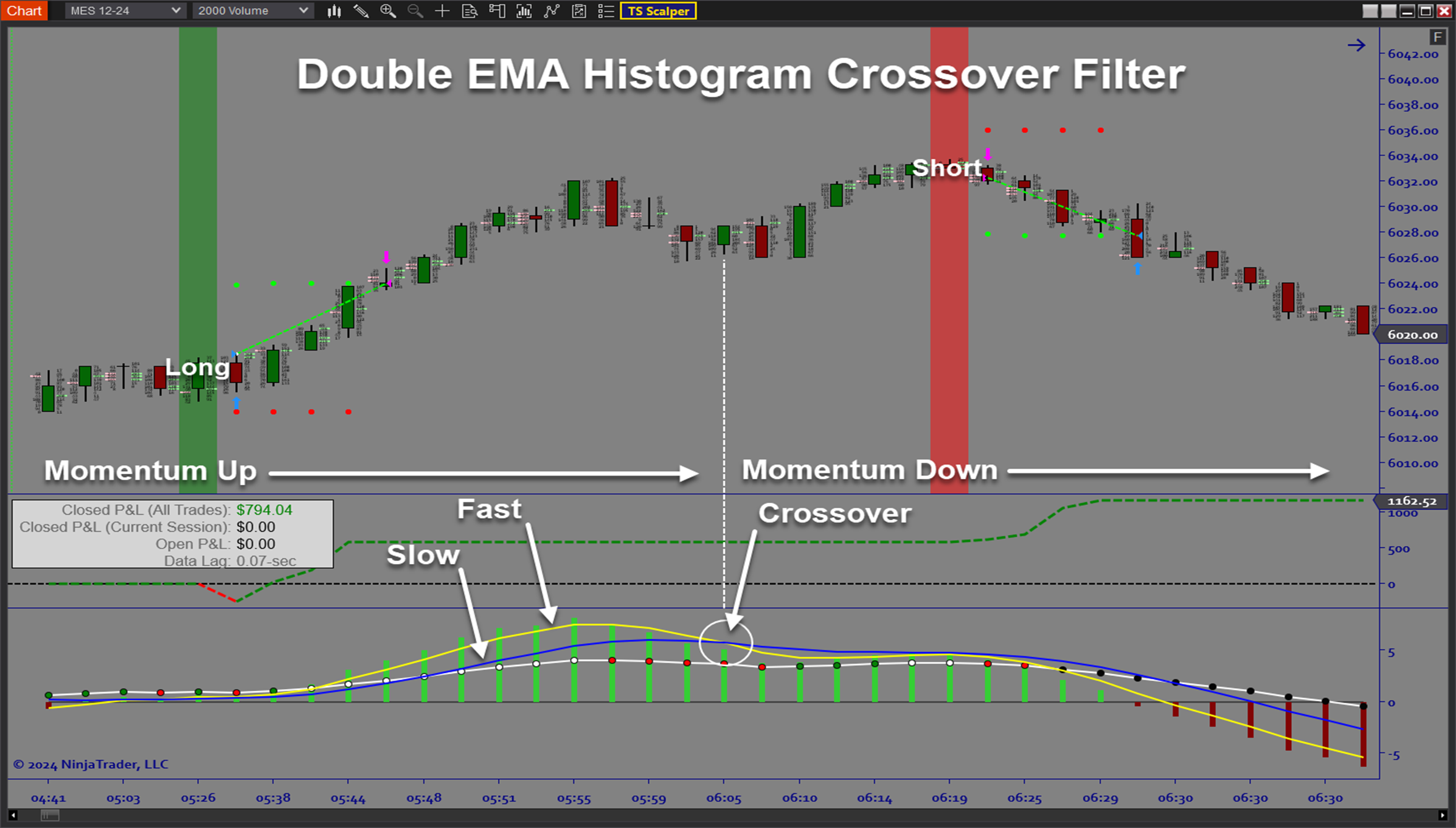

- Comprehensive trend, momentum, and market structure directional filters

- AutoTrail and Breakeven strategies

- Utilize dynamic trade sizing to control Dollar Risk per trade

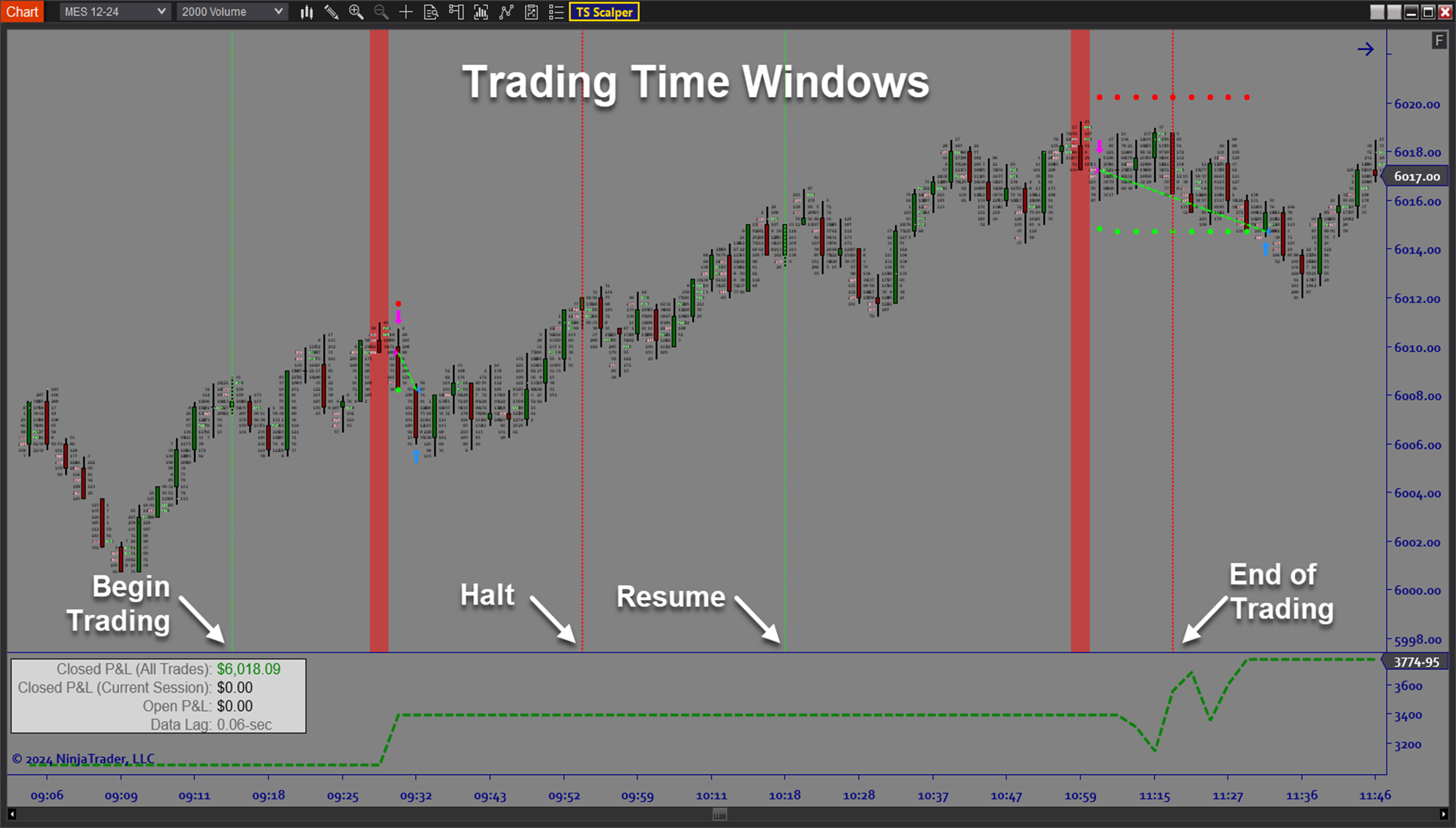

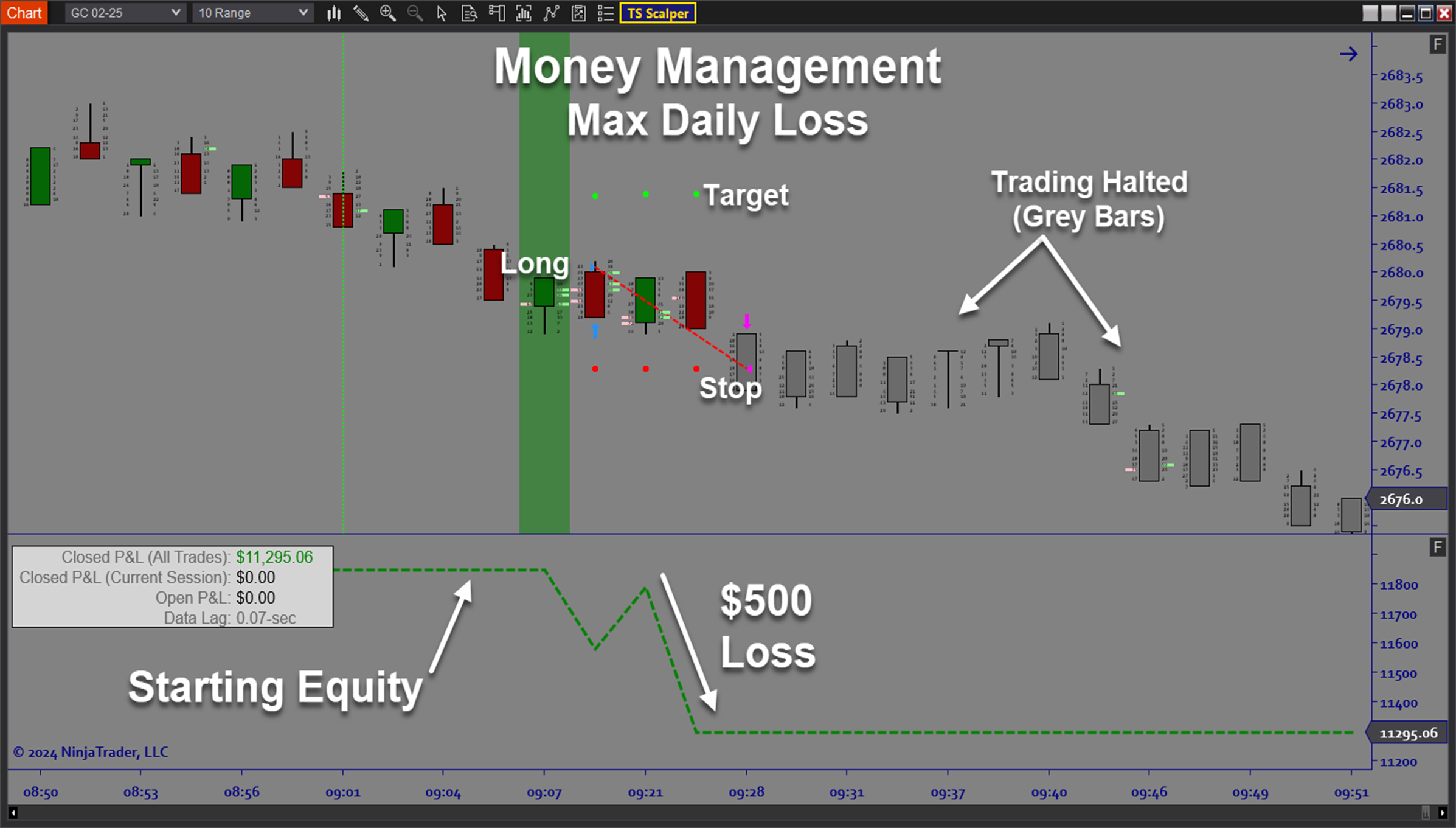

- Time filters, Day of Week filters, Holiday filters, and money management function

- Built in trade signal graphics, execution markers, stop/target graphics, realtime P&L

- Built In Backtesting and Optimization capability

Functions:

The TS Scalper Algo is best used by focusing on large block orders in trending conditions and also looking for reversals at key levels. The software can trade continuously or it can be configured to be used semi-discretionarily by arming the algo only in the right conditions. The best thing is to fully understand the 2 types of setups included and to have a game plan for when to use them. You can use the built in optimization capability to get a preliminary strategy configuration. Next forward test your strategy in live simulation mode. Once you are comfortable with the performance, you can start auto trading a live money account at your own discretion. When market conditions change, it is easy to use the flexibility of the software to adjust to changes in market conditions.

Problem Solved:

- Stops traders from missing out on lightning fast orderflow scalp setups

- Stops traders from getting in too late

- Stops traders from sabotaging their trading due to indecision and fear

- Stops traders from failing to recognize brief surges in volume that precede a reversal in price

- Stops traders from failing to account for price action when placing their stops

- Stops traders from trading without a well defined trade plan

- Stops traders from failing to adjust to market conditions

- Stops traders from failing to identify the best days and times to trade

- Stops traders from trading against momentum, market structure, and directional bias

- Stops traders from failing to manage risk appropriately

- Stops traders from not being able to objectively compare the performance of different strategies

- Stops traders from not allowing the data to guide their strategy development