RSG Algo

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

Category: Algos

Tags: Algos and Bots, Backtesting, Breakouts, Candle Patterns, Market Structure, Momentum, Money Management, Patterns, Reversals, Risk Management, Signals, Strategy Development, Trade Management, Trade Performance, Trade Planning, Trade Sizing, Trend Trading

Description

Overview:

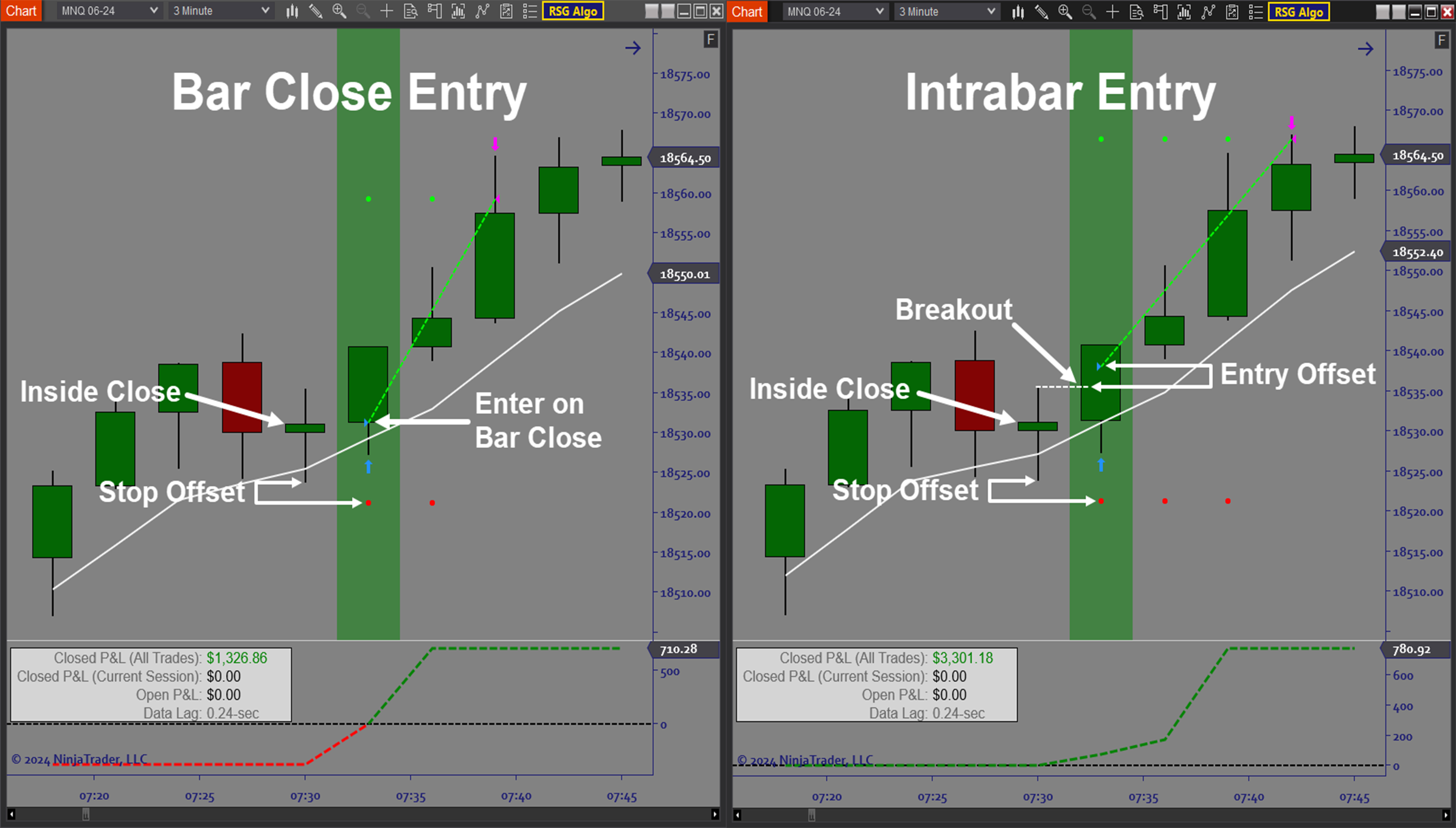

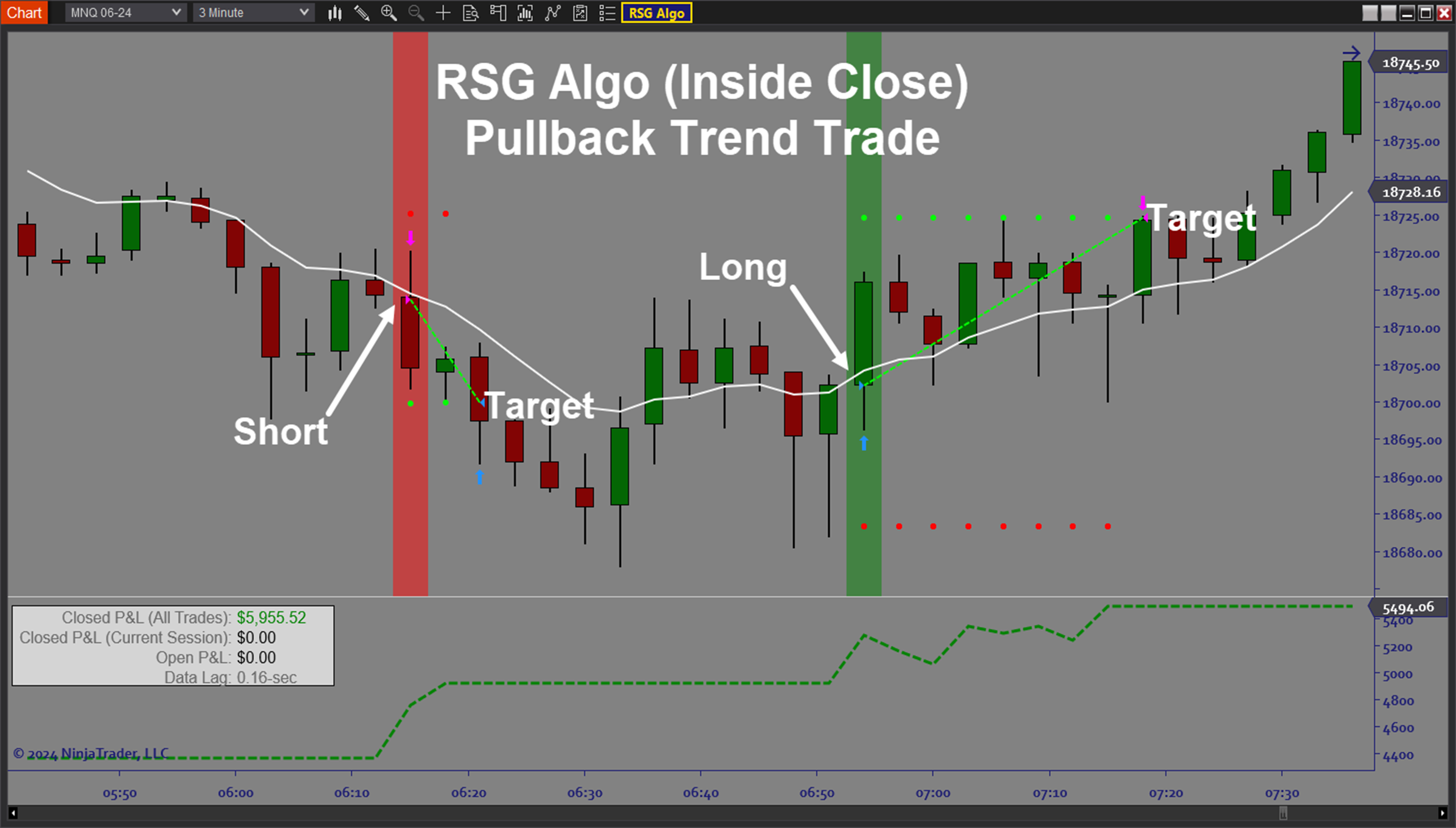

The ARC_RSG Algo (“Ready Set Go”) is an automated trading solution for Ninjatrader based on price-action setups focused on an inside bar close pattern. The “Ready Set Go” pattern setup applies equally well to scalpers, daytraders, and intraday swing traders. While a trend is unfolding, a 2-bar pattern sometimes occurs where a pullback bar is immediately reversed by a bar that closes inside the pullback bar’s body. The Inside Close is the signal to enter either immediately or with the option to wait for a breakout. This makes it well suited for automated trading, especially for shorter timeframes because the opportunity to enter can pass quickly. The entry location for this setup represents an optimal balance between entering too early and waiting too long for confirmation. It is designed to capture more of the move by detecting early confirmation which derives from the pattern itself. The software makes it easy to control risk because the pattern determines both the entry point and the stop location. The result is a simple to understand and easy to implement micro trend trading system.Purpose:

Traders need the ARC_RSG Algo software because a good trading strategy only works if the rules are applied consistently. Pullbacks always happen within trends but deciding when and where to enter can make all the difference. The algo software allows for full control of the entry conditions through the adjustment of strategy parameters. Combining the RSG Algo toolset with the Ninjatrader built-in performance tracking functionality allows you to find and deploy the best strategies for each given market.Elements:

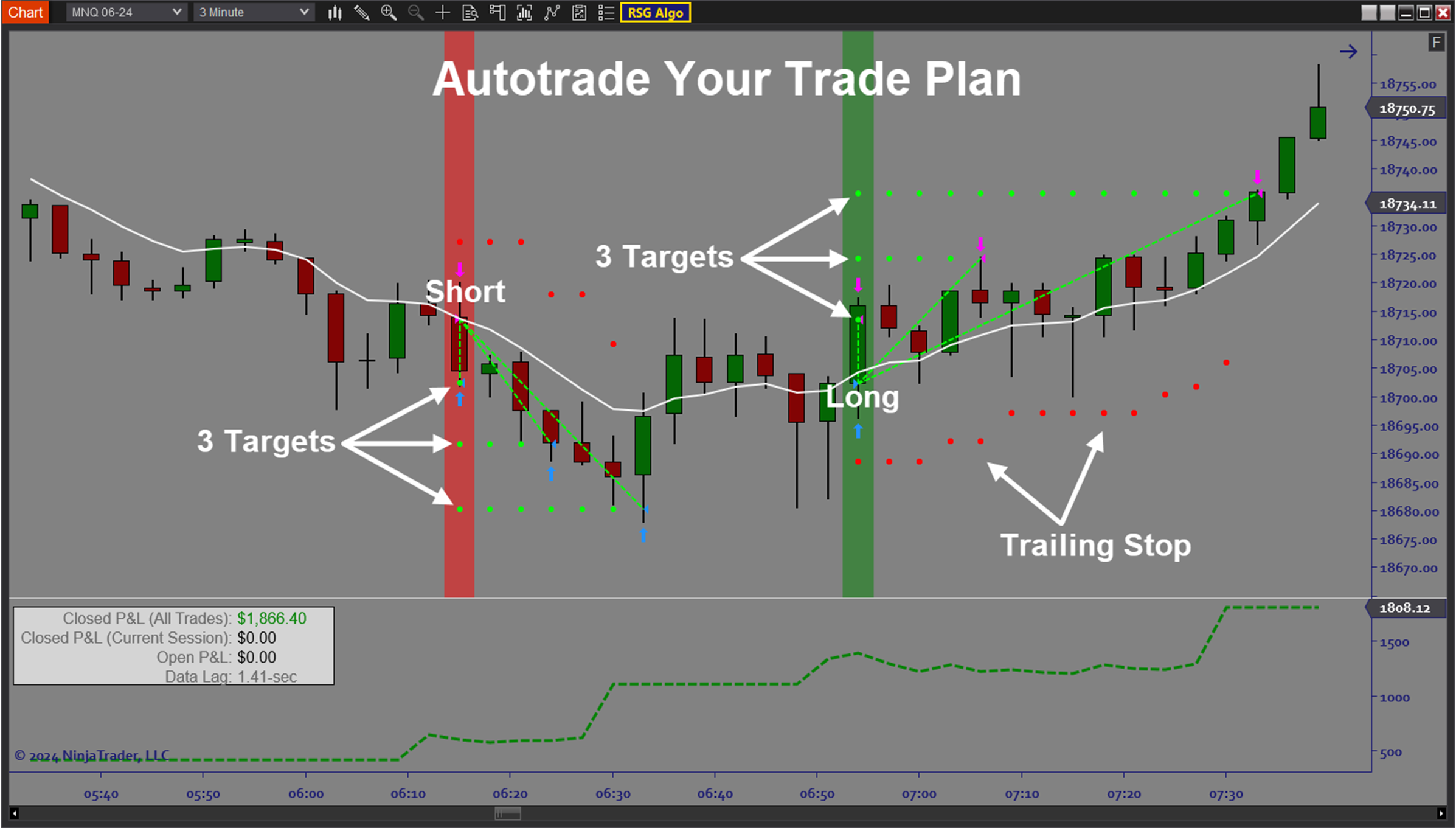

- Autotrade Inside Bar Close trend trade pullbacks with pattern-based exit management

- Leverage the Inside Bar Close setup on any timeframe from scalp to swing

- Control the confirmation required for entry with customizable settings

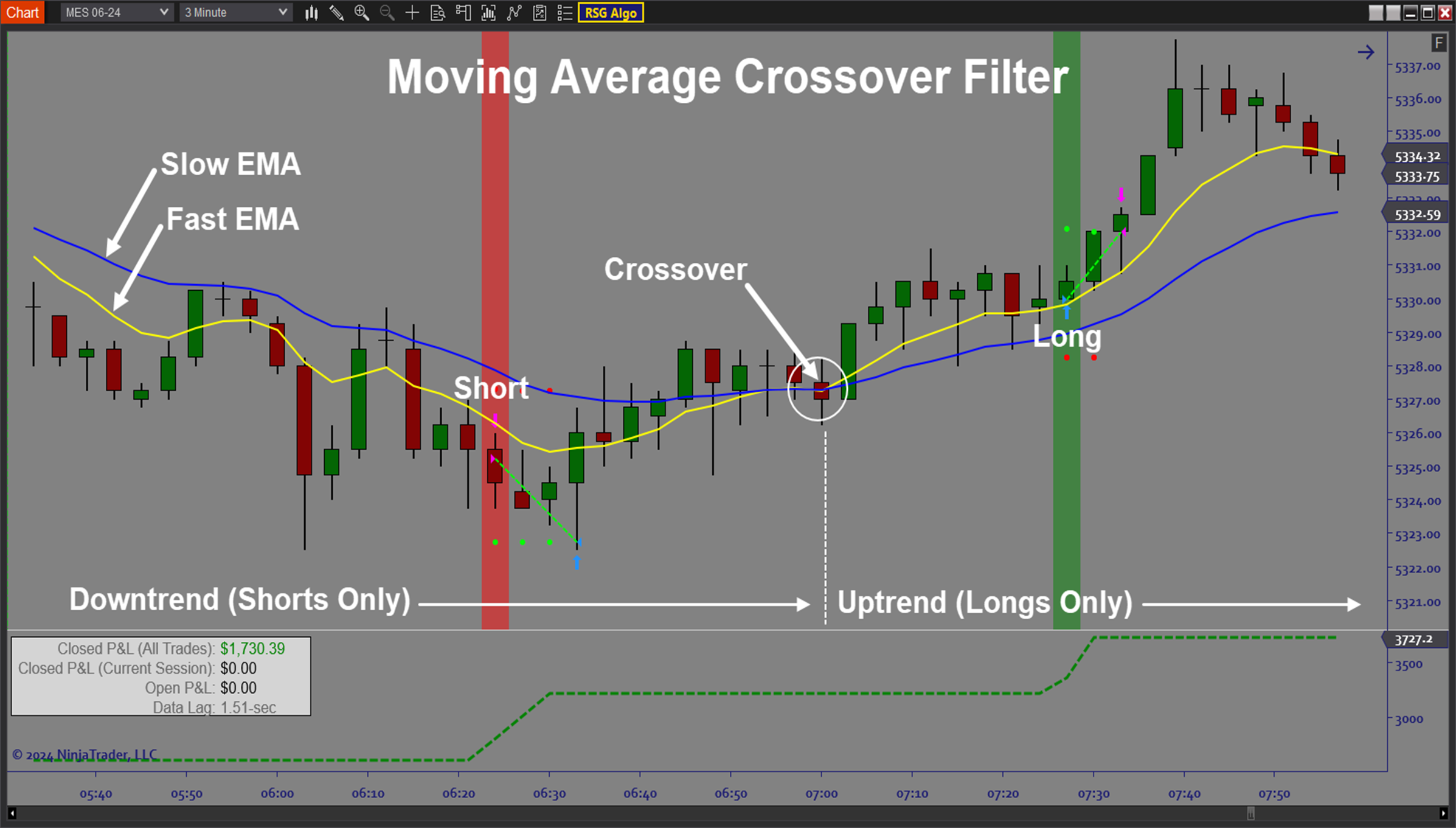

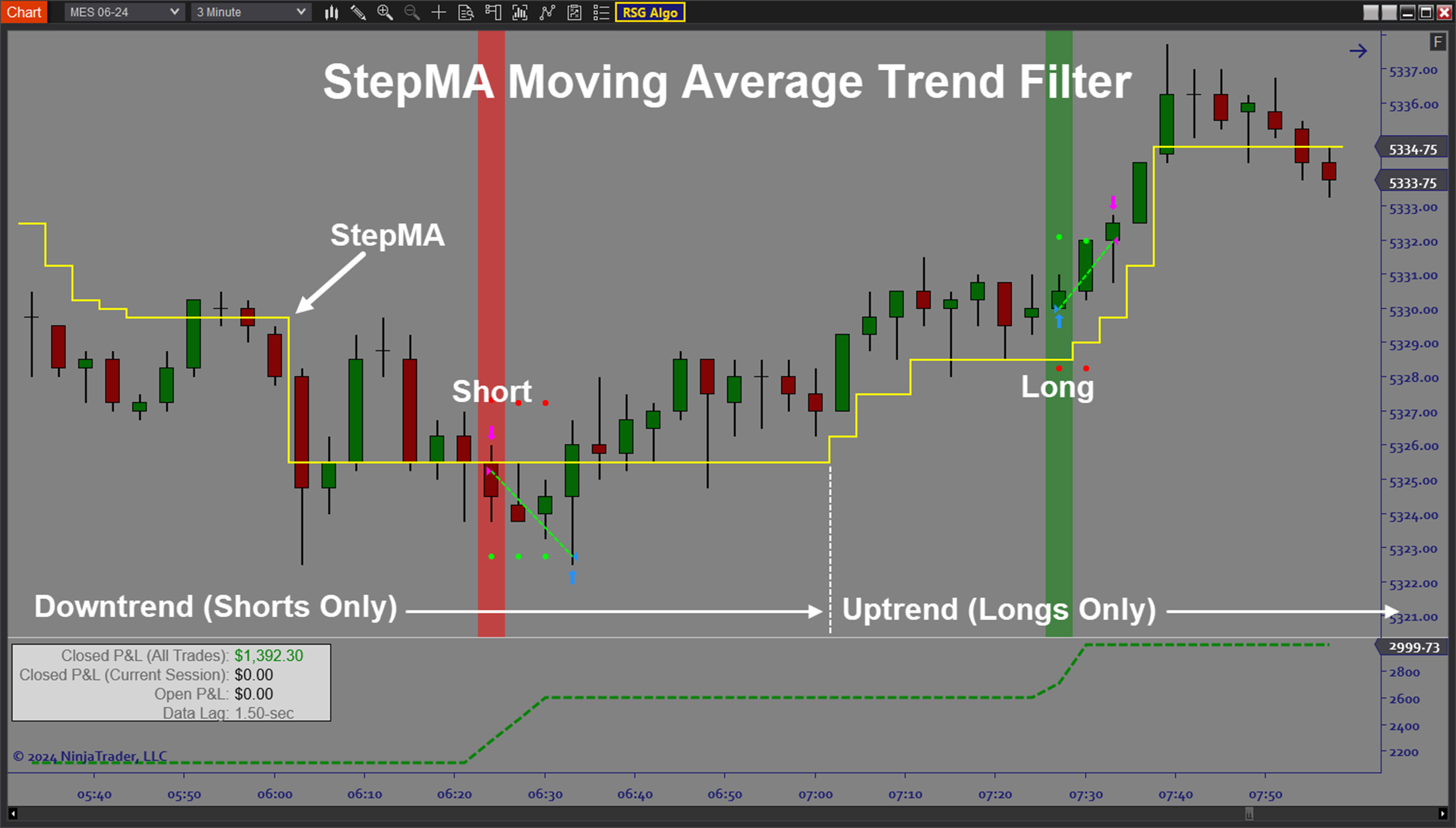

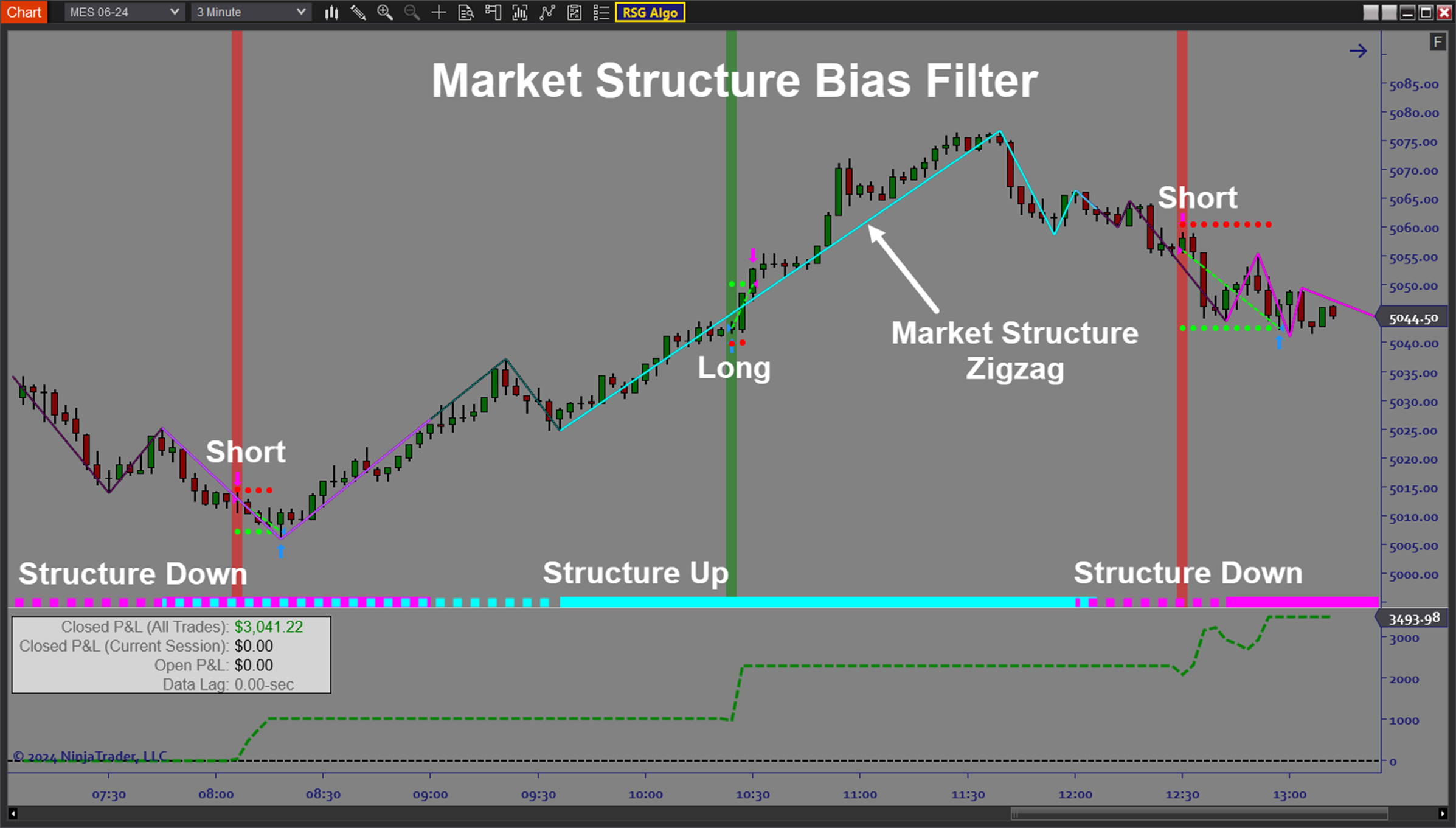

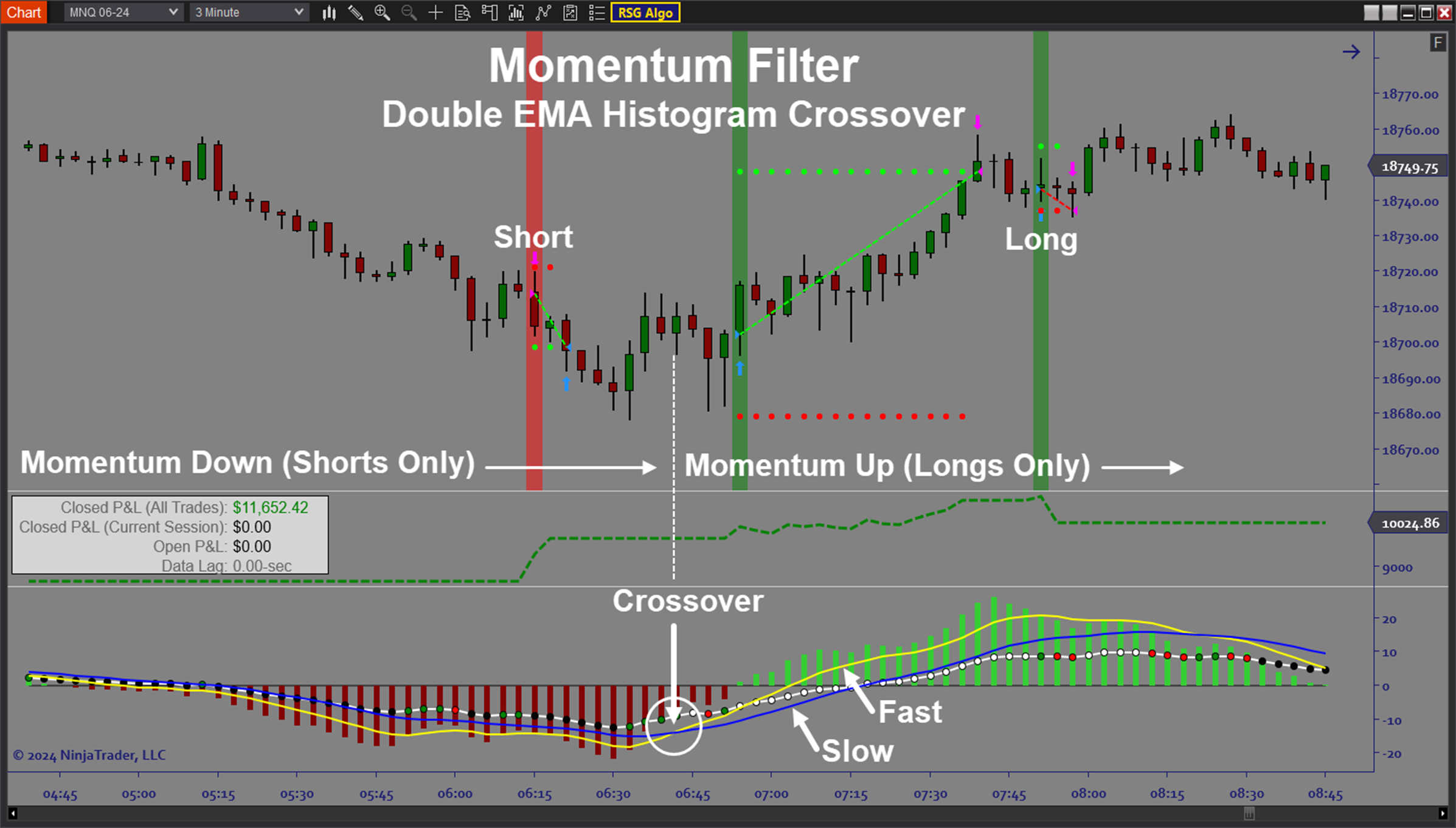

- Control micro and macro trend filters for entry selection and placement

- Utilize dynamic stop sizing based on pattern anchor points

- Utilize dynamic trade sizing to control Dollar Risk per trade

- Fully automated trade plans with stop placement and up to 3 targets

- R-multiple target placement

- Comprehensive trend, momentum, and market structure directional filters

- AutoTrail and Breakeven strategies

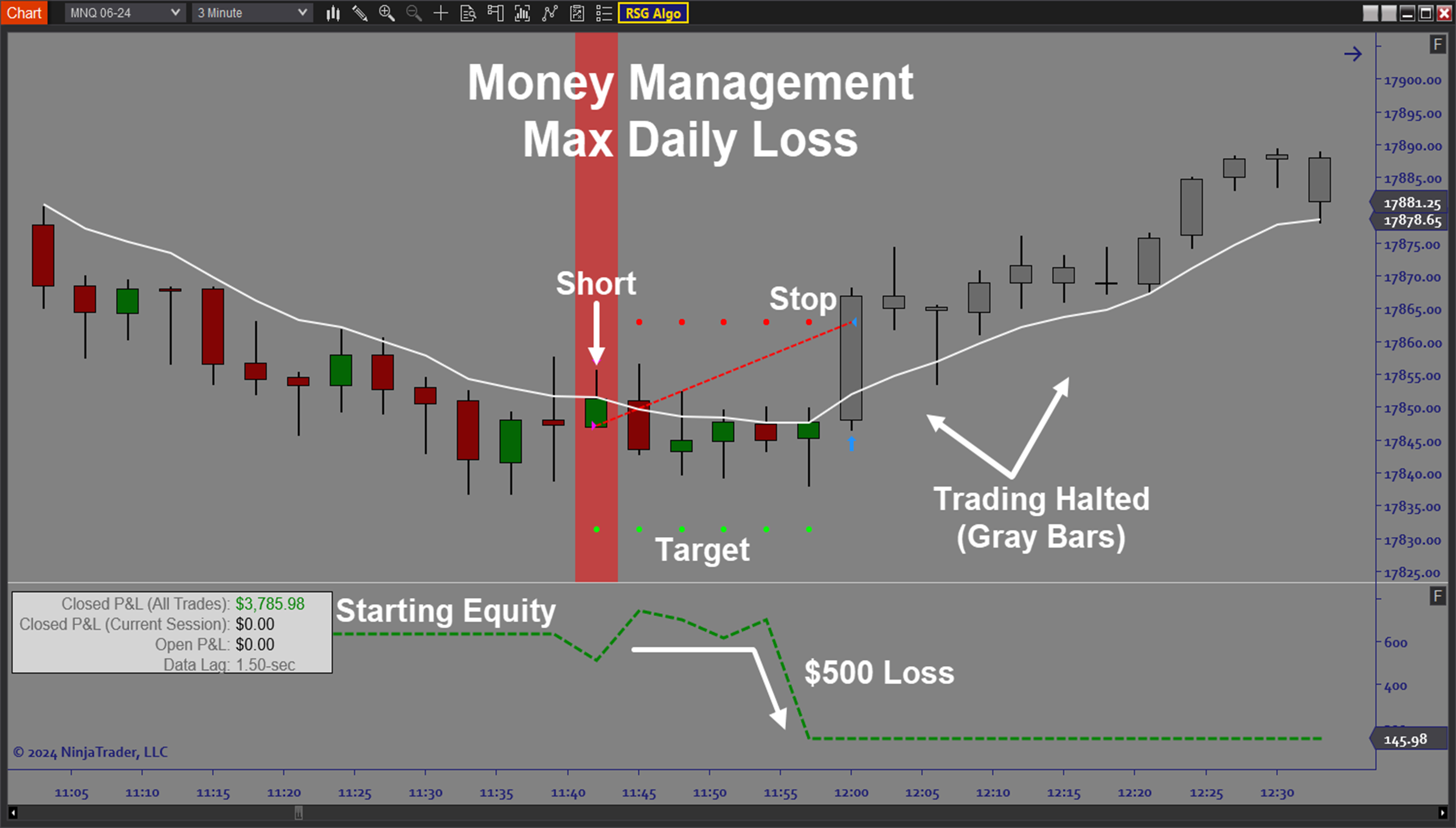

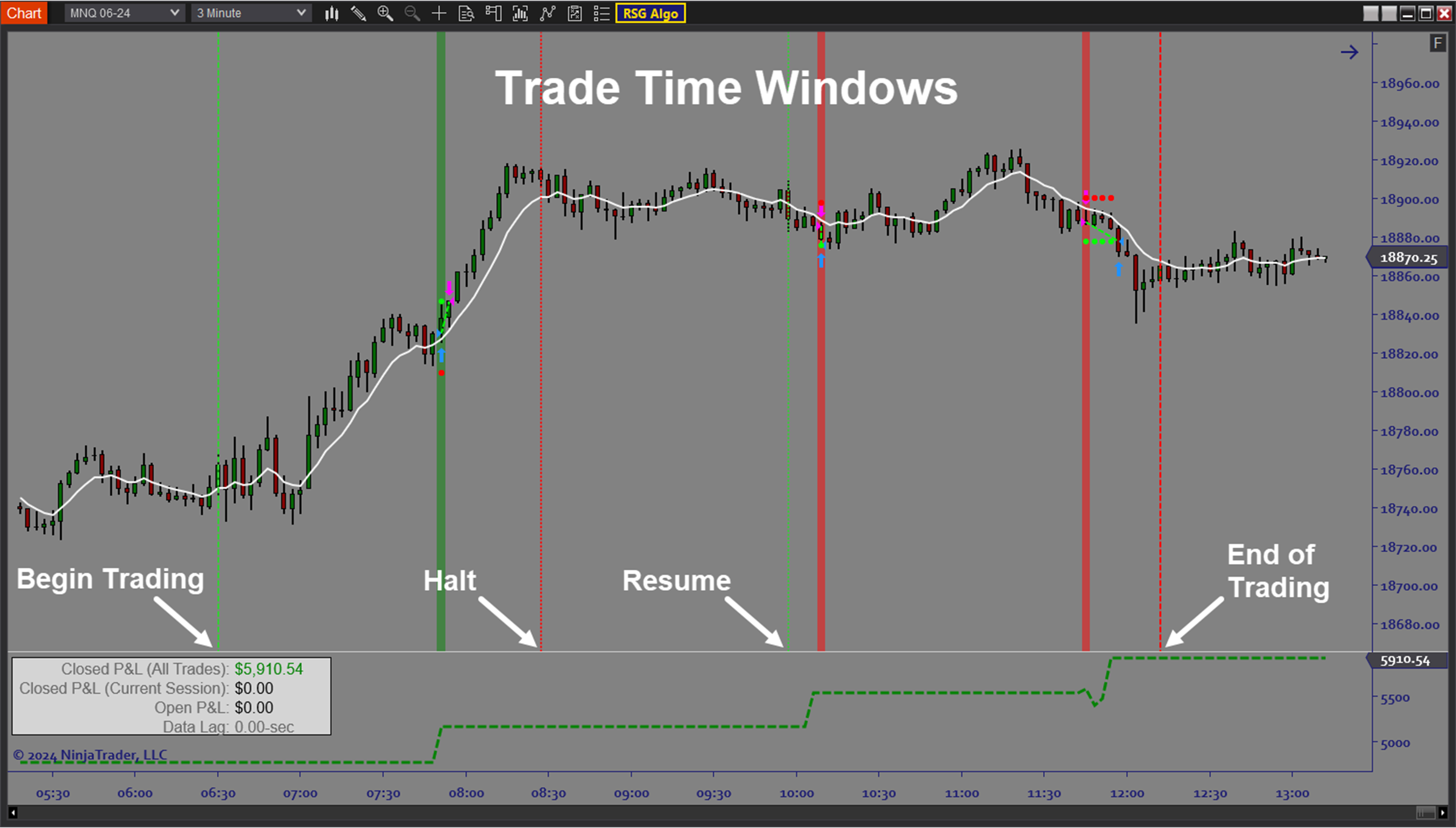

- Time filters, Day of Week filters, Holiday filters, and money management function

- Built in trade signals, execution markers, stop/target graphics, realtime P&L

- Built In Backtesting and Optimization capability

Functions:

The RSG Algo is best used by choosing the appropriate timeframe for your trading style and then using the algo controls to dial in where and when to enter on each setup as well as configuring the dynamic stop placement. Then make use of the built in backtesting and optimization functionality to fine tune the settings including any signal filters. From there it is important to forward-test your strategy settings by deploying the algo in live markets on a Sim account. This gives you time to test your strategy before you risk trading capital. When you have achieved consistency in Sim, you can deploy the algo on your live trading account. The automated trading system will follow the signal rules and pre-defined trade plan exactly as configured, so you don’t have to worry about execution and can focus on improving performance as well as periodically adjusting to changing market conditions.Problem Solved:

- Stops traders from missing out on simple setups that are difficult to correctly time without automation

- Stops traders from failing to know when to enter and when to wait

- Stops traders from having to wait all day for a good trade setup

- Stops traders from hesitating and then getting in too late

- Stops traders from being too aggressive when trading pullbacks

- Stops traders from sabotaging their trading due to indecision and fear

- Stops traders from dealing with the stress of manual trading

- Stops traders from failing to identify the best days and times to trade

- Stops traders from failing to adjust to market conditions

- Stops traders from trading against momentum, market structure, and directional bias

- Stops traders from failing to manage risk properly

- Stops traders from trading without a good and easy way to compare performance of different strategies