Pinbar Algo

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

Category: Algos

Tags: Algos and Bots, Backtesting, Breakouts, Candle Patterns, Chart Patterns, Market Structure, Momentum, Money Management, Patterns, Reversals, Risk Management, Signals, Strategy Development, Trade Management, Trade Performance, Trade Planning, Trade Sizing, Trend Trading

Description

Overview:

The ARC_Pinbar Algo is an automated trading solution for Ninjatrader that exploits a simple but powerful candlestick pattern, namely the Pin Bar. The Pin Bar tells a story of the battle between bullish and bearish forces and liquidity at key locations and traders have been using this simple strategy successfully for many years. In the right conditions, the appearance of a Pin Bar can signify that a directional move is imminent and that move can be either a reversal or a trend continuation after a pullback. When manually trading this pattern there can be some subjectivity regarding what is a valid Pin Bar and it can be difficult to measure its performance as a strategy. That is where the true value of deploying the Pin Bar strategy as an automated system. First, the parameters which define a valid Pin Bar can be optimized. Second, the statistical performance of the strategy can be generated for any given Pin Bar settings thereby making it easy to find the most profitable settings for any instrument in the current trading environment. Because the markets are fractal and Pin Bars apply to any timeframe, the system can be equally applied for scalping, daytrading, and intraday swing trading strategies. The built in backtesting and optimization functionality can be used to find the best instruments and timeframes for any given market environment, making the Pin Bar Algo an excellent choice for any trader that wants to incorporate the Pin Bar strategy in their trading automation toolset.Purpose:

Traders need the ARC_Pinbar Algo software because in addition to providing excellent trade setups, the software includes a wide variety of customizable settings which make it easy to adapt to various instruments and changing market conditions. The interplay between bullish and bearish aggression sometimes plays out within a single candlestick and when this pattern forms in the right location, action must be taken immediately in order to capture sufficient profit. What you need is a systematic way to parameterize the setups so you can measure the performance and let the system determine when to engage and when to wait. Once you have optimized your settings, you can then let the software do all the work for you.Elements:

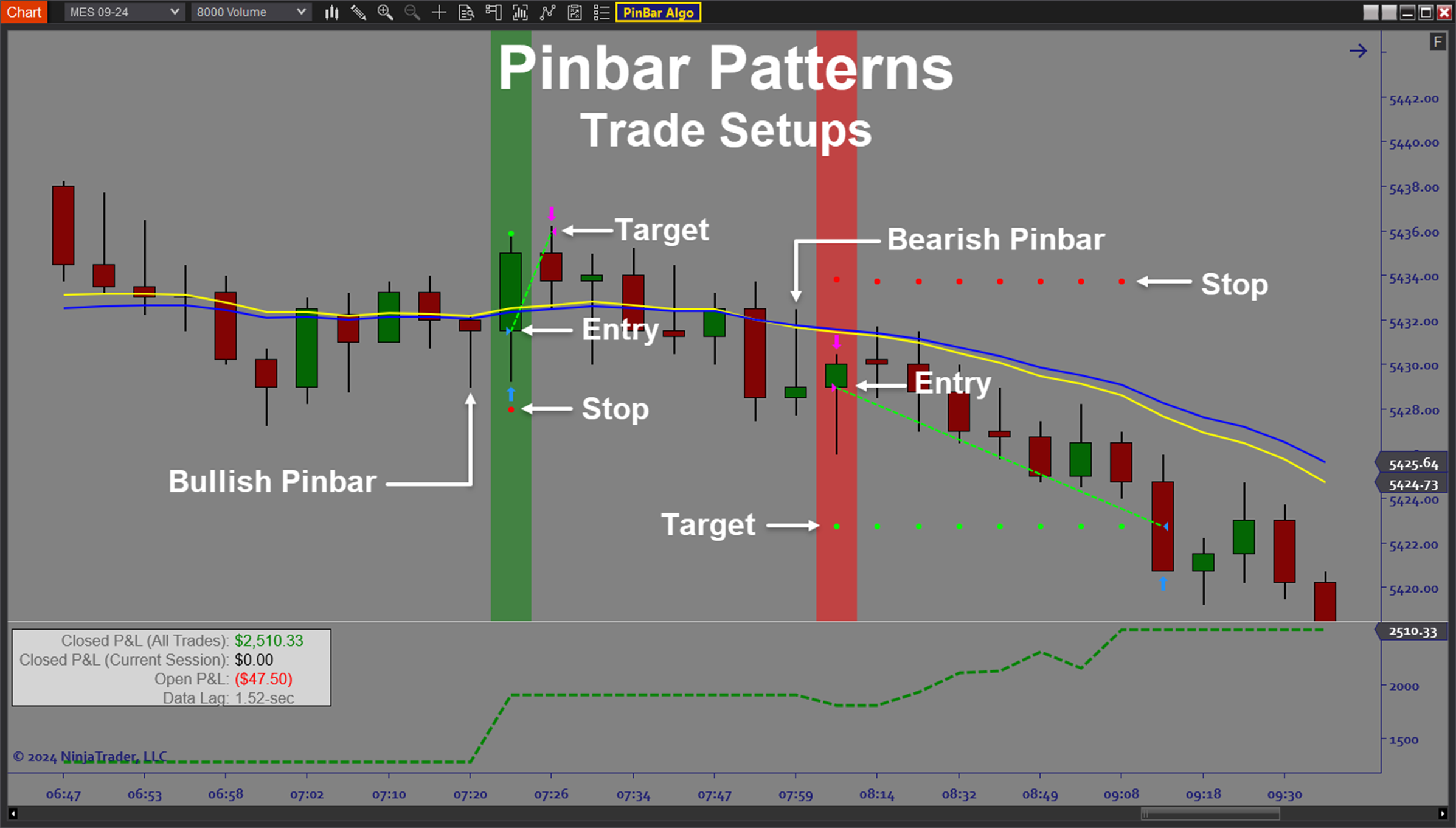

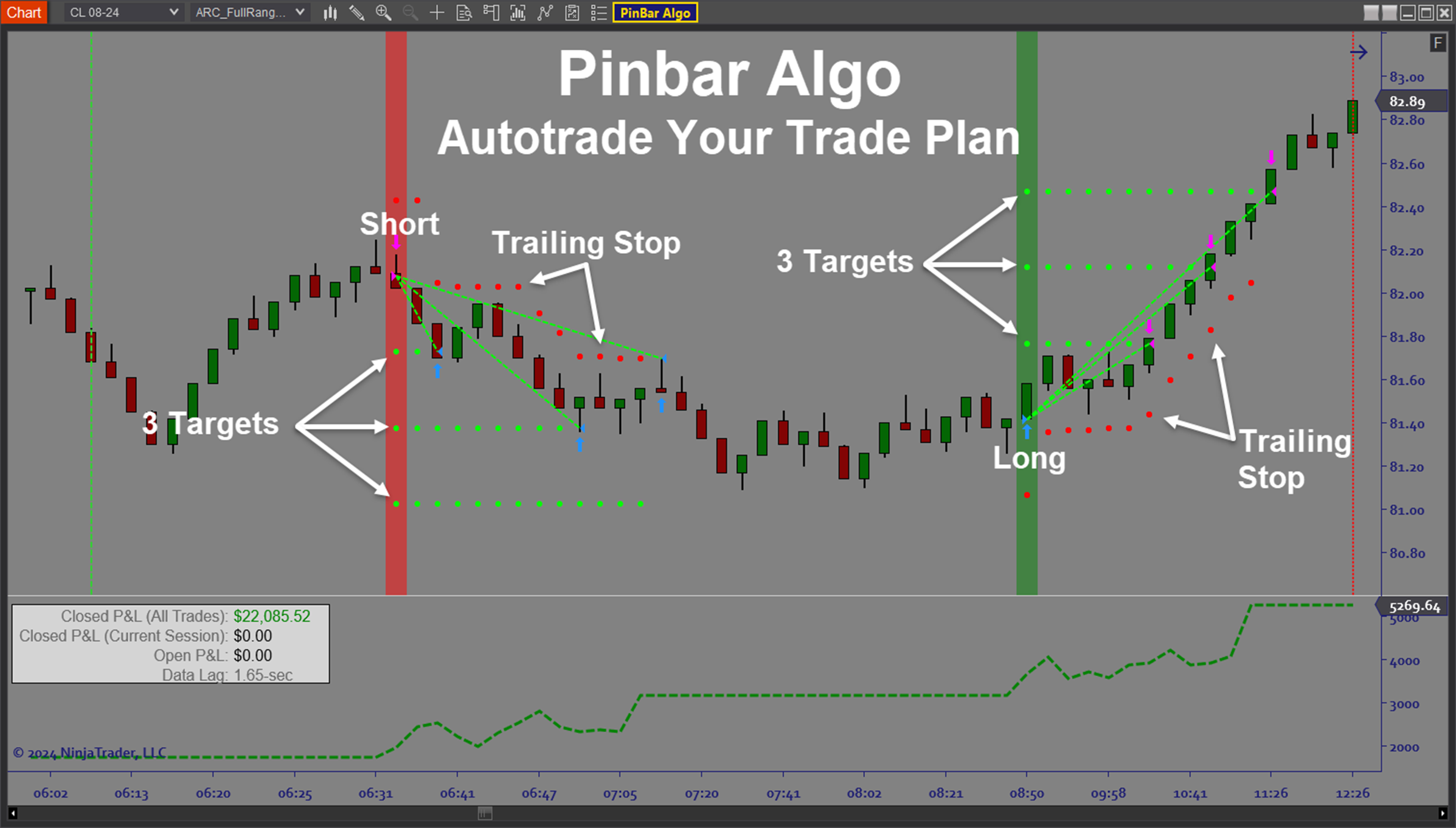

- Autotrade Pin Bar setups on any timeframe

- Trade both reversals and trend continuation strategies

- Fine tune the exact definition of a valid Pin Bar based on optimizing performance statistics

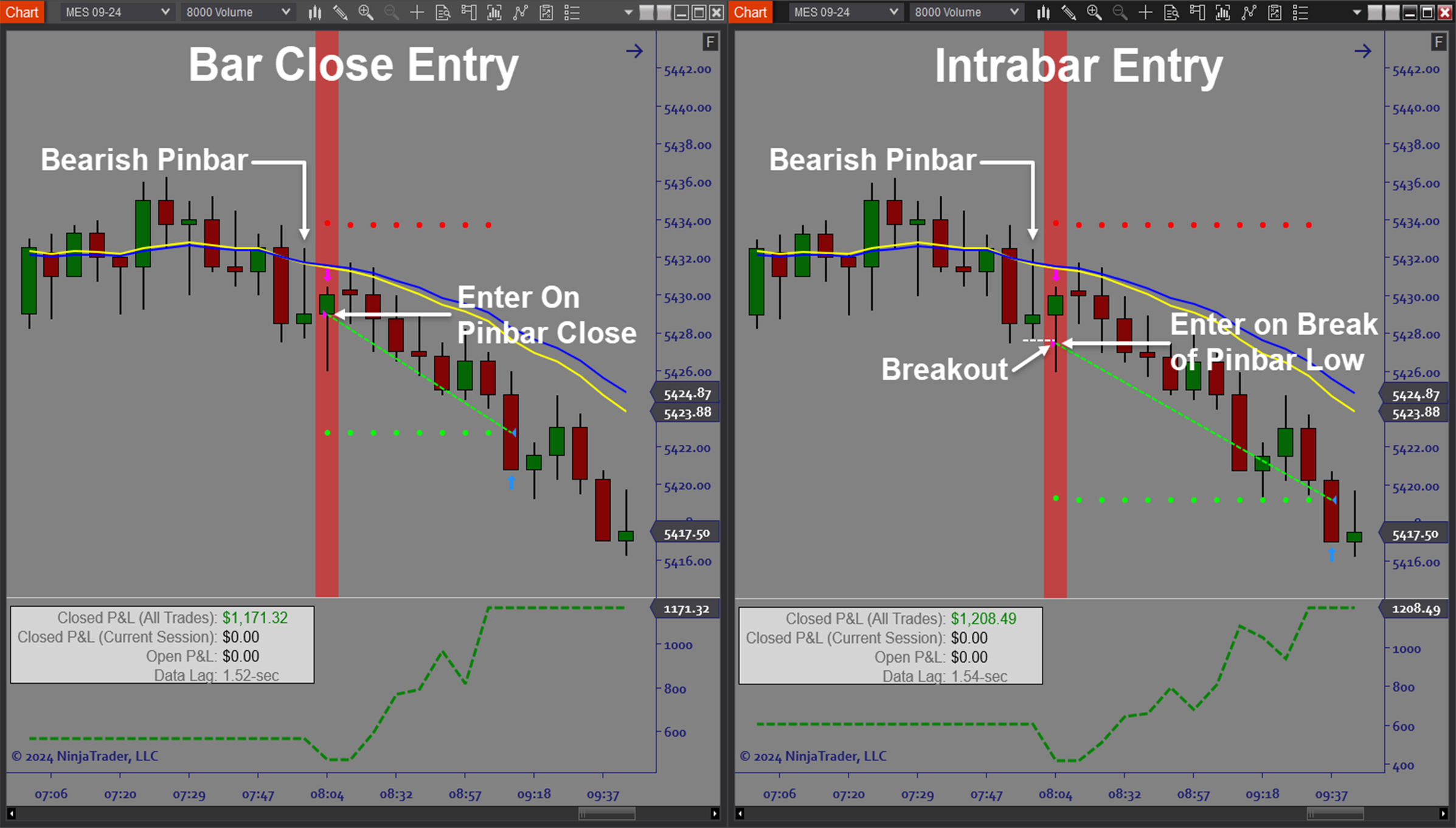

- Control the level of confirmation required by choosing between bar close and intrabar breakout entries

- Automatically adjust stop sizes to price action patterns, thereby adjusting risk on the fly to immediate price action

- Apply fully automated trade plans with stop placement and up to 3 targets

- Utilize dynamic trade sizing to control Dollar Risk per trade

- Utilize R-multiple target placement

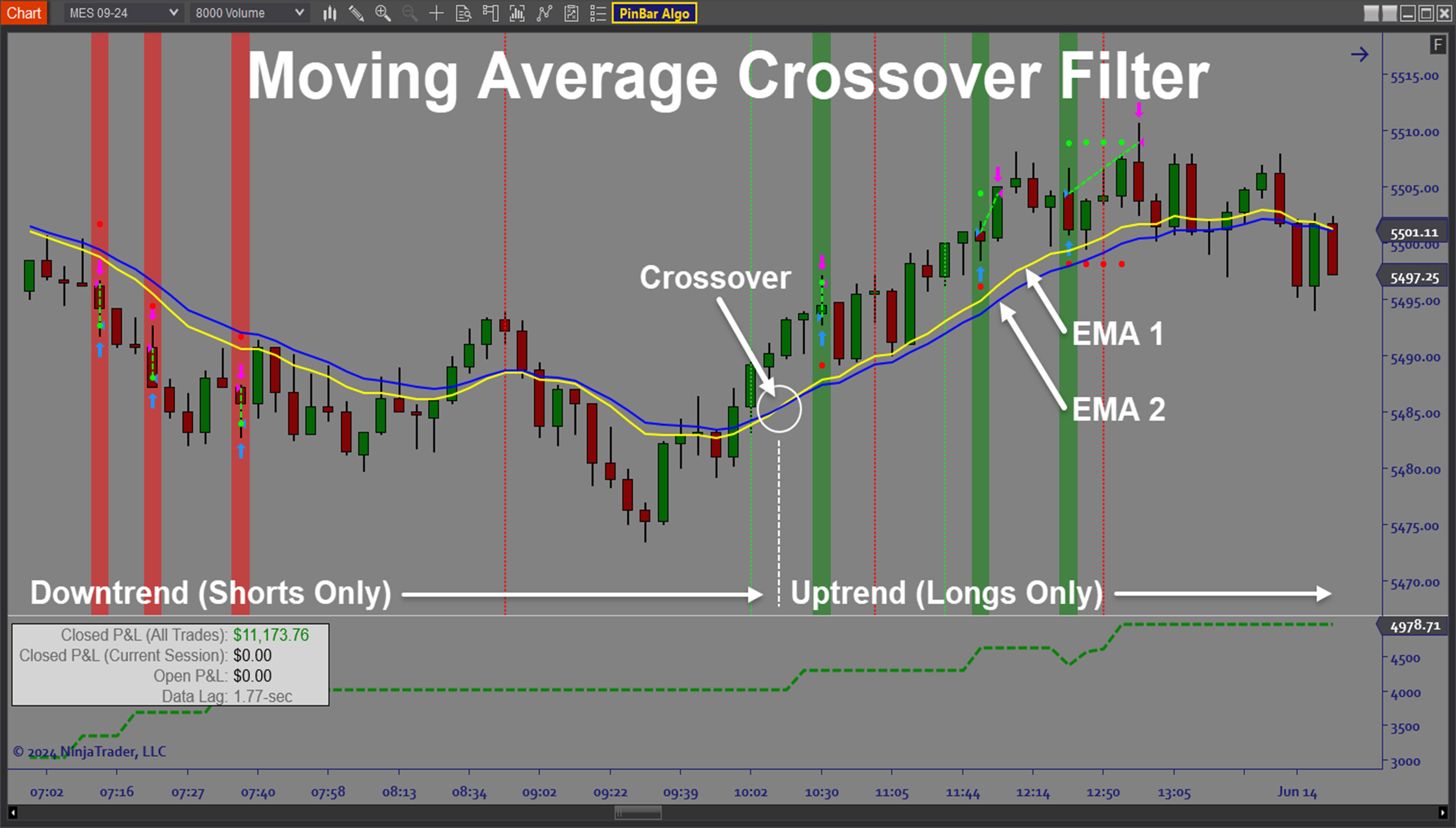

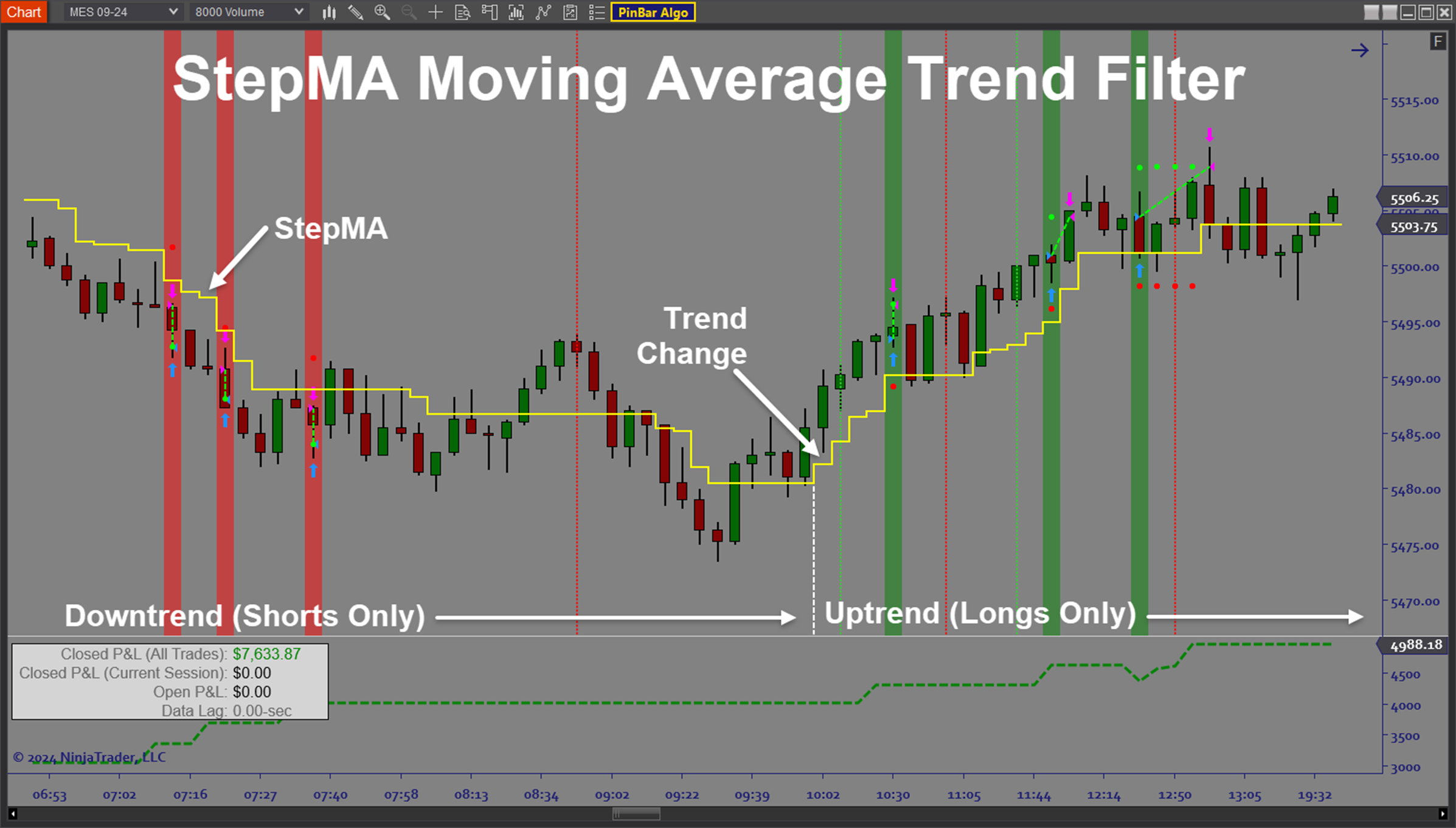

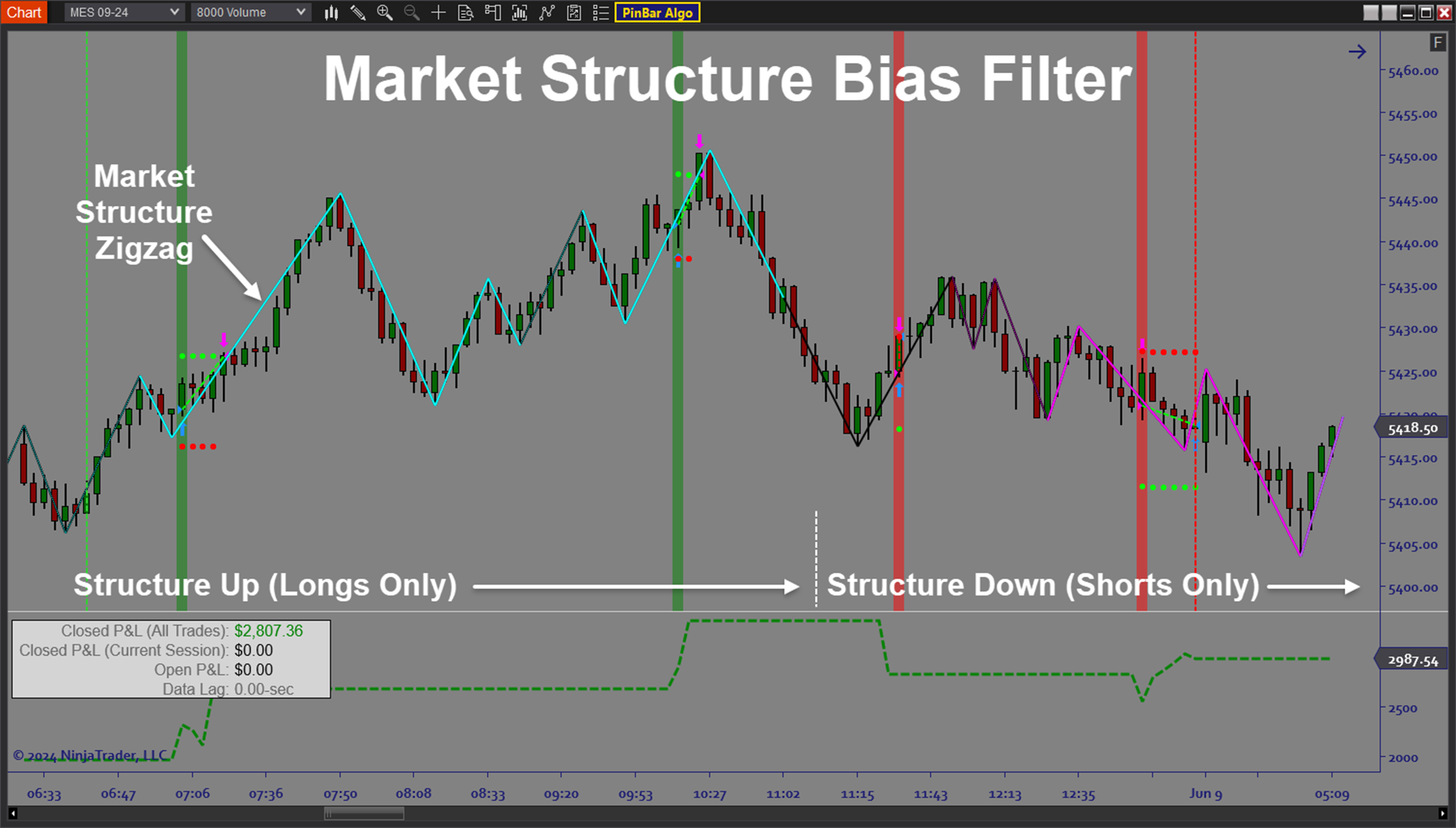

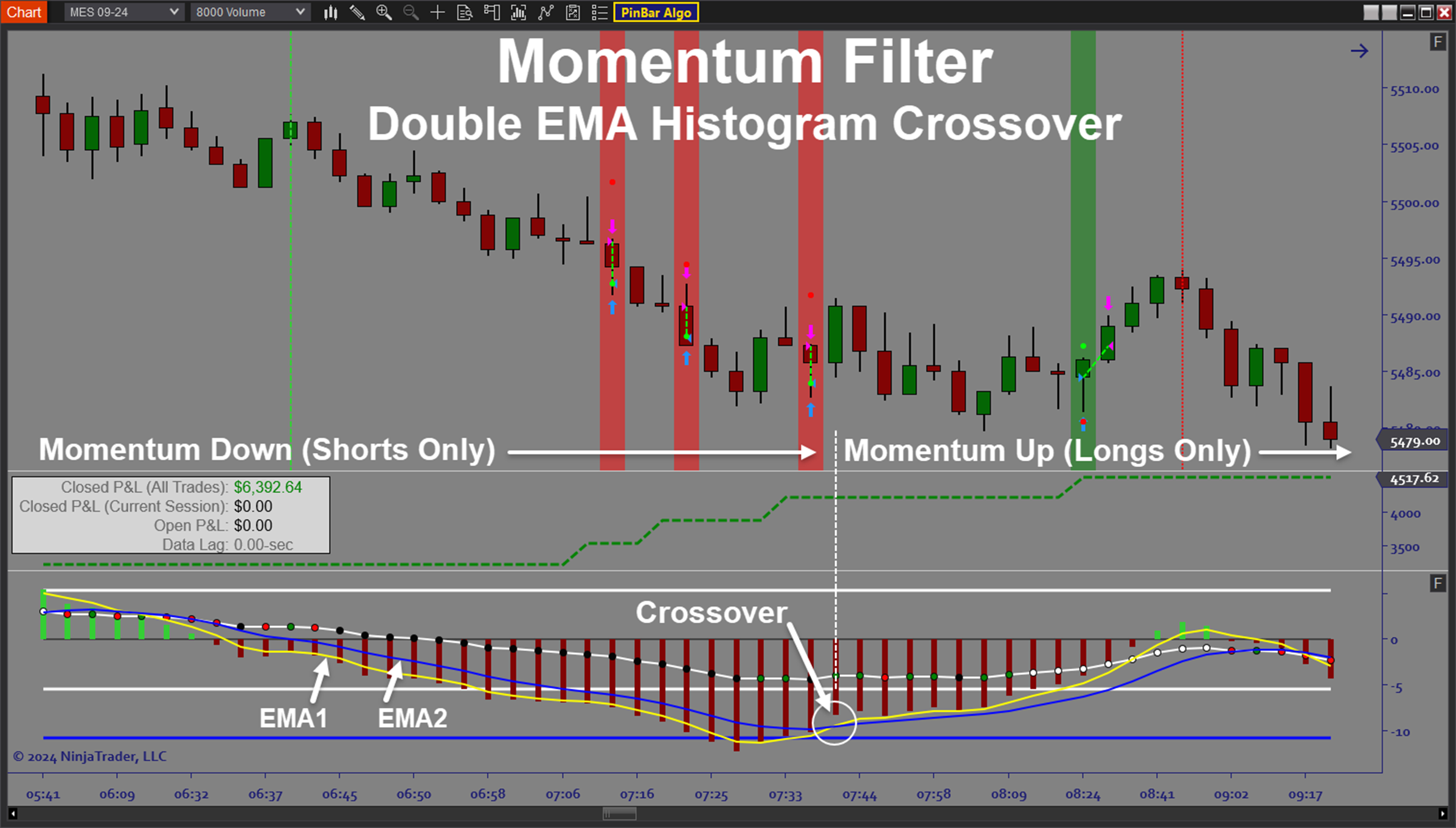

- Comprehensive trend, momentum, and market structure directional filters

- AutoTrail and Breakeven strategies

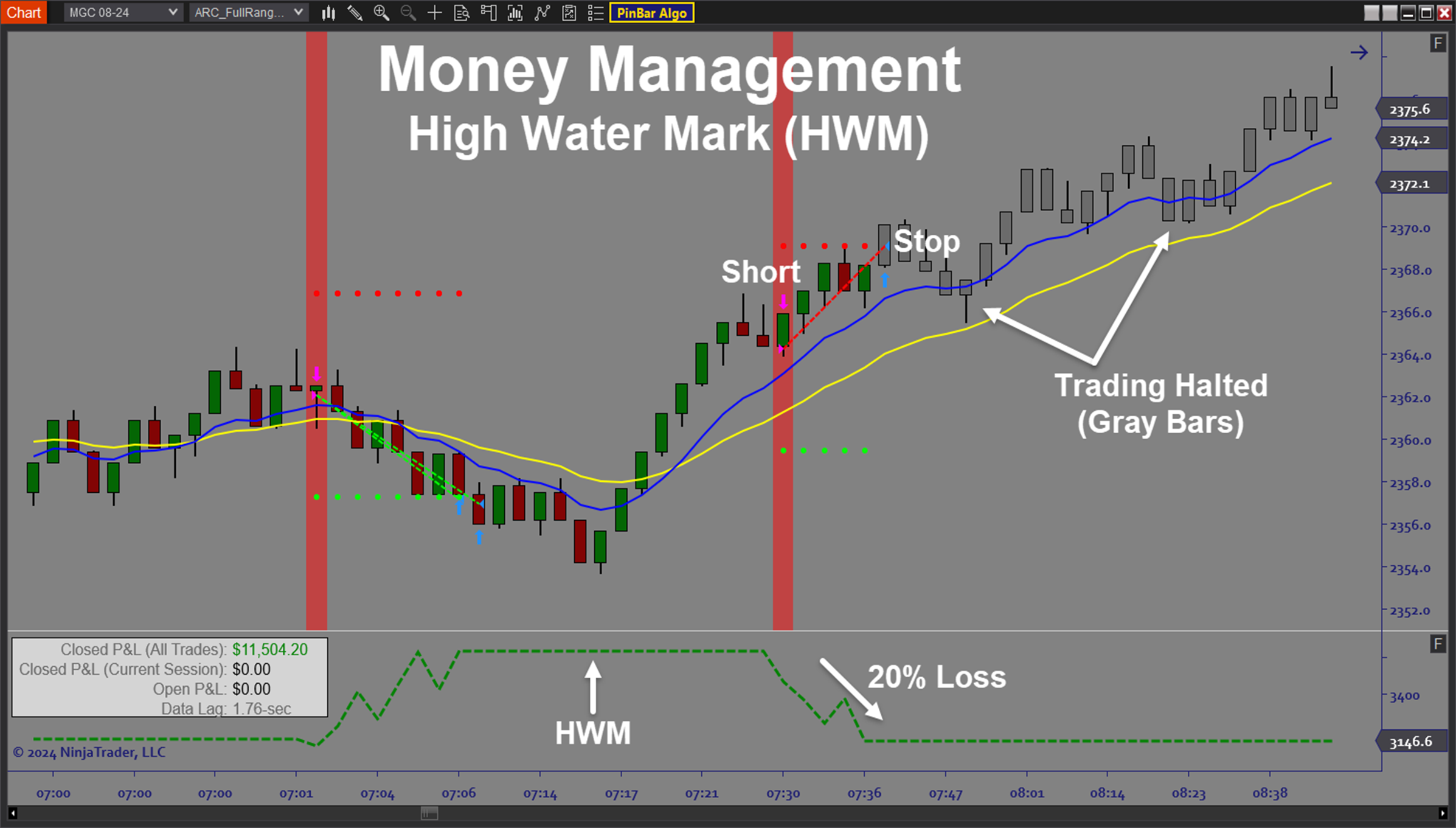

- Time filters, Day of Week filters, Holiday filters, and money management function

- Built in trade signal graphics, execution markers, stop/target graphics, realtime P&L

- Built In Backtesting and Optimization capability

Functions:

The Pinbar Algo is best used by focusing on the instruments, timeframes, and trading style that you are most comfortable with. The main component of deploying the strategy is to set limits of what defines a valid Pin Bar and to determine whether you want to use Pin Bars as a trend or reversal system. At first it is best to perform preliminary backtests and view the chart signals to get a general idea of reasonable settings. Then move on to the optimization of all the relevant parameters. Once you have done that it is best to forward test those optimized settings in live trading (in Sim) to validate performance. It is always best to test your strategy before risking your actual trading capital. When you have achieved consistency in Sim, you can deploy the algo on your live trading account. The automated trading system will follow the signal rules and pre-defined trade plan exactly as configured, so you don’t have to worry about execution and can focus on improving performance as well as periodically adjusting to changing market conditions.Problem Solved:

- Stops traders from failing to recognize profitable Pin Bar setups

- Stops traders from trading Pin Bar setups at the wrong time or place

- Stops traders from getting in too early or too late

- Stops traders from failing to adjust to market conditions

- Stops traders from taking reversal trades in trending conditions

- Stops traders from finding the best instruments for trending or reversal strategies

- Stops traders from dealing with the stress of manual trading

- Stops traders from sabotaging their trading due to indecision and fear

- Stops traders from failing to identify the best days and times to trade

- Stops traders from failing to manage risk properly

- Stops traders from trading against momentum, market structure, and directional bias

- Stops traders from trading without a good and easy way to compare performance of different strategies