NRBO Algo

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

Overview:

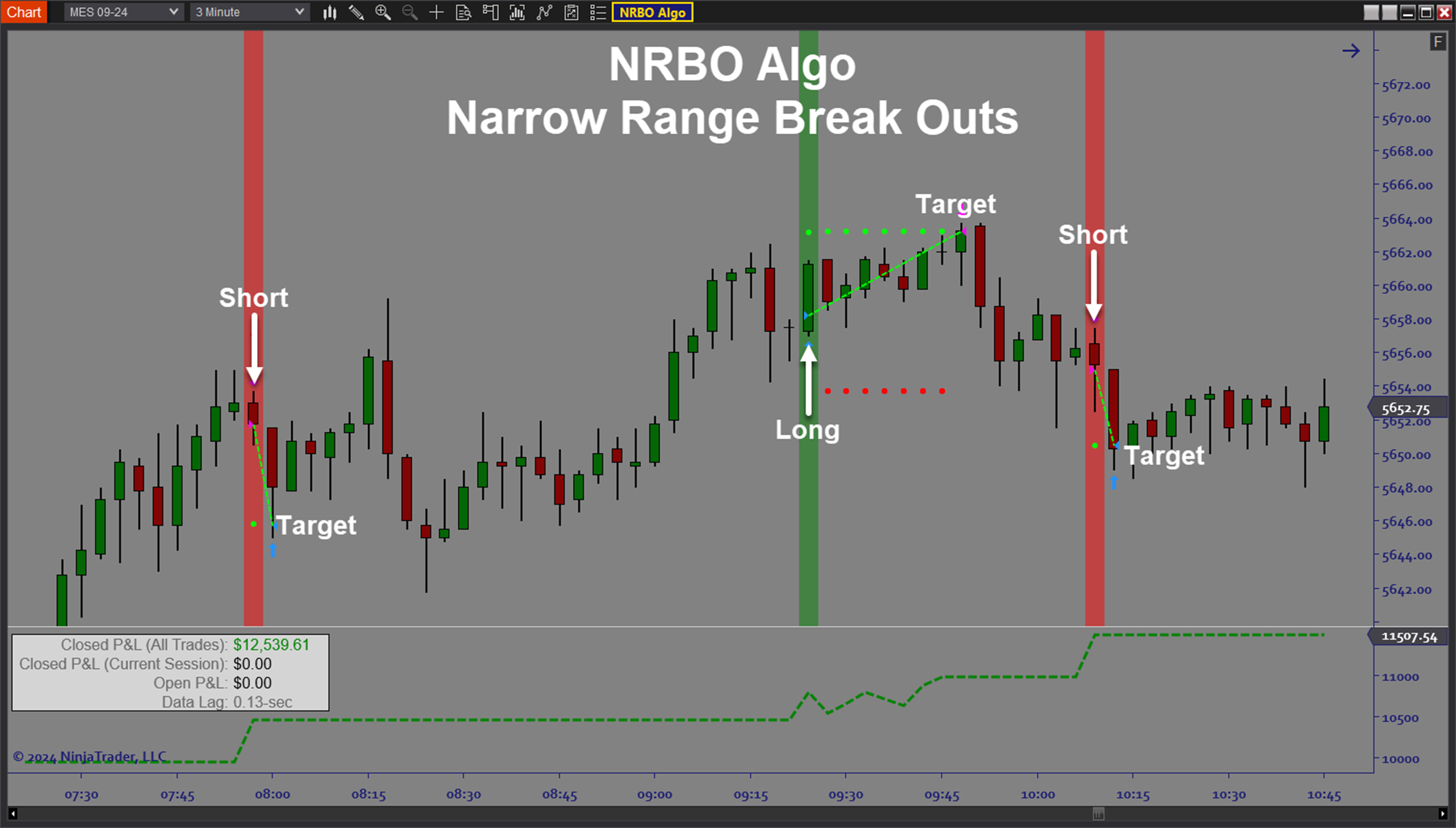

The ARC_NRBO Algo (“Narrow Range Break Out Algo”) is an automated trading solution for Ninjatrader which captures breakout moves after consolidation. When there is a pause in the trend evidenced by price remaining in a narrow range for a short period of time, it reflects a balance between buyers and sellers such that neither side is able to move the market. Eventually one side has to win and when it does there can be sufficient follow through for a tradable setup. The duration of the pause in price movement can vary but the one thing that always holds true is that on a certain timeframe, that pause in price movement can be represented by a single candlestick. And the distinguishing characteristic of that candlestick is that its range is relatively small compared to the bars that immediately preceded it. For any given timeframe, the software utilizes an adaptive sizing algorithm to scan for profit opportunities from breakouts that occurs after a brief consolidation. Breakouts can be quick so the ability to automate not only the signal detection but also the execution and trade management is what makes the NRBO Algo an excellent automated trading tool.

Purpose:

Traders need the ARC_NRBO Algo software because automatic pattern recognition is the best way to capture profits when trading candle patterns. It is nearly impossible to identify the setups in real time with the naked eye. Even if that wasn’t an issue, entering the trades manually will always lag an automated system because human reaction time is slower. And this becomes even more important in fast markets. Why not let the software do the heavy lifting so you can concentrate on testing and fine tuning your strategy.

Elements:

- Autotrade candle patterns for daytrading setups on any timeframe

- Control the frequency and type of trade signals with just a handful of settings

- Capture profits from quick range breakout trades

- Leverage custom Stop/Target placement to include a volatility component

- Utilize optimization functionality to get the best signals

- Optimize the breakout confirmation factor for the best performance

- Automatically adjust stop sizes consistent with current price action

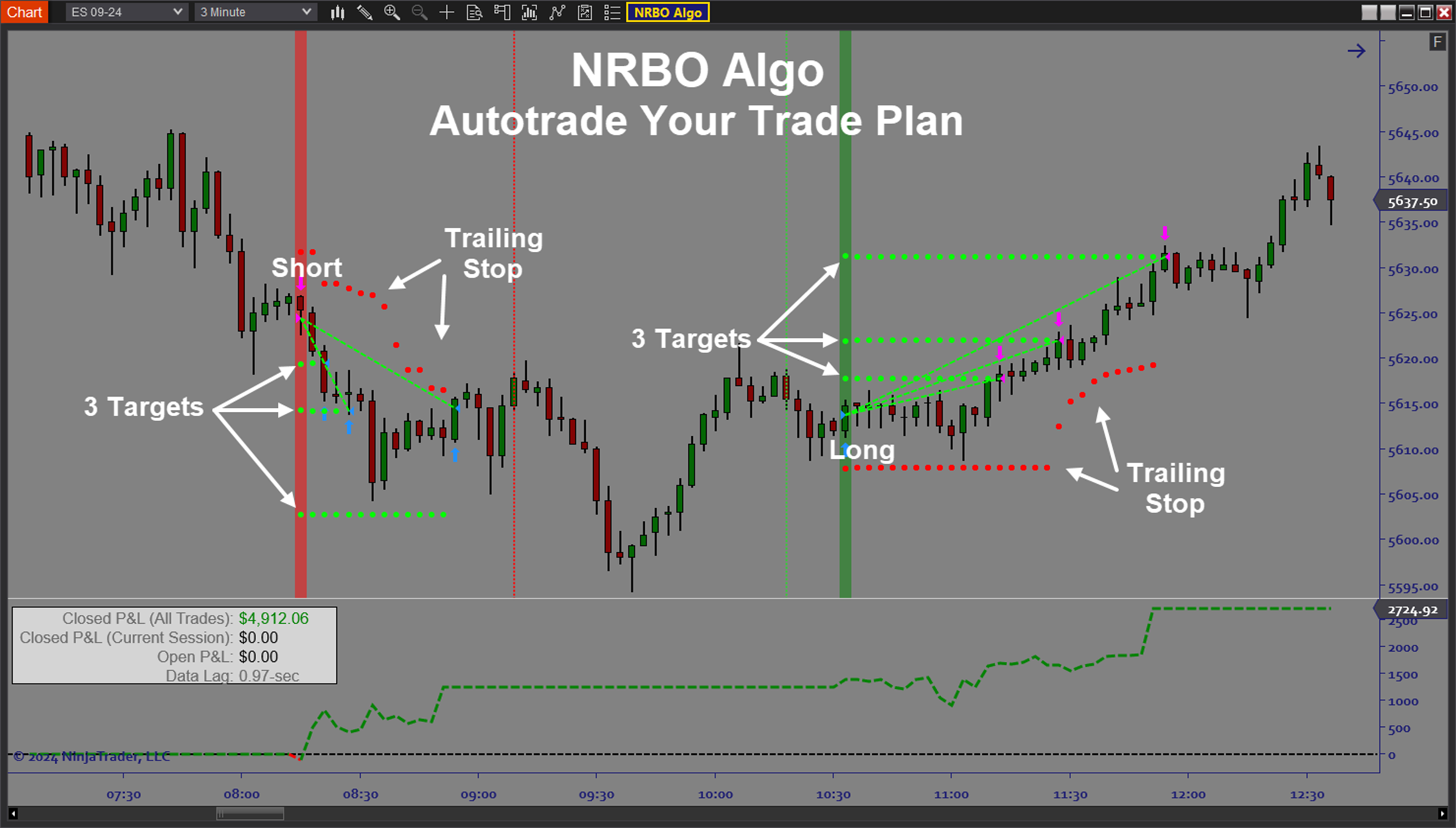

- Apply fully automated trade plans with stop placement and up to 3 targets

- Utilize R-multiple target placement

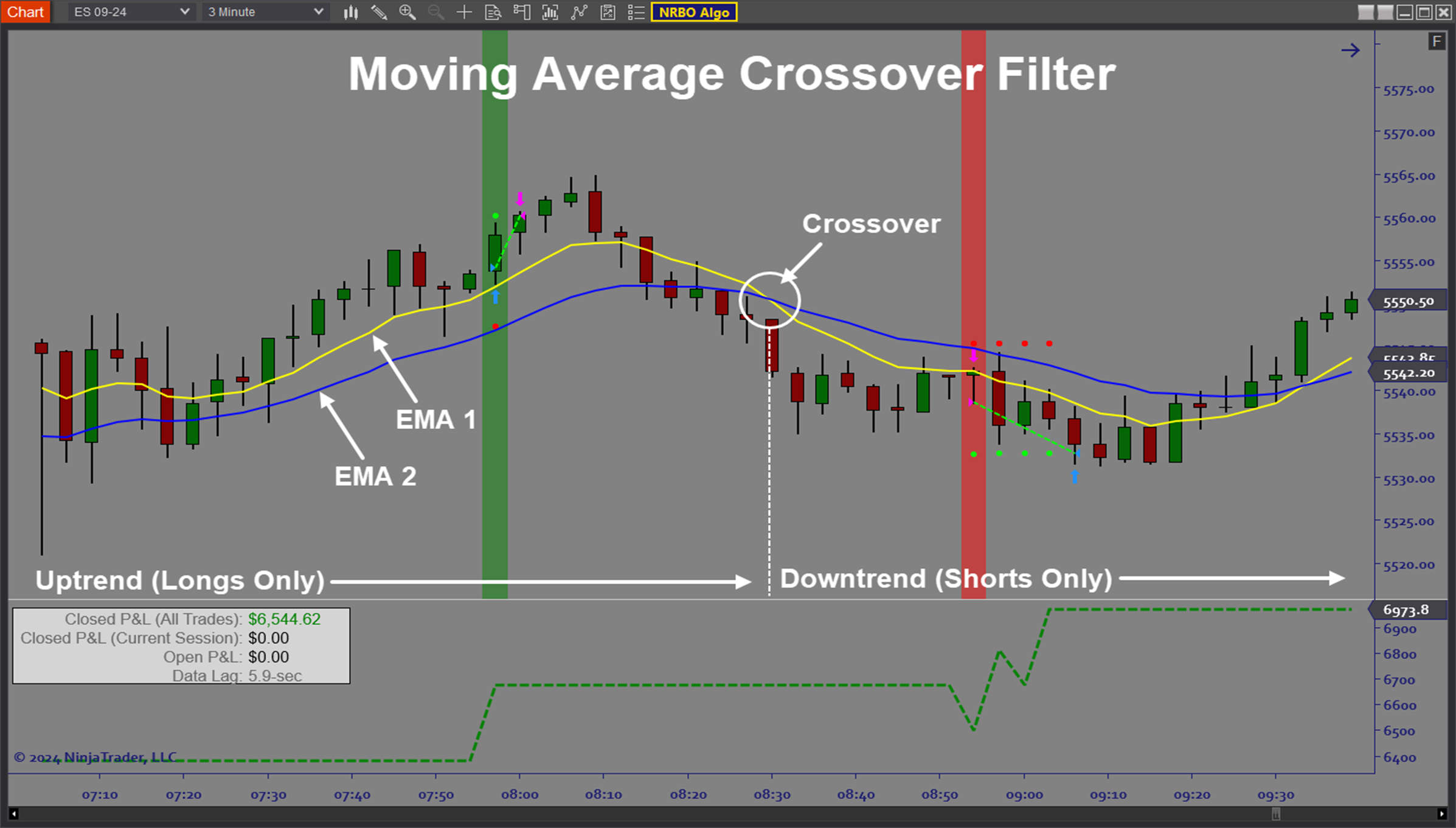

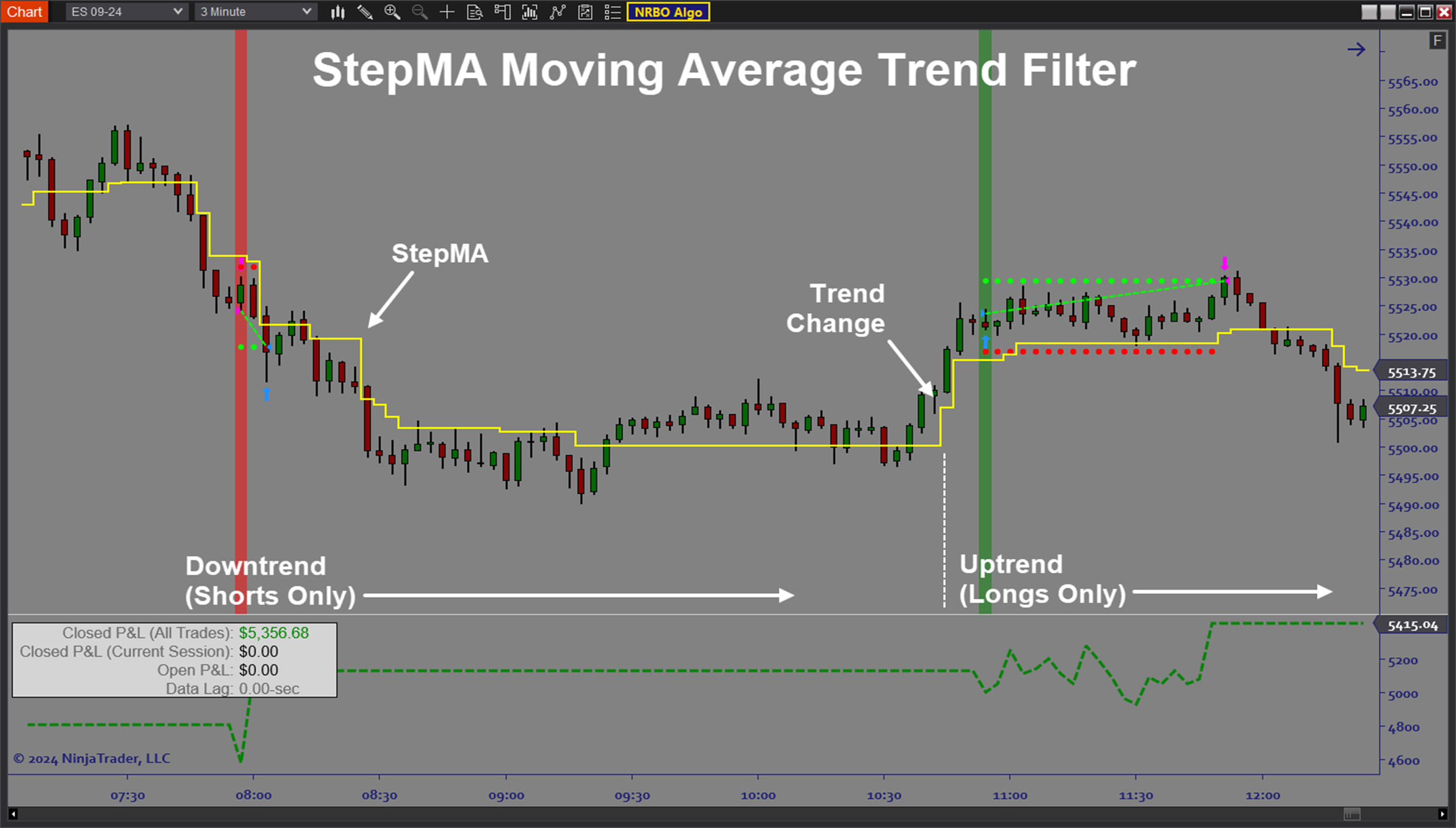

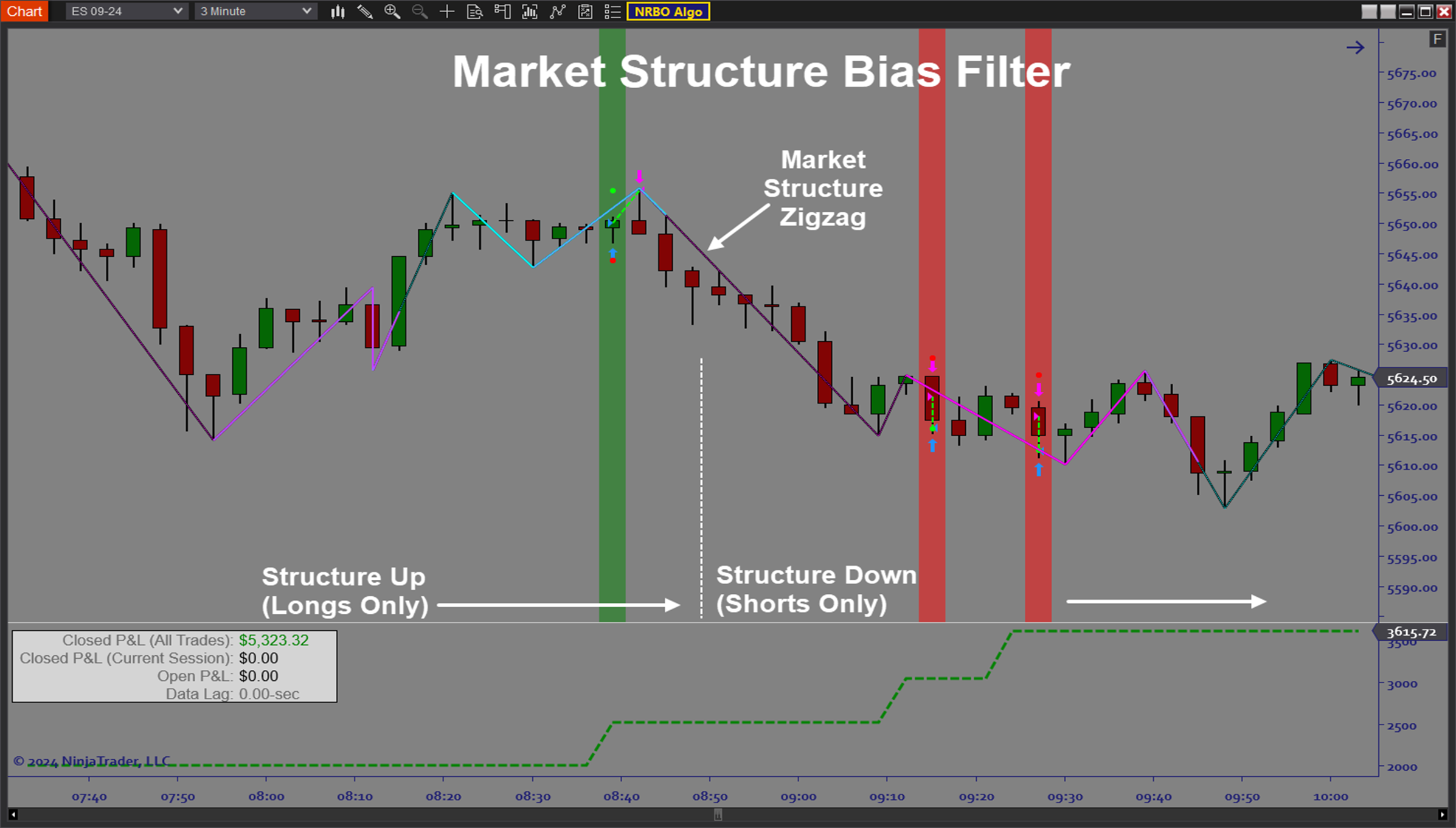

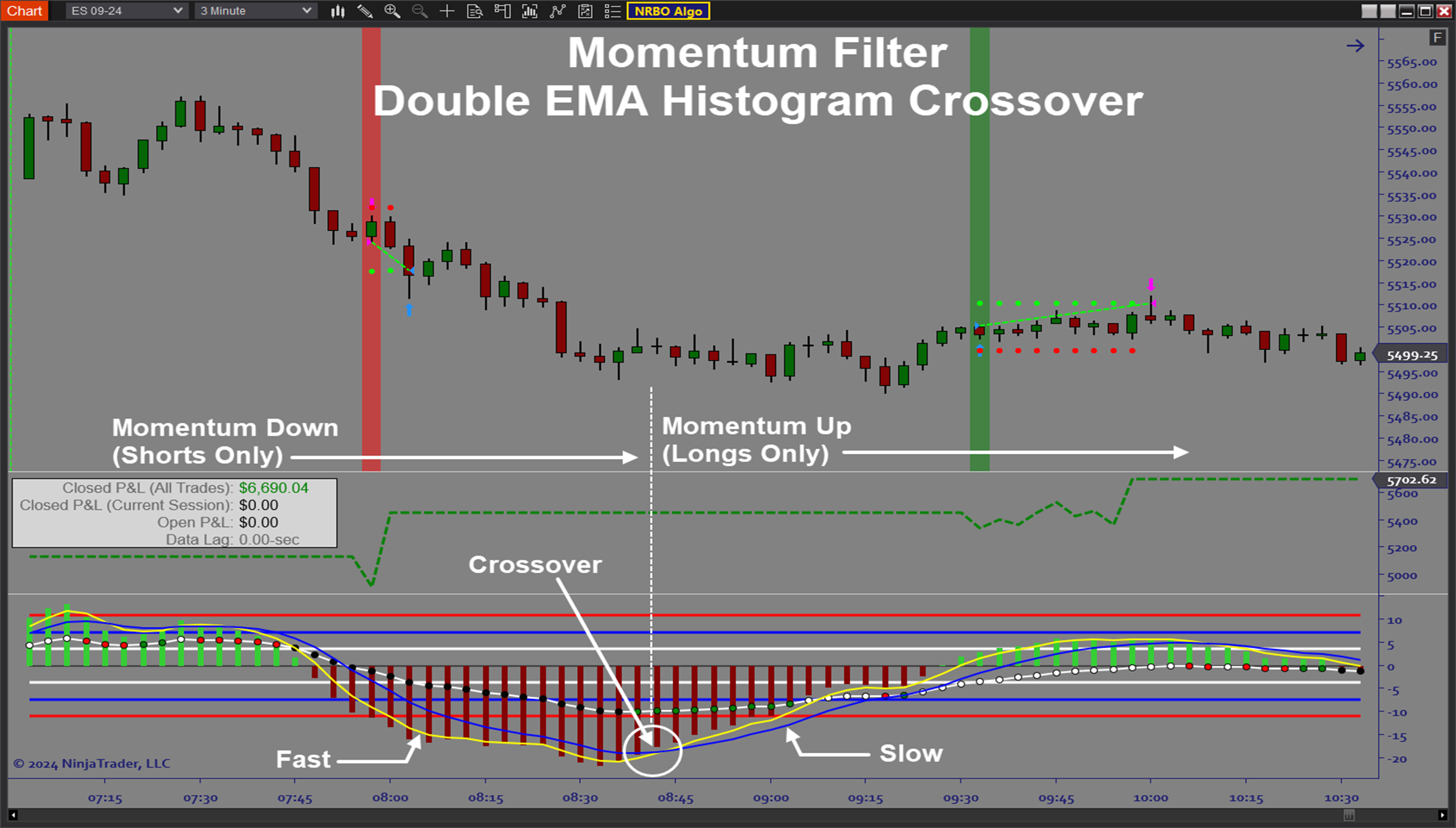

- Comprehensive trend, momentum, and market structure directional filters

- AutoTrail and Breakeven strategies

- Utilize dynamic trade sizing to control Dollar Risk per trade

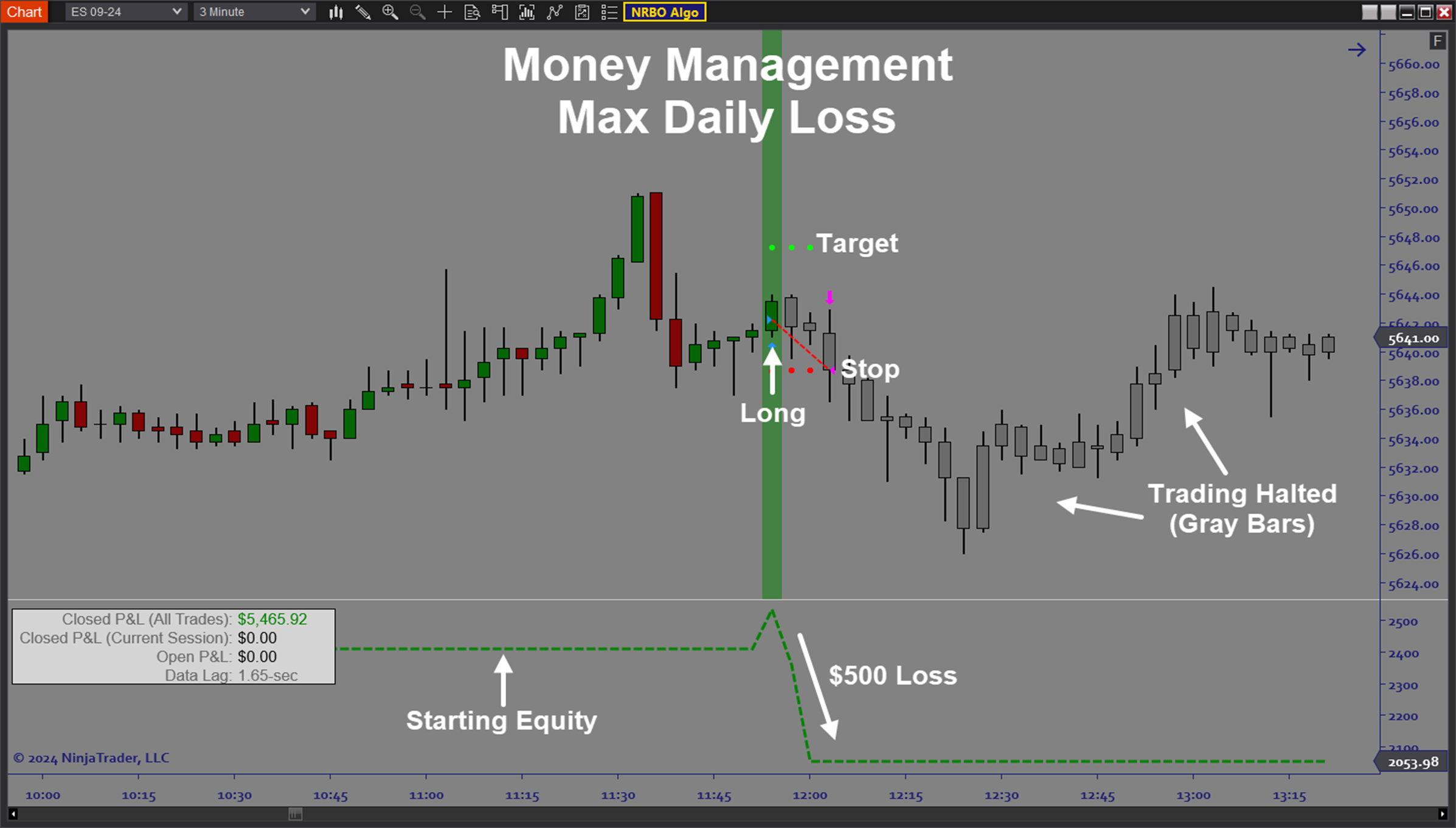

- Time filters, Day of Week filters, Holiday filters, and money management function

- Built in trade signal graphics, execution markers, stop/target graphics, realtime P&L

- Built In Backtesting and Optimization capability

Functions:

The NRBO Algo is best used by first testing on your favorite instruments. Most markets will at times pause temporarily before a mini breakout move. Once you have selected your instruments to trade, you can fine tune your settings through backtests and optimization. Depending on your settings you can focus on high frequency scalps or bigger daytrades, whatever fits your preference. Once you have your initial settings, you can fine tune by applying a variety of signal filters. Then when you have achieved consistency in Sim, you can deploy the algo live. The automated trading system will follow the signal rules and pre-defined trade plan exactly as configured, so you don’t have to worry about execution and can focus on improving performance as well as periodically adjusting to changing market conditions.

Problem Solved:

- Stops traders from missing quick narrow range breakout setups

- Stops traders from getting in too late

- Stops traders from not knowing which direction to trade

- Stops traders from not allowing the data to guide their strategy development

- Stops traders from trading without a well defined trade plan

- Stops traders from dealing with the stress of manual trading

- Stops traders from sabotaging their trading due to indecision and fear

- Stops traders from failing to adjust to market conditions

- Stops traders from trading against the dominant trend or against momentum

- Stops traders from failing to adjust their strategy to the instrument being traded

- Stops traders from failing to identify the best days and times to trade

- Stops traders from failing to manage risk properly

- Stops traders from trading against market structure and directional bias

- Stops traders from trading without a good and easy way to compare performance of different strategies