Matrix Algo

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

Category: Algos

Tags: Backtesting, Breakouts, Candle Patterns, Chart Patterns, Market Structure, Momentum, Money Management, Patterns, Reversals, Risk Management, Signals, Strategy Development, Trade Management, Trade Performance, Trade Planning, Trade Sizing, Trend Trading

Description

Overview:

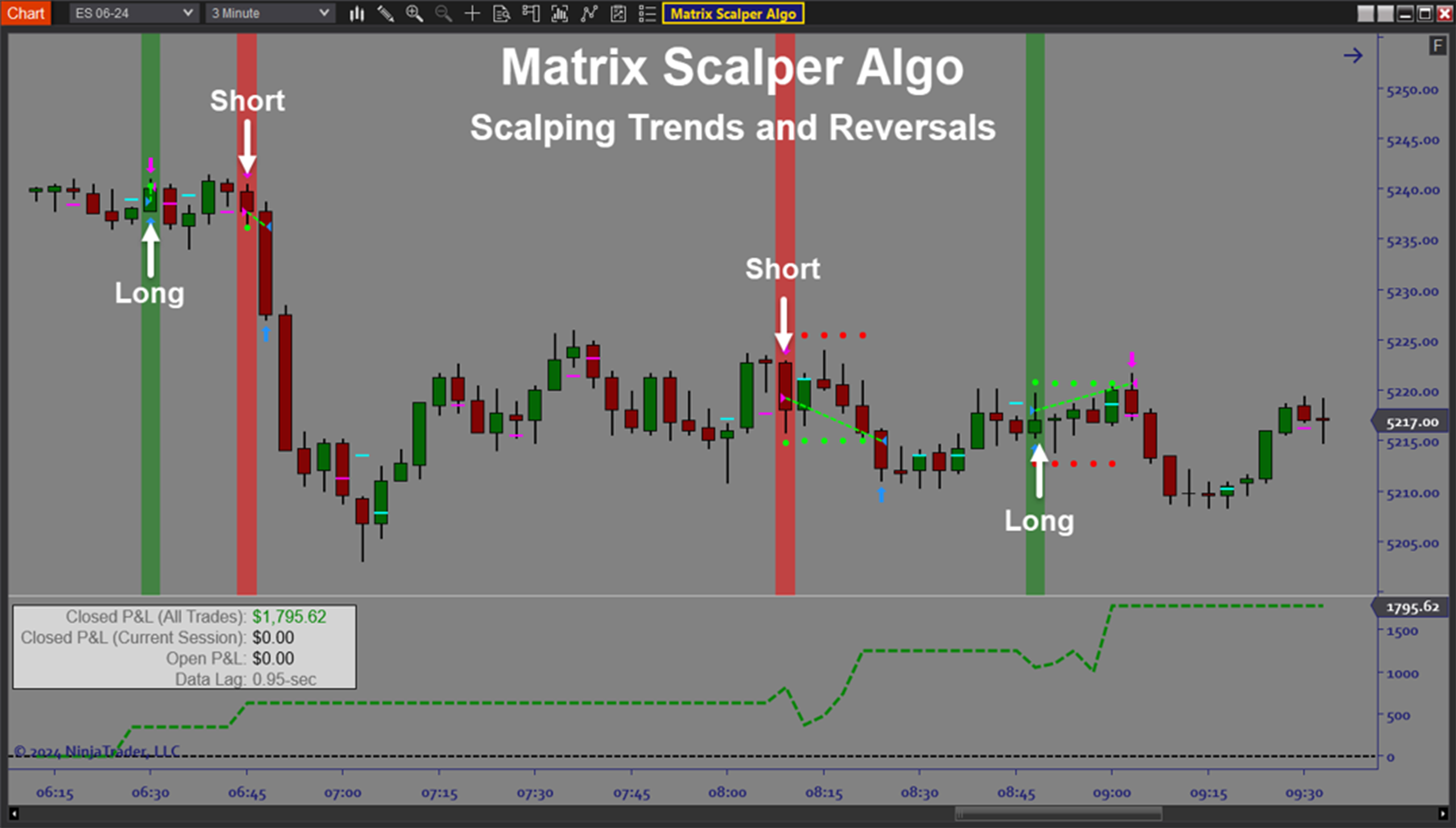

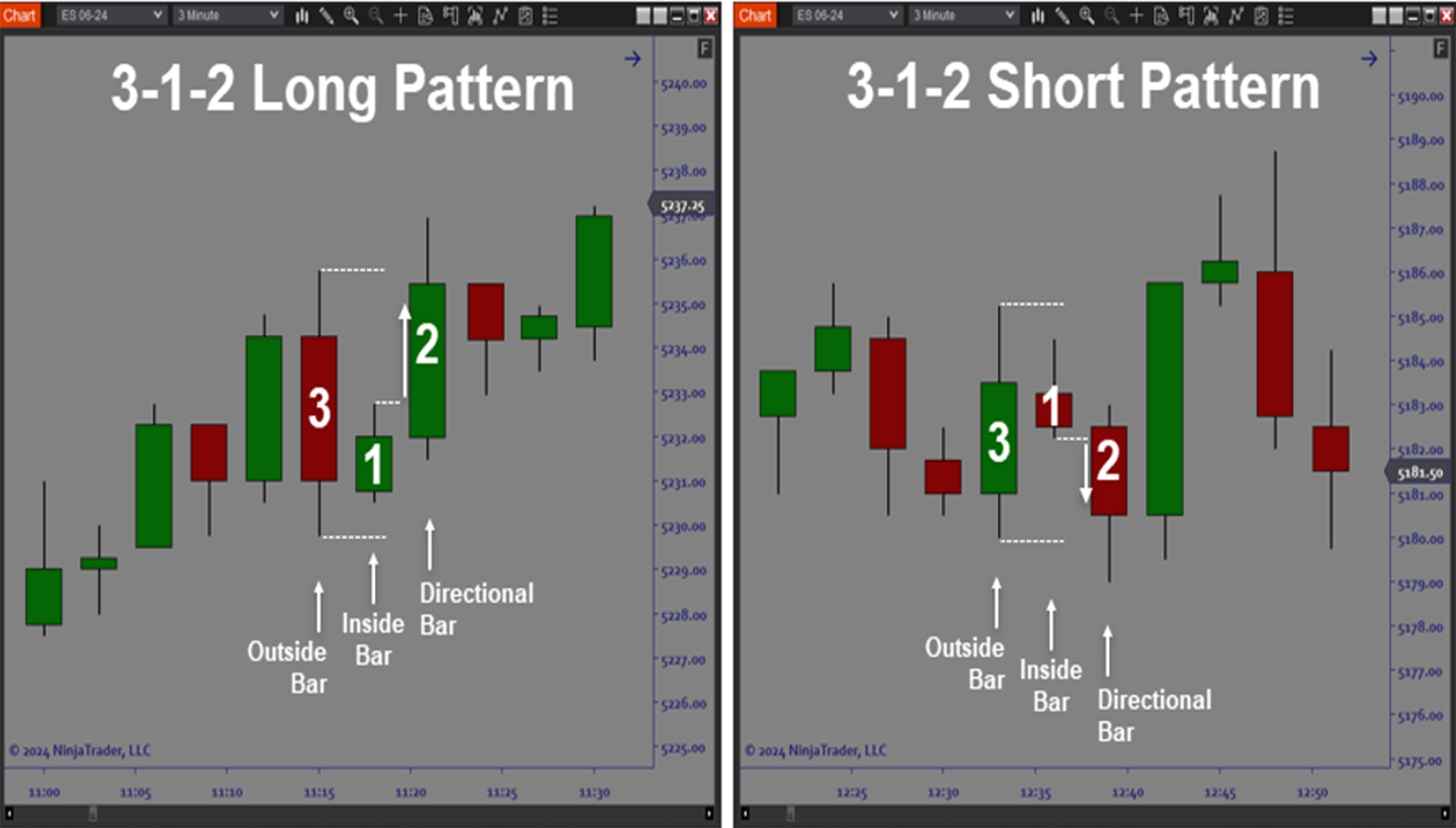

The ARC_Matrix Algo is an automated trading solution for Ninjatrader based on focused 3-bar price patterns which can be used for both trend continuation and reversal trades. Some of the most successful traders have discovered that hidden candlestick patterns can generate effective trade setups on daily, weekly, or even monthly stock charts. Because all markets are fractal in nature, these price pattern-based setups can be effectively traded on smaller timeframes meaning they can be used for daytrading. The main challenge however is that on smaller timeframes it can be nearly impossible to manually identify the pattern and act quickly enough to successfully exploit a valid setup. This is where automated trading can represent a substantial benefit because the software can identify the setup instantly and enter the trade immediately to take full advantage of the opportunity for profit. This is what makes the Matrix Algo an excellent solution for daytraders who want to autotrade price pattern setups without ever having to worry about missing a trade or misreading a setup pattern.Purpose:

Traders need the Matrix Algo software because key reversal scalp patterns can be a very effective trading strategy but they are very difficult to identify without the aid of automated pattern recognition. In fact it is nearly impossible to identify the pattern in real time when you are hunting for effective scalp trades. If you are trading on small timeframes, when the opportunity arises you must immediately or else you can leave profits on the table. The Matrix Algo automatically finds the setups and enters the trade for you. You can rely on the software to automatically trade the best setups and allow you to focus on strategy development and managing risk to protect your trading capital.Elements:

- Autotrade hidden candlestick pattern combinations for both trend and reversal setups

- Seamlessly incorporate automated pattern recognition in your trading

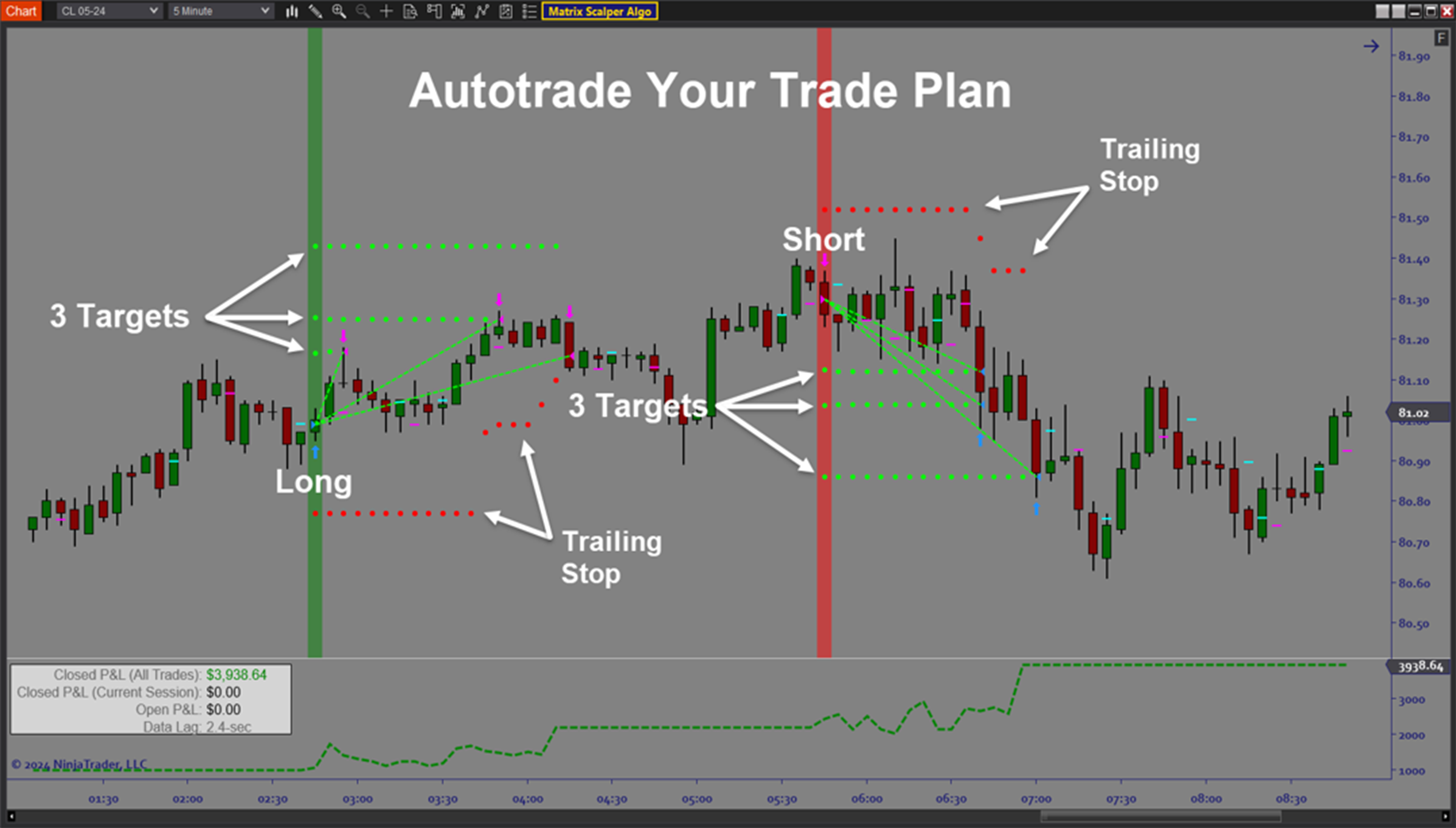

- Utilize pattern-derived stops and targets to tailor your strategy to current price action

- Dynamic trade sizing to control Dollar Risk per trade

- Fully automated trade plans with stop placement and up to 3 targets

- R-multiple target placement

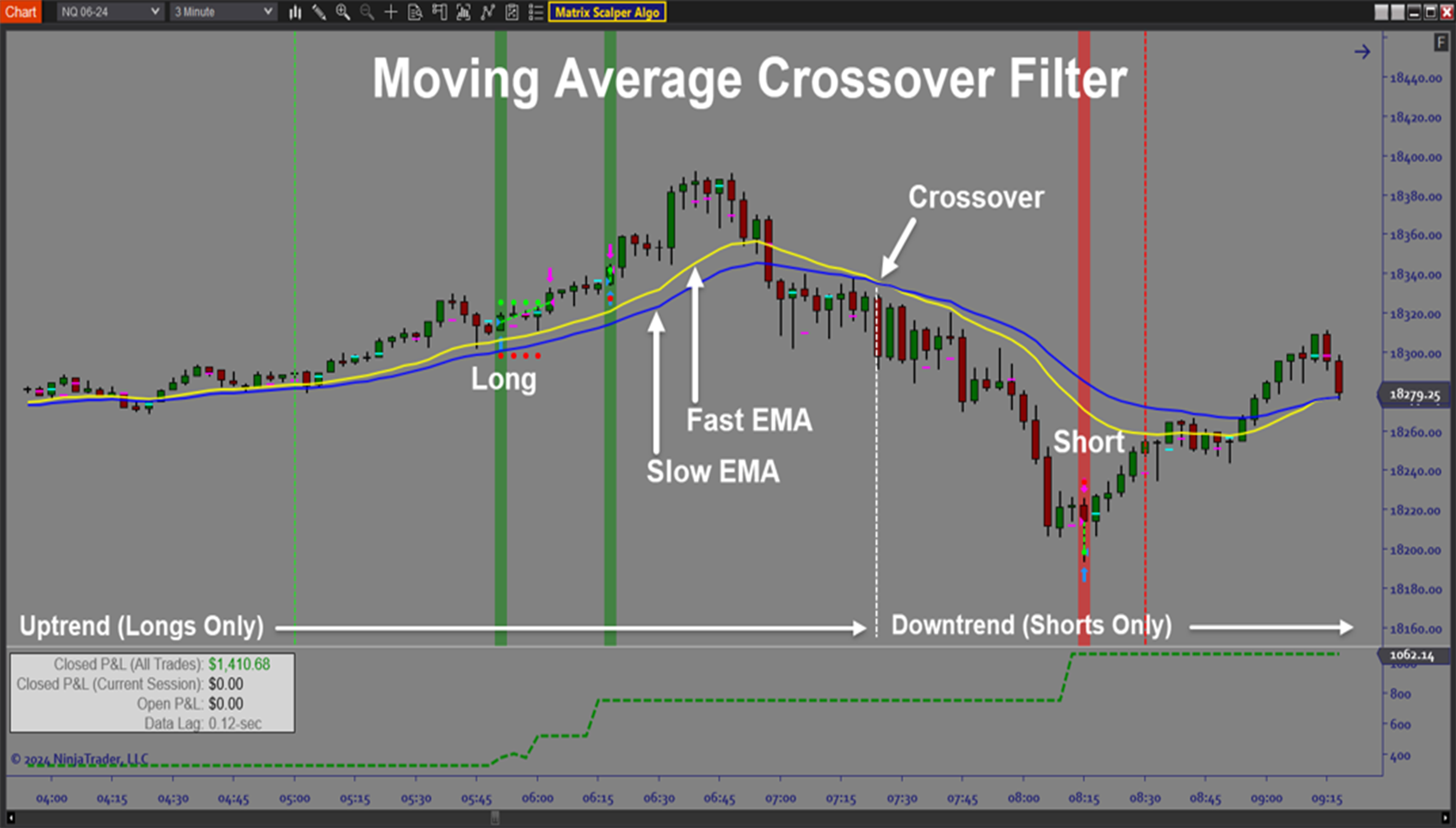

- Comprehensive trend, momentum, and market structure directional filters

- Custom trend inversion filter to capture early trend flip trades

- AutoTrail and Breakeven strategies

- Time filters, Day of Week filters, Holiday filters, and money management function

- Built in trade signals, execution markers, stop/target graphics, realtime P&L

- Built In Backtesting and Optimization capability

Functions:

The Matrix Algo is best used by focusing on your favorite instruments and deciding whether you want to scalp, daytrade or even trade higher timeframes. Then start with an initial configuration of Signal settings to view the performance on a chart. Then you can use the built-in backtesting and optimization features to quickly customize the trade signals for your favorite instruments. From there it is important to forward-test your strategy settings by deploying the algo in live markets on a Sim account. This gives you an opportunity to fine tune your strategy before you risk trading capital. When you have achieved consistency in Sim, you can deploy the algo on your live trading account. The automated trading system will follow the signal rules and pre-defined trade plan exactly as configured, so you don’t have to worry about execution and can focus on testing and improving the strategy as well as periodically adjusting to changing market conditions.Problem Solved:

- Stops traders from missing out on hidden price patterns that generate opportunity for profit

- Stops traders from letting the fear of missing out cause them to enter too late and getting stopped out

- Stops traders from failing to identify the best days and times to trade

- Stops traders from trading against momentum, market structure, and directional bias

- Stops traders from trading with a plan and without the benefit of comprehensive performance statistics

- Stops traders from sabotaging their trading due to indecision and fear

- Stops traders from dealing with the stress of manual trading

- Stops traders from failing to manage risk properly

- Stops traders from failing to adjust to market conditions