This indicator is part of our Annual Indicators Membership.

To access this indicator for free, please click below.

Overview:

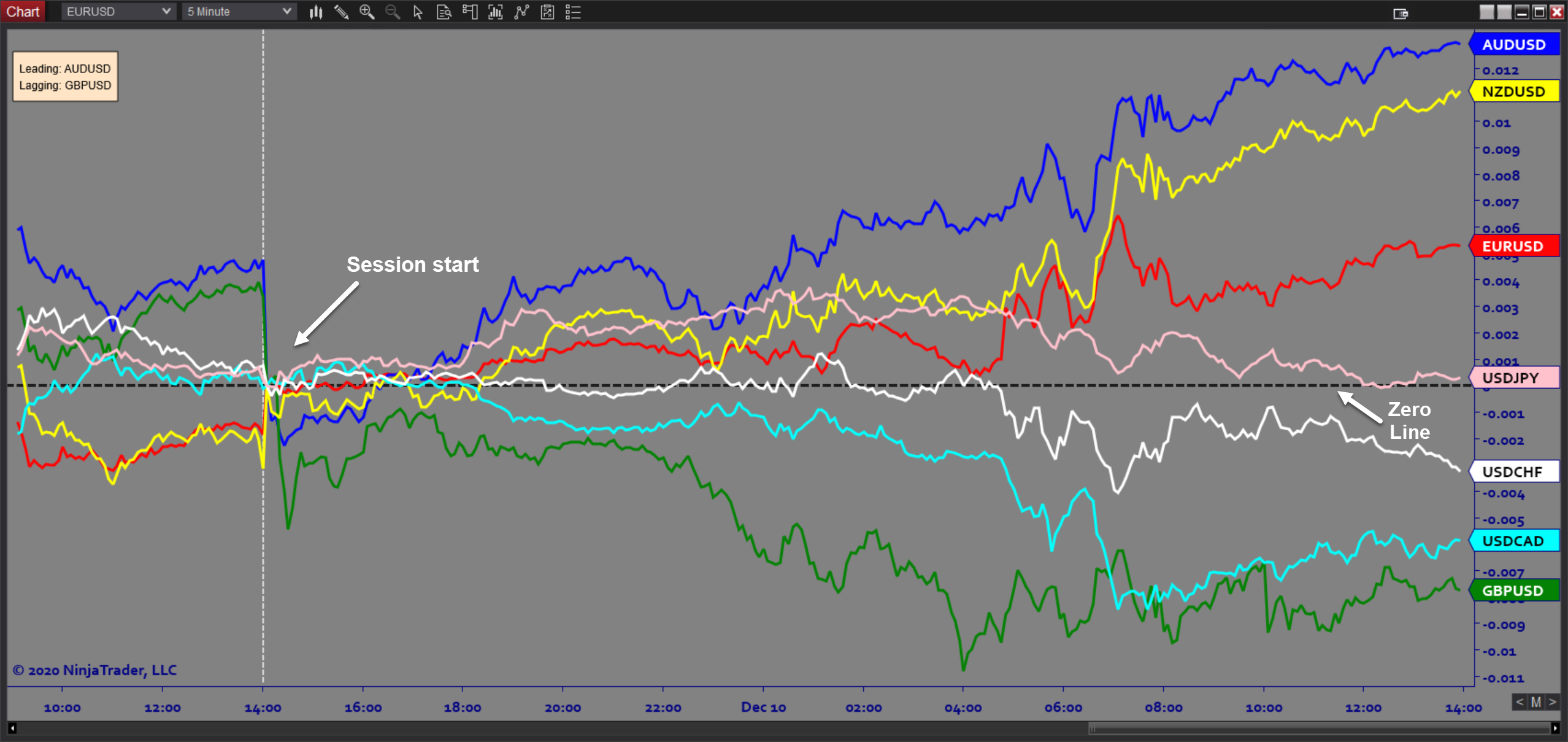

Leaders and Laggers displays market correlation and the relative strength of up to 16 instruments on the same price panel. The prices are all converted to %-change from a designated start time (can be Session Start or Custom). The purpose of the software is to identify strength and weakness between correlated and non-correlated assets when looking at market selection.

Purpose:

Traders need the Leaders and Laggers software because, when trading correlated assets, it is crucial to know which instruments are leading the market and which ones are relatively weak. If you’re bullish, picking the weakest instrument may not be the best choice. The user can select any instruments to compare, correlated or uncorrelated. Leaders and Laggers is a simple but essential tool for any trader.

Elements:

- Up to 16 instruments compared

- Any Asset Class

- Customizable Start Time

- User selected timeframe

- Customizable Correlation Lines

- Leader/Lagger Info Box

Functions:

The Leaders and Laggers software is best used by setting up a correlation chart in your workspace and monitoring it regularly, especially before entering a trade. Leaders are favored for longs and Laggers favored for shorts – not a strict rule, just something good traders keep track of, because correlations can shift quickly.

Problem Solved:

- Stops traders from second guessing market selection

- Stops traders from losing sight of market conditions

- Stops traders from picking the wrong instrument at the wrong time

- Stops traders from getting confusing when trades have no follow through