Inside Bar Outside Bar Algo

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

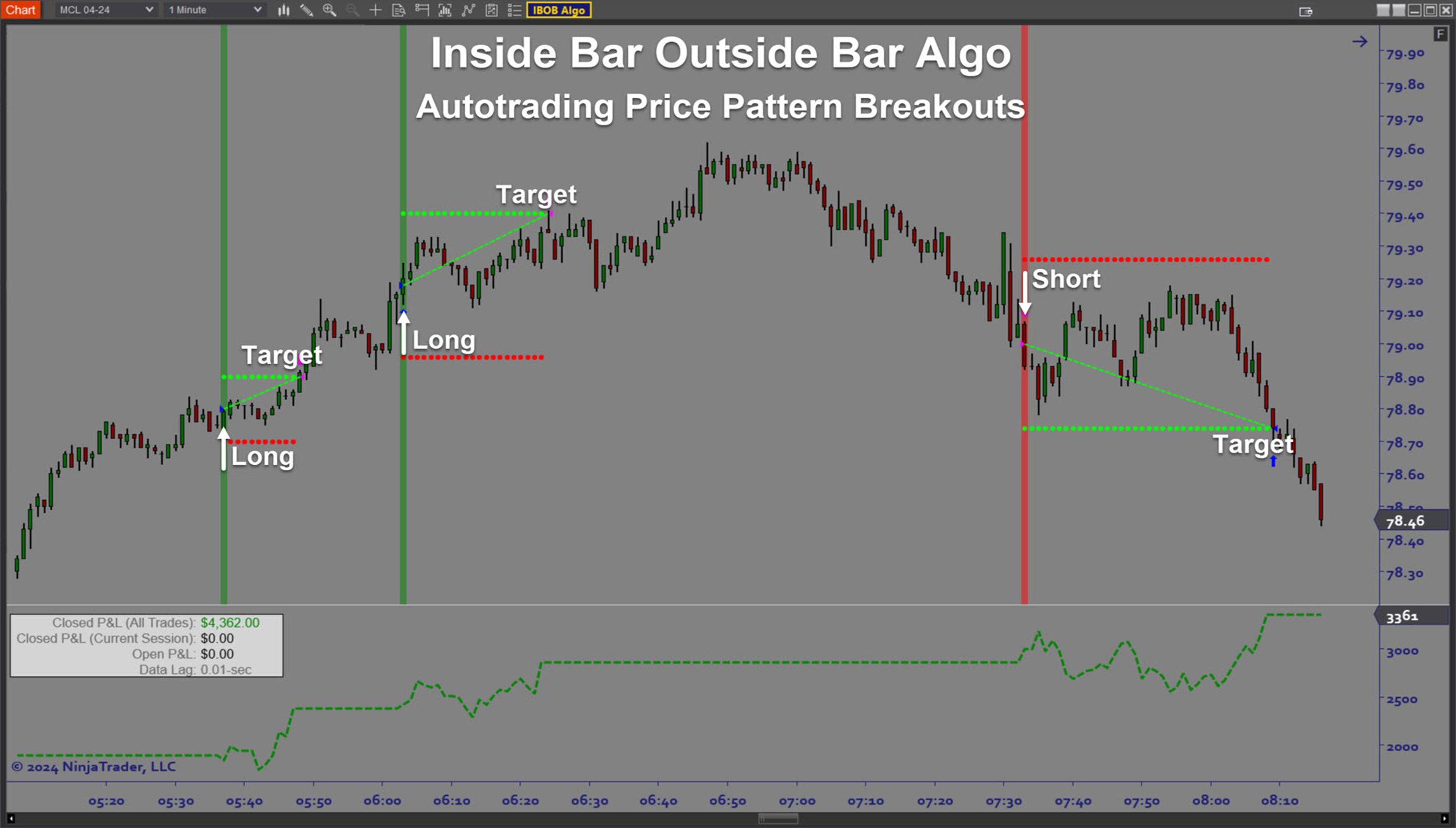

Overview:

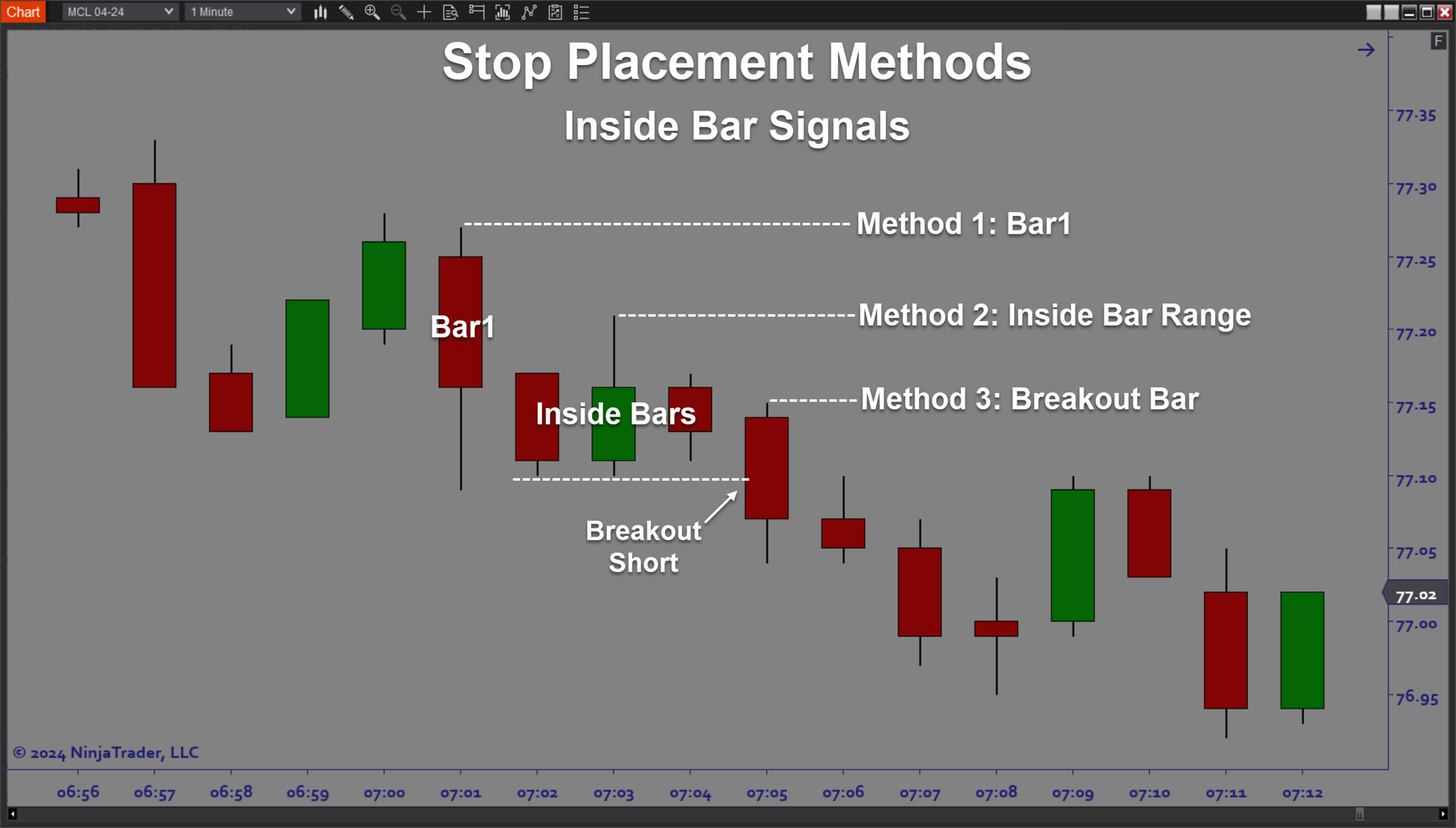

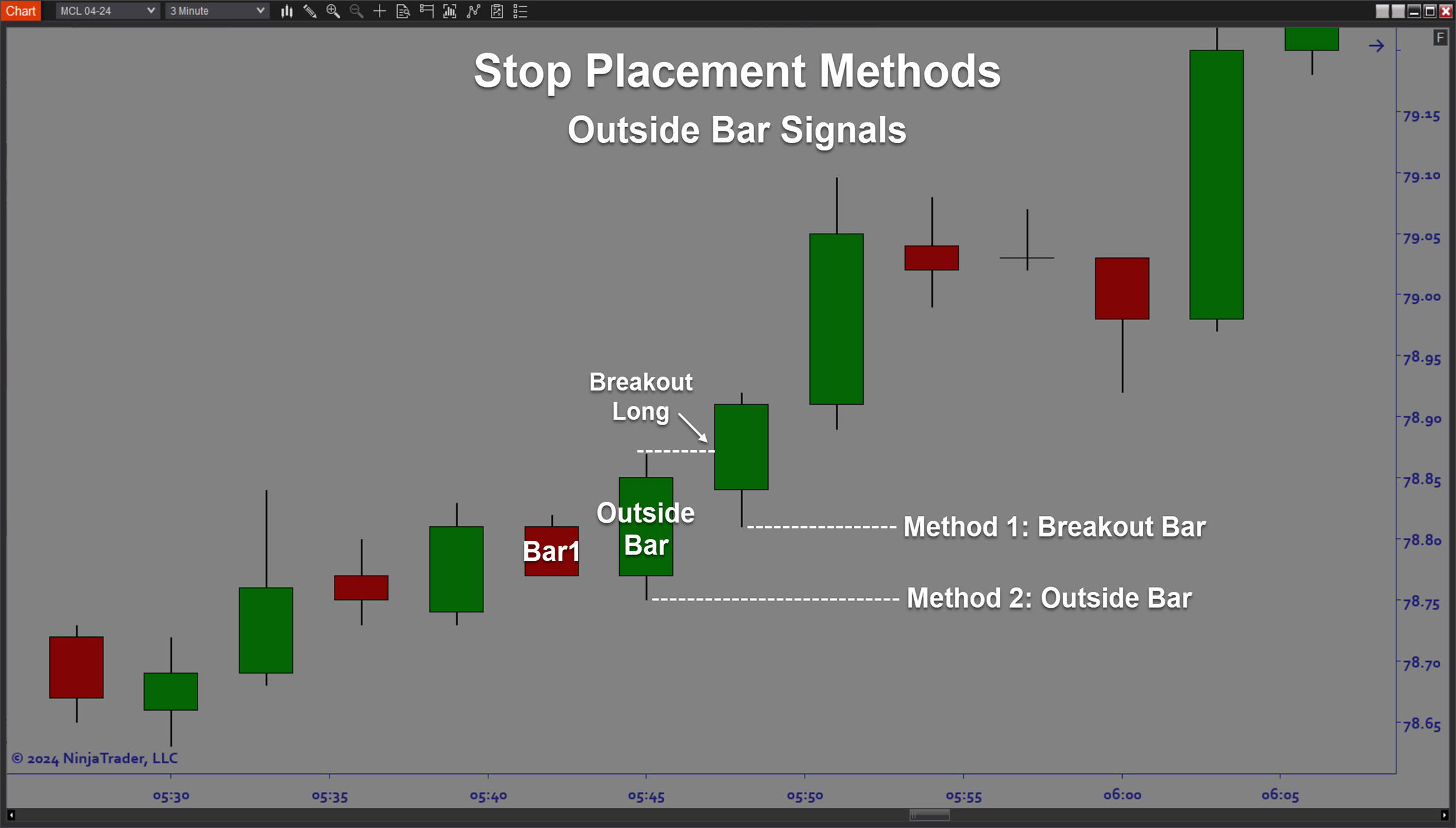

The ARC_InsideBarOutsideBar Algo (“IBOB Algo”) is an automated trading solution for Ninjatrader based on specific price patterns which are often observed before a breakout occurs. The software includes 2 main signal patterns: an Inside Bar Signal and an Outside Bar Signal. Both signify an imminent breakout. An Inside Bar represents a temporary consolidation period which is expected to lead to a trend continuation or a reversal. An Outside Bar signifies an engulfing pattern which can be exploited for breakout setups as well. In either case a breakout must occur eventually and the focus of the software is to identify if and when to take action and when to wait. While it is reasonable to trade these kinds of setups manually on higher timeframes, it is much more difficult to trade them on smaller intraday timeframes. The reason is that recognizing the pattern and taking action must occur nearly instantly in order to take full advantage of the setup. The true value of an automated trading solution is that it can identify the signal and enter the trade faster than is humanly possible. That is what makes the InsideBarOutsideBar Algo an essential tool for any breakout/reversal daytrader.

Purpose:

Traders need the InsideBarOutsideBar Algo software because while bar pattern breakouts can be a very effective trading strategy they are very difficult to identify without the aid of automated pattern recognition. Also even a slight delay in entering the trade can leave profits on the table. If you are not able to enter in time, the opportunity may be gone before you even have a chance to act. The InsideBarOutsideBar Algo automatically finds the setups and enters the trade for you. When you take the time to optimize the algo settings for the instrument that you are trading, you can rely on the software to automatically trade the best setups and allow you to focus on strategy development and managing risk to protect your trading capital.

Elements:

- Autotrade Inside Bar and Outside Bar breakout setups

- Autotrade trend continuation and reversal setups utilizing pattern recognition

- Customize Signal rules for any instrument

- Fully automated trade plans with stop placement and up to 3 targets

- Adaptive Stop placement to reflect volatility and market dynamics

- Dynamic trade sizing to control Dollar Risk per trade

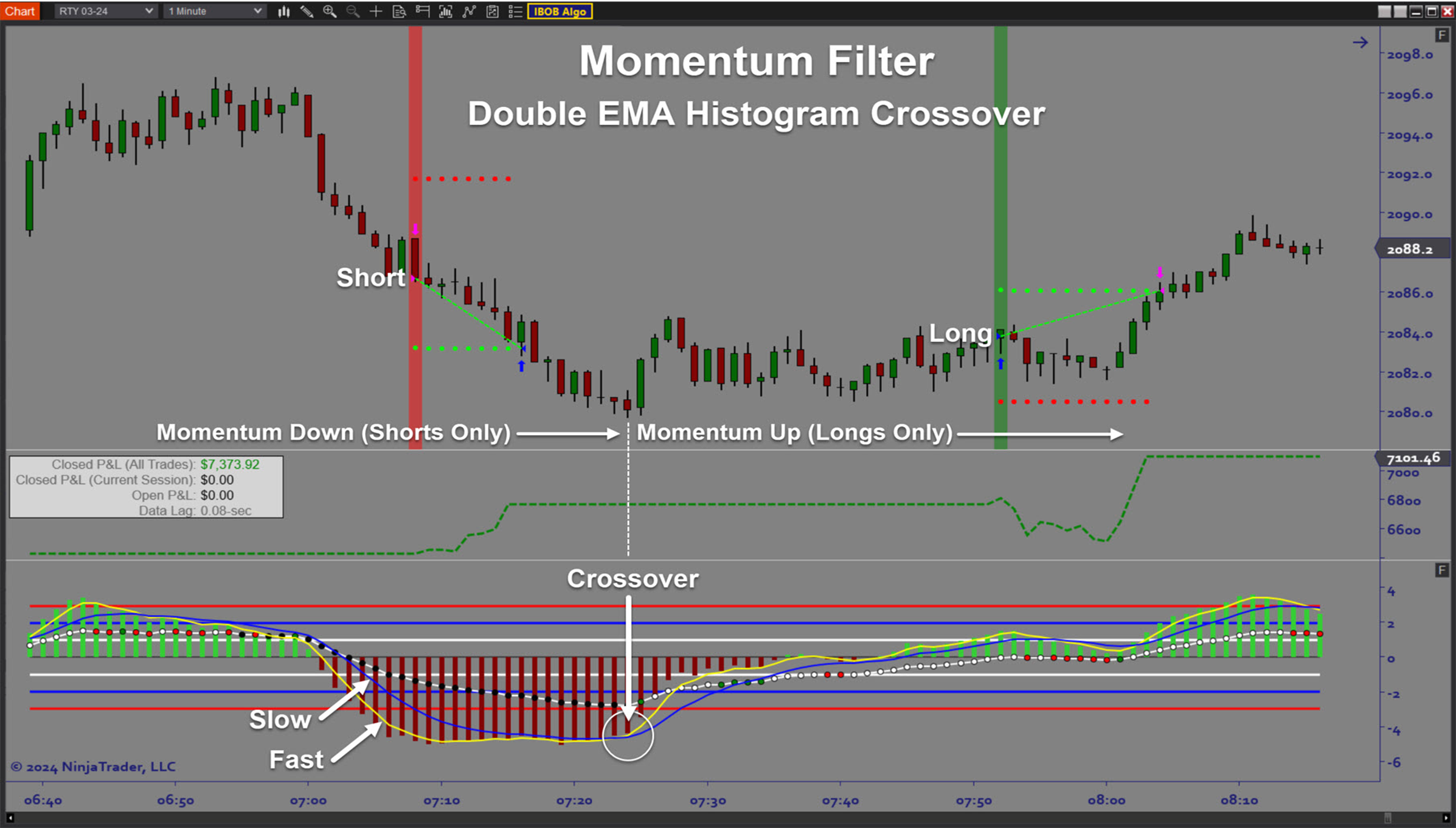

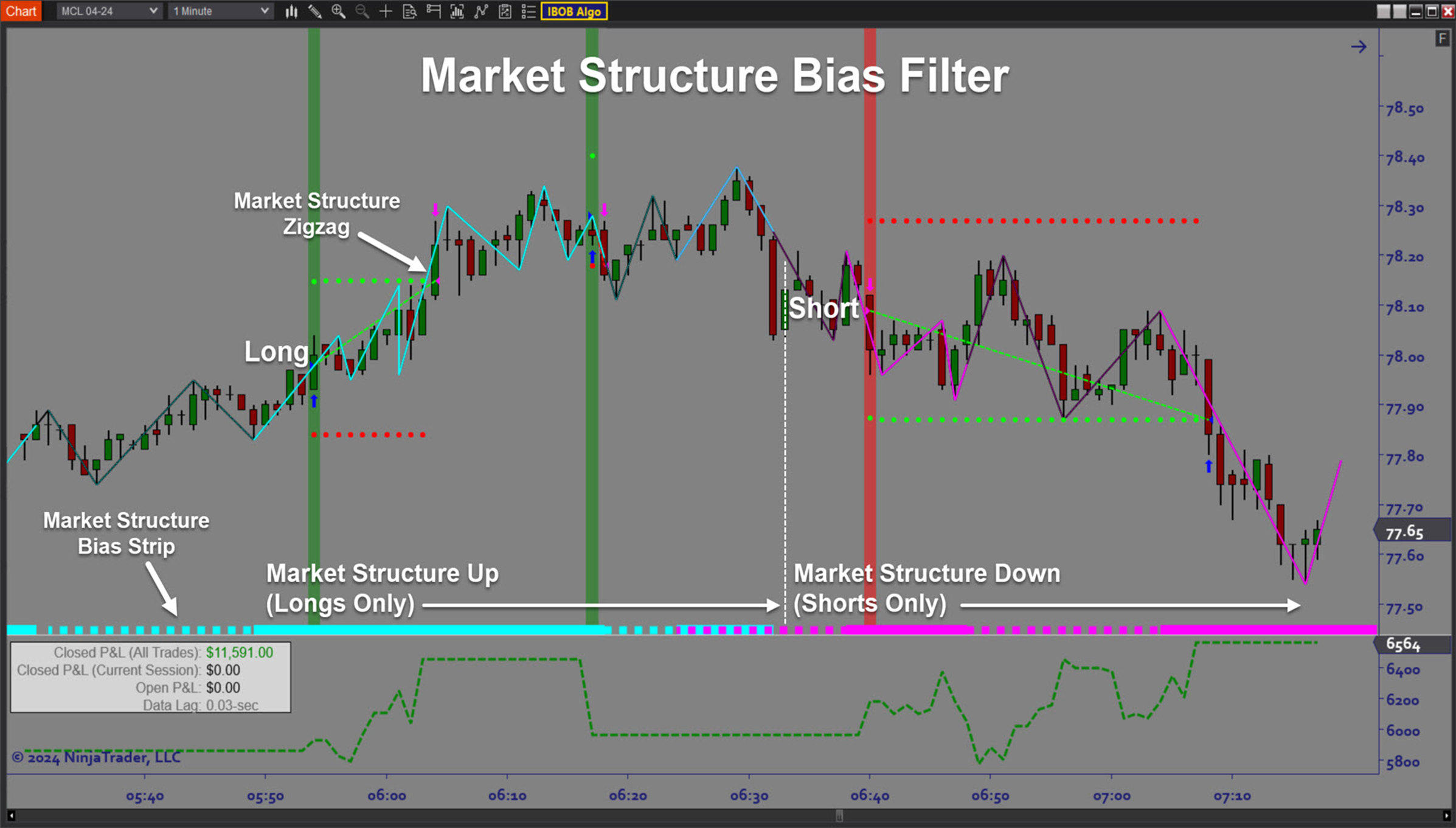

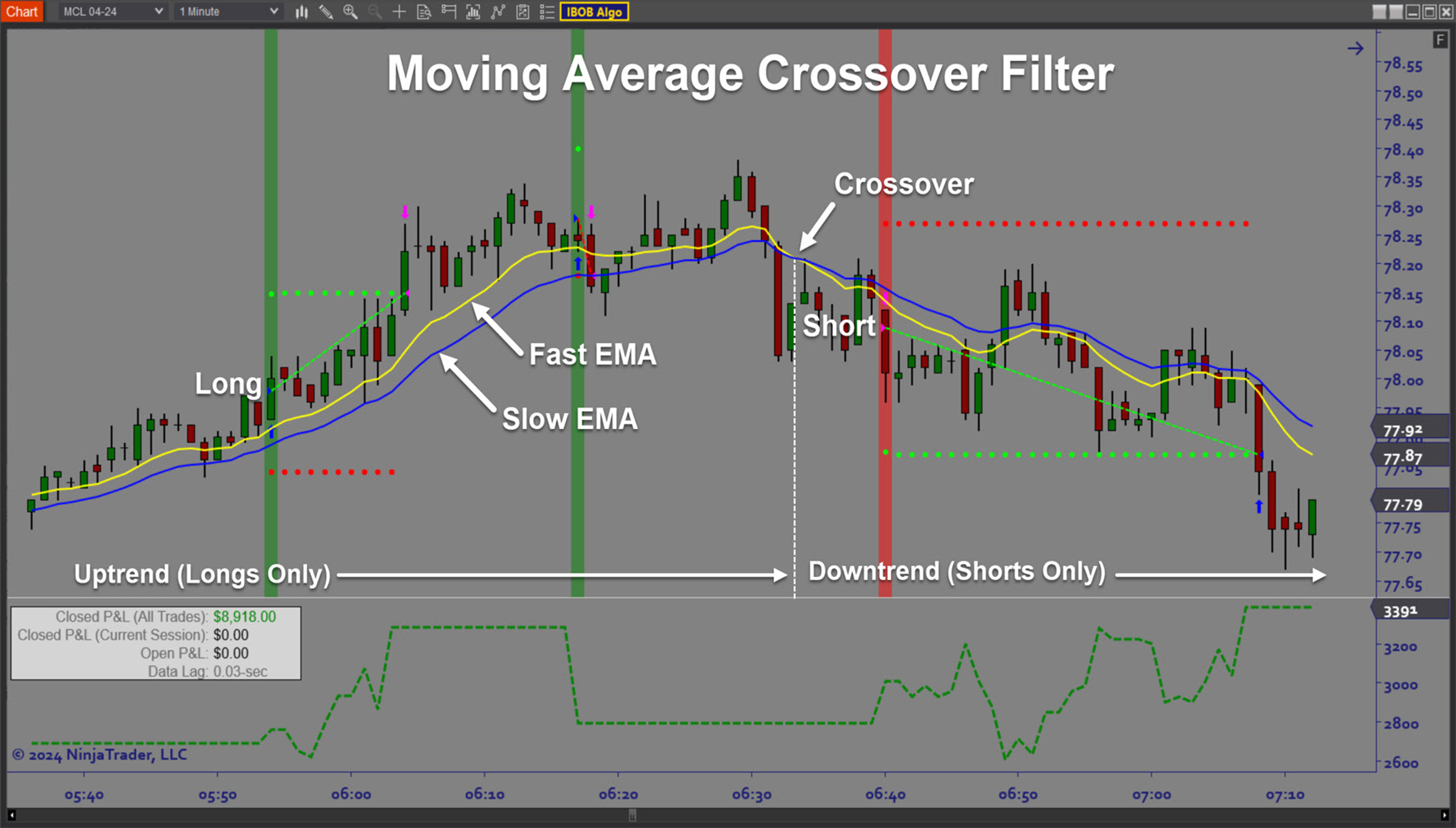

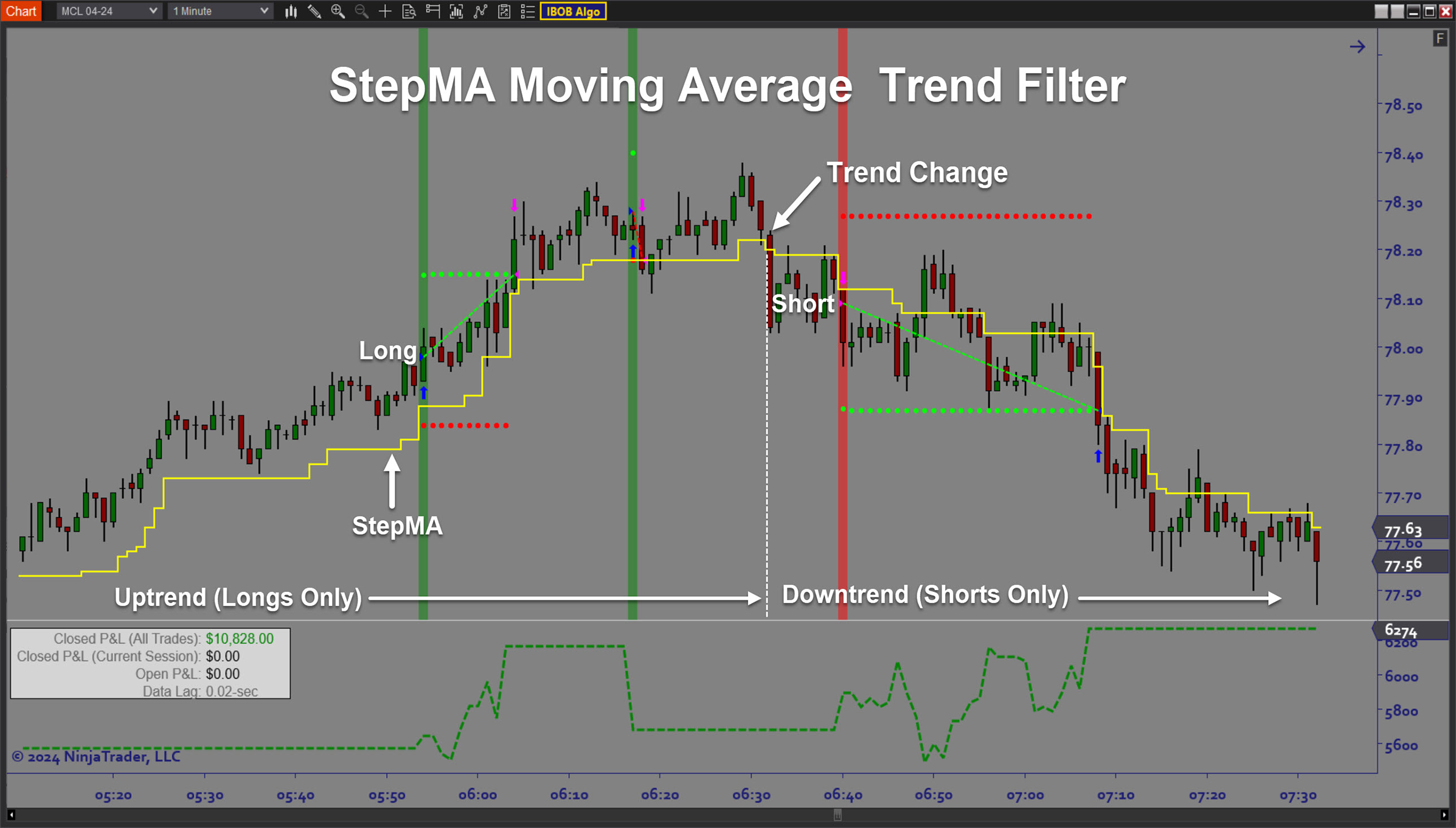

- Comprehensive trend, momentum, and market structure directional filters

- AutoTrail and Breakeven strategies

- R-multiple target placement

- Time filters, Day of Week filters, Holiday filters, and money management function

- On screen trade signals, entry/exit markers, stops/targets, realtime P&L

- Built In Backtesting and Optimization capability

Functions:

The InsideBarOutsideBar Algo is best used by starting with the instruments and timeframes you are typically used to trading. The advantage of price pattern signals is that they are not overly complex, meaning you can use the built-in backtesting and optimization features to quickly customize the trade signals for your favorite instruments. This gives you a good starting point to forward-test your strategy in live simulation mode and make adjustments if necessary. When you have achieved consistency in Sim, you can deploy the algo on your live trading account. You can rely on the automated trading system to follow the signal rules and pre-defined trade plan to the letter, meaning that you can spend more time focusing on testing and improving the strategy as well as periodically adjusting to changing market conditions.

Problem Solved:

- Stops traders from missing out on frequent micro price action patterns

- Stops traders from failing to capitalize on reversal and trend continuation trades

- Stops traders from sabotaging their trading due to indecision and fear

- Stops traders from entering too late and missing out on most of the profits

- Stops traders from dealing with the stress of manual trading

- Stops traders from failing to identify the best days and times to trade

- Stops traders from trading against momentum, market structure, and directional bias

- Stops traders from failing to manage risk appropriately

- Stops traders from failing to adjust to market conditions