CWAP Algo

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

Category: Algos

Tags: Backtesting, CWAP, Market Structure, Micro Volume Analysis, Momentum, Money Management, Reversals, Risk Management, Signals, Standard Deviation, Strategy Development, Trade Management, Trade Performance, Trade Planning, Trade Sizing, Trend Trading, Volume Profile

Description

Overview:

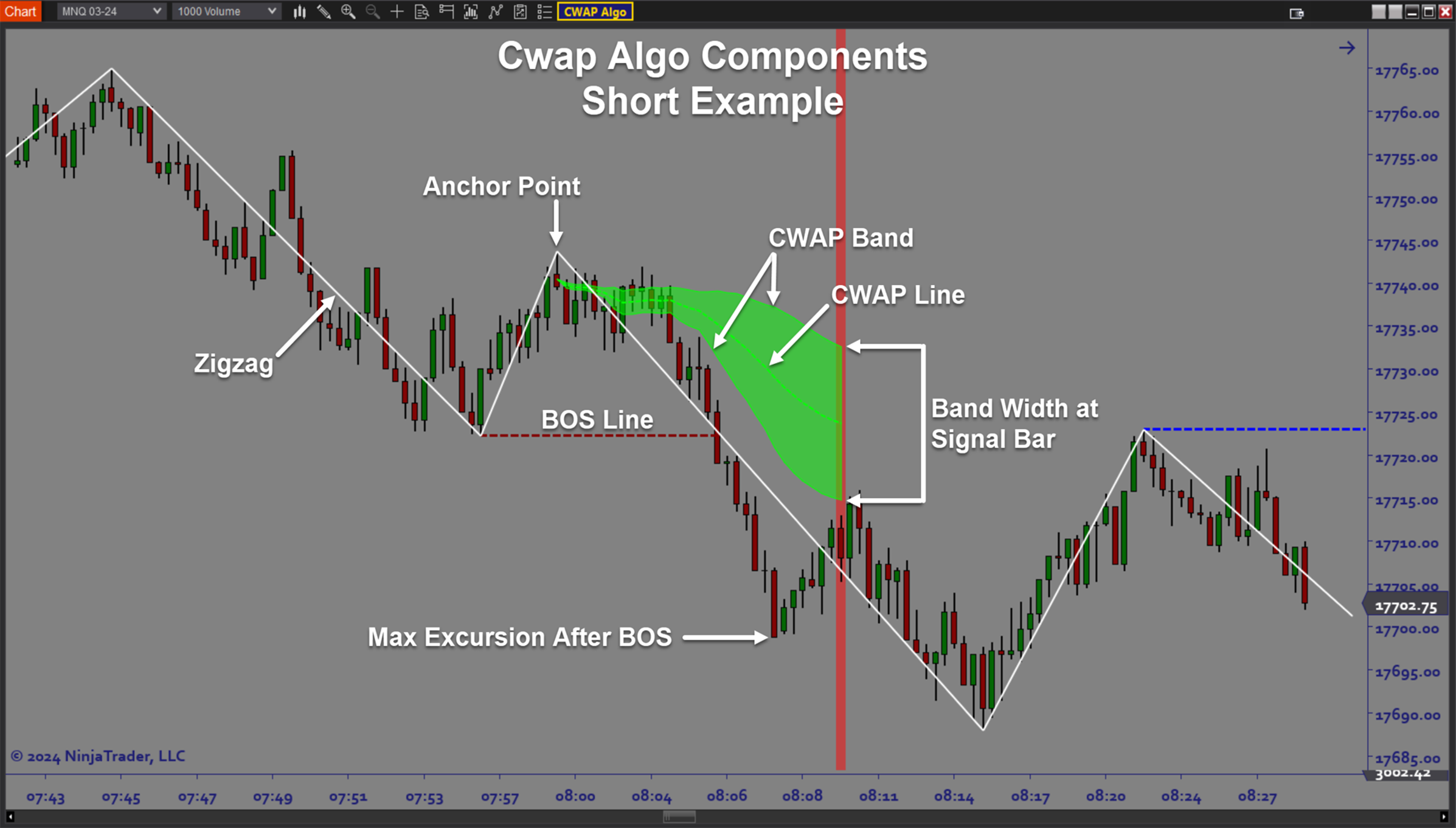

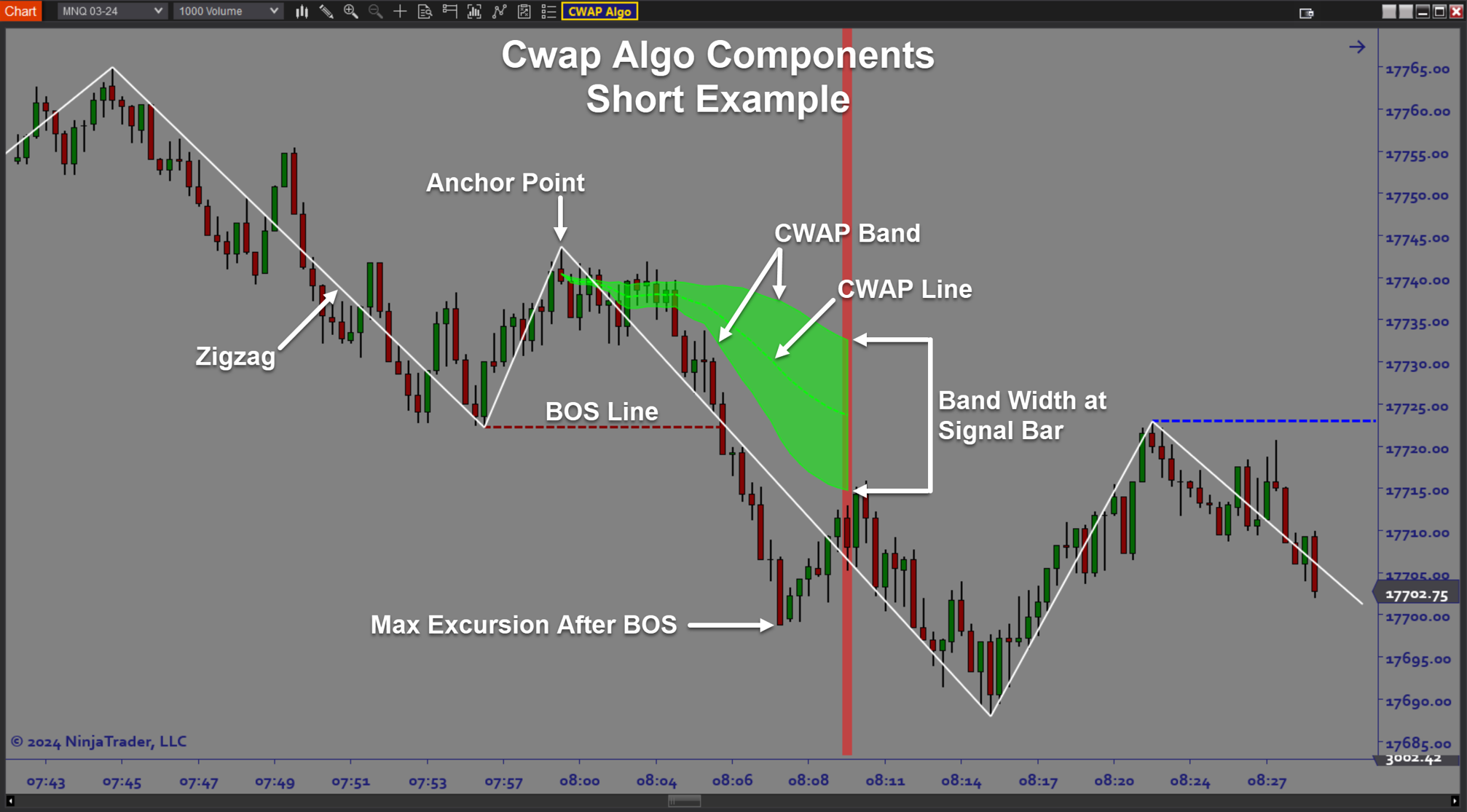

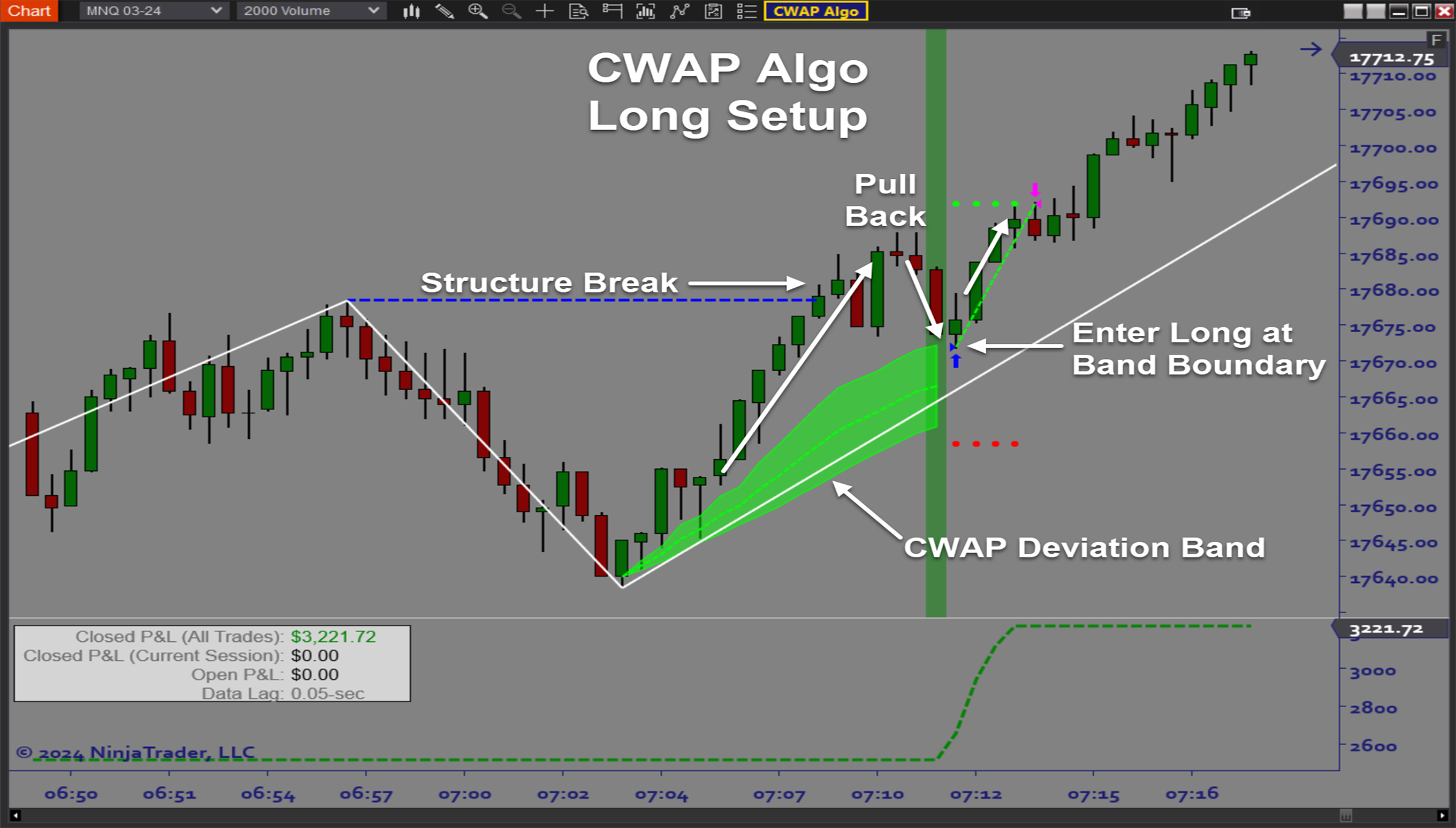

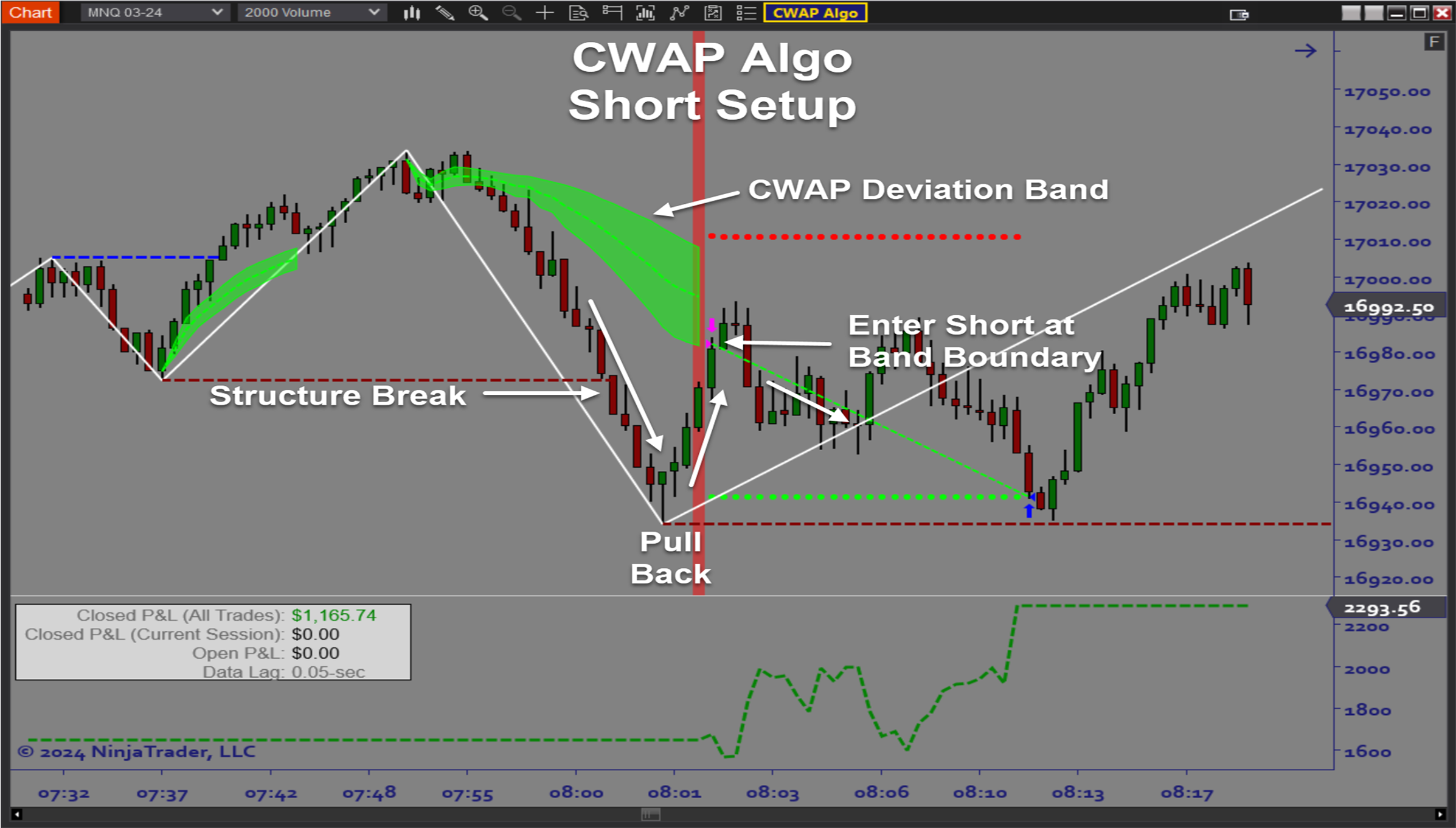

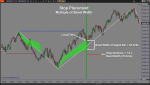

The ARC_CWAP Algo is an automated trading solution for Ninjatrader which uses market structure and statistical analysis of realtime volume profiles to identify and exploit pullback trend trade opportunities. Volume moves the market and market structure reveals directional bias. Combining these 2 important concepts in a trading strategy results in a solid tradable edge that can apply to any market. Even with the right tools, attempting to trade such a strategy manually would be quite difficult. This is because performing the necessary calculations to derive the right entry location and setting the Stop and Target distances consistent with current price action is simply too time consuming to do efficiently without automation. The software is adaptable to any bartype and timeframe as well as to any trading style from micro scalping to larger daytrades.Purpose:

Traders need the CWAP Algo software because manually performing statistical analysis of micro volume patterns and market structure is time consuming and it is difficult to apply without the benefit of trading automation. By allowing the software to perform all the necessary calculations and map out your entire trade plan in the blink of an eye means that you will never miss a trade or leave money on the table by entering too late. Taking advantage of the built in backtesting and optimization functions means that you can customize the strategy to any trading instrument for the best results.Elements:

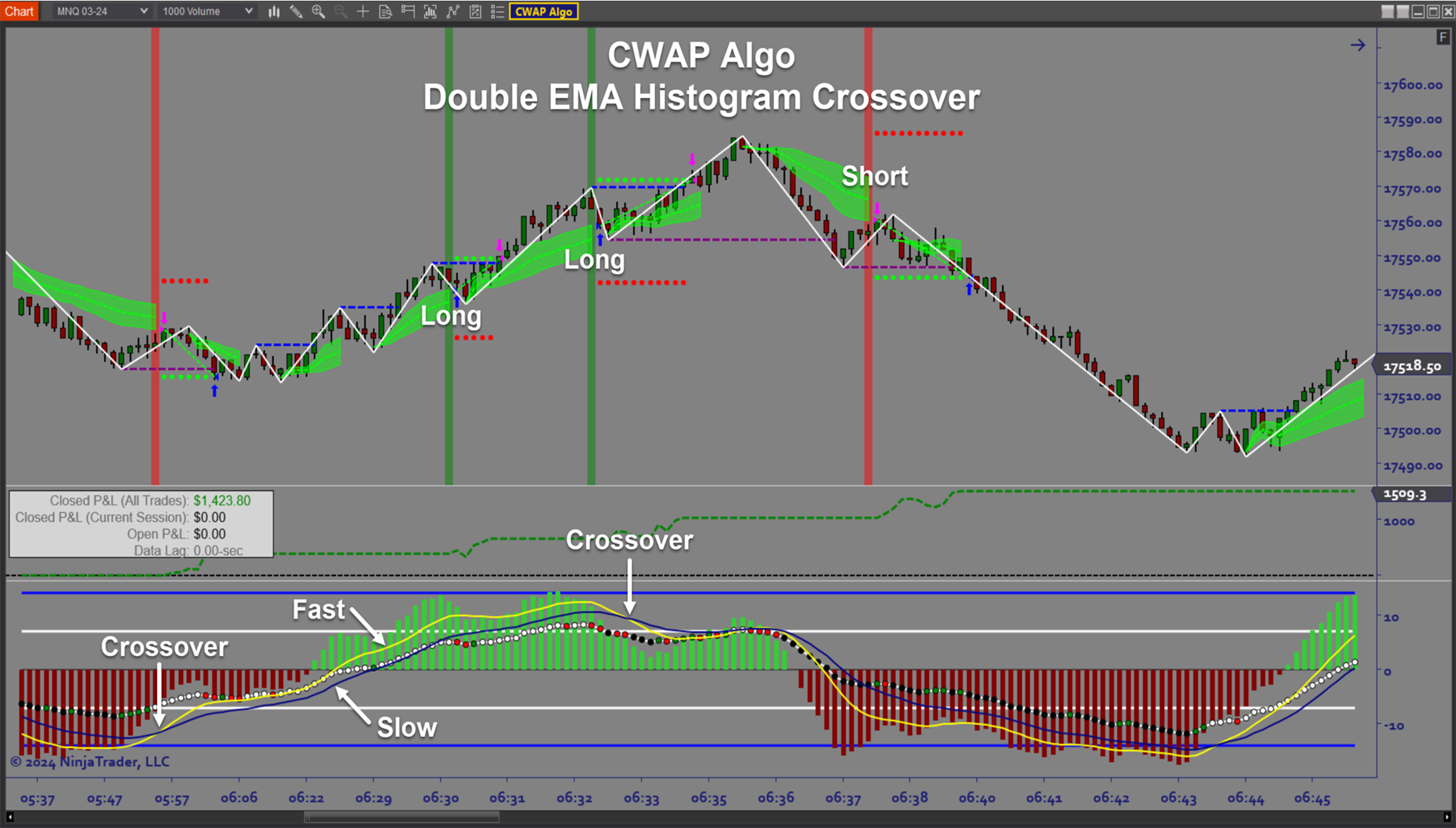

- Trend trade automation using statistical analysis of realtime volume profile and market structure

- Entry locations based on volume cluster analysis

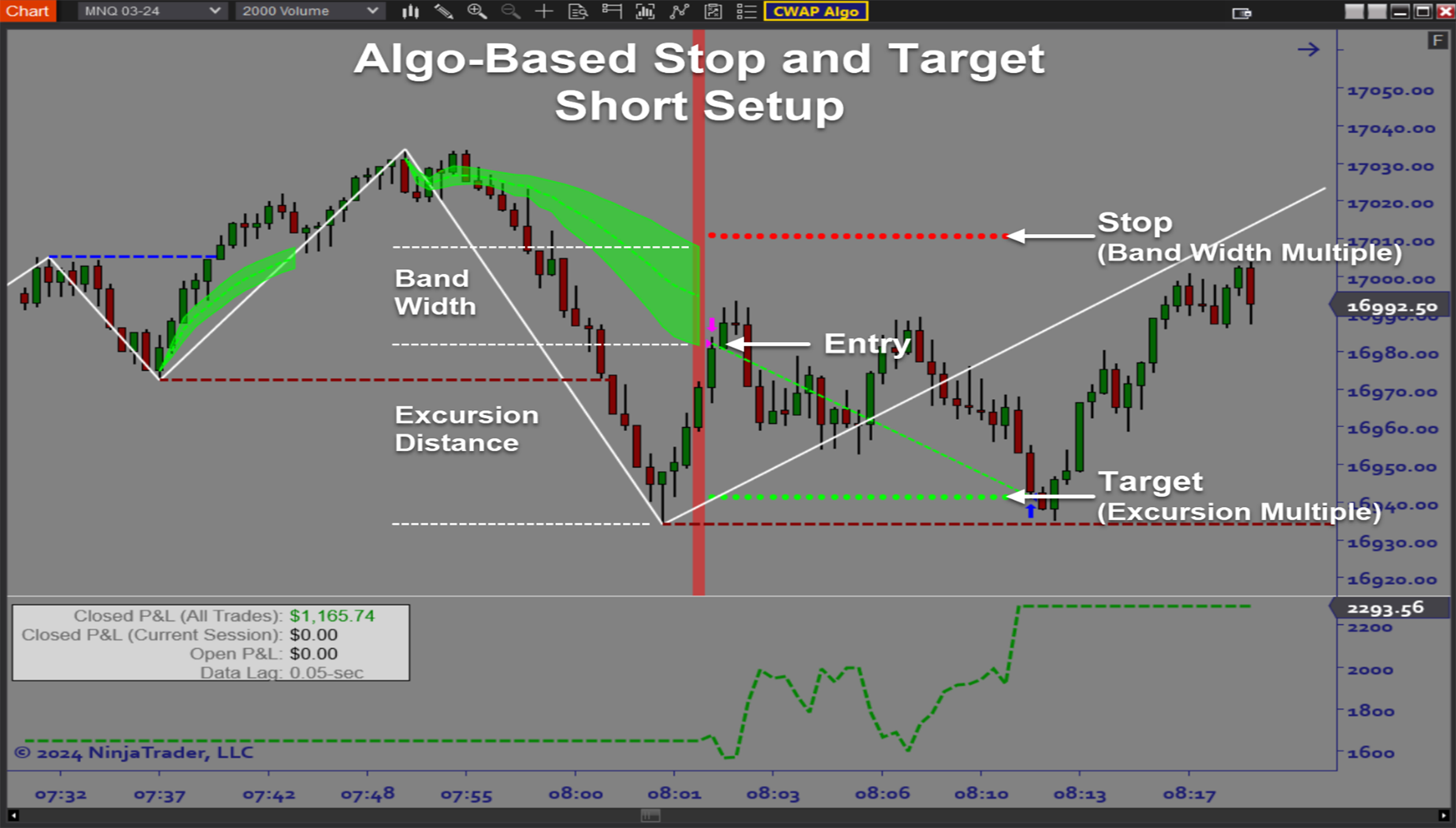

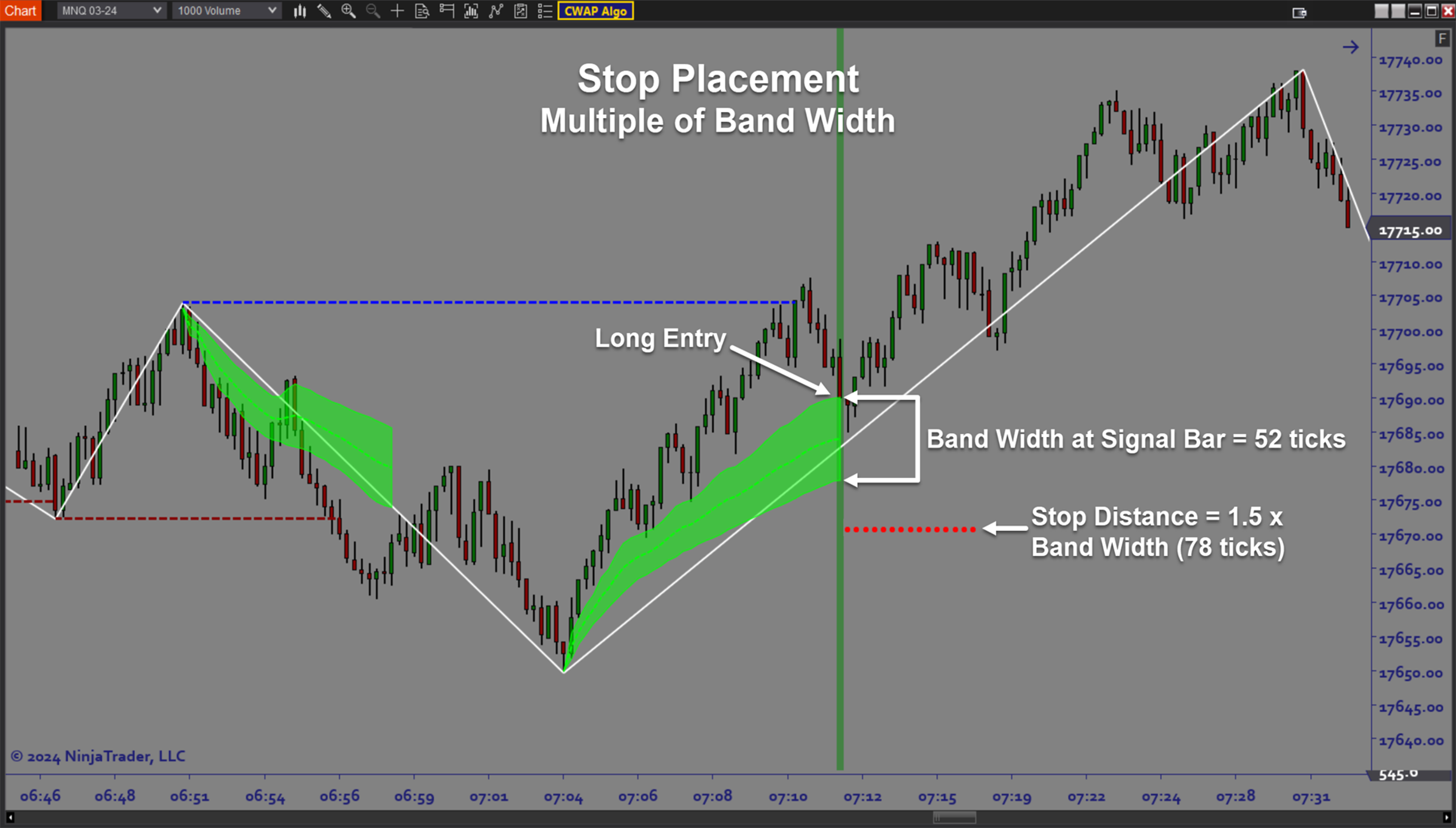

- Stop sizes based on volume and price statistics and current price action

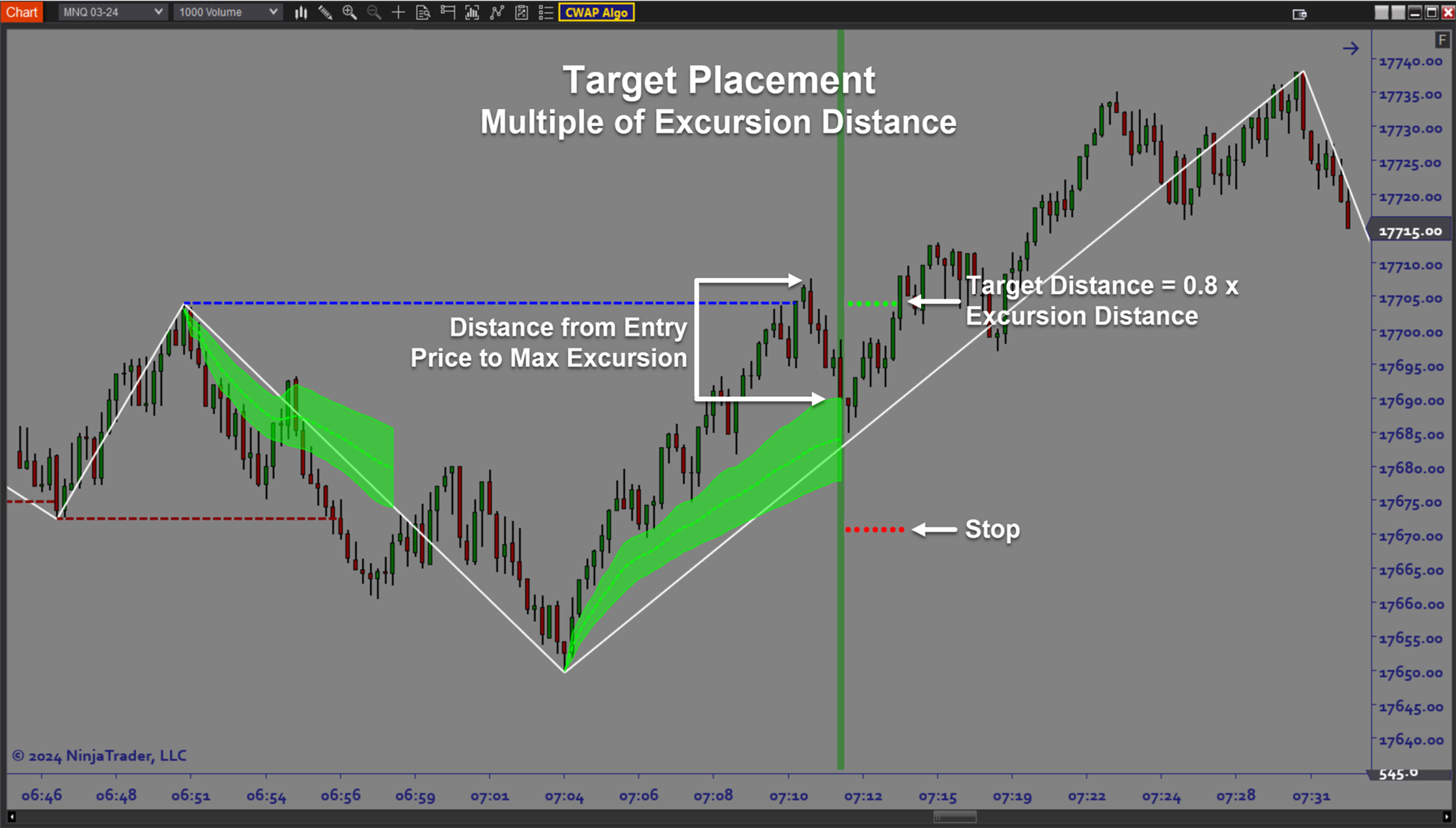

- Targets based on structure pivot points

- Dynamic trade sizing including Fixed Dollar Risk and Percent of Account Balance

- Fully customizable trade setup rules to optimize for any instrument

- Ability to accommodate any trading style from micro scalping to intraday swing trading

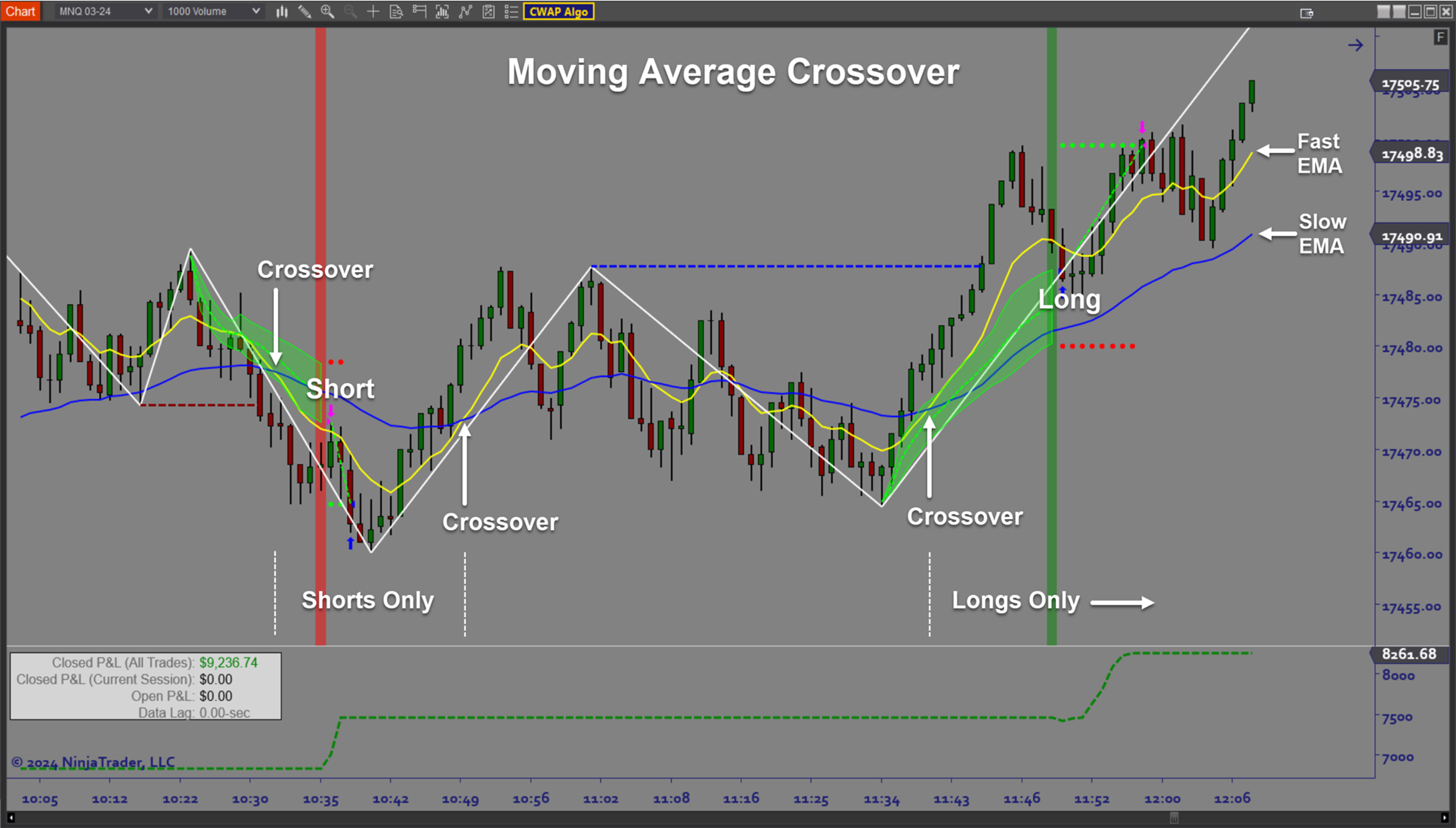

- Comprehensive trend, momentum, and market structure directional filters

- AutoTrail and Breakeven strategies

- R-multiple target placement option

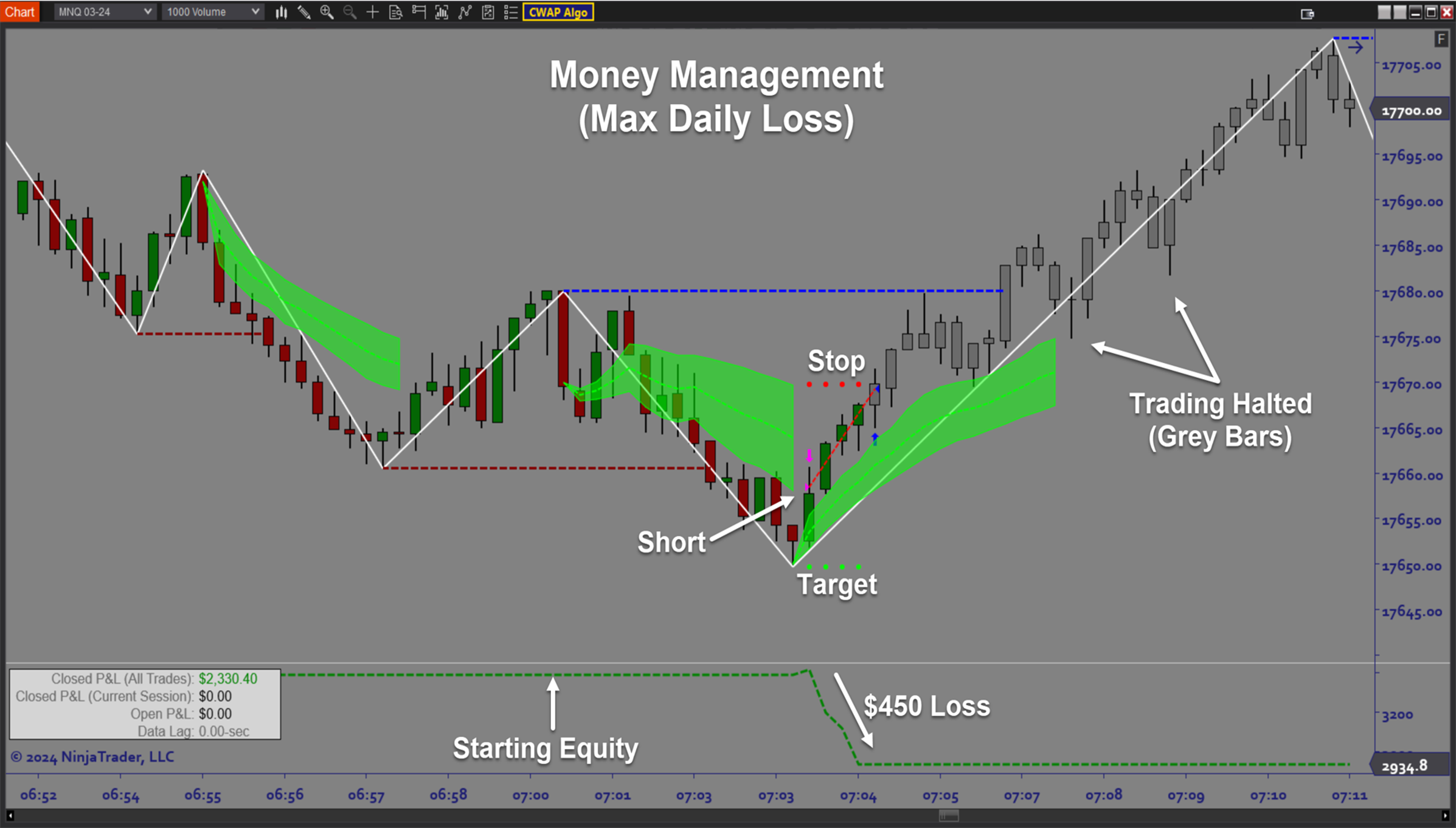

- Time filters, Day of Week filters, and money management

- Ability to exclude specific dates (holidays) from backtest and optimization results

- On screen trade signals, entry/exit markers, stops/targets, realtime P&L

Functions:

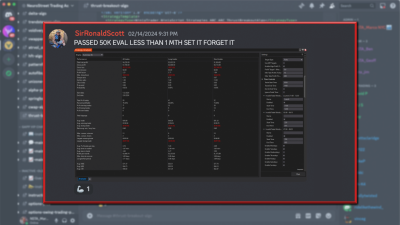

The CWAP Algo is best used by selecting an instrument and timeframe that is consistent with your trading style. Then use the built in optimization capability to get a preliminary strategy configuration. Next forward test your strategy in live simulation mode. You can easily run multiple strategy configurations simultaneously in Sim to find the best profitability. Once you are comfortable with the performance, you can start auto trading a live money account. When market conditions change, it is easy to use the flexibility of the software to adjust to changes in market conditions. Following this approach allows you to focus on strategy development without the stress of live trading. Because the algo software is doing all the heavy lifting, you can devote attention to fine tuning performance over time. In this way, you can always stay on top of the markets.Problem Solved:

- Stops traders from missing out on important trend setups

- Stops traders from ignoring important volume information

- Stop traders from trading against the structure of the market

- Stops traders from entering at the wrong place and time

- Stops traders from guessing when to trade and when to wait

- Stops traders from placing stops that are too large or too small

- Stops traders from allowing winning trades to turn into losers

- Stops traders from sabotaging their trading due to indecision and fear

- Stops traders from dealing with the stress of manual trading

- Stops traders from trading against momentum, market structure, and directional bias

- Stops traders from failing to manage risk appropriately

- Stops traders from failing to identify the best times to trade

- Stops traders from failing to adjust to market conditions