Close Flip Algo

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

Category: Algos

Tags: Algos and Bots, Backtesting, Breakouts, Candle Patterns, Chart Patterns, Market Structure, Momentum, Money Management, Patterns, Reversals, Risk Management, Signals, Strategy Development, Trade Management, Trade Performance, Trade Planning, Trade Sizing, Trend Trading

Description

Overview:

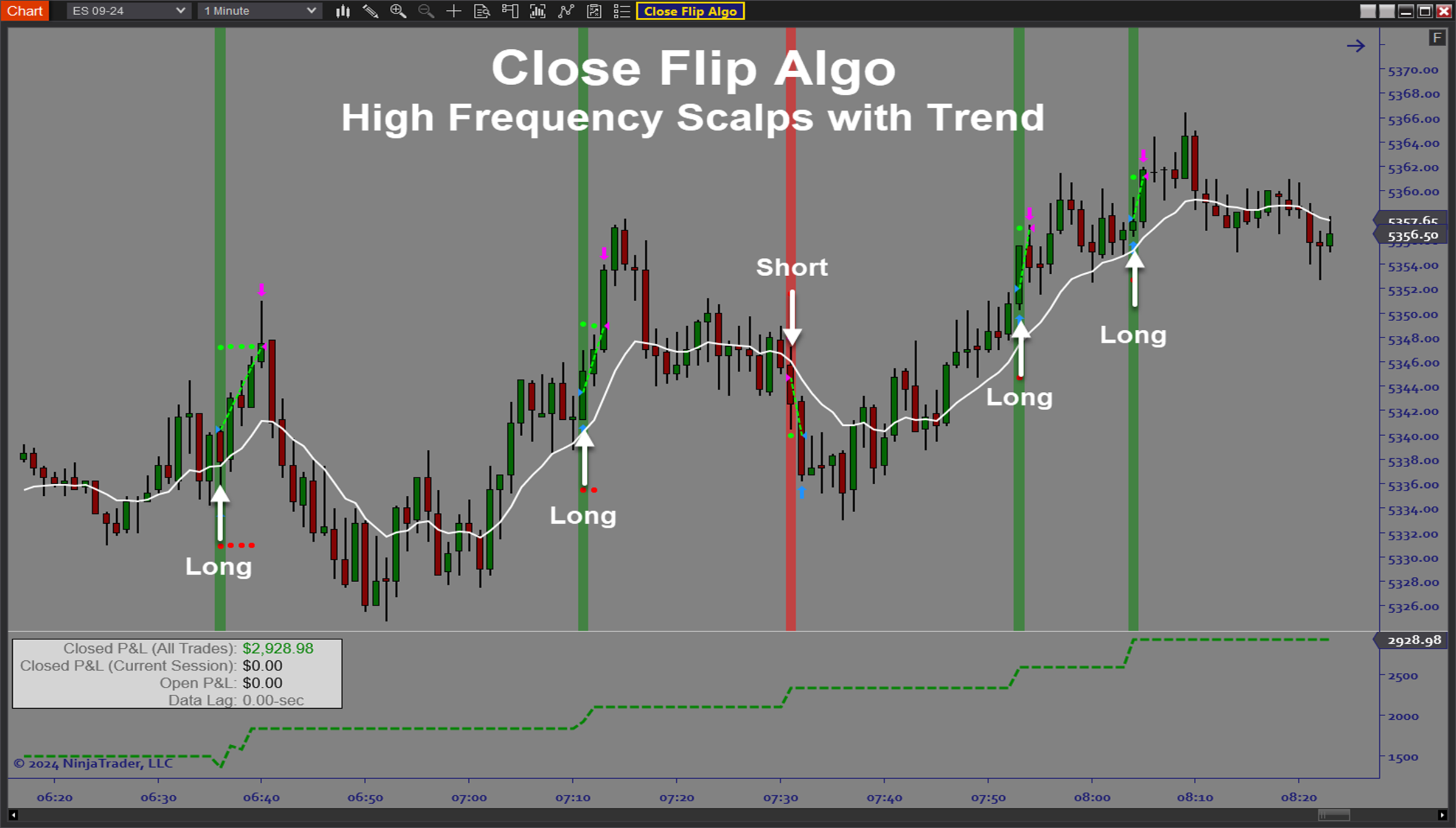

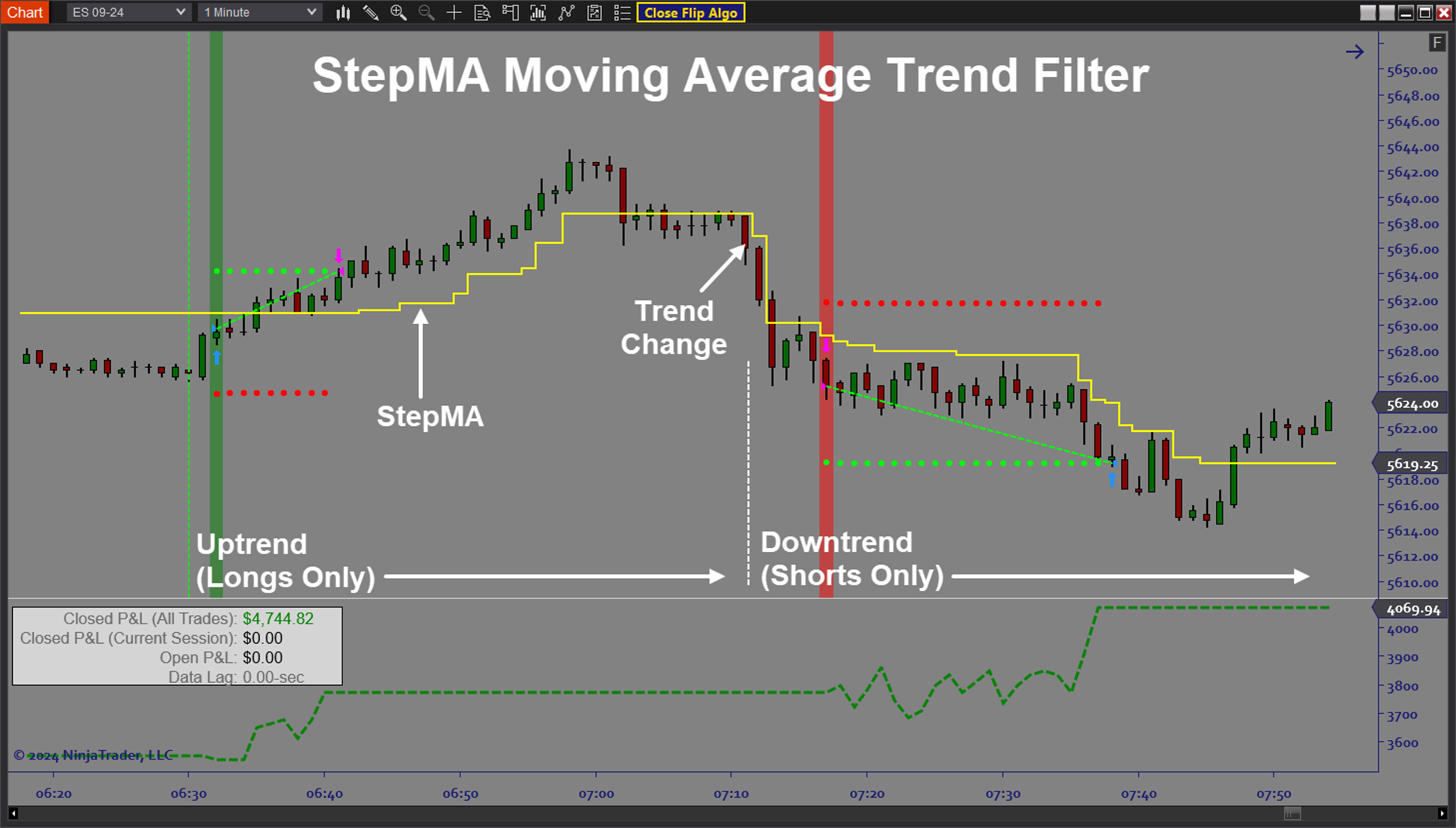

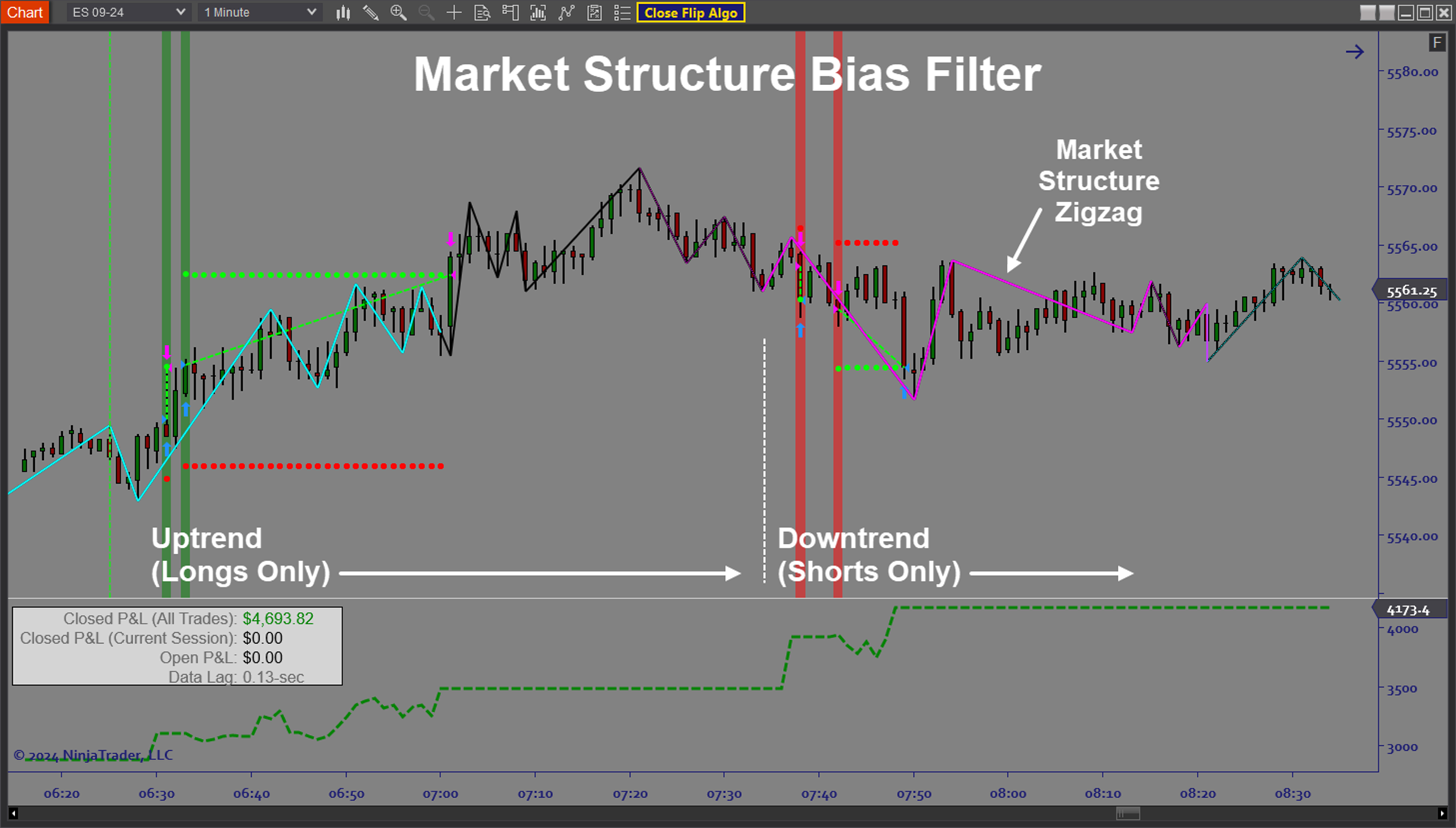

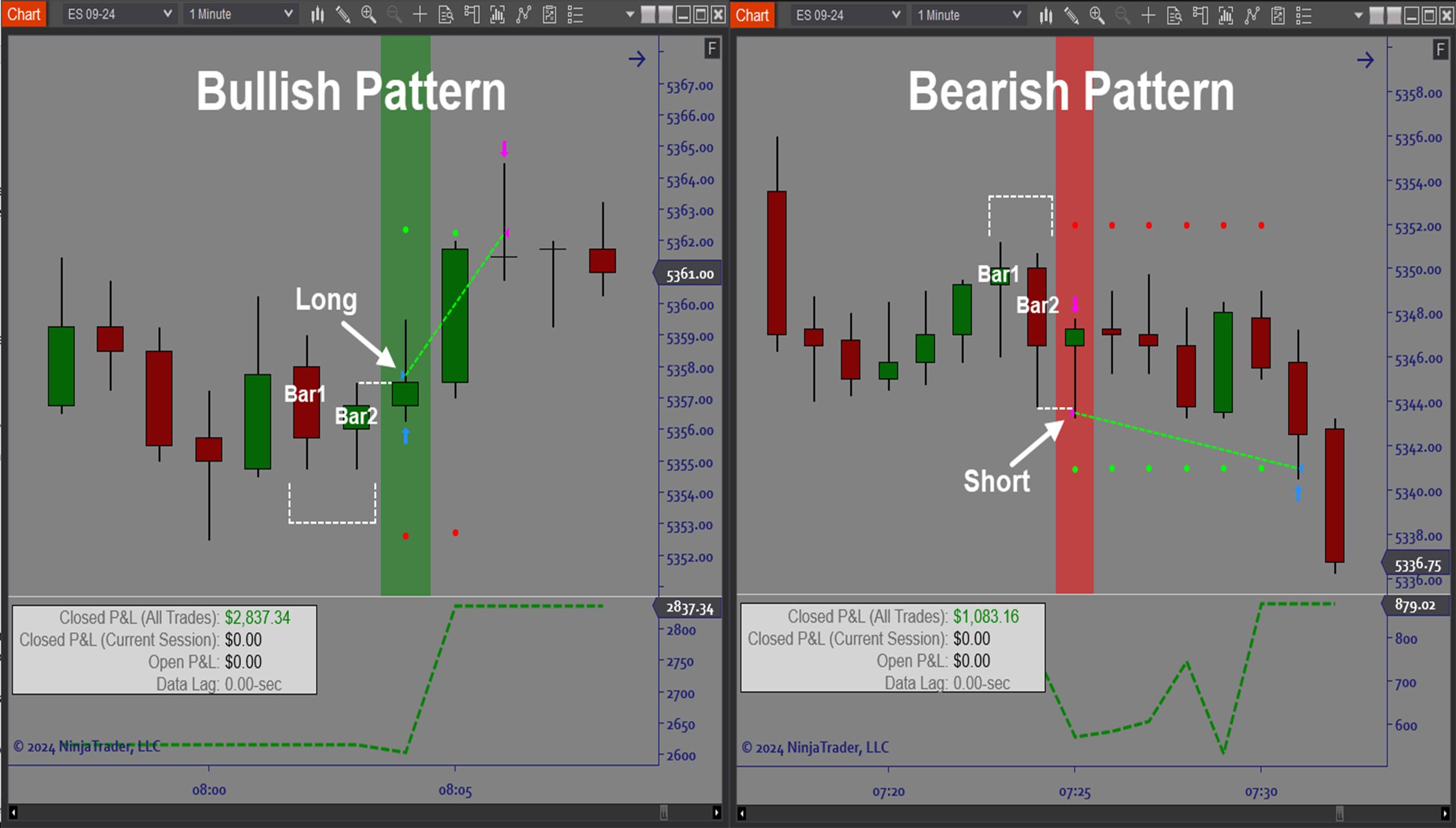

The ARC_Close Flip Algo is an automated trading solution for Ninjatrader which is a high frequency scalping system based on pattern recognition. The system scans for candle patterns that can generate quick scalp trades when a brief pullback is immediately reversed in the direction of the dominant trend. These types of setups occur very quickly and are difficult to trade manually. This is where the benefits of an automated trading system really become apparent. Any attempt to trade such a strategy manually on short timeframes would most likely lag behind the market and miss out on a portion of the profits because human reaction time isn’t quick enough. The software identifies the trade setup and executes the trade immediately, then manages the open position according to a customizable trade plan. While the Close Flip Algo can be used on any timeframe, the efficiency and accuracy of automated execution makes this strategy very well suited for small timeframe scalping.Purpose:

Traders need the ARC_Close Flip Algo software because automating pattern recognition is the best way to capture the most profit possible when candle pattern setups occur. Recognizing the pattern in real time with the naked eye is very difficult, especially in fast markets. In addition to providing excellent trade setups, the software includes a wide variety of customizable settings and filters making it easy to customize the autotrader to your favorite trading instruments.Elements:

- Autotrade Bar Flip daytrading setups on any timeframe

- Use a wide range of settings to determine trade frequency, including high frequency capability

- Capture profits from quick reversals within the dominant trend

- Leverage customizable signal generator settings for the best performance

- Define entry conditions to your desired level of confirmation before allowing the algo to take action

- Automatically adjust stop sizes consistent with current price action

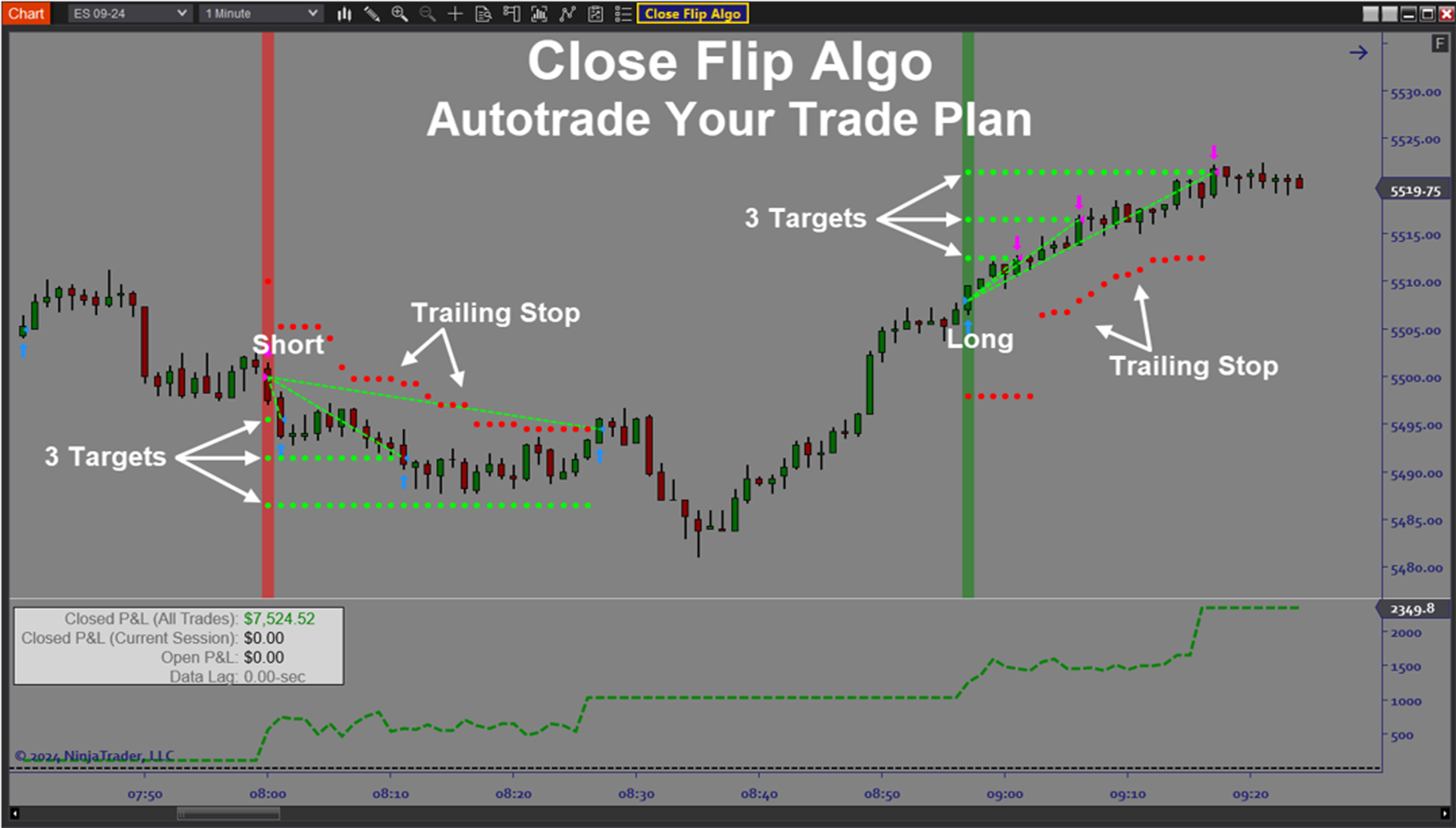

- Apply fully automated trade plans with stop placement and up to 3 targets

- Utilize dynamic trade sizing to control Dollar Risk per trade

- Utilize R-multiple target placement

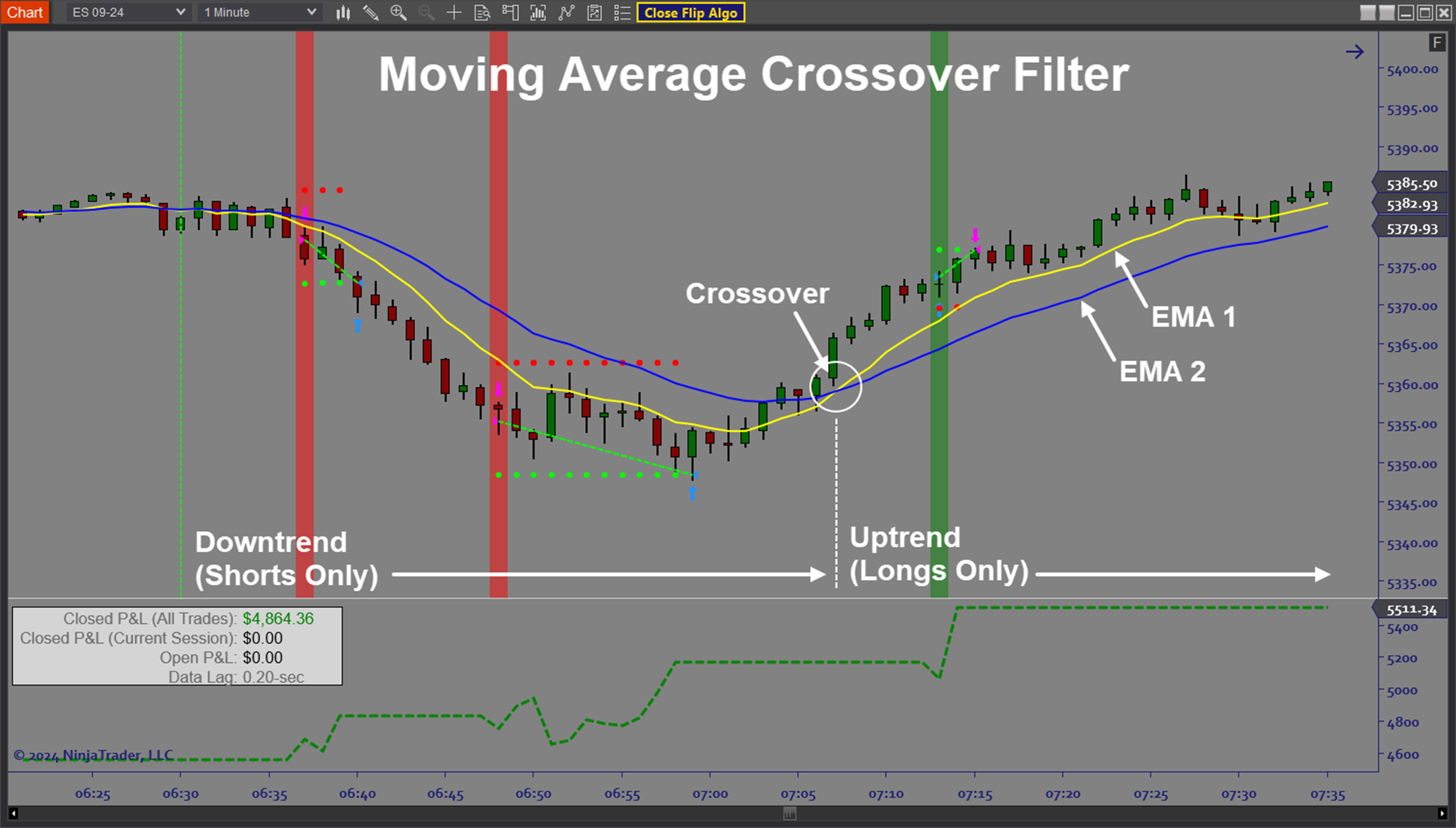

- Comprehensive trend, momentum, and market structure directional filters

- AutoTrail and Breakeven strategies

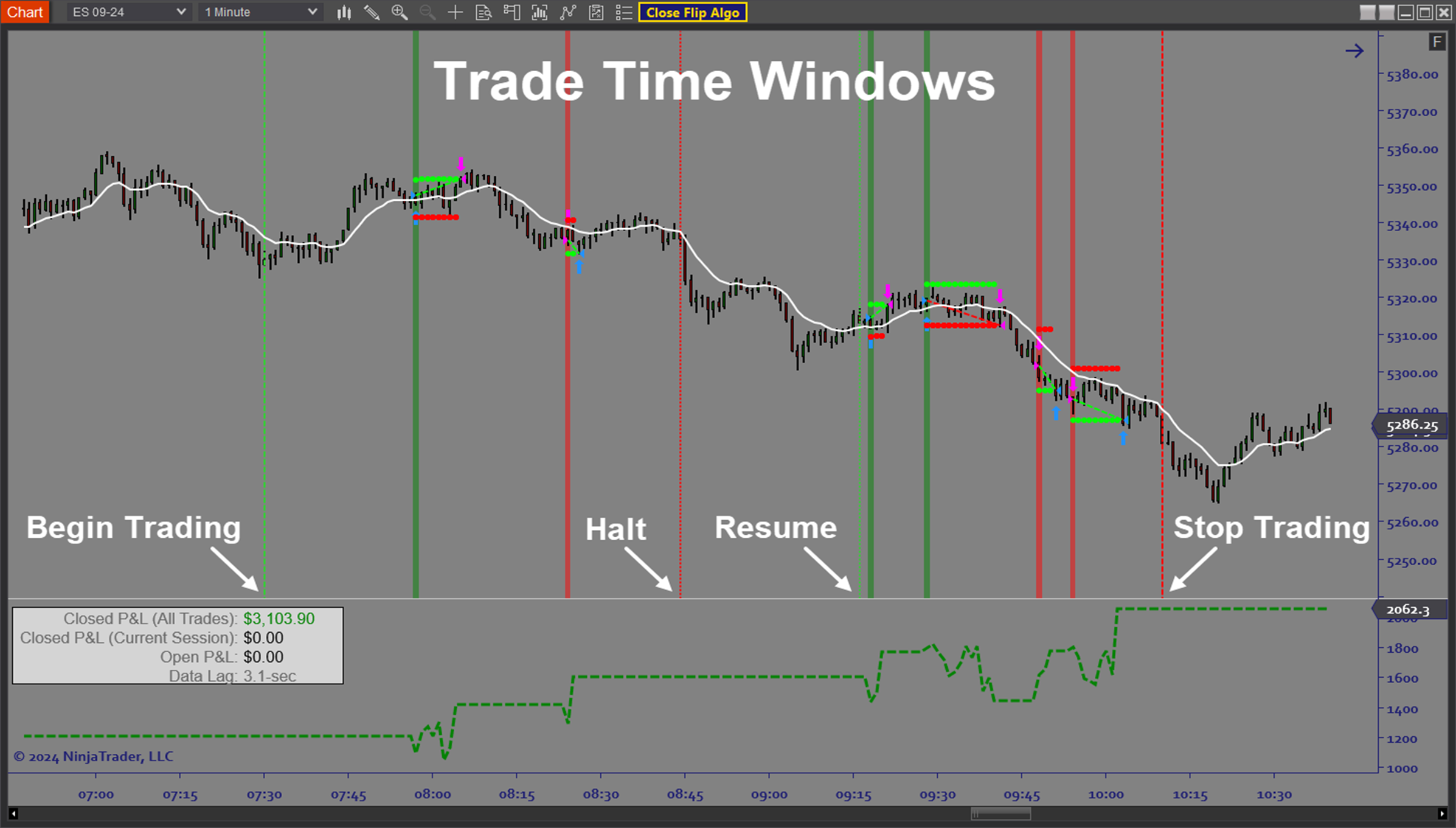

- Time filters, Day of Week filters, Holiday filters, and money management function

- Built in trade signal graphics, execution markers, stop/target graphics, realtime P&L

- Built In Backtesting and Optimization capability

Functions:

The Close Flip Algo is best used by first defining your desired level of autotrading activity. Because the core signal pattern occurs quite frequently, the inclusion of a wide range of signal filters makes it possible to configure the system for high frequency, normal daytrading, or even low frequency-high probability trade setups. Once you know this, you can use the multiple signals filters to create a system that fits your preferred trading style. Take advantage of the built-in backtesting and optimization capability to find profitable settings. Once you have a profitable backtest, it is best to test your strategy in Sim first. Then when you have achieved consistency in Sim, you can deploy the algo on your live trading account. The automated trading system will follow the signal rules and pre-defined trade plan exactly as configured, so you don’t have to worry about execution and can focus on improving performance as well as periodically adjusting to changing market conditions.Problem Solved:

- Stops traders from missing scalp setups that are difficult to trade manually

- Stops traders from trading without a well defined trade plan

- Stops traders from getting in too late

- Stops traders from dealing with the stress of manual trading

- Stops traders from sabotaging their trading due to indecision and fear

- Stops traders from failing to adjust to market conditions

- Stops traders from trading against the dominant trend

- Stops traders from failing to adjust their strategy to the instrument being traded

- Stops traders from trading without any data-driven optimization of strategy settings

- Stops traders from failing to identify the best days and times to trade

- Stops traders from failing to manage risk properly

- Stops traders from trading against momentum, market structure, and directional bias

- Stops traders from trading without a good and easy way to compare performance of different strategies