Overview:

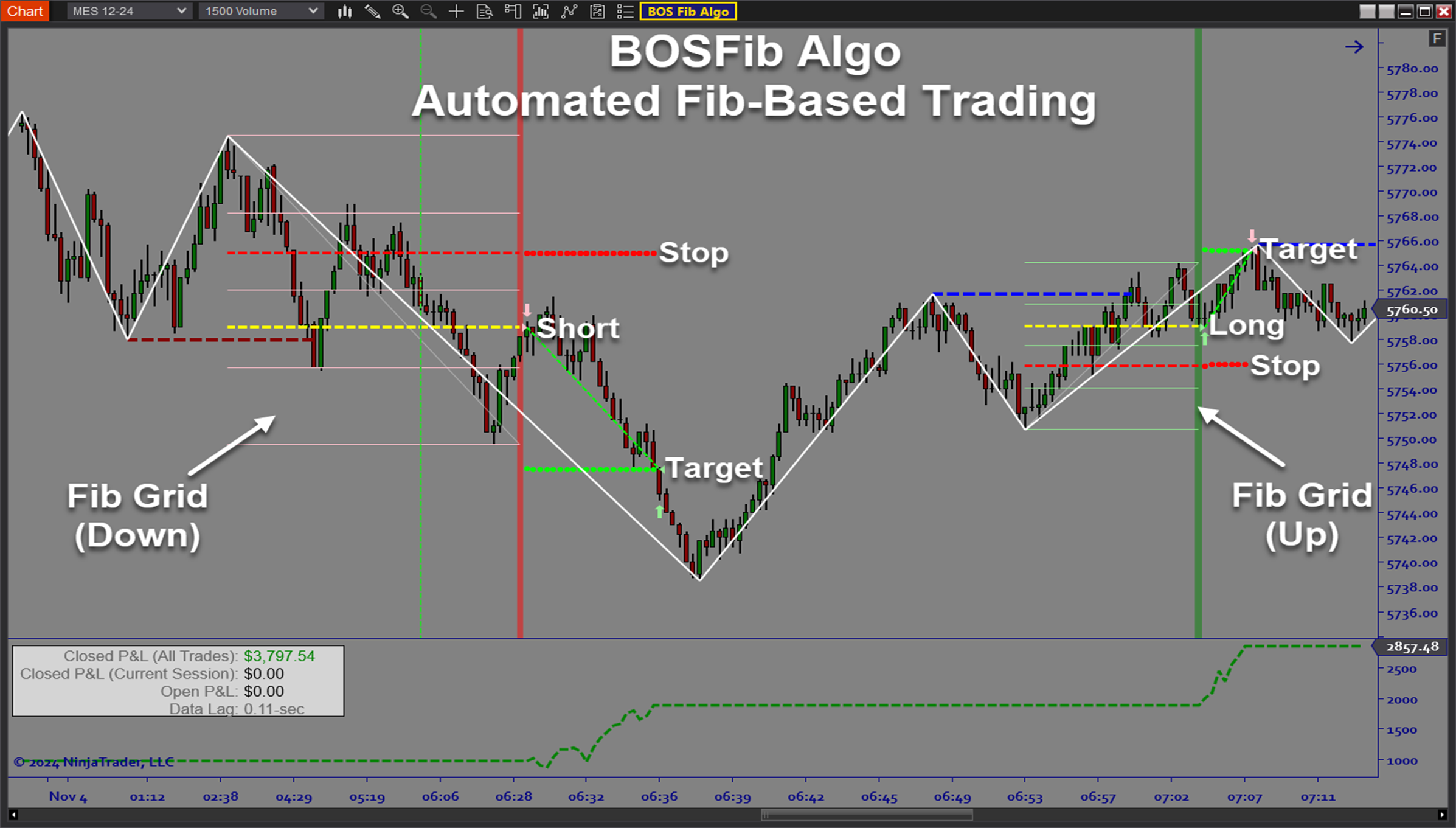

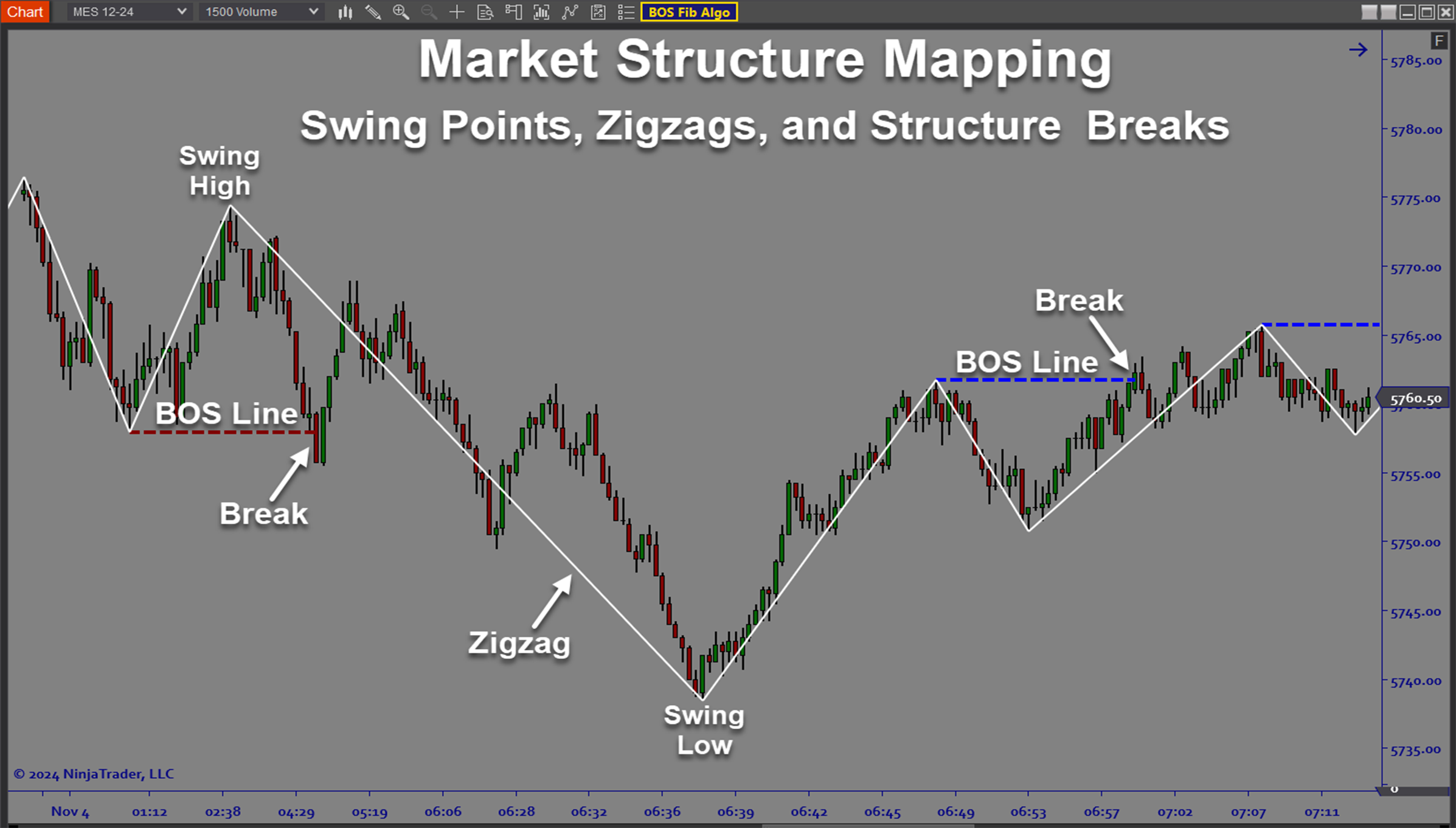

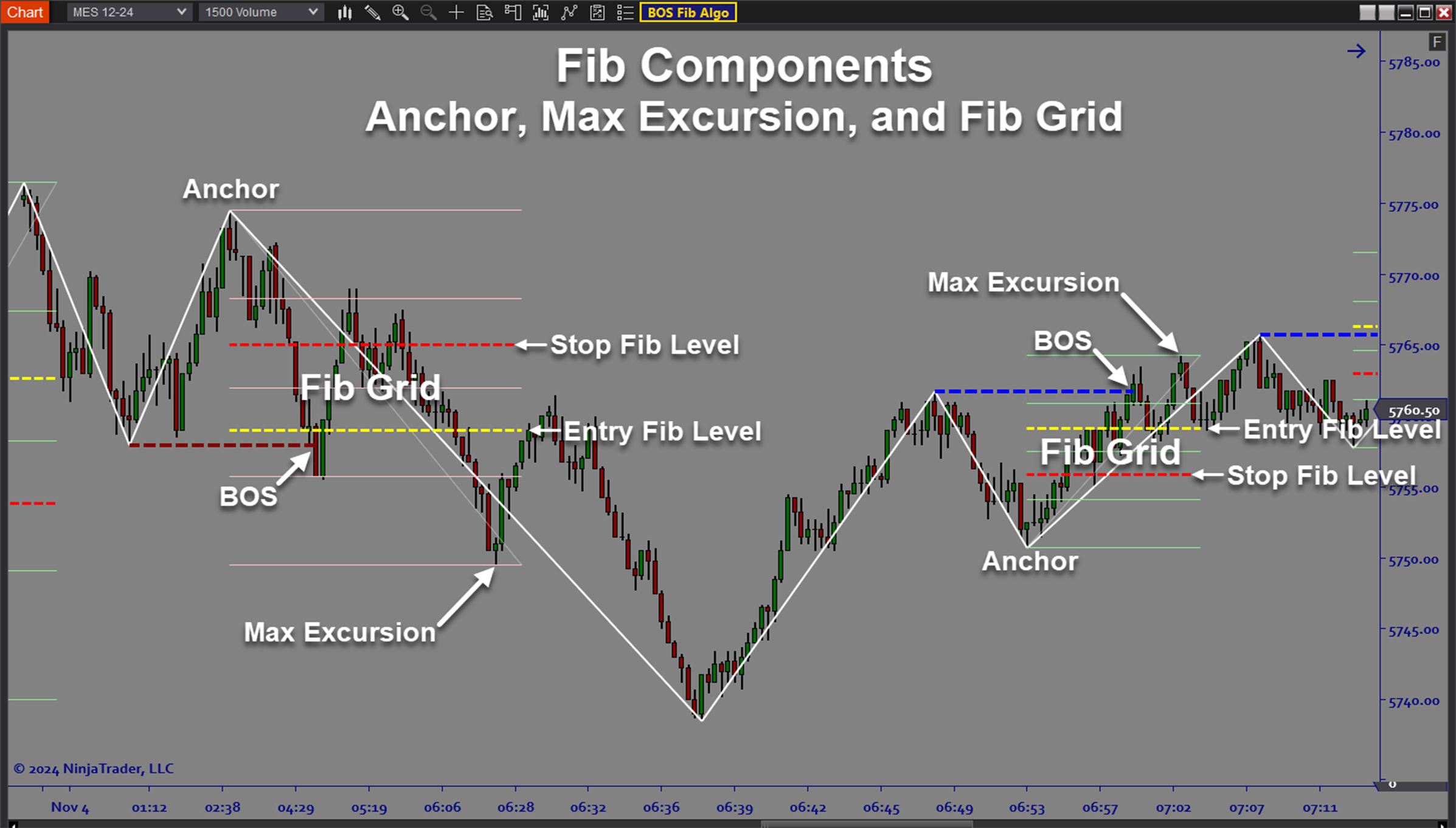

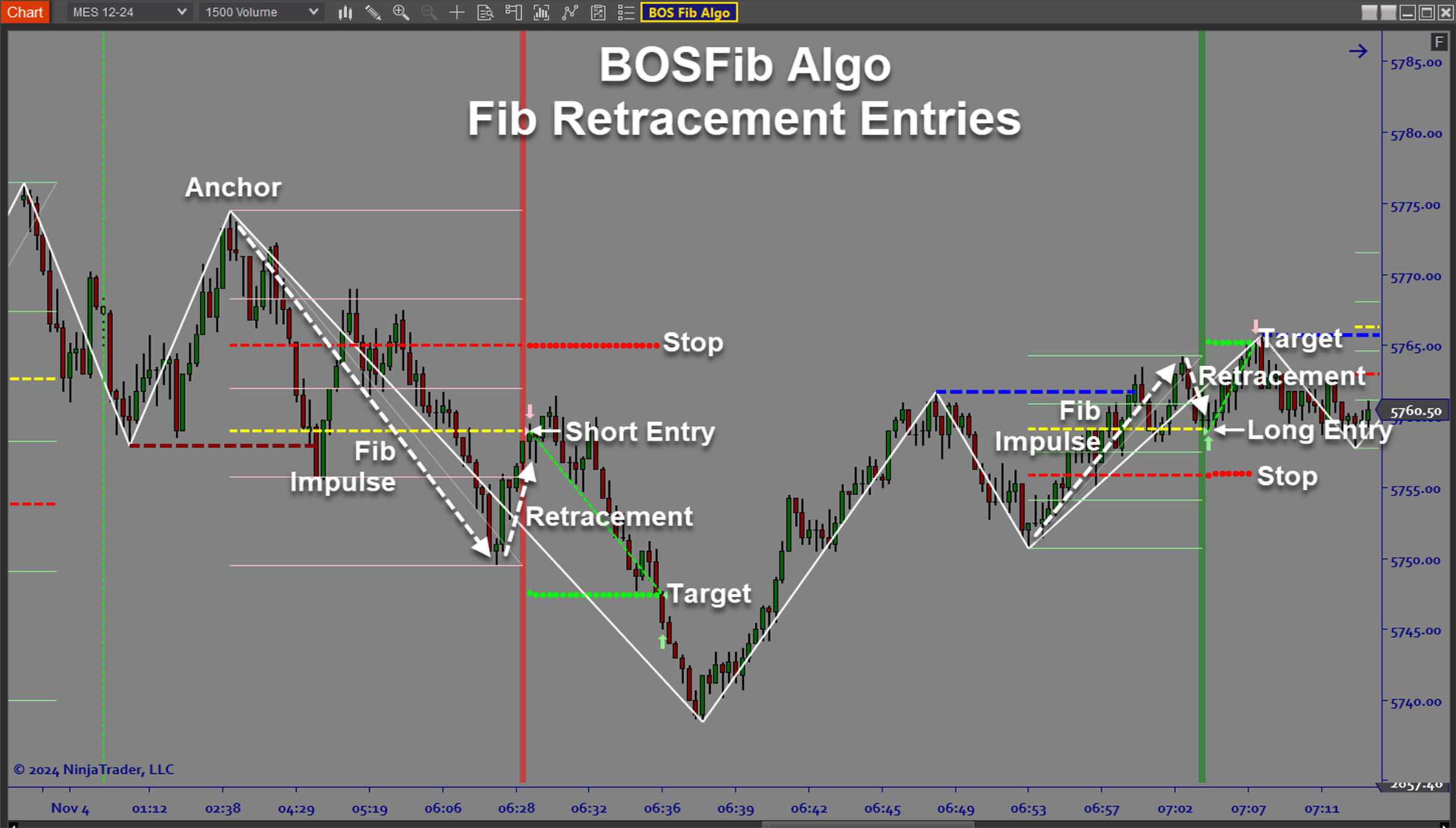

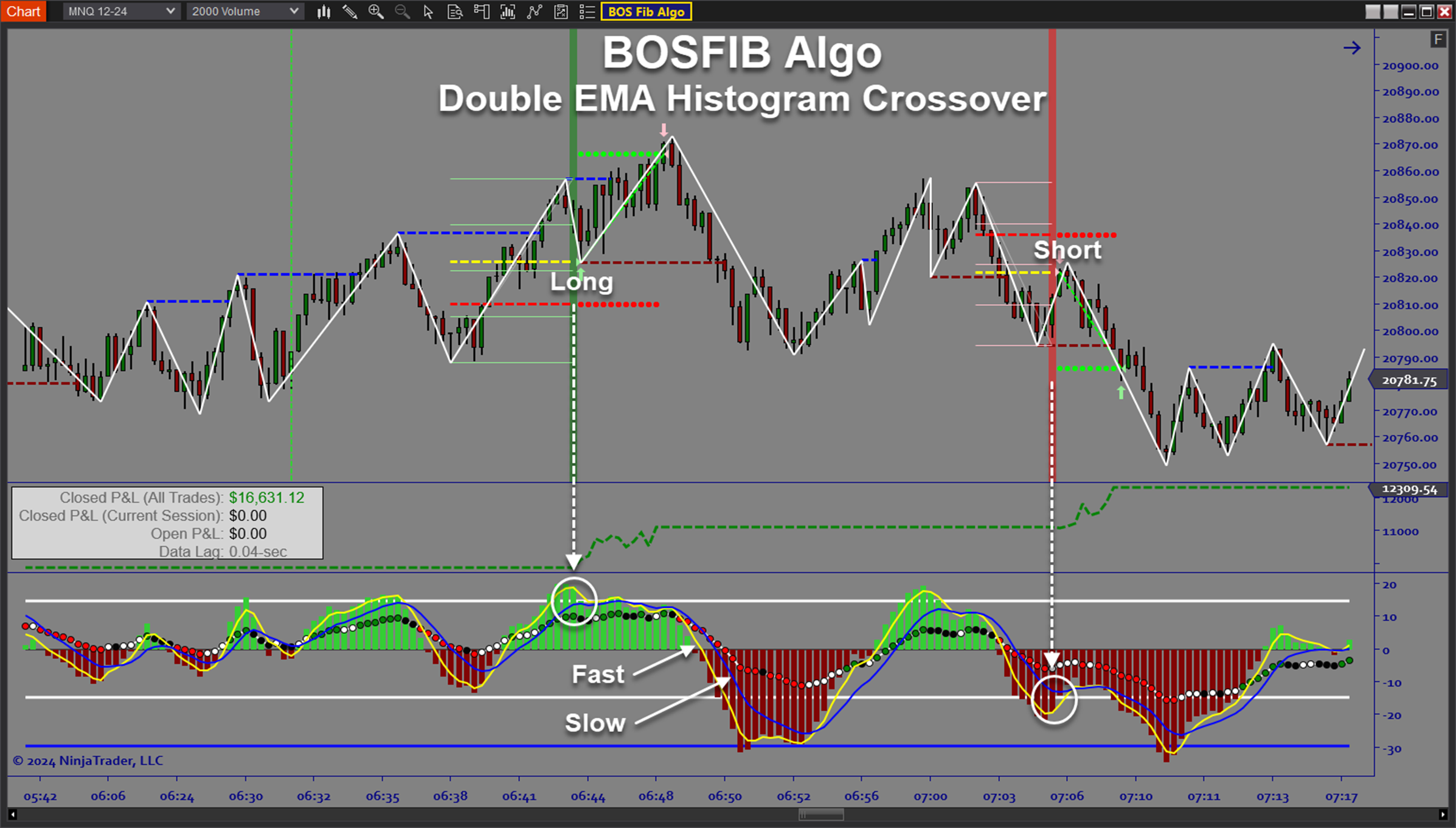

The ARC_BOSFib Algo is an automated trading solution for Ninjatrader which combines market structure and Fibonacci retracement concepts to automate pullback trend trade setups. The analysis of market structure provides a good way to determine the directional bias of the market and traders often use this to ensure that they are not trading against the trend. “The trend is your friend” but markets never move in a straight line. There are always pullbacks within a trend. One of the most important questions to answer is where and when to enter while the trend is unfolding. That is where Fibonacci analysis comes in. Fibonacci retracement levels can be used for entry locations on pullbacks within a larger trending move. The software requires a break of structure (BOS) before allowing pullback entries at Fibonacci levels (Fib). The end result is the “BOSFib” Algo which is an excellent autotrading system for trend traders.

Purpose:

Traders need the ARC_BOSFib Algo software because manually calculating good entry points and stop placement using Fib retracement analysis can be difficult and inconsistent, especially in fast markets. The software automatically plots the correct levels and executes the trades in realtime. Once you have established the best settings for each market, you know that the software will consistently deploy your trade plan exactly to your specifications without hesitation. In this way you can let the software do the hard work while you have complete control.

Elements:

- Autotrade pullback trend trades based on Fibonacci retracement

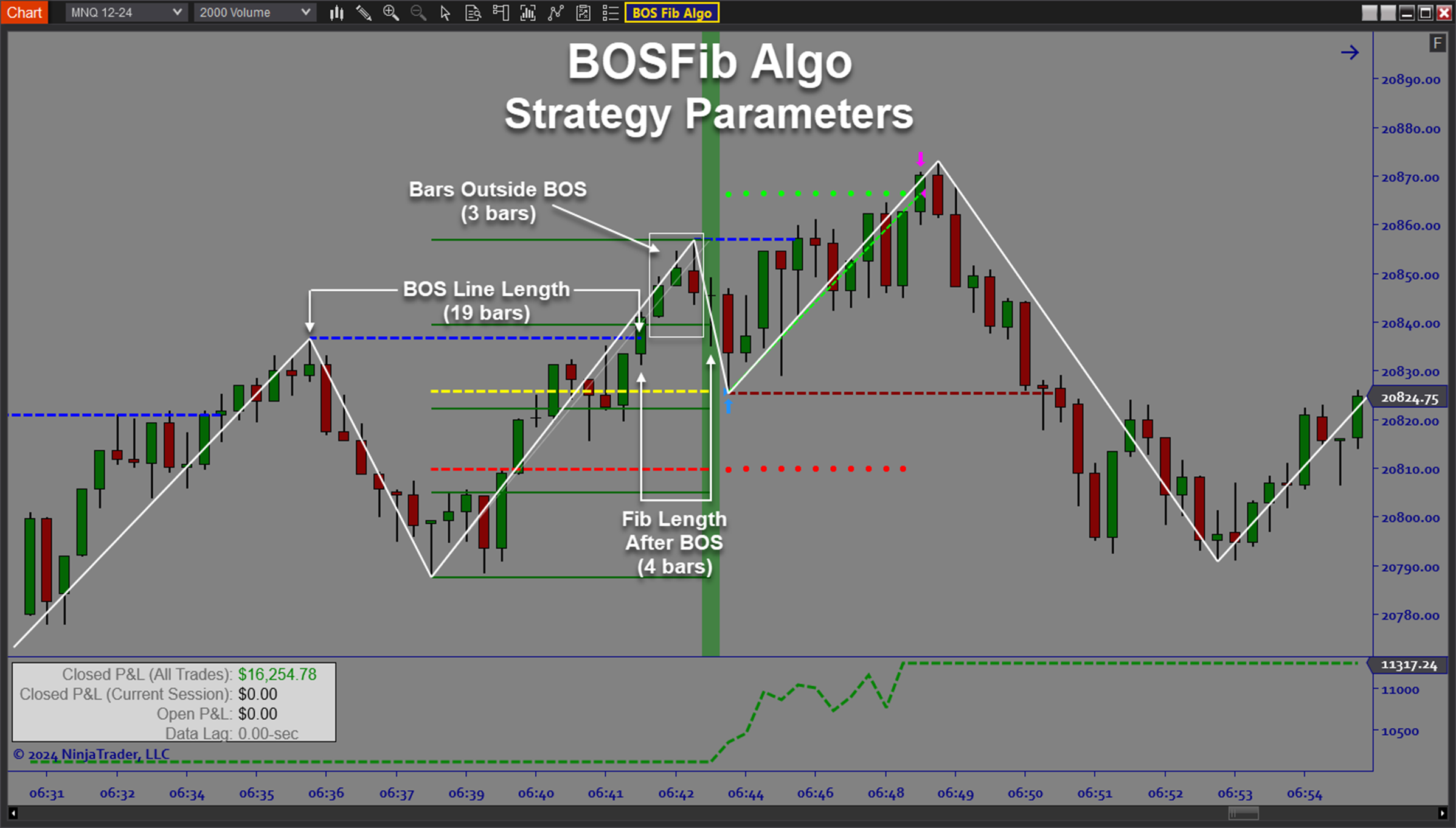

- Control the frequency and type of trade signals with just a handful of settings

- Customize Entry location and Stop placement based on Fibonacci analysis

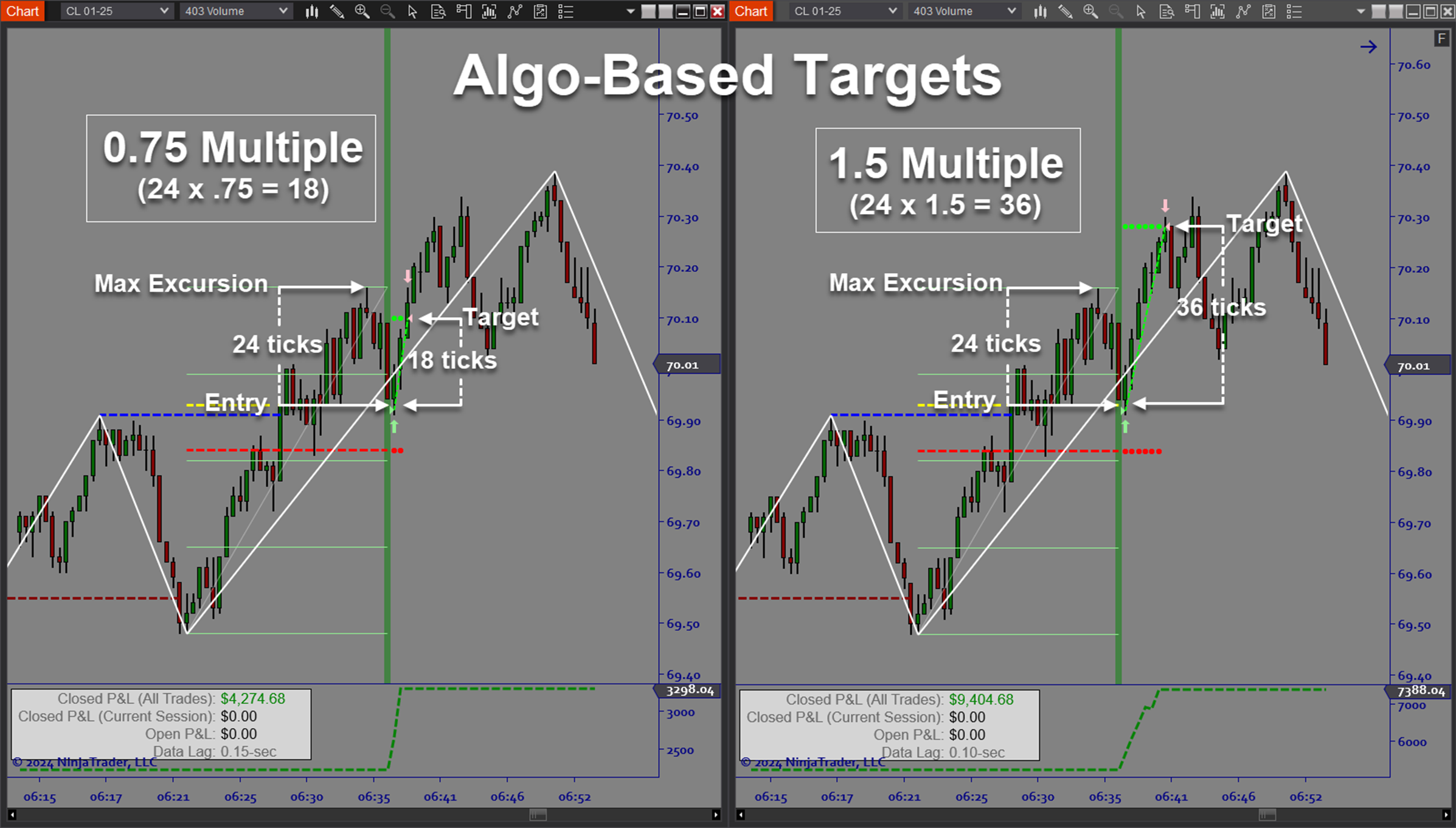

- Customize Target placement based on Fibonacci and market structure analysis

- Utilize optimization functionality to get the best signals

- Apply fully automated trade plans with stop placement and up to 3 targets

- Utilize R-multiple target placement

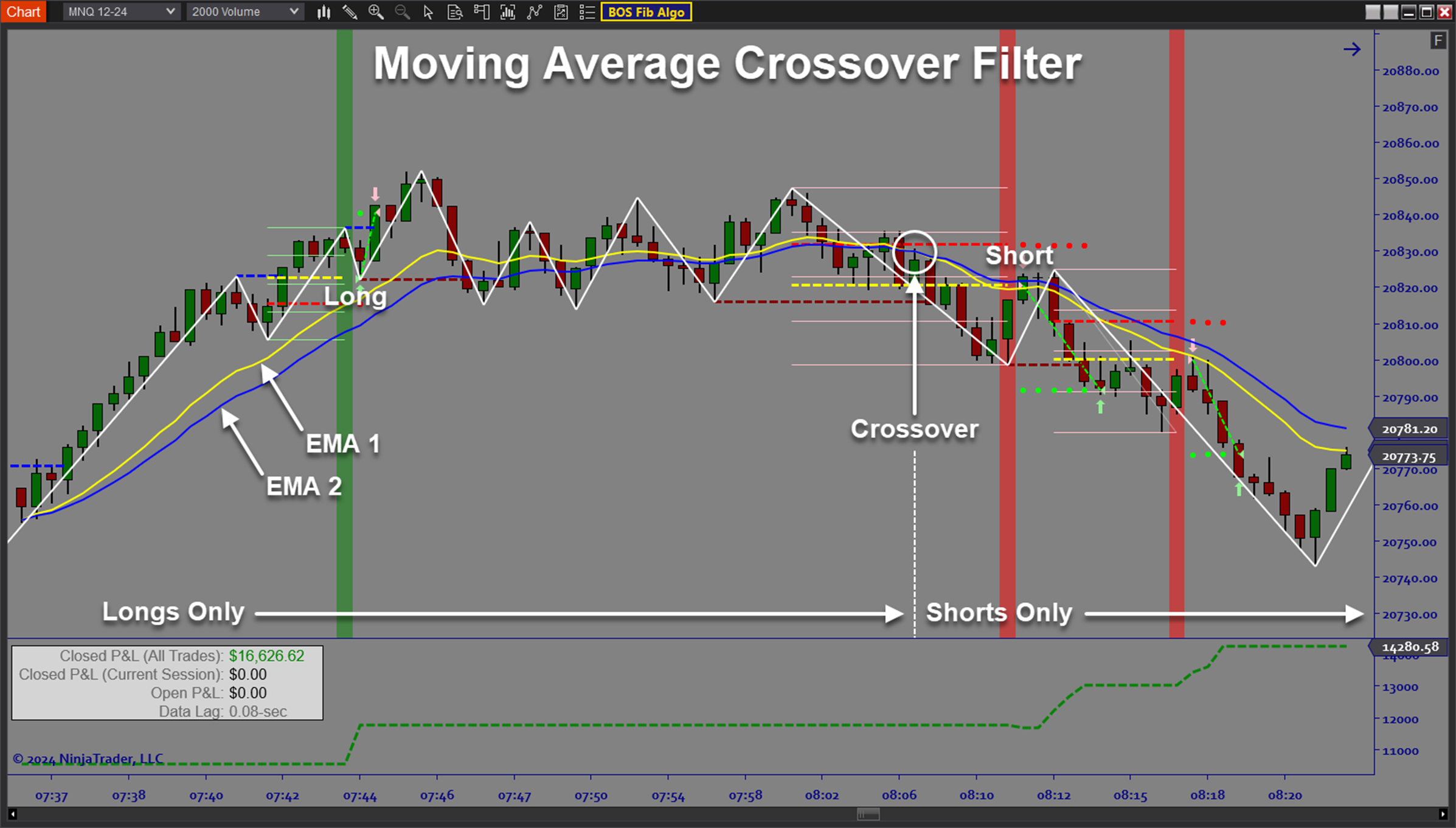

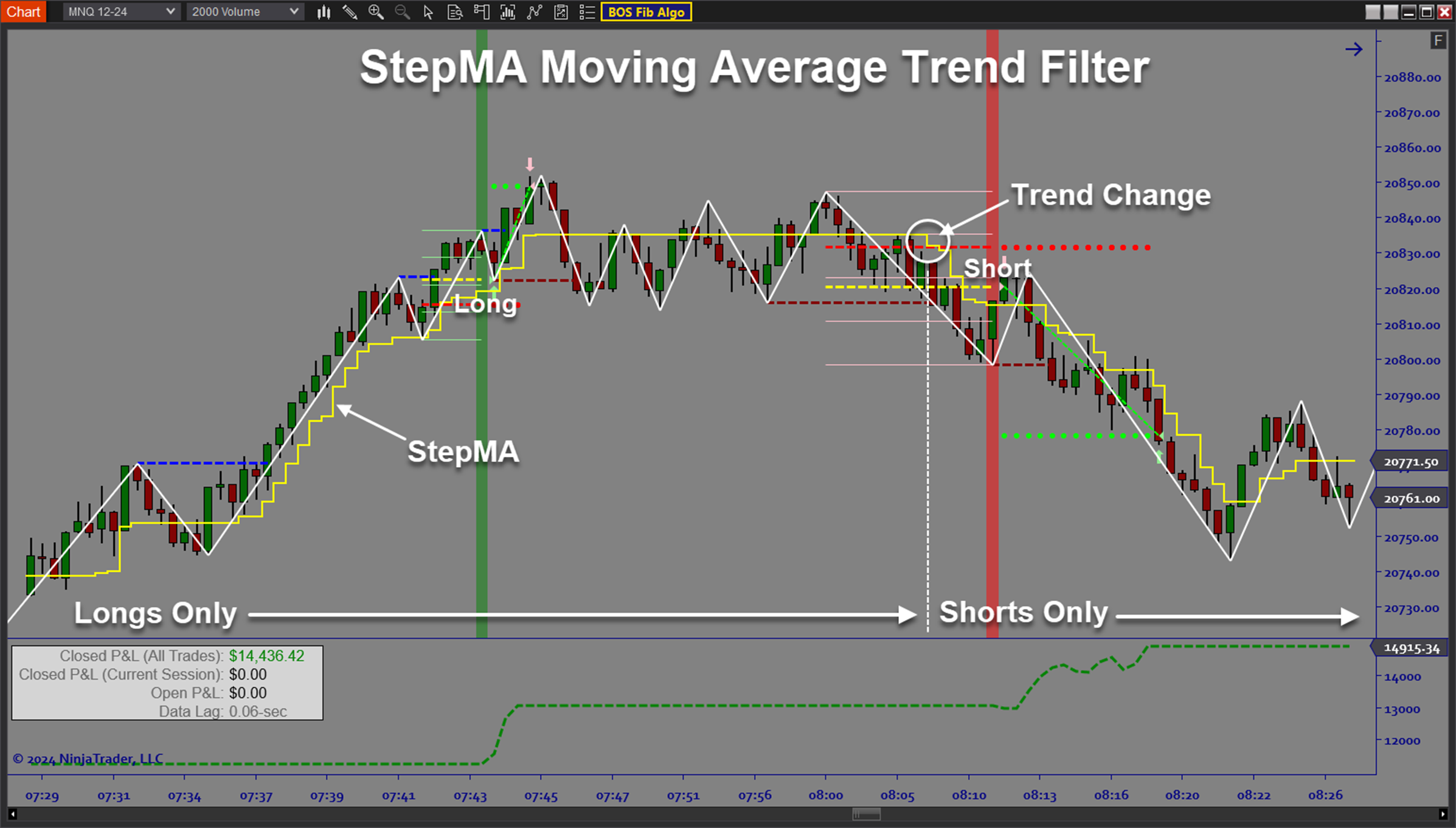

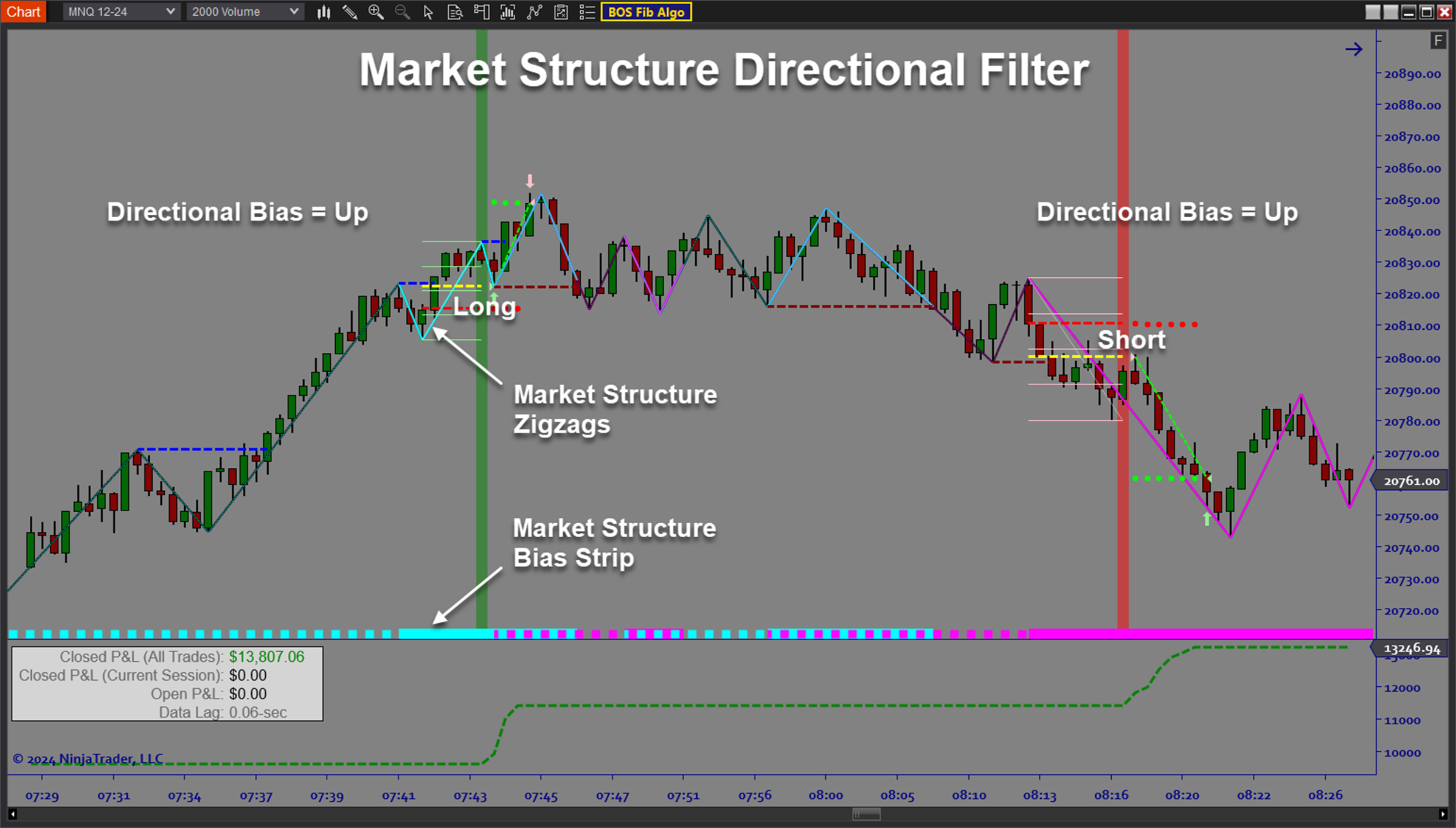

- Comprehensive trend, momentum, and market structure directional filters

- AutoTrail and Breakeven strategies

- Utilize dynamic trade sizing to control Dollar Risk per trade

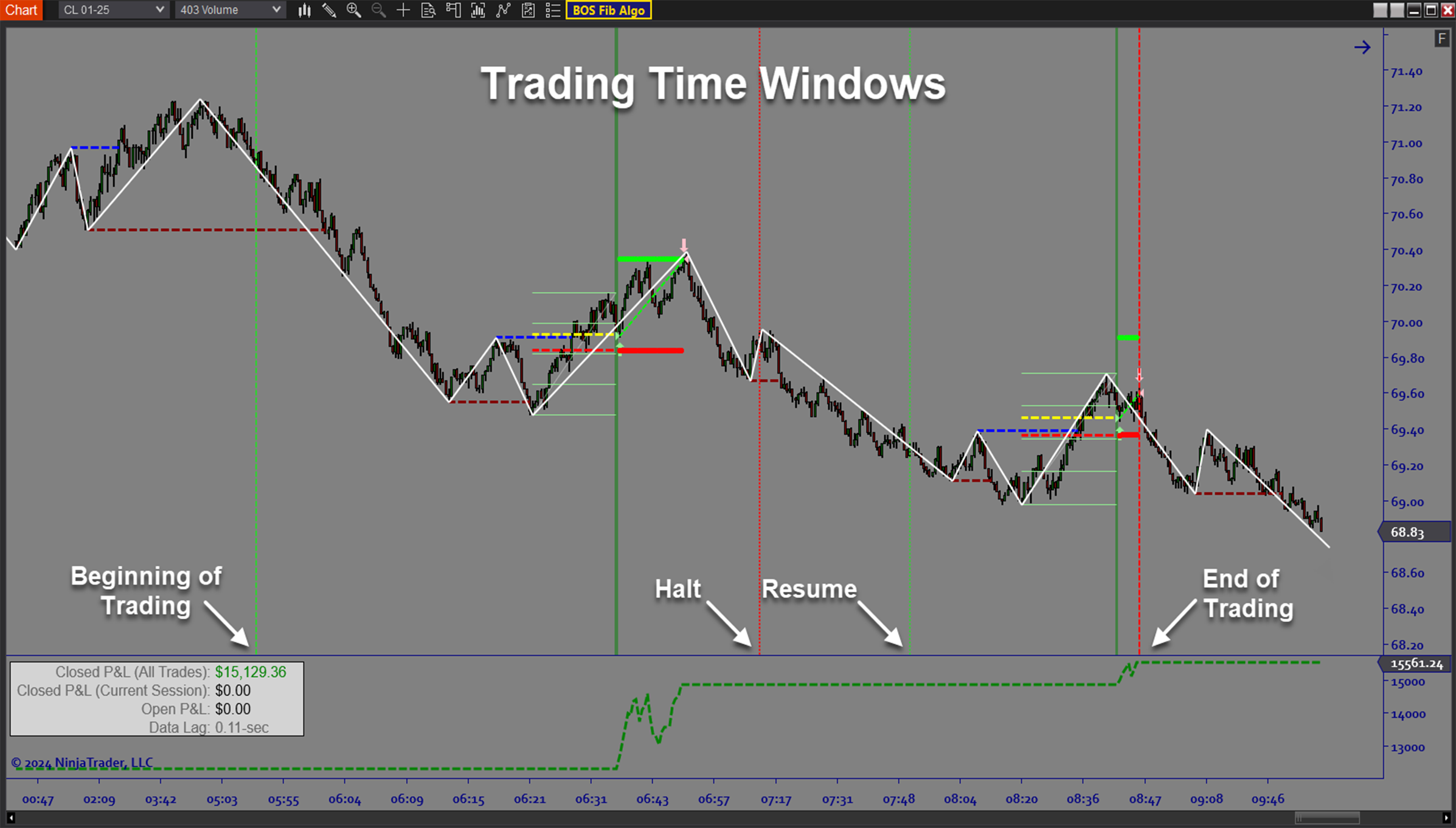

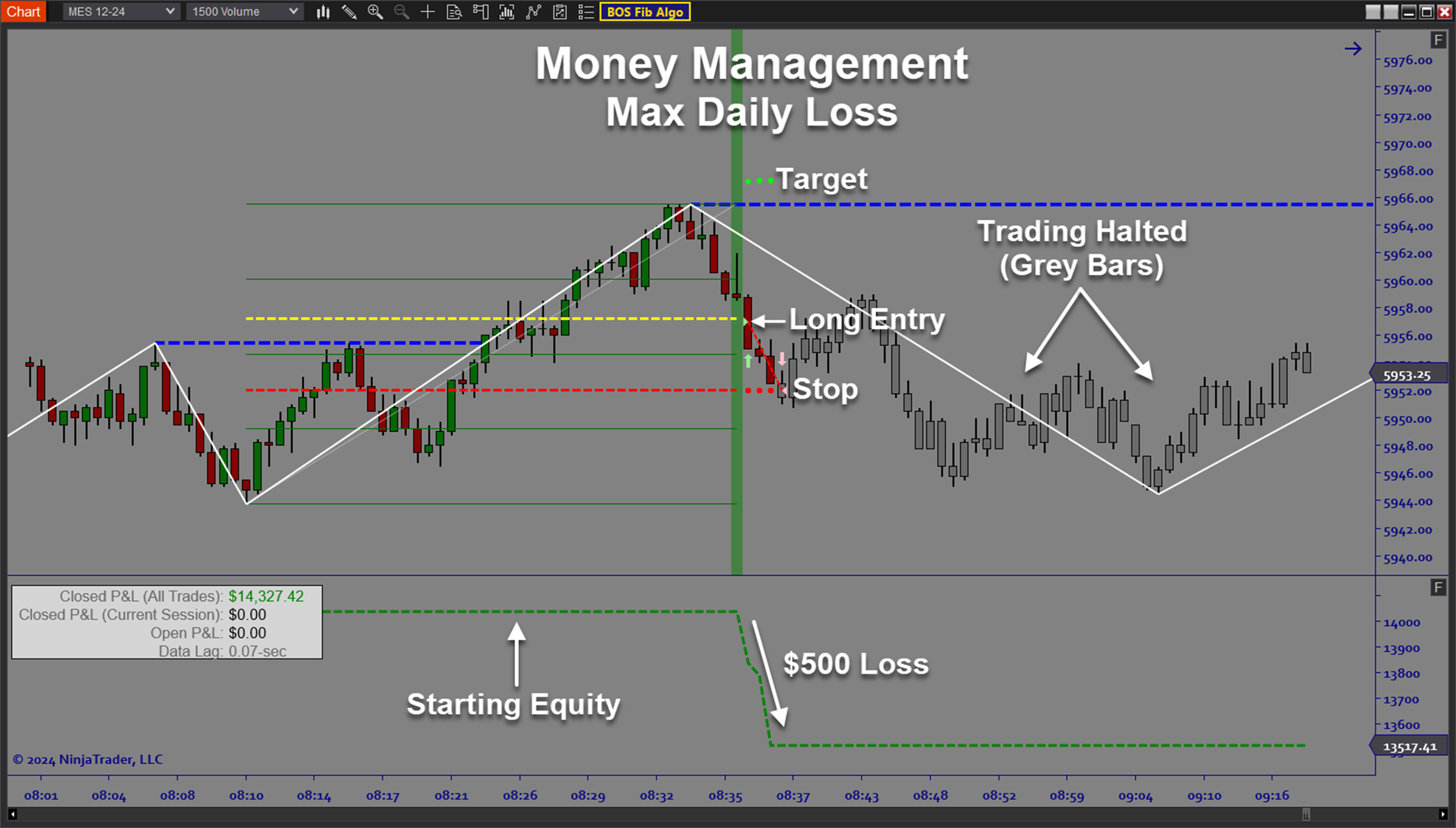

- Time filters, Day of Week filters, Holiday filters, and money management function

- Built in trade signal graphics, execution markers, stop/target graphics, realtime P&L

- Built In Backtesting and Optimization capability

Functions:

The BOSFib Algo is best used in trending conditions on any timeframe. You can use the built in optimization capability to get a preliminary strategy configuration. Next forward test your strategy in live simulation mode. Once you are comfortable with the performance, you can start auto trading a live money account. When market conditions change, it is easy to use the flexibility of the software to adjust to changes in market conditions. Following this approach allows you to focus on strategy development without the stress of live trading. Because the algo software is doing all the heavy lifting, you can devote attention to fine tuning performance over time. In this way, you can always stay on top of the markets.

Problem Solved:

- Stops traders from missing out on Fib based trend trade setups

- Stops traders from trading against the structure of the market

- Stops traders from getting in too early or too late

- Stops traders from not knowing where to place their stops

- Stops traders from leaving money on the table by not knowing where to place their targets

- Stops traders from sabotaging their trading due to indecision and fear

- Stops traders from not allowing the data to guide their strategy development

- Stops traders from trading without a well defined trade plan

- Stops traders from failing to adjust to market conditions

- Stops traders from entering at the wrong place and time

- Stops traders from guessing when to trade and when to wait

- Stops traders from failing to identify the best days and times to trade

- Stops traders from trading against momentum, market structure, and directional bias

- Stops traders from failing to manage risk appropriately

- Stops traders from not being able to objectively compare the performance of different strategies