AutoFib Algo

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

Overview:

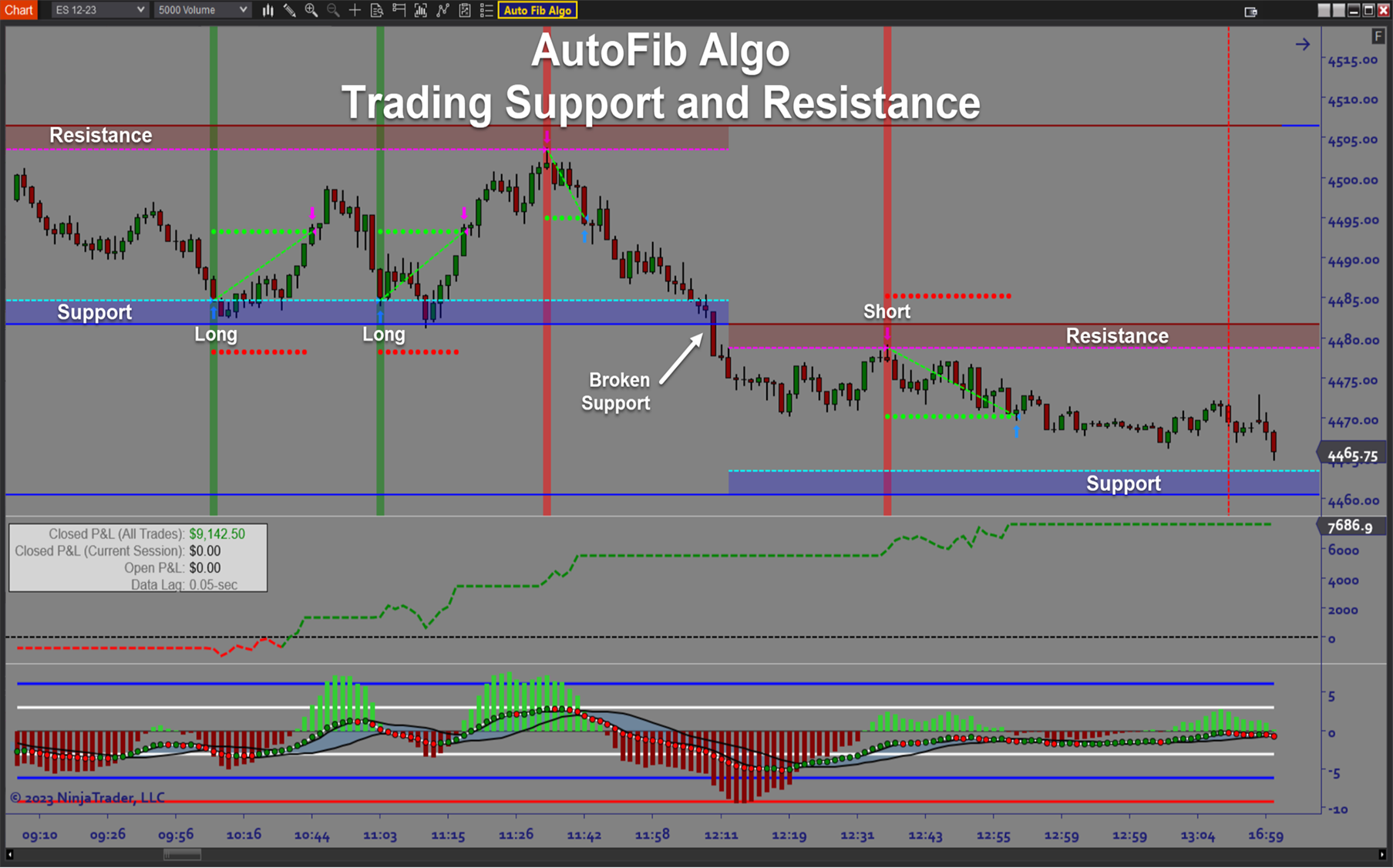

The ARC_AutoFib Algo is an automated trading solution for Ninjatrader based on the confluence of Fibonacci sequences across multiple timeframes. The software analyzes extensive historical data reflecting multiple timeframes to identify key support and resistance levels derived from swing levels, retracements, extensions, and projections.

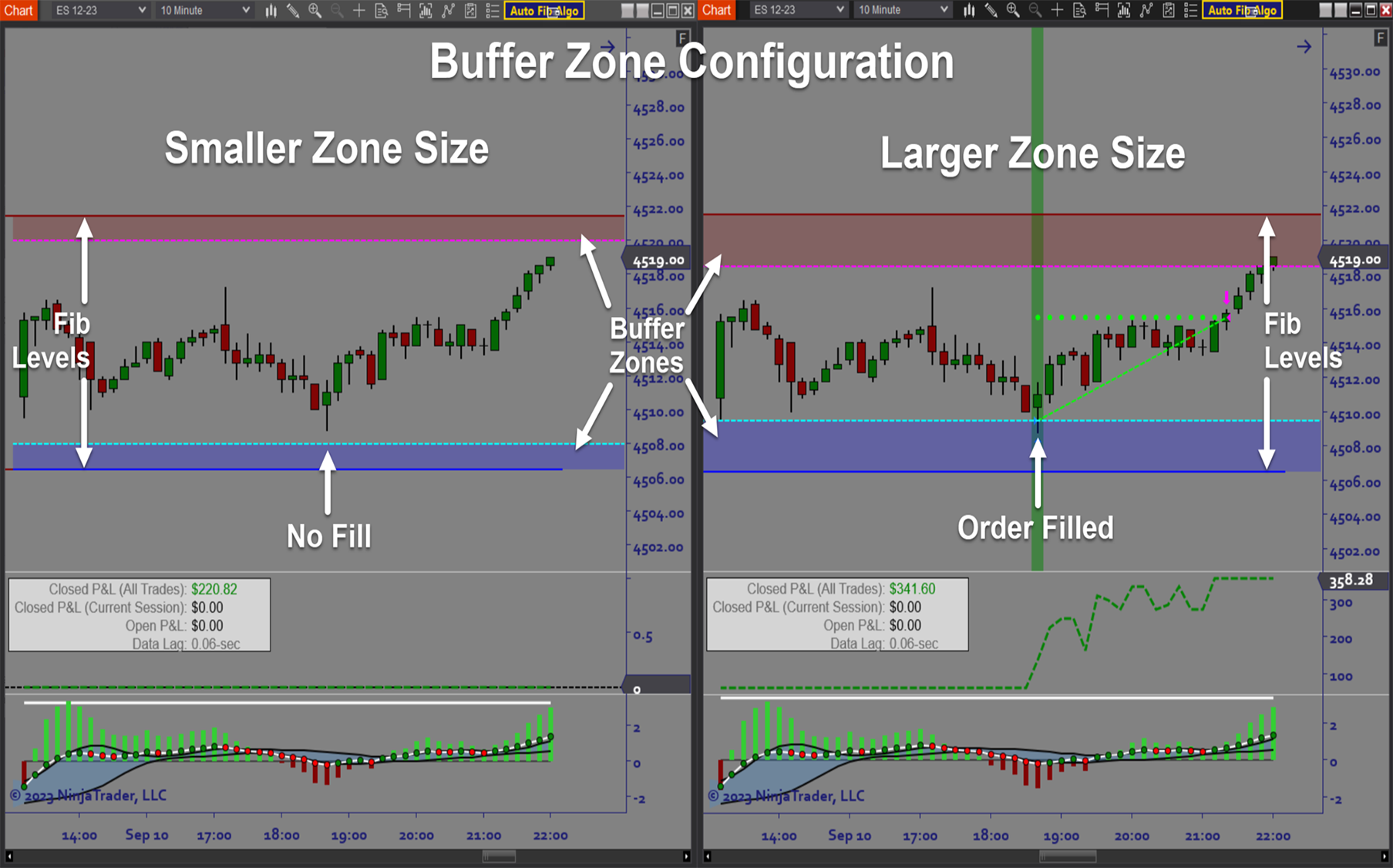

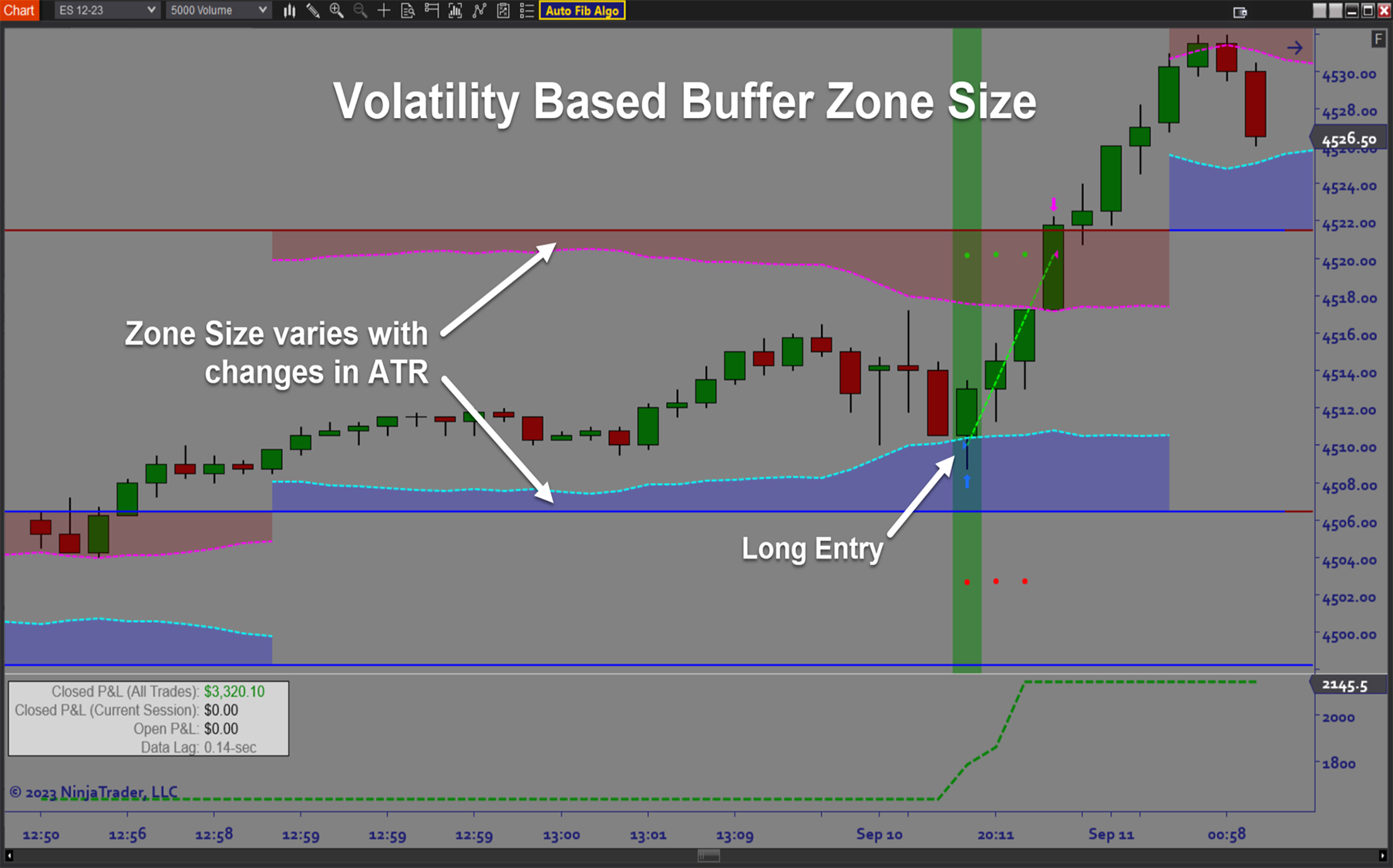

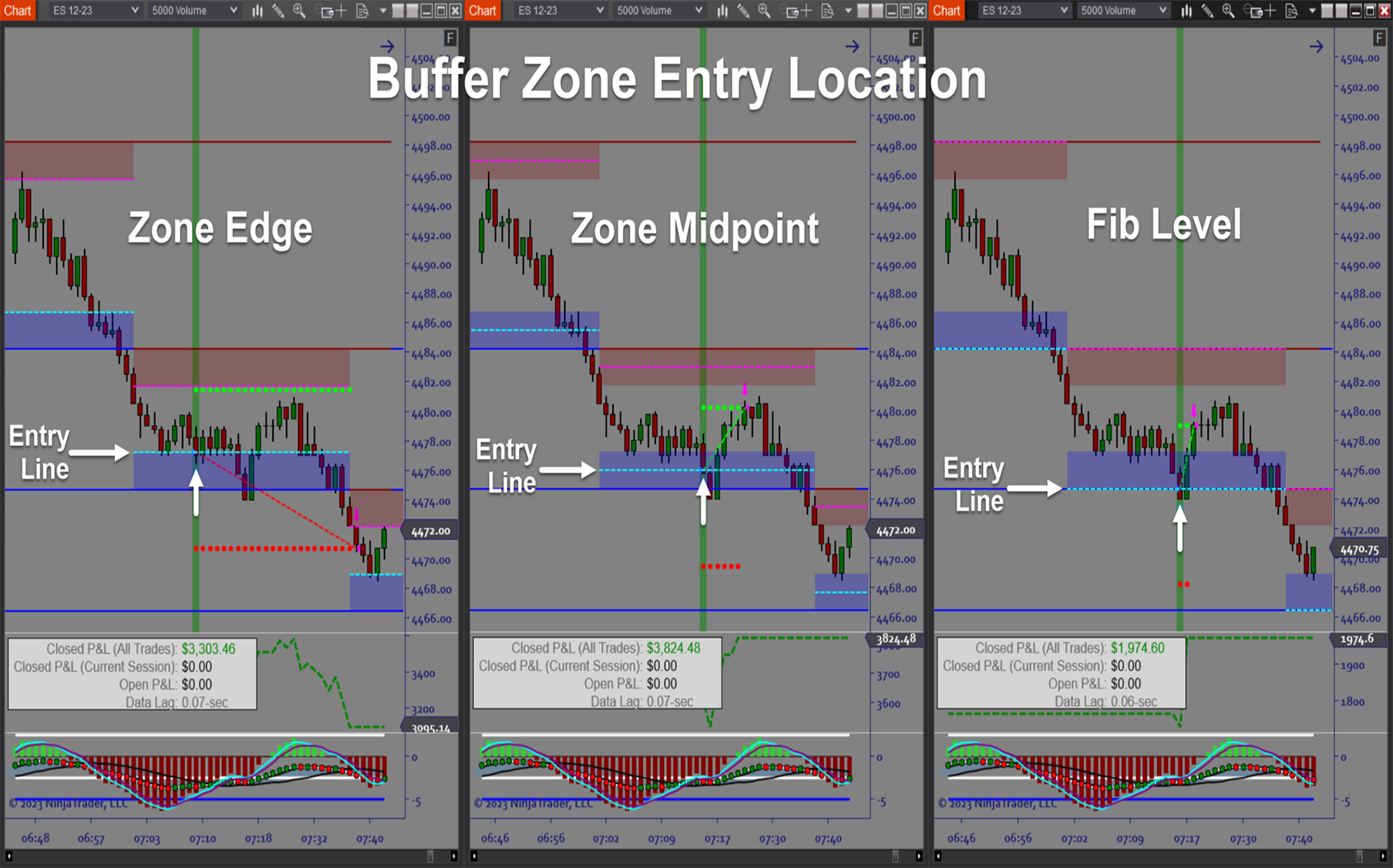

The software includes a variety of settings to customize the frequency of trade signals as well as the size of Buffer Zones for trade entry location. A great deal of quantitative analysis goes into the derivation of confluence levels ensuring that only the strongest levels are identified. The impossibility of manually calculating such levels coupled with the extremely flexible core algo engine make the AutoFib Algo an essential tool for any levels trader.

Purpose:

Traders need the AutoFib Algo software because Fibonacci confluence derived from hundreds of days of historical data is impossible to calculate manually. Having the levels automatically displayed and ready for automated trading is the most efficient way to trade key Fib support and resistance levels. The software allows you to customize your trade plan and apply a variety of signal filters to trade any market conditions. Money Management, trading time windows and Breakeven/Trail strategies give you all the tools you need to autotrade your favorite markets. The end result is more consistent trading performance.

Elements:

- Autotrade multi timeframe Fibonacci support and resistance levels

- Comprehensive Fibonacci confluence derived from hundreds of days of historical data

- Adjustable Buffer Zones customize trade entry location

- Trade both reversal and continuation strategies

- ATR-based Stops and R-Multiple Targets

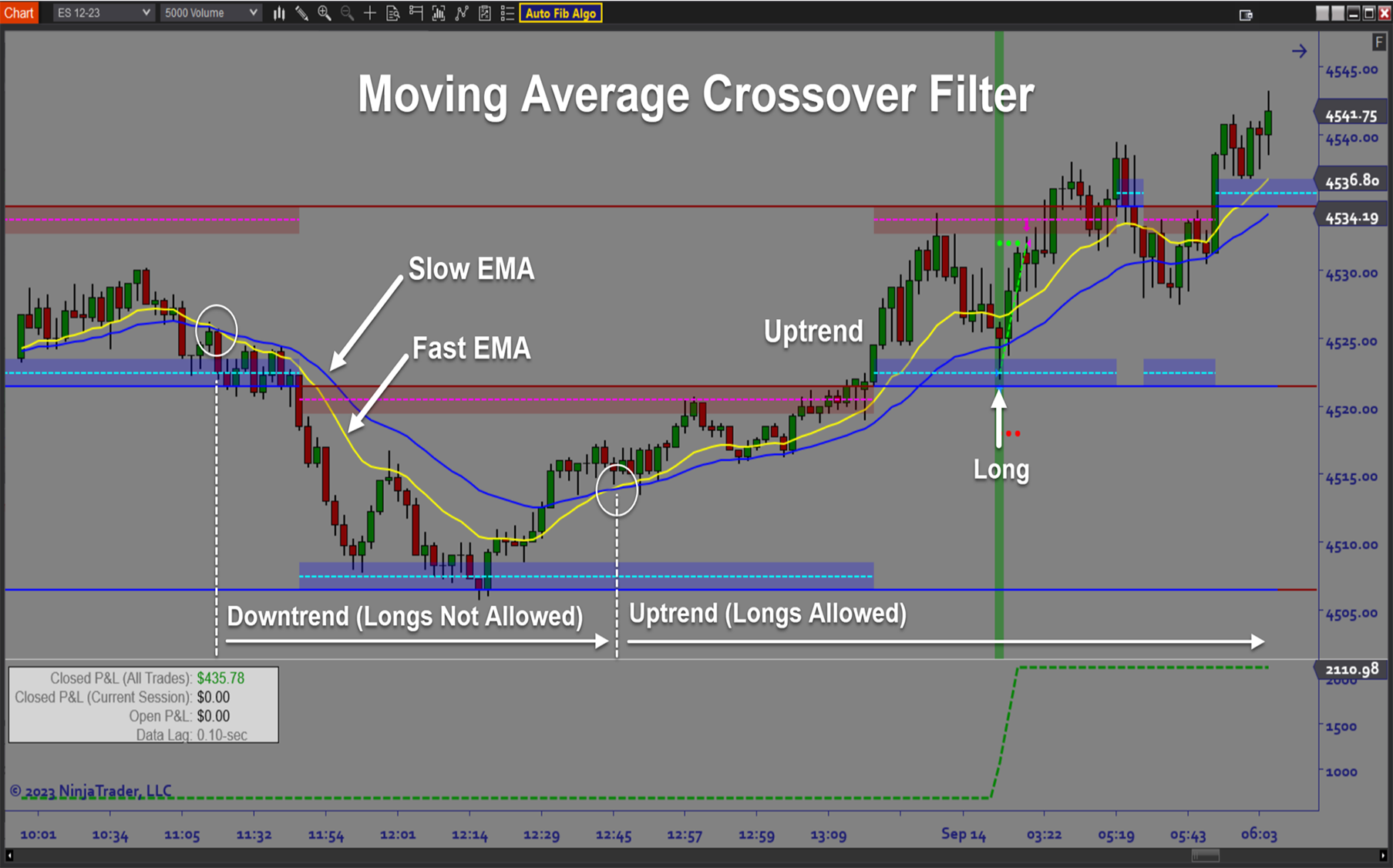

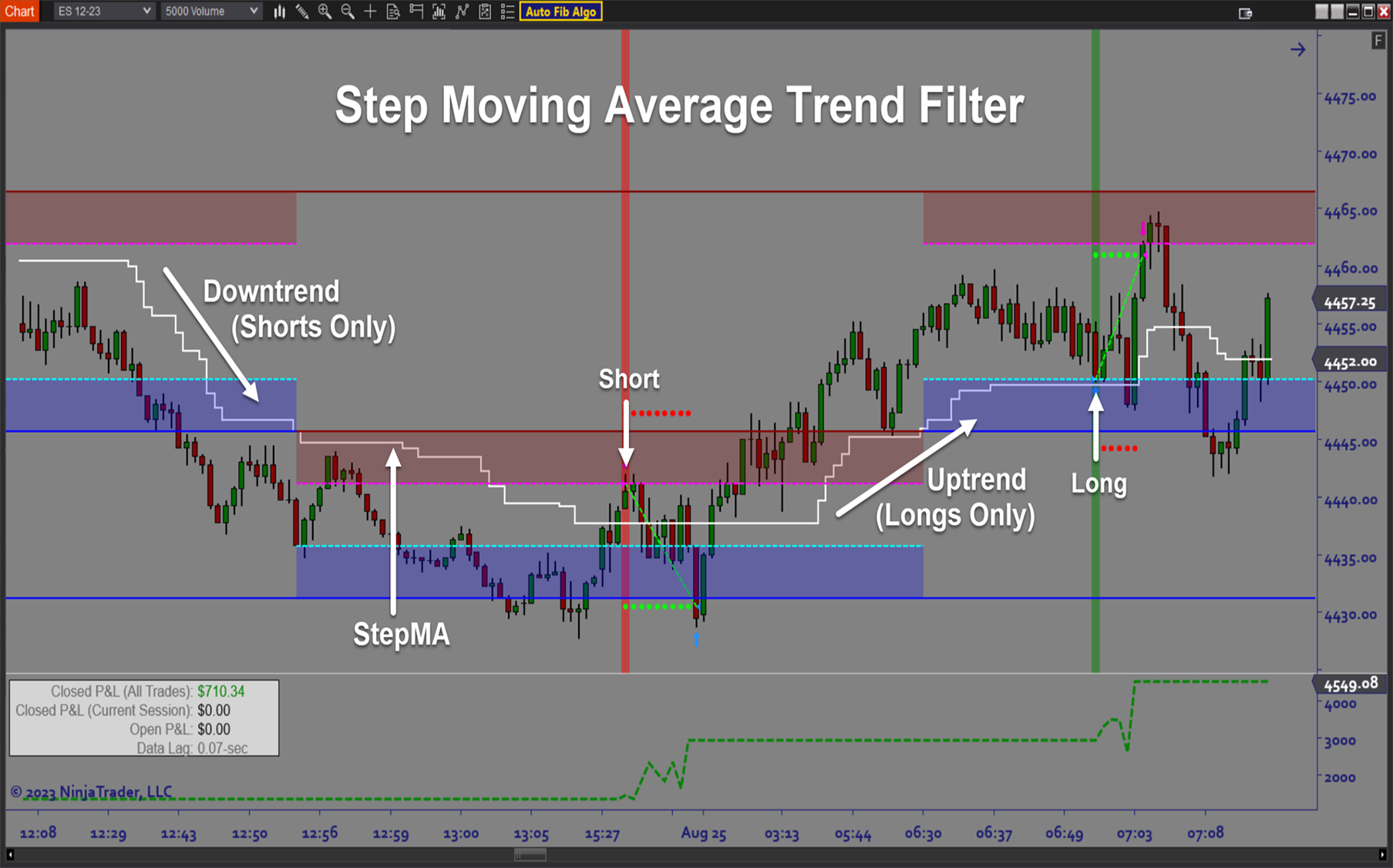

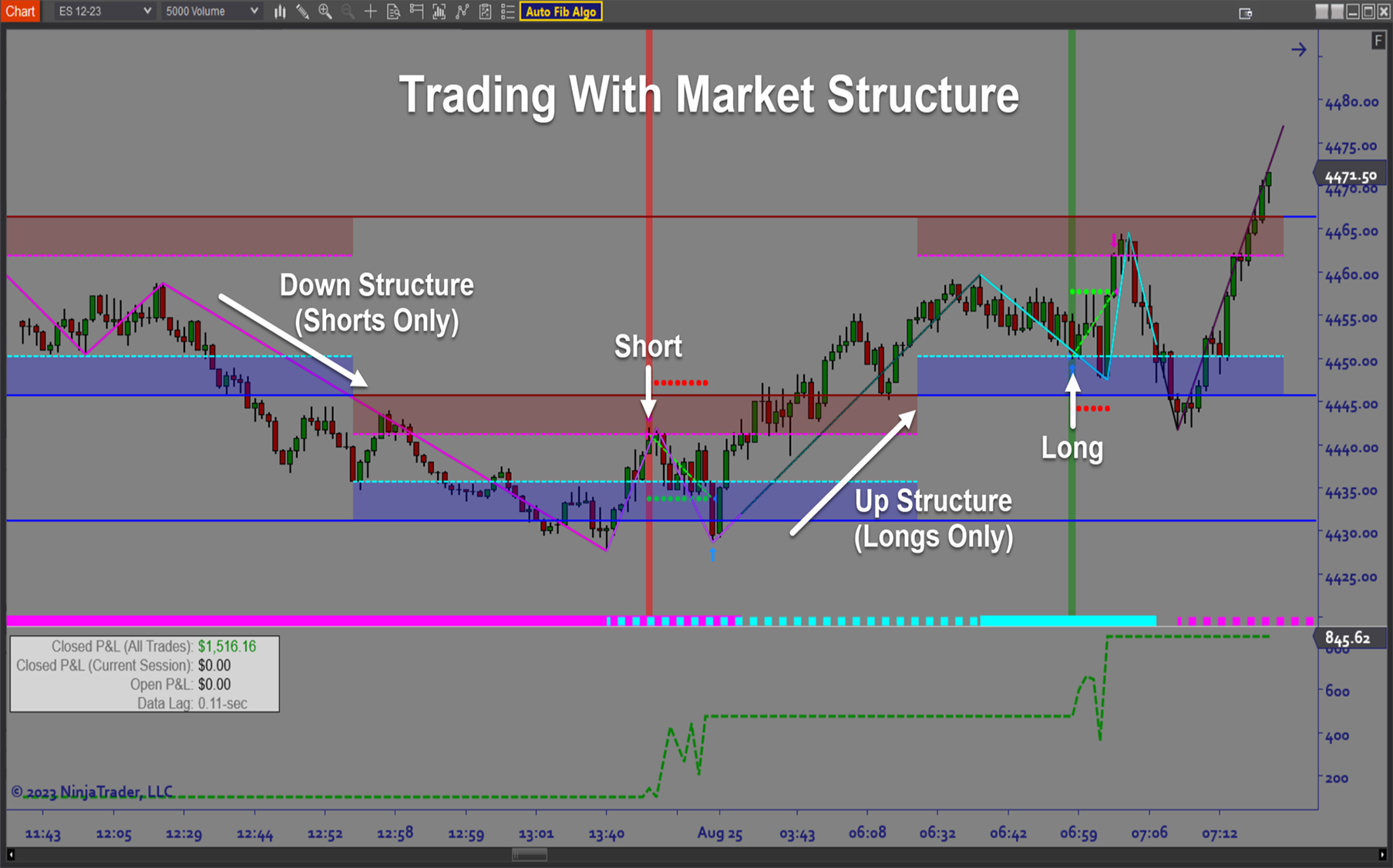

- Comprehensive trend, momentum, and market structure directional filters

- AutoTrail and Breakeven strategies

- Money Management (Max Daily Loss, Profit Goals, High Watermark Trail)

- On screen trade signals, entry/exit markers, stops/targets, realtime P&L

- Backtesting and Optimization

Functions:

The AutoFib Algo is best used by setting the chart timeframe to fit your trading style and then selecting a higher timeframe for the background Fibonacci confluence calculations to ensure that you are trading only the strongest support and resistance levels. Next set up the trade entry Buffer Zones to reflect the volatility of the instruments that you are trading. Next, leverage the power of the flexible core trading engine to customize your trade plan, trend and momentum filters as well as enable money management functionality to protect trading capital. The built in optimization and backtesting will help refine your settings. Lastly, always be sure to trade in Sim to establish stable performance before risking live capital.

Problem Solved:

- Stops traders from second guessing support and resistance

- Stops traders from missing out on the strongest Fibonacci confluence levels

- Stops traders from entering at the wrong time or place

- Stops traders from overtrading

- Stops traders from accounting for changes in volatility when deploying trading strategies

- Stops traders from trading against momentum, market structure, and directional bias

- Stops traders from sabotaging their trading due to fear and uncertainty

- Stops traders from dealing with the stress of manual trading

- Stops traders from breaking their money management rules