Overview:

The Risk Reward Entry Algo is an integrated solution for planning, entering, and managing trades. A manual drawing tool is used to plan the entry price, stop size, and multiple targets based on user-defined risk reward ratios. The software then reads that information and automatically enters a trade and manages the position according to customizable risk parameters. The result is an easy to use but powerful trade execution and risk management system.

Purpose:

Traders need the RiskReward Entry Algo software because traders need a reliable and easy to use tool for planning out trades while keeping a tight control on risk. When actively trading, it is important to be able to focus on your actual trading and not be distracted by the mechanics of trade sizing calculations, order placement, and risk monitoring. The software streamlines these functions and also ensures that you never violate your risk limits.

Elements:

- Dollar Amount Risk Sizing

- Percent of Account Balance Risk Sizing

- Static Risk Sizing

- Target Driven Auto Breakeven Plus Offset

- Manually adjust Stop/Targets of open positions

- Auto Exit

- Realtime Risk/Reward metrics

Functions:

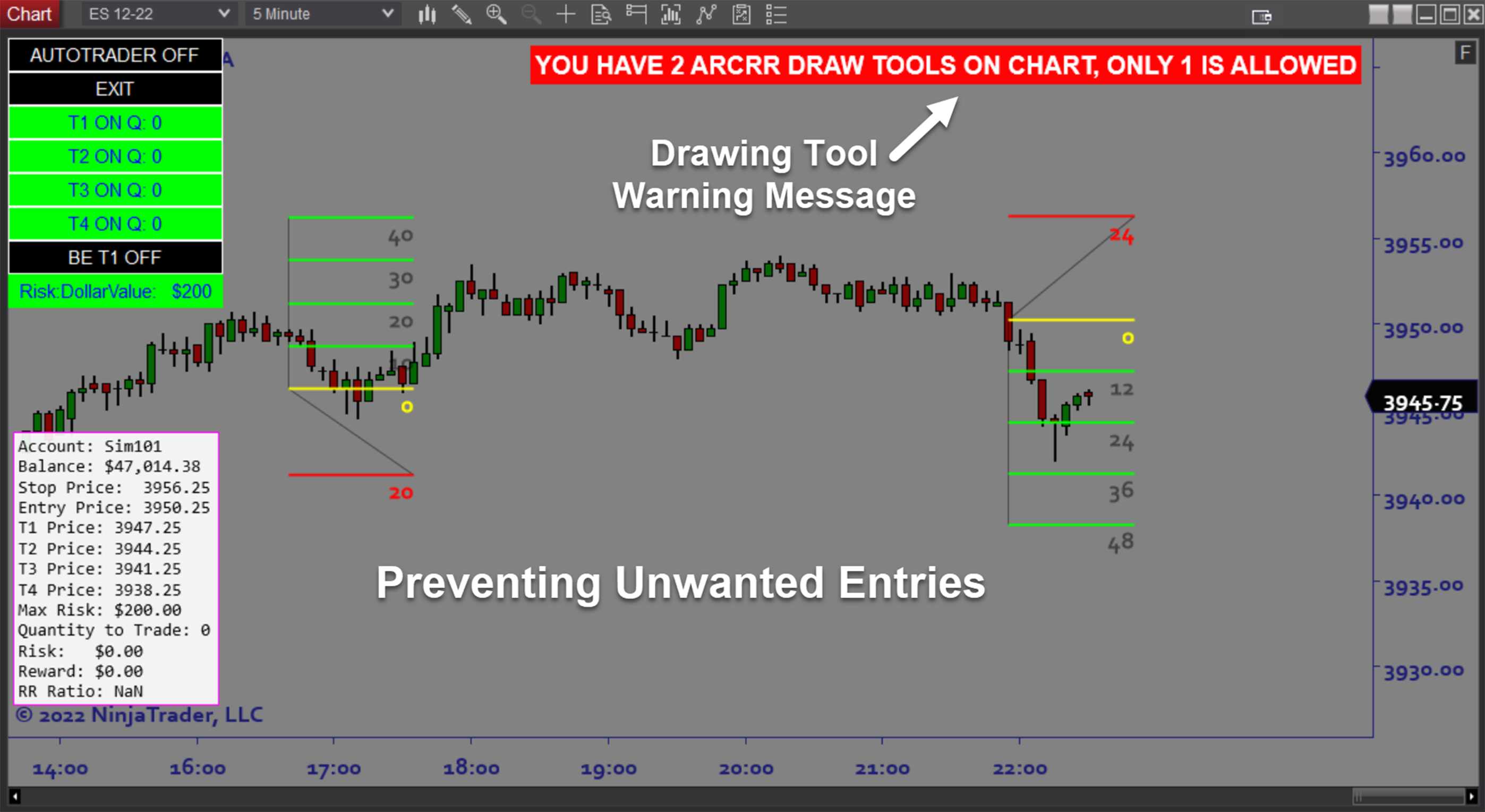

The RiskReward Entry Algo software is best used by starting with a defined risk model. The software is designed to prevent you from taking excessive risk. Once you map out your next trade right on the chart, the software automatically enters the market at the moment your price is hit. The software then continues to manage the position while still allowing manual intervention to adjust stops, targets, and breakevens. When used as designed, the software makes it easier to focus on your trading and controlling risk.

Problem Solved:

- Stops traders from second guessing risk management

- Stops traders from second guessing trade management

- Stops traders from trading too much or too little size

- Stops traders from breaking their risk management rules

- Stops traders from missing out on trades while trying to set them up

- Stops traders from losing track of risk exposure

- Stops traders from entering too early or too late

- Stops traders from struggling with their platform