Overview:

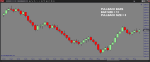

The PullBack Bars software is a custom bartype which reduces noise to facilitate the visualization of trends, highlights areas of support and resistance, and displays smoother rotations. This is accomplished by waiting until a significant pullback occurs as a condition to close the current candle and start forming a new one. By doing this, insignificant pullbacks are ignored, preserving the current trend visually. This is essentially a way to gain the trend clarity of a fixed range candle but in the form of a variable range bartype.

Purpose:

Traders need the Pullback Bars software because they want to reduce the noise to see the trend more clearly but they want to use variable range candles which are better suited for certain trading strategies.

Elements:

- Bar size sets the minimum threshold for triggering the Pullback test

- Pullback Size sets the required distance to form a reversal bar

- A variable range bartype which preserves the benefits of fixed range bars

Functions:

The Pullback Bars software is best used when the trader wants the smoothing benefits of fixed range bars but is using strategies that rely on variable range candles. Customizing the bar settings to each market that you trade will ensure you get the most out of this software.

Problem Solved:

- Stops traders from getting distracted by noisy price action

- Stops traders from getting fooled by false reversals

- Stops traders from second guessing trending conditions

- Stops traders from failing to recognize key rotations

- Stops traders from missing out on support and resistance based on price action