Range Bar Indicator Overview:

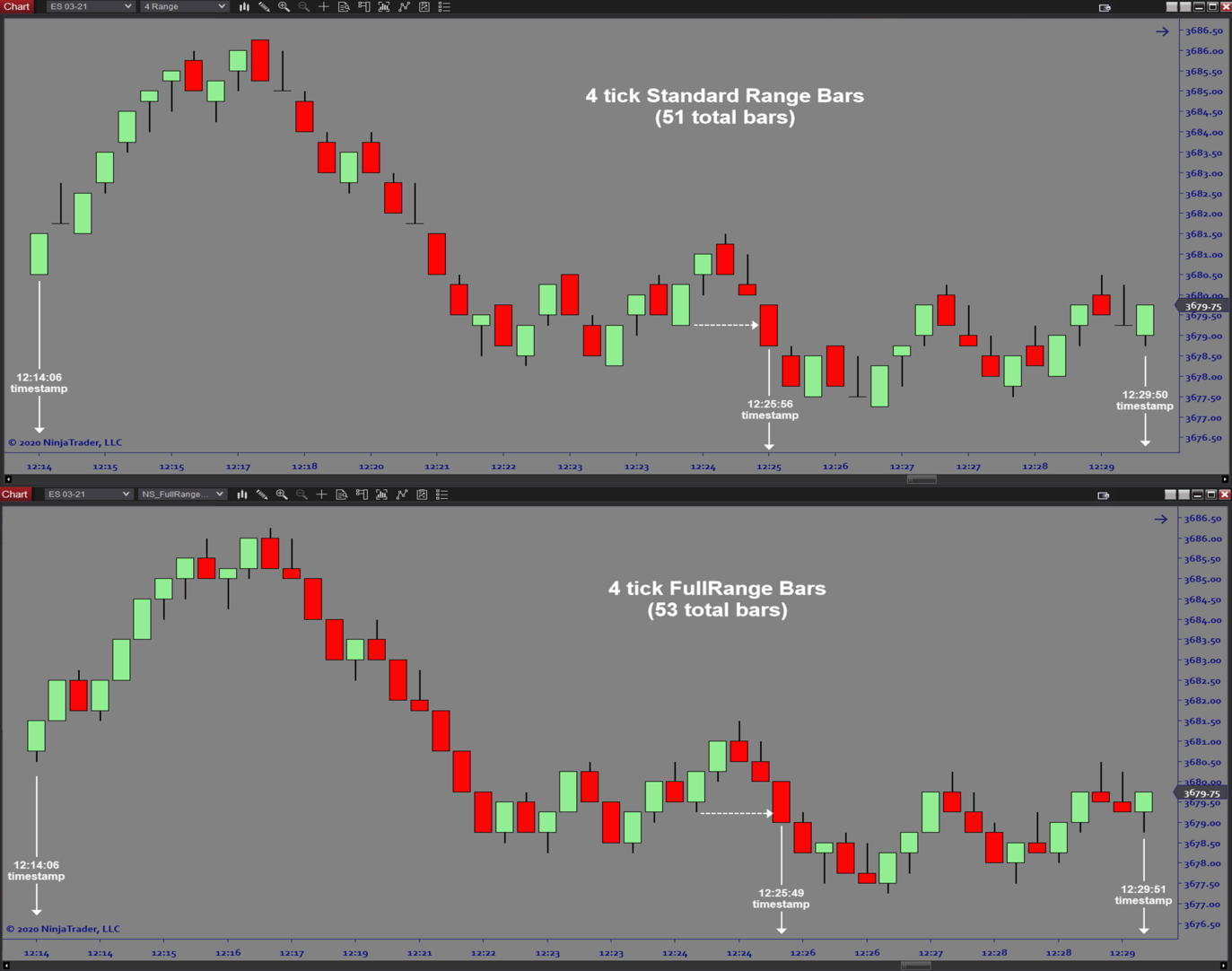

The FullRange Bars software is a custom bartype which is similar to a standard Range Bar except that there is no longer a gap between the close of a bar and the open of the next bar. For strategy development purposes, it can be useful to standardize performance measurement by always taking the trade entry at the close price of the signal bar. Using FullRange Bars standardizes test results but also improves price action visually.

Purpose:

Traders need the FullRange Bars software because they want improved testing for strategy development. FullRange Bars also have a smoother look visually, making chart reading easier. Another benefit is earlier signals due to backfilling the gaps between standard Range Bars.

Elements:

- Bar size determines the base fractal

- Eliminates bar gaps of standard Range Bars

- Standardized backtest results

Functions:

The FullRange Bars software is best used for any trader who uses standard Range Bars by replacing them with FullRange Bars. Doing this will improve strategy development and simplify chart reading.

Problem Solved:

- Stop traders from getting inconsistent backtest results

- Stops traders from second guessing price action

- Stops traders from getting in too late due to inferior due to late signals

- Stops traders from lack of clarity from messy charts