This indicator is part of our Annual Indicators Membership.

To access this indicator for free, please click the link below.

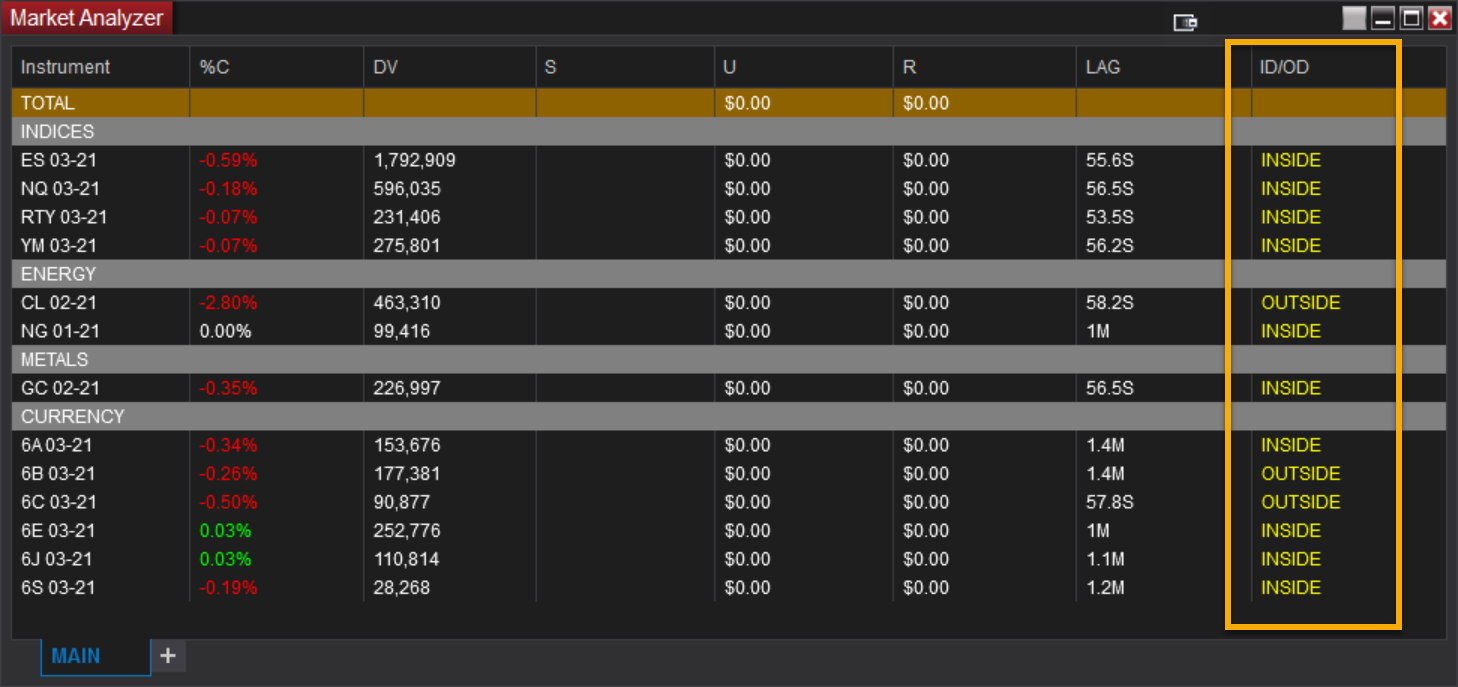

Ninjatrader Market Analyzer Indicator Overview:

The InsideDayOutsideDay software is a custom Market Analyzer column which provides a quick and easy way to know when the current market price is trading inside or outside of the previous day’s range. A label in the status column shows the current state: “Inside” or “Outside”. This makes it easy to know with a glance the current condition of the market you are trading.

Purpose:

Traders need the InsideDayOutsideDay software because while you want to keep track of current trending conditions you don’t necessarily want to clutter your charts any more than necessary. The software allows you to add a column to your market analyzer so you don’t have to add anything to your trading chart.

Elements:

- Market Analyzer Column Showing Inside or Outside Day Status

- Optional Trading Hours Windows

Functions:

The InsideDayOutsideDay software is best used by adding a single column to the Market Analyzer where you track your instruments. This column will tell you immediately if prices are trading inside or outside of the previous day’s range. Essential information is now available without taking up extra screen space.

Problem Solved with our Market Analyzer Indicator:

- Stops traders from trading in the wrong locations

- Stops traders from trading at the wrong times

- Stops traders from second guessing trending conditions

- Stops traders from ignoring price action at key levels

- Stops traders from losing track of important areas of interest