Alpha Price Scalper Algo

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

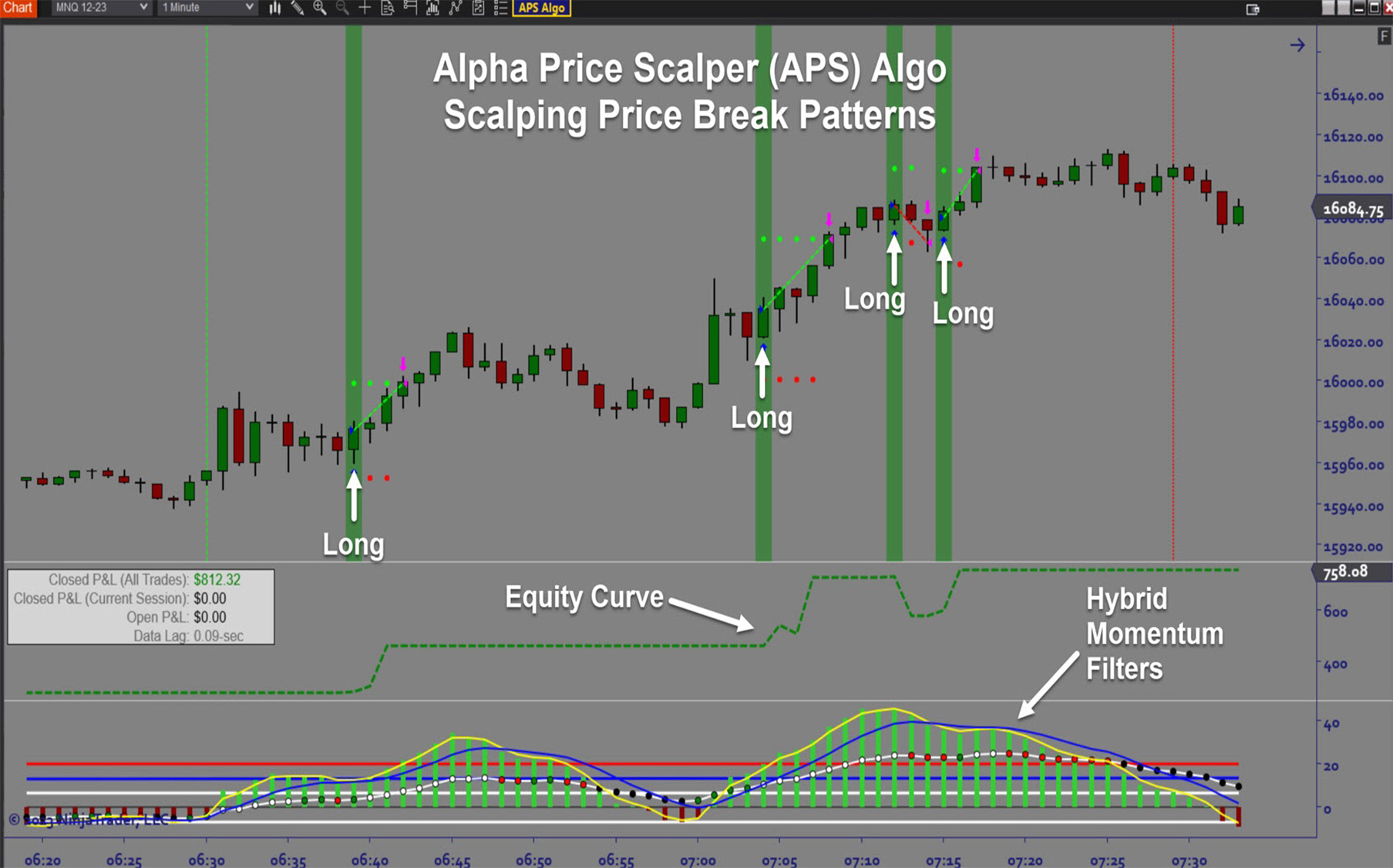

Overview:

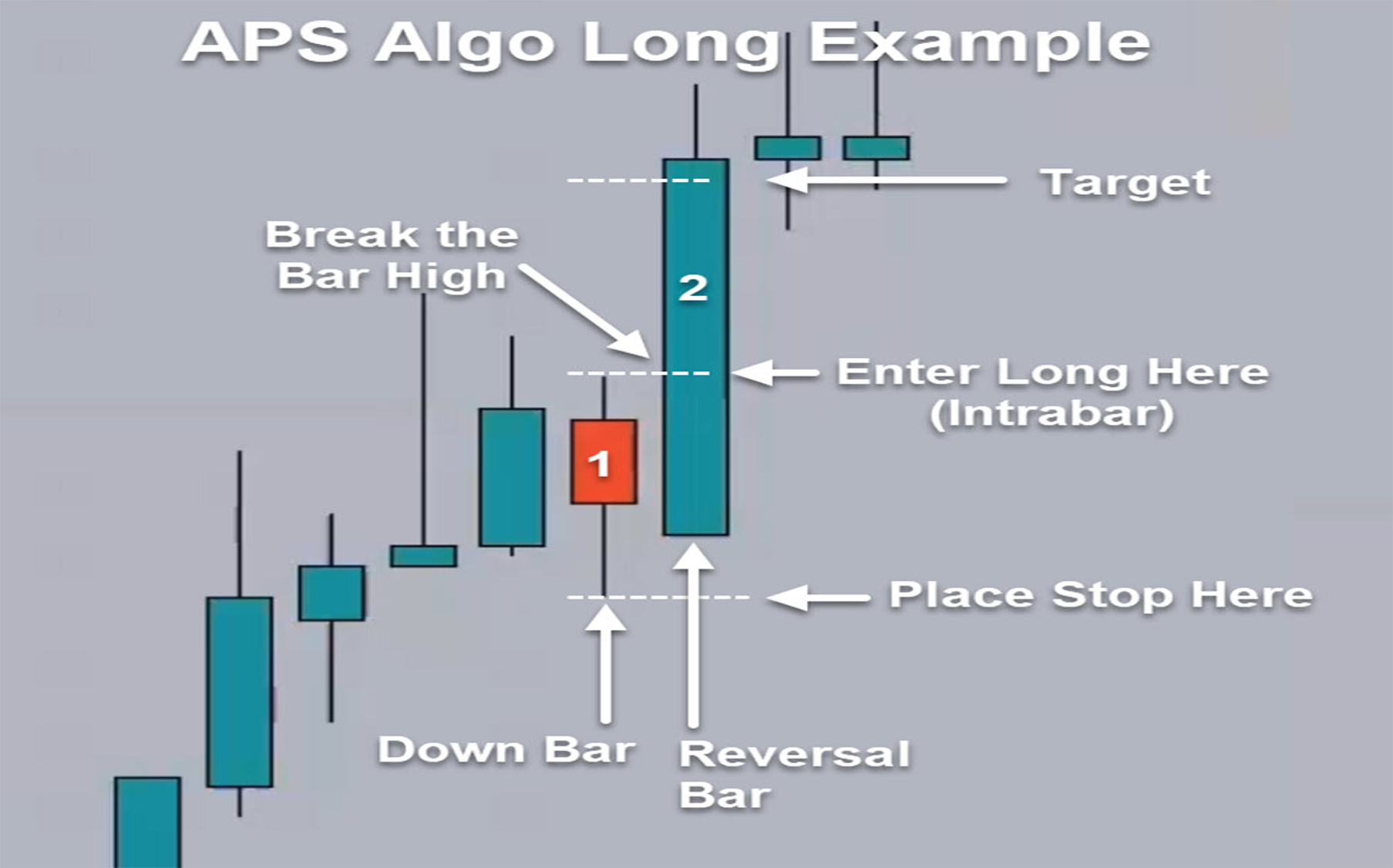

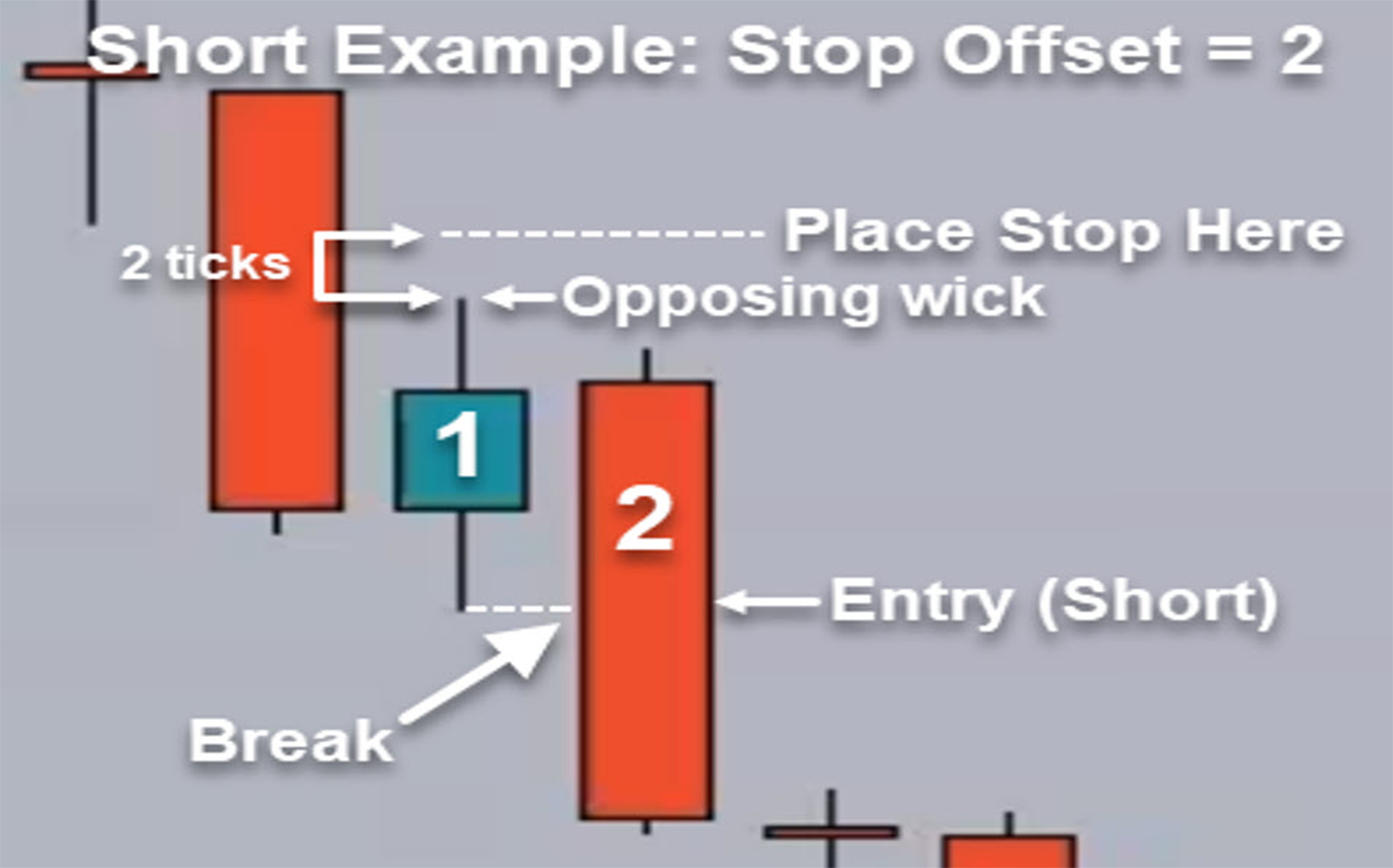

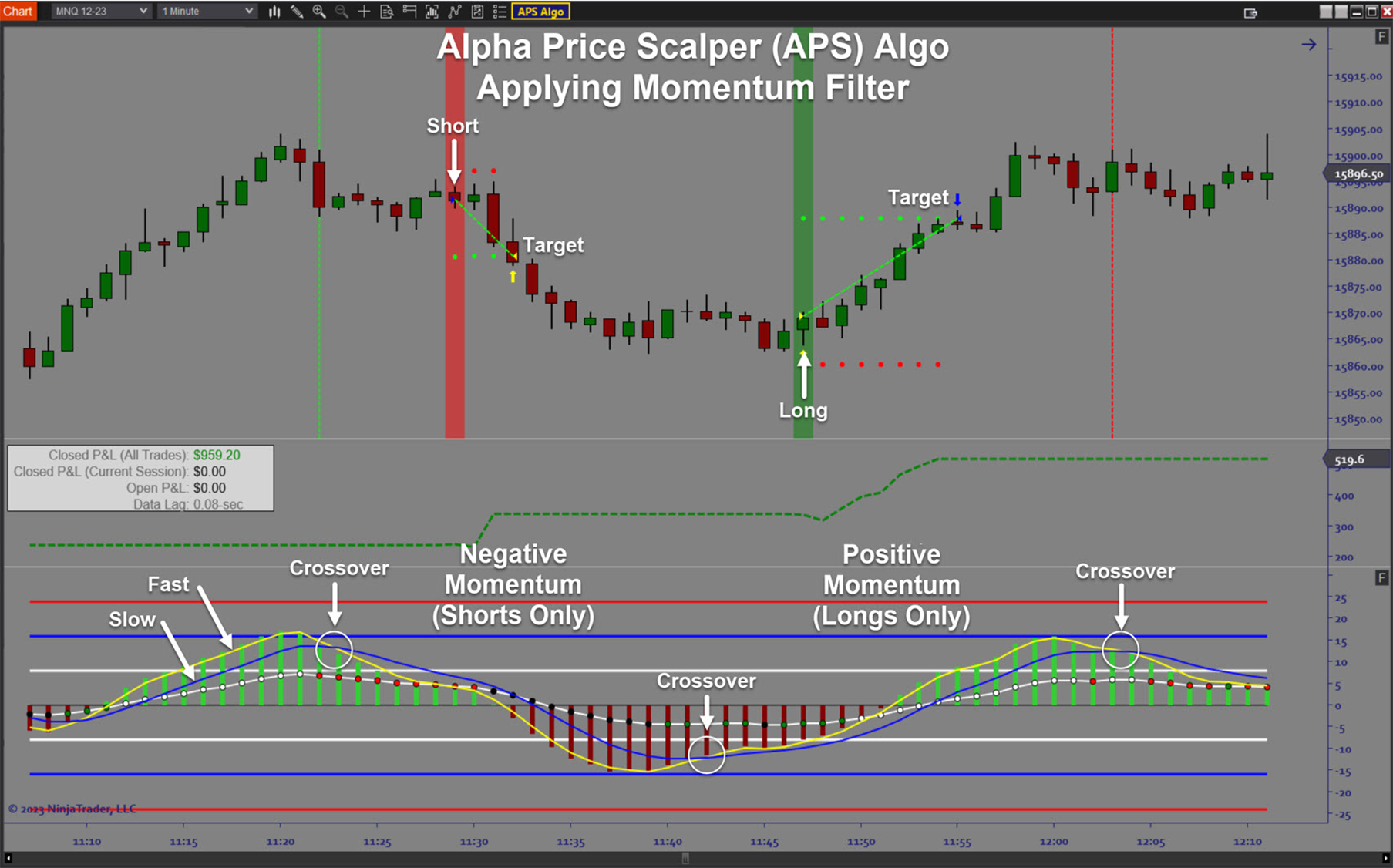

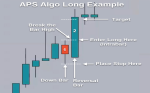

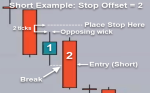

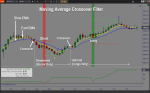

The ARC_APS Algo (“Alpha Price Scalper”) is a pure price action-based automated trading solution for Ninjatrader which scans for exploitable micro price patterns to generate breakout trade setups. While the software can be applied to any timeframe, it is well suited for scalping smaller timeframes during periods of substantial volume and volatility because there is sufficient follow through once a setup pattern has been detected. The basic strategy is to identify the prevailing directional bias, wait for a brief counter-trend pullback, and then enter immediately in the dominant direction on a breakout of the pivot level which initiated the pullback. Applying the automated trading capability of the APS Algo software in the right market conditions has the advantage of generating frequent trades with low risk exposure and quick profits, which is quite difficult to do manually.

Purpose:

Traders need the APS Algo software because identifying price patterns for quick scalp setups is very difficult to do manually, especially in fast markets. Time is of the essence when a trade setup is detected because even a few seconds delay in getting a manual order placed can cause you to miss out on a significant portion of the potential profit. The APS Algo software detects the price pattern and enters the trade immediately, much faster than can be accomplished manually. The end result is frequent trade setups for quick profits meaning you don’t have to spend all day waiting for one good trade. Instead you can let the software do all the work for you, making it easier to accomplish your goals with less time and effort.

Elements:

- Autotrade price action patterns for frequent scalp opportunities

- Price action pattern recognition of trend continuation breakout setups

- Customizable settings to control trade frequency

- Fully automated trade plans supporting up to 3 targets

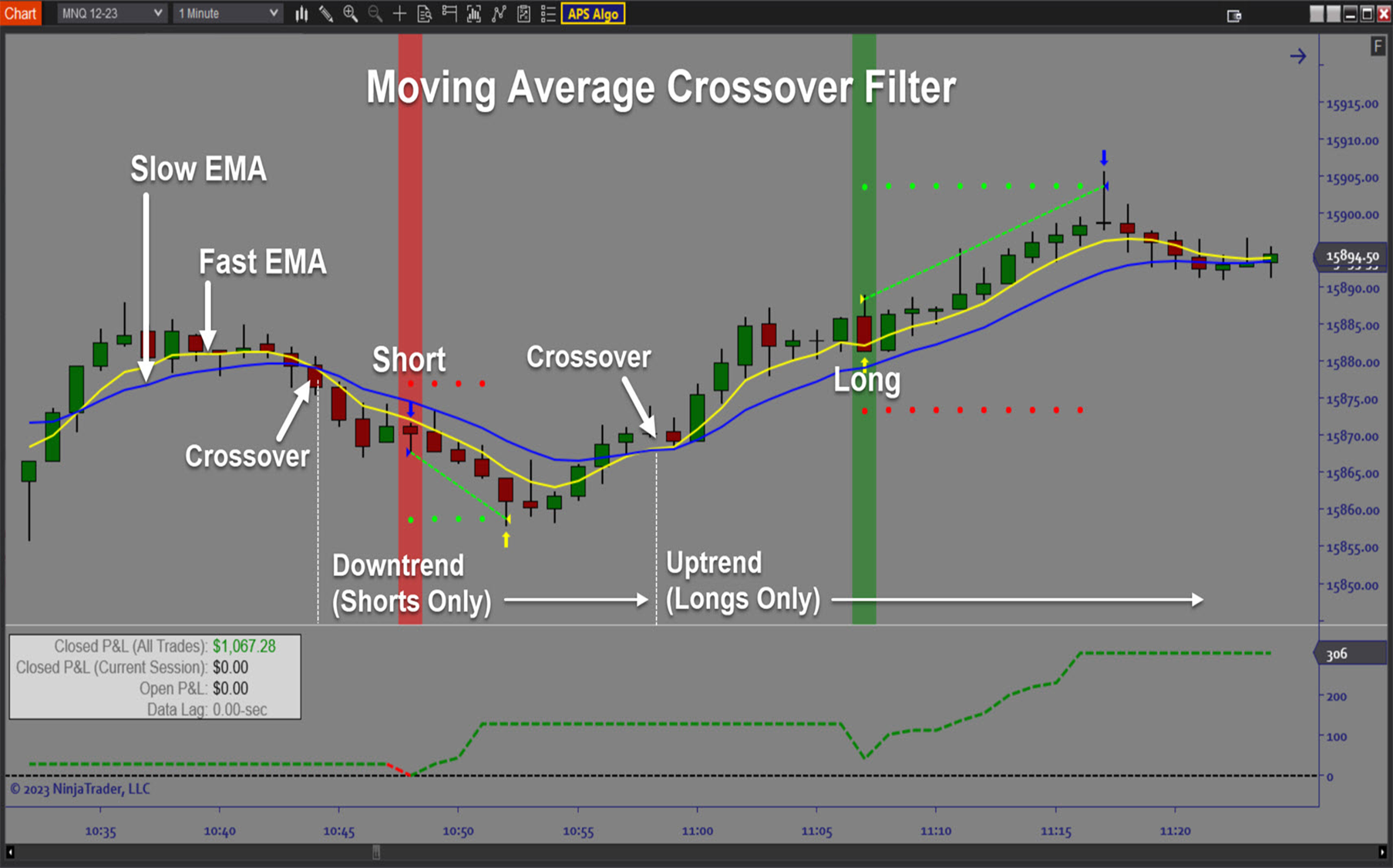

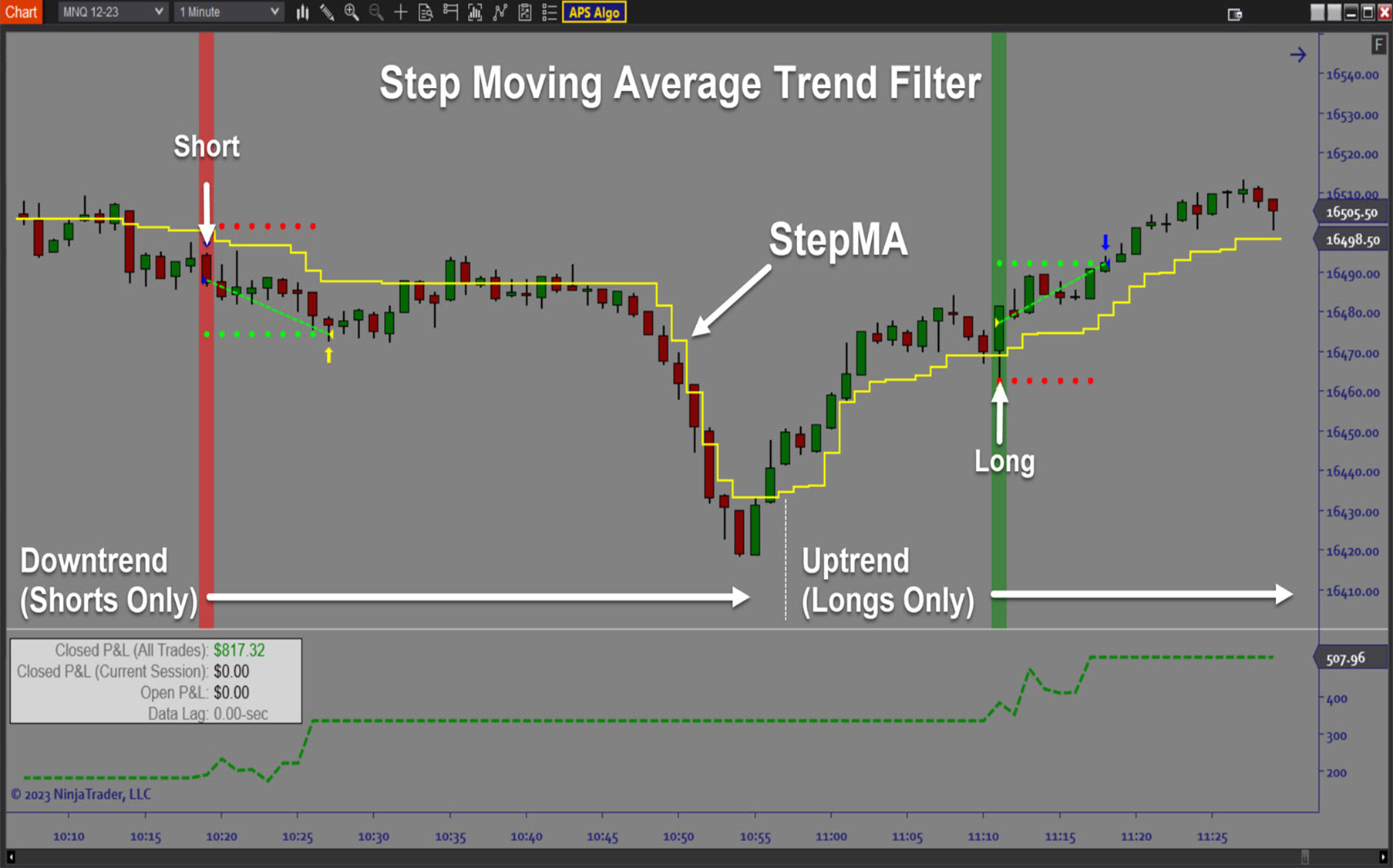

- Comprehensive trend, momentum, and market structure directional filters

- Dynamic Stop Sizing based on volatility

- AutoTrail and Breakeven strategies

- R-multiple target placement

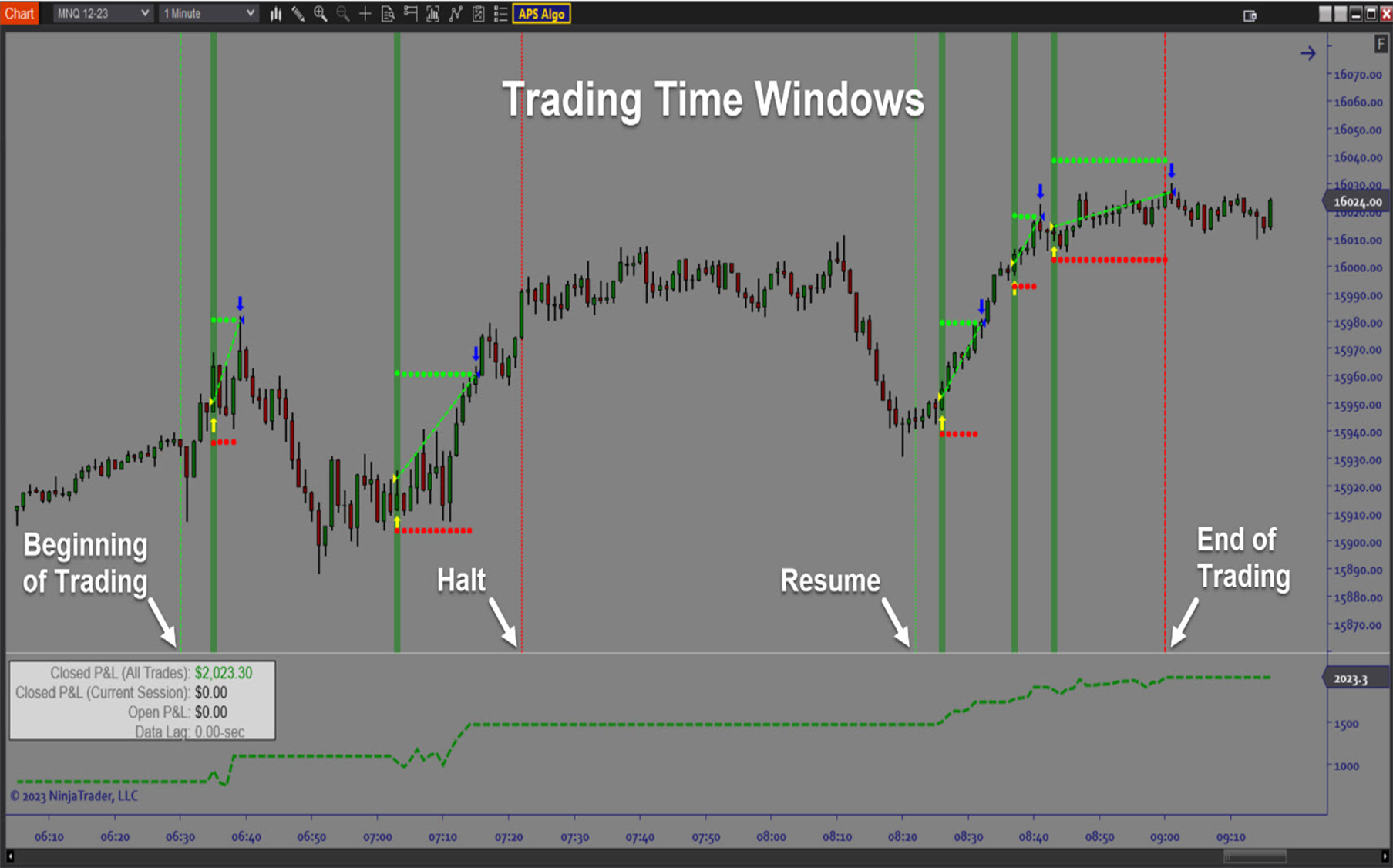

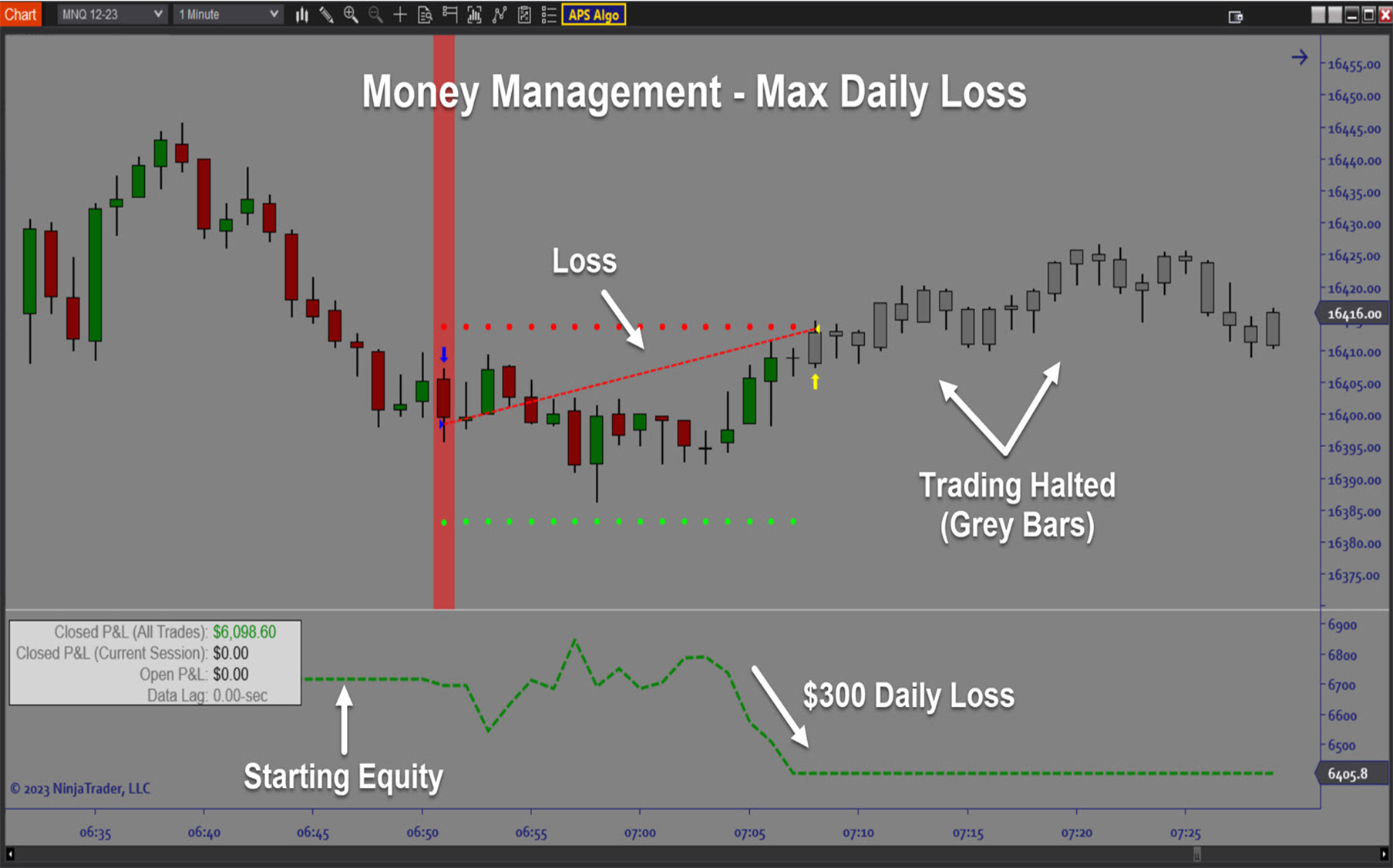

- Time filters and money management

- On screen trade signals, entry/exit markers, stops/targets, realtime P&L

- Backtesting and Optimization

Functions:

The APS Algo is best used by first selecting your favorite instruments to trade and identify a suitable scalping timeframe. Then take advantage of the backtesting and optimization capability to fine tune the strategy parameters. Next you can forward test your strategy in live simulation mode. And once you achieve consistency you can deploy the algo using risk capital. The advantage of the system design is that the number of parameters needed to define the strategy for your trading instrument is relatively small. This means that not only can you complete your strategy development rather quickly but you can also easily adapt to changing market conditions.

Problem Solved:

- Stops traders from missing out on frequent scalp opportunities

- Stops traders from failing to recognize price action patterns

- Stops traders from being unable to keep up in fast markets

- Stops traders from entering too late and missing out on most of the profits

- Stops traders from having to wait all day for one good trade setup

- Stops traders from trading against momentum, market structure, and directional bias

- Stops traders from failing to adjust to market conditions

- Stops traders from sabotaging their trading due to fear and uncertainty

- Stops traders from dealing with the stress of manual trading

- Stops traders from entering at the wrong place or time

- Stops traders from trading without optimizing their strategies