Macro Profiles

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

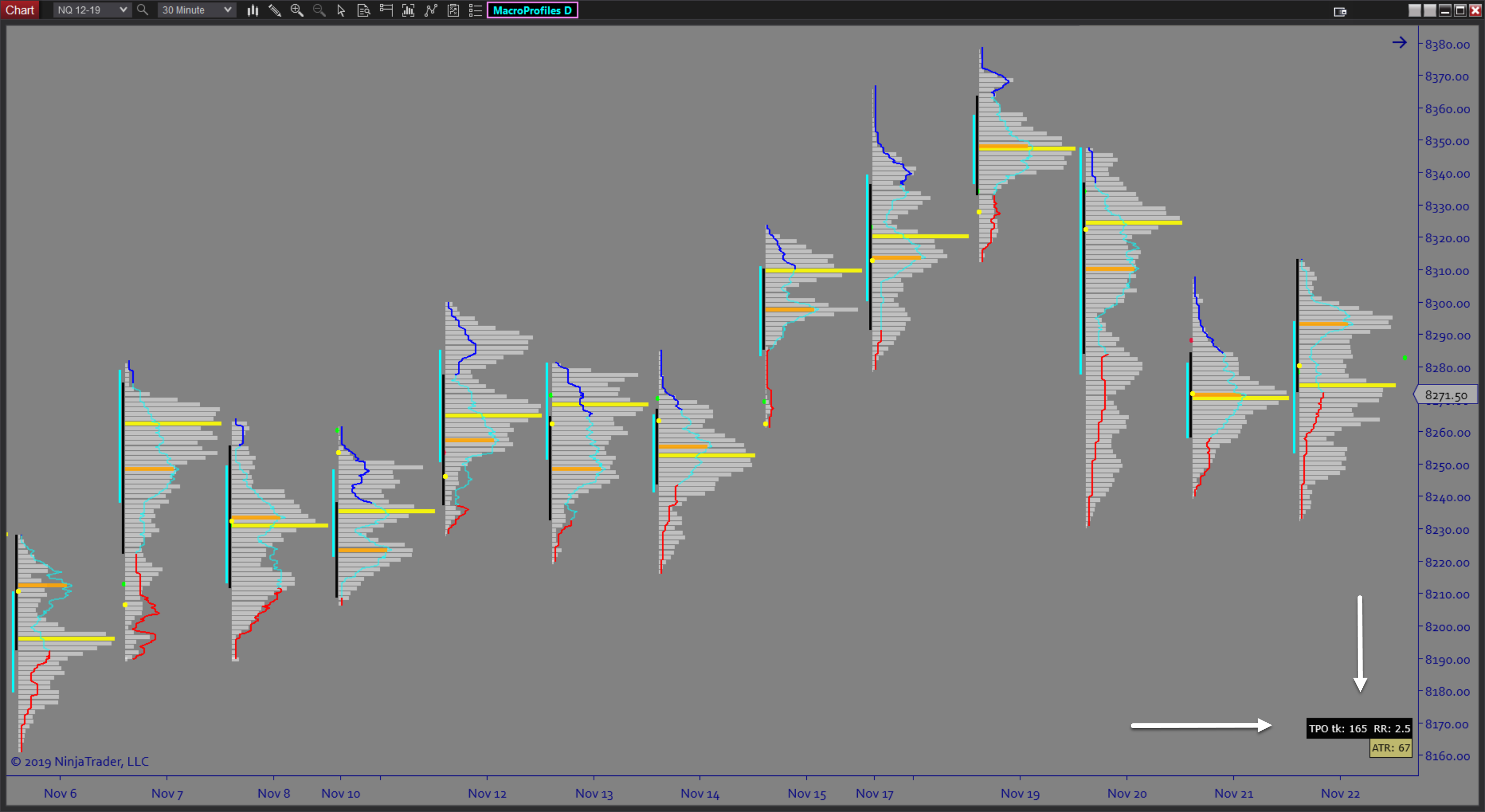

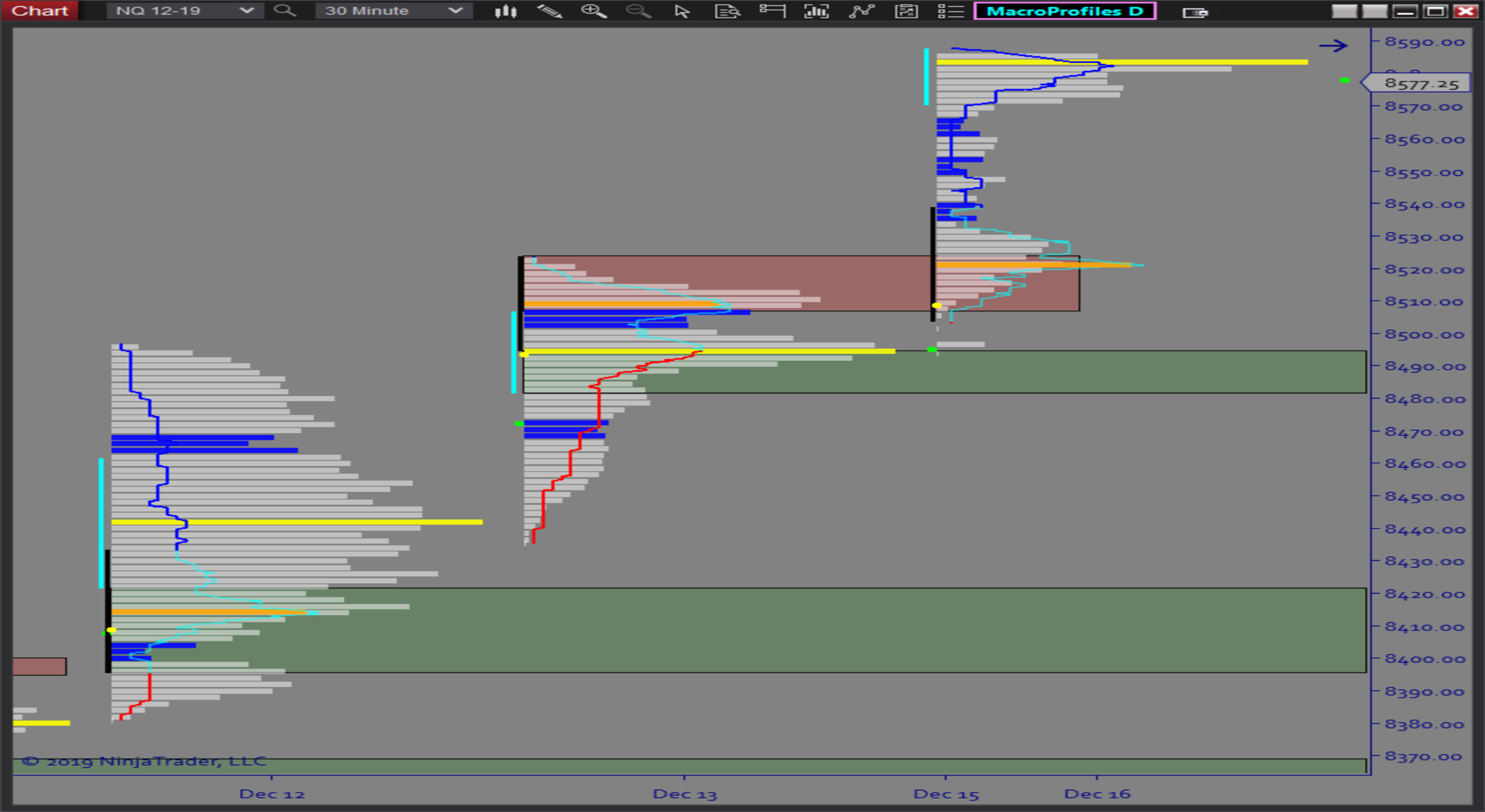

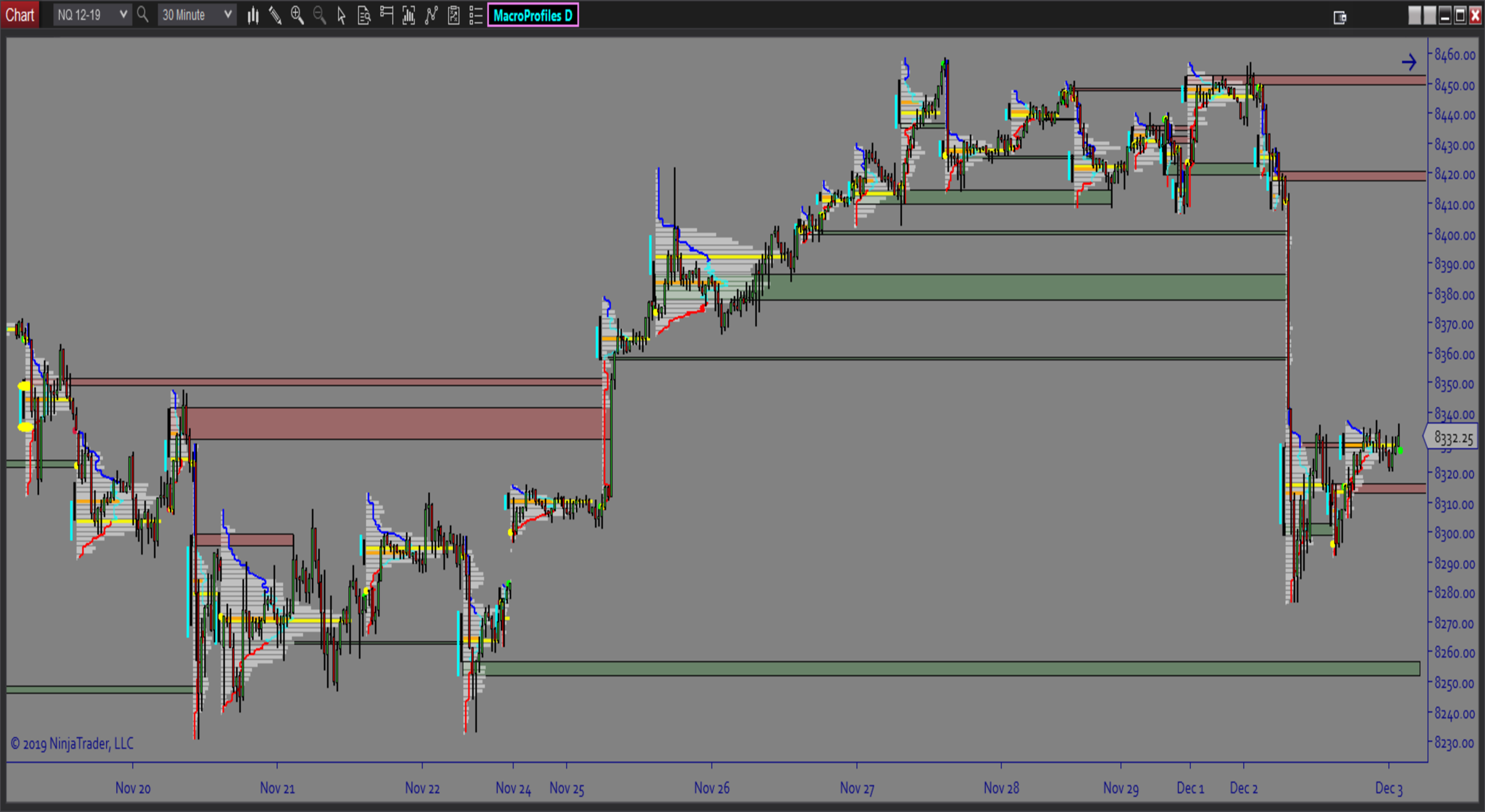

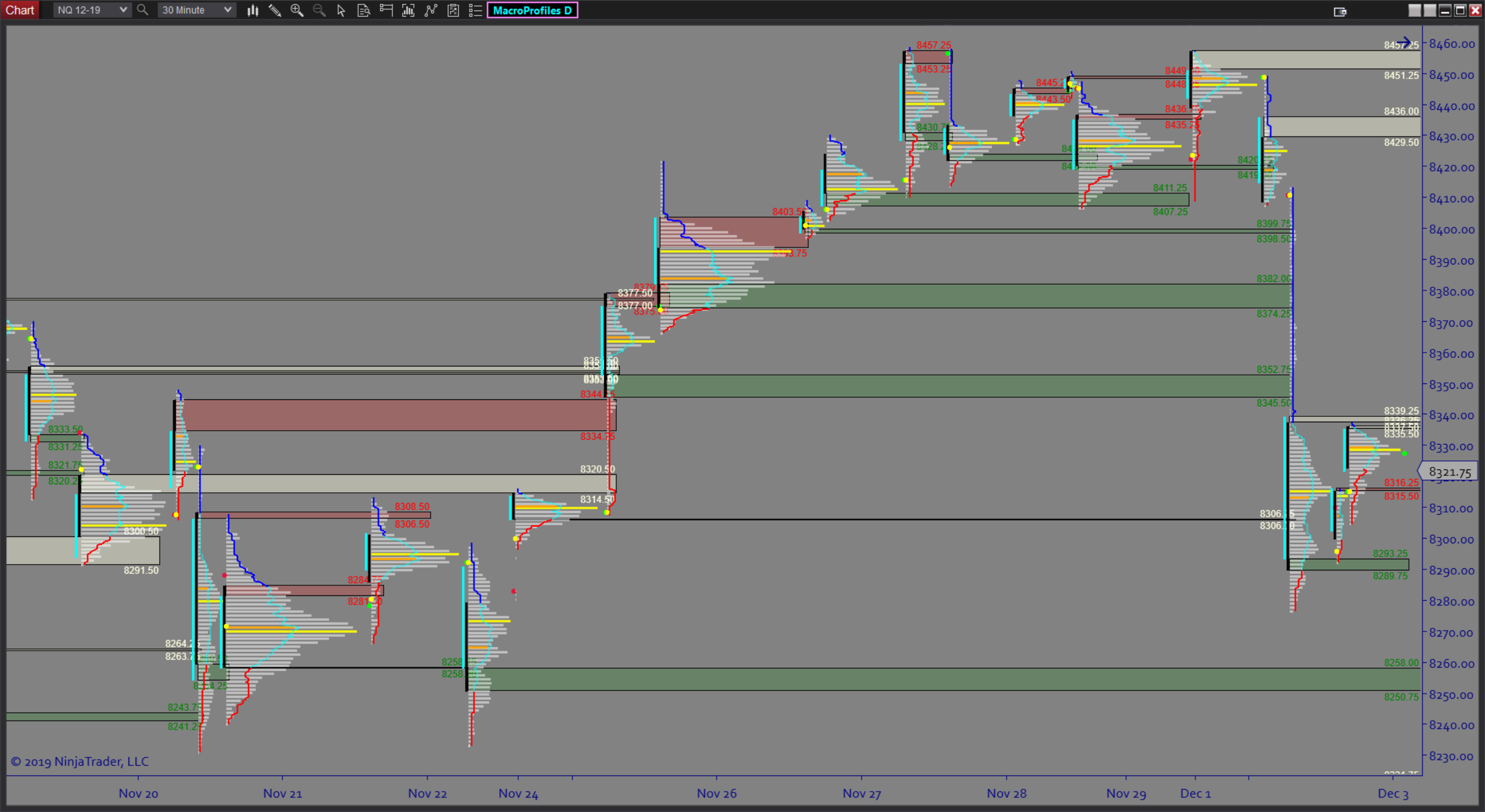

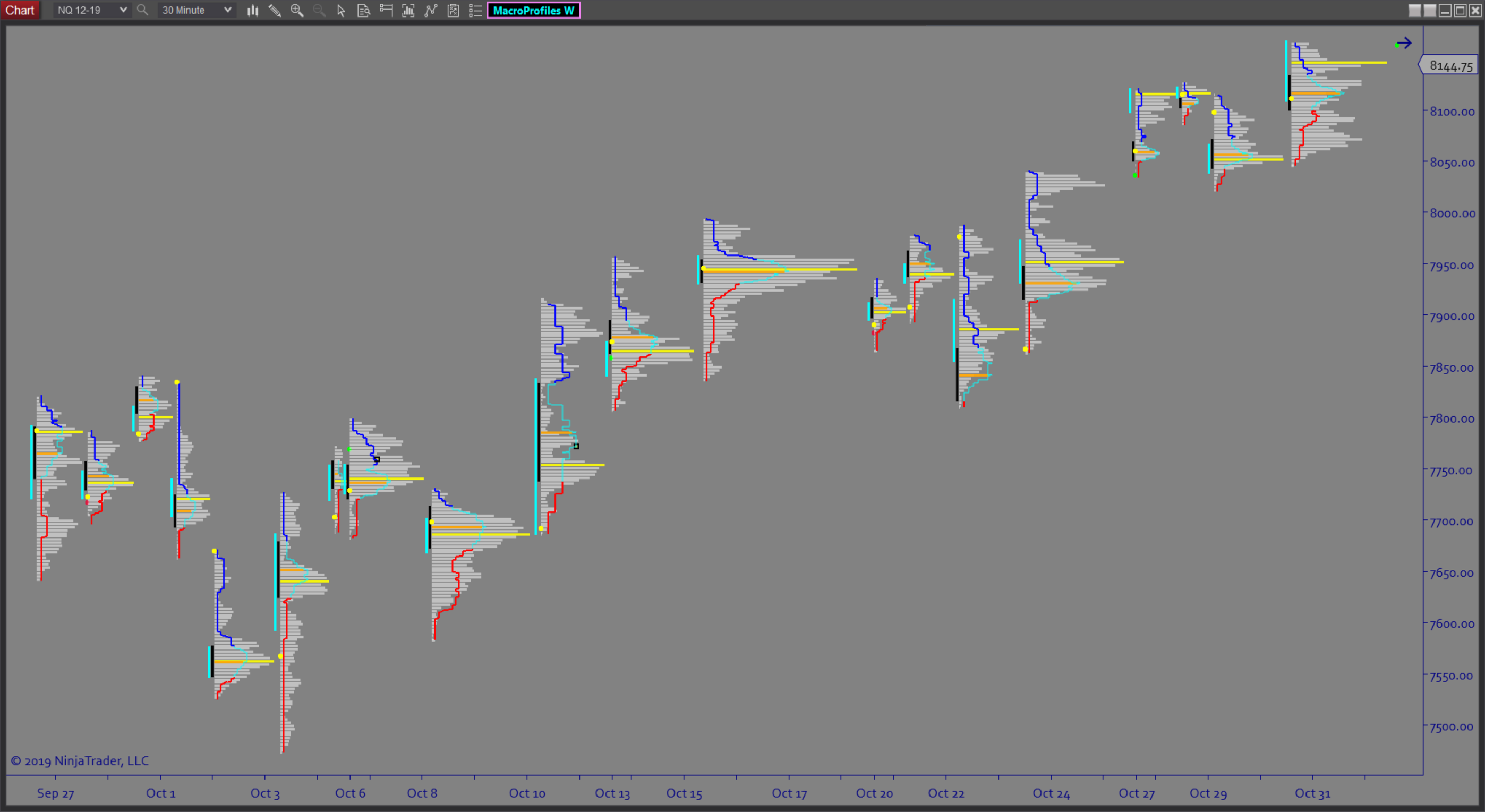

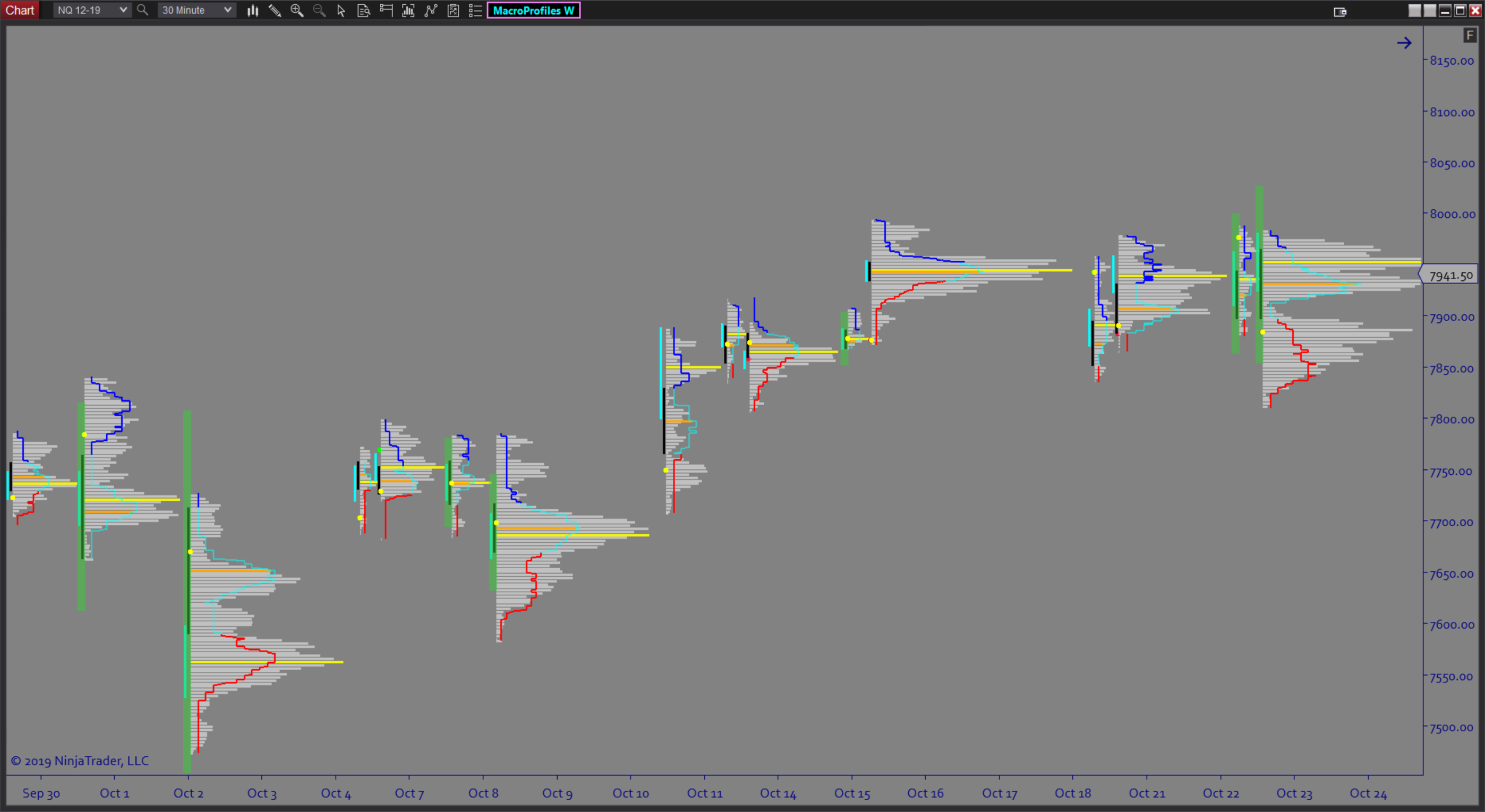

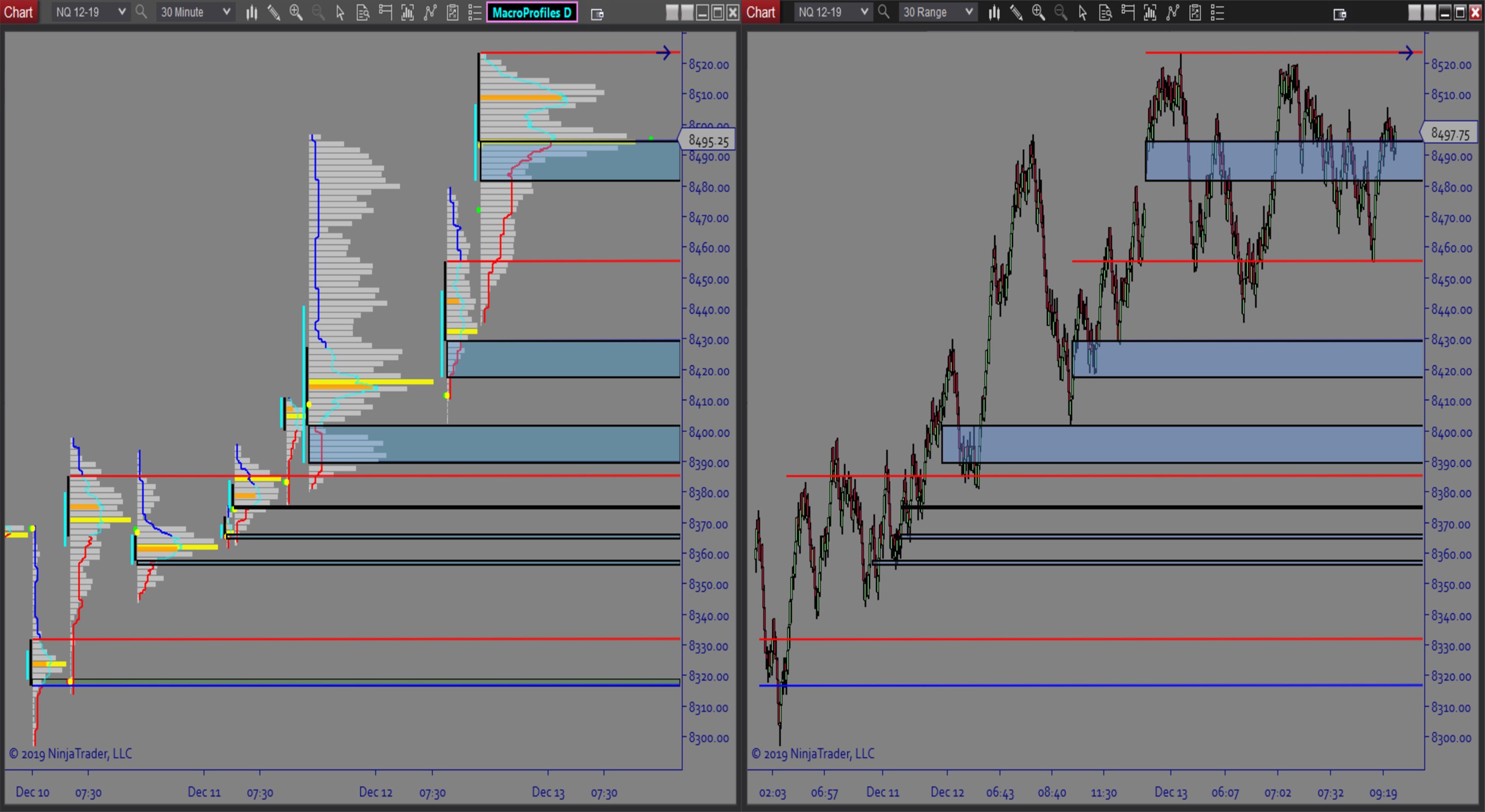

Overview:

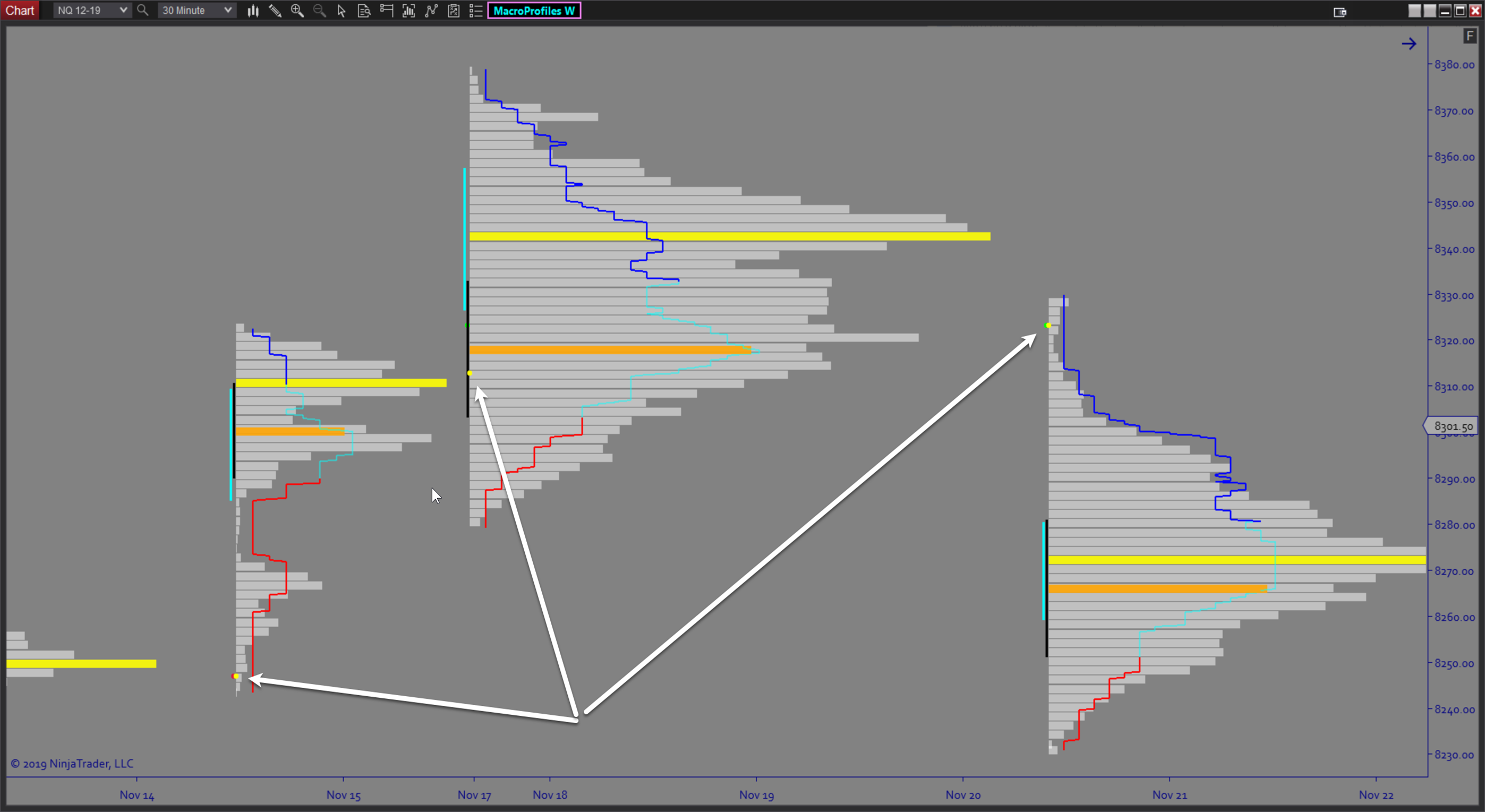

Macro Profiles is an all-inclusive multi-timeframe profile arbitrage trading solution. Using Daily, Weekly & Monthly profiles, you can now locate volume-based Support & Resistance trading zones that offer low risk highly accurate trading opportunities. Its multi faceted splitting distribution system allows traders to locate shifting profile distributions and determine intra-session auction theory on-the-fly. This is by far the most sophisticated profile software on the market.

Purpose:

Traders need the macro profiles because manually trying to attempt this form of analysis is actually impossible without using software to perform the job. It uses volume and auction theory to forecast distribution analysis both from a macro perspective as well as from a shifting profile pattern display. Essentially without such resources, traders are trading blind to the institutional volume and putting themselves in a harmful situation towards accuracy and risk mgmt. Also, knowing where the banks are doing business is the most powerful place for a retail trader to be. It empowers the little guy to trade with the smart money and have an edge!

Elements:

- Automated profile splitting

- MTF Profile Arbitrage Levels

- LVN & HVN Analysis

- MTF Profile Distributions

- Automates support & resistance trading zones

- Globalized drawing tools for easy level transfers

- Custom User Interface (UI) control center

Functions:

The Macro Profiles are best used for automatically splitting multiple timeframe profiles. By combining daily, weekly and monthly arbitrage, traders get a complete picture of profile trading confluence. Using MTF levels allows for better trade entry and exits by leveraging different aspects of fractal confluence. This in turn, helps with confidence and trade accuracy. Its also ideal for Volume analysis so trades can spot LVN & HVN Levels

Problem Solved:

- Stops traders from second guessing trade entries

- Stops traders from second guessing trade exits

- Stops traders from trading weak levels against smart money

- Stops traders from taking trades in wrong locations

- Stops traders from fearing their strategy and execution

- Stops traders from trading without institutional knowledge

- Stops traders from trading without proper volume information