VP Scalper Algo

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

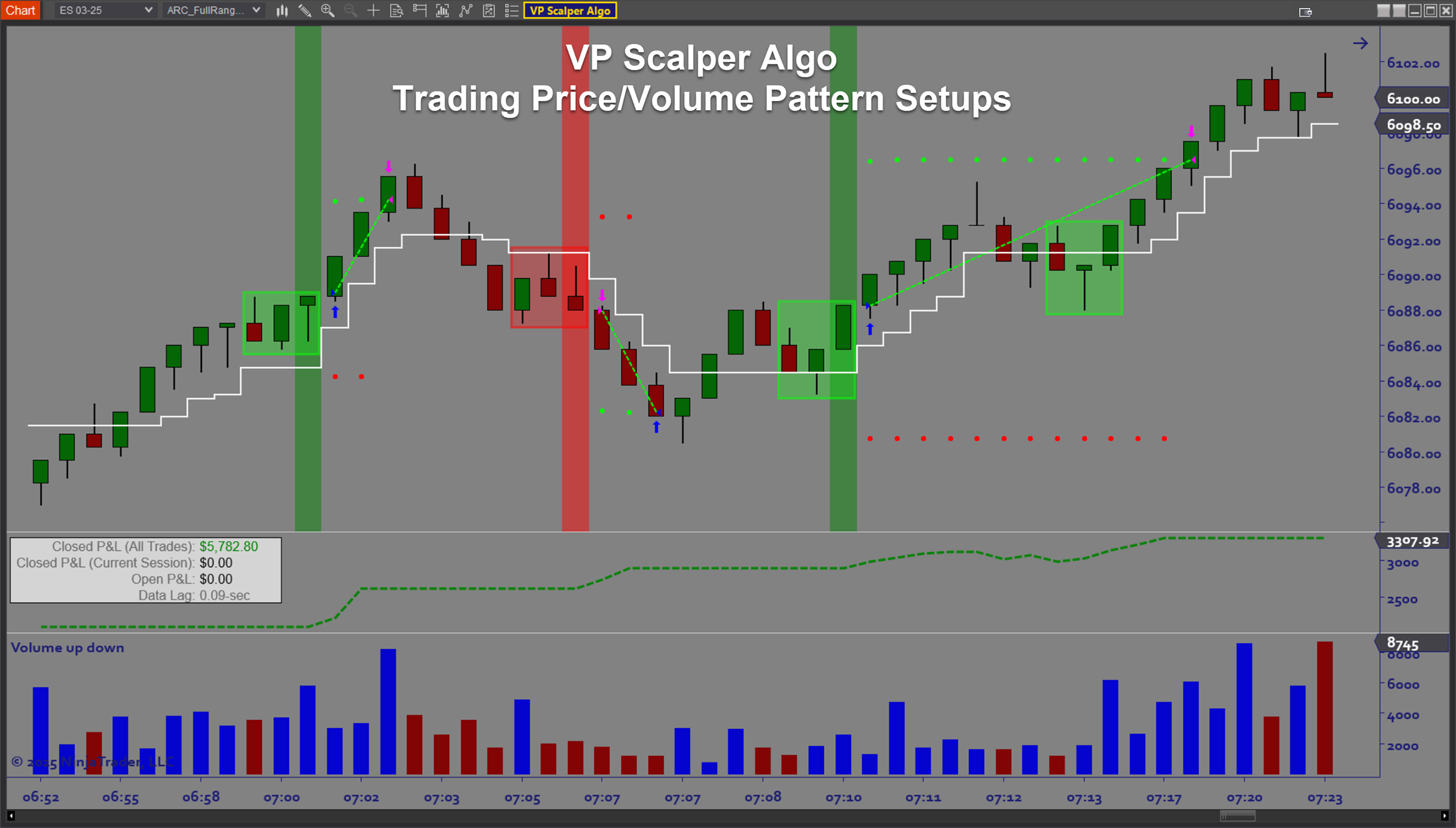

Overview:

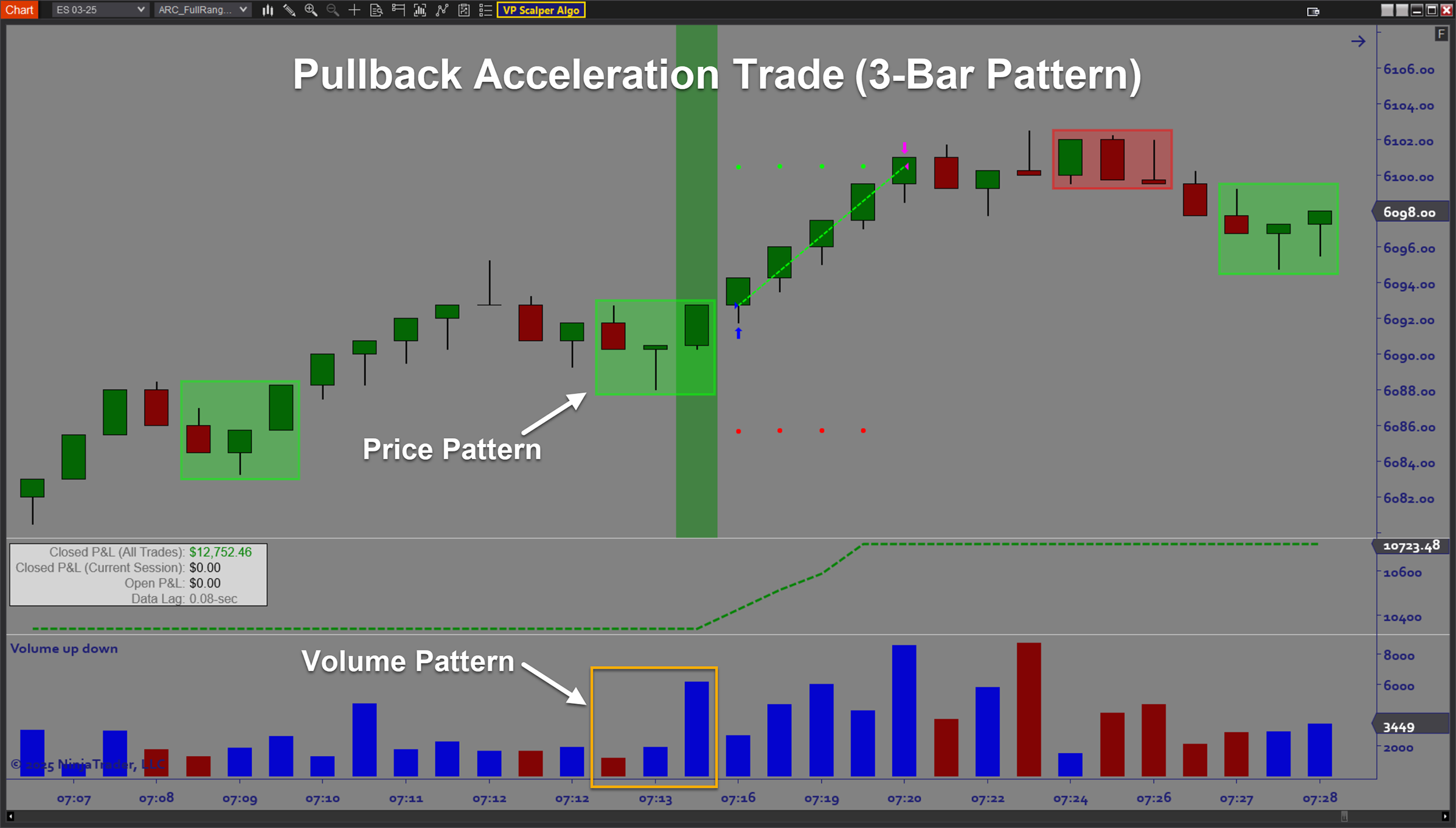

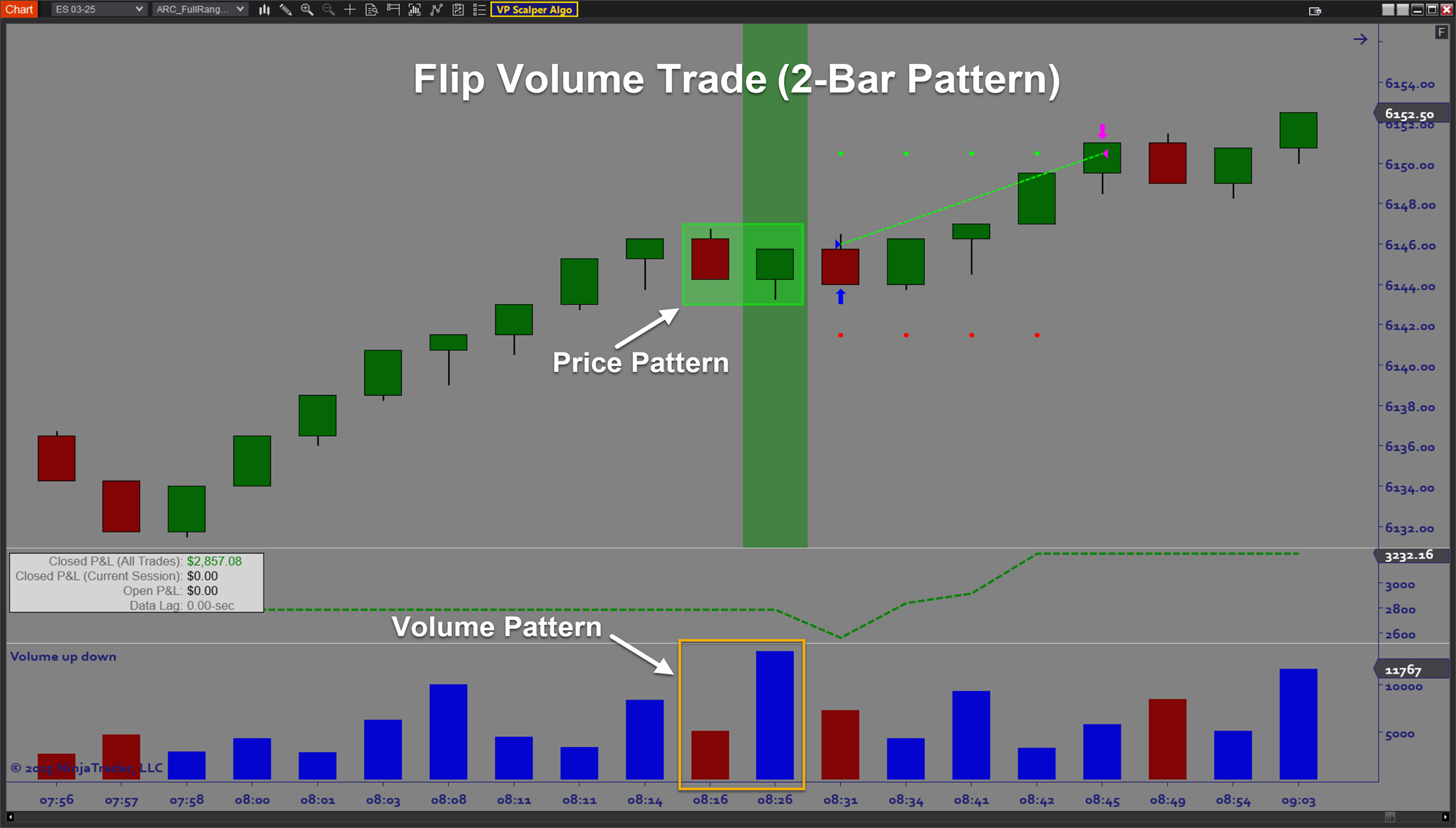

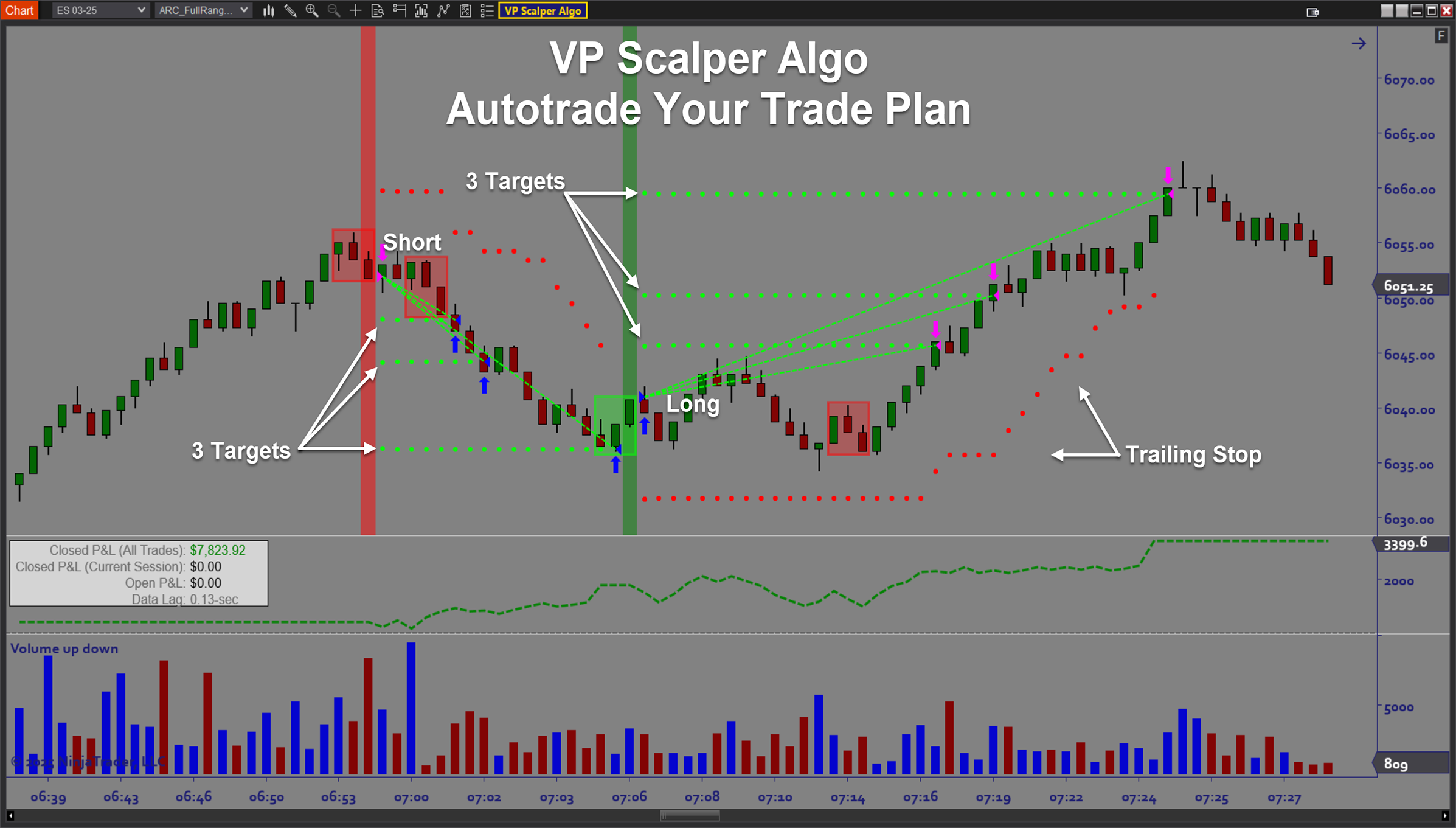

The ARC_VP Scalper Algo is an automated trading solution for Ninjatrader which scans for volume-price rotation patterns to generate scalping and daytrade setups. When the price bars form a directional rotation combined with a specific volume pattern, there is often enough follow through due to the impact of an increase in volume associated with the pivot in price movement. There are 3 patterns available for generating signals: the Flip Volume Pattern (2-bar), the Pullback Acceleration Pattern (3-bar), and the “V” Volume Pattern (4-bar). The software continually monitors price action and volume and when a pattern is detected a trade is entered along with a complete user defined trade plan. The speed of automation is essential for capturing the trade opportunities more quickly than is feasible with manual trading. These patterns occur frequently which provides ample opportunity for profit.

Purpose:

Traders need the ARC_VP Scalper Algo software because it is very difficult to recognize subtle price and volume patterns let alone being able to act quickly enough to capture the opportunity. Trade automation lets the speed of the computer work in your favor by both detecting the signal and entering the trade almost instantly, allowing you to capture more of the profits. The other benefit of an automated system is the discipline it imposes by requiring you to define an explicit trade plan, giving you the confidence of knowing you won’t be committing manual errors and can rely on the system to implement your strategy as designed.

Elements:

- Autotrade subtle price/volume patterns for quick profits

- Trade with the dominant energy in the market by detecting micro bursts in volume

- Benefit from instant pattern recognition and fast order execution

- Fine tune the signal generator for the best results

- Customize Stop size based on price action

- Utilize optimization functionality for the best performance

- Apply fully automated trade plans with stop placement and up to 3 targets

- Utilize R-multiple target placement

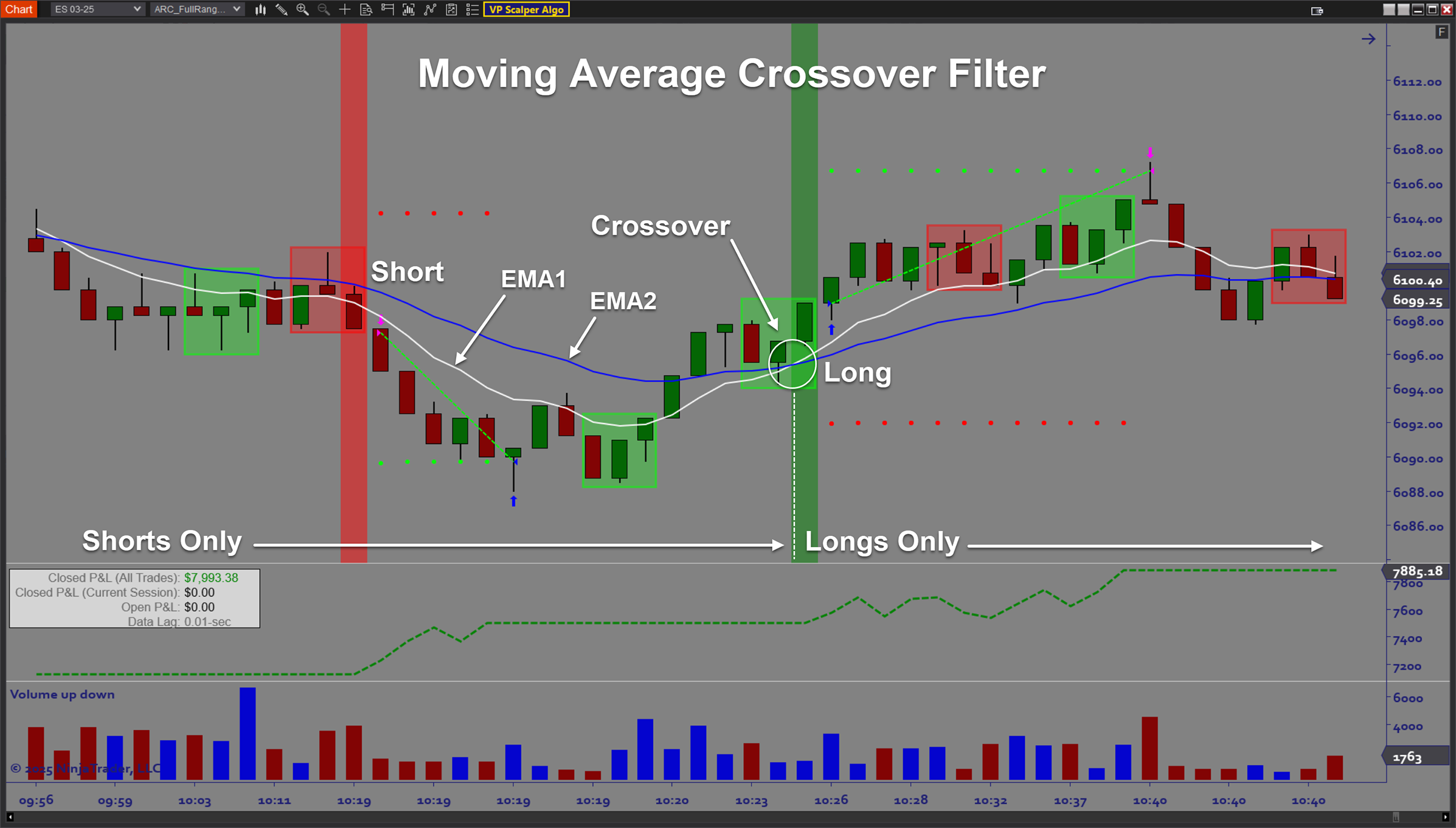

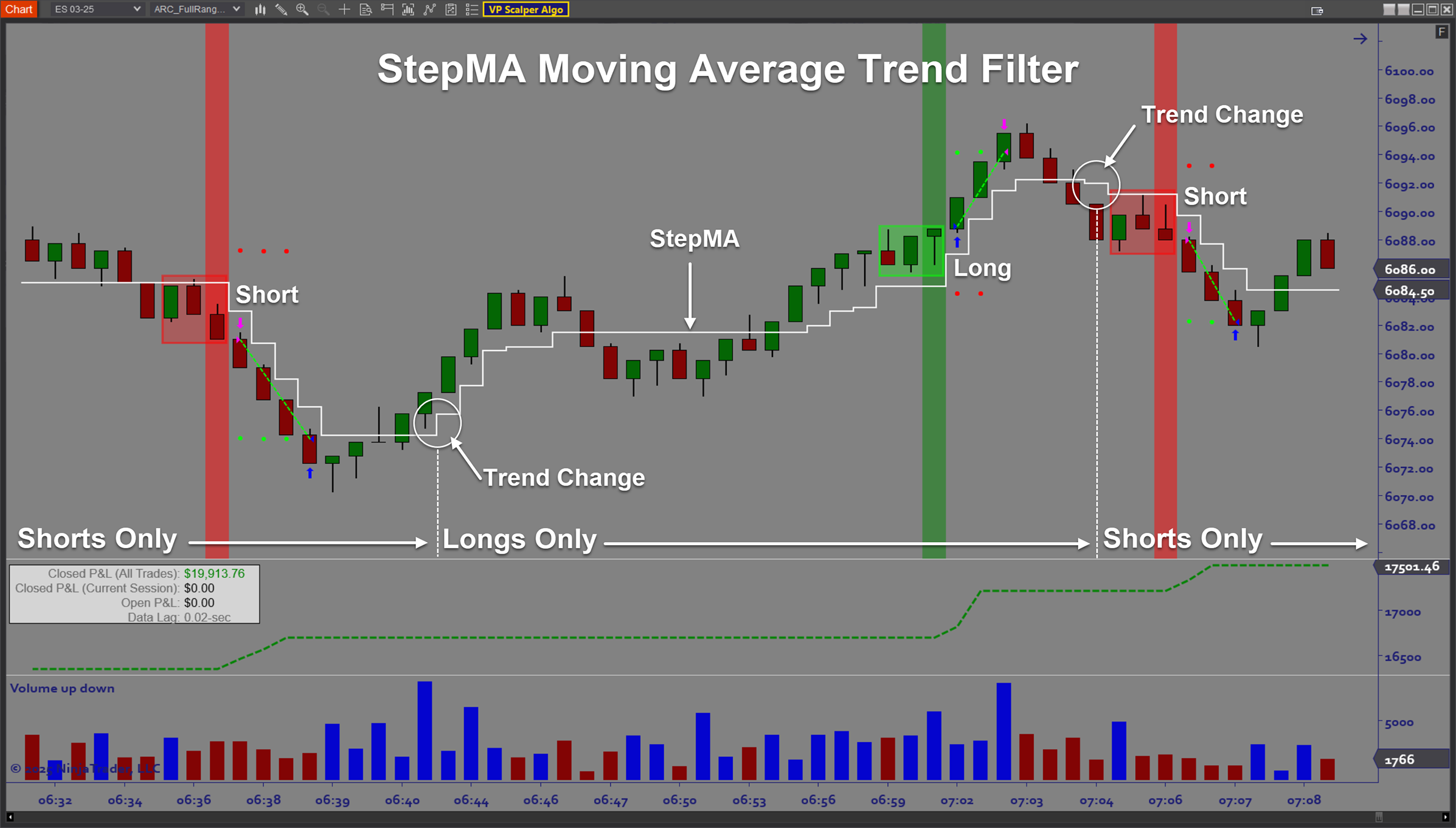

- Improve signal quality with comprehensive trend, momentum, and market structure directional filters

- Utilize AutoTrail and Breakeven strategies

- Take advantage of dynamic trade sizing to control Dollar Risk per trade

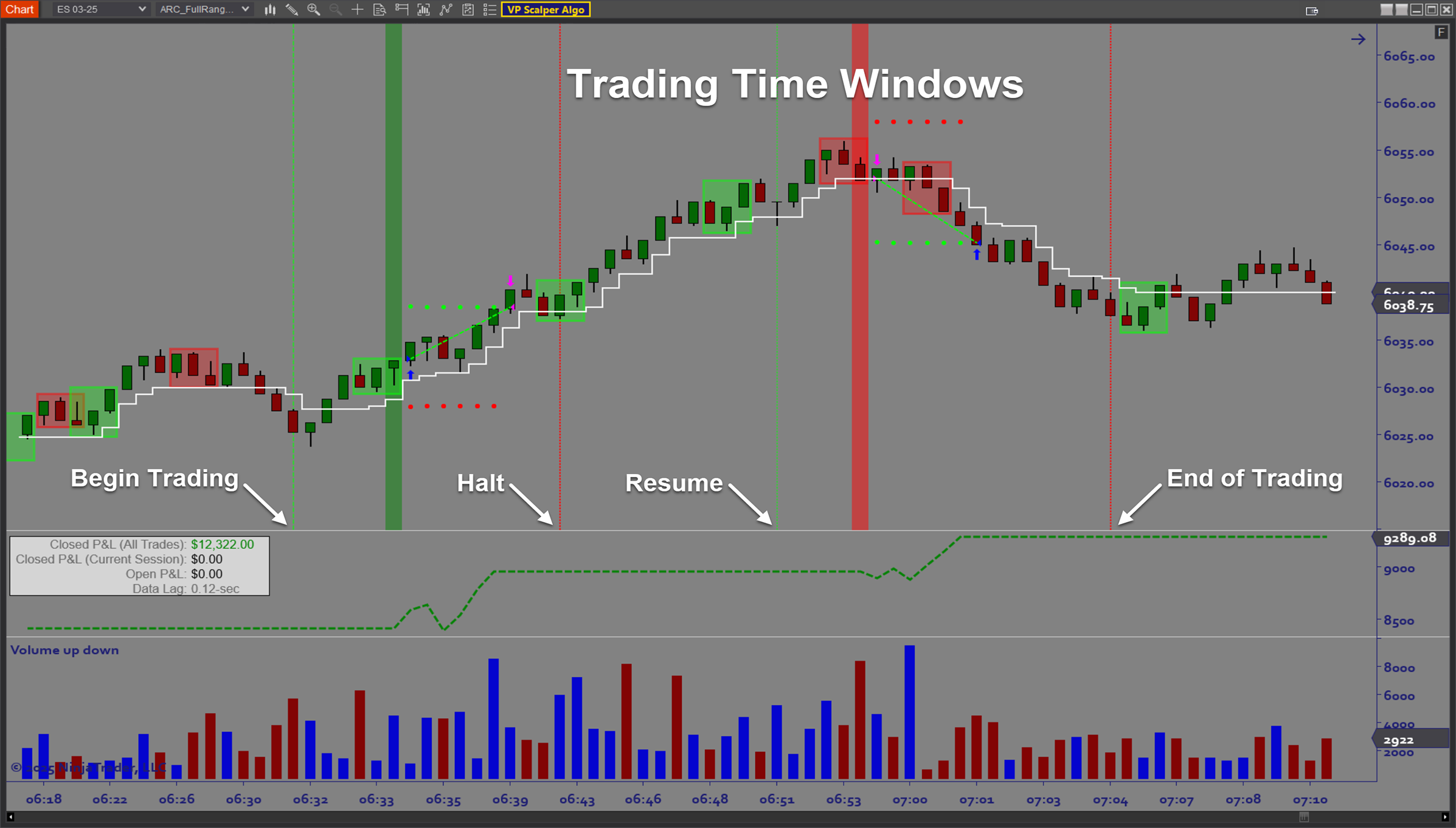

- Time filters, Day of Week filters, Holiday filters, and money management function

- Built in trade signal graphics, execution markers, stop/target graphics, realtime P&L

- Built In Backtesting and Optimization capability

Functions:

The VP Scalper Algo is best used on markets with high volume and price movement for the best performance. The software is designed to make it easy to fine tune the signal generator for your favorite instruments. Because volume-price patterns occur frequently, you can make extensive use of the signal filters to find the best trades and still have plenty of trade opportunities every day. The software can trade continuously or it can be configured to be used semi-discretionarily by arming the algo only in the right conditions. The best thing is to fully understand the 3 types of pattern setups included and to have a game plan for when to use them. You can use the built in optimization capability to get a preliminary strategy configuration. Next forward test your strategy in live simulation mode. Once you are comfortable with the performance in Sim, you can start auto trading a live money account at your own discretion. When the market environment changes, it is easy to use the flexibility of the software to adjust to changes in trading conditions.

Problem Solved:

- Stops traders from missing out on subtle price-volume patterns which generate profitable trade setups

- Stops traders from getting in too late

- Stops traders from failing to recognize brief surges in volume that overwhelm price action for a brief but tradable period of time

- Stops traders from sabotaging their trading due to indecision and fear

- Stops traders from failing to account for price action when placing their stops

- Stops traders from trading without a well defined trade plan

- Stops traders from failing to adjust to market conditions

- Stops traders from failing to identify the best days and times to trade

- Stops traders from trading against momentum, market structure, and directional bias

- Stops traders from lacking the proper tools for managing risk appropriately

- Stops traders from lacking the ability to objectively compare the performance of different strategies

- Stops traders from not allowing the data to guide their strategy development