Stop Finder

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

Overview:

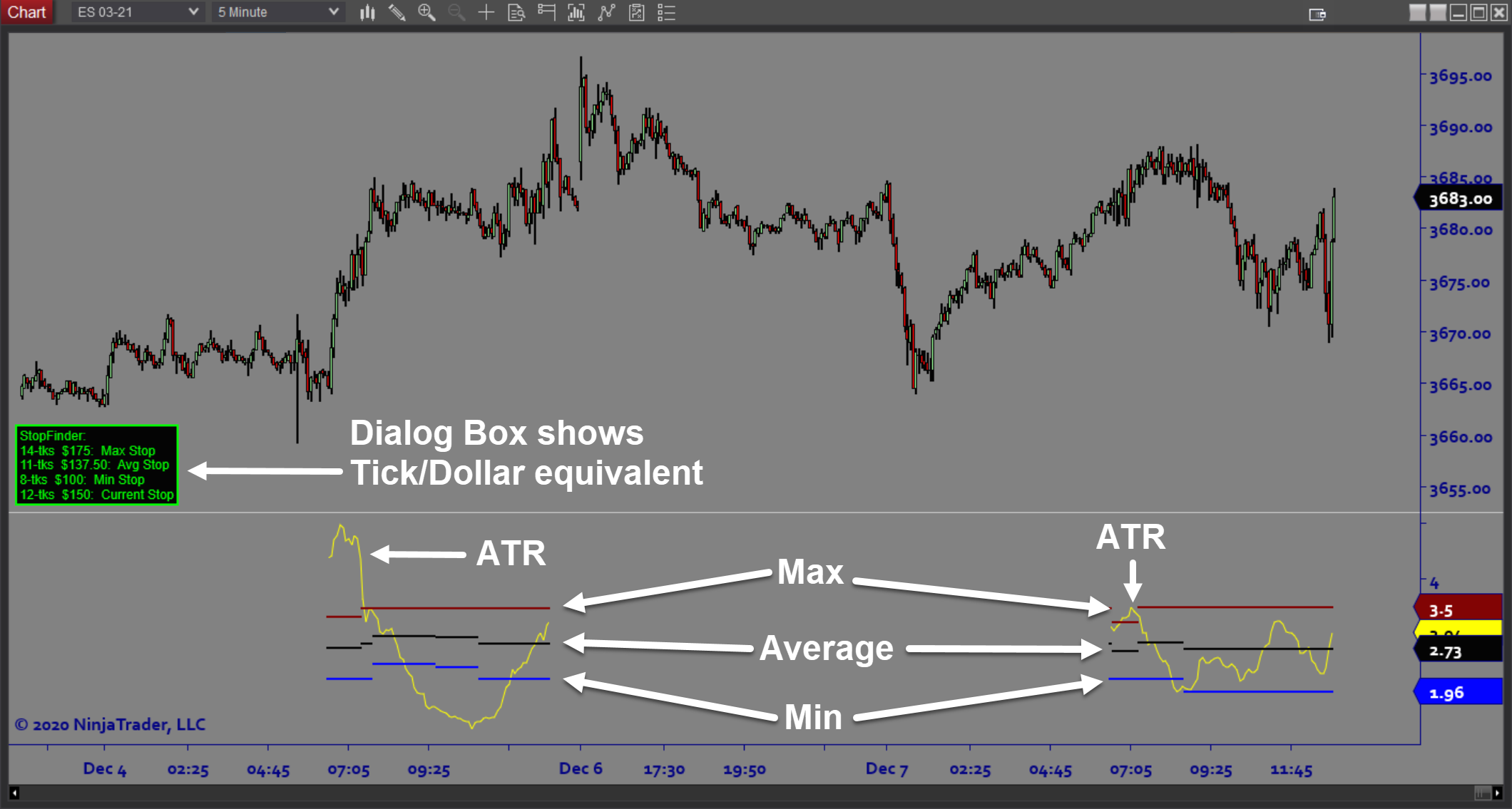

The StopFinder is a dynamic volatility grid that depicts the variations of volatility for stop placements. It tracks changes in volatility over time and facilitates setting stop sizes based on current market conditions.

Purpose:

Traders need the StopFinder software because stop sizes should reflect current volatility levels. Your normal stop size might be too small when volatility spikes. StopFinder constantly updates the Average, Maximum, and Minimum stop sizes based on changes in market conditions. Using this tool helps you manage risk more consistently.

Elements:

- ATR based calculation of risk \

- Average, Maximum, and Minimum Stop Size

- Stop sizes remain constant until volatility shifts significantly

- Stop Sizes shown in tick, points, and dollar amounts

- Differentiate Stop Sizes by Session

Functions:

The Stop Finder software is best used by always keeping the Stop Size Info Box visible so you know how to size your stops at any given time. You can choose to focus the calculations on your specific Session window or all Sessions. The most important thing is to make sure your risk management takes into account changes in volatility.

Problem Solved:

- Stops traders from second guessing stop placement

- Stops traders from getting stopped out when volatility spikes

- Stops traders from getting stopped out right before a big move in the right direction

- Stops traders from failing to recognize changes in market conditions

- Stops traders from not knowing when to exit a trade